This is an extract of a feature which appeared in Vol.35 of PV Tech Power, Solar Media’s quarterly technical journal for the downstream solar industry. Every edition includes ‘Storage & Smart Power,’ a dedicated section contributed by the team at Energy-Storage.news.

Introduction

BESS projects do not only come with high costs, but also with high risks of failure or unplanned downtime. Between 2015 and 2022, 58% of energy storage system failures happened in the first two years of operation. Two thirds of the incidents occurred in the first year, shortly after the storages were deployed.

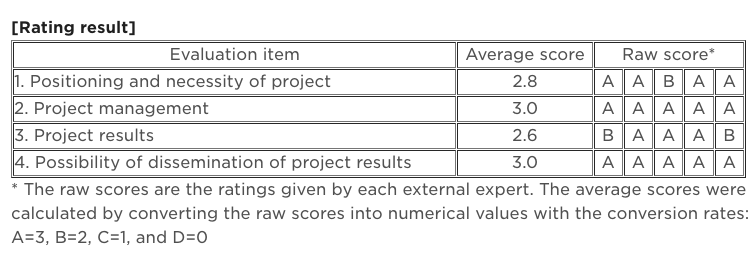

These incidents have many different causes, from cell and fan issues, cooling system errors, inverter breaks, battery management system (BMS) malfunctions, and more. Figure 1 above illustrates this point with data taken from the EPRI BESS Failure Event Database.

Get what you pay for (since you are paying a lot!)

Commissioning

Before deploying an energy storage system, a process generally referred to as “commissioning” takes place to test and verify that the storage system and its components are installed and configured correctly.

Commissioning is performed once the project is handed over from the EPC to the owner. The aim is also to test the operability of the storage at its initial state in terms of performance, reliability and safety. To put it simply, not only are the keys handed over, but also the responsibilities and risks regarding the asset.

Industry standards for commissioning reports have not yet been developed, but more and more common practices are emerging.

What commissioning typically includes

The part of the commissioning covering the battery typically includes information such as the system’s capacity, efficiency, and power output. It also includes details on issues that were identified during the commissioning process and the steps taken to resolve them. Additionally, the report will serve as the foundation in case of warranty claims or disputes about the asset’s status.

What commissioning does not typically include

However, conventional storage commissioning comes with drawbacks.

One of the significant drawbacks of commissioning reports for batteries is that they often focus on the system level, which is not where most issues are happening. Most problems occur at the sub-component level, such as individual cells, modules or strings.

The overall system performance is determined by the weakest sub-component; hence it is essential to identify underperforming and high-risk strings and modules as early as possible. Identifying and replacing these underperforming sub-components can significantly improve the efficiency and lifespan of the system. However, commissioning reports that only focus on the system level may not provide this level of detail, leading to continued use of underperforming sub-components and decreased efficiency.

The benefits of more insights into storage commissioning

Deeper insights than can be provided with onsite commissioning are crucial to get an overall picture of the asset and uncover more manufacturing failures, system design failures or other issues.

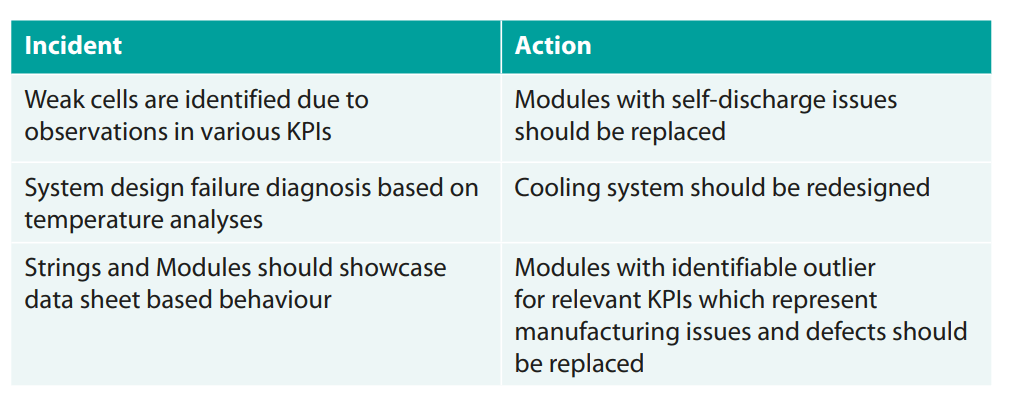

Let’s look into the inside of a storage system and at three common findings that could be fixed with additional KPIs.

You got off to a great start – now keep up the good work!

Successful commissioning and the detection of potential anomalies in the early phase of storage life is only the first step to profitable and reliable energy storage operations. After deployment, in-life monitoring and analytics is essential to ensure high availability and avoid safety-critical incidents.

In-life analytics for a safe and healthy operation

Using safety analytics, possible safety incidents can not only be identified, but grouped into meaningful technical units so that trends can be detected, and Operation & Maintenance (O&M) teams can plan and act accordingly.

One temperature or voltage value outside the boundaries is not necessarily a cause for immediate concern, but an accumulation could be a long-term risk. Values occurring outside safety-critical thresholds must be interpreted correctly and considered in the context of other KPIs. Notifications can be helpful in finding out when an unsafe level has been reached. This is where battery analytics is the ideal solution.

To make it more concrete, a vital component of battery safety involves detecting anomalies and trends outside the norm. Deviations from the average distribution in resistance and temperature, for example, could indicate side reactions within battery cells. These are the incidents you want to know about and fix as quickly as possible. Having enough time to fix such anomalies before they escalate will help to keep storage availability high.

Energy storage management systems (ESMS) usually do not provide sufficient information to ensure health and safety of energy storage systems. Such systems do not provide an analysis of historical data and hence do not supply the necessary data to detect long term trends or anomalies.

Conclusion

Battery energy storage systems are valuable assets. As much as BESS are advantageous in storing and trading energy, reliable insights are essential to ensure continuous operation and optimal performance of the batteries. At the beginning of the storage life, the storage needs to be commissioned. However, the main concern with conventional commissioning is that it often lacks detailed insights into the batteries. Digital commissioning can provide the necessary insights to ensure problems can be solved before deployment. This lays the foundation for a safe and long lifetime as well as high availability.

Digital commissioning is one option to deal with these challenges. Once digital commissioning has been carried out on an asset, the data connection is established and in-life analytics can finish what digital commissioning has started.

About the Authors

Dr. Stephan Rohr is Co-CEO of TWAICE. Before founding TWAICE with Dr. Michael Baumann, Stephan completed his Ph.D. at the Technical University of Munich after working in start-ups, PE, and in consulting.

Sebastian Becker: Sebastian is Director of Partnerships & Industry Strategy for the Energy sector at TWAICE. In his role, he drives the TWAICE go-to-market approach to enable integrators, developers and owners of battery energy storage systems to get the most of their assets.

Dr. Matthias Simolka: Matthias Simolka is part of Technical Solution Engineering at TWAICE. In this capacity, Matthias bridges the gap between Sales, Product and Tech, working with all teams to ensure maximum value and the optimal solution is delivered to battery customers.

Continue reading