Today, it’s the turn of our popular Guest Blogs, contributed by experts and industry players, to whom we are always grateful and happy to work with. You can read all of Energy-Storage.news’ published Guest Blogs here, including more than 20 published last year and dating all the way back to 2015.

Here, in order of the date of publication, are the 12 Guest Blogs we have been proud to feature on the site by the end of H1 2023. Click the headline to go to the blog:

800MWh of utility-scale energy storage capacity added in the UK during 2022

1 February 2023

By Mollie McCorkindale, market analyst, Solar Media Market Research

Guest Blogs from our colleagues at Solar Media Market Research are always eagerly awaited and well-received. Energy storage market analyst Mollie McCorkindale’s look back on the UK’s buildout of energy storage in 2022, as well as a look ahead to what the market could expect going forwards, was no exception.

Diversifying a US$200 billion market: The alternatives to Li-ion batteries for grid-scale energy storage

21 February 2023

By Oliver Warren, investment banking associate, DAI Magister

One topic that came up a couple of times in our retrospective look at this year’s most-read news stories is the subject of diversifying the market away from reliance on lithium-ion. Oliver Warren at investment bank DAI Magister offered a take on some of the alternative, or complementary technologies with a chance of carving out a niche.

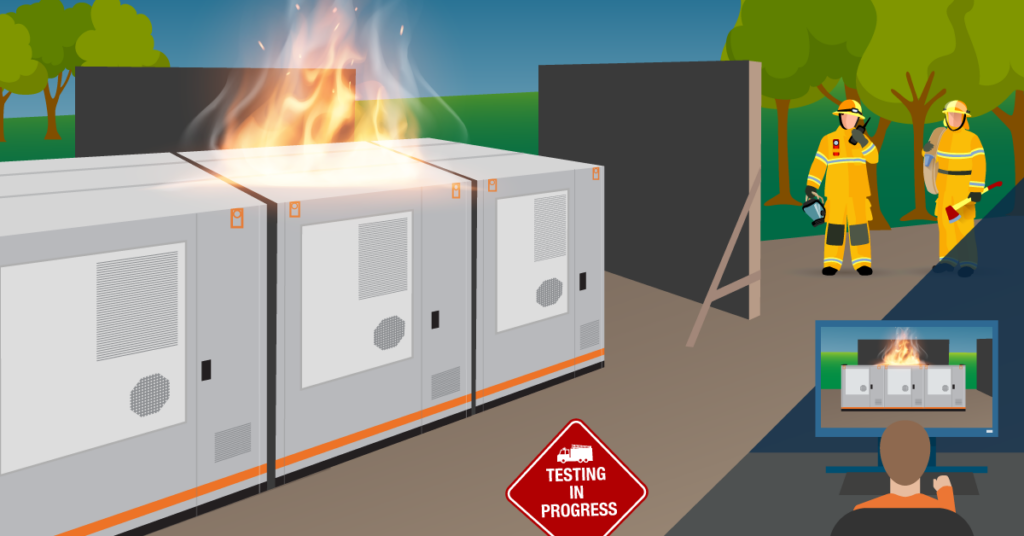

Fire safety is crucial to the growth of energy storage in 2023

8 March 2023

The industry needs to go further on fire safety, from engaging with first responders to going beyond required standards for testing, Nick Warner and Darrell Furlong’s Guest Blog argued. Image: Wärtsilä.

By Nick Warner, Energy Safety Response Group & Darrell Furlong, Wärtsilä

Fire safety remains a vitally important topic in any industry. For energy storage, that recognition is perhaps already in place, but some of the approaches being taken fall short, argued Nick Warner of Energy Safety Response Group and Darrell Furlong at Wärtsilä.

“By being clear about the challenges we face, developing our fire safety standards and working more closely with regulators, the energy storage industry can alleviate safety concerns, streamline project development, and ensure the energy grids receive the support from battery storage that they desperately need,” they wrote.

Solving the battery supply chain’s structural deficit with modular, standardised approaches

3 April 2023

By Greg Pitt, VP of battery materials, Worley

Battery manufacturing has scaled up massively in the past few years, thanks largely to the success of electric vehicles (EVs). Beyond supply chain issues, challenges going forward in getting manufacturing to the scale needed, at the speed required to meet net zero targets, will require a rethink in design philosophy and production techniques, argued Greg Pitt, VP of the battery materials growth team at Worley.

Protecting investments in artificial intelligence for energy storage

2 May 2023

By Ben Lincoln, partner, Potter Clarkson

With the rise of artificial intelligence (AI) and machine learning comes a need to protect the IP involved. Patent attorney Ben Lincoln of Potter Clarkson wrote about strategies to protect IP for AI innovations in the energy storage sector, emphasising the need to recognise the value of data and algorithms, and to apply several layers of protection.

Comparing the path to maturity and insurance’s role in the battery storage and wind turbine markets

17 May 2023

By Charley Grimston, executive chairman, Altelium

An interesting take on the path to maturity in clean energy technologies from Charley Grimston at specialist insurance technology company Altelium. Grimston noted that the early wind energy market was characterised by many of the same planning and permitting issues battery storage now faces, but went on to describe other ways in which the stories diverge. The common factor is that insurance has a key role to play in the bankability and maturing of both industries, according to Grimston.

Vanadium electrolyte: the ‘fuel’ for long-duration energy storage

22 May 2023

By Samantha McGahan, marketing manager, Australian Vanadium / VSUN Energy

The “elegant and chemically simple design” of vanadium redox flow battery (VRFB) technologies was in focus in this Guest Blog. Australian Vanadium’s Samantha McGahan wrote about the key ingredient, the electrolyte, which plays the most important role in the market growth of VRFBs.

A snapshot of Canada’s energy storage market in 2023

30 May 2023

By Justin Rangooni, executive director, Energy Storage Canada

Energy Storage Canada executive director Justin Rangooni wrote about the big developments seen in the past year or so to mobilise activity in the country’s market. Ranging from the 2023 Federal Budget’s investment tax credit (ITC) scheme announcement to major milestones recently logged in Ontario, to the future of energy storage, the blog gives a great picture of what’s going on, and what we might expect to see in Canada in 2023 and beyond.

Taking stock of energy storage in India in 2023

5 June 2023

By Dr Rahul Walawalkar, president, India Energy Storage Alliance

Following the 2023 edition of India Energy Storage Week, we published this blog looking back on the five-day industry event, authored by Dr Rahul Walawalkar, president of organisers India Energy Storage Alliance (IESA). From domestic manufacturing and national renewable energy targets to the need for more diversity and representation of women leaders in the energy industry, Dr Walawalkar’s blog speaks of an industry sector in an exciting phase of growth and transformation.

One in seven rooftop solar PV systems installed in Australia in 2022 included battery storage, as market uptake continues to rise dramatically. Image: Smart Energy.

Empowering Australian consumers: The rise of battery storage solutions in solar energy

14 June 2023

By Joel Power, head of battery storage and dealerships, Smart Energy

Nearly 50,000 residential battery storage systems were installed in Australia in 2022, with one battery deployed for every seven solar PV systems. Joel Power of solar PV solutions provider Smart Energy explained how batteries can give solar users a way to “take control of their power,” reducing bills while increasing energy independence.

How battery storage accelerates decarbonisation in Asia-Pacific

26 June 2023

By Hendrik Bohne, head of asset management & business development, Aquila Clean Energy Asia Pacific (ACE APAC)

Using the examples of two leading markets – Australia and Japan – Hendrik Bohne of ACE APAC showed that decarbonisation can become reality for the Asia-Pacific region when renewable energy and energy storage are combined. But it will take a lot of work, and cooperation, with Bohne imploring governments to incentivise energy storage, adopt clear guidelines for its market participation, or do both.

Delivering grid-scale battery storage as an enabler of the Philippines’ energy transition

29 June 2023

Carlos Nieto, energy storage global product manager, ABB

Our final Guest Blog of H1 2023 also looked at the Asia-Pacific region, with Carlos Nieto of engineering and automation company ABB offering a case study into a 60MW battery energy storage system (BESS) project in the Philippines. Recently visited by the country’s president Ferdinand R. Marcos Jr as it was inaugurated, Nieto described how the project protects the grid while enabling higher shares of renewable energy.

Continue reading