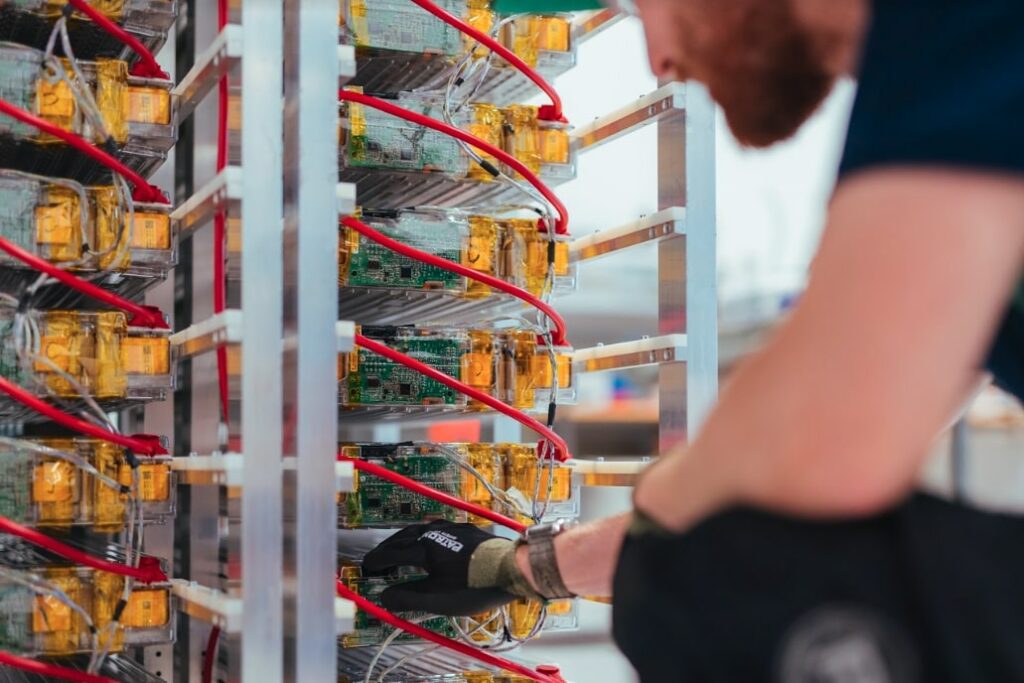

Flow battery demonstration plant in Hubei, China, where the world’s biggest VRFB system, at 100MW/400MWh, went online recently. Image: VRB Energy.

Enough money has been invested into long-duration energy storage (LDES) technologies and projects over the past three years to result in 57GW of deployments.

That’s according to Wood Mackenzie Power & Renewables, which added up investment figures into the technology class, finding US$58 billion of commitments have poured in since 2019. If all of those projects were to go ahead, it would result in the figure cited above, the analysis group said.

Along with those investment commitments, made by a mix of governments and private companies, US$30 billion of long-duration projects – defined broadly as those capable of storing and discharging energy for 8 to 100 hours – are in operation or under construction.

However, despite this evidence of growing interest in the sector, Wood Mackenzie thinks it unlikely developers of long-duration energy storage (LDES) technologies will be able to scale cost-effectively before the end of this decade.

The company included its findings in a new report on the sector. One table shared from inside the contents compares eight different technologies across a range of different metrics, including the stage of commercialisation reached.

Among them, only pumped hydro energy storage (PHES), the legacy technology that still represents more than 90% of the world’s installed base of energy storage, is categorised as having reached large-scale deployment. Pumped hydro will continue to dominate the market until 2030, the firm predicts.

The majority of other technologies compared, including flow batteries with electrolytes made from vanadium and other materials like zinc-bromine and iron, are still at what Wood Mackenzie would classify as the pilot and demonstration phases.

Incidentally, Wood Mackenzie benchmarked the cost range of vanadium flow batteries between US$1,180 to US$4,000/kW and between US$295 to US$844/kWh.

Trade association Long Duration Energy Storage Council (LDES Council) launched in November last year at COP26. The CEO-led group comprises technology companies and other stakeholders including large corporate energy end users like Microsoft and Google.

The council aims to accelerate the development of a market for LDES that supports the deployment of between 85TWh to 140TWh of capacity by 2040 that it said will be needed to have hopes of keeping global warming limited to 1.5°C, in line with the Paris Agreement.

Policy support, innovative business models needed alongside innovation in long-duration energy storage tech

LDES Council said in a report published in June that the sector will likely need strong and committed policy support to help bridge the gap to commercial viability for LDES technologies until at least 2030 and possibly to 2035.

Perhaps the good news is that the majority of the world’s grids aren’t yet at the level of renewable energy penetration that means long-duration energy storage is a must to keep networks balanced and electricity supplies stable. As with another report from European storage association EASE, LDES Council highlighted that the need for long-duration becomes urgent as penetration of variable renewables like solar PV and wind exceeds the 60% – 70% mark.

Similarly, on the West Coast of the US, consultancy Strategen and the California Energy Storage Alliance modelled a tremendous need for LDES in the state, which starts to grow rapidly and enormously by the start of the 2030s.

But to achieve high levels of LDES deployments in the 2030s, investment, or investment decisions will need to be made soon, if not already.

Some governments, like China and the US, are more supportive of LDES than others. The US Department of Energy (DOE) recently launched a US$350 million competitive funding opportunity for LDES projects, while in China the world’s largest vanadium redox flow battery system (VRFB) was commissioned. The VRFB is actually 100MW/400MWh (4 hours duration), so technically not long-duration, but the technology class is the same as it would be for a higher energy capacity project.

Europe, with the exception of the UK, has been slow to back LDES technologies, Wood Mackenzie pointed out.

At this year’s RE+ 2022 trade show, Kiran Kumaraswamy, VP of growth and head of commercial at battery storage tech company Fluence said that for alternative non-lithium technologies like flow batteries to gain market traction, they need to display qualities that offer different features or applications to lithium, rather than just competing on a side-by-side comparison basis.

Wood Mackenzie appeared to agree, stating that in addition to advancing the technologies with innovation, business models need to be created that can attract private investors and run sustainably without the need for subsidy.

That means being able to compete directly with the likes of combined cycle gas turbines (CCGT) equipped with carbon capture and storage (CCS), green hydrogen, or even small modular nuclear reactors, the analysis group said.

Continue reading