No more.

Battery, EV manufacturers, and energy companies like LG Chem and Panasonic have invested billions of dollars into research on energy solutions, including battery technologies and production methods to meet the high demand for lithium-ion batteries. This has dramatically reduced the cost and increased capacity for lithium-ion batteries for ESS, allowing them to take a large and growing share of the market.

In this article, we’ll examine the six main types of lithium-ion batteries and their potential for ESS, the characteristics that make a good battery for ESS, and the role alternative energies play.

The types of lithium-ion batteries

1. Lithium iron phosphate (LFP)

LFP batteries are the best types of batteries for ESS. They provide cleaner energy since LFPs use iron, which is a relatively green resource compared to cobalt and nickel. Iron is also cheaper and more available than many other resources, helping reduce costs. The overall production cost is lower as well.

Tesla CEO Elon Musk says he expects all stationary energy storage products will embrace LFP battery chemistry and make the transition.

LFP batteries have a lower power density, but this characteristic is less important for energy storage systems than it is for EVs, as ESS can occupy larger spaces without concern. While LFP batteries are heavier, that’s only a concern during the initial installation.

LFP batteries are also safer because thermal runaways are less likely, and they have a higher life cycle (between 2,000 and 5,000 cycles) than most other Li-ion battery technologies.

2. Lithium Nickel Manganese Cobalt (NMC)

NMC batteries are a popular type of Li-ion battery for several reasons. They feature both strong energy and power density, and they are relatively safe compared to other types of lithium-ion batteries when it comes to thermal runaways.

However, they offer a significantly lower number of life cycles compared to LFP batteries, generally between 1,000 and 2,000 cycles.

NMC batteries also require cobalt and nickel, which are more expensive and harmful to the environment. There is also significant concern about shortages in these minerals, which can significantly impact both cost and availability.

3. Lithium Nickel Cobalt Aluminum Oxide (NCA)

NCA batteries are similar to the NMC with some key differences. While providing higher energy density than NMC batteries (allowing them to store more energy per unit volume), they also are more prone to thermal runaways.

Similar to NMC batteries, NCA batteries have about 1,000 to 2,000 life cycles and also depend on cobalt and nickel for manufacturing.

4. Lithium-Ion Manganese Oxide (LMO)

LMO batteries are quickly losing popularity because they offer the same characteristics as LFP batteries, but with a much smaller number of life cycles, often as few as 500-800.

While the production cost is a bit lower than LFP batteries, the short lifespan creates challenges for the total cost of operation and increases replacement costs.

LMO batteries do charge quickly, provide high specific power, and can operate efficiently at higher temperatures than some other types of batteries. As such, they are most widely used in portable power tools, medical instruments, and some electric vehicles.

5. Lithium-Ion Cobalt Oxide (LCO)

LCO batteries were one of the first Li-ion battery chemistries to have existed. Found commonly in laptops and smartphones, LCO batteries offer low power. They are best used for applications that require extremely lightweight solutions and do not need high power since they can deliver their energy over an extended period under low-load applications.

However, LCOs have short lifespans, typically between 500 and 1,000 cycles, and low thermal stability which prevents use in high-load applications. This makes LCOs a poor candidate for ESS.

6. Lithium Titanate Oxide (LTO)

LTO batteries feature a very high life cycle, often up to 10,000 life cycles, and are less polluting than most alternatives. They can also charge quickly, although that’s not necessarily an important feature for ESS installations.

LTOS have a lower energy density, which means they need more cells to provide the same amount of energy storage, which makes them an expensive solution. For example, while other battery types can store from 120 to 500 watt-hours per kilogram, LTOs store about 50 to 80 watt-hours per kilogram.

What makes a good battery for energy storage systems

Maximising battery output for ESS requires several key factors that must be taken into consideration:

High number of cycles

Different types of batteries have different life cycles depending on the number of charge and discharge cycles they can complete before losing significant performance. Today’s EV batteries have longer lifecycles. Typical auto manufacturer battery warranties last for eight years or 100,000 miles, but are highly dependent on the type of batteries used for energy storage.

Energy storage systems require a high cycle life because they are continually under operation and are constantly charged and discharged. Battery capacity decreases during every charge and discharge cycle. Lithium-ion batteries reach their end of life when they can only retain 70% to 80% of their capacity. The best lithium-ion batteries can function properly for as many as 10,000 cycles while the worst only last for about 500 cycles.

High peak power

Energy storage systems need to support high surges in demand for electricity, as they are used to meet energy needs during periods of peak demand in electrical grids.

Energy needs occur unevenly but ESS can shift charging to times when energy is cheaper or more available. By storing energy during low demand and releasing it when needed, it can dramatically reduce costs.

Low production cost

Energy storage systems require an impressive number of cells to meet energy demands. For example, the amount of energy used per hour is measured in megawatt-hour (MWh). For EV batteries, it is measured in kilowatt-hours (kWh). That’s 1,000 times greater!

Because the quantity of battery cells needed is so high in ESS, more expensive battery technologies are not economically viable.

Minimised chances of thermal runaway events

Thermal runaway remains a serious consideration. When a lithium-ion battery reaches an uncontrollable, self-heating state, it can result in fire, smoke, and ejection of gas, particulates, and shrapnel.

Thermal runaways occur at different temperatures for different types of lithium-ion batteries. For example, NCA, NMC, and LCO are types of lithium-ion batteries that are at risk of thermal runaway events at lower temperatures. LFP batteries are the safest.

Weight and size are not important

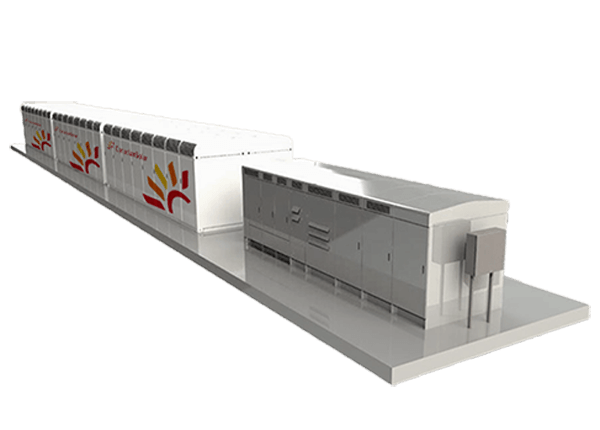

Unlike EVs that need to manage weight and size carefully, the weight and volume of the battery do not matter in ESS operations as these installations are typically installed in containers or storage units.

The cost of the land where ESS are installed is usually low, so the battery’s size has little impact on cost. Weight is unimportant because it does not affect the battery’s performance as it does in electric vehicles.

ESS and LFP batteries are essential for the future of ‘alternative energies’

The need for electrical power keeps growing at an accelerating rate. In fact, McKinsey projects electric power consumption will triple by 2050 globally. Everything that we use requires power, and EVs add an increased burden on the electric grid.

Traditional forms of energy (such as nuclear, hydroelectric, and coal power) simply cannot meet the growing demand. There are significant regulatory hurdles and building restrictions in many countries. Even where hurdles can be cleared, it can take 10 years or longer to build infrastructures.

Installations for alternative energy sources like wind and solar power can often be built much faster as requirements are less complicated and public support is growing. The International Energy Agency (IEA) highlights the growth in clean energy sources, expecting an increase in capacity by a third from 2022 to 2023.

Alternative energies will likely take an important place in our future, but they are dependent on the weather. They cannot generate power at a steady rate, so they need ESS to store energy, meet periods of peak demand, and provide energy even when weather conditions are not right.

Energy storage systems also make electric power plants more efficient by smoothing out power peaks. They also help deliver a more consistent and regulated power, which can extend the lifespan of power plants.

All of this points to LFP batteries as a good bet for the future. LFPs are well-suited to meet the needs of ESS due to their high life cycle, low production cost, and low risk of thermal runaway.

Recently, the LMFP battery—a type of LFP battery that includes manganese as a cathode component—was announced with promising performance for EVs. Depending on the production cost, this new type of cell chemistry could become a competitive solution for energy storage systems.

About the Author

Stéphane Melançon is battery expert at Laserax, a provider of innovative laser technology tailored specifically for the automotive and electric vehicle sectors, battery production, foundries, primary metals, surface preparation and heavy equipment industries. Technical expert and consultant in batteries and electrical propulsion systems, Stéphane holds a Physics degree with specialisations in Photonics, Optics, Electronics, Robotics, and Acoustics. Invested in the EV transformation, he has designed industrial battery packs for electrical bikes. In his free time, he runs a YouTube channel on everything electrical.

Continue reading