Cell imbalances within BESS present significant challenges, leading to efficiency losses, safety concerns, and revenue impacts. These imbalances result from variations in individual battery cells’ quality and aging, affecting overall system performance. Imbalances can cause wasted energy, system stress, and increased downtime, posing operational and financial risks.

Battery analytics offers granular insights into BESS performance, enabling the identification and mitigation of cell imbalances. By providing detailed information on subsystem levels, analytics tools facilitate predictive maintenance and optimisation strategies. These insights help asset owners and operators maintain high availability, safety, and profitability of BESS.

Battery analytics also improve state of charge (SoC) accuracy, addressing limitations of traditional battery management systems (BMS). By offering precise SoC calculations, analytics tools enhance system reliability and performance, ensuring BESS meet their operational and regulatory requirements.

This webinar provides invaluable insights into the challenges, risks, and solutions associated with battery energy storage systems.

Gain a deeper understanding of the importance of proactive monitoring, maintenance, and the role of battery analytics in optimising BESS performance and ensuring regulatory compliance. Additionally, the expert speakers discuss industry best practices and emerging trends in BESS management.

Speakers:

Lennart Hinrichs, executive VP and general manager for Americas, TWAICE

Ryan Franks, senior technical solution engineer, TWAICE

[embedded content]

You can also register to watch the webinar from the on-demand section of the site, which will also enable you to access presentation slide deck, as well as all other Energy-Storage.news webinars.

Greece: €1 billion state aid approved by European Commission for solar-plus-storage CfDs

The other project, the Seli Project, will have 309MW of solar PV capacity and an integrated lithium-ion battery energy storage system (BESS). This project aims to optimise electricity generation and grid stability.

The EC did not disclose the storage capacity, nor output, on either project. Construction of both projects is targeted to be completed by mid-2025.

The financial aid will be carried out via a two-way contract for difference (CfD) over a 20-year period. The strike price will be determined by a technical committee on the basis of, inter alia, a cost-benefit analysis and a risk assessment. Whereas the reference price is expected to be determined as a monthly output-weighted average of the market price of electricity in the day-ahead markets.

In case of the reference price being lower than the strike price, the beneficiaries will be entitled to receive payments equal to the difference between the two; however if the opposite happens – reference price higher than strike price – the beneficiaries will have to pay the difference to Greek authorities.

The Regulatory Authority for Energy (RAE) of Greece is currently running a separate European Union-backed solicitation for energy storage, funded by the EU Recovery and Resilience mechanism. According to reports, in February the RAE narrowed down a shortlist of 1.5GW of bids down to around 300MW from 11 projects.

A previous auction round held in August 2023 selected 411MW of winning bids across 12 projects. In a deep dive article for Energy-Storage.news, analysis group LCP Delta noted that the first round had seen more than 27GW of unsuccessful bids. Greece is targeting 8GW of storage by 2030 through its most recent National Energy and Climate Plan (NECP). Meanwhile, sources have told this site that many of the winning bids in both rounds so far came in at very low prices which made it open to question whether those developers will be able to hit good IRRs.

To read the full version of this story, visit PV Tech.

Additional reporting for Energy-Storage.news by Andy Colthorpe.

‘Duke-CATL case won’t be unique’: BESS land grab to continue as curbs on China imports loom

The global average price of BESS for US deployment has been falling since peaking in 2022, as consultancy Clean Energy Associates’ (CEA) VP market intelligence Dan Shreve detailed in an article for the most recent edition of Solar Media’s quarterly journal PV Tech Power.

Discussing the dynamics in more detail at the two-day event, Shreve told Energy-Storage.news: “The BESS market land grab is primarily coming from Tier 2 providers sitting behind CATL, which has a massive market share currently.”

“Companies like EVE, REPT and Hithium are working aggressively to capture as much global market share as possible, growing their shipments 100%-plus annually, while CATL is a more moderate, but still impressive, 40%.”

(China-based CATL, Contemporary Amperex Technology Co., Limited, is the world’s largest lithium-ion battery cell manufacturer and a major supplier of BESS too.)

Some companies – not necessarily those listed above – are going as low as US$110 per KWh for 20-foot DC BESS units, Shreve added. New players from China have emerged on the global scene due to fierce domestic competition and oversupply there, including Hyperstrong, a sponsor and speaker at the Summit.

Part of the growth in Tier 2 (and 3) providers is being driven by a desire from diversification from the buyer side. That was something alluded to by developer Available Power’s president Ben Gregory in an interview, also at the event, where he suggested that other projects may go the way of a Duke Energy-CATL unit at a US military base and see their BESS equipment from China removed because of political pressure.

“The pricing is attractive from China, but other countries are nearing price parity. China will likely continue to dominate the market right now, but there’s going to be a lot more political pressure, like we saw with the Duke-CATL project,” Gregory said.

“I don’t think that case will be unique, so we are diversifying our supply chain to mitigate political risk.”

CATL called the accusations underlying the decision “false and misleading” in a statement shortly after the BESS unit was turned off, in December 2023. February 2024 saw the decision taken by Duke, under pressure from the US Congress, to remove the units entirely.

In the rest of the interview, Gregory discussed the positive impact that the falling price of BESS is having on downstream deployments and M&A activity.

The growing potential of trade rules to the detriment of BESS products from China, as well as the size of the US market, are also leading to “aggressive” moves to gain a foothold there and abroad.

“There are some companies working very aggressively to gain a toehold in the US. By global deployments, its China, the US and then everybody else, so it is enormously important to establish a toehold here, especially in the light of massive oversupply in China,” Shreve said.

“In addition to the US, you may see other markets work to curb imports from China, so whatever market relationships can be developed before that happens is very important.”

The US already applies a 10.89% Section 301 tariff to BESS from China. This, combined with incentives from the Inflation Reduction Act, could make US-made BESS cost-competitive with those from China, CEA said in October.

The US could theoretically apply additional duties under separate protocols. For solar PV modules, it applies additional tariffs through the antidumping and countervailing duty (AD/CVD) scheme. The long and complicated recent history of that has been covered extensively by our sister site PV Tech.

Belgium’s energy minister visits flow battery, BESS sites, TotalEnergies announces next project

The 25MW/75MWh Li-ion project is due for completion by the end of this year, with 40 containerised BESS solutions provided by battery manufacturer and storage system integrator Saft, owned by TotalEnergies.

It is the energy company’s largest battery project in Europe to date, and TotalEnergies used the occasion of the minister’s visit to announce a second project of equal sizing and capacity in the country, roughly a year after the Antwerp refinery project was announced.

Also being deployed at one of TotalEnergies’ petrochemicals refineries, this time in Fuloy, Wallonia province, the project will again have a power rating of 25MW to 75MW capacity, for a 3-hour duration. As with the Antwerp project, Saft’s Intensium Max High-Energy BESS solution will be used.

The company claimed the two projects represent a total investment of about €70 million (US$75.43 million), with the Fuloy project expected to go into commercial operation by the end of 2025.

TotalEnergies aims to develop 5GW of its own battery storage projects globally by 2030. It has already delivered four projects in France which were awarded 129MW of ancillary services contracts from the grid operator RTE.

As with the two new projects in Belgium, TotalEnergie’s French BESS sites are all located at various refineries and platforms the company owns and operates, benefiting from available land and perhaps more importantly, grid connections.

In January, TotalEnergies acquired German BESS developer Kyon Energy, for €90 million (US$98 million) upfront, plus further payments linked to development targets, while a few months back in October, the French company switched on a 255MWh Saft BESS at a solar PV plant in Texas, US.

Within Belgium, TotalEnergies has a combined cycle gas turbine (CCGT) power plant, a pumped hydro energy storage (PHES) plant and an offshore wind farm, while it is also developing further wind plants and solar PV projects.

Belgium is becoming a market that represents good opportunities for battery storage assets, due to its congested grid with a rising share of renewable energy. In an Energy-Storage.news webinar to be hosted tomorrow (4 April) with consultancy Clean Horizon, Bart Pyke of Belgian route-to-market optimiser Yuso will discuss the business case and fundamental drivers for storage in the country’s energy markets.

VRFB inauguration at industrial site

Last week (27 March), minister Van Straeten was at the inauguration of a 0.8MWh vanadium redox flow battery (VRFB) system co-located with a 0.6MW solar PV array at an industrial site in the East Flanders city of Aalst.

Provided by Anglo-American flow battery tech company Invinity Energy Systems in partnership with the Belgian subsidiary of another French multinational, ENGIE, and energy and technical services firm EQUANS, the flow battery is installed at the headquarters of Jan De Nul, a civil engineering firm.

ENGIE’s energy management system (EMS) will control the batteries as they store energy generated from the onsite solar PV for use in the evenings. Invinity said it, ENGIE and EQUANS hope to use the project to better understand how flow battery technology could be used at such sites as an alternative to Li-ion.

Currently, Belgium’s two biggest battery storage systems are a 50MW/100MWh system in Wallonia from French developer Corsica Sole, and a 25MW/100MWh system in Ruien by a Nippon Koei-Aquila Clean Energy joint venture.

Minister Van Straeten also attended the inauguration of the Ruien project, which is optimised by Yuso.

In November last year, Belgium’s grid operator Elia awarded 15-year Capacity Remuneration Mechanism (CRM) contracts to 357MW of new-build BESS projects. Those capacity market contracts are thought to represent a relatively small portion of the revenue stack available to BESS assets in the country, but offer long-term revenue certainty, while other applications include the lucrative frequency control reserve (FCR) and secondary reserve ancillary services products.

Optimiser Flower buys 42.5MW BESS in Sweden from OX2 in milestone deal for both firms

It is expected to come online in the current (Q2) quarter and OX2 will continue to provide technical and commercial management of the project for five years thereafter.

The deal, which still needs approval from the Swedish regulator, represents a big ‘first’ for both companies.

First owned BESS project for Flower, first BESS sale for OX2

For Flower, it is the company’s first large-scale owned BESS project, something CEO John Diklev told Energy-Storage.news the firm was considering in order to prove its ‘long-term’ optimisation and asset management model in an interview earlier this year (Premium).

Optimisation and virtual power plant (VPP) companies do not typically own their own BESS projects, and instead contract with project owners to trade using them on their behalf.

Diklev explained in our interview that Flower wants to enter into 5-10 year electricity market risk management agreements with customers, using BESS and other assets, but needs equally long partnerships with BESS owners to do that.

In the absence of such available partnerships, owning BESS was an option but “…only if it necessitates it,” he said. The company increased its available funding to SEK600 million (US$55 million) last month through debt funding from Norion Bank.

“Project Bredhälla will help us stabilise the electricity grid, reduce volatility in the electricity markets and act as a hedge for our solar and wind power partners,” commented Flower’s chief strategy officer Emma Hellström.

The company is mainly active in Sweden but has pan-European plans, and at the time of our interview managed around 25MW of large-scale BESS.

For OX2, it is the company’s first transacted BESS project, having primarily worked in wind and solar until now.

The company’s model is typically to sell at the ready-to-build (RTB) stage but the different approach in this case – work started on the unit in late 2022 – was explained by the company’s technical lead for energy storage Michiel van Asseldonk in an interview (Premium) at the Energy Storage Summit Central Eastern Europe 2023 in Warsaw, Poland.

He explained that the firm “saw a lot of value” in keeping the asset during construction and then revisiting the sale later and was also considering the potential combined sale with a Finnish BESS project it is developing.

The Bredhälla project will be the largest BESS in Sweden when online, though a much larger 93.9MW/93.9MWh project is being built by Neoen and Nidec for a 2025 commissioning.

BESS projects in Sweden primarily target the country’s ancillary service markets, historically provided by hydropower assets which are increasingly being displaced by BESS. Some 200MW of BESS is expected to come online this year according to another optimiser Flextools.

South Africa’s DMRE launches third round of grid-supporting BESS procurement

DMRE has also revealed that special purpose vehicle (SPV) AGV Projects is the fifth preferred bidder status winner from the first BESIPPPP bid window, following awards to Norway’s Scatec for one and a consortium of Copenhagen Infrastructure Partners (CIP), utility EDF and IPP Mulilo for the other three.

AGV Projects will build a 153MW BESS, Red Sands, at Eskom’s Garona substation for a total cost of ZAR6.43 billion (US$341 million), bringing the total round one projects to 513MW/2,052MWh.

The BESIPPPP projects will provide Eskom with capacity, energy and frequency control via ancillary services Instantaneous Reserves, Regulating Reserves, Ten Reserves and Supplemental Reserves, under 15-year power purchase agreements (PPAs).

Eskom has in general struggled to prevent frequent and widespread load shedding and power outages and plans to use BESS to increase resiliency on the grid.

DMRE has also extended the bid submission deadline for the second bid window of BESIPPPP, from 30 April 2024 to 6 June 2024, and done the same for the seventh bid window of the separate Renewable Energy Independent Power Producer Procurement Programme (REIPPPP). BESIPPPP round two will procure 615MW/2,460MWh.

The government of South Africa uses REIPPPP to procure large-scale solar and wind capacity, and has been covered extensively by our sister site PV Tech, and its latest bid submission deadline has been pushed to 30 May 2024.

It is also procuring BESS through another scheme, the Risk Mitigation IPP Procurement Program (RMIPPPP) for generation-plus-BESS projects, with winning parties including Scatec and Saudi-based ACWA Power.

The launch of BESIPPPP last year and its 70% round-trip efficiency (RTE) provoked some lively debate around whether flow batteries would be able to compete with lithium-ion for projects (Premium access), though winning projects so far appear to have utilised lithium-ion.

US developer/IPPs Lightshift and MN8 raise US$425 million for storage and solar

Lightshift said it has 20 battery energy storage system (BESS) projects contracted to-date and a total pipeline of over 4,000MW. To-date it has mainly deployed and projects in the 3-20MW range in the Northeastern and Southeastern regions of the US, a project size often called ‘distributed’ in the US market.

In November and October 2023 it announced four projects for Massachussetts municipal utilities: a 3MW/9MWh system for PMLD, two separate 2MW/9MWh projects for GELD and a 5MW/22MWh system for HMLD. Its first project was a 10.5MW/24.5MWh system in Virginia for Danville Utilities in 2022.

Alongside the utility play, a large part of the market opportunity in Massachusetts is around attaching BESS to community solar projects, a segment driven by the state’s SMART programme. Other developers active there include Agilitas Energy and BlueWave (Premium).

Greenbacker already invested US$20 million in Lightshift/Delorean back in 2021.

Goldman Sachs spinout MN8 Energy bags US$325 million for solar and storage

In concurrent news, solar and storage developer and operator MN8 Energy has secured a private placement of US$325 million through selling convertible preferred stock to two investment firms.

US$200 million of the investment came from Mercuria Energy Group while the remaining US$125 million came from Ridgewood Infrastructure. Mercuria will obtain one board seat as well as an observer seat on the MN8 board, while Ridgewood will have an observer seat.

Jon Yoder, president and CEO of MN8 Energy said: “Our agreements with Mercuria and Ridgewood provide us with the financial means and capital to scale our growth, engineer innovative solutions for our clients and deliver enhanced value to our shareholders.”

MN8 was founded inside Goldman Sachs Asset Management as Goldman Sachs Renewable Power in 2017. In 2022 it was spun out into a separate, independently-owned company called MN8 with around 100 employees moving to the new entity.

MN8 said it has 3.2GW of solar PV projects spread across 875 projects in 28 states, an average project size of just over 3MW, and serves ‘enterprise customers’, implying it has a commercial and industrial (C&I) segment focus. However, it is in the grid-scale segment too, buying a stake in a 200MW California project in 2022, reported by our sister site PV Tech.

It also said it has 270MW of battery storage projects as well as EV charging solutions, though didn’t reveal how much of these are operational versus in development or deployment.

Fluence to start shipping BESS for German TSO’s 250MW Grid Booster after local authority approval

It marks the formal completion of the approval process and means shipments and construction of the BESS can begin, with deliveries from Fluence expected to begin this year. The approval of the construction site had already occurred in August 2023, and a groundbreaking ceremony is expected in June 2024. The project is scheduled to be online in 2025.

The BESS will act as a strategic network node along a transmission line, mimicking the line’s injection or absorption of power into the system. That will prevent the need for extra transmission line investment, as well as allow TransnetBW to operate the line’s more efficiently.

It can also act as a safety buffer in the event of a fault by replacing the power a transmission line would provide, reducing the need for an extra line.

The news follows another of Germany’s TSOs, Amprion, getting the green light from the German regulator for five smaller Grid Booster projects, also totalling 250MW, last month. Those will be built at the 110kV level of its network in the states of Bavaria-Swabia and Rhineland-Palatinate.

Fluence’s senior manager for policy and market development Lars Stephan explained the calculations underlying the approval of Amprion’s projects in Linkedin comments detailed in our coverage of Amprion’s announcement.

The US-listed company has made the segment, sometimes called storage-as-transmission, a strategic focus.

The Grid Booster concept was introduced in Germany five years ago. Other similar projects have been deployed in Lithuania and Brazil, while US states, such as New York, have deployed similar, smaller-scale ‘non-wires alternative’ projects.

The three states mentioned earlier where Grid Boosters are being deployed in Germany are three of the six most populous in Germany and all in the south and south-east of the country. Part of the underlying reason for the Grid Booster system is that the south accounts for the majority of the country’s electricity demand, while generation from wind, solar and other resources is primarily in the north, making long, high-voltage transmission lines a key part of the German power infrastructure.

California regulator approves export regime for PV, energy storage to avoid costly grid upgrades

“Now, by taking into account the grid conditions at their proposed project site, and designing an export schedule based on those conditions, project developers have a means to avoid potentially costly grid upgrades,” wrote the Interstate Renewable Energy Council (IREC), a non-profit that has lobbied in support of the adoption of LGPs, in response to CPUC’s decision.

“Not only will this save money for individual developers and customers, it will also enable the grid to accommodate significantly higher levels of renewable energy at a lower overall cost.”

The proposals were submitted by the Pacific Gas and Electric Company, Southern Edison Company and San Diego Gas & Electric Company, utilities that serve around 24 million customers in California. CPUC has been considering the proposals since 2022, and the decision follows growing interest in updating California’s grid infrastructure, with around US$370 million in new grid investment required in the state.

To read the full version of this story, visit PV Tech.

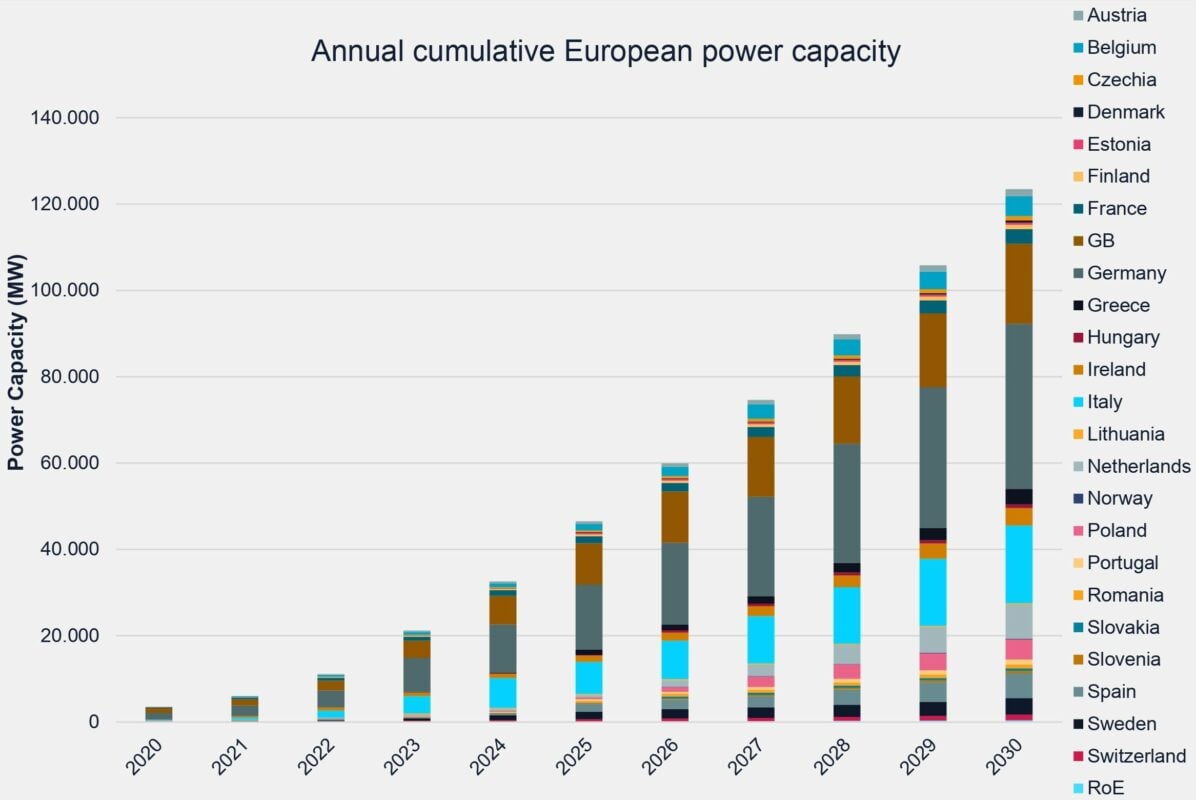

Europe installed 10GW of energy storage in 2023, EU policies to drive major growth this decade

It found that total installations in Europe – including European Union (EU) and non-EU countries – across the residential, utility-scale, and commercial and industrial (C&I) market segments throughout last year added up to around 10.1GW.

That was more than double the 4.5GW recorded across Europe for 2022, and way above the 6GW forecast for 2023 by LCP Delta in last year’s EMMES 7.0 report published around this time last year.

The “impressive results” were driven by a combination of support schemes and improving market conditions for storage, LCP Delta said.

One key takeaway, which we wrote about in the most recent ESN Premium Friday Briefing, was the split between front-of-the-meter (FTM, utility-scale) and behind-the-meter (BTM, residential and C&I). There were around 2.7GW of FTM installations completed in 2023, versus around 7.3GW of BTM systems installed.

Over 500,000 residential systems deployed in Germany last year

In a webinar held earlier this month to preview and discuss the results, LCP Delta analyst Silvestros Vlachopoulos said that the BTM figure was 2.5x higher than the 2.7GW total that had been forecast a year previously.

The analysis “missed the mark by far,” Vlachopoulos said, because there was an underestimation of demand in the two leading markets in Europe for residential storage systems: Italy and Germany.

In Italy, a ‘Superbonus’ subsidy scheme for energy technologies including energy storage and renewable heat is being phased out and lower rates were paid out in 2023. While LCP Delta had thought this meant the high demand period was over, consumers’ appetite for batteries, typically paired with home solar PV systems, persisted.

Meanwhile in Germany, demand has been high for some time, particularly following the Russian invasion of Ukraine, and higher energy prices coupled with energy security fears. However, in 2022, the supply chain was constricted and storage systems couldn’t be sold and deployed fast enough to meet demand due to low stock availability.

That situation has eased up more than anticipated, “stock availability grew and was able to meet market demand,” and German households installed more than 500,000 residential battery systems in the past year.

Residential dominated the BTM segment, and another dynamic was that average system sizes across Europe continued to grow.

In the front-of-the-meter segment, LCP Delta’s forecast was conversely higher than the final tally, although with much less disparity than in the residential estimation.

Projects forecast to come online in 2023 experienced delays due to factors including grid connection waiting times as well as regulatory and policy uncertainty, while around half of a 1.7GW portfolio being built by Enel in Italy was expected to go into commercial operation last year but has been pushed back – albeit those projects are still going ahead and expected to be completed soon, the analyst said.

The next year or two will see much-improved prospects for FTM storage in selected markets, with Italy again a standout, due to grid operator TERNA forecasting a need for 8GW/70GWh of deployments by 2030 and targeting the procurement of a portion of that sum through the forthcoming MACSE capacity market tenders.

“A lot of capacity” will be unlocked in the Netherlands in the medium-term through improving market conditions, while Belgium and Poland’s capacity market auctions will drive deployments towards the end of this decade.

The storage durations of utility-scale FTM projects in Europe is expected to “grow very fast, very soon,” Vlachopoulos said, with roughly 1.5-hours the average duration for >10MW projects deployed in 2023. There are increasing numbers of 2-hour duration projects being built, while development pipelines in “multiple countries” include 4-hour projects.

‘Mismatch’ in Europe between deployment speed and need for storage

Jacopo Topsoni, head of policy at EASE, said that there is growing recognition at both EU level and at national level that there is a mismatch between deployment rates in Member States and the amount of storage that will be required to meet EU goals on renewables and electricity system flexibility.

National policymakers in the EU will have “several tools at their disposal” to address this mismatch. These include making regulatory changes to remove barriers to storage deployment, introducing or reforming capacity market mechanisms, introducing national targets or strategies, and introducing support schemes and storage-specific auctions.

Topsoni noted a “shift in policy trends,” had occurred in 2023, from national policymakers in Europe being focused previously on setting basic frameworks for increased market participation of storage, by adding new revenue streams and opening up markets to aggregation and other business models.

This has again shifted, and in short, there is “recognition there needs to be more deployment,” Topsoni said, noting that there will be more grid services products rolled out, removals of tariffs and grid fees, and more favourable tax conditions in general.

There is also the Electricity Market Design (EMD) reform process, which is ongoing, and Topsoni said that both the European Commission and pan-European regulator ACER have been “vocal” about removing barriers to storage deployment through this process.

While still a work in progress, EMD will introduce requirements for Member States of the EU to make regular flexibility assessments of their electricity grids, which will in effect mean they must also create targets for energy storage, which is a key tool to add that flexibility. EU nations can then introduce support schemes to get to those targets.

This is very different from the current situation, where only a handful of states, such as Spain and Italy, have introduced strategies or targets around storage. Germany is another which is presently formulating its own strategy.

However, while Member States will be mandated to reach those national flexibility objectives, they will not be introduced until 2027. While countries are free to go faster than mandated, it seems likely EMD will not present a significant boost to deployments until the latter part of this decade, Topsoni said.

The EASE policy director also said that creating a methodology for assessing flexibility needs will be challenging, and that it is essential the association of grid operators, ENTSO-E, and regulator ACER, get that part right.