Canada could be reasonably expected to reach at least 5,000MW of cumulative battery energy storage systems (BESS) by 2030 across all provinces and territories. According to consultant Patrick Bateman, that figure comes from adding up the few hundred megawatts already installed to major announced developments like the 250MW/1,000MWh Oneida project in Ontario, that province’s 2,500MW procurement, a big pipeline of standalone and hybrid storage projects in Alberta and smaller developments in other provinces.

In fact, much more is likely to come by then, says Bateman, who has been retained by Energy Storage Canada for market development activities in Atlantic Canada. The Atlantic Canadian province of Nova Scotia, for example, has an integrated resource plan (IRP) that calls for 200MW of storage by 2030, but the IRP is undergoing revisions and “could take a few steps up gradually,” and New Brunswick’s government-owned utility NB Power is currently seeking bids for 50MW.

However, Canada’s different provinces represent a “patchwork” of different electricity markets, with different structures, rules and regulations, and activity so far is largely concentrated in Ontario and Alberta – around 94% of the entire projection, according to Bateman.

Both those provinces have a pretty strong head start; Ontario has about 225MW of large-scale behind-the-meter energy storage resources installed at industrial facilities to mitigate Ontario’s unique Global Adjustment Charge peak pricing tariffs, while Alberta has about 100MW of battery assets providing operating reserves to the grid.

LT1 procurement

Ontario’s LT1 procurement, through which around 2,500MW of energy storage will be contracted for through competitive solicitation, along with a similar amount of new gas resources, is serving a primary function of contributing to resource adequacy.

While adding much-needed dispatchable firm capacity, new resources contracted for will be able to participate in ancillary services markets. It seems likely Ontario will see other energy storage added too, including non-wires alternatives (NWA) projects at the distribution level, and more commercial and industrial (C&I) projects.

Alberta on the other hand has just 100MW of operating reserves today. Yet as a rapid adopter of renewable energy as well as a traditional home of carbon-intensive energy industry activity, there is a fundamental need for clean energy resources.

Of around 2,500MW of energy storage project applications waiting for grid connections in the Alberta Independent Electricity System Operator (AESO) queue, about two-thirds are standalone energy storage and the remaining third hybrid renewables-plus-storage or thermal generation-plus-storage.

“A lot of these projects have posted in-service dates of 2023-2024, and it’s probable that some of them will be pushed back to the 2025 to 2030 timeline, but there’s really a very substantial amount of projects proposed already,” Bateman says.

Alberta storage tariffs in transition

An often-encountered trend when looking at the energy storage industry is that the technologies involved are far newer than the market and regulatory constructs they have to abide by. One challenge both provinces face – and that the other provinces in Canada will no doubt wrestle with too – is that market participation is limited by those structures today.

The 100MW of BESS installed in Alberta today, for example, provides operating reserves, “and some initial exploration of providing primary frequency response as well,” Bateman says. However, work to develop an appropriate storage tariff has not been completed despite an ongoing modernisation process.

“The AESO has initiated a new process with a view to having the storage tariff modernised by the middle of next year. So if that goes through, and if it’s favourable, a lot of these projects in the connection queue might more quickly move forward,” the consultant says.

One company with projects in that interconnection queue is Westbridge Renewable Energy. Founded just a couple of years ago, Westbridge is developing five large-scale solar-plus-storage projects in Alberta.

Each of those is planned with 2-hour duration BESS in the 100MW range, paired with around 300MWp of PV per site. While Westbridge also develops standalone storage projects in other territories, in Alberta, co-location with renewables offers the quickest path to grid connection, Westbridge special advisor and technical expert Alex Dickinson says.

Francesco Cardi, VP of development of Westbridge, adds that Alberta is a “great place for solar development,” which he says is well-planned and straightforward, with clear requirements for developers.

The Alberta market’s likely evolution is impossible to predict, Cardi says. The fundamental drivers for energy storage are there, as variable renewable energy sources represent a growing share of the energy mix, but as a developer the key characteristics of its planned projects are flexibility and optimisation to adapt to changing conditions.

“We’re looking at fast response systems so that we can adapt as the market evolves. Our revenue streams in two years’ time, we would imagine would be totally different to revenue streams in six years’ time. But what that difference is, we can’t say.”

‘Absolute necessity’ to adopt storage across Canada

Another developer active in Canada, NRStor, can reasonably be described as one of the country’s pioneers of energy storage.

In business for over a decade, largely focused on Ontario, the company has worked on a broad range of different projects and technology types: it owns and operates an advanced compressed-air energy storage (A-CAES) system and a flywheel-based system, in addition to working on everything from residential and C&I BESS, to the 250MW, 4-hour duration Oneida project.

Oneida has been five years in development already and represents just another deal NRSTor has brokered with Ontario’s Independent Electricity System Operator (IESO), albeit one on an unprecedented scale.

“Many different kinds of service agreements” between NRStor and the IESO have helped lay the foundation for large-scale storage development in Ontario, claims Jason Rioux, the company’s chief development officer (CDO).

For instance, the company’s A-CAES project is the world’s first compressed air plant to run without thermal generation, using technology from Ontario-headquartered Hydrostor.

“When these first projects get through all of the heavy lifting, it sets the stage for compressed air energy storage projects of the future to be able to move ahead without similar roadblocks,” Rioux says.

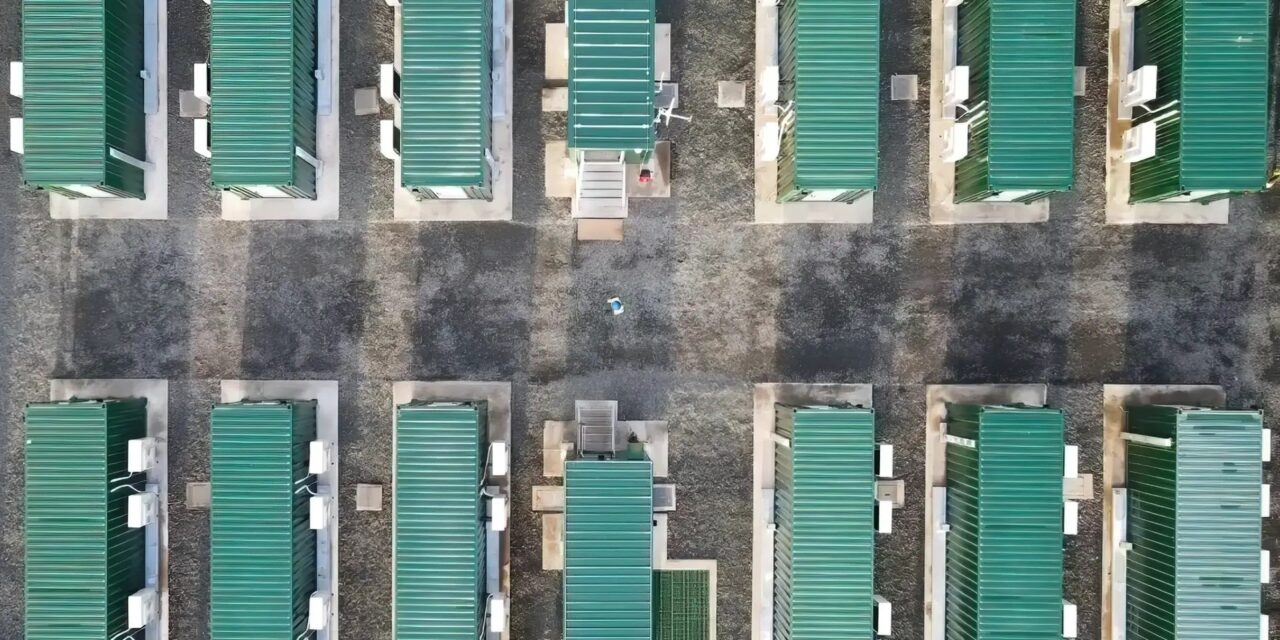

NRSTor and technology provider Hydrostor completed the world’s first advanced compressed air energy storage plant (pictured) in 2019. Image: Hydrostor.

Transferable lessons and provincial competitiveness

What is important is that lessons learned in Ontario particularly, as well as in Alberta, can be applied to the rest of Canada too. Patrick Bateman says that although the market structures and regulations need to be tailored, the technology lessons are almost all transferable.

Jason Rioux agrees, adding that Canada’s other provinces don’t now need years of pilot projects proving out what’s already been proven elsewhere. Ontario’s 2,500MW RFP, for instance, shows that scaling up energy storage is “not a crazy idea”, but that it is in fact “an absolute necessity to adopt storage in smart and scalable and quick ways for each of these provinces, especially the ones that are looking to decarbonise their power grids,” Rioux says.

Especially with several of Canada’s provinces still reliant on coal, cleaning up the grid and using the grid more efficiently, experiences from Ontario – mistakes as well as successes – can be an important springboard, Rioux claims.

“It’s becoming a little bit clearer now as well that the jurisdiction of the province with the most energy storage wins, in respect to how you trade energy with your neighbours, and managing clean energy supplies for your jurisdiction’s benefit. Those that are further behind are going to suffer in their energy management and operations and in the commercial aspects of delivering low cost energy to their customers.”

This is an extract of a feature which appeared in Vol.35 of PV Tech Power, Solar Media’s quarterly technical journal for the downstream solar industry. Every edition includes ‘Storage & Smart Power,’ a dedicated section contributed by the team at Energy-Storage.news.

Continue reading