The developer said the combination of debt and tax equity financing will go towards its Kuna project near Idaho’s capital city, Boise.

The 150MW/600MWh asset is scheduled to go into commercial operation in mid-2025 and is expected to be the northwestern state’s largest BESS project to date when it does.

The new financing package comprises US$90 million in tax equity funding, alongside a US$233 million green loan including construction and term loans, a tax equity bridge and a letter of credit facility.

As with other recent financings, the investment has been participated in by a raft of major global finance institutions. ING Capital, Société Générale and the New York branch of the Industrial and Commercial Bank of China led debt financing.

Deutsche Bank Trust Company Americas and US Bank were also involved, as coordinating lead arranger and lender, and depositary and collateral agent, respectively.

Meanwhile, the tax equity investment was led by UK Bank subsidiary US Bancorp Impact Finance, which the bank launched in 2023 to make tax credit investments and other financial solutions to impact-focused customers.

Aypa has secured a long-term offtake agreement for the Kuna BESS project with utility Idaho Power. Idaho Power, the state’s monopoly electricity supplier, modelled 1,373MW of energy storage in its preferred resource portfolio from its most recent integrated resource plan (IRP) in 2023, including resources already contracted for to come online this year and next, like Kuna.

Its first two build-own-operate BESS facilities were constructed in 2023 by BESS system integrator and manufacturer Powin Energy.

For developer Aypa Power, the finance raise follows recent progress on its 400MW/1,600MWh San Gabriel standalone BESS project in California and 100MW/200MWh Stargazer solar co-located BESS in Texas, as reported in depth by Energy-Storage.news Premium in late June.

The company claims to have more than 22GW of energy storage projects in development including standalone and hybrid facilities across the US.

Manulife invests in dispatchable storage and peakers

Hunt Energy Network, a developer of dispatchable energy resources including energy storage and fossil fuel peaker plants, has secured a US$250 million funding commitment from Manulife Investment Management.

The investment arm of global insurance company Manulife is contributing to financing a network of resources which Hunt Energy Network will develop and operate across the ERCOT Texas market.

While details of specific projects were not given, the developer said the portfolio will include energy storage and thermal peaking capacity.

There would also be ‘significant’ onsite fuel storage at the peakers, which Hunt claimed would be able to run on a variety of fuel types and therefore would not be dependent on natural gas supply chains.

The new projects could also be leveraged as customer-sited backup power when not participating in ERCOT markets.

The new commitment follows a previous, separate one, made by Manulife three years ago, as it committed US$225 million to create a joint venture (JV) with the developer.

That JV, HEN Infrastructure, develops and operates distribution-level energy storage resources in ERCOT. To date, 270MW of storage has gone into operation through it, with a further 80MW in development pencilled in for completion early next year.

Over US$3 billion financings announced since mid-July

The announcements follow other financings for energy storage and solar-plus-storage in the multiple hundreds of millions of dollars reported by Energy-Storage.news and our colleagues at PV Tech over the last few weeks alone.

RPlus Energies, a developer of renewables and storage including both batteries and pumped hydro energy storage (PHES), raised more than US$1 billion for a solar-plus-storage in Utah, and Intersect Power closed two financing deals worth US$837 million for three ERCOT projects. Both items were reported on the same day (18 July) by Energy-Storage.news.

Then, Clearway Energy Group closed a US$700 million construction financing transaction on a portfolio of California solar-plus-storage plants (reported 24 July), before just under a week later, independent power producer (IPP) Enlight Renewables said it had secured US$400 million towards a solar-plus-storage project in New Mexico which will feature 1.2GWh of BESS capacity.

At the beginning of this month, we reported that a trio of IPPs and developers, Eolian, BrightNight and esVolta, raised over a billion dollars between them for hybrid and standalone projects around the US.

IPP Ørsted targets 1GW of BESS in US Midwest

The pair have submitted interconnection applications for the projects which total 1GW, in the Central and North regions of the Midcontinent Independent System Operator (MISO).

MISO Central includes Wisconsin, Masachussetts, Illinois and parts of Indiana, Kentucky and Missouri, while MISO North covers Minneapolis, Iowa, North Dakota, part of Montana and South Dakota, and the Canadian province of Manitoba.

Ørsted will have the option to acquire an ownership stake in the projects as they mature, it added. The company is mainly known for offshore wind but has been making a push into solar and storage in the last few years. But this partnership is its first foray into large-scale standalone energy storage with a portfolio of multiple projects.

It built its first standalone BESS, a 20MW system in the UK, five years ago, and two years later added a 40MW BESS to a solar project in Texas. More recently it added a 300MW/1,200MWh BESS to its Eleven Mile solar project in Arizona, for which it secured financing with JP Morgan earlier this year.

It is also starting to deploy large-scale BESS in Europe. In June it made a final investment decision (FID) on a 300MW/600MWh BESS (premium access) co-located with a 2.9GW wind project off the coast of England, UK.

Global BESS landscape became less consolidated in 2023, Tesla takes top spot

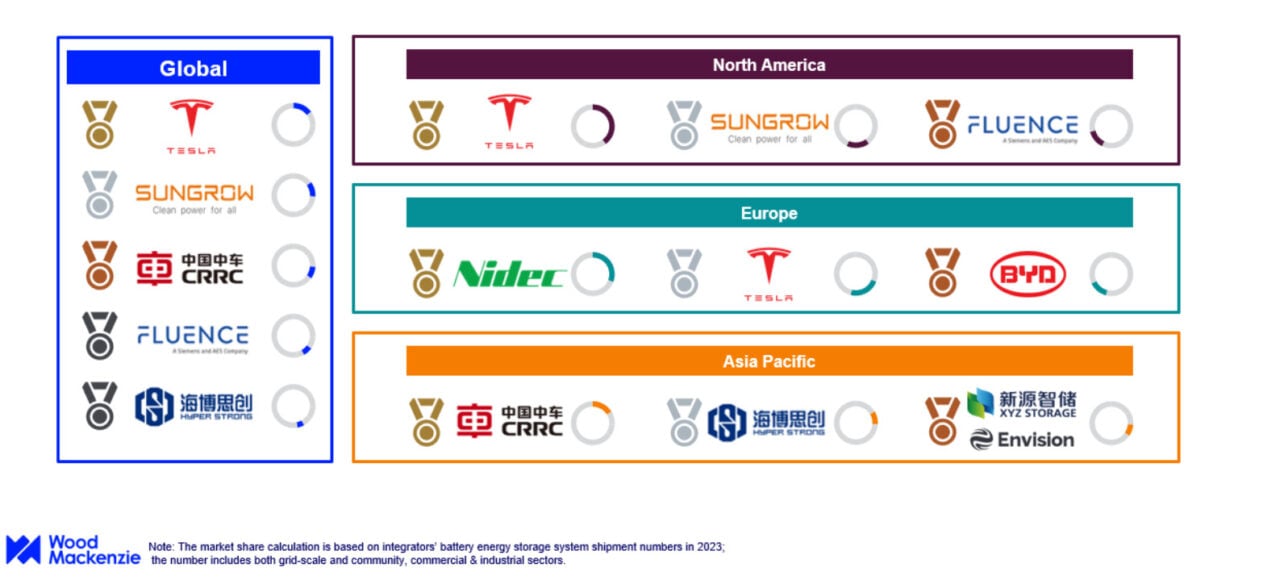

EV and BESS firm Tesla has taken the top spot from inverter and BESS company Sungrow, as shown in the left of the infographic above, while the third-largest is power and industrial solutions firm CRRC, followed by pure-play BESS integrators Fluence and HyperStrong. Sungrow, CRRC and HyperStrong are based in China while Tesla and Fluence are US-headquartered. Six of the global top ten providers are China-based.

Wood Mackenzie’s Kevin Shang, principal research analyst, energy storage technology and supply chain, said: “The global BESS integrator market is becoming increasingly competitive, especially in China, resulting in declining market concentration. As a sector with a relatively low entry barrier, the BESS integrator industry has attracted a significant number of new players.”

The firm’s data includes both grid-scale and commercial & industrial (C&I) projects. Energy-Storage.news has reported extensively on the falling price of BESS because of increased competition.

However, Wood Mackenzie’s research showed that the regional energy storage markets of North America and Europe have actually become more, not less consolidated by the top three providers. In Europe, power solutions firm Nidec, Tesla and BYD – Tesla’s biggest competitor, also China-based – increased their market share, from around 54% in 2022 to 68% in 2023.

The same trend was noted in the US, with Tesla, Sungrow and Fluence remaining market leaders and increasing their share to 72% compared to 60% in 2022.

Wood Mackenzie also said Chinese companies strengthened their position in the Asia Pacific market although didn’t provide numbers in its press release.

“Tesla has the energy storage industry’s most vertically integrated supply chain, from manufacturing hardware to providing energy storage solutions. This enables Tesla to deliver continued improvements and new features to clients quickly and helps customers maintain storage assets for their entire lifespan,” Shang added.

“Importantly, established companies have also been bolstering their competitiveness in terms of price, performance of products and solutions across all regions.”

While the BESS landscape is becoming more competitive, providers are increasingly converging on the same, 20-foot 5MWh-plus form factor as the standard product, as covered in a recent article (Premium access).

Brookfield commences permitting for Oregon 4GWh hybrid BESS facility

The NOI, filed 30 July 2024, is stage one of a seven-step procedure, typically taking one to two years and administered by the state regulator that integrates all permits, standards and requirements into one approval process for new energy-generating facilities in Oregon.

If the project is deemed suitable, the EFSC will grant Brookfield a Site Certificate, allowing for the construction and operation of its proposed Raceway Solar project located in Sherman County, Oregon (OR), US.

4GWh co-located BESS

Brookfield’s Raceway project will pair a 500MW/4,000MWh BESS with an up to 900MW solar farm across 8,782 acres of land approximately 0.75 miles east of the City of Grass Valley in Sherman County.

The project will interconnect to the local grid via a nearby transmission line owned by Portland, OR-headquartered utility Bonneville Power Administration (BPA).

Full application expected towards end of 2024

Within a NOI, applicants are required to provide basic details on the proposed facility and also begin to discuss potential impacts of the development during construction and operation.

Brookfield will disclose more detailed information on the project at the next stage of the EFSC review process when it lodges a full application, which the developer expects to submit towards the end of this year.

Brookfield expects to receive a Site Certificate for the project in the second quarter of 2026.

Oregon planners have 4.4GW of storage applications under review

Oregon’s EFSC currently has 5.125GW of energy storage capacity under its jurisdiction in the form of both standalone and co-located projects, with 56MW of this currently operational, 663MW approved but not yet operational, and just over 4.4GW still under review, according to the regulator’s monthly update document.

One of the largest projects currently under EFSC review is Savion’s Yellow Rosebush Energy Center that will pair a 800MW BESS with a 800MW solar farm occupying 8,075 acres of land across Wasco and Sherman counties in Oregon.

Savion, a wholly owned subsidiary of Shell New Energies, has submitted a NOI for the Yellow Rosebush project and is expected to submit a preliminary application for a Site Certificate by the end of the summer.

Brookfield Renewable: 200GW development pipeline

Headquartered in New York City, Brookfield Renewable US is part of Brookfield’s global renewables subsidiary, Brookfield Renewable Partners L.P. (BEP), which recently issued its financial results for the three- and six-month period ending 30 June 2024.

The first half of 2024 was a strong period for BEP in terms of energy storage milestones. It secured long-term storage capacity contracts totalling 400MW with the Ontario Independent Electricity System Operator (IESO) selected as part of the Long-Term 1 Request for Proposals (LT1 RFP), as reported in Energy-Storage.News.

The two projects, Fitzroy and Tailroad BESS, are being developed through BEP’s Canadian operating business, Evolugen, in a joint development partnership with the Algonquins of

Pikwakanagan First Nation.

BEP claims to have a renewable development portfolio exceeding 200GW consisting of hydroelectric, wind, solar and storage facilities across the Americas, Europe and Asia.

Brookfield approaching US$1 trillion in assets under management

Brookfield Asset Management (BAM), which owns a 60% majority stake in BEM, also recently posted its financial results for the past quarter, reporting that it now has US$995 billion in assets under management (AUM).

The 6-K filing, submitted to the US Securities and Exchange Commission (SEC) on 7 August 2024, highlighted recent commitments from the company including an agreement to acquire a majority stake in French independent power producer (IPP) Neoen, covered by Energy-Storage.News in May.

Through its wholly owned Shift Solar subsidiary, Neoen also secured a capacity contract in the recent Ontario IESO LT1 RFP covering 380MW from its Grey Owl Storage project located in the Municipality of Arran-Elderslie.

Differing Q2s for Eos and Energy Vault on long road to scale and profitability

Revenues were down substantially quarter-on-quarter, however, nearly 90% lower than the US$6.6 million in Q1.

Overall, it ended up with a net loss of US$28.2 million in Q2, much lower than the US$131.6 million loss in Q2 2023.

The firm manufactures a proprietary zinc-based battery pack which it sells to system integrators for projects with up to 12 hours of discharge duration.

Highlights during the quarter included a US$315 million financing package with private equity firm Cerberus and the expansion of a microgrid project with the Viejas Band of Kumeyaay Indians in California to 60MWh from 35MWh previously.

The company repeated what it said in its Q1 results, that it expected the ramp-up in manufacturing to help its profitability shift this year.

It claims a commercial pipeline of US$13.8 billion and an orders backlog of US$586.8 million, although these figures have been questioned by influential short-sellers in the past.

Energy Vault

Energy Vault meanwhile provides gravity energy storage technology as well as battery energy storage systems (BESS).

It saw a 90% drop in annual sales in Q2, to US$3.8 million, which it said reflected seasonality and timing of project revenues. Its cost of goods sold however also came down, by 92.5% to US$2.7 million, meaning its adjusted EBITDA loss narrowed from US$18 million to US$15.8 million.

It reiterated full-year guidance for 2024 of US$50-100 million, a substantial decrease from 2023.

BESS projects commissioned in and around the quarter include projects in Nevada and Texas while it has also made several recent announcements about its gravity storage tech, including new form factors one of which it is exploring deploying at a coal mine in Italy. The technology however has its fair share of critics, to put it mildly.

Both Eos and Energy Vault were part of an article Energy-Storage.news published last year looking at how energy storage SPAC-listed firms have fared since going public (Premium access).

Mixed Q3 for Fluence: revenue and guidance down but orders and profits up

Fluence said the revenue fall was down to the ‘timing of product deliveries’, the same reason it gave for a revenue fall in its Q2 (January-March). The same happened with numerous other system integrators, and most sources have said this is largely down to delays in getting BESS projects online in the US due to supply chain and grid infrastructure completion issues.

The trend appears to have affected its full-year performance too, with the company narrowing down – though not reduce the bottom end of – its revenue guidance. It is revising its full-year forecast to US$2.7-2.8 billion from US$2.7-3.3 billion previously, and its adjusted EBITDA to US$55-65 million from US$50-80 million previously.

However, the company’s profit margins improved in the quarter, with its GAAP gross profit margin more than quadrupling to 17.2%, a net income of US$1.1 million versus a US$35 million loss the previous year and adjusted EBITDA of US$15.6 million versus negative US$27.5 million a year prior. It also saw its quarterly order intake more than double year-on-year to US$1.3 billion leaving it with a backlog of US$4.5 billion, a record.

Fluence is one of the world’s largest BESS providers globally by projects deployed and contracted and also has a strong digital offering, which will have brought its annual recurring revenues (ARR) to US$100 million by the end of the financial year.

The firm also revealed recently that it will provide 2.2GWh of BESS to asset owner Excelsior for US projects that will qualify for domestic content investment tax credit (ITC) incentives under the Inflation Reduction Act (IRA).

In its Q3 presentation, it explained that using using cells and modules that are manufactured in the US will enable it to ‘easily’ meet the domestic content thresholds required for BESS. The threshold starts at 40% for 2025, and US-made cells comprise 38% and modules (packaging) comprises 3.3%, pushing it over the line. A thermal management system is 4.9%, battery management system (BMS) 5.2% and production of the overall battery pack is another 21%.

It said it expects deliveries of US-made cells from supplier AESC to start in December 2024, ramping up over the course of 2025. It’s not clear if that is the same supplier for the Excelsior deal, which it didn’t name but said would be from a factory in Tennessee, while AESC’s announced gigafactory is in neighbouring Kentucky.

Akaysha begins construction of 410MWh BESS in Queensland, Australia

Akaysha has confirmed that the Brendale BESS will incorporate Tesla Megapack technology, with Consolidated Power Projects Australia Pty Ltd (CPP) set to deliver the Balance of Plant (BoP).

Tesla Megapack has been used across several Australian sites, including RWE’s 50MW/400MWh Limondale BESS in New South Wales.

Akaysha is also using Megapacks at its 1,660MWh Orana BESS, located in the Central-West Orana Renewable Energy Zone (REZ), in New South Wales.

However, the developer has a multi-supplier approach and for its biggest project to date, the Waratah Super Battery project, also in New South Wales (slightly larger than Orana at 850MW/1,680MWh), system integrator and manufacturer Powin is providing the BESS solution.

Akaysha, backed by major global asset manager Blackrock, closed project financing for the Orana BESS in July. The AU$650 million three-year agreement will fund the construction of the BESS in the Central-West Orana REZ. It includes AU$75 million in support for project security obligations with a Letter of Credit.

The Brendale BESS project aims to provide energy arbitrage and Frequency Control Ancillary Services (FCAS) to support the national electricity market (NEM) and facilitate the integration of solar PV and wind projects by utilising the existing transmission infrastructure in the region.

Paul Curnow, managing director and chief commercial officer (CCO) at Akaysha Energy, said the Brendale BESS is a “crucial step” in the company’s mission to deploy large-scale BESS.

“The Brendale BESS is an important element of Akaysha Energy’s portfolio across not only Queensland but the NEM more broadly. It is a crucial step in our mission to rapidly deploy large-scale BESS, enhancing grid stability and energy security while driving the global shift to sustainable energy,” Curnow said.

“The Brendale BESS is one of four projects under development in the state and it’s clear that the Queensland energy sector is serious about the transition. Once operational, the Brendale BESS will significantly bolster the delivery of a stable supply of energy to the local community.”

Shell Energy signs UK’s first single-asset BESS tolling agreement for 330MWh project

In 2021, global energy storage owner-operator BW ESS and Penso Power, which deploys, owns and manages grid-scale battery energy storage projects, announced a joint venture that will see BW ESS fund the build out of Penso’s UK project pipeline totalling over 3GWh.

The fixed price tolling agreement will provide revenue certainty for BW ESS and Penso Power while Shell trades the Bramley BESS into a range of ancillary services and wholesale markets. Shell will pay the owners a fixed fee for the BESS and keep all the upside.

It may be the first tolling deal of this size for a single asset, but the first major UK tolling deal announced in the UK was by Gresham House and Octopus Energy for a 568MW portfolio of operational projects earlier this year. Gresham House New Energy assistant fund manager, James Bustin, recently spoke to Energy-Storage.news Premium about that deal, suggesting that it “woke up the wider market to the possibility” that tolls could be an option for their projects.

The 100MW/330MWh Bramley site is also the first project in Europe to deploy Sungrow’s PowerTitan 2.0 liquid cooled BESS – a system that combines a 2.5MW Power Conversion System using integrated string inverters and a 5MWh battery into a single container.

“This tolling agreement, which has been some time in the making, demonstrates the attractiveness of longer-duration, higher-performance battery systems,” BW ESS CEO Erik Strømsø said.

“It not only secures long-term revenues for Bramley, but also helps enable the market’s shift away from short-term frequency response towards load shifting.”

According to Rupen Tanna, head of power and systematic trading at Shell Energy Europe, because tolls are a feature of conventional energy trading, Shell has “the trading experience to add significant value, while supporting the UK’s ongoing energy transition”.

This story first appeared on Solar Power Portal.

Philippines: Renewable energy policies and rural electrification drive battery storage push

We brought you a write-up of the panel, ‘Growing the Japanese storage market,’ just over a week ago. Now, it’s the turn of ‘Building BESS in the Philippines,’ which brought up just as many interesting talking points about a very different but equally important market.

The afternoon panel followed the keynote address by Philippines Department of Energy (DOE) Assistant Secretary Mario C. Marasigan. During his speech in the morning, Marasigan announced that the next round of the government Green Energy Auction Program (GEAP) would be for renewable energy systems with integrated energy storage.

More details emerged on that round, GEA-4, last week. Alongside, Marasigan, representatives of leading private sector names in the Philippines renewables, storage and power industry gave their thoughts on renewables integration with storage, off-grid electrification and much more.

Speakers:

Hon. Mario C. Marasigan, Assistant Secretary, Philippine DOE

Jason Soberano, VP and chief business development officer, SNAP (SN Aboitiz)

Joanna Mae Millares, project execution manager, Aboitiz Power

Colin Steley, VP for storage and board of trustees

Dr Ruth Briones, chairman and CEO, Greenergy Solutions

Moderator:

Eric San Pedro, business development, Entoria Energy

Policy questions DOE is handling

Moderator Eric San Pedro at renewable energy developer, investor and asset owner Entoria Energy kicked off by asking DOE Assistant Secretary Marasigan about the policies and incentives in place to support the integration of battery energy storage system (BESS) technology in the power sector, and specifically with renewables.

The government sees energy storage as a vital enabler for the Philippines’ “ambitious targets” for renewable energy, Marasigan said, aiming for 35% renewables in the energy mix by 2030, 50% by 2040 and continuing to rise from there.

“We have to integrate everything that we can make use of to ensure that those targets will be met,” he said, including, of course, energy storage, but specifically BESS as the most suitable mature technology for near-term deployment.

As has been seen in markets across the world, and the governments and regulators that oversee them, the Philippines has questions to answer on the classification of storage systems for the grid.

“We have to classify whether these energy storage systems will be considered as generators, we have to classify them as well whether these are providers of ancillary services, and lastly, what if we integrate these energy storage systems with renewable energy that serves as a component [of that renewable energy asset] rather than a separate one?”

In the last instance, incentives available to renewable energy generators would also be accorded to energy storage, Marasigan said, with every kilowatt-hour produced by renewables and stored in batteries considered renewables by regulators.

Upcoming Green Energy Auction for integrated renewables and storage

The Assistant Secretary noted that for the upcoming GEA-4 renewables-plus-storage solicitation, winning projects would maintain the must-run or priority dispatch status that renewables.

The auction will aim to accelerate the development of the Philippines’ renewable energy resources and get projects commissioned on time and align power sector investments with policy targets

Moderator Eric San Pedro said that the first two GEA tenders for variable renewable energy (VRE) had encountered some issues, primarily, he said, because low prices bid “were somewhat difficult to achieve”.

Marasigan acknowledged these challenges for developers in arriving at the right bid price. DOE is working with the Energy Regulatory Commission (ERC) to come up with different pricing mechanisms for energy storage systems.

Dr Ruth Briones of Greenergy Solutions, a Philippines-headquartered developer of renewable energy specialised in utility-scale projects, said that Greenergy successfully bid for GEA-1 and GEA-2 project that are going ahead to commissioning and commercial operation.

For GEA-4, however, the DOE and industry need to figure out a more complex set of financial equations, Briones said, as well as conquer some unique technical challenges and understand policy frameworks that themselves are a work in progress.

Energy storage is a technology that can not only drive the modernisation of power infrastructure in the Philippines, but also attractor investors in the country’s economy.

“However, as a utility developer, we are looking at challenges in the implementation of the policy framework, and at technology challenges,” Briones said.

For example, permitting complexities as well as environmental factors such as scarcity of land mean that Greenergy is tending to go work on smaller utility-scale solar-plus-storage projects rather than larger ones in the Philippines.

“How do we respond to this? There will be a lot of feasibility studies to be done, especially to help the system operator respond to the issues, and also, the permitting process is not easy if you have co-located projects. Permitting in solar PV alone is challenging and even more if we’re going to co-locate the BESS project,” Briones said.

At the same time, it is difficult to attract investors to finance solar-plus-storage projects with uncertainties over the business case. The optimal price per kilowatt-hour, the Internal Rate of Return (IRR), how to sell the stored energy are all questions that need to be answered.

At this stage in the market, feasibility studies are “trial and error,” the Greenergy CEO said.

Big power players leveraging existing generation sites

The Philippines’ power generation sector is dominated by a handful of big power producers, backed by the country’s major industrial conglomerates.

These have largely taken the lead in deploying grid-scale BESS, including Aboitiz Power, subsidiary of holding company Aboitiz Equity Ventures. As part of a rollout of 248MW of BESS, Aboitiz Power (AP) has completed a 49MW project on a floating power barge on Mindanao Island.

AP project execution manager Joanne Mae Millares said that the floating BESS, paired with an existing 100MW diesel plant to reduce its ramping time from 15 minutes to just three, is a “very unique innovation” and, as such, faced some of those challenges Briones referred to.

There were no “firmed up regulations for BESS at that time,” Mae Millares said, and AP had to help come up with a protocol for the “hybrid diesel generator (DG)-BESS,” and in terms of permitting essentially followed whatever the local government asked the company to do, “in order to finish the project if not on time, then as early as possible”.

What is also notable is that projects by power companies like Aboitiz Power or San Miguel Power Corporation (SMPC) are being installed, like the Mindanao barge, at existing power plant facilities. As regular readers of Energy-Storage.news might be aware, battery storage can greatly increase the efficiency of power plants, behind which lies the business case and what one expert described as a race between power companies to add those BESS enhancements.

In addition, AP already has existing land available for BESS additions at its thermal plants.

“We will continue to do that, to integrate BESS with our thermal plants, and at the same time, we will be starting to integrate BESS with our renewable portfolio,” Mae Millares said.

At the moment, AP’s BESS assets perform frequency regulation ancillary services, because its thermal plants have contracts in place to do so in the Philippines’ highly regulated electricity market. However, in addition to capacity-based ancillary service markets, BESS could also participate in reserve markets, which are energy plays.

By contrast, SN Aboitiz Power Group (SNAP), which is a joint venture (JV) between Aboitiz Power and Norwegian state-owned renewables developer Scatec, made its first BESS project a standalone one that provides ancillary services through participation in the reserve market.

SNAP’s Magat BESS is co-located with, but operates separately from, an existing hydroelectric plant of the same name. Image: SN Aboitiz Power.

The project, which operates separately but is co-located with an existing hydroelectric plant, went into operation in January. SNAP intends to ramp up its 24MW/36MWh output and capacity to 240MW and is currently running a tender.

However, as SNAP VP Jason Soberano noted, the reserve market has been closed since February.

This was to allow for adjustments to the Wholesale Electricity Spot Market (WESM) design, to align the reserve market’s 1-hour dispatch interval with 5-minute intervals for trading in the energy market.

While it had been expected to reopen in late July, shortly after Energy Storage Summit Asia took place, this did not happen. A few days ago (2 August), the DOE said it targeted the resumption of the market “early this month”.

Despite this, Soberano said SNAP was “excited for incentives and how the market would move,” looking forward to seeing how batteries could be integrated with renewables in behind-the-meter (BTM) projects, and regulations being drafted by the DOE and ERC.

“We can’t just pump in more renewable energy and not take care of the grid itself,” Soberano said.

Off-grid: renewables, BESS with diesel backup

As Eric San Pedro pointed out, it’s also important to remember that the Philippines is an archipelago with more than 7,000 islands.

The moderator asked Assistant Secretary Marasigan about specific policies and frameworks for battery storage as part of off-grid systems in many of the outlying island regions.

The DOE is preparing to launch its second competitive solicitation for implementing microgrid systems in rural areas, he said, targeting deployments in around 48 different locations the department has identified.

Those microgrid systems will comprise renewable energy, energy storage, and backup facilities, typically diesel generators.

Marasigan noted that the first round, held last year, “was not that successful,” with projects awarded to private sector bidders in just eight identified locations out of 41, but said lessons have been learned from that experience.

“We have identified the challenges of the developers, and we hope that by addressing those challenges, there will be more participants,” Marasigan said.

In addition to that procurement, there will be programmes to incentivise the retrofit of renewables and storage at existing off-grid diesel microgrids, hosted via the National Power Corporation coordinating with the country’s Small Power Utilities Group (SPUG).

Longer durations ‘would be beneficial’

An audience member asked if the panel envisaged the Philippines BESS market moving toward 2-hour or even 4-hour duration systems.

“Definitely,” said DOE Assistant Secretary Marasigan.

“We are hoping that the improvement and enhancement of energy storage systems, particularly the batteries, will be one of the drivers for us to attain our targets in renewable energy,” he said.

Philippines President Ferdinand Marcos Jr cutting the ribbon to inaugurate a large-scale BESS facility. Image: ABB.

The DOE is looking to use every tool in its disposal to ensure that “every kilowatt-hour generated” is useful for the nation’s consumers, and that includes transition fuels too. The DOE has said that alongside integrated renewables and storage, it is considering liquid natural gas (LNG) procurements through the GEA-4 mechanism.

It is a matter of practicality, Marasigan said.

The renewable targets “will be met by looking at all possible solutions,” and batteries are in the front running of that assessment right now.

“What we have readily at hand would be the batteries, because even if we consider that pumped storage hydro will be one of those better solutions, it will take us at least seven years before we can come up with the pumped storage hydros in realisation.”

That said, the DOE’s ongoing GEA-3 auction is open to pumped hydro, and other non-battery-based storage technologies.

SNAP is developing PHES plants as well as BESS and Jason Soberano said that the mechanical storage technology may be more viable for long-duration energy storage (LDES) projects of 8-hour duration than lithium-ion (Li-ion) batteries.

Even so, 4-hour duration Li-ion plants would be beneficial, Soberano argued, helping to provide mid-merit power generation—filling some of the gap between peaking power and baseload—until longer duration storage can help renewables replace the thermal generation baseload too.

The Energy Storage Summit Asia, hosted by our publisher Solar Media, returns to Singapore in July 2025. Energy-Storage.news Premium subscribers can benefit from exclusive discounts on tickets to this and other events in the Summit series.

Funding for US grid upgrades includes US$147 million for 8.5GWh ‘multi-day’ battery storage

As reported by our colleagues at PV Tech earlier today, the DOE selected eight projects in total spanning 18 US states for a share of US$2.2 billion funding for transmission infrastructure and technology upgrades.

The awards form part of the Grid Resilience and Innovation Partnerships (GRIP) Program, which in total will pay out more than US$10 billion, and was created through the Biden-Harris Administration’s Bipartisan Infrastructure Law.

In total, close to 13GW of new grid capacity will be opened up by the projects, enabling the addition of renewable energy including 4.8GW of offshore wind, and hardening the grid’s resiliency from outages while increasing overall reliability. The expected load growth coming from data centres and manufacturing is a big driver of those needs.

Within that remit, innovative new technologies are also being supported.

Iron oxide battery startup Form Energy announced that its technology will be used as part of the Power Up New England project. A statement from the company’s CEO Matteo Jaramillo revealed that an 85MW Form Energy system with 100-hour duration (8,500MWh), will be deployed at the former paper mill site in Maine.

That means that, while relatively small in megawatt terms (power output), the multi-day project’s duration and therefore capacity makes it the largest single battery storage project announced to date in megawatt-hours.

The world’s largest standalone lithium-ion (Li-ion) battery energy storage system (BESS) project in operation today is the 3,000MWh Moss Landing Energy Storage Facility in California, while Edwards Sanborn Solar and Storage Project, also in California, and as the name suggests, a hybrid solar-plus-storage project, has 3,278MWh of BESS onsite.

Those are the operational projects, but even the world’s biggest announced in development so far, including one in the Philippines and another in Australia, range in planned capacities between about 4GWh and 5GWh.

Funds form part of total US$389 million Power Up New England award

Back in April, a statement on behalf of the New England states about Power Up New England was published by the Connecticut Department of Energy and Environmental Protection, revealing that the project had applied for the GRIP programme Federal grant funding.

It also stated that the project was backed by a consortium of private sector organisations including energy storage developer Elevate Renewables, utilities Eversource and National Grid, and an unnamed “multi-day energy storage technology provider”.

Energy-Storage.news had taken that to be Form Energy which a source later privately confirmed ahead of this week’s announcement.

The office of Massachusetts governor Maura Healey said yesterday that Power Up New England had been awarded a total US$389 million funding via GRIP, of which US$147 million was earmarked for the Form Energy system.

Form Energy has been developing and commercialising a novel battery technology based on oxidisation i.e., rusting, and deoxidisation of iron as the battery charges and discharges.

It revealed the battery chemistry after coming out of stealth mode in 2020, and claimed it is suitable for very long-duration energy storage (LDES) applications with around 100 hours the sweet spot. The materials used are also abundant and cheap, and able to be sourced domestically within the US, Form Energy has said.

The multi-day energy storage provider is building its first factory in West Virginia and has scored a number of pilot project agreements with utilities around the US.

“Located at the site of a former paper mill in rural Maine, this iron-air battery system will have the most energy capacity of any battery system announced yet in the world,” Matteo Jaramillo said yesterday.

“The project will ensure a more reliable, clean, and affordable grid in New England by reducing transmission congestion and making valuable wind energy resources available when and where they are needed. By locating the project at an EPA brownfield site, we look forward to driving local job growth and other community benefits.”