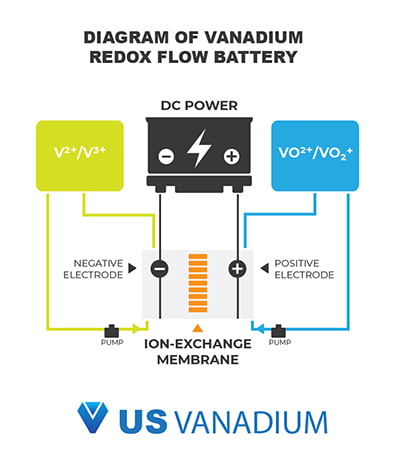

VRFBs have an elegant and chemically simple design, with a single element of vanadium used in the vanadium electrolyte solution. The supply of this vanadium electrolyte is now playing the most important role in the batteries’ market growth.

Inside a VRFB. Image: US Vanadium.

Most VRFBs used what is known as ‘Gen 1’ vanadium electrolyte which is a combination of vanadium pentoxide (V2O5), sulphuric acid and water.

‘Gen 2’ was a vanadium bromide mix that was more costly and more chemically reactive. Issues with the solution included the formation of bromine gas and corrosion.

‘Gen 3’ is a solution using a mixed acid of hydrochloric acid, sulphuric acid and water. It was invented in the USA at Pacific Northwest National Laboratory (PNNL) and there are only a few licences available worldwide.

Gen 3 has a higher energy density and other benefits such as an even wider operating temperature range, however it is more corrosive and more complicated to ‘unscramble’. All of the major VRFB manufacturers around the world currently use Gen 1 vanadium electrolyte.

Supply chains

Since the advent of COVID-19, everyone has become a lot more aware of supply chains. For vanadium electrolyte the major producer is currently China, which also consumes a lot of that electrolyte for its own VRFB installations.

US Vanadium LLC (USV) in Arkansas, USA, supplies the highest purity vanadium electrolyte produced in the world and has a current capacity of 4 million litres per year, which equates to approximately 60MWh equivalent. USV has an agreement with Europe-headquartered VRFB manufacturer CellCube to supply up to 3 million litres of that electrolyte. In the UK, Oxkem is another electrolyte supplier. It has the capacity to manufacture in excess of 3 million litres per year.

Global supply of vanadium electrolyte is however currently very tight.

Primary vanadium producer Bushveld Minerals in South Africa is completing construction of its BELCO electrolyte plant which is expected to start operation in H1 2023, with an initial capacity of eight million litres per year. This production can be expanded to deliver 32 million litres per year.

Emerging vanadium producer Australian Vanadium Limited (AVL) in Australia is building a vanadium electrolyte manufacturing facility in Western Australia which will have an initial capacity of 33MWh per year. Production is due to commence later this year. AVL also intends to build further manufacturing facilities on the east coast of Australia to supply the growing local demand.

Several other companies have indicated their plans to manufacture vanadium electrolyte in Australia. The Australian Government is keen to support downstream processing in Australia, adding value to the country’s resources and leveraging strong international trading relationships to move up the value chain.

How that translates into serving VRFB end-market demand

In this nascent market, numbers used for vanadium electrolyte switch between the equivalent megawatt-hours, the number of litres of electrolyte and the contained amount of vanadium. One megawatt-hour (1MWh) of stored energy equals approximately 68,000 litres of vanadium electrolyte or 9.89 tonnes of vanadium pentoxide (V2O5), which can include a proportion of vanadium (III) oxide (V2O3) depending on whether a chemical or electrical method of production is used.

Specifications for elements contained in the electrolyte vary between VRFB manufacturers. The molarity, or concentration, of the solution also varies, but will usually be between 1.6 and 1.8 molar. Vanadium electrolyte manufacturers work with VRFB manufacturers to ensure that their electrolyte is suitable for supply, with some manufacturers insisting on particularly stringent requirements.

There are three primary vanadium mines in the world outside China that are currently in operation. One in Brazil which is operated by Largo Resources and two in South African which are operated by Bushveld Minerals and Glencore. However, 75% of the world’s vanadium is currently produced by China and Russia, not from primary production i.e., mining and extraction of vanadium from the ground, but as a by-product in the production of steel.

Why it matters

Vanadium electrolyte’s characteristics mean that VRFBs have the advantage over other energy storage mediums of being non-flammable and not having any degradation of performance over the battery’s lifespan.

VRFB manufacturers are generally offering 25-year warranties on their batteries. With good maintenance of pumps and other mechanical elements, they could last a lot longer. At the end of the battery’s 25+ year lifespan, the vanadium electrolyte can be reused in another battery. It might only need to be rebalanced to recover any minor capacity loss over that time. For example, VRFB manufacturer CellCube reported a ~1% capacity loss for a VRFB that had been operating for 10 years.

If there is no longer a requirement for the vanadium electrolyte to be used in a VRFB, the vanadium pentoxide can be reclaimed and used in a different application. US Vanadium can recycle spent electrolyte from VRFBs at a 97% vanadium recovery rate. This makes the VRFB a truly sustainable solution – the vanadium resource is only being borrowed from future generations, not consumed at its expense.

One of the main costs affecting vanadium electrolyte is the price of moving it. Essentially when you transport the electrolyte you are moving acid and water. To reduce the cost of the battery, manufacturing the electrolyte close to the installation makes a lot of sense.

Vanadium electrolyte makes up 40% of the battery’s cost for a 4 to 6-hour battery, rising in percentage as the duration is increased. VRFB power and energy is decoupled, meaning that the energy can be increased without having to pay for increased power. In comparison, an increase in energy storage for a lithium ion battery requires a related power increase which is then paid for, but not used.

Because vanadium electrolyte doesn’t degrade, it is an appropriate commodity for leasing. The customer then has an operating expense rather than a capital expense. This also provides comfort to the customer as at the end of the battery’s life the electrolyte belongs to someone else who will then be responsible for retrieving and repurposing it.

With a wide consensus on demand growth for VRFBs and the resulting demand for vanadium pentoxide and vanadium electrolyte supply, there is a bright future ahead for this versatile decarbonisation material.

Read Energy-Storage.news/ PV Tech Power’s 2021 feature interview with Maria Skyllas-Kazacos, University of New South Wales professor and co-inventor of the vanadium redox flow battery, here.

About the Author

Samantha McGahan has worked as marketing manager for Australian Vanadium Limited (ASX: AVL) and its vanadium redox flow battery focused subsidiary VSUN Energy for seven years. She has represented both companies to government and industry and has built a sound knowledge of the vanadium market and AVL’s pit to battery strategy. AVL is developing the high-grade Australian Vanadium Project in Western Australia to produce high-purity vanadium pentoxide for the steel and battery markets. The Company is also building its first vanadium electrolyte manufacturing facility in Perth, WA. VSUN Energy is focused on developing the vanadium redox flow battery market.

Continue reading