The company’s value proposition is largely centred around its HybridOS energy management system platform, which Brandt told us in a previous interview is aimed at being like the Microsoft Windows of energy storage; the platform is designed to allow asset owners to access the full range of applications and market opportunities available.

In addition to his role at FlexGen, Brandt is chair of the energy storage division at the US Solar Energy Industries Association (SEIA).

The interview you’re about to see was recorded at the 2024 Energy Storage Summit EU in London.

The discussion spans a lot of areas: from why a company with a foothold in the US is watching the UK and European markets with great interest, the role of the energy management system (EMS) in solving operational and availability challenges, to how economic growth and growth in energy demand go hand-in-hand and much more.

[embedded content]

Later in the year, we anticipate launching an online interview series with energy storage industry experts, insiders and thought leaders exclusively for Energy-Storage.news Premium subscribers, so again, stay tuned for that.

Video editing by Fergus March.

Tesla Megapack battery storage system enters Japan’s ancillary services market

The Megapack installation is based on Tesla’s integrated solution which includes lithium-ion (Li-ion) batteries, power conversion system (PCS, described as ‘power conditioner’ in Japanese industry parlance), thermal management and controls.

It is listed as available in Japan in 2-hour duration (1927.2kW/3854.4kWh) and 4-hour duration (979.2kW/3916.8kWh) configurations.

The BESS will enter Japan’s newly opened ancillary services markets through which assets will participate in helping balance the frequency of the electricity grid. The services, which require fast response times to correct deviations in grid frequency, were launched through tenders which were held for the first time in April.

Kanden Energy Solutions, the services arm of regional electric utility Kansai Electric Power Company (KEPCO or Kansai Electric), will handle the market operation.

KEPCO operates as a utility in the Kansai region in the southwest of Japan, but the 112MW coal-fired Sendai Power Station is part of its generation fleet, which the company operates as well as joint-owning with Enex Electric Power, a retail electricity subsidiary of Itochu Corporation.

KEPCO is one of Japan’s former monopoly energy companies which until the mid-2010s operated both electricity markets and grids across 10 major regions. Through a process of deregulation and unbundling of electricity supply and transmission and distribution (T&D), the market is now nationalised, but with regional pricing.

As noted in a recent LinkedIn article by Jack Greenwood, an APAC market analyst at Octopus Energy-owned electricity trading and optimisation software group Kraken, the national procurement of ancillary services is a “key feature of the new country-wide market”.

Formerly, ancillary services were procured regionally and served solely by thermal generation and pumped hydro energy storage (PHES) plants. They are now procured nationwide through auctions, although it is worth noting the Japanese grid network is split into two operating frequencies: 50Hz in the north and east and 60Hz in the south and west of the country.

Kraken’s Jack Greenwood highlighted that auctions, which have been rolled out this year with the most recent in April, have so far been undersubscribed. This is a major contrast to the country’s first-ever low-carbon capacity market auction, which saw 20-year contracts handed to 1.67GWh of storage, mostly batteries, along with around 500MWh of PHES.

The Supply and Demand Adjustment Market was established by the Electric Power Reserve Exchange in 2021, gradually introducing new ancillary services markets from that year onward, beginning with tertiary adjustment reserve, then adding primary adjustment reserve and secondary adjustment reserve this year, as well as starting trading in all markets.

Megapacks to provide tertiary, primary control frequency services

Tesla Japan said its system at Sendai will provide two levels of frequency regulation, tertiary adjustment and primary adjustment:

Tertiary adjustment reserve including corrections to mitigate forecasting errors for production of renewable energy at plants remunerated by the feed-in tariff mechanism and other errors after market gates close to respond to forecast errors and other disruptions such as power station outages.

Participants must respond within 45 minutes for the first type of tertiary adjustment and within 15 minutes for the second, with a required 3-hour discharge duration per block of delivered power.

Primary adjustment, or primary control reserve, calls for much shorter cycles. It requires a response time within 10 seconds of receiving a grid signal and a discharge duration of at least 5 minutes in response to intra-hour fluctuations of electricity supply and demand.

As noted by Jack Greenwood of Kraken in his recent article, the market is auctioned for weekly, and procured nationally but dispatched locally by transmission system operators (TSOs).

Tesla’s first megawatt-scale battery project in the country was in Osaka in the Kansai region, a 7MWh project added to Kansai Electric’s virtual power plant (VPP) demonstrator programme.

Deployed at a train station, that project is equipped with the company’s Powerpack system which was aimed at commercial and industrial (C&I) applications as well as being Megapack’s predecessor for larger projects, as reported by Energy-Storage.news in 2019.

Since then, the company has variously talked-up its potential to provide VPP services in Japan, while it got its first order for a Megapack in the country in 2021, a 1,523.8kW / 6,095.2kWh system for Chitose Battery Park on the northern island of Hokkaido, by energy aggregation company Global Engineering and its EPC partner Ene-Vision.

At the Sendai project, Tesla will continue providing maintenance services, including 24-hour remote servicing. Directly connected to the grid from its strategic location at Sendai Power Station, the BESS went into operation on 20 May ahead of last week’s official announcement.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

AES withdraws hybrid solar-plus-storage project from Hawaiian Electric procurement

In a heavily redacted filing submitted with the regulatory Hawaii Public Utilities Commission (PUC) on 31 May 2024, AES explained that although it had been able to secure site control to develop the hybrid facility, it had been unable to secure the land to interconnect the project to HECO’s electricity grid.

AES submitted separate notices with the PUC cancelling a System Impact Study (SIS) and Feasibility Study (FS) which were underway as part of the interconnection process.

The Puu Hao Solar and Storage project has also been removed from HECO’s project status board that tracks the progress of renewable energy projects which the utility has power offtake deals with.

In the filing lodged with the PUC, AES added that it “remained committed” to meeting the energy needs of the county of Maui through the development of its Kuihelani Phase 1 + 2 Solar and Storage facilities.

Phase 1 of the project, which includes a 60MWac solar farm co-located with a 240MWh BESS, was brought online 31 May 2024, according to HECO’s project status board.

Puu Hao project part of 2.1GWh Hawaiian Electric procurement

The Puu Hao Solar and Storage facility was slated to comprise a 20MWac solar farm co-located with an up to 80MWh battery energy storage system (BESS) approximately 1.9 miles southwest of Kula in the county of Maui, Hawaii.

According to a website set up by AES, the project would have connected to the local grid via the Kealahou Substation owned by one of HECO’s subsidiaries Maui Electric Co. AES expected to commence construction on the project in 2026 and was targeting a commercial operation date (COD) in 2027.

The Puu Hao project was selected alongside 14 other developments as part of Hawaiian Electric’s Stage 3 Request for Proposals for Renewable Dispatchable Generation and Energy Storage. The utility opened negotiations with the selected projects in December 2023. Of the 14 remaining projects, nine are expected to incorporate BESS facilities totalling 2.06GWh of capacity across Oahu, Maui and Hawaii Island.

Longroad PPA declared null and void ahead of resubmission

One of the 14 selected projects is being developed by Longroad Energy in the County of Oahu and will incorporate a 120MWac solar farm co-located with a 480MWh BESS. An agreement between Longroad and Hawaiian Electric for the offtake of power from the Mahi Solar facility had already been negotiated as part of a previous procurement but was ultimately declared null and void in March 2022.

In order for the project to remain viable for Longroad Energy, it proposed amendments to the original PPA which HECO brought to the PUC for approval in February 2022. Amendments included a delay to the guaranteed commercial operation date (GCOD) from the end of 2023 to March 30th 2024 and a 19.3% increase in the unit price paid by HECO.

The Hawaiian PUC declined to approve these amendments in March 2022 after it argued the proposed unit price increase and delay to project schedule were not in the public interest.

As part of the latest procurement, Longroad is targeting a COD in the fourth quarter of 2027 for its Mahi development.

Hawaii Clean Energy Initiative: 100% renewables by 2045

The Hawaii Clean Energy Initiative (HCEI) was first launched in 2008 by the US Department of Energy (DOE) and the State of Hawaii with the goal of achieving 100% renewable energy by the year 2045.

HECO announced in February of this year that 33% of the energy it generated across Maui, Hawaii Island and Oahu came from renewable sources which was a 1% increase on the year before. HECO has an intermediate goal of generating 40% of its electricity from renewable sources by 2030.

Arevia and NV Energy sign PPA for ‘Nevada’s largest’, 2.8GWh solar-plus-storage project

It will require US$2.3 billion in investment and will be among the largest solar-plus-storage projects in the US, and the largest in the state, Arevia said.

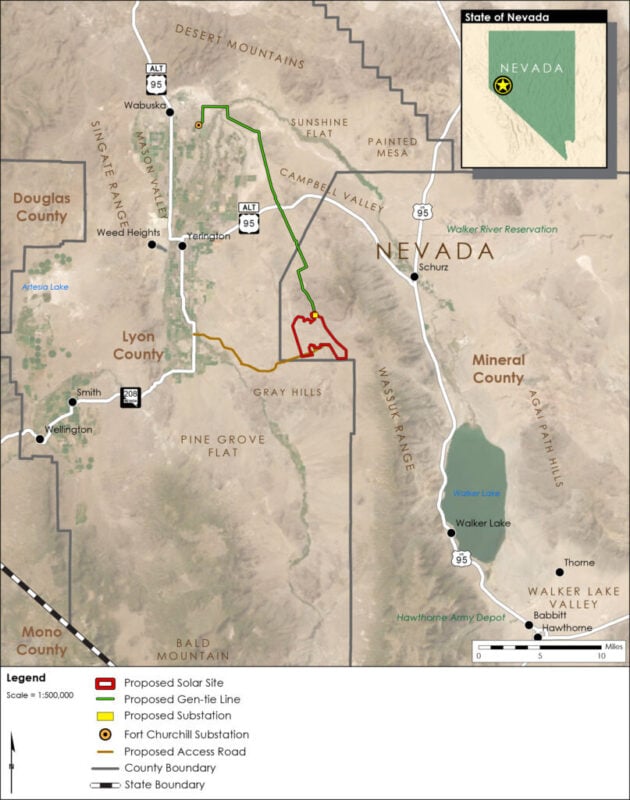

A site layout of the project. Image: Libra Solar / Arevia Power.

Libra Solar will be located about 20 miles south of the Fort Churchill substation in Yerington, near the border between Mineral County and Lyon County.

It will span 5,141 acres of land in Mineral Country while most of the generation tie line will be in Lyon County.

US representative for Nevada’s 4th congressional district Steven Horsford commented: “The signing of the power purchase agreement for the Libra Solar project marks a pivotal moment in our fight against climate change. This transformative project will not only generate an unprecedented amount of solar energy and battery storage but will also create over 1,000 good jobs and drive economic growth in Mineral County.”

The project is set to be approved as part of Berkshire Hathaway-owned NV Energy’s Integrated Resource Plan (IRP) which includes three major solar-plus-storage PPAs totalling over 1GW of capacity, of which Libra Solar is the largest.

The projects will help NV Energy meet Nevada’s renewable energy deployment targets as well as control costs for customers, while helping the utility meet peak demand load.

Arevia was advised by Patrick Groomes and Brenda Hanzl, who also advised Arevia in its prior negotiations with NV Energy on the 690 MW Gemini solar-plus-storage project, for which it also has a long-term PPA in place.

The utility also recently put a 440MWh standalone BESS project, integrated by Energy Vault, into commercial operation, and last year launched a request for proposals (RFP) for renewable and energy storage resources.

Nevada along with other desert Southwest states is quickly becoming as active an energy storage market as the US’ leading states of Texas and California, with utilities signing long-term PPAs for developers of large-scale projects making it easier to get financing for construction.

Projects in Nevada can also serve the comparatively larger California energy market, with the entire contiguous US West’s 14 states interconnected via the Western Interconnection grid area. EDF Renewables North America and California utility SCPPA signed a PPA for 780MWh, solar-plus-storage project in Nevada in February, for example.

Volkswagen’s Elli plans large-scale BESS projects, first in Germany

The largest individual project in its planned portfolio are 350MW/700MWh in size, though it did not say if that would be the size of the first project in Germany.

“Germany and Europe need sufficient storage solutions to meet the increasing demand and to compensate for the volatile feed-in of renewable energies,” said Volkswagen Group board member for technology Thomas Schmall.

Elli said that last year saw 10.5GWh of renewable energy curtailment in Germany due to a lack of energy storage options, enough to power 3.2 million electric vehicles (EVs) for the whole year.

“We see high financial potential in this business area and the opportunity to develop Elli into a holistic energy provider in Europe,” said Giovanni Palazzo, CEO of Elli.

Elli manages electric vehicle (EV) charging infrastructure across Europe as well as retail energy products both B2B and B2C built around EV charging needs.

Last year the company launched a 560kWh second life BESS using batteries from Volkswagen’s ‘e-up!’ line of EVs and an energy trading platform to monetise its fleet of EVs and EV charging via vehicle-to-grid (V2G) and vehicle-to-home (V2H) technology.

The second life BESS was also to be managed on the platform and serve as the testing ground for it, and may have helped facilitate the company’s entry into the large-scale, first life BESS space announced last week (7 June).

Elli’s head of energy solutions Ingo Müller explained to Energy-Storage.news at the time that V2G technology was fundamentally proven from a technical perspective, but that scaling it up required a lot of development around retail energy products that provided the right mix of security and benefits to consumers.

The grid-scale market in Germany is a hotbed of activity at the moment, with a 215GW solar PV 2030 deployment target driving the energy storage market to potentially over 100GWh of installs by that year, according to BloombergNEF. Just in the past month, triple-digit-MWh projects have been announced by Eco Stor, Uniper and Nofar.

Australia sees more than AU$1 billion in energy storage investments for four successive quarters, says Clean Energy Council

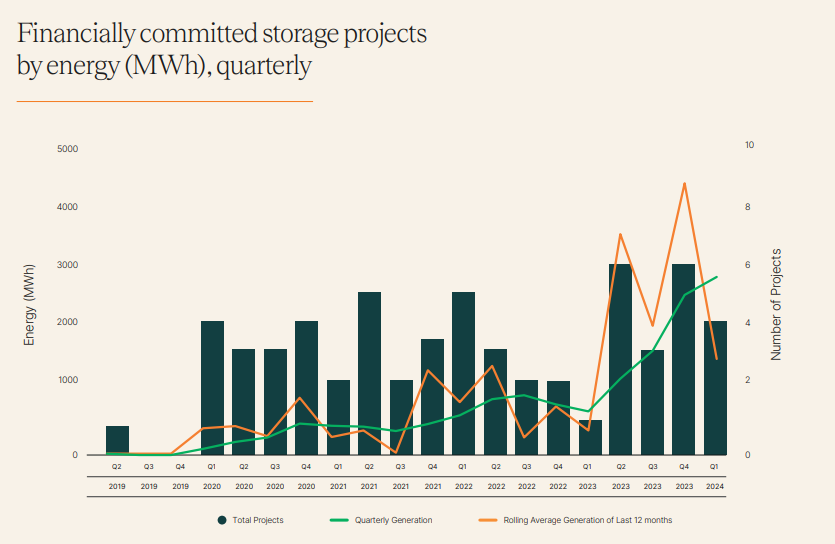

It’s important to note that there are currently 121 generation and energy storage projects that have either secured financial commitment or are currently under construction. This represents 12.3GW of electricity generation capacity and 8.4 GW/18.8GWh of energy storage projects.

Kane Thornton, chief executive of the Clean Energy Council, highlighted the “encouraging signs” of the Australian renewable market moving in a positive direction and on a “road to recovery” aided by landmark commitments by the Federal government.

“Landmark commitments made by the Federal government in recent months have been designed to build certainty for renewable energy investors, which we expect will drive a resurgence for the large-scale generation we need,” Thornton said.

“These results are an encouraging sign that Australia’s clean energy transformation is moving in a positive direction and on the road to recovery.”

Energy storage saw a fourth consecutive quarter in which projects secured financial investment commitments of over AU$1 billion (US$660 million). According to the report, four storage projects, representing 760MW/1,640MWh, received a financial commitment.

The largest of these projects was the 300MW/650MWh Mortlake Power Station Battery in Victoria, which Australian generator-retailer Origin Energy is set to develop. The 100MW/200MWh Mannum Battery Energy Storage System and the 110MW/290MWh Templers Battery Energy Storage System in South Australia also reached financial commitment.

Two energy storage projects also commenced construction in Q1 2024. These include Synergy’s 500MW/2,000MWh Collie Battery Energy Storage System in Western Australia and the 250MW/500MWh Swanbank Battery in Queensland.

Meanwhile, the 50MW/100MWh Bouldercombe Battery was the one storage project which reached commissioning in Q1.

Commenting on the energy storage results, Thornton said: “Investment in large-scale storage continues to be very strong, following a record year in 2023. It is abundantly clear that renewables firmed by storage are the future of Australia’s energy system and investors have a strong appetite for new energy storage projects.”

To read the full version of this story, visit PV Tech.

Eku Energy: ‘Shareholders understand balance between merchant and contracted revenues’ in Australia’s NEM

Canadian institutional investor British Columbia Investment Management Corporation (BCI) came on board as Macquarie’s joint owner of the developer a few months later, and while it now has a development pipeline that includes projects in the UK, Italy and Japan, its first announced projects were in Australia.

Rachel Rundle, Eku Energy’s senior manager for policy and regulation in the APAC region, tells Energy-Storage.news that the company has more than a gigawatt-hour of assets in delivery in Australia, across three projects with different partners and business cases.

Its first Australian asset, Hazelwood BESS, was built on the site of a decommissioned coal power plant in Victoria, jointly developed with French utility Engie. Construction began in 2021 with the Green Investment Group and Engie financing the project, and Fluence supplying and integrating the battery storage technology.

Commissioning took place in June 2023, marked by an event attended by Victoria’s minister for energy & resources, Lily D’Ambrosio, and the battery asset is operating and trading in the National Electricity Market (NEM) on a full merchant basis for the owners.

Minister D’Ambrosio was again in attendance as construction began on Eku Energy’s next project in July 2023. Also in Victoria, the 200MW/400MWh Rangebank BESS at Cranbourne in Southeast Melbourne is by contrast to Hazelwood contracted to a 20-year tolling agreement with co-development partner Shell Energy.

Oil and gas company Shell’s energy solutions and retail utility arm will trade and operate the BESS in the market over the asset’s lifetime.

Rundle says she can’t speak to Shell Energy’s strategy for how it will optimise the Cranbourne project, but says it is likely that will be a combination of balancing or firming up the utility’s own customer load and trading it across the NEM’s ten separate frequency control ancillary services (FCAS) markets and wholesale trading.

The third project already in delivery is in the Australian Capital Territory (ACT) and was awarded to the developer in April 2023 through an ACT state government competitive solicitation process.

The ACT government pledged AU$100 million (US$67 million) in funding towards the total expected cost of between AU$300 million and AU$400 million from the 2020-2021 state budget before running the procurement tender.

In this case, the state government will be Eku Energy’s partner for the 250MW/500MWh Big Canberra Battery (BCB), as it is known. The pair will share revenues generated by NEM participation, while the ACT government will also pay Eku fixed sums on a quarterly basis over a 15-year term.

“We very much do look at each asset, at what’s the best for financing outcome at the asset level, but also thinking about the broader portfolio,” Rundle says, speaking at the 2024 Energy Storage Summit Australia which took place in Sydney a few weeks ago.

Hazelwood BESS, the 150MW/150MWh asset brought into operation in mid-2023. Image: Eku Energy

“So yes, that portfolio has three assets at the moment that are all contracted in different ways, but we’ll be looking at what’s optimal for that asset to get the lowest cost of capital.”

Eku Energy does not have a “hard and fast rule on the level of contractedness” it goes for with each project, with shareholders Macquarie and BCI both having appetite for merchant risk, and understanding the balance between merchant and contracted revenues, according to Rachel Rundle.

Having a broader portfolio view of assets and pipeline means that the developer can “take a higher merchant case in some assets and a higher contracted case in others,” Rundle says.

Differences across NEM jurisdictions

All three projects are in the interconnected states and territories that comprise the NEM, but the market’s different regions, while offering access to the same markets for ancillary services and wholesale trading, will see revenues vary.

“The NEM has five jurisdictions. Five zonal markets, as you might call them in other electricity markets, all with their own spot price. So those spot prices, usually they correlate, but I think what we see when there’s inter-regional transmission constraints, or different supply mixes in different states, we see that price divergence,” Rundle says.

“We’re seeing a bit of that now with the northern states, Queensland and New South Wales having different price dynamics from the southern states, and that sort of changes over time as the thermal fleet comes in and out.”

Therefore, for each project, it’s a case of modelling the revenue case in that particular jurisdiction for the asset.

In terms of the merchant business case, long-term forecasts across all of the different energy products in the NEM need to be taken into account.

As has been seen in other markets such as PJM in the US, the UK and Germany, frequency regulation ancillary services have been the first big opportunity for batteries to participate on a broad scale in the NEM, but as installed BESS capacity grows, those relatively shallow markets tend to saturate.

Rundle notes that the FCAS markets are where the bulk of revenues for batteries have come from in the past.

“But I think as we’re seeing more saturation in those markets, the way we need to operate our assets and develop our assets is shifting towards more of an arbitrage play, and arbitrage being a bigger portion of that revenue stack, and in and amongst that, we’ll have ancillary service revenues, arbitrage revenues, network support-style revenues.”

ESN Premium also spoke to representatives of technology provider Fluence at the Australia Summit, and heard that those network support services could be an important source of revenues, likely contracted, going forward.

Those services today, which include System Integrity Protection Scheme (SIPS) contracts where batteries act as a kind of ‘shock absorber’ to the grid, building in redundancy to cope with unexpected transmission service disruptions, are largely contracted with the transmission operators, or transmission network service providers (TNSPs) as they are called in Australia.

Not every asset across Eku Energy’s Australian fleet may be in the right place on the grid, or equipped with the right technologies such as advanced grid-forming inverters, to provide them, but Rundle says the developer will be looking to bid into those opportunities where it can.

“Those types of services, whether it’s reactive power, or dynamic voltage support, or whatever it might be, some of those services are quite locational in the NEM,” Rundle says.

Australia’s grid is often described as long and “stringy,” stretching vast distances to the rural ends of each line, meaning some parts of the grid require much more strengthening and reinforcement than others.

“Some of those [opportunities] will be very locational, and if we don’t have batteries in that location, then we perhaps won’t win that service,” Rundle says.

‘Natural dynamics benefit storage’

The necessary framework for rolling out system services contracts on a wide scale is yet to be implemented in Australia, whether that be TNSPs holding regular tenders or some other structure.

The contracts that have been awarded, such as the SIPS contracts held by Neoen’s Victorian Big Battery already in operation, or Akaysha Energy’s Waratah Super Battery in New South Wales (NSW) currently in construction, have been on something of a case-by-case basis.

In that sense, it’s impossible to say what the commercial and revenue case for such schemes might look like, Rundle says, but the decarbonisation benefit of putting batteries to work performing such applications, traditionally provided by fossil-fuelled thermal generation, is clear.

“That’s the good thing. We definitely see that with all the system challenges that we as a sector are aware of, through all these thermal plants coming out of the system, batteries are really well-placed to provide those services: whether it be system strength, whether it be synthetic inertia, voltage support, batteries are sort of that multi-tool asset,” Rundle says.

Energy storage can certainly help smooth the transition to renewable energy away from thermal generators, if enough of it is built and in the right places. The only question around that is whether enough can be built in time to meet Australia’s national and state goals on decarbonisation, Rachel Rundle points out.

Going forward, one big challenge will be getting the durations of energy storage right. There is growing recognition that Australia will need significant quantities of storage going to durations longer than the 1-hour, 2-hour and even 4-hour lithium-ion (Li-ion) assets being built today.

The natural dynamics of the NEM’s wholesale market, which has a very high cap and sees negative pricing events, benefit storage already today, but how the market can now evolve to “value depth” is the big question.

“When we’re thinking about those longer durations, we need to think about, what the shape of wholesale price over the day will look like, and then what size storage we need to capture enough arbitrage spread to earn enough revenues through the market,” Rundle says.

The government has already stepped in with the landmark Capacity Investment Scheme (CIS) tenders for firmed renewable generation, which Rundle says is recognition that the market is not yet really delivering wholesale revenue returns.

It’s likely the CIS tenders and future tenders will support getting 4-hour+ durations into the market because wholesale market opportunities today are not attracting sufficient investment commitments to do so.

Eku Energy will be looking at different depths of duration, Rachel Rundle says, looking already at deploying systems beyond the 1-hour and 2-hour durations it has already committed to, noting that Li-ion technology is likely well-suited to providing longer durations at 4-hours and even 8-hours-plus.

Belgium’s Montea investing €30 million in distributed BESS across logistics network

The firm is already investing €17.5 million in the BESS installations at 14 sites across Belgium, totalling 35MWh, and is planning to invest another €12.5 million at another seven locations in the Netherlands, totalling 21MWh.

Combining the BESS with EV charging will help to alleviate grid congestion. BESS can reduce the peak demand needs of large EV charging hubs, reducing the transmission & distribution (T&D) upgrades needed for such power-intensive facilities and reducing energy costs for their operators.

“Electric vehicles are booming in terms of passenger transport and in a few years, the same will betrue for e-vans and trucks. Logistics centers that are equipped for this – in a sustainable andaffordable way – will have the upper hand,” said Dirk Van Buggenhout, chief sustainability officer forMontea.

The firm said it expects an internal rate of return (IRR) for the investment of 12%, for both countries.

Belgium’s transmission system operator (TSO) Elia said in its Adequacy and Flexibility study for Belgium (2024–2034) that flexibility will be a core strategy in the coming years.

Elia is having its flexibility requirements provided by both large-scale BESS, with one of Europe’s most active markets, and distributed BESS like those from Montea as well as residential units.

In September 2022, Elia said that a virtual power plant (VPP) comprising residential BESS units would cover 15% of its grid balancing needs by the end of the year.

‘Energy storage can meet Europe’s energy challenges’: Trade group EASE issues ‘manifesto’

According to various media reports, the climate is more of a hot-button topic than ever in some European Union Member States, while ever since the 2022 invasion of Ukraine by Russia sent the cost of imported gas skywards, energy costs have been a constant headline issue.

EASE argued that energy storage paired with locally generated renewable energy can replace gas peaker plants, reducing dependency on polluting fossil fuel imports. Clean energy technologies can also help stabilise and reduce consumer and industry exposure to high and volatile electricity prices.

At the same time, the risk of falling short of the EU’s 2030 decarbonisation targets can be mitigated by leveraging energy storage to maximise the adoption of renewables integration on the grid, reduce the cost of transmission and distribution (T&D) infrastructure upgrades, and decongest increasingly constrained networks.

Grid congestion costs in Germany alone totalled €4 billion (US$4.36 billion) in 2022, while the country experienced more than 150,000 electricity supply interruptions in the previous year. EASE also noted that around 60% of energy is imported across Europe.

Storage deployment in the continent is accelerating, with over 10GWh of new installations recorded in 2023, about 70% of which were residential battery systems.

At the top level, European Union lawmakers have recognised the potential roles energy storage must play in meeting goals that include 90% renewable energy by 2040 and a net zero economy by 2050 while maintaining and enhancing energy security and stability of supply.

In April 2023, European Commissioner for energy Kadri Simson described energy storage as a “centrepiece” of the energy transition in a speech to Members of European Parliament (MEPs), while proposed reforms to Electricity Market Design a couple of months later and since voted in for adoption by the EU highlighted that increasing shares of renewables would be impossible without energy storage deployment increasing.

However, the various plans have also contained missed opportunities to address barriers to storage deployment, according to EASE and the Energy Storage Coalition, which the trade association is part of, along with counterparts in solar PV, wind power, and Bill Gates’ Breakthrough Energy sustainability VC group.

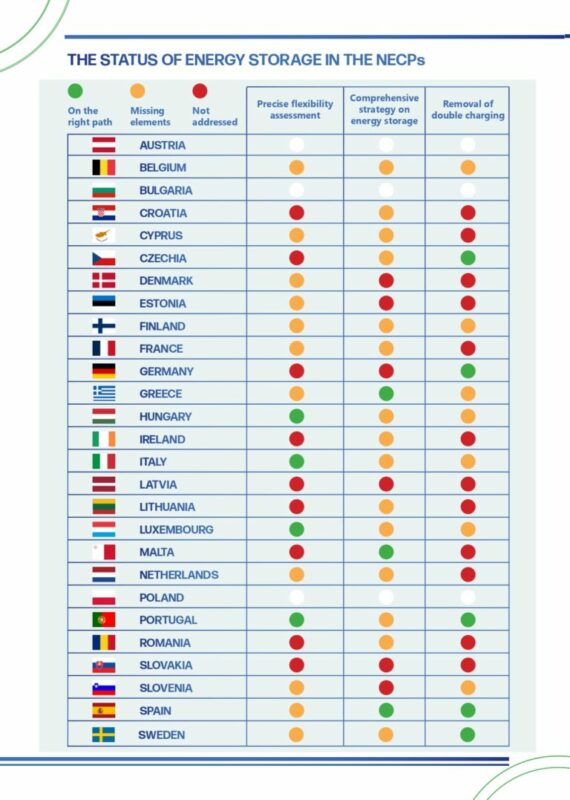

At the beginning of this year, the Energy Storage Coalition also said that EU Member States’ draft National Energy and Climate Plans (NECPs) largely fell short in supporting energy storage. Only Spain and Portugal’s NECPs were assessed to be “on the right path” on two out of three metrics, and none of the 27 states’ plans were commended in all three areas.

Analysis infographic of EU Member States’ draft NECPs. Image: Energy Stoage Coalition.

‘Six-point plan: ‘Remove barriers, enable long-term investment certainty’

EASE’s manifesto contains a six-point plan to achieve the various goals set out:

Accelerate regulatory changes to eliminate persistent barriers to storage deployment and ensure NECPs are ambitious and in line with EU goals. These would include rapidly implementing Electricity Market Design reform and the EU’s long-awaited Clean Energy Package while addressing “legal ambiguities” in the latter.

Develop a European Union energy storage strategy. Various Member States have introduced different schemes and tools to support storage, including Contracts for Difference (CFDs), capacity markets and auctions, and these should be coherently designed and complementary, EASE said.

Align the EU Heating and Cooling Strategy with climate and energy security policy drivers. This would enable greater efficiencies and sector coupling, with EASE noting that in the industrial sector, for example, some 2,500TWh of waste heat could be recovered globally using energy storage system technologies.

To swiftly write into law 2040 decarbonisation targets. A leaked draft earlier this year set out the 90% by 2040 target, and putting the EU on that trajectory would provide certainty to investors in the clean energy sector including storage.

Develop local electricity flexibility markets and new market products, which would integrate rising shares of renewable energy, limit curtailment and cost-efficiently solve network constraints and congestion.

Update grid use and access fee structures, including the elimination of double taxation—where storage resources in most EU countries are charged fees twice, for discharging into the grid as well as for receiving power from it—taking into account the positive impact of energy storage on network management and decarbonisation. In most EU Member States, and in many other parts of the world, grid regulations were drawn up long before the advent of grid-connected battery storage, meaning that storage resources are defined as both ‘generators’ supplying into the grid and ‘load’ drawing from the grid, and levied charges accordingly.

Queensland Energy and Jobs Plan commits AU$26 billion to Australian state’s renewables and storage push

As part of the investment, AU$16.5 billion will be provided to renewable energy and storage projects, AU$8.5 billion will go towards the construction of a ‘SuperGrid,’ AU$500 million will be allocated for network batteries and local grid solutions, and AU$192 million will be provided for the Transmission and Training Hubs in Townsville and Gladstone.

Commenting on the budget, Miles highlighted the economic opportunity renewables could bring to the state, asserting that it would mean “more jobs for Queensland, more investment and more industry innovation”.

“One thing I’m particularly passionate about is our state’s transition to renewables and the economic opportunity that transition can bring. It means more jobs for Queensland, more investment in Queensland and more industry innovation right here in Queensland,” Miles said.

“The Queensland Energy and Jobs Plan is a plan I am proud of, and I am proud to be investing in it through the first budget handed down as Queensland premier.”

To read the full version of this story, visit PV Tech.

Read more of Energy-Storage.news coverage of Queensland’s energy storage sector.