However, patent protection for other energy storage technologies is on the rise. The patent databases around the world are open for public inspection and insights into levels of activity and who is making patent filings can be found.

The patent system itself is built on the premise that an innovator is rewarded with a time-limited monopoly in exchange for sharing, in detail, how the invention is made. Therefore, a wealth of information, company activity statistics and trends are there to investigate.

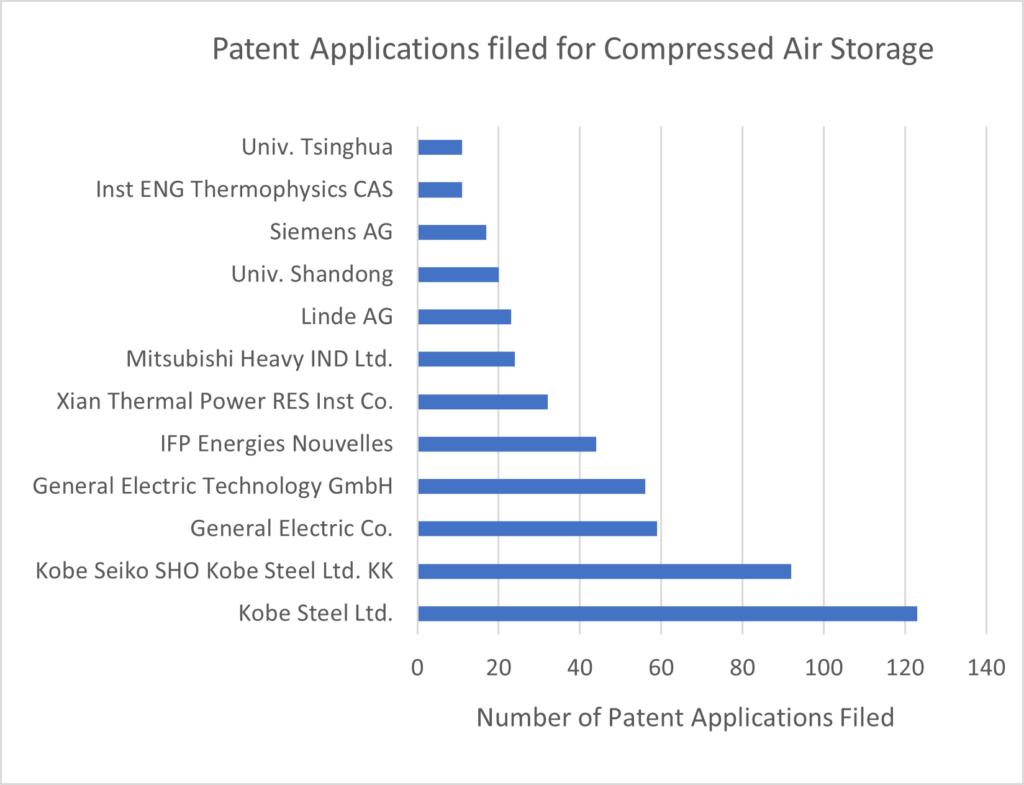

Compressed air and liquified air storage

Compressed Air storage has been gaining investment and looking at the patent databases, Kobe Steel and General Electric lead the innovation leader board in terms of patent applications filed. The number of applications filed per year increased sharply around 2008 driven in part by filings by General Electric. The number filed per year has now levelled off at around 140 patent applications per year.

Chart: Ben Lincoln / Potter Clarkson

Turning to liquid air energy storage (LAES) or cryogenic energy storage, fewer patent applications are filed. The leading innovative companies are Xi’an Thermal Power Research Institute, The Technical Institute of Physics and Chemistry of the Chinese Academy of Sciences and Linde AG.

Chart: Ben Lincon / Potter Clarkson

If we look at filing activity for liquid air energy storage compared to compressed air storage, we see there is a slower and later increase in patent filing activity. Looking more deeply, the activity in 2010 included patent applications by Lightsail Energy Inc and Expansion Energy LLC.

Chart: Ben Lincoln / Potter Clarkson

Mass-based energy storage

Turning to mass-based energy storage systems, pumped hydroelectric energy storage (PHES) has seen the most innovation among technologies. Looking at the owners of those patent applications, the field is dominated by Chinese companies and Universities. Interest in the technology outside China is with Hitachi Ltd, Toshiba, Mitsubishi Heavy Industries and Sulzer AG.

Chart: Ben Lincoln / Potter Clarkson

Gravitational potential energy storage systems using a motor to lift a mass to store potential energy. This technology has seen changes in patent filings that have risen and fallen numerous times in recent years.

Chart: Ben Lincoln / Potter Clarkson

Again, China leads the way in the filing of patent applications in this area. The lead filer is Xi’an Thermal Power Research Institute with patent filings involving steel balls and micro-solid particles. Huaneng Group Tech Innovation Center Co Ltd also have many patent filings. Outside China, US-based Energy Vault Inc and UK-based Gravitricity Ltd are active in the patent application databases.

Flywheel systems accelerate a rotor to high speeds to store the energy as rotational kinetic energy. The following graph shows the number of granted patents, rather than patent applications, for each patent owner.

Patent applications are examined by the patent offices around the world and only those that meet the legal criteria become patents. Thus, the following graph shows only those patent applications that have been successful. Boeing Company and Beacon Power LLC are shown as having the greatest number of granted patents for flywheel technology.

Chart: Ben Lincoln / Potter Clarkson

In terms of patent application filings, they have been steadily rising since 2006.

Chart: Ben Lincoln / Potter Clarkson

Conclusions

Flywheel storage and pumped hydroelectric systems appear to be the most active areas of innovation amongst the technologies we have considered here. However, all of the different technologies are growing in popularity.

It is evident that the companies and research institutions of China are well invested in the patent system and typically file the largest number of patent applications. However, not all of those Chinese organisations are filing patent applications outside China.

The patent data that is publicly available provides insights into the market, active players and the technology. As shown here, the data that can be obtained is useful for identifying trends in a field of technology.

However, looking more deeply at the content of the patent applications can reveal the research areas upon which a company is focussed. The information can guide R&D and IP strategies so that new opportunities for innovation can be explored. It is therefore highly advantageous for players across the energy storage market to understand the IP landscape and in doing so, become more IP aware.

Read Ben Lincoln’s May 2023 Guest Blog for this site, Protecting investments in artificial intelligence for energy storage.

About the Author

Ben Lincoln is a partner and patent attorney at Potter Clarkson, a full-service intellectual property law firm based in Nottingham, UK. He has drafted hundreds of patent applications in a variety of sectors from telecommunications through to green technology, and has prosecuted patent applications relating to industrial networking, computer programs, medical equipment and control systems for manufacturing.

Continue reading