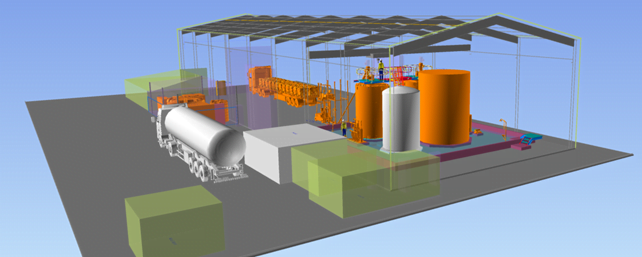

Rendering of the Waranga electrolyte processing plant. Image: Australian Vanadium.

Australian Vanadium has secured a site and progressed the design and development of a flow battery electrolyte facility in Western Australia.

Australian Vanadium (AVL) is a publicly listed vanadium resource company creating a vertically integrated vanadium redox flow battery (VRFB) energy storage business, as well as targeting supply of the metal into the steel industry.

The company made an announcement to the Australian Securities Exchange (ASX) yesterday regarding its manufacturing facility, which will have a 33MWh annual production capacity. Its selected site is in Wangara, a suburb in northern Perth.

In addition to securing the land, AVL has ordered equipment from suppliers with a long lead time, for which deliveries are expected to begin in the second quarter of this year. AVL did not say in its release when the plant will be up and running, but said site preparation work ahead of the arrival and assembly of equipment will likely begin in April 2023.

Engineering company Primero Group has worked with AVL to design the plant, which will comply with national requirements and standards.

Meanwhile, AVL has licensed key vanadium electrolyte manufacturing technology from US Vanadium (USV), which in addition to the manufacturing IP and tech sells high purity vanadium pentoxide from its own processing facility in Hot Springs, Arkansas, US.

USV currently sources its vanadium feedstock from India, having signed a five-year supply deal for the metal – deemed a Critical Mineral by the US and other governments – with an unnamed producer back in late 2021.

While AVL has ambitions and plans to become a vanadium processor and eventually open and operate its own “flagship” vanadium mine in Australia, firstly through building a processing hub in the Midwest of Western Australia with capacity to produce 13,000 tonnes of vanadium pentoxide flake per year, and then build a mine to exploit a high-grade vanadium deposit near the mining town of Meekatharra in the state.

The latter has been given Federal Major Project Status by the Australian federal government in 2019, as well as State Lead Agency Status by the Western Australian state government a year later, in recognition of the project’s potential strategic importance to both.

Vanadium flow batteries are considered a suitable technology for providing bulk electrochemical storage of energy for mid to long durations i.e., several hours, and have long expected lifetimes in operation equivalent to roughly 20,000 daily cycles.

However, barriers to adoption include high upfront capital cost versus lithium-ion, despite a potential lower cost of ownership over lifetime and crucially, access to vanadium, both in raw material form and in terms of access to electrolyte processing and manufacturing.

In an interview published this week, the CEO of Lion Storage, a Netherlands-headquartered battery energy storage system (BESS) project developer, said the current VRFB industry ecosystem is not big enough to support massive scale-up of the technology.

Efforts to address this gap are ongoing around the world. Australia has a perceived head start in this respect, holding significant vanadium deposits and being the country incidentally where the technology was invented.

The government of another Australian state, Queensland, is targeting taking a share of that potential market too: its recently published Energy and Jobs Plan outlined that while Queensland has cobalt, nickel and other materials used in lithium-ion batteries and other clean energy tech like LED lights, vanadium, and VRFBs, could be the one area where it holds the most advantage. The state government is helping to fund a processing plant worth AU$75 million (US$53.38 million) in the Queensland coastal city of Townsville.

AVL was awarded a AU$3.9 million (around US$2.88 million at that time) grant from the federal government to fast-track development of its processing capabilities in 2021. Further downstream, the company also has a subsidiary, VSUN Energy, which is focused on developing the VRFB market in Australia.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Asia, 11-12 July 2023 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

Continue reading