Construction is expected to start on Green Turtle in 2025 for completion in 2028. It will be among the largest BESS projects in Europe when it comes online.

Giga Storage first revealed the project in January, when it said that construction was expected to start this year. Asked why the date had been pushed back, a spokesperson sold Energy-Storage.news that the company “…now has a better idea on the supply chain and building contracts”.

They added that the company is in the process of selecting the BESS supplier and expects to have chosen them after this summer.

When asked what learnings the company had gained from developing such a large project, the spokesperson simply said: “Take your time and be complete.”

Green Turtle is on the former site of a major zinc factory and the land was acquired from the Budé family. A high-voltage transmission line already runs past the site and a new substation will be built by transmission system operator (TSO) Elia.

Discussing how it would commercialise the BESS once operational, the spokesperson said: “In general we will stack revenue models by trading the batteries in the energy markets ourselves, preventing/lowering congestion and by renting out parts of the energy storage capacity.”

In separate news, Giga has appointed global engineering consultancy Mott MacDonald to provide engineering and advisory services on the Leopard Project, a separate large-scale BESS project in Belgium totalling 300MW/1,200MWh that it announced in September last year. The consultancy said the project should be completed and commissioned by 2026.

Company to start building 45MWh project in Netherlands

Giga Storage has also said it will start building its Giraffe project in the Netherlands, its home market, this summer. The project in Westhavenweg has an energy storage capacity of 45MWh and a power output of 10MW, making it (roughly) four-hour system, the company said.

It will be completed in 2025 and provide reserve capacity on the ‘transport network, preventing transport restrictions’ according to a Dutch-language press release. This may be referring to the GOPACS market, a congestion management platform run by TSO TenneT where parties can buy and sell power based on regional imbalances.

The gulf in size between its Green Turtle and Giraffe projects is emblematic of, according to industry commentators, how much more friendly the Belgium market is to the deployment of energy storage.

There are still major challenges around grid, market revenues and local permitting in the Netherlands. In one of its last moves in office, the outgoing government last week allocated €100 million (US$107 million) in operating subsidies to PV co-located energy storage in 2025 to help kickstart the segment’s growth.

Has CATL cracked the battery ageing code? Industry reacts to ‘zero-degradation’ BESS claims

Lithium-ion battery cells typically degrade – lose their energy storage capacity – by 10-20% in the first five years of operation which is then offset by adding new units to maintain capacity, otherwise known as augmentation. If true, the breakthrough has huge ramifications for energy storage applications and the technology’s cost-effectiveness.

CATL applying zero-degradation technology after three-year demonstration

In a product launch ceremony video posted on YouTube since then (on 18 April), the firm’s energy storage division CTO, Dr Jinmei Xu, explained that it had applied technological learnings from an R&D project into a zero-degradation BESS started in 2016.

In 2020, it made a ‘major technological breakthrough’ in BESS by achieving ‘zero degradation’ over three years using lithium iron phosphate (LFP) battery cells on the Jinjiang Project in Fujian province. It had an annual utilisation rate of 98%, and none of the battery cells were ever replaced during the operation.

The word CATL used was shuāi jiǎn (衰減), which directly translates as either degradation or attenuation, with the latter used in the ceremony’s translation and the former used in English-language press releases.

“We’ve strived hard to explore the technologies to achieve zero attenuation. However it takes a giant leap forward to put lab technologies into practice,” Dr Xu said in the ceremony.

“I’m proud to announce that we have made it to reach mass production of the five-year zero attenuation product. It is a milestone in the long-life lithium battery technology development.”

CATL is being tight-lipped on how it has achieved zero degradation, only mentioning the use of biomimetic SEI (solid electrolyte interphase) and self-assembled electrolyte technologies. Others have posited that ‘lithium compensation technology’ or ‘pre-lithiation’, where additives gradually release extra lithium in the first operational cycles, could help achieve such a breakthrough.

Clever marketing, adaptive BMS or technological breakthrough?

The five-year zero degradation claim has been met with both scepticism and awe from the energy storage industry, with many taking to business networking site LinkedIn to comment on the claim.

Many have praised the company and pointed out that as the world’s largest lithium-ion battery firm and one with a track record for technology breakthroughs, its claim should be taken seriously, while others have poured cold water on it.

Dave West, CEO of Australia-based battery procurement platform BatNav, said: “It’s clever marketing, but no cell has zero degradation. You either oversize or augment your battery. Either way, the customer pays.”

Several have speculated that the Tener product is, therefore, most likely a 7.5-8MWh system marketed as a 6.25MWh one, including Drew Lebowitz, managing director of Oregon-based energy storage design and advisory firm PowerSwitch, and Konsta Anttila, an asset manager engineer for US system integrator FlexGen.

However, others have pointed out that such an energy-dense system would be very heavy and could present logistical challenges for delivery and deployment.

Dr. Kai-Philipp Kairies, CEO of battery analytics firm Accure Battery Intelligence, offered an alternative postulation as to how CATL had achieved it.

“So what about the “5 year without degradation” promise: Has CATL cracked the battery ageing code?,” Kairies wrote.

“The simple answer is “no”. They probably use an adaptive BMS (battery management system) that gradually opens up the upper voltage limits to compensate the occurring ageing. Over 5 years that should be anything between 5 and 12 percent of the system’s overall capacity. Owner are advised to regularly track if the system fulfills its contractual capacity obligations, since BMS are typically not very accurate.”

Andreas Fornwald, former CEO of energy management software solution provider Doosan Gridtech, was upbeat, saying he “…witnessed the product in person and can confirm that this one is real, moreover CATL is just a year or so ahead of many other battery cell manufacturers.”

“I am convinced that by the end of this year, we will see similar BESS containers coming from all major competitors, [just as] it happened last year with the 5MWh container and three years ago with the 3.4MWh container. The race is far from over, and I bet that in two to three years, we will see the 10MWh container with a 10-year zero-degradation system.”

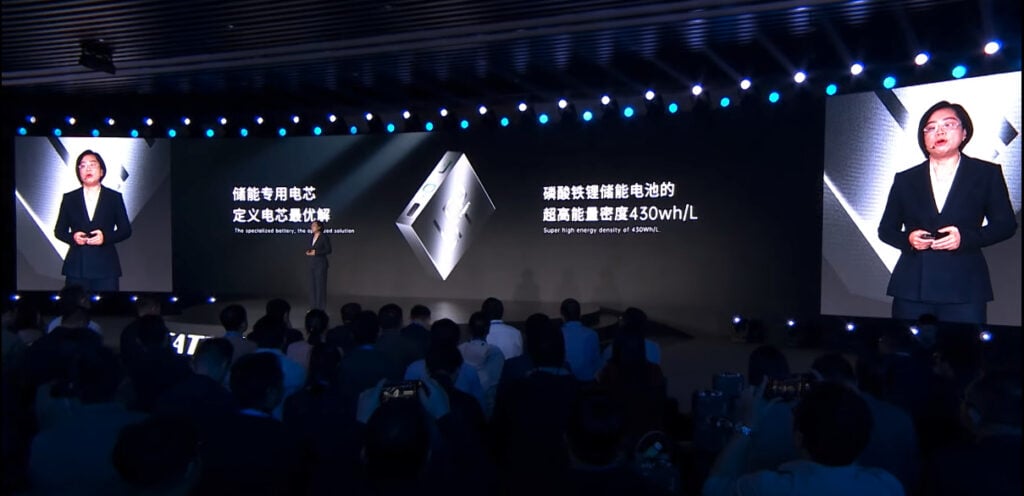

CATL revealed in the presentation that the Tener product is equipped with the ‘L long-line battery’ specialised for energy storage, which has an energy density of 430Wh/L. This battery is pictured below.

The battery set to be featured in the Tener product. Image: CATL via YouTube.

Energy density

The energy density aspect of Tener, at 6.25MWh per 20-foot container, has also garnered praise, although it may not be the highest in the industry. EV giant BYD, Tesla’s main Chinese competitor, has teased a 6.432MWh product, while Svolt Energy is reportedly launching a 6.7MWh product of the same size.

The move beyond 5MWh, which for a long time appeared to be the industry-leading standard adopted by most China-based companies, has partially been made possible by a redesign of the battery cell composition itself.

As explained by engineering and advisory firm Clean Energy Associates (CEA) in a guest blog last week, lithium-ion batteries have started to move from a ‘jelly roll’ stack design to a ‘Z-stack’ design which offers a 10% volumetric energy density improvement.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

Trina Storage to supply 1,500MWh battery storage to Pacific Green’s ‘grid-scale energy parks’

The pair held a signing ceremony for the collaboration agreement (pictured above).

Trina Storage said it intends to supply the developer with equipment that includes its newest BESS solution, Elementa 2, along with power conversion systems (PCS) and energy management systems (EMS).

Pacific Green is headquartered in London, UK. Its two main areas of business are developing standalone BESS assets, and emissions reduction projects for industrial customers that include the maritime sector.

The company has projects in development in Europe and Australia. Its first grid-scale project—a 100MW/100MWh project connected directly to the transmission network at Richborough Energy Park in Kent, UK—went online in December last year, a few months after Pacific Green sold it to asset manager Sosteneo Infrastructure Partners.

Another Chinese manufacturer, Gotion High-Tech, was the BESS supplier to that project. It was the initial project in a 1.1GW project exclusivity deal Pacific Green signed in 2021 with another developer, TUPA Energy, for projects in the UK, including Sheaf Energy Park, a 249MW/373.5MWh system to be sited adjacent to and connecting to the same substation as Richborough Energy Park, due for completion in 2025.

In Australia, it has been on a drive to acquire land for some bigger projects, targeting 1GW/2.5GWh of projects in that country, leading to it securing a land deal for a planned 500MW/1,000MWh project in South Australia a few months ago, in November.

The company has also recently acquired a 500MW BESS portfolio in development in Italy from developer Sphera Energy, with the potential for the included projects to have as much as 6-hour durations.

Trina Storage’s release did not specify where the supplied projects will be located, except that they would be Pacific Green’s “grid-scale energy parks… across multiple jurisdictions.”

Trina launched the first iteration of its Elementa grid-scale product in the UK and offered a preview of Elementa 2 late last year at a trade event in Australia before making its global launch at this year’s Energy Storage Summit EU, hosted by our publisher Solar Media in London, UK, in February.

Speaking exclusively to Energy-Storage.news Premium at that show, Trina Solar executive president Helena Li said that the UK is the company’s biggest energy storage market outside of China: of more than 4GWh+ of Elementa systems shipped to date, over a gigawatt-hour is in the UK, with the rest in the company’s homeland.

Li discussed the product design and development strategy behind Elementa 2 in that interview, including the fact that the systems’ lithium iron phosphate (LFP) cells are being sourced from Trina’s in-house production lines, at which mass production began last year.

In another ESN Premium piece published a couple of weeks ago, Li spoke about the safety features of the Elementa 2 product, including its liquid-cooled thermal management system and several layers of detection, protection and suppression against thermal runaway and fire events.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Friday Briefing: Thermal plants offer brownfield opportunities but require ‘a lot of coordination’

Put in extremely simple terms, brownfield developments are sited on land that has already been in use for industrial purposes, while greenfield projects put assets on undeveloped land.

Thermal power plant sites are considered a suitable fit for renewable energy, hybrid renewables-plus-storage and standalone BESS projects, due to their existing land and grid connection, as well as often giving access to a skilled local workforce.

They also offer owners of legacy fossil fuel assets a means to repurpose their assets to host clean energy technologies that can continue to drive revenue as well as enable them to lower their carbon footprint.

Standalone battery storage is often the easiest technology to deploy at such sites due to its relatively lower demand for physical space compared to, for example, ground-mount solar PV.

Landmark projects over the past few years, such as Moss Landing Energy Storage Facility and Alamitos in California, have been placed at former gas power plant sites. In Australia, the country’s many coal power plants, scheduled for decommissioning in the coming years or already decommissioned, offer similar opportunities.

Last week, Energy-Storage.news reported as Engie said it will deploy a 116MW/660MWh BESS at the site of a former coal plant in Chile.

In March, construction began on Australia’s biggest battery storage project to date, a 500MW/2,000MWh plant in Western Australia (WA) at the site of Collie, a coal power plant marked for decommissioning in 2027. Also last month, system integrator Fluence was awarded a 300MWh BESS supply contract for the UK’s SSE Renewables at a decommissioned coal plant site.

Sites offer land and valuable grid infrastructure

This week, South Africa’s electricity minister Dr Kgosientsho Ramokgopa attended the inauguration of the largest solar-plus-storage project in the Southern Hemisphere, in the Northern Cape town of Kenhardt.

While that project, comprising three sites with 540MW solar PV generation capacity and 225MW/1,140MWh of battery storage is itself a greenfield site, thermal power plant sites owned by national utility Eskom could host brownfield developments.

One of South Africa’s main challenges in deploying new renewable energy resources is the country’s shakey grid infrastructure and the minister said Eskom will play a major part in a forthcoming announcement around how to improve grid access for renewables.

“…Eskom is going to be a major player, because at the [thermal power] stations that are going to be decommissioned in the future, you have grid capacity, you have the land, you have the infrastructure,” Ramokgopa said.

“So it’s important that you are able to transition using those assets, to make sure that you minimise the cost of production, what I call capital efficiency allocation. It’s important and if you go to, if you like, brownfields development, there’s going to be greater levels of capital efficiency allocation.”

Meanwhile in the US, a consortium made up of the six states that comprise New England has just announced that it is applying to the federal government for funding for two transmission corridor projects that will unlock opportunities for offshore wind and energy storage.

One interesting aspect of that twin application is that the New England states noted that one of those two projects, Power Up New England, is supported by developers including Elevate Renewables.

Elevate is a BESS developer which was formed by power generation company ArcLight, which among other things owns a large fleet of thermal power plants throughout the US.

Its remit is to develop battery storage assets at those thermal power plants, which could potentially include co-locating batteries with existing generation, or replacing the legacy plants altogether.

It said earlier this month that in Connecticut, New England, it is advancing BESS developments at six ‘baseload’ thermal generation sites, as well as at a “number of” peaker plants in the state. This is in addition to projects it is “actively pursuing” in California ISO (CAISO), PJM, ERCOT, Southwest Power Pool (SPP), and MISO, and it anticipates being able to participate in “all major markets.”

“We are committed to redeveloping brownfield sites and optimising the utilisation of current energy infrastructure at strategic locations,” Elevate founder and head of development Eric Cherniss told ESN Premium.

“Our BESS facilitate the seamless integration of substantial offshore wind and other intermittent resources, deliver essential grid-supporting services, innovate grid management practices, and strengthen resiliency within the ISO New England region and across the country.”

Unprecedented systemic change

In both the South African and New England examples this week, keeping up with electricity demand growth and furthering the transition to renewable energy will likely need to lean on the sector’s investments of the past as well as the future.

They will also both leverage public-private partnerships, from the New England consortium’s request for state funding through the US Department of Energy (DOE) Grid Innovation Program, to South Africa’s forthcoming announcements on transmission buildout.

Eskom’s power stations are in potentially ideal brownfield locations for enabling the “capital efficiency allocation” that minister Ramogkpa referred to, “but Eskom’s balance sheet is constrained,” he told SABC on Thursday.

“So you need to work out your model for partnering with the private sector and getting skin in the game. What Eskom brings is its level of equity, the grid, the land… the infrastructure that already exists,” Ramogkpa said.

South Africa wants to “tap into the liquidity of the private sector,” but those assets will eventually revert to Eskom over time, he said, with the state continuing to be a “major player on the generation side,” not to be displaced permanently.

Coming from the regulatory angle, Elevate Renewables’ Eric Cherniss said too that for New England and the wider US picture, participation models need to be worked out and that “it takes a lot of coordination.”

“As a nation, we haven’t gone through a systematic change like this in our history,” Cherniss told Energy-Storage.news.

“When the industry made significant changes – decades ago – that was under a different regulatory environment, where transmission owners and generation owners were (often) under the same parent company.” Cherniss said.

Happy Friday!

This week on ESN Premium

Australia’s ‘Year of the Big Battery’ could be followed by a ‘Decade of the Smaller Battery’

Energy-Storage.news Premium speaks with Warwick Johnston, founder of solar energy consultants Sunwiz, on Australia’s distributed battery storage market dynamics.

Australia’s utility-scale battery storage market is on an upward trajectory, with around six times more capacity in megawatt-hours under construction at the end of last year compared to the end of 2022.

But we shouldn’t forget that the renewables market in the country is largely driven by what happens in behind-the-meter (BTM) settings, the rooftops of houses where the adoption of solar PV is higher than almost anywhere else in the world.

Mitsubishi Power’s BESS spinout and ownership restructure to make unit more ‘nimble and fast-moving’

The spinout and change in ownership of Mitsubishi Power Americas’ energy storage activities into standalone unit Prevalon will make it as “nimble and fast-moving as possible,” its CEO said, while not “chasing market share for the sake of market share”.

Prevalon CEO Thomas Cornell speaks to Energy-Storage.news, following the spinout earlier this year and a change in ownership structure which means Prevalon is now jointly owned by Mitsubishi Power Americas and ‘EES’, an entity representing Prevalon senior management and ‘some outside investment’.

Safety practices of the BESS industry, Part 2: Battery analytics

ESN Premium’s look at safety practices in the battery storage space continues with an example of how battery analytics helped a developer respond to community concerns.

Safety continues to be a number one priority for the battery storage industry but considering media reports around community opposition to new-build projects, that message is perhaps not filtering down to the public.

As we have seen in numerous territories in the US and UK in particular, battery energy storage system (BESS) is sometimes perceived by local communities as a potential fire and even explosion hazard.

In this series, we will look at some of the things that companies in the industries are doing to mitigate fire and explosion risk.

Tax credit transfer deals ‘not simple’ and carry different benefits, risk and downsides – ITC seller

The CFO of Goldman Sachs-backed US battery storage developer-operator GridStor discussed its recent investment tax credit (ITC) transfer deal for a California BESS project, highlighting some downsides as well as positives from the new mechanism.

The company sold the ITC for the 60MW/160MWh Goleta BESS project in California to JP Morgan this year after the project came online in late 2023. GridStor CFO Frank Burkhartsmeyer said the company “really liked the option” and that he was pleased with the execution, but that it did have some downsides.

Transferability for clean energy tax credits was brought in under the Inflation Reduction Act to simplify the form of investment and open it up beyond the handful of large banks that have previously dominated the tax credit investment space. Buyers can directly buy the credits associated with a project, avoiding the need to form complicated structures to avail of those credits via tax equity investment.

FlexGen to deploy 15MW BESS in Puerto Rico for Arclight and Infinigen

It will be deployed in the Yabucoa Municipality of Puerto Rico, an unincorporated overseas territory of the US in the Carribbean, paired with the YFN Yabucoa Solar Project.

FlexGen said it will provide reliability and flexibility to the local grid and comply with ‘some of the most demanding grid specifications’ from the islands’ transmission system operator (TSO) Puerto Rico Electric Power Authority, using its HybridOS energy management system (EMS).

Kelcy Pegler, CEO of FlexGen, added: “Energy storage is critical to helping Puerto Rico with extreme weather and grid reliability. The island also has some of the strictest grid requirements in the world.”

Puerto Rico has been rebuilding and increasing the resiliency of its energy sector over the last few years after hurricanes in 2017 and a 2020 earthquake damaged or destroyed up to 80% of its grid infrastructure.

This includes through grid-scale solar and storage projects like ones we’ve recently reported on by EPC firm DEPCOM and IPP Genera PR as well as home battery virtual power plants (VPPs) like a 17MW scheme spreadheaded by US residential energy solutions and management firm Sunrun.

Arclight is a US-headquartered independent power producer (IPP) of primarily gas plants but has made big plans to deploy BESS technology at those sites as they are brought out of service. It launched Infinigen Renewables with a US$400 million capital commitment in 2021 to develop and operate its renewables assets, while launching a separate BESS developer Elevate last year.

‘South Africa is a trailblazer’: Electricity minister opens solar-plus-storage plant with 1,140MWh BESS

“It’s significant. It’s significant that we’re hosting the largest project combination of renewable PV and also battery storage. [It] simply means South Africa is a trailblazer, and we want to retain that unassailable position, I think, as a country,” the minister told a reporter from state broadcaster SABC.

Asked what it meant for energy security, Ramokgopa said the project underlines the essential need to bring online more generation capacity to add to what is produced by state utility Eskom, to help South Africa come out of a “very, very difficult situation of load shedding”.

Ramokgopa was joined by Northern Cape provincial premier Zamani Saul and Scatec CEO Terje Pilskog on Thursday (18 April) at the site of the Kenhardt project, which features three separate solar-plus-storage systems.

With a combined solar generation capacity of 540MW, and 225MW/1,140MWh of battery energy storage system (BESS) technology, the project is providing electricity to state utility and grid operator Eskom under a long-term (20-year) power purchase agreement (PPA).

The plants began commercial operations in December before this week’s ceremonial unveiling. As part of ongoing efforts to mitigate energy supply and peak demand management issues, Scatec is contracted to supply 150MW of dispatchable electricity from the complex between the evening peak demand hours of 5:30 pm and 9:30 pm daily.

Transmission is the next problem for South Africa government to solve

South Africa’s grid is under frequent strain and Eskom is forced into frequent load shedding events along with unplanned power outages.

Solar PV arrays at the site. Renewables are growing “exponentially,” contributing to energy security, the minister said. Image:Dr Kgosientsho Ramokgopa via X/Twitter.

As a result, the government has turned to procuring energy capacity from private sector independent power producers (IPPs) and designing programmes such as the one which awarded Scatec its contract in Kenhardt to manage peak demand.

While the development of renewables is “growing exponentially,“ the government is investing in a combination of clean energy and fossil fuels to ensure there is “an energy future, ensure that there is energy sovereignty and security in the country,” minister Dr Kgosientsho Ramokgopa said.

For example, while the government has held seven bid windows for its Renewable Energy Independent Power Producer Procurement Programme (REIPPPP), and recently opened a third bid window for a battery storage equivalent, its Risk Mitigation IPP Procurement Programme has awarded contracts to natural gas power plant operators, as well as to developers of solar-plus-storage projects.

SABC reporter Ulrich Hendricks also asked the minister what is being done to fix the South African grid, noting that it remains the biggest challenge for the development of new capacity resources.

“You’re absolutely correct,” Ramokgopa said.

“If you take this, the project [at Kenhardt] is ‘overdesigned’. By that, I mean, at any given time, especially now [in the middle of the day], it’s producing more than what it’s dispatching, what it’s making available to the grid, and part of the limitation is the issues with transmission.”

The government, Eskom and the National Transmission Company of South Africa are working together to create a model to accelerate transmission buildout so that the country can take advantage of its rich renewable energy potential, including some of the highest irradiation levels in the world.

The minister told Hendricks that the limiting factor is the grid although land is available. Locating load as close as possible to demand is the best way to take advantage of that potential, and an announcement will be made soon on “how we’re not going to deal with transmission,” he said.

This will involve identifying transmission corridors that are initial “low-hanging fruit,” making development easier, while state utility Eskom’s thermal power plant fleet could provide suitable brownfield sites for siting new assets that offer built-in, existing grid access.

The minister did say in a post on Wednesday (17 April) to social media site X (formerly Twitter) that due to sustained generation capacity, there have been no load shedding events for 21 consecutive days, and that load shedding “will continue to be suspended until further notice.”

Tax credit transfer deals ‘not simple’ and carry different benefits, risk and downsides – ITC seller

Transferability for clean energy tax credits was brought in under the Inflation Reduction Act to simplify the form of investment and open it up beyond the handful of large banks that have previously dominated the tax credit investment space. Buyers can directly buy the credits associated with a project, avoiding the need to form complicated structures to avail of those credits via tax equity investment.

‘Not a simple process’

Firstly, the process is still complex: “Transferability is more straightforward than traditional tax equity but it is still not a simple process by any means. There’s still a lot of documentation and considerations to go through,” he said.

As he explained, transferability also has a few downsides. Transferability deals carry with them something called ‘recapture risk’, where a tax credit may be invalidated because of a mistake in the quantity or calculation within five years after the project’s commercial operation date.

“The buyer of the tax credit therefore really wants to be indemnified against that risk, so there are specific agreements and the option for insurance around that,” Burkhartsmeyer said. That can also affect the pricing of a tax credit deal, i.e. how many cents buyers pay on the dollar for a tax credit.

Transfer deals also mean that tax credit buyers give up the tax benefits of project depreciation over time, relative to the proportion of the project’s cost the tax credit covers (30% at the basic rate if wage criteria are met, up to 60-70% if all ‘adders’ including domestic content are met).

Because depreciation is accounted for as an annual expense, becoming an equity partner in the project via traditional tax equity structures would give them that benefit, whereas buying the ITC upfront does not.

The Goleta project used Tesla Megapacks, which may also qualify for the 10% domestic content adder to the ITC since the units are manufactured at the electric vehicle (EV) and energy storage firm’s Lathrop, California, facility.

However, as Energy-Storage.news has written frequently, further clarity on how to qualify for the domestic content adder is still needed by the industry.

The transferability market has taken off much faster than many expected according to tax credit transfer market ecosystem platform Crux, whose CEO Alfred Johnson discussed the market in a recent interview with Energy-Storage.news.

The firm’s data shows that energy storage ITCs were priced higher than any other tax credit at 94 cents on the dollar versus 89-93.4 cents for other types, although this was also because the projects were larger in size than other types which would also drive the price up, Johnson said.

Gridstor was formed in 2022 with funding from Goldman Sach’s Horizon Energy Storage fund and has acquired large project/project portfolios in California and ERCOT, Texas.

Clearway commissions California solar and storage projects as industry calls for Congressional action before election

The two projects are separate but located at the same site and represent a combined 463MW of solar PV and 186MW of battery energy storage system (BESS) capacity. The MWh (megawatt-hours) capacity wasn’t revealed, but California projects are typically 4-hour systems, equating to 744MWh of storage in this case.

Both projects have long-term contracts in place with utilities, both for-profit and non-profit. Victory Pass is contracted with Silicon Valley Clean Energy (SVCE) and Central Coast Community Energy (3CE) while Arica is contracted with Clean Power Alliance (CPA), Peninsula Clean Energy (PCE), MCE, Southern California Edison (SCE), NRG Energy, and consumer brand conglomerate PepsiCo.

Its announcement comes on the same day as 200 solar and storage companies co-signed a letter to congressional leaders urging new legislation to reform and improve permitting, project siting, transmission, and public lands for solar and storage projects.

The letter asked for action before this year’s Presidential elections in November and was sent by trade body Solar Energy Industries Association (SEIA), whose CEO Abigail Ross Hopper commented:

“There are hundreds of billions of investment dollars that depend on our ability to get clean energy projects sited, permitted and efficiently connected to a modern transmission system.”

“Lawmakers in both parties understand the importance of getting new energy infrastructure built quickly and efficiently. Now is the time for policy action to strengthen America’s energy industry and support local economies with jobs and private investments.”

Buy now or wait? Tensions pull at US battery energy storage procurement decisions

The risk of more restrictive trade policy in the future points to buying now, while technological advancements that promise energy density improvements favour delaying the procurement decision for a year or two.

First, the uncertainties

With virtually every utility-scale battery, reams of paperwork must be in order to demonstrate to US Customs and Border Protection officials that supply chains are free of forced labour.

Scrutiny has heightened in recent years following federal action that began in the solar PV sector aimed at preventing the import of solar modules that could contain components made by forced labour. A bill passed by Congress in late 2023 added new complexities.

A section of the National Defense Authorization Act that was approved on 22 December bars the Pentagon from buying batteries from Chinese suppliers alleged to have ties either to China’s military or the ruling communist party. The ban takes effect in October 2027 and targets CATL, BYD, Envision Energy Ltd., EVE Energy Co., Gotion High Tech Co. and Hithium Energy Storage Technology Co.

Although the enforcement date remains three years away, the congressional action had an immediate impact on the utility sector.

In early February, Duke Energy said it would decommission an 11MW/11 MWh lithium iron phosphate battery storage system at the Marine Corps base at Camp Lejeune, North Carolina. The system entered service in the spring of 2023 as part of a US$22 million energy services contract. It used a battery sourced from Chinese supplier CATL. Duke agreed to replace the CATL equipment with US-sourced battery technology.

That shutdown is the latest example of how trade policy between the two countries impacts US and Chinese businesses alike. The Camp Lejeune project’s high profile could result in ripple effects among other utility-scale project developers and their procurement decisions.

And the scrutiny over Chinese suppliers — which together control most of the global supply — comes at a time when battery design changes are driving efficiency gains that improve project economics by reducing balance-of-system costs.

From jelly roll to Z-stack

The improvements start with a shift from the standard “jelly roll” stack design to one that more closely resembles the letter Z. This shift allows for greater energy density within the same cell packaged into today’s standard 20-foot containers. That means a container using a Z-stack design can offer as much as 5.5-6MWh of capacity. Here’s how.

The jelly roll design layers the battery cell’s electrodes and separators. This cell is rolled into a cylinder and then inserted into a rectangular case. The roll does not fit cleanly into the rectangular can; instead, gaps are inherent in this approach and reduce the cell’s overall efficiency.

A Z-shaped design, by contrast, allows the electrodes and separators to be collapsed and folded to fit more neatly into the container. This design shift offers around a 10% volumetric energy density improvement using the same materials.

Liquid cooling

At the same time, manufacturers are moving away from air-cooled batteries to favour liquid cooling. That’s because cooling with air can result in uneven temperatures, which in turn can lead to accelerated cell degradation and safety issues. Liquid cooling reduces uneven temperature control and supports the move to larger Z-stack cell designs.

In practice, these improvements mean the same cell that earlier held a 280 Amp-hour (Ah) configuration can now hold a cell as large as 316Ah. This year and next will see a push by most manufacturers to install production lines to produce the more efficient Z-stack.

Battery maker BYD is taking a somewhat different approach to replacing jelly rolls. It introduced a blade-like design in which individual cells are placed in arrays when they are inserted into the battery pack. The company states this approach increases the battery pack’s space utilisation by more than 50% compared to earlier jelly roll designs.

Together, these developments leave procurement teams with a tough question: buy now and take delivery of what is a soon-to-be outmoded stack design or wait for a more energy dense Z-stack or blade model?

Buy or wait?

Given the uncertainty over potential congressional or Customs and Border Protection action, now may be the best time to import equipment from Chinese suppliers. Heightened scrutiny — akin to what solar PV procurement teams have experienced — raises the stakes and may lead to expedited buying decisions.

Prudent procurement teams will continue to demand robust traceability protocols and be ready to prove to border officials that components comply with forced labour federal requirements.

But buyers also shouldn’t lose sight of significant technological gains in the manufacturing pipeline — as Z-stack cell designs permeate the market, a patient, long-term view could pay dividends.

George Touloupas is senior director, technology and quality, for Clean Energy Associates. Jeff Zwijack is CEA’s senior manager of energy storage.

Britishvolt ESS gigafactory plan dead after Blackstone buys site for data centre

Receivers for one of the Britishvolt companies, Bob Maxwell and Julian Pitts of Begbies Traynor Group, told outlet the Guardian that Blackstone planned to turn the site into “one of the largest data centre facilities in western Europe”.

A blow to domestic battery production

Britishvolt emerged in 2019 with an ambitious plan to build a car battery gigafactory to rival the Chinese-owned AESC plant in Sunderland. Promising to generate as many as 3,000 jobs, Britishvolt won tens of millions of pounds of private investment but failed to secure the orders necessary for further funding.

In January 2022, then-Prime Minister Boris Johnson hailed the startup’s plans, and Britishvolt became a flagship of his levelling up policy. The government promised a £100 million subsidy to the company.

By August of the same year, the Guardian reported that construction of the 30GWh factory had been put on ‘life support’. Britishvolt collapsed into administration in January 2023, a year before the first batteries were due to be produced.

It was then acquired by Australia-based Recharge Industries, owned by investor Scale Facilitation, the following month. Scale’s CEO David Collard told BBC News at the time that the company would pivot the gigafactory to selling to producing batteries for the energy storage system (ESS) market, something McKinsey battery expert Dr. Nicolo Campagnol told Energy-Storage.news has upsides and disadvantages to it (Premium access).

Former Britishvolt employee and communications advisor Ben Kilbey said on Linkedin in reaction to the Blackstone news: “At the end of the day, after the farce of an administration and the complete car crash that was the potential purchaser – we should be glad that the land, which was starting to resemble an elephants graveyard, will be put to some use.”

See the original version of this article on our sister site Current.