The prices for successful bids ranged between €0.0678/kWh (US$0.073/kWh) and €0.0917/kWh and the average volume-weighted price was €0.0833/kWh, which the Bundesnetzagentur said was “well below” the maximum tendered price.

The auction sought solar-plus-storage projects on arable grasslands, with different criteria offered for different states. Bavaria was awarded the most capacity by far, with 245MW across 24 projects. Next closest was Mecklenburg-Western Pomerania with four projects for 79MW and Schleswig-Holstein with five projects for 73MW.

The October 2023 iteration of the innovation auction was oversubscribed and awarded 408MW of solar-plus-storage capacity.

At the same time, the government announced the results of its latest onshore wind auction, where over 2.3GW of capacity was awarded, which it said “set a new record”.

To read the full version of this story, visit PV Tech.

NHOA: TCC share purchase and delisting to enable ‘gigawatt-hour scale’ project bids

However, TCC intends to fully acquire the company and take it into full private ownership, delisting NHOA from the Euronext Paris Exchange.

TCC will file a simplified Tender Offer for NHOA shares before a squeeze-out of remaining holdings, as reported by Energy-Storage.news on 13 June.

NHOA has business lines in the battery energy storage system (BESS) space and electric mobility infrastructure solutions. It has been majority-owned by TCC since 2021 after the sale of a 60.48% stake by previous owner Engie, under which the Italian company traded as Engie EPS from 2018.

Reasons given included an underperforming stock price due to low volume of trading and the freedom that going private would offer TCC to make long-term strategic decisions around investments.

The move is “almost a bit overdue,” with TCC already holding such a big stake, Giuseppe Artizzu, CEO of NHOA Energy, the business line active in the BESS space, in an exclusive interview with Energy-Storage.news Premium.

“Clearly a listing is something that is beneficial to the extent that you have a liquid stock that trades, that reflects news flow, and the price is reflective of the underlying value of the company, so that the moment the company needs further capital, you can tap into the capital, at least in proportion to the existing ownership structure,” Artizzu said.

In 2023, NHOA made a significant capital raise through a €250 million (US$270 million) rights issue in which TCC was the main participant and increased its holding to its current level.

The resulting “significant dilution” and the impact it made on share price, coupled with the low volumes of trading made the listing “almost counterproductive over the last year,” Artizzu said.

“The stock was not trading. The value was basically discounted on cash balance in the balance sheet of the company, so it was not reflective of the fundamentals,” he said.

“Generally speaking, something had to happen. I don’t think really this is big news, this is just a consequence of something that had been happening for more than a year and it is lastly a financial efficiency driver.”

Going private to put NHOA in running for ‘gigawatt-hour scale’ projects

Artizzu said the impact on the energy storage business would likely be minor, but it would facilitate greater financial support from its parent company when a balance sheet backup might be needed.

NHOA, which began as an integrator specialised in microgrids and has traded on Euronext Paris since 2015, has been working on increasingly larger size and capacity BESS projects in the US, Europe and Asia-Pacific markets.

The company been increasing scale of average project in common with many of its rival integrators, but it has yet to bid for projects in the gigawatt-hour scale as a handful of competitors have done.

Artizzu said that NHOA could likely handle projects of up to half a gigawatt-hour, but that for projects twice that size and bigger, the balance sheet backstop and “clean financial structure” would help.

“We still haven’t won projects in the gigawatt-hour scale, and clearly we want those because we want to be on the big stage,” Artizzu said.

Italian lawmakers scrutinising deal, Reuters says

Reuters reported yesterday (3 July) that the proposed transaction is under “government scrutiny” in Italy, according to two unnamed sources the news agency spoke to.

Noting that under Italian law governance changes by companies involved in strategic sectors like telecoms and energy can be blocked by the government, as well as strategic or domestic “forays,” Reuters said Italian prime minister Giorgia Meloni’s office wants to check whether TCC plans to move NHOA’s strategic activities out of Italy, or change the management structure.

The news agency also said that after the initial 2021 acquisition, then-prime minister Mario Draghi’s government ordered TCC to notify the Italian government of any possible relocation of NHOA activities as well as changes in governance.

‘Financial visibility is in our interests’

While NHOA apparently declined to comment on yesterday’s news to Reuters, Giuseppe Artizzu described to the potential deal to Energy-Storage.news as a “reconfirmation of financial support,” from TCC that would also enable more agile decision-making.

“This is done in order to make things easier both from a strategic and from a financial support perspective. Absolutely, this is something in which taking out that disturbance coming from the stock price movements, that was not reflective of performance, helps”

NHOA’s majority owner is a multi-billion-dollar market cap company which has sought to diversify from over-reliance on its core cement business, with ‘New Energy’ including energy storage a key pillar of that strategy.

TCC also has an independent power producer (IPP) business in Taiwan, EV fast-charging networks in Asia and Europe, and its own high-performance battery cell manufacturer, Molicell.

One advantage of the public listing, at least for journalists, was the visibility it offered into NHOA’s financial results.

Artizzu said that NHOA already has consolidated financial results that are in the public domain summarising its financial position, and that maintaining transparency will continue to be important.

“We won’t have a quarterly call [anymore] but we have an interest in being quite transparent from a financial perspective, for the simple reason that bankability is critical to our role as energy storage suppliers, in the contractor business model,” Artizzu said.

“If we want to be a bankable provider, we need to give visibility, so it is going to be in my interest to ensure that enough visibility is given to the market on our financial reports.”

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia next week, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

World’s largest sodium-ion BESS comes online in China as it seeks to diversify away from lithium

Its capacity will eventually be doubled to 100MW/200MWh, but is almost certain to already be the largest sodium-ion project in the world, as claimed in both announcements. It comprises 42 BESS containers containing 185Ah sodium-ion batteries, 21 power conversion system (PCS) units and a 110kV booster station.

As Energy-Storage.news reported when covering the project in January, it is being developed and operated by Datang Hubei Energy Development, part of the state-owned Assets Supervision and Administration Commission of the State Council (SASAC). Its deployment is part of a national-level effort to build large-scale storage projects using non-lithium technologies.

Sodium-ion: high potential but bumpy road to commercialisation

The technology is generally seen as the battery chemistry most well-placed to commercialise at scale and ease supply chain bottlenecks around lithium-ion, the dominant battery chemistry for both electric vehicles (EVs) and BESS applications. Part of this is a similar design making it easier to ‘drop in’ to lithium-ion production lines.

Sodium-ion has a lower energy density and, because of lower scale, generally a higher cost than lithium-ion, although by 2025 it could already be 15-30% cheaper than lithium-ion according to BYD. However, commercialisation and cost reductions have come slower than expected, Yicai Global said.

Technically it also has some advantages according to HiNa Battery. One is a better round-trip efficiency (RTE) and cycle lifetime at extreme temperatures. They also perform much better than general batteries in acupuncture and impact-resistance tests, the project manager said.

Energy-Storage.news has been told anecdotally that one reason China is investing so heavily on sodium-ion technology is because of fears that, long-term, it could start to be cut out of the lithium supply chain. China does dominate the supply chain today, both in terms of battery manufacturing and lithium refining, but HiNa’s announcement pointed out that it only has about 6% of the world’s lithium reserves for mining, whereas it has abundant reserves of the minerals for sodium-ion batteries.

HiNa Battery’s general manager Li Shujun has claimed that the a ‘terawatt-hour’ sodium-ion battery industry will gradually form by 2030, Yicai Global added.

Pumped hydro energy storage projects in New South Wales, Australia, granted ‘critical’ status

Other projects designated as CSSIs include the Pacific Highway Upgrade, the Inland Rail project, and the 2.2GW PHES power station Snowy 2.0. Our sister publication, Energy-Storage.news, reported that the NSW government granted Oven Mountain, a 600MW/7200MWh, billion-dollar energy storage project, CSSI classification in 2020.

Of the six new CSSI projects, three proposed transmission projects will connect additional renewable energy generators to the National Energy Market (NEM) to attract further investment in NSW. The other three proposed pumped hydro projects will provide reliable energy generation, capacity, and dispatchable power when solar or wind resources are unavailable.

Pumped hydro energy storage and solar triumph in new CSSI allocation

The CSSI list includes the Stratford Pumped Hydro and Solar project. Proposed at the Stratford Renewable Energy Hub, this project consists of a 330MW solar farm alongside a pumped hydro storage facility with a capacity of 3,600MWh over a 12-hour cycle.

The behind-the-meter solar farm facility would provide a portion of the energy needed to recharge the pumped hydro during daylight hours when excess renewable electricity is already in the grid. It will also take advantage of existing mine voids and infrastructure associated with the Stratford Mining Complex, due for closure in 2024.

Alongside the Stratford project, the Muswellbrook and Lake Lyell pumped hydro storage projects have also been designated CSSIs.

Muswellbrook will generate 250MW of hydroelectricity with eight hours of storage capacity for 2GWh of stored energy. This will feed electricity into existing high-voltage power lines nearby. It is being developed by AGL and Idemitsu Australia.

On the other hand, Lake Lyell has a proposed capacity of 335MW and a storage duration of eight hours. It has an operational life of 80 years and is being explored by EnergyAustralia.

The project would use water from the existing purpose-built Lake Lyell dam and a new purpose-built upper reservoir behind the southern ridge of Mount Walker to operate a utility-scale energy storage project.

Other projects classified as CSSIs included the New England Renewable Energy Zone (REZ) Transmission project, the Victoria NSW Interconnector, and the Mount Piper to Wallerawang Transmission.

NSW’s minister for Planning and Public Spaces, Paul Scully, highlighted that the classification of the new CSSIs “signals trust from the wider industry in our government’s capacity to move projects through the planning system”.

“These projects will be subject to a comprehensive assessment, including a public exhibition seeking submissions from the community,” he added.

This article first appeared on Energy-Storage.news’ sister publication PV Tech.

Uzbekistan: European Bank for Reconstruction and Development supports solar PV project with 500MWh BESS

The financing will be delivered through an A-loan of up to US$183.5 million and a B-loan of up to US$40.5 million, supported by commercial co-financiers.

Nandita Parshad, managing director of the EBRD’s sustainable infrastructure group, said: “We are proud to partner with ACWA Power and co-financiers on the pioneering Tashkent Solar PV and energy storage project in Uzbekistan, the largest of its kind in Central Asia. The project is core to Uzbekistan’s ambition to install 25GW of renewables by 2030.”

The EBRD has invested over US$5.1 billion (€4.7 billion) in 162 projects in Uzbekistan alone to date; it has been the leading recipient of EBRD funding in the Central Asia region for the last four years.

ACWA Power signed power purchase agreements (PPAs) in March 2023 with national grid operator JSC Uzbek National Electricity Grids for 1.4GW of solar PV and 1.2GW of energy storage, which the government of Uzbekistan would finance via the Ministry of Investment, Industry and Trade.

Uzbekistan and the wider Central Asia region has received significant foreign investment in its energy sector, particularly from the Middle East and China.

Cero to oversize next UK solar-storage project amidst co-location challenges, BESS en route to first

The project has a 120MW grid connection and, once complete, will combine a 50MW BESS array and 50MW of solar PV, the latter operational since May last year as per our sister site Solar Power Portal’s reporting. The PV project was the UK’s first transmission-connected one, and with the addition of the BESS it will become the first solar and storage one too, Cero claims. It was co-developed with developer Enso Energy.

Its next solar and storage project in the UK will have a roughly similar generation profile, with a 57MW BESS and 50MW of solar, but will only have a 57MW grid connection. That means different considerations to commercialising it, as O’Connor explained.

“For the Larks green project, EDF is doing route-to-market and optimisation, the solar has a PPA, and because the project isn’t oversized the BESS is not competing with the solar for export capacity.”

“For our new, oversized project, the BESS will be equal to the grid connection size, meaning the PV and BESS will use the same constrained grid connection. This has a minimal effect on the revenues available to the PV and BESS due to complementary export profiles. We expect the solar project will have a CfD or PPA.”

PV module and BESS firm Canadian Solar is providing engineering, procurement and construction (EPC) services for the Larks Green project.

Co-location challenges

As Energy-Storage.news has previously reported, co-locating solar and storage with a shared grid connection poses challenges around maximising the value of both assets, despite what O’Connor said about the minimal effect on revenues. Without a grid connection large enough to accommodate both assets discharging at maximum output – as Larks Green has – compromises have to be made.

O’Connor’s senior, Tadgh Cullen, head of energy storage for Cero, said at Solar Finance & Investment Europe (SFIE) in February that optimising co-located projects was much more challenging than standalone BESS.

That was echoed later that month at the Energy Storage Summit EU 2024, where optimiser Arenko’s CEO Rupert Newland said there wasn’t a proven commercial model across the sector for co-located projects, as reported in another of our sister sites PV Tech.

Speaking anonymously, a separate source for a developer/IPP told Energy-Storage.news, in agreement with Newland: “The commercial structure for a true co-located project doesn’t really exist yet. People haven’t figured out how to price the shifting of renewable generation into the evening. If you can’t get a fixed income stream then it makes financing hard. No one has figured out who is taking the risk in that scenario.”

Solar and storage projects have generally only proliferated at scale with specific subsidies, with examples including the Innovation Tenders in Germany or the investment tax credit (ITC) in the US before it was extended to standalone energy storage projects. The other route by which they have been commercialised is via long-term tolling agreements and PPAs covering the whole project, generally by large utilities, again mainly in the US.

However, projects are expected to be built at scale without specific subsidies in places with high solar penetration, including Chile and Spain. O’Connor said Cero is preparing to add battery storage to its solar projects in Spain, with co-located projects soon to be the most commercially active project type there.

Engie withdraws local planning application for 1GWh California BESS and heads to state regulator

Engie rezoning request denied

The City of San Juan Capistrano was initially introduced to the Compass Energy Storage project in March 2021 after Broad Reach Power (BRP) – now a wholly-owned subsidiary of Engie – submitted a pre-application review of the facility with the city’s Development Services Department.

Saddleback Church, the landowner for the proposed project, filed a rezoning request with city officials in September 2022 which, if granted, would have allowed the developer to obtain a Conditional Use Permit (CUP) for the battery project.

However, progress on the project was seemingly halted after city officials denied the church’s request in November 2022. This was followed by Engie officially withdrawing its application with the city of San Juan Capistrano in February 2024.

In amongst all this, BRP and its entire project pipeline became part of Engie after the French multinational energy company finalised its acquisition of the utility-scale energy storage developer from funds owned by EnCap and Apollo in October 2023, as reported in Energy-Storage.News.

According to Engie’s 2023 annual report, the acquisition included 350MW in operating assets, 880MW of under-construction assets with an expected online date in 2024 and a further 1.7GW longer-term development pipeline across California, Texas and other central areas within the United States.

Objection to CEC jurisdiction

Following Engie’s recent April 2024 application with the California regulator asking for approval of its proposed Compass battery storage project, officials at the city of San Juan Capistrano have spoken out against the CEC’s jurisdiction over the project.

In a 31 May filing lodged with the CEC, city officials argue that AB 205 was not enacted to give developers a “second bite of the apple”, and accuse the developer of looking for “a more favourable project decision” after it was denied through the local planning process.

The CEC online docket used by the regulator to house Engie’s application has also attracted over 100 comment filings from locals with the majority of these opposing the project.

Once the CEC deems Engie’s application complete, it will have 270 days to prepare an environmental impact report (EIR) for the proposed development and make a final decision on whether the project can move forward at a public meeting.

Temporary battery storage moratorium

On 7 May 2024, San Juan Capistrano officials enacted a temporary ordinance prohibiting the development of new battery storage facilities within the city until next April.

According to the ordinance, officials will use the time to “explore adjustments to the City’s General Plan and Zoning Regulations to mitigate the safety risks associated with BESS facilities.” The introduction of the temporary moratorium does not prevent Engie from permitting the Compass project with the CEC, however.

The Compass battery project will utilise lithium iron phosphate (LFP) battery technology and connect to the CAISO grid via San Diego Gas & Electric’s (SDG&E’s) Trabuco – Capistrano 138kV transmission line.

An interconnection agreement for the project has already been secured under the queue request named “Captive Energy Storage” (queue no. 1806).

Intersect Power also goes CEC route for solar-battery-hydrogen project planned with 4.6GWh BESS

Similar to Engie, clean energy company Intersect Power has also chosen to obtain planning permission for one of its renewable developments, known as the Darden Project, through the CEC rather than through the more traditional local route.

Intersect Power’s proposed Darden facility will consist of an up to 1,150MW behind-the-meter solar farm and 4.6GWh BESS hooked up to a 1,150MW green hydrogen generation facility in Fresno County, California.

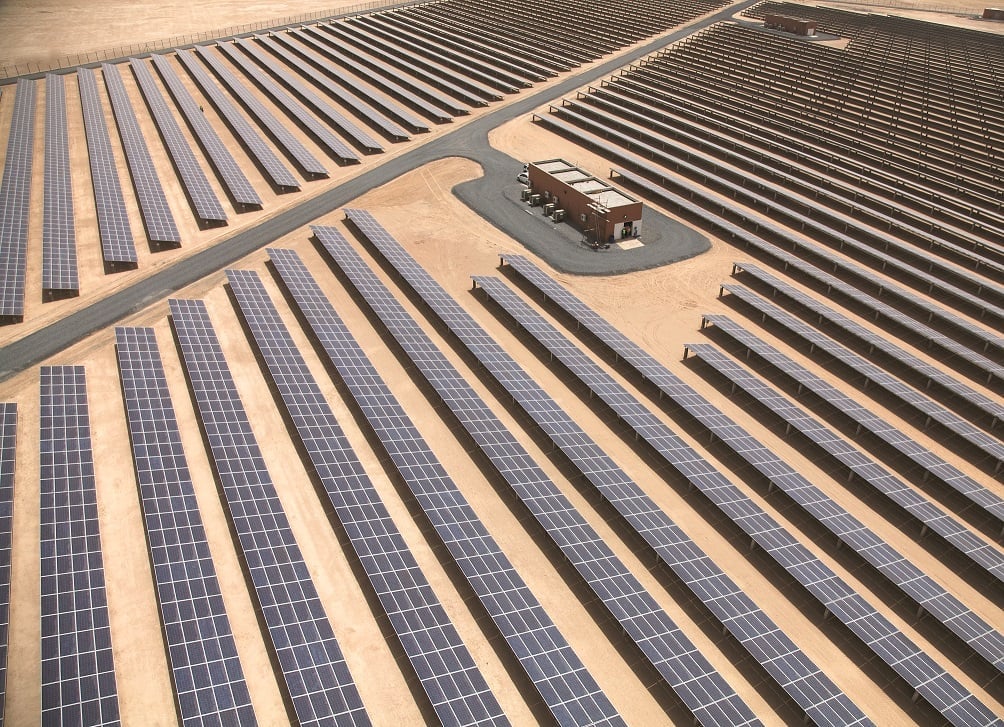

As reported in Energy-Storage.News, Intersect Power recently brought online its Oberon Solar and Storage project (pictured above) which comprises a 679MWp/500MWac solar PV facility paired with a 250MW/1,000MWh BESS located in Riverside County, California.

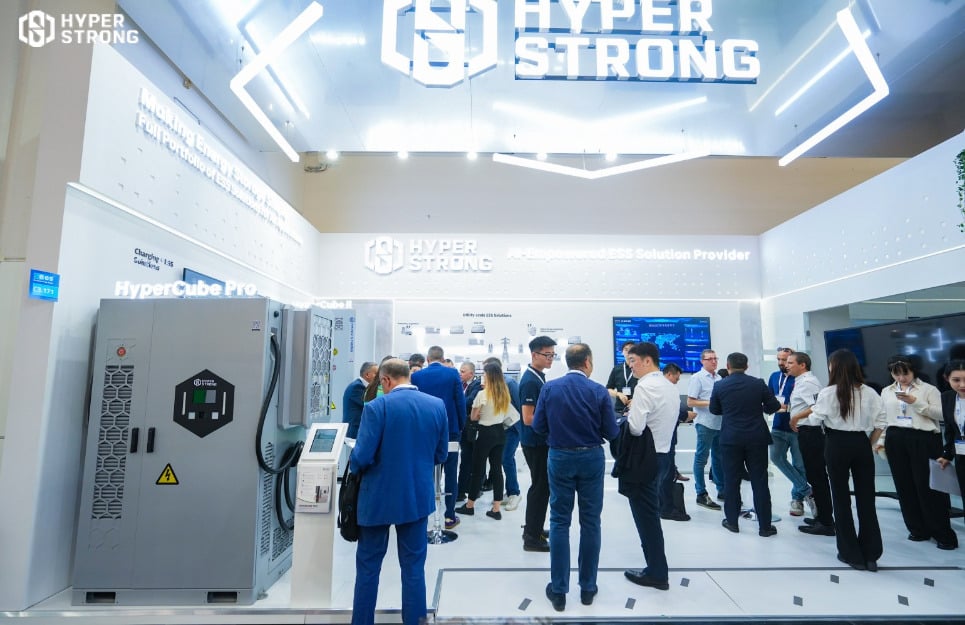

HyperStrong showcased new ESS innovations at the smarter E Europe 2024

At this year’s smarter E Europe, we have showcased our cutting-edge products, full-scenario solutions, and sharing our landmark projects.

HyperBlock III

HyperBlock III is a 5MWh integrated ESS for utility-scale application. It utilises intelligent liquid cooling technology to ensure optimal performance of the battery and PCS throughout the life cycle, effectively extending battery life. The system also saves costs by reducing auxiliary power consumption through intelligent thermal control strategies. The integrated structure significantly reduces commissioning time.

Meanwhile, the single-side opening design provides flexible installation options, optimises space utilisation, and reduces operations and maintenance (O&M) workload. Its high capacity of up to 5MWh and increase in energy density makes the system highly cost effective and competitive in energy storage applications.

Liquid-cooling pack

This pack has features including high capacity, high safety, long lifespan and easy maintenance:

The long-life, high-capacity 314Ah cells, with an integrated ultra-long liquid-cooling battery pack design, providing a capacity of 104.5kWh per pack

3D thermal propagation barrier design, offering safety that surpasses UL9540A standards

Up to 59 NTCs inside pack, with monitoring rate >50%

Integrated liquid-cooling lower enclosure and micro-channel variable-diameter cooling technology, achieving a cell temperature difference within 2° Celsius, thus extending the battery’s lifespan

Integrated electrical component connection panel significantly enhances the reliability of electrical connections and ease of maintenance

HyperCube II

HyperCube II is liquid-cooling outdoor cabinet for multiple C&I applications. It controls risk at the source with AI-enabled smart alert technology, while multi-level electrical protection cuts off potential threats in milliseconds. Its three-dimensional fire prevention design, combined with a full range of safety measures, ensures the stable operation of the system.

HyperCube II has a high conversion efficiency of over 91% and supports plug-and-play and seamless parallel expansion to meet the needs of rapid deployment and flexible adaptation.

With intelligent balancing algorithms, the system can maintain stable performance in various extreme environments with a lifespan of over 12 years. In addition, its intelligent monitoring function supports multiple operation modes and provides Web/APP real-time monitoring and remote wireless control, which perfectly fits the needs of multi-scenario integrated energy applications.

HyperCube Pro

HyperCube Pro is a new power system that integrates charging and energy storage functions. Charging stations can be over-equipped by one to two times under the same transformer capacity, which significantly improves the charging capacity of the station and slows down the need for transformer capacity increase. The system employs energy storage for peak shaving and valley filling, which not only improves the charging efficiency of the station but also realises peak and valley arbitrage and related subsidy benefits.

In addition, the built-in solid-state battery, combined with AI intelligent warning and three-dimensional fire detection technology, provides all-around electricity security for the charging station. HyperCube Pro supports six major applications (peak shaving and valley filling, demand control, station capacity expansion, virtual power plant, reactive power regulation and backup power supply), realising the diversification of income, showing excellent performance and broad market prospect.

Can you talk through your digital intelligence (digital and intelligent) service and delivery capability?

With more than a decade dedicated to ESS with founders’ technological expertise, we are capable to offer all-scenario solutions for the energy 3.0 era empowered by AI technology.

We achieve intelligent operation and management through the smart energy operation management platform. We use AI algorithms to systematically optimise the efficiency and lifecycle of power stations, reduce safety risks, and increase the asset value for clients.

Through experience of more than 300 projects in the past decade, HyperStrong has accumulated 100TB of battery cell test evaluation and system operation data through the design and operation project capacity of more than 15GWh, and it is growing at a rate of 1TB per day.

Through the mining and application of data from the full lifecycle of ESS, HyperStrong has established the technological leadership of “digital energy storage”:

A very complete layout of energy storage system software and hardware products

An underlying architecture based on full life cycle big data drive and AI technology to improve system performance

Iterative optimisation of core technologies such as digital modelling using a large amount of operating data

These technological leaderships systematically improve the safety, reliability and economy of ESS.

Over the past year, we have built dedicated local service teams in Europe, North America and Australia. In addition, O&M centres and spare parts warehouses are under construction in countries including Germany and the US.

Can you give an overview of your achievements in the past: 15GWh+ operational, the world’s top five, China’s top, 300+ projects?

Founded in 2011, HyperStrong has built itself into a global leading energy storage system integrator and system service provider, providing one-stop solutions and services, including energy storage power station development, design, integration, and operation.

According to S&P Global, HyperStrong is among the top five BESS integrators worldwide in terms of projects installed as well as total pipeline as of July 2023. Based on the ranking of EESA (Electric Energy Storage Alliance), HyperStrong has been consecutively ranking the No. 1 ESS integrator in the Chinese market from year 2021 to 2023.

Participating in more than 300 ESS projects in total, with more than 40 projects with 100MWh scale or above, around ten projects with 500MWh scale or above, and participated in China’s first GWh level ESS project, which has been completed and connected to the grid, HyperStrong has garnered massive project delivery experiences.

All in all, we bring the following values to our customers:

Safe, reliable and efficient solutions proven by practice

AI-enabled ESS technical expertise

Localised support & service

Efficient and flexible one-stop customisation

What does your international business currently look like and how are you approaching the European market?

Our international business has seen substantial growth and expansion over the past few years. We have established a robust international presence in Europe, focusing on strategic markets that align with our vision for sustainable energy solutions. We have set up our EMEA Regional Headquarters and a Regional O&M Centre in Germany, and joint ventures in UK and Italy. So far, we have project references in Germany, Finland and Sweden, with over 1GWh in negotiation in Europe.

Our approach to the European market is multi-faceted. We are committed to offering a comprehensive portfolio of energy storage solutions that cater to various applications, from utility-scale projects to commercial and industrial uses. Innovation and sustainability are at the core of our strategy, and we continuously invest in R&D to bring cutting-edge technologies to our customers. By engaging in meaningful collaborations and staying attuned to market trends, we aim to contribute to Europe’s energy transition and help achieve its ambitious renewable energy targets.

Image: HyperStrong.

Continue readingProvincial Electricity Authority of Thailand signs MoU to assess energy storage system feasibility

Last week (26 June), PEA deputy governor Prasit Chanprasit signed a Memorandum of Understanding (MoU) with representatives of Nuovo Plus, which is a battery business launched by PTT Group.

PEA sits under the governance of the Ministry of the Interior, while PTT Group has the Ministry of Energy as its parent organisation.

Under the terms of the MoU, the pair will jointly study the feasibility of deploying energy storage system (ESS) technology in Thailand and the development of suitable energy storage business models, leveraging each party’s expertise and experience.

PEA noted that energy storage could increase access to clean energy including renewable sources, while helping stabilise the power distribution network and provide continuous and stable economic growth for the country.

Nuovo Plus manufactures products including battery solutions for electric mobility in both passenger and commercial electric vehicles (EVs), UPS for data centres and other applications, as well as energy management system (EMS) technology.

It also makes and markets battery energy storage system (BESS) solutions for commercial and industrial (C&I) and utility-scale segments, as well as providing system integration services to BESS projects.

The PTT Group-owned company is in a manufacturing joint venture (JV) with the Singapore subsidiary of major Chinese battery manufacturer Gotion High-Tech. Called Global Power Synergy Company (GPSC), it launched in late 2022 with a view to establishing a gigawatt-hour scale factory (‘gigafactory’) in Thailand producing battery packs and modules, as reported by Energy-Storage.news at the time.

GPSC’s products include GCELL, a lithium-ion (Li-ion) battery cell featuring the licensed SemiSolid electrode developed by US-headquartered battery materials and manufacturing platform company 24M.

Thailand prepares for renewable energy and peak demand growth

This morning (3 July), the PEA announced that Thailand’s deputy prime minister and energy minister Peerapan Salirathavibhaga had made a visit to one of the country’s first large-scale BESS facilities, in the tourist hotspot region of Koh Samui.

The minister made the visit to inspect the project onsite, as well as to discuss how energy storage and broader government policy can support energy security in Koh Samui.

According to Ministry of Energy electricity statistics published in February, Thailand is heavily reliant on fossil fuels for power generation, with about 57% coming from natural gas and domestic coal about 15%.

Renewable energy including biofuels and waste-to-energy accounted for about 10% of the generation mix, with PV and wind at just 4% together.

According to Bangkok-based lawyer David Beckstead of the firm Chandler MHM, who published an entry on the International Bar Association blog in February this year, there has been little push to date for energy storage.

This is due not only to the low levels of renewable energy penetration on the grid, but also due to overabundant generation capacity of thermal generation: Beckstead noted that grid capacity stood at about 48.8GW, but peak demand has never exceeded 34.2GW.

However, under the latest edition of Thailand’s national Power Development Plan, published last month, the Ministry of Energy plans to procure 77.4GW of new energy capacity to meet growing demand.

The peak is projected to grow to 56.1GW by 2037, while renewable energy’s share of the electricity generation mix will increase to 51%.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia next week, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

Nearly 140MWh of vanadium flow battery sales and fundings for Invinity last year

Total income for the year grew to £22.0 million (US$28 million), a 511% increase on 2022’s £3.6 million, while it saw an 800% increase in products shipped, to 32.5MWh.

With the scaling up of its operations has also come a widening of its loss, to £22.8 million from £19 million the prior year. The majority of those losses relate to projects signed before 2022, and margin improvement is a ‘key strategic objective’, the company said.

More recent projects are forecast to achieve broadly flat or small positive gross margins at the project level, before allocation of facility costs, Invinity said.

The company is debt-free with £53.2 million of cash as of 31 May 2024, a significant increase from £15.4 million at the end of 2023.

That reflects a large cash injection from investors including the state-owned UK Infrastructure Bank in May, which we interviewed company CCO Matt Harper about at the time (Premium access). Alongside shoring up its finances and directly investing in projects, the money is going towards expanding manufacturing.

As of June 2024, Invinity has a base pipeline of 45.8MWh, an advanced pipeline of 446.5MWh, a qualified near term pipeline of 2,009MWh and a qualified further term pipeline of 4,122MWh.