The news emerged as engineering company Gensol announced a win in a tender of similar size in the state of Gujarat.

The new NTPC tender is for 150MW/300MWh of battery storage at the site of an NTPC solar PV plant in the Madhya Pradesh city of Gadarwara, and 100MW/200MWh at one of the IPP’s thermal power plants in Solarpur, Maharashtra.

Formerly known as National Thermal Power Corporation of India, the company rebranded to NTPC Limited in 2005.

Projects would have an expected life of 12 years, with two daily cycles, each of 2-hour duration, with a guarantee of less than 2.5% degradation in megawatt-hour terms annually and nominal roundtrip efficiency at the point of interconnection to the 132kV network of 80% or more.

The scope of works for bidding developers includes the supply and transportation to site of BESS equipment including inverters, power conversion system (PCS) and energy management systems (EMS); design and engineering; grid integration and commissioning; as well as providing warranties, operations and maintenance (O&M) and insurance for the 12-year lifetime of the projects.

A bidding document posted by the company (PDF here) gives more comprehensive details of the scope of work and eligible bidders. Eligibility criteria include a track record of working on grid-connected BESS projects of 40MW or more cumulatively, as well as financial and other project experience requirements.

India-based and international entities are entitled to submit bids, with the window for enquiries from prospective bidders closing in early July. Bids comprising price and techno-commercial components must be submitted by 18 July, and on that date, bidding for techno-commercial bids will open.

Gensol wins 250MW/500MWh Gujarat tender

NTPC is among the government-owned entities that have been holding tenders in India for battery storage, either standalone or in hybrid pairing with generation facilities, along with others, such as the Solar Energy Corporation of India (SECI).

SECI is due to host the first large-scale tender for BESS supported by the Union government’s viability gap funding (VGF) after sending out pre-tender documents in March. VGF will help improve the economic feasibility of strategic energy storage projects that the government hopes will help kick off further deployment waves.

In fact, as of October last year, around 9GW of tenders for “firm and dispatchable renewables” – backed with storage – had been launched by state agencies in the year-to-date for 2023 according to consultancy JMK Research.

Locally held tenders have been launched by regional utility and transmission and distribution (T&D) organisations, and the winner of one such competitive solicitation was announced the same day as NTPC launched its IFB.

EPC and electric mobility group Gensol Engineering bid with the lowest tariff and won in a reverse auction hosted by Gujarat Urja Vikas Nigam Ltd (GUVNL), a holding company owned by the state of Gujarat responsible for the bulk purchase of electricity and sale to four distribution companies (Discoms).

The 250MW/500MWh project is worth IR13.4 billion (US$160.4 million), Gensol said in a 12 June announcement, noting that GUVNL could take a ‘greenshoe’ option to expand the project to 500MW/1,000MWh which would generate IR26.8 billion for the company over the 12-year term of a battery energy storage purchase agreement (BESPA).

Debmalya Sen, India lead at the World Economic Forum (WEF), posted some of the bid figures for the tender to LinkedIn earlier this year as bidding progressed, noting that Gensol’s winning bid at roughly IR372,978/MW/month represented a fall of 66% in two years from a previous round of tenders.

It also followed a March tender win with GUVNL for Gensol, in which its winning bid for a 70MW/140MWh was IR448,996/MW/month, while fellow winner and second-lowest bidder, IndiGrid, entered a bid at IR449,996/MW/month. IndiGrid, which announced its win in March, received a GUVNL letter of intent (LOI) for its 180MW/360MWh project.

WEF’s Debmalya Sen noted that as well as registering a 17% fall in just one quarter, GUVNL’s tenders are becoming more competitive in that growing numbers of bidders are joining, from eight in the March Phase II tender to 13 in the just-announced Phase III results.

Sen said that VGF of the type to be included in a total of 4GWh of procurements including SECI’s next tender will likely boost competition even more, adding that “the coming days look super-promising and exciting for batteries in India.”

Smart Cube AI-optimised battery storage: Smart integration equals energy independence

Combining a hybrid solar inverter, EV DC charger, battery PCS, battery pack, EMS and integrating heat pumps into a single, powerful energy system, it features high-capacity lithium iron phosphate (LFP) battery cells, and up to 20 systems can be connected in parallel.

It offers instantaneous switching to backup power mode, five layers of battery safety protection and four layers of comprehensive system protection, helping customers feel secure in their choice.

Versatile in nature yet simple to use and install, the Smart Cube caters to every energy usage scenario. The system can be floor standing or wall mounted, weighing just 18kg per unit.

Its stylish front eagle eye and side ambient lighting design blend elegantly with any surroundings, while its sleek, compact design complements a variety of home styles perfectly.

Whether for home or business, its unique modular and stackable design allows it to be truly scalable on demand and flexible in configuration.

For instance, the system can be configured from 25kW to a maximum of 500kW and to potentially store up to 960kWh.

Clever design, robust performance with the modular and scalable Smart Cube.

The modular storage capacity allows to have up to six modules per inverter with mixed capacity that spans from 5kWh to 8kWh.

This product offers robust performance and peace of mind. It features 280Ah large capacity battery cells with long cycle life, multi-system boot-up sources, and an IP66 protection rating, allowing for installation in any environment.

Its safety protection features include DC ground fault protection, arc fault circuit interrupter, DC reverse polarity protection, residual current monitoring, anti-islanding protection, and more.

Our advanced technology allows direct tapping into DC power from the battery and solar panel, enabling virtual grid capacity expansion and 100% green power charging.

Get ready for the future with V2H (Vehicle-to-Home) and V2G (Vehicle-to-Grid) capabilities, unlocking limitless possibilities for modern living.

The Smart Cube is simple and capable. It allows quick and easy connections between battery modules, which can be auto-plugged once stacked. This eliminates the need for hand-wiring and saves time during installation.

Each battery pack contains a DC-DC Optimiser, which allows for parallel connections of packs. This feature supports using both old and new batteries, capacities, and SOH/SOC. It eliminates the cask effect for users and simplifies warehouse management for distributors – allowing the user to add more modules, anytime.

The Smart Cube is a cloud-native solution that incorporates machine learning capabilities. This self-evolving, quick-to-distribute and easy-to-manage and scale platform allows for a safer, smarter and optimised experience at any level.

Intelligently and efficiently support your way of producing, storing and consuming energy. Enjoy a tailored energy plan that boosts cost savings and contributes to a sustainable future.

The Smart Cube DC-coupled charging module enables the harnessing of solar energy to directly charge electric vehicles (EVs) with clean energy. It also allows users to tap into the power of their EVs, whether to power their homes during an outage or to share energy with the grid.

For more information, visit the Haier Nahui official website.

Seamless integration of technologies for the lifestyles of today and tomorrow. Image: Haier

Continue readingStem, Prometheus complete first of three 2024 BESS projects for Arizona co-ops

The Sulphur Springs project is one of three similarly sized deployments that Stem and Prometheus are deploying for AEPCO utilities in Arizona, all of which are expected to be online by the end of the year.

Stem is employing its Athena energy management system (EMS) software platform to operate and monitor the project. A photo provided in the announcement, shown above, indicates that the BESS units used for the project were the Stack750e that are part of system integrator Powin’s Centipede grid-scale BESS platform.

Stem Inc has been active in the co-operative utility segment which the company’s CEO John Carrington said is a significant part of the grid-scale energy storage market in the US.

“More than 900 electric co-ops across 48 states make up the largest electric utility network in the U.S. The segment is forecasted to be one of the fastest growing segments of the front-of-the-meter (FTM) market through the end of this decade and is projected to represent over 20% of all future storage deployments,” Carrington said.

Stem Inc said in May that it expected positive EBITDA in 2024 despite a dip in revenues and bookings in the first quarter of the year, something seen by other US-focused system integrators.

Arizona meanwhile continues to grow as a major energy storage market in the US, among the most active behind leaders California and Texas. In the last few months, Leeward signed a cross-border PPA for a 450MWh BESS, Plus Power secured US$82 million tax equity for a BESS project while the largest in the state was brought online by SRP and NextEra.

Plus Power closes financing on 300MWh BESS project with ISO New England capacity contract

Financing was raised through First Citizens Bank and Nord LB, which acted as coordinating lead arrangers, along with joint lead arrangers Investec and Siemens Financial Services. Investec is the administrative agent, and US Bank serves as the depositary bank.

Plus Power is targeting completion of the project in Q2 2025. Along with Cross Town Energy Storage, a 175MW/350MWh project that the company is also developing in Massachusetts, Cranberry Point was a winner in an ISO New England Forward Capacity Auction (FCA) with long-term contracts awarded at a preliminary price of US$3.58 per kilowatt-month, as announced in February.

The Plus Power projects were among 1,800MW of winning energy storage projects including more than 700MW of new build, demonstrating a rapid growth in secured storage capacity at auctions, from just 5MW cleared in a 2018 FCA when batteries first became eligible.

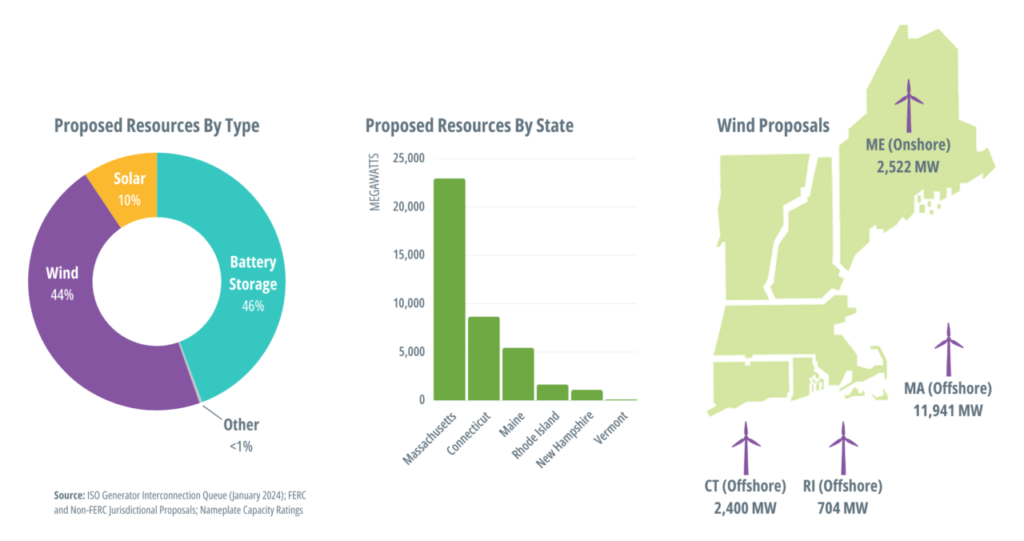

BESS represents 46% of projects in ISO interconnection queue

According to ISO New England, the independent system operator (ISO) that oversees the electric system and wholesale power market in the five New England states, there was only 90MW of battery storage available to it for dispatch as of the beginning of this year according to ISO data on its resource mix.

These are thought to comprise mostly distributed scale and small front-of-the-meter (FTM) solar-plus-storage projects, incentivised over the past few years in particular by the Massachusetts Clean Peak Standard for grid emissions and Solar Massachusetts Renewable Target (SMART) incentive scheme.

In addition, the ISO can currently call on 1,800MW of pumped hydro energy storage (PHES) from two existing plants.

However, as of January 2024, 46% of proposed projects totalling 40,000MW in the ISO New England Interconnection Request Queue were battery storage, the biggest share by technology, with wind second (44%), solar representing 10% and the remaining 1% from other technologies.

ISO New England’s generator interconnection queue as of January 2024 saw battery storage facilities comprise nearly half of all requests. Image: ISO New England

For the title of first, Plus Power appears to have overtaken rival developer Eolian, which had the biggest project to win in the FCA auction with its 250MW/500MWh Medway Grid BESS.

Both Cranberry Point and Medway Grid became embroiled in a dispute that one local news outlet had described as a regulatory “black hole”. Planners in the towns of Carver and Medway enacted moratoriums on BESS development in 2022 and 2021, respectively, arguing that local zoning laws did not fully encompass the relatively new technology.

That state of regulatory limbo ended in late June 2023, as the Massachusetts Department of Public Utilities (DPU) granted local Zoning Law exemptions, effectively clearing the path for the projects to go ahead.

Energy-Storage.news has contacted Eolian for a status update on the Medway Grid project and will update this story accordingly when a response is received.

Plus Power said that its Cross Town Energy Storage project began construction in April 2024, while Cranberry Point began construction in December 2023. Both facilities’ FCA contracts will be for delivery from 2027 through 2031. The developer noted that they will comprise a significant portion of Massachusetts’ 1,000MWh by 31 December 2025 energy storage policy target.

According to Plus Power, Cranberry Point is also the first battery project in the Commonwealth state to reach financial close that will benefit from the Massachusetts Clean Peak Energy Certificates (CPECs) scheme, which is an expansion of the Clean Peak Standard to enable batteries to be compensated for their role in shifting energy use from more polluting peak times to off-peak periods.

Other recent Plus Power projects reported by Energy-Storage.news include the 90MW/360MWh Superstition BESS in Arizona for which the developer secured US$82 million tax equity financing from Morgan Stanley a couple of months ago, and Hawaii’s biggest standalone BESS project to date, the 185MW/565MWh Kapolei Energy Storage (KES) project which is equipped with grid-forming inverters to provide inertia and other system support services to utility Hawaiian Electric Co (HECO). Kapolei went online at the beginning of this year.

In October 2023, Plus Power concluded US$1.8 billion financing for five projects in Arizona and Texas, including what is thought to be the largest financing for a single project to date, US$707 million raised for the 250MW/1,000MWh Sierra Estrella BESS project in Arizona.

Austria making €18 million available for medium-scale energy storage projects

The Federal Ministry for Climate Protection (BMK) is providing €10 million of the funding while €7.9 million is coming from the EU’s European Agricultural Fund for Rural Development (EAFRD). The deadline for project proposals is 28 February, 2025, 12 pm local time.

The announcement said the projects should be operated in a way that benefits the grid via their interaction with other parts of the energy system. The call for proposals is particularly aimed at investors who want to optimise their own consumption of energy generated at their PV plants to help with grid stability.

People, companies, utilities, public institutions, contractors and energy communities are all eligible to apply, with a maximum of five projects allowed per entity.

The announcement did not specify a technology, but at that scale technologies would most likely use electrochemical storage, most commonly lithium-ion.

Climate protection minister Leonore Gewessler said: “By 2030, we want to generate our electricity only from clean energy sources. Medium-sized electricity storage systems enable us to integrate renewable energy into the power grid more efficiently – and thus achieve our goal!”

Although not specified, it sounds like most projects targeted as part of this will be behind-the-meter (BTM) applications. However, the country’s front-of-meter (FTM) grid-scale market is also developing, with a 20MWh battery energy storage system (BESS) commissioned in September 2023 by developer NGEN, the country’s largest.

Energy-Storage.news has heard anecdotally that opportunities in the ancillary services market in Austria have grown substantially since continental Europe started the process of harmonising its ancillary service market via the creation of the automatic frequency restoration reserve (aFRR) market.

New York puts US$5 million to long-duration energy storage projects

The money will support the development and demonstration of scalable LDES solutions to help the state meet its clean energy and energy storage deployment goals, including a 6GW by 2030 energy storage target.

The competitive solicitation will support innovative and under-utilised LDES solutions, devices, software, controls, and other complementary technologies which are yet to be commercialised by funding demonstration projects. Hochul’s office said.

Eligible projects will need to be between 10-100 hours in duration at rated power and, the announcement said: “should advance and field test electrical, chemical, mechanical, and thermal to electric long-duration storage solution technologies that will address cost, performance, and renewable integration challenges such as grid congestion, hosting capacity constraints, and lithium-ion siting limitations in New York City.”

Siting limitations for lithium-ion in a dense urban area like New York City could include fire safety concerns—which the state has sought to tackle through an interagency working group convened by Hochul—noise emissions and logistical challenges with containerised battery energy storage systems (BESS) becoming ever more energy-dense and therefore heavier.

Those with eligible projects have until 3 pm local time on 24 September, 2024, to submit their proposal.

It follows previous LDES funding solicitations of US$15 million allocated in 2023, the bulk to an iron-air battery project from Form Energy, and a US$16.6 million round for five projects in 2022.

NYSERDA president and CEO Doreen M. Harris said: “Investing in long duration energy storage solutions can help replace fossil fuel peaker plants while incentivising clean energy development that will tangibly improve air quality and mitigate the future impacts of climate change for traditionally overburdened communities.”

The NYSERDA Innovation Program is funded through the State’s 10-year, US$6 billion Clean Energy Fund.

See more recent news about the New York energy storage market here, including New York City’s largest BESS being deployed at a retiring gas plant, a 150MWh rollout by Eaton and Endurant and a like-for-like gas turbine replacement project on Staten Island.

Ethical Power gets approval for 65MW solar-plus-storage project in New Zealand

The project’s solar element will comprise 140,000 single-axis tracking modules, 13 inverters and a co-located battery energy storage system (BESS) of an undisclosed capacity.

Selwyn District Council granted consent for the project in May 2024. The proposed Buckleys Road site is adjacent to the Brookside 66kV substation and has close access to the grid and Christchurch, a significant demand hotspot.

See the original version of this article on PV Tech.

Highview raises £300 million to start building 300MWh liquid air energy storage project in the UK

The funding round was led by the state-owned UKIB and utility Centrica, with participation from mining firm Rio Tinto, bank Goldman Sachs, private equity firm Mosaic Capital and KIRKBI, the family office of the Lego-founding Kristiansen family.

UKIB mobilises private finance to help first-of-a-kind technologies, including those for the energy transition, to reach commercial scale whilst driving local economic growth. Centrica, meanwhile, has come on board as Highview Power’s strategic partner and contributed £70 million of the £300 million.

Highview will also now start planning its next four larger scale facilities totalling 2.5GWh requiring £3 billion of investment in line with the UK’s support mechanisms and forecasted required deployments of LDES.

Meeting support mechanism requirements

The support mechanism for LDES currently being discussed is a cap and floor mechanism for projects of a minimum size and duration – 300MWh and six hours – that exactly matches Highview’s, suggesting the project has been built with an eye on bidding for support via the scheme. Highview said its technology can store renewable energy for up to several weeks, indicating its duration could go beyond several hours.

The company has had a smaller-scale 5MW/15MWh project operational, also in Manchester, since 2018. It first revealed plans for a large-scale project in Carrington in 2019 which the then-CEO told Energy-Storage.news would start construction the following year.

The UK already has a substantial fleet of over 4GW/4GWh of short-duration, 1-hour and 2-hour lithium-ion BESS projects online, which are primarily providing ancillary services and some grid balancing and energy trading activities.

But many in the industry suggest that as renewable generation grows, the gigawatt hours of capacity will need to grow far beyond what is financially cost-effective with just lithium-ion BESS.

UKIB also recently invested £25 million into another LDES company, vanadium redox flow battery (VRFB) firm Invinity Energy Systems, for it to expand manufacturing and start directly investing in projects using its tech.

BESS integrator NHOA to delist from Euronext Paris as majority owner TCC plans buyout

It has since increased its stake to 87.78% of NHOA’s share capital following a €250 million (US$270 million) rights issue last year, in which most minority shareholders chose not to exercise preferential subscription rights.

TCC Group Holdings said this morning (13 June) that it intends to file a simplified Tender Offer for NHOA shares at €1.10 per share, and request implementation of a squeeze-out of remaining holdings if legal conditions are met at the offer’s conclusion.

The squeeze-out procedure would see NHOA’s shares delisted from Euronext Paris, where they have been trading since 2015, peaking in December 2021 at €12.90.

Taiwan Cement Corporation, in business for over 78 years, rebranded its English name to TCC Group Holdings following a shareholders’ meeting in May. With the rebrand came a shift in emphasis from its core cement business to 11 industries.

Over the past six years, the group has made investments into areas including renewable energy, smart grids, battery energy storage system (BESS) technology, and lithium-ion (Li-ion) battery cell production.

Post-acquisition, NHOA company leadership claimed that TCC’s ownership would enable synergies between the parent company’s upstream technology investments with NHOA’s experience in downstream deployment of battery storage and EV infrastructure.

Speaking at a TCC AGM in mid-2022, group chairman Nelson Chang highlighted the importance of investing in energy storage as a strategic business and “key to the future of energy.”

Both TCC and NHOA have previously outlined plans to rapidly grow energy storage deployments and market share. TCC Group Holdings said NHOA will require “significant investments” that could be more easily decided on and implemented as a private, non-listed company.

The company claimed that private ownership would enable more long-term strategic decision-making that would be less exposed to financial market expectations, regulatory costs, and share price fluctuations.

TCC Group Holdings also claimed that with it already holding a large majority of shares and with low volumes being traded on the market, being listed was not particularly beneficial to NHOA.

New projects booked or announced by NHOA in the past year include a 107MWh project at a TCC cement plant in mainland China, a 31MWh BESS in Peru for former owner Engie, a win in Italy’s low-carbon capacity market auctions, and two projects in Taiwan for its parent company: one a 311MWh BESS asset designed for a new frequency regulation grid service commissioned in December 2023, and more recently a 120MWh system which will perform behind-the-meter (BTM) peak shaving as well as ancillary grid services.

Energy-Storage.news has approached representatives of NHOA for comment on the proposed transaction and will update this story in due course as applicable.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

Ees Europe: Product launches from big players to startups, at Europe’s biggest cleantech industry expo

One of the highlights is always walking the show floor across the many packed halls and seeing equipment and solutions from a diverse range of providers and technology types at all scales.

Below is a short preview rounding up some of the releases Energy-Storage.news has seen ahead of the event.

While we can only bring you a very small sample of the products that will be on show from leading providers to interesting startups, we hope it will give you a taste of some of the trends and tech you might find at the exhibition.

SMA: Central PCS/inverter for solar, storage and hydrogen

Solar PV inverter company SMA Solar Technology has been increasing its presence in the energy storage space for some time and new products it will bring to the show include a new version of its Sunny Island battery inverter and a home energy management solution.

Perhaps of most interest to Energy-Storage.news readers however, will be Sunny Central Flex, a large-scale power conversion solution designed to be as at home in a standalone battery energy storage system (BESS) or hydrogen electrolysis project as it is at a solar farm.

SMA’s Sunny Central Flex – visitors can expect to see a full-scale unit in the expo halls at ees Europe/Intersolar Europe. Image: SMA

The product comes with fully integrated AC-DC and DC-DC converter, with energy storage retrofit optionality, medium-voltage (MV) transformer and switchgear, as well as grid-forming capabilities.

Sunny Central Flex comes in a 40-foot tall cube configuration with a CSC-certified transportation frame. The company claimed it enables a wide range of storage applications, from frequency containment reserve (FCR) to new grid services such as black start capability and inertia.

Sunny Central Flex has been nominated for the prestigious ees Award at the show, and SMA will be unveiling the product on 19 June.

Ampace presents ‘innovative’ thermal management technology

Also holding an unveiling at ees Europe on 19 June will be Ampace, manufacturer of distributed energy storage systems formed as a joint venture between CATL and ATL.

Ampace said a range of lithium-ion (Li-ion) products featuring an innovative full range temperature control technology which requires no auxiliary power consumption for cooling, and a battery cell which is capable of 15,000 cycles, making it ideal for pairing solar PV with energy storage.

The company’s products include residential, commercial and industrial (C&I) and portable and UPS battery solutions. According to Shenzhen Gaogong Industry Research (GGII), it was the leader in exporting residential battery systems from China overseas, representing about 30% market share.

Its Kunlun Battery Cell 2.0 utilises a new technology, called GT40, which comprises “new” cathode and anode materials, new electrolyte materials and a double-headed battery tab structure.

Kunlun powers Ampace’s C&I range, and in combination with the company’s thermal management system, which it claimed is a “breakthrough” innovation, customers can enjoy improved operation and lower lifetime costs.

Voltfang’s C&I energy storage with European automotive batteries

German company Voltfang will be launching the next generation of its battery storage system for C&I applications, equipped with second life electric vehicle (EV) batteries.

Voltfang 2 is an integrated system which is designed to be installed as a turnkey solution. It offers 100% more capacity than its predecessor, and is lower cost. Like Ampace, Voltfang claimed its product’s thermal management technology is a selling point, enabling the system to be used in ambient temperatures of -20 to 50C, and temperature optimisation can extend the cycle life of the system’s battery modules to a guaranteed 10-year, or 6,000 cycle lifetime.

“Our system is specifically designed for outdoor use to provide our customers with a seamless process. Installation requirements such as a fire room or expensive fire insurance are no longer necessary,” CTO and founder Afshin Doostdar said, adding that Voltfang 2 is designed to be installed in as little as two hours.

Each unit comes with 180kWh usable energy storage capacity, with batteries sourced from European automotive OEMs.

Hyperstrong brings 5MWh+ containerised BESS

China-headquartered battery energy storage system (BESS) manufacturer and integrator Hyperstrong will showcase a range of full-stack energy storage solutions for applications ranging from large utility-scale to C&I and EV charging with integrated energy storage.

Joining the growing ranks of global BESS providers with a solution packing 5MWh or more of capacity into a 20-foot standard container configuration, Hyperstrong will be presenting its HyperBlock III for utility-scale.

HyperBlock III is equipped with large format 314Ah cells, and battery packs and power conversion system (PCS) components are integrated into one cabinet, featuring liquid-cooled thermal management.

Hyperstrong claims cell, electrical and structural safety in the product are monitored with “intelligent” sensor technology, while digital modelling is used to provide AI-driven analysis of cells through their entire lifecycle, both of which are features that contribute to a high safety standard.

Hyperstrong’s solar PV, wind and battery storage project in Anhui, China, has been shortlisted for a Smarter E Award. Image: Hyperstrong.

CLOU’s ‘unique’ Engineering and Procurement Package

CLOU, another China-headquartered manufacturer and integrator, will be returning for its third appearance at the Munich event next week.

This time out, its offerings are led by the CLOU Engineering and Procurement Package (EP Package), which the company claims is a “unique” end-to-end turnkey solution including DC block, PCS, MV transformers, switchgear, EMS, SCADA, and operations and maintenance (O&M) services—the entire BESS value chain, CLOU said.

EP Package also covers site-level system sizing, electrical and communications design, financial analysis and Long-term Service Agreements (LTSAs).

CLOU will also be displaying its latest, higher energy density BESS unit, Aqua-C2 which among other things is claimed to be capable of withstanding extreme weather environments, and previewing Aqua-C2.6, a 5MWh+, 20-foot containerised BESS solution, compatible with either string PCS or DC-DC converter.

Energy-Storage.news will be attending and reporting from ees Europe, which takes place next week, 19-21 June 2024 at Messe München, Munich, Germany.