Texas sits in second place behind California in terms of US states with the most operational BESS capacity and still has some way to go if it wants to take the number one spot, after the Golden State recently surpassed 10GW of cumulative installed BESS capacity.

As indicated in the Texas system operator’s most recent Monthly Outlook for Resource Adequacy (MORA) report, ERCOT currently has 4,738.8MW of operational BESS capacity.

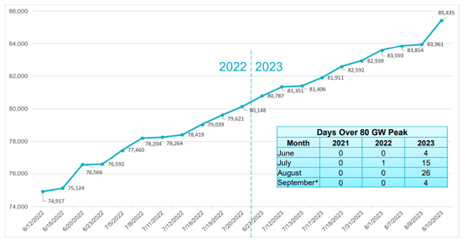

Forecasted 86GW August peak electricity demand

The 640MW of new BESS capacity comes at an ideal time for Texas, as it approaches the month of August where ERCOT has historically witnessed its peak electricity demand.

Evidently, the system operator expects this year to be no different, and has forecasted a peak electricity demand of 86,017MW, which would be an all-time high for ERCOT.

Last year was a record-breaking year for ERCOT as the Texas grid operator saw demand for electricity surpass 80GW on 49 different days throughout the summer, something that had only ever occurred once before 2023.

Not only this, but the grid operator saw its record peak electricity demand broken on ten separate occasions throughout the summer, culminating in a 85,435MW record peak on 10 August 2023 (as illustrated in the graph below).

A graph showing ERCOT’s summer peak demand records for 2022 and 2023. Source: ERCOT Summer 2023 Operational and Market Review.

650MW of new BESS capacity in ERCOT

In total, five new battery storage projects were cleared for commercial operation dates (COD) during the month of June, including Engie’s Five Wells BESS facility located in Bell County and co-located with the company’s 320MW Five Wells solar project that was brought online last year.

Rated at 221MW, Engie’s Five Wells battery storage facility became the largest operational storage facility in terms of capacity on the grid. The title was previously held by the 200MW Libra BESS facility, also owned by Engie, following the French multinational IPP’s acquisition of Broad Reach Power which carried out initial development of the project.

Two standalone battery storage projects owned and developed by Plus Power were also cleared for operation – Anemoi Energy Storage located in Hidalgo County and Ebony Energy Storage in Comal County, rated at 205MW and 204MW, respectively.

The remainder of the capacity was made up by two projects developed by HEN Infrastructure – a venture formed between developer Hunt Energy Network and the global wealth and asset management arm of Manulife.

The two projects, known as Farmersville West BESS 1 and Mainland BESS, each comprise 9.9MW of storage capacity and were processed through ERCOT’s less stringent interconnection process for projects smaller than 10MW – which ERCOT refers to as “small gen” projects.

Progress for NextEra Texas project

Utility-scale renewable energy developer NextEra Energy Resources (NEER) is one of many developers looking to grow its energy storage footprint in ERCOT over the next few years, and recently obtained a tax abatement for a BESS development in Texas.

At a 9 July, 2024 meeting, commissioners at Hill County approved a reinvestment zone and tax abatement agreement to NEER-owned subsidiary Hubbard Energy Storage II, LLC for the development of a 100MW BESS – expected to cost the developer US$115 million.

The Hubbard site located east of Bynum in Hill County is also expected to include a 300MW wind facility, as reported on a NEER website for the project.

NEER has yet to submit an ERCOT interconnection request for the storage portion of the project but holds three queue positions for the wind portion (queue numbers 22INR0499, 27INR0052, 27INR0053) under the name Aquilla Lake Wind which the facility is also known as.

Frosty reception for Black Mountain BESS facility

Elsewhere in Texas, representatives from Black Mountain Energy Storage (BMES) received a somewhat frosty reception from commissioners at Kerr County, as the developer introduced plans for its 120MW/240MWh East West BESS facility at a taxable value of US$86 million.

After the brief presentation during the 22 July 2024 county meeting, Kerr County commissioner Jonathan Letz addressed the BMES representatives stating that the project didn’t “make much sense” to him, describing the 2-hour duration facility as a “band-aid” when it came to addressing power outages in the area.

Rich Paces, another commissioner at Kerr County and volunteer firefighter, went on to say that he’d heard a lot of concerns from residents surrounding battery fires, and made reference to recent fires at BESS facilities in California.

After representatives from BMES attempted to address commissioners’ concerns, Letz rounded off the discussion stating that although BMES is welcome to submit an application for an abatement, he didn’t see it being successful.

Letz went on to say that he was struggling to see how the facility would benefit Kerr County, even suggesting BMES “go to Houston” for the abatement instead.

BMES holds an ERCOT interconnection queue position for the project (queue number 25INR0202) and expects to commence construction on the project during the third quarter of 2025, with commercial operation scheduled for the end of 2026.

New York Fire Code updates to provide ‘added BESS safety and standardisation’

The Working Group recommended updates as well as additions to the existing Fire Code of NY (FCNY), adopted in 2020 when battery storage installations were in their nascency. There are also additional considerations that the group put forward for instances where issues identified did not fall into either category.

Among them is that the state should mandate peer reviews for all BESS installations that exceed established capacity thresholds for lithium-ion (Li-ion) batteries, to be paid for by the industry.

It also calls for the availability of staff with knowledge of each BESS installation to respond within 15 minutes to an incident, extended safety signage, central monitoring of fire detection systems, and regular safety inspections, also to be industry-funded.

Meanwhile, every BESS installation should have an Emergency Safety Response Plan in place, and a Fire Code exemption for electric utility-owned or operated projects should be removed, the Working Group said.

More information on the Working Group, including its draft recommendations in full, can be found here.

‘Working diligently to ensure concerns of the fire service, public, and overall industry are accounted for’

The Working Group was led by state agencies Division of Homeland Security and Emergency Services (DHSES), New York State Energy Development and Research Agency (NYSERDA), Office of Fire Prevention and Control (OFPC), New York State Department of Environmental Conservation (DEC), Department of Public Service (DPS), and the Department of State (DOS).

It also consulted with various industry and otherwise interested stakeholders, subject matter experts and organisations.

One of those expert organisations was Energy Safety Response Group (ESRG), which specialises in safety and risk mitigation for energy storage technologies and projects.

ESRG told Energy-Storage.news yesterday that the Working Group “has worked diligently to ensure that the concerns of the fire service, public, and overall industry are accounted for, allowing for continued progress while also bolstering safety.”

“As a contributing member of the Governor’s Interagency Fire Safety Working Group, ESRG is proud to leverage our experience in battery energy storage safety, large-scale fire testing, and emergency response to ensure the greatest level of safety for BESS across the New York State,” the company said.

The Working Group was convened after three fires happened in relatively quick succession from March to June in New York’s Jefferson, Orange and Suffolk Counties.

While New York, particularly New York City, already has some of the US’ strictest fire codes, it was deemed necessary to both evaluate the state’s existing installations and prepare for a massive growth in installed capacity: from a couple of hundred megawatts of installations today, New York’s Climate Leadership and Community Protection Act (CLCPA) policy calls for the deployment of 6GW of storage in New York Independent System Operator (NYISO) territory by 2030.

“The incidents which occurred last year were unfortunate, but we have learned a great deal from them and the associated Working Group efforts which will benefit the industry as a whole,” ESRG said.

Learnings that came directly from those fires were that the fire service needs better support, in both training and during emergency response, developers and AHJs must continue their due diligence in ensuring code and standards compliance, “and must continue to be educated on the current state of codes and enforcement,” ESRG said.

Meanwhile, the Working Group’s investigation of those fires found no significant off-site environmental impacts had occurred as a result of them.

Consultation period open

The proposals are a revision of the initial recommended changes which emerged from the Inter-Agency group towards the beginning of this year.

One interesting aspect is that when Energy-Storage.news reported on those back in February, the group had recommended provisions to allow stakeholders, including authorities having jurisdiction (AHJs) and first responders, access to the battery management system (BMS) data of battery storage assets.

This site is aware that there had been some pushback on this from the industry. One source said at the time that BMS data would not necessarily be helpful or readily usable information for those stakeholders. The recommendation does not appear in the final Inter-Agency Working Group report.

The industry and other stakeholders now have their chance to comment on the draft proposal, with a consultation period open until 24 September 2024.

“Key proposed updates to the fire code – such as requirement for third-party peer reviews, site-specific Emergency Response Plans (ERPs), additional protections for cabinet-style enclosures, and timely on-site support for local fire departments – will provide added levels of safety and standardisation for BESS installations across the state,” ESRG said.

“New York State has been, and will continue to be, a leader in BESS safety across the country, and we look forward to continuing to support the Working Group in their efforts.”

A few months ago, California introduced legislation requiring safety and communications protocols to be put in place for all BESS installations.

Fortis Energy buys solar and storage project in Serbia

The majority of the company’s portfolio is in operation in its home country, but Fortis has sought to expand its offerings in other countries in recent years. The company currently has three solar-plus-storage projects under development in Serbia, with a combined solar generation capacity of 600MW, alongside three solar-plus-wind projects in the south of the country. Fortis now has close to 2GW of new renewable power capacity under development in Albania, Serbia and North Macedonia.

The deal is the latest encouraging development for the eastern European renewable power sector. Earlier this year, figures from Ember demonstrated that clean power generation exceeded that of coal in Central and Eastern Europe for the first time, and the continued investment into renewable power facilities will only continue to expand the sector.

To see the full original version of this article go to PV Tech.

Enlight secures US$400 million for 1.2GWh co-located BESS in New Mexico

The 1,700-acre project is already in the commissioning phase and will reach a full commercial operation later this year. It was developed by developer RES and the BESS is being provided by Tesla, and has a 20-year PPA with utility Public Service Company of New Mexico.

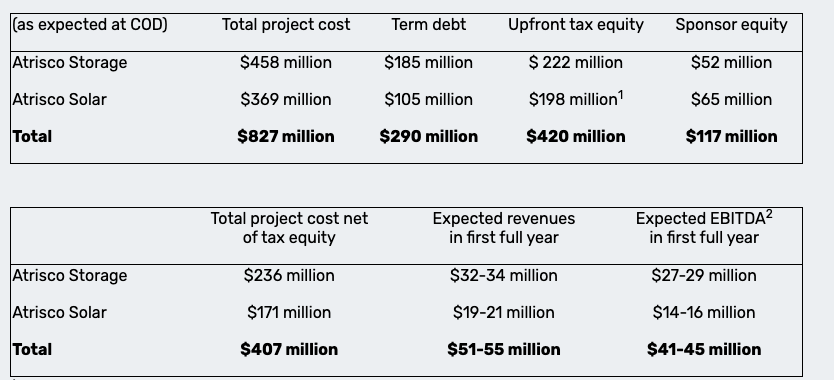

Enlight has secured US$290 million in term debt, US$420 million in tax equity and will invest the remaining US$117 million itself as sponsor equity for the whole project. The financing for the solar portion had already been secured in December 2023 and the storage financing has now also been completed.

Enlight, via the subsidiary Clenera, secured the loan from eight banks led by HSBC for the storage portion while tax equity was provided by US Bancorp Impact Finance. HSBC also led the consortium for the solar financing, while Bank of America provided the tax equity there.

The firm also provided the debt, tax equity and sponsor equity breakdown for the solar and storage separately, shown below. Debt is a larger portion of the storage financing, while tax equity and sponsor equity are larger for the solar.

Image: Enlight Renewable Energy.

New Mexico has an energy storage deployment target of 7GWh by 2034. The project is Enlight’s largest so far, but it is about to being construction on several other large-scale projects.

That includes the Country Acres (392MW solar and 688 MWh of storage) in California, Roadrunner (290MW and 940MWh) in Arizona, and Quail Ranch (128MW and 400MWh), which is a brownfield extension of the Atrisco project.

Hybrid power plants are the future for IPPs and they can benefit from CAMOPO, the leading hybrid optimiser

Nevertheless, higher shares of renewable energy bring new challenges to the system that must be addressed to not slow down the additional integration of renewable projects necessary to achieve targets set all around the world.

The current situation: Traditional renewable generation plants, which used to generate steady profit, are struggling. Power producers are suffering from severe curtailments in solar PV-rich countries, such as Chile and Australia, and in Europe we are already observing increasing numbers of negative price hours, especially around noon.

The implications: Renewable generation plants have lower revenues and weaker business cases because they face the risk of low, zero, or negative prices when supply is high (low capture price rate) and cannot adapt their production flexibly.

In addition, the existing electricity grid is also increasingly suffering from congestion due to local overproduction. This results in curtailments, stability issues and limited and/or costly grid connections for new projects or for the expansion of existing plants. These are clear signals that the market demands more flexibility and will also pay for it. Some countries, like Chile and the UK, are ahead of others in this development, making swift regulatory changes, while other regions are still lagging.

The challenge: Future energy markets need more flexibility and would have many different energy market products to organise grid stability and balance the system based on renewable and inverter-based resources. Power producers in this respect must plan and operate competently to be economically successful in these evolving markets.

This involves the ability to provide grid services, exploiting the opportunities in spot markets, and avoiding curtailments. This variety clearly indicates that the energy generation of the future needs flexible solutions.

The solution: True flexibility through hybrid power plants

Only hybrid power plants offer real flexibility and adaptability. These kinds of power plants usually integrate one or more technologies such as solar, wind and energy storage but operate as a single unit.

The main difference between hybrids versus standalone and co-located plants is the integration of generator and storage with the requirement of a joint dispatch. Hybrid power plants offer numerous advantages:

Optimised use of generation capacity: By combining different energy sources and storage capacity, usable production can be maximised by charging the storage with surplus energy, which can be otherwise wasted due to limited grid interconnection capacity.

Adjustability during operation: Hybrid power plants can respond faster to market shifts and weather situations compared to standalone renewable generators.

Multiple revenue streams: Hybrid power plants perform revenue stacking by tapping into different revenue streams, significantly increasing their profitability.

Balanced operation: The storage system can also be used to avoid imbalance costs or to create a more valuable production profile.

In contrast, standalone or co-located plants are often less efficient because they cannot fully utilise the benefits of integration and shared dispatching.

We recommend the following expert article: ‘Co-location vs hybrid: Is the future of power plants a battle of business models?’

Cost-effectiveness of hybrid power plants through optimised schedules and revenue stacking

Hybrid power plants have huge potential and untapped opportunities that many developers and investors are still unaware of or are just starting to explore.

CAMOPO optimises and executes the most profitable dispatch strategy. Image: CAMOPO

These types of plants can boost profits, which can be fully exploited through precise calculations and a deep understanding of optimisation opportunities. Hybrid systems can access multiple revenue streams and adjust to market conditions, making them more attractive and profitable.

Most importantly, their flexibility allows them to adapt to market and regulatory changes in the medium and long-term. This helps to lower the risk of investing in a renewable energy project.

What distinguishes hybrid power plants?

With the integrated energy storage capacity, smartly operated hybrid power plants can decide when and how to use the energy produced by the renewable generator.

In addition, they are also capable of providing certain grid services. This feature requires active and optimised operation management of the plant. This can be realised by using a sophisticated energy management system (EMS) with an optimisation algorithm which adapts the output of the power plant dynamically, based on current conditions.

Their secret to success:

Is called revenue stacking: The aim is to make the most out of the given flexibility and generate multiple revenue streams. This includes participating in wholesale markets, balancing markets as well as engaging in various grid services.

What they need to be profitable:

Optimise daily operation and adjust it to the real situation: Based on forecast data and the respective market developments, the energy management strategy must be adjusted continuously to achieve the best economic utilisation.

The following graphic shows a respective schedule for a PV + BESS project with revenue stacking approach, from our CAMOPO Optimiser:

As seen above, even this 48-hour period is sufficient to recognise the complexity of revenue stacking, which is only doable with an automated energy management system and optimisation infrastructure.

The logic behind hybrid power plants is that they are operated as a single unit and the dispatching must be optimised continuously. The number and possibilities of revenue streams vary depending on the country or grid’s regulation and market conditions.

Hybrid power plants are the future

Hybrid power plants are the future for independent power producers (IPPs), because they provide the necessary flexibility to respond to the rapidly changing conditions of energy markets. By combining different energy sources, such as solar PV and battery storage systems (BESS) or wind energy and BESS, hybrid power plants can maximise their production while minimising operating costs.

This flexibility allows IPPs to create multiple revenue streams by operating in different markets and offering additional services such as grid stability. In a market environment that increasingly values flexibility and efficiency, hybrid power plants are ideally positioned to offer sustainable and profitable solutions.

CAMOPO: one of the world’s leading hybrid optimisers

For several years, CAMOPO has been specialised in the optimisation of hybrid power plants with its software solution and operates worldwide as an independent product of SMA, yet benefiting from SMA’s substantial know-how of managing complex power systems.

CAMOPO, as an automated brain, plans, optimises and executes steadily the most profitable dispatch strategy and thus increases the return for investors and operators. Here are two reference cases that illustrate the effectiveness of CAMOPO:

Reference case 1: Chilean IPP

A Chilean IPP contacted CAMOPO to conduct an optimisation study. The aim was to increase the profitability of its planned plant (PV+BESS) through an energy management system (EMS). The results were impressive:

With 8% cost of capital, the net present value (NPV) of the investment would turn negative without an optimised strategy.

The expected internal rate of return (IRR) over the lifetime of the battery (15 years) increased by 4.6% with the optimised CAMOPO-EMS strategy.

With the optimised CAMOPO strategy, the NPV of the storage system increased by US$14 million to US$10.7 million, jumping strongly from the negative NPV zone to the positive, making the investment profitable.

Reference case 2: Power purchase agreement (PPA) with constant power output profile

An IPP wanted to build and operate a PV+BESS power plant to meet a PPA with a specific production profile:

The objective was to realise the specific production profile and avoid penalties for deviations from the profile. The optimised energy management strategy resulted in:

7% more revenue through improved use of generation capacity

Mitigation of penalties during operation

Up to 9% more IRR with hybrid and CAMOPO optimisation

In a case study for Pelion Green Future, involved in IslandGP, Tion etc., among others, it was investigated how an AC-coupled BESS addition can increase the profitability of a PV system.

The result: The IRR expectation for this battery investment is between 4.8% and 9%, depending on the scenario chosen and the use of multi-market strategies. Hear from our customer how they benefited from working with CAMOPO and the value that we added.

[embedded content]

The result

The future of power generation lies in hybrid power plants that combine flexibility and boost profitability. CAMOPO impressively demonstrates how optimised schedules and revenue stacking can make hybrid power plants profitable.

We invite all interested parties to a free initial consultation. Contact us at [email protected] to learn more and maximise the potential of your investments.

About the Authors

Isabella Caschetto is a product manager at SMA Solar Technology AG and responsible for CAMOPO.com, a commercial optimisation software for hybrid power plants. Her focus is on the development of digital products and business models related to the integration of renewables into the energy market. This includes especially solutions for the optimised plant operation of power plants. She has extensive experience in the energy market and energy management and previously worked as an energy consultant for industrial customers.

Dominic Multerer supports and advises CAMOPO on commercial topics with a focus on marketing, sales, and strategic orientation. He supports to integrate the CAMOPO software solution in SMA AG’s global solutions portfolio for Large Scale Projects. For CAMOPO, he is the first point of contact for interested investors, developers, IPPs, etc. With his experience in building new and digital business models, he is a valuable support to the team and is very familiar with the subject matter.

Cell-level improvements in BESS technology ‘translate into LCOS savings for customers’

Speaking earlier this month at the Energy Storage Summit Asia 2024, hosted by our publisher Solar Media, Zhao, who represents the energy storage arm of Chinese solar PV giant Trina Solar, said that cell-level innovations and improvements are vital in enhancing energy density, cycle life and safety of complete BESS solutions.

The company launched its second-generation containerised BESS solution, Elementa 2, in February of this year at our Energy Storage Summit EU in London, but quickly followed up the debut of that 4MWh, 20-foot containerised product with a 5MWh version in April at an event in the Middle East. Since then, the company has also launched a back-to-back version for the US market that combines two containers to form a 10MWh unit, with complete cell-to-AC solution integration.

The 4MWh version uses 306Ah cells, and the 5MWh uses 314Ah cells. Both are equipped with lithium iron phosphate (LFP) lithium-ion (Li-ion) cells, manufactured in-house by Trina Storage.

Energy-Storage.news has previously covered aspects of Elementa 2 and its predecessor Elementa’s complete system design and manufacturing, as well as Trina’s market strategy from ESN Premium interviews with Trina Solar executive president Helena Li and in reports around various projects.

However, at Energy Storage Summit Asia, Leo Zhao presented a deep dive into Trina’s cell-level innovations, noting their immediate impact on LCOS.

LCOS is defined as the total cost of the project over its lifetime—including capital expenditure (CAPEX) and operating expenditure (OPEX)—divided by the total energy throughput or energy discharged, again, over its complete lifetime.

Zhao told Energy-Storage.news that from Trina Storage’s OEM perspective, drivers to lowering LCOS include larger capacity cells, enabling more cycling and throughput, and reaching higher roundtrip efficiency.

“Underlying all of that is safety, because that guarantees the operation of the project over the designed lifetime,” Zhao said.

Pre-lithiation of cathode

Battery lifetime can be extended by improvements to any of the four major components of the cell, Zhao said, from cathode to anode, electrolyte and separator.

One major example of an advance that enables longer battery cell lifetime, is pre-lithiation of the cathodes.

“Pre-lithiation is technology to gradually release active lithium, to compensate for the loss of active lithium, to compensate for the loss of active liquid.”

Model of an Elementa 2 solution on display at All Energy Australia in 2023 ahead of its official launch this year. Image: Trina Storage.

Regular readers will note that rival Chinese manufacturer CATL recently launched a BESS solution, which the company claimed would experience no degradation in its first five years of operation.

How CATL had achieved this had been a source of speculation around the industry, before it was revealed in June that one of the manufacturer’s main strategies was, similarly, pre-lithiation.

“There are many different ways to do pre-lithiation,” Trina Storage’s Dr Leo Zhao said.

“For this particular technology, we’re working on adding extra additive materials to the cathode so that, especially at the beginning of cycling, this gradually releases extra lithium into the lithium-ion battery to overcompensate for the loss of active lithium. This can reduce degradation and also enhance the life cycle.”

This type of benefit which can sometimes be a complex proposition to understand, Zhao said, can be explained to customers in the way it directly translates into lowering the LCOS.

“We can always associate it back to earlier discussions around LCOS, because if we can ensure longer life cycles, and lower degradation, that will make sure that there’s more energy throughput over the lifecycle of the project,” Zhao said.

“This will be associated with and translated directly to the battery’s warrantied cycles. From the OEM’s point of view, how many cycles can be warrantied for the project, and how many cycles the product can be used for. This is directly translated to the warrantied usable capacity of the product because that’s associated with State of Health (SOH) and also how much is being guaranteed.”

Trina Storage head of BESS solution engineering, Beyond Li, will speak about Elementa 2 and BESS design and innovation in a sponsored Energy-Storage.news webinar tomorrow, 31 July 2024 (1pm BST, 2pm CET). Register here to attend ‘From cell to complete AC system integration with Trina Storage Elementa 2’, or to watch on-demand after the live broadcast.

Honduras to reform electricity market to facilitate energy storage deployment

Renewable generation now accounts for 22% of Honduras’ electricity mix, but growth has been limited by its transmission system operator (TSO) CND to ensure quality and security of supply. Energy storage will be key to continuing to ensure that while increasing renewables, the CREE said.

“The integration of Energy Storage Systems (ESS) in the national electrical system represents a key strategy to increase the stability, efficiency and sustainability of the electricity supply in Honduras,” said the CREE in its consultation document.

“Given the energy transition scenario and the growing contribution of energy generation from intermittent renewable sources, ESS emerge as important technical solutions to guarantee the continuity and reliability of the electrical service.”

But to enable that integration the current framework needs to be changed. “The CREE has identified that the current regulatory framework should be reviewed to identify possible barriers to the integration of ESS, as well as gaps in the regulation that should be filled to allow and facilitate the development and installation of ESS,” it said.

Read the CREE’s consultation outline, in Spanish, here. The actual acronym used by CREE is SAEs, which stands for the direct translation of ESS: Sistemas de Almacenamiento de Energía.

CREE said that energy storage could be deployed as part of hybrid power plants, combining with generation resources, as standalone transmission and distribution (T&D) assets, or as user installations allowing energy consumers to manage their usage.

One change to the regulatory framework could be allowing hybrid plants to be remunerated for the firm, dispatchable power that energy storage would enable them to produce. However, the CREE also said that it is considering barring co-located energy storage systems from charging from the grid. Such a rule is typically only employed for specific subsidy schemes.

Another change would be allowing energy storage systems to be developed as transmission assets.

The scope of the review appears to be technology-agnostic in terms of its definition of energy storage, comprising lithium-ion, pumped hydro energy storage (PHES), compressed air energy storage (CAES) and ‘others’. “All different types of storage systems will be treated interchangeably as ESS,” CREE said.

CREE added that the electricity market in Honduras has similar conditions to those in Chile and Colombia when they were first developing their energy storage markets.

NHOA revenues fall 11% because of industry-wide BESS price falls

NHOA said the fall was ‘entirely attributable to the industry-wide drop in system prices deriving from a welcome rapid degression in battery prices’, a trend Energy-Storage.news has reported on extensively (Premium article).

Including its EV charging solutions divisions Atlante and Free2move eSolutions (a joint venture with OEM Stellantis), group revenues were €124 million, up 7%, with Free2Move doubling its figure to €32 million. The group is in the process of being bought out and de-listed by its parent company Taiwan Cement Corporation (TCC), pending regulatory approval.

For NHOA Energy, EBITDA for the period was €4.4 million while net income was positive, and it increased its operational projects deployed by 344% to over 1GWh with another 1GWh under construction. It commissioned a 120MWh BESS for TCC in Taiwan in April, and won contracts for a 50MWh system in Italy and a 313MWh system in the UK.

Tesla: 9.4GWh of BESS deliveries in Q2 drives ‘record profits’ for energy business

Tesla said it deployed 9.4GWh of utility-scale Megapack battery energy storage systems (BESS) and residential Powerwalls in Q2 2024. In Q1, that figure was 4.1GWh, beating its previous record in Q3 2023 by 100MWh. The latest numbers also showed a 158% increase in deployments year-on-year, from 3.7GWh in Q2 2023.

To give further context, the company reported a total of 14.7GWh storage deployments for the full-year 2023.

That performance drove Tesla’s energy business segment’s most profitable quarter to date, and CEO Elon Musk said in an earnings call with analysts that potential demand for energy storage is widely underestimated.

Tesla’s Megapacks are currently produced at a single factory, in Lathrop, California, and shipped worldwide, but a new production plant, in Shanghai, China, is on schedule for opening in Q1 2025, the company claimed.

Lathrop, meanwhile, will be fully ramped to 40GWh annual production capacity by the end of this year.

“I think people don’t understand just how much demand there will be for storage. They really just… like the people, I think, are underestimating this demand by product order of magnitude,” Musk, who is also Tesla’s chief product architect, said.

Musk gave the example of the US power grid, noting the “huge gaps” between peak demand and energy supply. He described how the grid has to “support the load at the worst minute of the worst day of the year,” in order to not have blackouts.

Tesla CFO Vaibhav Taneja said that the company’s “energy storage backlog is strong,” although investors can expect some fluctuation from period-to-period in recognition of orders, deployments and revenue from storage.

While in recent quarters, Tesla has heavily emphasised the contribution from Megapack large-scale deployments to its reported figures, Taneja noted that Powerwall also drove activity in the segment in Q2.

Vertical integration is ‘a unique proposition’

Colin Rusch, a stock analyst with Oppenheimer & Co, asked about Tesla’s strategy around the potential saturation of key energy storage markets, “given that some of these larger systems are starting to shift wholesale power markets in a pretty meaningful way quickly,” as well as how the company planned to remain competitive in the face of growing competition on the supply side.

Taneja and other executives replied that one of the Megapack’s strengths was in Tesla’s full integration of hardware including power electronics and site-level controls, as well as the solution’s software stack.

The CFO claimed that to be a “unique proposition” within the storage space, while Musk claimed customers often try and put together “a hodgepodge solution,” presumably attempting to integrate different hardware and software technologies at site or portfolio level.

“And then that doesn’t work, and then they come back to us,” Musk said.

According to Tesla, saturation of markets is not really happening on a global scale, although it may be in some limited pockets—the UK might be a contemporary example of this—but owing to the huge, often underestimated demand Musk spoke of, the company expected to see different markets open up around the world.

End of IRA subsidies ‘may help Tesla long-term’

No Tesla earnings call would be complete without a statement or two from Elon Musk that might be considered provocative or controversial.

This time out, that talking point, or perhaps one of them, would be the CEO’s view that, having endorsed Donald Trump in the US presidential race a few days ago, the cutting of Inflation Reduction Act (IRA) subsidy policies would not have a major impact on Tesla’ business.

Colin Langan, stock analyst at Wells Fargo, asked what the company thought the impact would be, in the context of some of Tesla’s EV models as well as battery production benefiting from tax credits.

“I guess that there would be like some impact, but I think it would be devastating for our competitors and for Tesla slightly,” Musk said.

“But long-term probably actually helps Tesla, would be my guess, yes.”

Musk then went on to say that the value of Tesla long-term is closely aligned with its ambitions in autonomous vehicle driving and that “all those other questions are in the noise.”

CFO Taneja clarified that Tesla planned its activities irrespective of “whether or not the IRA is there”.

“That’s the way we’ve always modelled everything. And that is the way internally, also even when we’re looking at battery costs, yes, IRA, there are manufacturing credits which we get, but we always drive ourselves to say: ‘OK, what if there is no IRA benefit? And how do we operate in that kind of an environment?’

See Tesla’s Form 10-Q filing of financial results for Q2 2024 with the US Securities and Exchange Commission (SEC).

Conference call transcript by The Motley Fool.

Local council in NSW, Australia, rejects ACEnergy proposal to pay reduced development fee for 1.1GW BESS

ACEnergy submitted a State Significant Development application (SSD) to NSW Planning for the BESS earlier this year. An SSD provides an alternate approval pathway for projects or sites considered to have state significance.

As part of this application, the Planning Secretary issued a Secretary’s Environmental Assessment Requirements (SEARS) assessment, which specifies what issues must be addressed in the Environmental Impact Statement.

ACEnergy is an Australian renewable energy developer which to date has delivered more than 30 projects, totalling 1.1GW of capacity and has a development pipeline of 2.7GW, according to the company’s website.

ACEnergy lists seven large-scale battery storage projects in development across various Australian states, as well as a partnership to deliver distributed-scale energy storage with investment group Sustainable Energy Infrastructure (SEI).

ACEnergy’s proposed payment less than 30% of current levy

For the construction of the project, ACEnergy would be required to pay a development levy, which, under Leeton Shire Council’s Section 7.12 Plan, amounts to 1% of the development cost. In this case, ACEenergy would be required to pay the council AUS$2.5 million.

In a bid to reduce this amount ACEnergy, the developer submitted a Voluntary Planning Agreement (VPA). This deal would have seen the company pay AUS$730,000 over five years – 29% of the traditional VPA.

Indeed, ACEnergy proposed an upfront payment of AUS$250,000 at the commencement of the project’s commercial operations. A further AUS$480,000 would then be paid at the start of the fifth year of operation. The company also said it should be excluded from the mandatory development levy as it is also establishing a community benefit fund to support the local population.

The Council rejected this proposal and reached a decision at a meeting last week (24 July). According to a statement released by the council, the councillors felt the 1% in developer contributions would go a long way in providing funds for public facilities and other long-term development pressures. The council also believed the figure is a “reasonable amount relative to the size of the project”.

During the council meeting, a key point raised was the unfairness of expecting potential home builders to pay the same levy to construct a property, regardless of their financial stability, unlike ACEnergy, a large corporation.

One councillor said: “The VPA is not even 30% of what they would have paid under our contributions. This development has an estimated development cost of around AUS$250 million.

“The developer is a very big corporate body. If mums and dads built a new home in Leeton, they buy a 1% contribution. It’s just as hard for them to pay as it is for this company to buy theirs.”