While that remains a fairly low sounding figure, company leadership emphasised in presentations and an earnings call with analysts that this represents the start of an ongoing upward trend. For the full-year 2022, revenues stood at US$894,000.

ESS Inc also said it has around US$100 million cash and equivalents on hand, which CFO Anthony Rabb said “should last us well into 2024,” with the company continuing to manage its cash burn rate “effectively”.

CEO Eric Dresselhuys said ESS Inc had been able to reduce the direct costs of its next generation flow battery by 30% and reduce build time by 29% during the second quarter alone.

With those cost reduction and efficiency gains playing a major part, ESS Inc expected its flagship Energy Warehouse (EW) flow battery product to be profitable on a non-GAAP gross margin basis in the second half of 2024, CFO Rabb said. The company had made “tremendous progress with our revenue recognition process,” the CFO claimed.

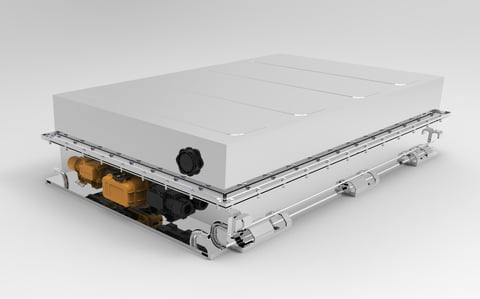

Energy Warehouse comes in 75kW containerised units with 500kWh peak energy capacity and 400kWh rated energy capacity. Designed for 25-year lifetime of operation and more than 20,000 cycles, it was first deployed in 2015, but the latest Generation II design came out in 2020.

Meanwhile, ESS Inc is preparing to launch a larger front-of-the-meter (FTM) product, Energy Center. Production is expected to begin in Q4 2023. Available in 145kWdc increments, Energy Center will allow for 8MWh of rated capacity per megawatt installed, or 10MWh of peak capacity per megawatt installed.

The long-duration energy storage (LDES) provider is the only manufacturer in the world of the flow battery, which uses an iron and saltwater-based electrolyte. Other makers’ flow batteries use different electrolyte solution, with vanadium pentoxide the most commonly used.

ESS Inc now has a total of 238 patents granted, pending or in application, the CEO said. That includes 10 new patents granted and 13 more filed in the second quarter alone.

“We feel confident that the moat around our IP portfolio will safeguard our iron flow technology approach for years to come,” Dresselhuys said.

Tailwinds take time

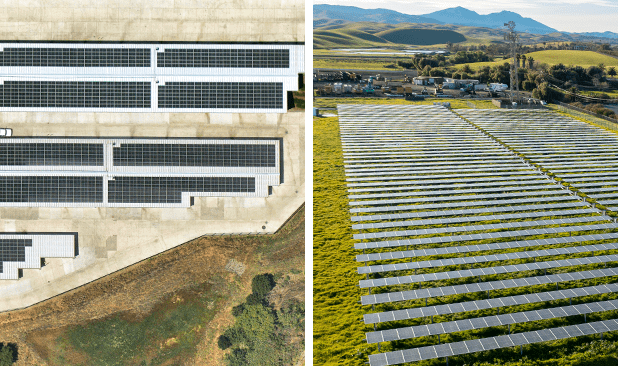

Whereas in Q1 2023 the company only delivered two units, recognising its US$400,000 revenues for the quarter, Dresselhuys had talked up ESS Inc’s prospects in energy storage markets both in the US and abroad enjoying tailwinds such as the US’ Inflation Reduction Act (IRA) and Europe’s raised renewable energy ambitions.

It would take time for those tailwinds to result in revenue growth for ESS Inc, the CEO had said in Q1, which was reiterated on the conference call that took place yesterday.

Referring to the US market, ESS Inc was continuing to “actively engage in the implementation of the Inflation Reduction Act (IRA), the Bipartisan Infrastructure Bill and various state-level initiatives to accelerate the deployment of energy storage”.

“These are large initiatives and the pace of activity isn’t as fast as I’d like,” Dresselhuys said.

However, ESS Inc was encouraged by the recent publication of guidance on domestic content requirements to get adders to IRA incentives from the IRS, as ESS Inc will be manufacturing its battery modules on US soil. Dresselhuys also said recent funding support for long-duration energy storage from the US Department of Energy (DOE) for its Energy Storage Grand Challenge was encouraging.

Three key deals

The company mentioned some recent deals as highlights of its Q2 activities, such as its agreement to deploy a 50MW/500MWh system with German energy firm LEAG, which is looking to develop a large net zero emissions baseload energy network using renewables, energy storage and hydrogen electrolysis.

While ESS Inc said the initial deployment is expected to result in a deal to provide a flow battery-based “standardised building block” for LEAG’s planned 2-3GWh LDES rollout, the contract is still due to be finalised this quarter (Q3), while deployments will not begin until 2027.

Elsewhere, Energy-Storage.news readers may have noticed a few days ago that ESS Inc’s partner and technology licensee in Australia, Energy Storage Industries Asia-Pacific (ESI), is being awarded funding for a pilot project in the state of Queensland.

While details of that project have not been specified, it will receive AU$12 million (US$7.85 million) of grant funding from Queensland’s government. ESI is building a factory in the state based on ESS Inc’s IP, and will distribute and manufacture iron flow batteries for the Australia, New Zealand and Oceania markets.

The US company claimed the partnership could be good for 1GWh of flow battery deliveries over the next seven years, although longer term the systems will be manufactured locally in Australia.

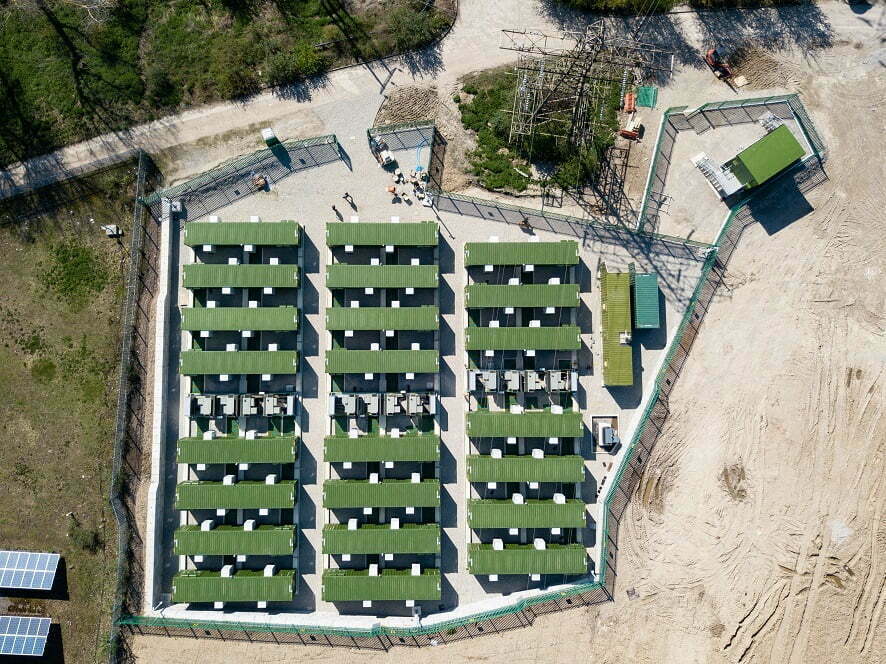

The third and perhaps most significant customer deal ESS Inc management referenced in its results presentation and earnings call is with California’s Sacramento Municipal Utility District (SMUD).

Again, announced as a partnership with multi-gigawatt-hour potential which is starting off with a number of smaller deployments, ESS Inc will supply SMUD with up to a targeted 2GWh of battery storage by 2028 as the utility pursues an aggressive decarbonisation agenda to the end of this decade.

Deliveries to SMUD’s first project have already begun and six flow battery units have been shipped and are now entering their commissioning phase.

Our publisher Solar Media is hosting the 10th Solar and Storage Finance USA conference, 7-8 November 2023 at the New Yorker Hotel, New York. Topics ranging from the Inflation Reduction Act to optimising asset revenues, the financing landscape in 2023 and much more will be discussed. See the official site for more details.

Continue reading