Having gone public in 2020 via a SPAC merger, one of several companies in the energy storage space to have done so, the company said at the time that reaching profitability would take time, but projected for it to happen during this year.

Its revenues for the first quarter 2023 (Q1 2023) stood at US$67 million, a 63% increase from Q1 2022, while bookings increased 141% and now stand at a value of US$364 million. While the Q1 2023 revenue figure sits at the higher end of guidance, non-GAAP gross margin was 19%, which CEO John Carrington said was also in line with previously offered guidance.

Carrington said in an earnings call to explain results that “…accelerating services growth will be the key factor that helps us achieve our goals this year, and for years to come,” with energy storage services revenues up 22% sequentially and solar PV services revenues up 7%.

“We are currently pursuing several significant software-only and professional services deals that we expect may close later this year,” the CEO said, adding that those types of deals generate higher margins and revenues can be recognised much more quickly than for projects which have longer development and commissioning cycles.

Supply chain issues that impacted both the storage and solar industries are easing, he said, while Carrington and CFO Bill Bush spent time in China recently meeting “the largest OEMs,” with plans to add “multiple Tier 1 hardware vendors”.

Supply chains easing, interconnection remains a challenge

In response to an analyst question regarding supply chain, grid interconnection, permitting delays and other causes for bottlenecks referred to by the company in previous quarters, Bush said that new capacity with lower prices is being seen in the energy storage market, helping the supply chain situation.

Bush said however that interconnection is an area where the market is more challenging, which is “not a problem that’s going to get solved overnight”. It is perhaps however, if looked at in a different way, a strong indicator of just how much demand there is for energy storage and other clean energy technologies, the CFO said.

Solving it will involve simplifying applications for grid interconnection and working at the local utility level.

“We’re definitely seeing some speeding up, particularly in our primary markets in ERCOT and in New England ISO. But it’s definitely something that has not been solved just yet,” Bush said.

Carrington also talked up the company’s position in two of its key markets on either coast of the US: ISO New England and California, with the Stem fleet of aggregated virtual power plant (VPP) assets in the latter responding to 110% more site events year-on-year and a 250% increase in demand response calls. Despite this activity, no degradation in performance of its portfolio has been recorded, the CEO claimed.

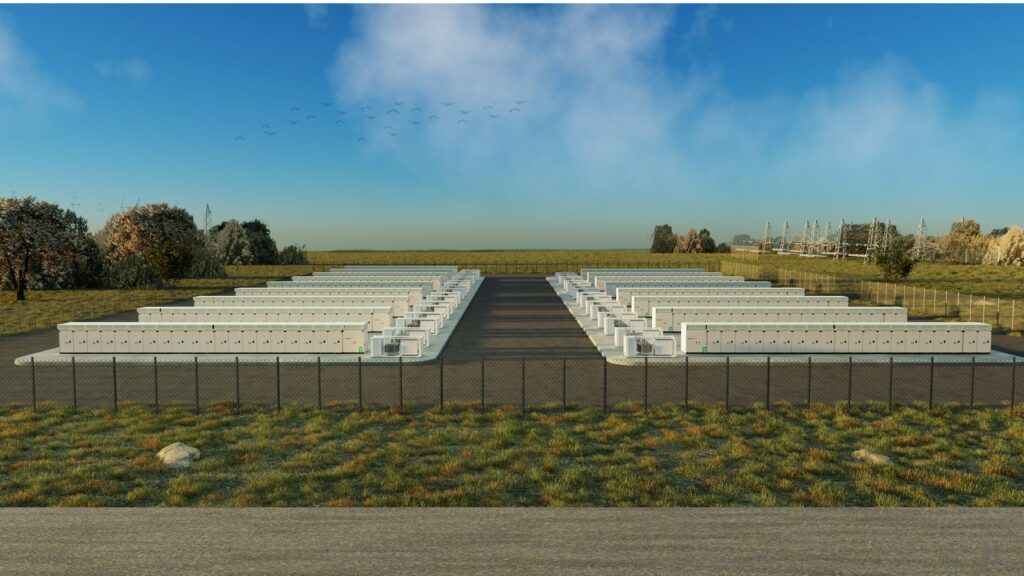

Things the company can look forward to are the growth of its electric vehicle (EV) charger-related business, a launch of Stem’s own modular energy storage system (ESS) solution for larger customer projects, and ongoing standardisation of the company’s Athena software platform which drives its energy management and market-facing activities.

For now, adjusted EBITDA for Q1 2023 stood at a loss of US$13.7 million, down from US$12.8 million in Q1 last year. Stem’s net loss was US$44.8 million for the first quarter ending 31 March 2023, versus a US$22.5 million net loss in Q1 2022.

However, revenues have been on an upward trajectory for several quarters. In February, the company reported that its Q4 2022 and full-year 2022 revenues were both up by almost 200% year-on-year.

In the earnings call last week, Carrington reaffirmed Stem Inc’s guidance, which includes 65% revenue growth by the mid-point of 2023 and achieving positive EBITDA during the second half of this year.

Read all of Energy-Storage.news’ coverage of Stem Inc.

Conference call transcript by Seeking Alpha.

Continue reading