Among the key takeaways of the latest, 63rd edition, published this week is that US$1.8 trillion was invested in clean energy worldwide in 2023, including a 507GW increase in installed capacity.

This was the biggest ever growth recorded in one year, and about two-thirds of that new capacity was solar PV.

However, the firm said this still falls well short of the investment required to triple renewable energy capacity by 2030 in line with COP28 targets, while underinvestment in infrastructure such as transmission networks means many grids around the world are not equipped to cope with integrating quickly rising shares of variable renewable energy (VRE).

Noting also that curtailment of renewables—preventing generation resources from injecting power into the grid due to congestion or overproduction—is on the rise, EY analysts identified the crucial role that battery energy storage system (BESS) technology can play in alleviating the strain on networks and enabling increased adoption of renewables.

The top three markets for renewable energy investment attractiveness were the same as for BESS investment attractiveness, except that Germany was in third place behind the US and China in renewables, instead of the UK.

‘Complex, localised markets’

Although BESS assets will play a key role in enabling the twin growth of renewables and electrification, through smoothing power supply, helping manage peak demand and deferring the cost of expanding and upgrading the grid, the BESS market is “complex, highly regionalized and fast-changing,” EY leader for global renewables Arnaud de Giovanni said.

There are four main factors that investors should consider, according to EY, which are: building a resilient business case for BESS, maintaining technology competitiveness, establishing the optimal business model or financing structure, and mitigation of supply chain risks.

The full report makes comparisons of various energy storage technologies by power requirements and discharge duration, finding electrochemical BESS—including lead acid, lithium-ion, sodium sulfur and flow batteries—to be the most promising of existing technologies.

This was due to its higher energy density, efficiency, modularity and fast response times, versus mechanical storage technologies like flywheels, pumped hydro energy storage (PHES) and compressed air, as well as chemical storage in the form of power-to-gas (P2G) hydrogen.

EY also examined the different range of services BESS can provide, from power smoothing and peak energy shifting to applications for the grid such as frequency response, voltage regulation and black start, as well as transmission and distribution (T&D) congestion relief and energy arbitrage (or trading).

The full report can be found here.

EY’s Top 10 rankings:

1. US

Drivers include the 30% investment tax credit (ITC) extended to standalone BESS through the Inflation Reduction Act (IRA). Research firm Wood Mackenzie said this week that the country’s annual BESS installations are expected to exceed the 10GW for the first time ever this year.

2. China (mainland)

Government subsidies and a 100GW by 2030 deployment target support the Chinese market.

3. UK

“Sophisticated energy market design” enables BESS asset owners and investors to earn revenues from market-based opportunities.

4. Australia

Diverse revenue streams available through daily spot markets for grid services and federal and state government commitments to support BESS, including through Capacity Investment Scheme tenders.

5. Germany

Grid fee exemptions and construction subsidies help create favourable market conditions, while there are day-ahead and intraday markets open to battery storage.

6. Italy

Italy’s grid operator, Terna, will tender for 12GW-15GW and 71GWh of energy storage by 2030, with fixed-price, long-term contracts available, while the government is expected to tender also for utility-scale BESS and soon issue a regulated BESS investment framework.

7. South Korea

South Korea’s government has a stated ambition to become a leading BESS market, while battery storage is set to become mandatory for public buildings and government tax breaks for BESS investment will be introduced.

8. India

India’s government is supporting the deployment of an initial 4GWh of BESS through Viability Gap Funding (VGP) and has agreed to secure 5GW of BESS commitments by the end of this year through its membership in the Global Alliance for People and Planet.

9. France

Tax credits for BESS investment are driving an acceleration of BESS deployment, while the French energy regulator is soon to reopen an auction for demand response power that was previously postponed.

10. Japan

BESS assets in Japan can stack multiple revenue streams from opportunities including rolling weekly and day-ahead energy markets, while a first low-carbon capacity market auction was held recently, with winners receiving subsidies equivalent to fixed project costs over a 20-year term.

Powin signs 15GWh master supply agreement with Eve Energy at ees Europe

It marks the third publicly announced multi-gigawatt-hour deal with Chinese battery makers this year for Powin, following a 5GWh agreement with Hithium, announced in January, and a 12GWh framework agreement with Rept Battero in late April.

It is also the Oregon-headquartered battery energy storage system (BESS) integrator’s third such deal with Eve Energy.

The two signed a 10GWh supply agreement last June, with some of those cells to be used at Powin’s 850MW/1,680MWh Waratah Super Battery for developer Akaysha Energy in Australia. In 2021, a “multi-gigawatt” two-year deal of undisclosed capacity kicked off their relationship.

On the signing of that first deal, Powin senior VP Danny Lu told Energy-Storage.news that the reasons for selecting Eve included the manufacturer’s 20-year performance guarantee and its prismatic LFP cells’ being of the right form factor to drop into Powin BESS racks, cabinets, and containers.

Powin’s supplier base is known to include at least five different cell manufacturers. In May, a company spokesperson told Energy-Storage.news Premium that “procuring cells is still a top concern for integrators who lack a diversified supply chain,” even after the pandemic-era lithium price spikes had eased up and costs began declining again in 2023.

With Powin’s average project size now over 100MW, procuring enough cells “can be challenging for companies that lack a diversified supply chain, which is one of the reasons we prioritise a diversity of suppliers,” the spokesperson said.

This has included broadening its net to include companies ranked as Tier 2, including Rept Battero, at the time of the companies’ initial 3GWh deal and then 12GWh upscaling.

With Powin having launched ‘Pod, a 20-ft containerised BESS solution a couple of months ago with 5MWh energy density—making it the latest BESS provider to target the higher energy density end of the market—large-format cells are also a priority with Rept also providing 312Ah cells and Hithium 300Ah cells.

Recurrent Energy, Hecate Grid raise US$640 million for US battery storage projects

The funding comprises a US$249 million construction and term loan, US$163 million tax equity bridge loan, and US$101 million letter of credit facility.

Banks Mitsubishi UFJ Financial Group (MUFG) and Nord LB acted as coordinating lead arrangers, with joint lead arrangers including Bank of America, Rabobank, Siemens Financial Services, and others.

Recurrent Energy signed its 20-year tolling agreement for the Papago project in Arizona’s Maricopa County last year with utility Arizona Public Service (APS), as reported by Energy-Storage.news in August.

The agreement was signed after the renewable energy and energy storage developer/IPP won a competitive solicitation through an APS all-source request for proposals (RFP) in 2022.

The BESS will be co-located with the Papago Solar 300MWac PV plant, with both connected to the grid at APS’ Delaney substation.

Canadian Solar’s BESS system integration and manufacturing subsidiary e-Storage will provide the battery storage equipment, which will have 300MW output to the grid and a nominal DC capacity of 1,519MWh to its 1,200MWh usable capacity.

Construction is scheduled to begin in Q3 2024, with the start of commercial operations in Q2 2025.

It is set to be the biggest BESS project in Arizona to date at the time it starts operations. The state’s biggest project to date is the 260MW/1,000MWh Sonoran Solar Energy Center which also features a 260MW solar PV array, brought online by another utility, Salt River Project (SRP), with developer NextEra Energy Resources a couple of months ago.

Arizona has around a gigawatt and 3.5GWh of grid-scale battery storage online, making it one of the top five states for cumulative deployments nationwide, along with California, Texas, Nevada and Florida.

Recurrent Energy has been shifting from a developer model to a build-own-operate IPP model in recent months, closing US$500 million financing from Blackrock at the beginning of this year to fuel that transition. It had also been heavily US-focused until fairly recently, but in May closed €674 million (US$730 million) financing towards a portfolio of solar PV and energy storage projects in Europe.

MUFG lends to Hecate Grid for standalone BESS portfolio

Meanwhile, Hecate Grid has secured a US$125 million letter of credit facility towards its pipeline of US BESS projects, with Japanese multinational bank MUFG once again involved.

Hecate Grid said on Tuesday (18 June) that it had recently closed the letter of credit with lender MUFG with a four-year term, to be used to finance interconnection and offtake security for a portfolio of 30 standalone BESS projects.

Like Recurrent Energy, Hecate Grid develops battery storage projects under a build-own-operate model, and “the financial resources provided by MUFG will substantially augment Hecate Grid’s ongoing growth programme,” according to the company’s head of finance John Bonner.

Hecate Grid was launched as a spinout from renewables developer Hecate Energy in 2018, in partnership with infrastructure investment manager InfraRed Capital Partners.

Hecate Energy secured a US$550 million credit facility from lenders, including Nomura Securities International and Investec, towards the start of the year, to be partly collateralised by the developer’s continued minority stake in Hecate Grid.

Hecate Grid itself secured a US$98.9 million credit facility shortly afterward, to recapitalise the storage IPP’s operational assets and to fund a portfolio of projects in construction in Southern California. This also followed the company receiving key planning approvals and signing offtake contracts for its 300MW/1,200MWh Humidor Energy Storage project in California in September last year.

The company has only brought one project online to date, the 20MW/80MWh Johanna project, also in California, but it has a claimed 7GW+ development pipeline.

That includes three further projects already in construction in California, with the majority of its in-development projects either in California and Texas with a handful in other states, one each in Nevada, New York, Maryland, and Philadelphia with two in New Jersey, according to the company’s website.

Nevada utility NV Energy seeks approval for 1GW+ of battery storage PPAs in 2024 resource plan

The PUCN has 180 days to scrutinise the plan and either accept the IRP, from the utility owned by Warren Buffet’s Berkshire Hathaway group, or deem it inadequate.

700MW hybrid solar-plus-storage project

The largest of the three PPAs is with Arevia Power covering 700MW of solar energy and 700MW/2,800MWh of BESS capacity from the developer’s Libra Solar project as reported in Energy-Storage.News on June 10 2024 after Arevia Power made a separate announcement covering the agreement.

The two parties have negotiated a 25-year contract whereby NV Energy will pay Arevia Power US$13,350/MW-month for storage capacity for the first 20 years of the contract, and for the final 5 years of the agreement the remaining battery capacity will be available to NV Energy at no cost.

NV Energy negotiated a separate flat energy price associated with the solar portion of the Libra project at US$34.97/MWh for the entire 25-year term of the contract.

Bureau of Land Management-approved solar and storage plant

The second PPA covers 200MW/800MWh of storage capacity and 200MW of solar energy from NextEra Energy Resources’ Dry Lake East Energy Center located 20 miles northeast of Las Vegas in Clark County connecting to the local grid via NV Energy’s Harry Allen Substation.

The Bureau of Land Management (BLM) gave its approval to NextEra in April 2024 to construct the Dry Lake East project which, along with the 200MW hybrid facility, also includes a separate 400MW standalone BESS.

NV Energy will pay NextEra US$13,440/MW-month for storage capacity over a 20-year term, and US$26.78/MWh for solar energy over a longer 25-year period. Commercial operation of the hybrid project is expected in December 2026.

New PPA with 174 Power Global to replace terminated agreement

The 2024 IRP also includes a PPA with 174 Power Global covering 127.9MW of solar energy and 127.9MW/511.6MWh of storage capacity from the developer’s Boulder Solar III project located in Boulder City, Clark County.

An agreement between the two parties covering the same amount of solar energy solar but a smaller 58MW/232MWh of battery capacity from the Boulder Solar III project was already in place as part of the utility’s 2018 IRP but was finally cancelled this year after a series of contract amendments and delays.

The original 12-year agreement, approved by the PUCN in 2020, required Boulder Solar III to be online by December 2023 but following a “variety of project delays”, NV Energy renegotiated the PPA with 174 Power extending the online date to June 2025, as outlined in an NV Energy filing submitted with the PUCN in August 2023.

However, a separate filing submitted with the PUCN in March 2024 revealed that despite amending the original Boulder Solar PPA, NV Energy and 174 Power Global decided to terminate the original agreement.

200% increase in battery capacity price

The new 25-year PPA works identically to the agreement negotiated with Arevia Power, except the price for storage capacity during the first 20 years is slightly higher at US$15,460/MW-month, and considerably higher than the US$6,800/MW-month stipulated within the original Boulder Solar III contract.

Although the terminated agreement and new PPA can’t be compared directly due to differences in contract length and capacity coverage, a 200%+ price increase is still noteworthy, and follows an industry trend of ever increasing capacity prices.

NV Energy will pay US$34.60/MWh for solar energy from 174 Power’s Boulder Solar III project.

NV Energy to own US$1.5 billion project

As part of its 2024 IRP, NV Energy is also seeking approval to add a further two 200MW gas-fired peaking units to its North Valmy Generation Station. The current coal-fired facility is being converted to run on methane (natural) gas after the utility received approval from the Nevada regulator in an amendment to its 2021 IRP to convert the facility at an estimated cost of US$83 million.

Within the 2021 IRP amendment NV Energy was also given the green light to develop a 400MW solar facility co-located with a 400MW/1,600MWh BESS in North Nevada known as the Sierra Solar project.

The utility-owned project is expected to cost approximately US$1.5 billion to develop.

Research group Wood Mackenzie noted in the Q2 2024 edition of its US Energy Storage Monitor report, published this week, that Nevada was the US state to deploy the most grid-scale battery storage in the first quarter of this year, due entirely to the coming online of Gemini, a solar-plus-storage project with a 1.4GWh BESS component.

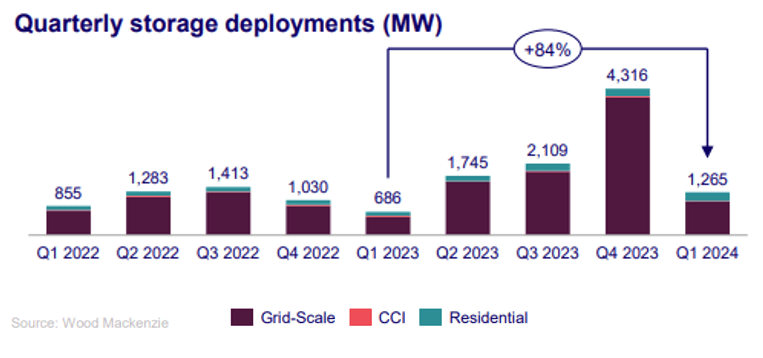

US sees 84% year-on-year rise in Q1 energy storage deployments, three states dominant

The report tracks the grid-scale (aka utility-scale), commercial and industrial (C&I), including community storage and residential battery storage market segments in the US, with the latest edition published this week covering Q1 2024 numbers and trends.

New additions included 993MW/2,952MWh of grid-scale storage, which was a 101% jump from the same period last year in megawatt terms.

Grid-scale in turn was dominated by just three states: Nevada, California and Texas. For the first time, Nevada was the leader, deploying 38% of all new battery storage in that segment, followed by Texas with 35% of total capacity.

Nevada’s battery storage sector growth has largely comprised solar-plus-storage hybrid installations, and as regular readers of this site may have noted, that generally means projects of 4-hour duration with long-term resource adequacy (RA) or power purchase agreement (PPA) type contracts.

Conversely, Texas, and more specifically Texas’ ERCOT merchant market comprises mostly shorter duration assets performing grid services with some arbitrage, leading to assets more typically being standalone battery energy storage system (BESS) configurations of 1-hour and 2-hour duration.

As a consequence, in megawatt-hour terms Nevada far outpaced Texas, deploying 1,416MWh of grid-scale batteries to just 553MWh. In fact, Nevada did so from just one project coming online, Gemini, which pairs 690MW of solar with the 1.4GWh BESS, developed by Arevia Power and Quinbrook energy storage platform Primergy.

By contrast, 12 new grid-scale projects went online in Texas and nine in California. California remains the leader for installed megawatts, surpassing the 10GW mark earlier this year for cumulative BESS capacity connected to the CAISO grid, but some projections forecast Texas to overtake during 2024.

2024: ‘US’ first double-digit year’

There is a “tight race for top storage state” playing out between the latter two, said ACP vice president of markets and policy John Hensley, that the association look forward to cheering on.

Hensley also said ACP was looking forward to the US seeing its first double-digit year of installations by gigawatt, with Wood Mackenzie predicting that the grid-scale segment alone will hit 11.1GW and 31.6GWh by capacity in 2024, and 12.9GW/35.8GWh across all segments combined.

In 2023, 8.7GW/25.8GWh of new storage was added, including 7.9GW/24GWh of grid-scale, according to the research group.

The first quarter has historically been the quietest of the year, so it’s unsurprising the market did not reach the heights of Q4 2023’s installs, which were the highest of any quarter to date.

The US grid added 4,235MW across all scales and 12,351MWh in the final quarter of last year, including 3,983MW/11,769MWh at grid-scale.

Nonetheless, it was a “strong start” to this year which “sets expectations high for the remainder of the year,” according to ACP’s John Henley.

“The rapid growth of the energy storage industry comes at a critical time, providing a solution to growing energy demand and increasingly variable weather conditions that are placing added stress on the grid.”

Tailwinds for OEMs, some headwinds for developers

Wood Mackenzie has revised its five-year forecast upwards by 5%, predicting that 62.6GW/219GWh will be installed cumulatively in that time.

While the grid-scale segment will likely continue to represent the biggest share by far, the distributed segments will experience major growth, with about 13GW of new installations forecast through 2028, about 79% of which (10GW) will be residential.

The value of exporting rooftop solar-generated power to the grid during the middle of the day continues to fall, while new opportunities for distributed storage are emerging. California’s controversial NEM 3.0 policy meanwhile which slashes daytime export tariffs for solar, contributed to a year-on-year tripling in household installs in the state.

A total 252.4MW/515.7MWh of residential installs were recorded across the US in Q1 2024, to 170MW/388.2MWh in Q1 2023, growth of 48% and 33%, respectively. The C&I segment had its “worst quarter in years” on the other hand, with just 19.4MW/44.4MWh of new additions, down from 33MW/105.6MWh in Q1 2023.

The C&I segment does however hold strong potential over a 10-year outlook, Wood Mackenzie said, due to underlying fundamental market drivers.

Despite the broadly positive outlook, however, the research group expects some flattening of grid-scale additions over 2025-2026 due to the often discussed early-stage project challenges, such as lengthy interconnection queue waits and permitting and siting, which are likely to push completion dates of projects further out.

Yet grid-scale BESS prices dropped year-on-year by 39%, with cost declines from cell to DC block-level, largely through marketplace competition and lithium battery oversupply, meaning that from US$1,778/kW in Q1 2023, grid-scale BESS costs overall fell to US$1,080/kW. The extent and impact of falling costs, a trajectory that has resumed after post-pandemic price spikes from around 2021-2022, has been a widely discussed topic throughout the industry.

Domestic Content guidance recently issued by the Treasury Department and IRS meanwhile will add a further boost to the market, Wood Mackenzie senior energy storage analyst Vanessa Witte said.

“US OEMs and integrators were dealt a win with the recently released Domestic Content guidance for the Inflation Reduction Act (IRA)– this changed the reporting structure to qualify for the 10% adder and enabled developers to declare their qualification without the use of manufacturing costs from the OEM directly.

While US installations look poised to break a metaphorical 10GW ceiling this year for the first time, Europe already did in 2023, with 10.1GW of additions across all segments, according to an edition of the European Market Monitor on Energy Storage (EMMES) published by consultancy LCP Delta and the European Association for Storage of Energy (EASE) in late March.

As well as marking the first time in recent memory that Europe has installed more energy storage in a calendar year than the US, it was notable that by contrast to its North American rival’s dominance of grid-scale, Europe’s new additions were about 70% in the residential segment.

NHOA Energy wins contract for Statkraft’s 113MWh BESS in Scotland

The two energy storage projects have a commercial operation date targeted for Q4 2024.

Coylton Greener Grid Park will deliver advanced functionalities such as grid-forming to provide synthetic inertia and potentially other system stability services, and enhanced power quality features, helping to stabilise the grid in the area.

Attached grid-forming inverters will provide stability with these to always stay in ‘grid-forming’ mode, meaning they inherently resist changes in voltage and frequency on the electricity grid.

Commenting on the agreement, Lucie Kanius–Dujardin, executive vice president of global markets of NHOA Energy, stated that BESS will “propel us [NHOA Energy] to the forefront of the energy transition, leveraging the UK’s dynamic market and Statkraft’s expertise”.

Lucy Kent, Statkraft principal project manager, Greener Grid Parks, added that the Coylton Greener Grid Park will “support the increased deployment of renewable energy into the grid and is another investment by Statkraft in the UK’s renewable energy infrastructure”.

NHOA delists from Euronext Paris

Last week (13 June), TCC Group Holdings, the majority owner of NHOA, outlined its intention to increase its holding and take the company private, delisting it from the Euronext Paris exchange.

The company said it intends to file a simplified Tender Offer for NHOA shares at €1.10 (US$1.18) per share and request implementation of a squeeze-out of remaining holdings if legal conditions are met at the offer’s conclusion.

NHOA’s Kanius-Dujardin spoke at the Energy Storage Summit in London in March on a panel about supply chain, while Eku’s Andy Hadland, head of technologies, EMEA, discussed optimising BESS revenues.

Meanwhile, Statkraft Ireland head of grid services Rory Griffin wrote a technical feature article for the most recent edition of our quarterly journal PV Tech Power (Vol.39) about the company’s first 4-hour duration grid-scale BESS project in Ireland, paired with a wind power plant.

Griffin’s piece details the technical and market considerations behind the project’s conception and design, as well as the challenges in scaling up energy storage for Ireland’s grid. You can read Griffin’s full article in PV Tech Power, included with a subscription to Energy-Storage.news Premium, while an extract will be published here on ESN in the coming days.

Queensland designates battery-backed ‘Local REZ,’ approves local network energy storage

The LREZ will allow customers to share the benefits of renewable energy, especially those who haven’t been able to invest in solar power, with support from Energy Queensland, the state-owned distribution system operator (DNO), and its local network-connected battery energy storage units.

Steven Miles, premier for the Queensland government, allocated AUS$40 million (US$26 million) in the State Budget to support the pilot project, with hopes it would “put Sunshine Coast rooftops at the centre of the renewable energy transition”, a government paper read.

In related news, Energy Queensland has received approval for an additional 18 local network-connected batteries. These batteries will play a significant role in the transition to deliver clean, reliable, and affordable energy for future generations.

The State government committed AUS$240 million in the Budget to build 18 new local network-connected batteries across the state. The funding package is also set to boost local manufacturers and suppliers in many communities throughout the state.

The new batteries will be part of Stage 5 of the Energy Queensland battery program. This stage will continue the success of previous stages, which have already seen the construction of 30 local network-connected batteries and three different flow battery systems across the state.

To read the full version of this story visit PV Tech.

Sunwoda applying decades of experience to push into ESS market

Grid-scale segment

Energy-Storage.news: What does Sunwoda do, and could you introduce its industry background to those not yet familiar with it?

Terry Yuan: First of all, Sunwoda is a leading new energy technology company focused on the research, development, production, and sales of various types of batteries and energy storage systems. Headquartered in Shenzhen, China, our products have been proven first-class for over 27 years, covering consumer electronics, industrial applications, and new energy fields, particularly excelling in energy storage batteries. Big companies such as Apple and Volkswagen, are all our strategic partners.

The industry background is very promising at the moment. As the global demand for renewable energy keeps rising, energy storage technology is becoming more crucial. In Europe especially, the energy storage market is growing very rapidly. Market research reports predict that by 2030, the European energy storage market will be worth tens of billions of euros. This growth is mainly driven by supportive policies, a higher share of renewable energy, and the need for grid stability.

Many people might also be curious about what important role energy storage systems play in power systems, and where is the benefit.

Well, first, they help balance the grid load and reduce peak load pressure, which cuts down the cost of expanding the grid.

Second, energy storage systems can store extra renewable energy and release it when demand is high, like during the nighttime, making the most of wind and solar power and cutting down on fossil fuel use.

Plus, by relying less on traditional power plants, energy storage systems can save money for businesses and homes and provide energy independence, especially in markets where energy prices fluctuate a lot.

Also, I am very happy to see Europe is pushing renewable energy policies, like Germany’s Energiewende and the European Green Deal, which strongly support the growth of the energy storage market. Residential and commercial energy storage systems are now the main drivers of this growth.

In this context, energy storage solutions aren’t just for big companies and grid operators anymore; more and more small and medium-sized businesses, as well as homeowners, are adopting these systems to better manage energy and save costs.

To embrace the new demand from the European energy storage market, we have crafted a strong R&D team dedicated to continuously improving battery energy density, cycle life, and safety performance. To have full control of quality and pricing, we believe in the self-development of our own high-performance battery cells.

We don’t want to purchase cells from others and integrate them because with this we would lose our control of battery performance. Therefore, we are investing over US$400 million, annually, in the research and development of new products and safety compliance, and this amount is increasing every year, far exceeding that of most battery manufacturers in the industry.

Sunwoda has been using our own cells for over 27 years, and this strategy enables us to work with Apple, Huawei, Amazon, and Volkswagen to provide batteries for these global firms.

In the meantime, Sunwoda now has 13 global advanced production bases worldwide, and one more in Europe is in the construction process right now, just to ensure stable supply and reliable quality to quickly respond to market demands.

Another important point is we offer customised energy storage solutions based on the diverse needs of our customers, covering all application scenarios from residential to large-scale industrial energy storage. If you want to use SMA inverters, good. If you want to use Ingeteam inverters, done. PE? Too easy. Sunwoda’s flexible solution has matched all top-tier AC side providers, which leaves developers with no worries in designing the systems.

In summary, Sunwoda not only has significant advantages in technology and production but also plays an important role in the booming global energy storage market. We look forward to cooperating with more European customers to jointly promote the future of sustainable energy.

How much of your business is in China and how much is overseas?

Well, as a globally responsible company, Sunwoda has a strong presence both in China and internationally. About 60% of our business operations and sales are in China, where we’ve built strong partnerships with, and are trusted by leading local companies and continue to grow significantly in areas like consumer electronics, EV batteries, and the energy storage market.

And the remaining 40% of our business is conducted overseas. We have a good international footprint, with a growing market presence in regions such as Europe, North America, Asia-Pacific, and Australia. Our international business is expanding rapidly, especially in the energy storage sector, where the demand for renewable energy solutions is rising.

In the European market, the energy storage sector is really taking off thanks to supportive policies and a big push towards renewable energy. Our BESS solutions have been well-received, and we’re constantly working on growing our market share in the region. We’ve also formed strategic partnerships with key industry players which helps us navigate and meet the different regulatory and market demands across various countries.

Can you introduce the company’s latest C&I and utility energy storage products, technologies, and application cases?

Certainly, I am pleased to introduce Sunwoda’s latest commercial and industrial (C&I) as well as utility energy storage products, technologies, and application cases.

For C&I applications, I would recommend the Sunwoda NoahX liquid cooling Cabinet Battery Series. Our 344kWh and 417kWh battery cabinet utilise high-efficiency LFP batteries, which offer high safety, long lifespan, and fast charging capabilities, maximum charging and discharging rate can reach 1C. This system helps businesses optimise energy management, reduce electricity costs, and provide backup power during unexpected outages.

Also, this system features a modular design, allowing customers to flexibly expand capacity based on actual needs. Whether for small to medium-sized enterprises or large industrial facilities, we offer suitable solutions.

The very recent project using this series is a 46MWh Wind + BESS project, located in Stockholm, Sweden. This project is owned by a German investment group and is meant to be North Europe’s First and largest 1c Wind + BESS project, designed for the European FRR market. We worked with Ingeteam for this project and used our 344kWh liquid-cooling cabinet battery.

For big projects, the Sunwoda NoahX Liquid-Cooling Container Battery Series is very popular. This series is our flagship product designed for utility-scale energy storage, primarily used for large-scale grid regulation, frequency response, and peak shaving. The latest container battery includes 5,015kWh, 4,179kWh, and 2,752kWh capacity per unit, using our self-manufactured 314Ah and 280Ah cell.

Our big BESS also offers high reliability and safety, capable of stable operation under extreme conditions, and complies with international standards and various national regulations.

For example, a 12MWh AC-coupled utility scale project which will be delivered in New South Wales, Australia, is using four units of our 2,752kWh battery containers, and we worked with SMA PCS for this project. Australia has a very strict regulation on design, and our customers are very satisfied with our product quality, service, and commitment to offering trustworthy products.

Residential and C&I segment

What are the competitive advantages you are bringing to your overseas expansion?

Ben Song: We are the global top 10 battery manufacturer with 27 years of devotion to this industry. Our advantages are in various areas, that include:

Vertical integration to the mining, refining, and battery cell production

Extensive battery cell R&D investment, ranked top 2 in China, top 5 in the world

Equivalent performance of battery cell to the global top 2 players, competitive price in terms of the system integration

Various solutions in terms of various scenarios including Network energy, residential, Commercial and Industrial, Utility, and Smart Energy (System Integration of PV, hydro, wind turbine, and storage)

What is your approach to selling energy storage systems to the overseas market?

We’ll sell energy storage systems under the brand of Sunwoda Energy. Meanwhile working with our strategic partnership across various industries such as PV, consumer electronics, and EV industries, we’ll help billions of Sunwoda’s users to recognise that Sunwoda has powered their lives for many years, and will continue to empower their life in future.

What is your latest ESS innovation for residential and commercial use?

For the residential products, we have launched our all-in-one system with a DC-coupled solution, named as SUNESS-Power. We have offered our cutting-edge solution, targeting to provide the Ecosystem from PV+storage to PV+Storage+EV.

For our latest C&I products, we’ll provide a unique turnkey solution with one CP feature, which will help our customers to reduce the system cost significantly, meanwhile satisfying various load configurations.

CATL provides more details on ‘zero-degradation’ Tener BESS product at ees Europe

CATL announced the new grid-scale BESS product in April this year, with two significant claims about its performance. The first was an industry-leading energy density of 6.25MWh of energy storage capacity per 20-foot container. The second was the the battery cells would suffer zero degradation for the first five years of operation.

In a Q&A with journalists, CATL executives Hank Zhao, CTO of ESS Europe, and Kevin Tang, director of ESS Europe, explained how it achieved – or claims to have achieved – the second, which had been a topic of lively discussion throughout the industry.

It is a by a combination of pre-lithiation, or lithium compensation, combined with reducing the consumption of lithium-ions during battery cycles themselves, they said. This was speculated by industry sources shortly after the announcement, as covered in our follow-up piece (Premium access).

The benefit of this to the end-consumer is a higher throughput on the BESS during those first years, and the ability to push out augmentation of a BESS to seven or eight years after deployment, rather than three or five. All this means a more cost-effective deployment, they added.

Rolls-Royce, via its power systems business, is among the first system integrators to announce a partnership with CATL to deploy projects using Tener, saying today that it would use it for projects in the EU and the UK.

In response to questions from Energy-Storage.news around why it had applied the zero-degradation battery technology to grid-scale BESS and not electric vehicles (EVs) Tang and Zhao said that the underlying technology had been used in some vehicle applications, though not passenger vehicles.

The reason it has been applied to BESS first is that that market demands more improvements around long lifetime for the batteries, compared with the EV segment. Demands for such lifetime-improving tech could be applied to EV batteries, but would be done in line with customer demand, the executives said.

EU Battery Passport and Batteries Regulation compliance: ‘Not as complex as it sounds’

However, as we hear in an interview ahead of Vahle’s appearance at the ees Europe conference this week in Germany as part of the Smarter E trade event, some of the technical solutions to facilitate compliance are already available, while reporting requirements involved on things like carbon footprint and recycled content labelling should not come as a surprise for most stakeholders.

Tilmann Vahle’s team at Systemiq is part of Battery Pass, a consortium advising the EU on how to create and implement the passport, which is not only an industry first, but is also the first-ever digital tracking and traceability effort for any kind of product in the EU, if not the world.

Systemiq was founded in 2016, after the Paris Climate Agreement of a year before, by two sustainability practise partners at McKinsey and a former EU sustainability commissioner, aimed at providing advisory services and thought leadership to advance the economic side of the transition away from fossil fuels towards renewables.

Following a number of circular economy initiatives that Systemiq had done in Germany, the group’s work on batteries as a vital piece of creating a more sustainable economy took shape.

Together with fellow Battery Pass Consortium members acatech (Germany’s national Academy of Science and Engineering) and Fraunhofer IPK, Systemiq identified that accessing lifetime data on batteries, “is super-vital to actually get the most out of them,” Vahle says.

“We have to extend [battery] lifetimes or take the responsibility to remanufacture, repair, refurbish them, or repurpose them,” he says.

At that time, in 2021, the first drafts of the EU’s Batteries Regulation—marking the first major update to EU policy on batteries since 2006—had been published, and even at that early stage, it became clear that new regulations would become law, and that the EU would introduce a Battery Passport scheme by 2026.

Systemiq and its partners from industry and academic circles decided that building an independent advisory consortium could provide “technical guidance that will be open source, to help the entire ecosystem of battery passports in the EU and then beyond. To actually develop these software pieces in a way that is consistent and makes sense and is also practicable to actually implement.”

The consortium applied for and got €8 million (US$8.6 million) funding from the German government to get started, and Tilmann Vahle makes it clear that Battery Pass is not building the Battery Passport itself, nor is it part of the EU’s Battery Alliance which seeks to support and promote European battery value chain development.

“We are independent, we make contributions to try and help everybody else figure it out and build working solutions,” Vahle says.

The passport will see QR codes placed onto all batteries and components that when scanned, show a wealth of data on the device, from the aforementioned sustainability criteria to data on performance and lifetime.

Some implications of the Battery Passport for BESS developers

So, what will the Battery Passport mean for the stationary battery energy storage system (BESS) industry and its stakeholders?

First off, one thing to mention is that, as regular readers of this site will know, the EU has placed responsibility for the Battery Passport—and indeed complying with the wider Batteries Regulation—on the economic operator which places the battery into the market.

That means that rather than the manufacturer, distributor or importer that made or sold the batteries, it will be the stakeholder that puts a BESS into operation that has to ensure the passport is complied with.

That’s no different to, for example, CE marking – the safety marks that are put onto any electronic product currently sold in the EU – and the reasoning for putting the onus on the economic operator is the same as for any other product.

“Otherwise, you would have to go into industrial policy and environmental manufacturing laws,” Tilmann Vahle says.

“Of course, batteries are typically not manufactured in Germany or in Europe but in Korea, Japan, and China especially. That’s about 90% of battery manufacturing, and we [the EU] cannot execute against them, it’s not in the jurisdiction. What you can do is handle those entities that sell onto the market, the economic operators.”

Anyone procuring batteries, particularly those procuring large quantities as might be used in stationary BESS applications, should be doing plenty of due diligence on those products.

The Systemiq director says that’s a “question we grapple with,” when it comes to whether the passport could actually help streamline those due diligence processes, or should be considered separately.

“Firstly, what does the battery passport as a tool give the economic operator or consumer? What does it contribute to? And secondly, basically, what information will a supplier of batteries have at scale across all of their batteries, because they need to feed it into the Battery Passport?”

The information required should already be held by manufacturers and distributors, and the digital product passport means it should be stored and then made accessible in one place, making it easier to share data with potential buyers, for example.

That information, which under the Batteries Regulation should be public anyway “should help transactions, especially on due diligence, on carbon footprint and responsibility in mining and manufacturing and human rights due diligence questions,” Vahle says.

“It’s not that the battery passport itself makes it necessary to create a carbon footprint label, for example. The majority of the data points are required to be developed and created by the regulation anyway,” he says.

“So, the additional effort is fairly small, but it does create a collection and, therefore, easier access.”

Indeed, in a value assessment of the Battery Passport published by the consortium in April, it was pointed out that the policy requirement could help reduce procurement and recycling costs for independent BESS operators, particularly those sourcing batteries from automotive OEMs for second life applications.

It could also have a big impact on the production of batteries for stationary storage applications within the domestic sector too. In a February interview with this site, Maher Chebo, managing director for Europe at Univers (formerly known as Envision) and chair of a European Commission taskforce on making the European battery value chain more competitive and innovative, said the increased transparency and traceability the digital passport provided could give investors more clarity on the bankability of the products they procure.

‘A trajectory you can anticipate very clearly’

Earlier this year, I moderated a panel discussion on the Battery Passport at Solar Media’s Energy Storage Summit EU. Panelist Richard Wagstaff, head of procurement at BESS developer-investor Gore Street Energy Storage Fund said that the passport, as well as the regulation, was welcome, and in many ways aligned with his fund’s existing ESG remit.

However, there remained a open question, Wagstaff said, over what impact the phased-in implementation of the regulation would have on procurements perhaps being made today or in a year’s time, for projects that would be commissioned further down the line when the policy has come into place.

“The good thing is, you know that it’s going to come, there is that two-and-a-half-year lead time,” Vahle says, noting that once the European Commission makes a policy proposal decision, “it’s going to happen”.

April 2023 presentation of the Battery Pass Consortium’s first content guidance. Tilmann Vahle’s Systemiq colleague Sophie Herrmann, the consortium’s director (centre) stands with Prof. Dr.-Ing. Thomas Weber, director of acatech (left) and Germany Parliamentary State Secretary of the Federal Ministry for Economic Affairs and Climate Action BMWK Michael Kellner. Image: FIWARE Foundation

“The details may differ quite significantly, but there will be a battery passport. That’s been clear for many years now, and also it’s been known that over time, the requirements get more stringent.

They are very rarely watered down, so there’s a trajectory you can anticipate very clearly, four, five, 10 years into the future.”

Vahle says, on the one hand, that it is quite challenging to figure out exactly how the technical details of the passport will be implemented and interpreted, such as how carbon emissions or recycled content are measured.

The fact that some of those definitions are yet to be set in stone is a “dilemma” for companies that want to get ahead of the requirements, but, again, he says that good faith interpretation of the rules will be acceptable in the meantime, even by regulators.

“I think the main message is, we don’t need to wait,” Vahle says.

“If there’s ambiguity, okay, just do as you think is right, and write it down, and make it reasonable and in the spirit of the law. Then it’s all good.”

Vahle says it is understandable that the regulation and passport may seem “overwhelming” at first glance.

“What’s important to keep in mind is that the majority of the points that the federal regulation is asking for have existed before in other places, such as transparency on hazardous chemicals that are in the EU’s REACH Regulation, or due diligence that’s in the Sustainable Supply Chain Act.”

It may, therefore, look as though the new rules add more layers of bureaucracy and compliance requirements, but in fact, it is more the case that the different laws governing products and services in the EU have been brought up to date to encompass batteries and put “all in one place.”

“It actually reduces complexity. It looks like a lot, and we identified around 90 data points that will have to be put into the Battery Passport, but the majority of the companies involved already have the majority of those data points.”

While there will be challenging aspects to the undertaking—and Vahle concedes that the development of technical software solutions is one of those challenges—there are plenty of stakeholders willing to take them on.

Engineering companies Siemens and Circulor are among those looking to develop interoperable and standardised software offerings that can be applied to collecting the necessary data, while Vahle says he has heard tech giants like Amazon, Microsoft and IBM are starting to build licensable solutions.

In an ESN Premium interview earlier this year, Wood Mackenzie senior energy storage analyst Kevin Shang said that the Batteries Regulation will give BESS industry stakeholders a need to focus on end-of-life and recycling, in a way that their electric vehicle (EV) counterparts are more commonly already doing.