Projects completed in the quarter include three solar-plus-storage arrays in Arizona for utility AEPCO.

Its margins improved, bar an 18% increase in its EBITDA loss to US$11.3 million. However, a one-time non-cash US$547 million impairment of goodwill led to a net loss of US$582 million.

Goodwill is typically generated when a company is acquired or publicly lists on the stock market, and represents the difference between its value post-deal and its tangible assets. As Energy-Storage.news has reported, the company’s share price has fallen substantially since listing via the SPAC route (as have other SPAC firms), so the goodwill impairment may reflect a re-evaluation in light of that.

The company’s bookings also fell substantially, down almost 90% to US$25.4 million (verus US$236.4 million) in the same quarter last year. The firm said this was ‘driven primarily by increased quarterly variability associated with Stem’s continued expansion into large, utility-scale projects’. However, its contracted backlog increase by 14% from the end of 2023.

The company has subsequently revised down full-year guidance. It is now forecasting US$200-270 million in revenue, less than half the previous US$567-667 million estimate, while bookings will be US$600-1,100 million versus US$1,500-2,000 million previously guided for. It has dropped its guidance of positive adjusted EBITDA too.

The company has initiated a strategic review of the business and appointed a new CFO in Doran Hole, who was previously CFO and executive VP at renewable energy, energy efficiency and storage project company Ameresco.

The firm is trading at US$0.56 at the time of writing, down over 40% from around US$1.00 before the results release.

Ambri, Nilar, AMTE: A look at recent bankruptcy events in the ESS battery space

Ambri: investors pulling out in ‘challenging fundraising environment’

US-based liquid metal battery firm Ambri’s Chapter 11 bankruptcy and recent sale of assets to a consortium of its lenders was covered by Energy-Storage.news last week. The firm’s technology is based around liquid calcium anodes and molten salt electrolyte.

Filing for Chapter 11 bankruptcy protection is different to a Chapter 7 one, which immediately kickstarts the process of asset sales, and Ambri has now come out of the process with a new CEO.

A statement by company CFO Nora Murphy in a filing from June 2024 with the bankruptcy court of Delaware court explained how the company ended up financial difficulties.

The company had been doing well in demonstrating its product development until 2022, raising nearly US$150 million in equity. In June that year, it entered into a lease for a Milford, Massachusetts space to set up a high-volume production facility for its battery technology. However, it required a ‘significant and costly buildout’, Murphy said, with US$18 million invested between June 2022 and 5 June 2024, when it filed a petition for Chapter 11 bankruptcy.

Ambri launched a Series F financing round in Spring 2023, which it would use to build out the Milford facility as well as fund R&D and working capital.

However: “Like many pre-revenue companies in the renewable energy space, that initialgrowth was interrupted by an incredibly challenging fundraising environment,” Murphy said, referring to the increase in interest rates globally.

“Although Ambri had initially secured an anchor investor for the round, this anchor investor declined to participate towards the end of the process. In turn, Ambri sought a replacement anchor investor. investors, due to softness in the market, Ambri was unable to secure a replacement anchor investorfor the Proposed Series F Financing and could not complete the Series F financing round thatwould have enabled it to meet its cell development milestones and manufacturing initiatives.”

The company then went to existing investors for a U$50 million of bridge financing, which was initially agreed only for one to then also pull out, leaving an US$8 million shortfall. Though the company attempted to reduce its burn rate, including by laying off 105 employees in November 2023, it could not secure enough concessions from its creditors to relieve liquidity constraints.

Ambri, an MIT spin-out, said the recent sale of assets would be the best avenue to recapitalise the company and secure its future. The company may have a more unique value proposition than other budding ESS battery technology firms, with its focus on the data centre market.

Read the Delaware filing in full here.

Nilar: slowdown in Swedish market and high commodity prices

In November 2023, Sweden-based nickel metal hydride battery company Nilar International AB filed for bankruptcy with a district court after it failed to find a solution to ‘strained and urgent liquidity needs in both the short and long term’.

Losses for Nilar International AB ran to 600 million SEK (US$57 million) in 2021 and 287 million SEK in 2022 according to Swedish company registry site Allo Bolag.

Last month, zinc-ion battery technology company Enerpoly acquired Nilar’s end-to-end battery production line and process development capabilities, as part of its efforts to set up a zinc-ion gigafactory this year.

Nilar had been trying to develop and manufacture batteries for the stationary energy storage system (ESS) market, and said its technology had higher safety and recyclability than other chemistries. Its facility and head offices were both located in Gävle.

In 2020, it received a €50 million (US$55 million) loan from the European Investment Bank (EIB) to commercialise and scale up and then IPOed on the Sweden Nasdaq a year later.

In an earnings call a month prior to the bankruptcy application, discussing the ESS market which it was targeting, Nilar CEO Erik Oldmark alluded to potential problems the company was facing.

“Even though are expecting tremendous growth in the market, for the time being we are seeing a bit of a slowdown in the Swedish market, driven by a few things. Firstly, we have lower electricity prices compared to the last two years, due to a very wet summer,” Oldmark said.

The latter point presumably refers to the impact that has on Sweden’s hydropower production, one of its main sources of electricity.

“Combined with the decrease in the Swedish currency and higher interest rates, that has put a pause on deployments in the Swedish market. But, it’s not something we see in the European market which has a completely different logic in its energy market which puts demand on ESS in a favourable place.”

Enerpoly meanwhile said, when announcing the acquisition, that Nilar’s battery chemistry used expensive raw materials and thus suffered from high commodity prices.

AMTE: delays in onboarding new investor

Also in November 2023, Scotland-based sodium-ion battery tech firm AMTE Power Plc said that it no longer had sufficient funds to continue operating and had appointed administrators FRP Advisory to seek potential buyers of the business and assets of the company. A year prior it had said its sodium-ion cells were ‘nearly ready’ to send to customers.

The decision was taken after private equity backer Pinnacle declined to advance funds under a convertible loan facility. AMTE had been developing products for electric vehicles (EV), ESS and ‘other speciality markets’.

In February 2024, three months later, FRP announced that it had secured the sale of part of the trading business and assets of AMTE to LionVolt, a Dutch battery technology startup.

AMTE made a £3.8 million (US$5 million) pre-tax loss in the year to 30 June 2021, at which point it identified a ‘significant funding gap’ and two of its five products development was ‘significantly delayed arising from difficulties in scaling up’, the administrators said according to Insolvency Insider UK. That scuppered plans for a Dundee gigafactory, and the loss grew to £6 million in the year to June 2022.

FRP was initially appointed to handle an accelerated mergers and acquisitions (AMA) process – used for distressed assets – in mid-2023 but no viable offers were received, shortly before Saudi-based Pinnacle came in with one. However, due diligence delays meant the money did not come in time. A second AMA led to the £3.05 million offer from LionVolt which was accepted.

The administrators’ report didn’t go into detail on why AMTE ultimately did not survive, but gave a few clues. It said that, although the company was the first sodium-ion manufacturer in Europe to certify a cell, it suffered delays in developing its products due to financial pressures. The uncertainty led to a fall in headcount from 70 in July 2023 to 35 at the time of the administration, all but one of which were voluntary departures, FRP said.

The company board also said that the 2022 Autumn statement by chancellor Jeremy Hunt—the UK’s chief finance minister—negatively contributed to AMTE’s future because of its negative impact on the markets. 2023 also saw a second attempt to certify a new cell product fail.

Proterra and Azelio

Other companies in the energy storage space to have entered bankruptcy proceedings in the past year include US battery pack manufacturer Proterra, which was sold to Volvo, and thermal energy storage technology firm Azelio, based in Sweden.

Canadian Solar supplying BESS for FRV Australia’s first standalone storage project

The project secured connection agreements with AusNet in 2024 and, according to FRV Australia, is situated in a “strategic location on the electricity grid”.

During the development of the Terang BESS, FRV Australia expects that the project will generate up to 150 jobs during the construction phase and hire three to four permanent operational staff. Additionally, FRV Australia said it will provide site maintenance contracts to local businesses.

Carlo Frigerio, CEO of FRV Australia, said that getting the company’s first large-scale standalone BESS to financial close represents a “major achievement” for FRV Australia.

“This project shows our commitment to different renewable energy technologies and strengthens our place in the renewable energy sector. It paves the way for future innovations and growth in our portfolio,” Frigerio said.

FRV Australia closes refinancing deal to aid expansion

The project, which will be aided by the financial close of an AUS$1.2 billion (US$780 million) refinancing facility announced last week (31 July), will provide additional stability to the national electricity market (NEM) as further variable renewable energy generation technologies are added.

According to FRV, the refinancing ensures robust financial support for the construction of the Terang BESS and other future projects, enhancing FRV Australia’s ability to continue operating in the Australian renewable energy sector.

Eleven financial institutions participated in the refinancing process, including ING Bank, Westpac Banking Corporation, MUFG Bank, Société Générale, Norddeutsche Landesbank, Mizuho Bank, Intesa Sanpaolo, United Overseas Bank, the Clean Energy Finance Corporation, China Construction Bank, and the Agricultural Bank of China.

FRV Australia, a subsidiary of Jameel Energy and the Canadian infrastructure fund OMERS, announced that the funding will currently support all solar PV plants in its portfolio and lay the groundwork for further expansion in the Australian market.

It is worth noting that, at the beginning of July 2024, FRV Australia turned its first solar-plus-storage project online: the Dalby, Queensland project. The site comprises a 2.45MWdc solar PV plant and a co-located 2.54MW/5MWh BESS.

The project’s engineering, procurement and construction (EPC) work was carried out by Spanish company Gransolar.

Ausgrid launches energy storage-as-a-service offering as community BESS goes online in NSW, Australia

The offering also grants additional benefits for Australians, such as improving grid reliability and supply security, and could also help facilitate the greater integration of renewable energy.

Ausgrid’s new Bondi community battery, a 160kW/412kWh system, becomes the organisation’s ninth asset, and the sixth to be launched under the Federal government’s Community Batteries for Household Solar Program. The Bondi system is also connected to an electric vehicle (EV) charger, allowing drivers to charge up with renewably sourced electricity.

Australia’s minister for climate change and energy, Chris Bowen, believes the ESaaS plan is the next step in the “evolution of the community batteries” and could relieve cost-of-living pressures.

“It’s incredibly exciting to deliver a community battery for Bondi today, our Reliable Renewables plan is bringing cleaner, cheaper reliable renewable energy to communities across the country,” Bowen said.

Indeed, the coupling of solar PV technology with these community batteries could support residential decarbonisation and create an additional incentive to introduce renewable energy generation technology to homes, even if the building has no access to a home BESS asset. This is where the community BESS’ strengths come to the fore.

Ausgrid has already installed community batteries to support households in Beacon Hill, Bankstown, Cameron Park, Cabarita, Narara, Warriewood, North Epping and Bexley North. Each community BESS a designated catchment area and is set by Ausgrid based on network connectivity and battery benefit.

EnergyAustralia’s managing director, Mark Collette, believes the service could play an important role in the energy transition.

“EnergyAustralia is focused on making energy simple for customers, combining customer assets into our portfolio to deliver the most predictable and affordable outcomes. Community batteries help the wider community coordinate their energy assets improving reliability, affordability and sustainability outcomes for everyone,” Collette said.

Community batteries in Australia continue to grow in number, and this is set to increase further. The Australian Renewable Energy Agency (ARENA) recently allocating AU$143 million in financial backing to build 370 community assets across Australia.

Indeed, the organisation’s Community Battery Funding Round 1 initiative will allocate funding to 20 applicants across all of Australia’s states and territories. ARENA anticipates the initiative will unlock around AU$359 million of investment in renewable energy infrastructure.

Queensland and New South Wales will receive the most community batteries, with 69 and 95, respectively, followed by Victoria with 37 batteries, Western Australia with 28, South Australia with 24, the Northern Territory with 16, and Tasmania with six.

ARENA stated that the batteries will benefit various energy consumers, such as households, hospitals, schools, and other facilities.

Readers of Energy-Storage.news will also be aware that the City of Melbourne recently switched on its first community BESS last month at Council House, as part of its ‘Power Melbourne’ scheme.

The newly installed battery system has an output and capacity of 450kW/1.1MWh, and the council aims to have 5MW of similar assets. Another BESS is expected to be installed at Boyd Community Hub in July, with another one planned for the Library at the Dock later this year.

Market consultancy group Sunwiz also weighed in on the potential of community BESS in Australia, which it dubbed the “Year of the Big Battery”. The group said adding that community battery—or ‘neighbourhood battery’ projects around Australia, classified within the commercial and industrial (C&I) segment—will help drive a 50% growth in C&I installs in 2024.

Arevon puts 800MWh California BESS into operation

Arevon secured financing to complete the project earlier this year, with a US$350 million of preferred equity and debt financing with Blackstone Credit & Insurance, as reported by Energy-Storage.news.

California is the leading state in the US for BESS with around 9GW online by July 2024 according to transmission system operator (TSO) CAISO with high renewable penetration and ambitious decarbonisation targets.

Arevon, a developer and independent power producer (IPP), is among the most active in the US solar and storage markets. Recently, it secured a deal for the offtake of its 1GWh Cormorant BESS in California with community choice aggregator (CCA) MCE shortly before securing financing for a solar-plus-storage project with a 600MWh BESS.

“The Condor Energy Storage Project signifies our ongoing commitment to energy storage technologies and to advancing clean, renewable energy across the nation,” said Kevin Smith, Arevon CEO.

“As California looks to achieve its sustainability goals and brings more renewable energy online, battery storage is an essential component to ensure grid reliability and facilitate further renewable energy adoption. Our projects here provide viable economic revenue, cleaner air for the community, and reliable energy access throughout the state.”

EMS: Wärtsilä’s new GEMS 7 platform, Generac buys microgrid controls specialist

While the monitoring, controls and optimisation platform can serve as an energy management system (EMS) for all manner of energy assets including thermal, renewable energy storage at portfolio, fleet and single asset level, it has its strongest market presence in battery storage.

GEMS 7’s design features partly reflect the growing average size of customer projects in the grid-scale battery energy storage system (BESS) space, the company claimed.

GEMS Digital Energy Platform—to give the EMS its full monicker—can support equipment from a wide variety of power electronics and battery storage manufacturers. That includes Wärtsilä’s own GridSolv Quantum range of containerised battery storage, the newest iteration of which was launched in March this year.

The platform uses machine learning techniques alongside historic and real-time data analytics to optimise energy assets and balance portfolios.

Its digital capabilities were among the chief reasons why Wärtsilä acquired GEMS’ creator, Silicon Valley-based BESS integrator Greensmith Energy in 2017, using the acquisition to kick off the Finnish marine and energy solutions provider’s energy storage business.

The company said this morning that in response to customer requirements, GEMS 7 is designed to be able to control multi-gigawatt-hour scale BESS plants with fast response times, and at the same time offer visibility into storage assets down to the battery cell level.

Other changes include the addition of new visualisation interfaces for the management of large sites, the ability to ‘partition’ sites down to allocate different revenue-generating applications and controls to enable cell balancing and state of charge (SoC) calibration.

It also has new alarm and remote monitoring management features, module-level data access, and reduced latency for responding to grid frequency events.

“An effective software system meets increasingly short response time requirements, provides ample data for monitoring and analysis to remote asset management teams, and is adaptable to changing grid requirements like synthetic inertia,” Wärtsilä Energy general manager for software product management Ruchira Shah said.

In a 2022 interview with Energy-Storage.news, Wärtsilä ES&O head Andy Tang commented on the ongoing increase in average customer project sizes, which at the time stood at around 100MW/200MWh, Tang claimed, a trend which appears to have continued since.

Generac buys out microgrid controls and EMS provider

New York Stock Exchange-listed backup power generation product manufacturer Generac has acquired Colorado-headquartered microgrid EMS specialist Ageto.

The company announced yesterday (5 August) that the deal to take over Ageto closed at the beginning of the month.

Ageto makes microgrid controllers for systems that combine and integrate different distributed energy resources (DERs), including energy storage and solar PV, as well as other power equipment from conventional generation to electric vehicle (EV) charging.

Ageto microgrid controllers have been incorporated into Generac battery storage system solutions and gensets since 2021, like Wärtsilä’s GEMS suite enabling the control, monitoring and optimisation of assets via a single interface. Its products are primarily aimed at the commercial and industrial (C&I) market.

Generac is best known as a manufacturer of standby generators for home and C&I use, but with business lines in everything from portable power solutions to EV chargers and even pressure washers.

The company entered the battery storage business following the 2019 acquisition of home storage system and inverter manufacturer Pika, subsequently launching its own brand home battery solutions, and forming Generac Grid Services post-takeover of distributed energy tech platform provider Enbala.

The C&I energy storage space has typically been the slowest moving of the three major market segments alongside residential and utility-scale. Research firm Wood Mackenzie found that in Q1 2024, 993MW/2,952MWh of new utility-scale storage was deployed in the US, alongside 252.4MW/515.7MWh of residential installs, but just 19.4MW/44.4MWh of C&I and community-scale storage was deployed in the quarter.

However, fundamental market drivers mean the C&I segment holds strong potential over a 10-year outlook, Wood Mackenzie said in its Q1 2024 US Energy Storage Monitor report.

Energy-Storage.news’ publisher Solar Media will host the 1st Battery Asset Management Summit USA in San Diego on 12-13 November 2024. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on Connecting Asset Owners and Optimizers to Maximize Strategies for Storage Assets. View the website today

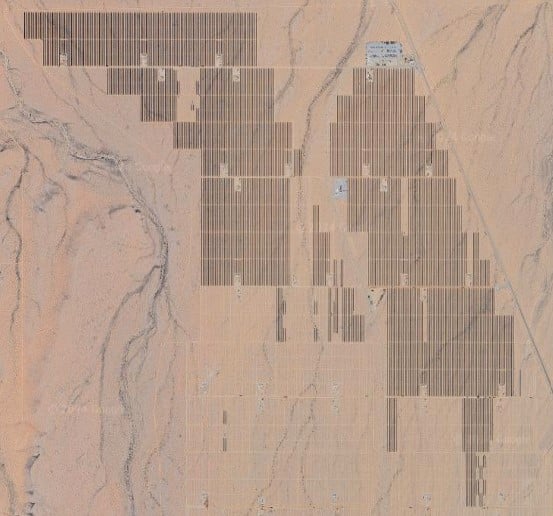

US Bureau of Land Management progresses 6.2GW of BESS at hybrid PV projects in Nevada and Arizona

At final buildout, the nine projects have the potential to house 6.2GW of BESS capacity with up to 7.17GW of co-located solar across 124,500 acres of public land managed by the BLM.

Esmeralda 7 Solar – 5.2GW of BESS capacity

Central to the recent announcement is the issuance of a Draft Programmatic Environmental Impact Statement (EIS) and Resource Management Plan Amendment for a group of seven hybrid solar and BESS facilities located in Esmeralda County, Nevada, known collectively as the Esmeralda 7 Solar development, which is now subject to a 45-day public comment period.

Publication of this document is an important first step for the Bureau of Land Management which will use it, along with any comments received, to conduct individual environmental analysis for each of the seven projects. The BLM will then use this information to decide whether or not to grant each development a right-of-way (ROW) authorisation, allowing for the construction and operation of the hybrid facilities.

Details of the Esmeralda projects currently under BLM review can be found in the table below:

Project nameDeveloperProject SubsidiaryBESS output (MW)Solar PV capacity (MW)Acreage Lone Mountain SolarLeeward Renewable EnergyUS Solar Assets, LLC5001,0008,350Nivloc SolarInvenergyNivloc Solar Energy, LLC5005008,280Smokey Valley SolarConnectGen CG Western Renewables III, LLC1,0001,0004,890Red Ridge 1 SolarAvantus335ES 8me, LLC6006006,190Red Ridge 2 SolarAvantus335ES 8me, LLC6006006,860Esmerelda Energy CenterNextEra Energy ResourcesBoulevard Associates, LLC1,0001,0008,360Gold Dust SolarArevia PowerGold Dust Solar, LLC1,0001,50016,720A summary of the seven projects currently under BLM review. Information is based on preliminary plans and is subject to change. Source: US BLM.

Each project is expected to connect to the local electricity grid through NV Energy’s Esmeralda substation, via the utility’s Greenlink West 525 kV transmission line that has yet to be built.

Construction on each project is expected to take 18-36 months, and the full buildout of all projects is expected to be complete within five years of receiving BLM approval.

700MW of lithium iron phosphate battery storage

In the last month, the BLM has also published a final EIS for Leeward Renewable Energy’s Libra Solar facility which is set to comprise a 700MW BESS co-located with a 700MW solar farm located across 5,100 acres of land in Mineral and Lyon Counties, Nevada.

The BLM will decide whether to grant a ROW for Leeward’s Libra development after the document’s 30-day availability period ends on August 26 2024.

Leeward is expected to utilise 3.7-hour duration lithium iron phosphate (LFP) battery packs for its Libra project, although the developer has stated it will use the “best technology” available at the time of construction. Leeward is expected to break ground on the project at the end of this year.

Arevia Power’s Elisabeth project

Arevia Power has also witnessed progress with another one of its projects, after the BLM issued a draft environmental assessment (EA) for the developer’s Elisabeth Solar facility located in Yuma County, Arizona.

The Bureau of Land Management is holding a virtual public meeting on 14 August 2024 to discuss the EA, and expects to make a decision on whether to grant the developer a ROW authorization in November this year.

It’s anticipated that Arevia Power will utilise lithium-ion technology for the 300MW BESS at the Elisabeth facility that will be co-located with a 270MWac solar farm.

Region home to ‘US’ largest co-located, single phase solar-plus-storage project’

The southwestern portion of the US is home to some of the country’s largest renewable developments, with this recent announcement from the BLM showing that this isn’t set to change anytime soon.

Quinbrook Infrastructure Partners and Primergy Energy recently announced that its Gemini solar-plus-storage project in Nevada had been brought online, covered in Energy-Storage.News during July.

A spokesperson from the companies told Energy-Storage.News that the development is the “largest co-located, single phase solar plus storage project” operating in the US.

Energy-Storage.news’ publisher Solar Media will host the 1st Battery Asset Management Summit USA in San Diego on 12-13 November 2024. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on Connecting Asset Owners and Optimizers to Maximize Strategies for Storage Assets. Energy-Storage.news Premium subscribers can benefit from exclusive discounts on tickets. View the website today

Spanish island Menorca investing in 18MWh of distributed battery storage

It will invest in 9.24MWp of solar PV across pergolas in car parks and roofs of public buildings for self-consumption and creating ‘local energy communities’, adding to 4.5MWp that is already operational.

Along with this it will add BESS, a technology which is less developed on the island currently, the Council said. The 18MWh to be deployed will be linked with the publicly owned generation and self-consumption facilities, in operation or planned.

See how the capacity additions split out by municipality in the table below.

MunicipalityPV (MWp)Batteries (MWh)Alaior0.640.7Ciutadella0.910.94Es Castell2.988.46Es Mercadal0.610.49Es Migjorn0.360.44Ferreries1.835.23Mao1.10.93Sant Lluis0.830.81Total9.2618Source of data: Consell Insular de Menorca.

For more information about the investment plans and details about the PV and EV charging installations, see the Council’s announcement (in Spanish) here.

On mainland Spain, the grid-scale energy storage market is expected to boom in the next few years largely driven by government tenders, covered here and here, as well as the emerging business case of energy storage smoothing out solar generation.

Energy Vault and municipality developing gravity-plus-BESS project at coal mine in Italy

It combines its proprietary gravity energy storage technology for which it is known and battery energy storage system (BESS) technology, and would be deployed in a large coal mine shaft that Carbosulcis is set to fully retire in 2026, called Nuraxi Figus.

Carbosulcis is owned by the Autonomous Region of Sardinia, the large Mediterranean island that is part of Italy. The Sardinia government wants to turn the coal mine into a Carbon Free Technology Hub to aid the industrial and economic development of an area heavily affected by the phase-out of coal production.

The solution would comprise a form factor of Energy Vault’s gravity tech that also combines with a water-based, modular pumped hydro application, though the company didn’t say more about how this would work. It would also utilise the company’s VaultO energy management software (EMS).

Installation of the first modular gravity components will begin in September 2024 with the testing of the underground component of the Hybrid Energy Storage System expected to be completed in 2025.

Energy Vault revealed a number of new form factors of its gravity storage tech earlier this year, including one for use in skyscrapers in partnership with world-leading architecture consultancy SOM.

The company has had several projects commissioned recently, including a BESS in Texas and its first gravity storage project in China, and will release its financial results for the most recent quarter after markets close today.

VIDEO: From Cell to Complete AC System Integration with Trina Storage Elementa 2

Additionally, the complexities and competitiveness of applications, merchant markets, and contracted opportunities are higher than ever before.

In this session, we explore Trina Storage’s latest innovation, the Elementa 2 Battery Energy Storage System. As one of the few integrators with the capability to manufacture battery cells and provide fully integrated AC turnkey systems, the company’s unique vertical integration process comes under the spotlight.

We delve into the market trends driving the need for advanced BESS solutions, the technical specifications and benefits of Elementa 2, and an overview of Trina’s state-of-the-art manufacturing and integration facilities.

Trina Storage is ranked as a Tier 1 energy storage provider by BloombergNEF, just three years after delivering its first Elementa project outside China, at Burwell in Cambridgeshire, England.

Energy storage technology is moving fast, and leading players in the industry, like Trina, are at the forefront of making those advances happen.

A presentation from Trina Storage head of battery storage engineering, Beyond Li, is followed by an interview-style discussion with Energy-Storage.news editor Andy Colthorpe. After that we have our usual audience Q&A session.

Speaker:

Beyond Li, head of BESS solution engineering, Trina Storage

[embedded content]

You can also register to watch the webinar from the on-demand section of the site, which will also enable you to access presentation slide deck, and where you can find all our other Energy-Storage.news webinars.