The value battery energy storage system (BESS) technology can provide will be measured by the flexibility it adds to an energy network, combating associated volatility and grid fluctuations.

That means making thousands of measurements per second in real time and matching them to forecasts of everything from weather data impacts on renewable generation to expected demand for energy, before using that information to make intelligent trading choices for the energy stored in the batteries.

enspired is a leading service provider for the commercial optimisation of power assets, implementing the most technologically advanced, data-driven and fully automated trading strategies to maximise profitability and minimise emissions.

With the primary focus on battery storage, enspired specialises in revenue diversification across relevant markets, taking into account warranty terms such as safety aspects and asset degradation as well as commercial restrictions.

The company’s in-house AI trading platform is the fastest on the European short-term power market, enabling customers to monetise the full potential of their flexibility with minimum time-to-market.

Energy and software expert Jürgen Pfalzer is chief growth officer (CGO) at enspired.

Energy-Storage.news: At which stage of a project can an optimiser step in?

Jürgen Pfalzer, enspired: Ideally, a battery optimiser gets involved as early as possible – that means as soon as project planning starts and before investments, land acquisition and building permits are settled.

Early involvement and consultation with all stakeholders puts you in the best position to evaluate the business case and revenue potential. It allows you to advise the customer on complex matters like warranty conditions, asset sizing, financing and optimisation.

How does the optimiser’s commercial optimisation model work?

Trading strategies are designed to leverage the revenue streams that exist in the markets. Concretely, you access ancillary services, wholesales and balancing mechanisms (plus additional ones if available) to identify favorable market conditions for revenue stacking.

Deciding on a daily basis where to allocate battery capacity, all the while staying within commercial and technical limitations to prevent asset damage, yields optimal results for the customer.

What can a partnership between optimiser and asset owner look like?

“Adding a human element to an otherwise algorithmic equation makes all the difference.” Image: enspired.

Transparency and knowledge sharing are key. An optimiser should maintain an intensive exchange with clients to ensure a thorough understanding of all asset specifications, so that marketing strategies can be implemented in full accordance with customer needs.

A partnership that emphasises joint development and innovation nurtures a successful response system, meaning you can react quicker and better to changes in the market and revenue streams.

Adding this human element to an otherwise algorithmic equation makes all the difference when it comes to customer relations.

What is the optimiser’s approach to the warranty terms and technical restrictions of a battery storage system, including lifecycle, throughput and state of health?

It is of the essence to optimise within the warranty terms and technical asset restrictions defined by the manufacturer. Any additional customer-specific requirements, especially concerning the degradation curve, should also be taken into account.

This brings us right back to the importance of collaborative conduct in a partnership. In the interest of transparency, optimisers must educate clients on the commercial impact of additional technical limitations.

How does the optimiser verify the economic viability of potential revenue streams for an asset?

There are two components to consider here. First of all, it is crucial to note that nothing and no one can predict the future with 100% accuracy. But: if a vast array of long-term data is extensively backtested, trading strategies become highly reliable in their anticipation of market conditions.

Historical data tells us how certain assets behave in certain market environments and situations. Optimisers can ensure a comprehensive data pool, by using a combination of long-term forecasts from third-party providers and their own backtests. From this, trading models can draw accurate conclusions about the market and react accordingly.

The second consideration is the asset’s exposure to the market. In mature markets, we observe a preference for fully merchant batteries because customers profit more if they carry the complete market risk.

In younger markets, on the other hand, customers often inquire about a floor price or tolling agreement to secure revenues in an insurance-like manner. However, this impacts pricing and results in a lower revenue split for clients, which is why most of them opt to go fully merchant and keep a higher share instead.

Does the optimiser have access to all revenue streams needed to build a viable business case, and can they ensure BESS availability?

Jürgen Pfalzer, Chief Growth Officer at enspired, comes from an educational background in management and entrepreneurship, with 25 years of experience in the energy and software industries. Image: enspired.

Creating access to all relevant markets for the identification of lucrative revenue streams is in the very job description of an optimiser and route-to-market provider.

Historically speaking, ancillary services were the main source of revenue for batteries, but now that we can tap into the wholesale market, balancing mechanism and other revenue streams, we can implement superior diversification strategies. Asset availability as such is the responsibility of the asset owner and operator.

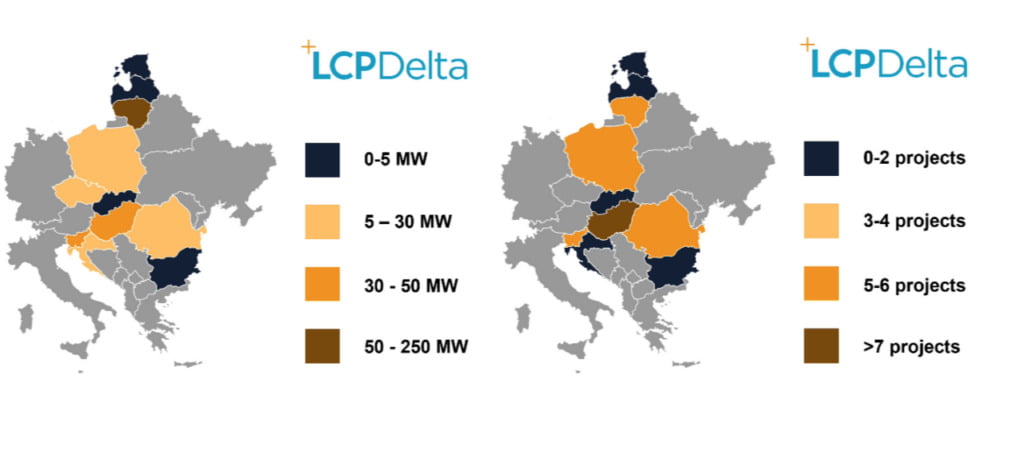

What is the optimiser’s geographical market reach, and what are some of the key differences in these markets?

Being able to branch out across different countries solidifies an optimiser’s market expertise. Current markets of interest in Europe include the UK, Germany, Belgium, the Netherlands, France and Austria.

It is also important to proactively scout emerging new battery markets. Going forward, Spain, Portugal, Greece, Italy and Poland look very promising.

Of course, none of these countries are one and the same when it comes to BESS marketing. Different markets have different revenue streams you can stack, typically between ancillary services, wholesales and balancing mechanisms. For the customer, it’s an added value if the optimiser can seamlessly apply existing technology to new revenue streams with country-specific parameters.

How does the optimiser benchmark returns and asset performance against those of competitors?

Due to the increasing demand for algorithmic trading services, more and more providers are surfacing on the market landscape, and it is crucial to compare them. We at enspired have a proven track record of outperforming the traditional revenue stacking approach by 30-60%, and this is the standard we aim for.

A networking event held by enspired near the company’s HQ in Vienna, Austria earlier this year. Image: enspired.

How does the optimiser ensure asset independence in trading strategies?

Employing algorithms and operating fully digitally without human interaction guarantees that every asset is individually optimised against the market.

Trading strategies for different assets must be mutually unaware to eliminate the possibility of preferential treatment of a specific client. Moreover, asset marketing depends heavily on the technical restrictions agreed upon with the customer. These variables affect how the trading strategies behave and react in the markets.

How important is the technological setup of an optimiser?

Very important. It makes a huge difference whether optimisers use third-party software or their own platform. Having this whole infrastructure in-house allows you to offer a fully integrated service and continually optimise it, which benefits the reactivity to new revenue streams, the deployment of new features and the adaptation to new countries and market designs (e.g. different types of intraday auctions).

Since these things can take third-party software developers six to 12 months or even longer to implement, working with an independent service provider with an in-house platform is in your best financial interest.

Learn more at https://www.enspired-trading.com/

Continue reading