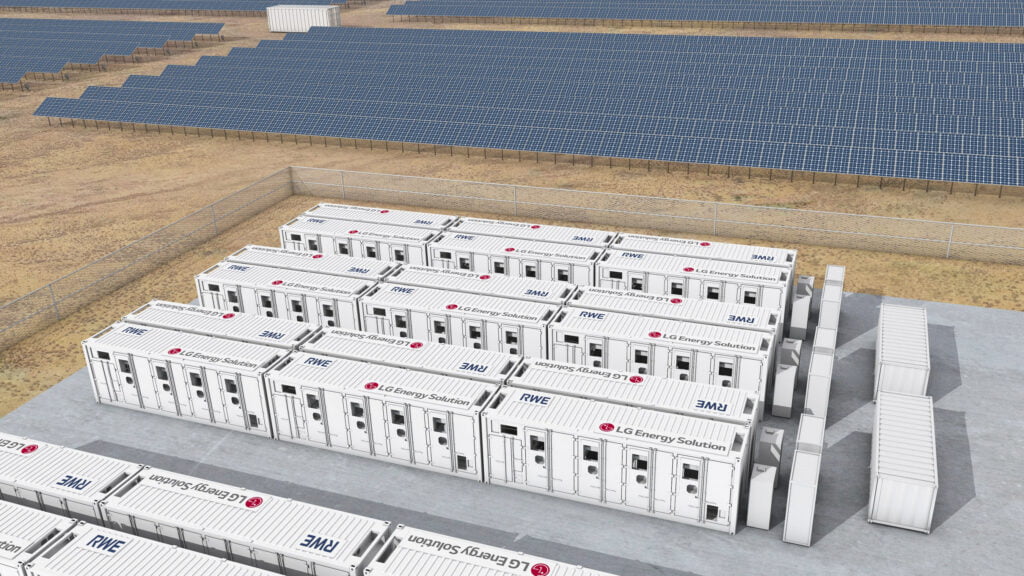

Austria-based CellCube commissioned a whitepaper to compare its VRFB product’s environmental impact versus lithium-ion. Image: Enerox/Cellcube.

The vanadium flow battery sector received a boost this week with news of a rental partnership between Invinity and Dawsongroup plc, a new electrolyte plant in Germany and a whitepaper around the technology’s environmental impact.

Vanadium flow batteries’ lower degradation than lithium-ion make it a good candidate to compete with lithium-ion for medium duration use cases (4-8 hours), and a potential solution for future long-duration energy storage (8-24 hours or more) needs.

But the commercialisation of the technology to-date has been held back by numerous factors, most notably a higher upfront cost than lithium-ion and a supply chain that has yet to ramp up to the capacity needed for large-scale projects (outside of China).

Announced project sizes for VRFB firms are starting to increase, with 2022 seeing VRFB firm Invinity Energy Systems’ recently getting its largest order-to date, Austria-based CellCube striking a five-year, 1GWh rollout deal in South Africa and the first half of an 800MWh project coming online in China.

Invinity and UK commercial rental firm Dawsongroup sign MOU

One way to lower upfront costs is to lease vanadium flow battery products rather than buy them outright, and a partnership between Invinity Energy Systems commercial asset and rental business Dawsongroup plc announced yesterday (16 January) will seek to do just that.

A memorandum of understanding (MOU) has been signed between the pair with a view to more definitive agreement down the line whereby Dawsongroup Power Solutions Limited will procure battery storage products exclusively from Invinity and become its exclusive rental partner in the UK market.

The companies expect to target customer commitments of more than 50MWh over the next two years.

As part of the agreement, Dawsongroup has acquired a 0.22MWh Invinity VS3 battery to be installed at its headquarters in Milton Keynes, UK this year. The battery system will be used as a showcase project for Dawsongroup’s corporate customers to view Invinity’s vanadium flow battery technology in operation.

Leasing of vanadium electrolyte is a model which has previously been used by Avalon Battery, a firm that merged with redT to become Invinity Energy Systems, and which has explored it since. It has also been proposed by primary vanadium producers like Largo.

New vanadium electrolyte plant in Germany approved

AMG Advanced Metallurgical Group, a speciality metals and minerals producer, has announced it will build a vanadium electrolyte plant in Nuremberg, Germany.

The management board last week (9 January) approved plans to build the plant, with a target capacity of 6,000m³ vanadium electrolyte, at its subsidiary AMG Titanium. Basic engineering for the plant was completed in November 2022 and production is expected to start at the end of 2023.

Although not explicitly said, the announcement indicated the plant may serve AMG’s downstream energy storage division AMG Liva, which recently launched a hybrid energy storage system (ESS) product combining lithium-ion and vanadium redox flow technology.

It sold its first system to Wipotec, a Germany-based global provider of intelligent weighing and inspection technology, in December 2022.

AMG said that the plant’s expansion is a vital strategic investment and will strengthen its strategy to enable energy efficiency and carbon dioxide reduction for its customers in industrial operations. It cited AMG Titanium’s technological expertise in producing highly purified vanadium products. Much of the world’s vanadium supply comes from slag, a by-product of smelting ores and metals.

CellCube says its VRFB’s environmental impact is 45-75% lower than lithium-ion

Austria-based VRFB company CellCube (official name Enerox) has released a whitepaper comparing the environmental impact of its technology of choice compared with today’s industry incumbent.

The whitepaper involved completing a ‘cradle-to-gate’ lifecycle assessment (LCA) analysing its VRFB’s environmental impact from raw material extraction through to customer deployment and the 20-year lifetime of a four-hour system with one cycle per day, with all power charged from renewables.

The analysis compared its VRFB’s figures to a 2018 study on lithium-ion and VRFBs of the time (Weber et al., 2018, Life Cycle Assessment of a Vanadium Redox Flow Battery).

CellCube’s VRFB had a global warming potential (GWP) of 32.6 kg CO2 per MWh, 15% lower than the 2018 study’s VRFB and 45% lower than the lithium-ion battery. This was in a scenario without reused materials going into the products.

With reused materials going into the product, its VRFB came out with a GWP 10% higher than the 2018 study’s VRFB, but some 75% lower than the lithium-ion battery.

Read the full whitepaper here.

Energy-Storage.news’ publisher Solar Media will host the eighth annual Energy Storage Summit EU in London, 22-23 February 2023. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.

Continue reading