Bergstrom’s HVAC solutions will be integrated into Powin battery energy storage system (BESS) products for global projects.

Bergstrom, headquartered in Illinois, US, develops and manufactures climate control technologies for a range of applications, with a major focus on commercial vehicles. In the energy storage space, it offers air-cooled, liquid-cooled and direct-cooled thermal management solutions.

Powin claimed the integration will enable improvements in energy efficiency, temperature control, safety and reliability. The strategic partnership announcement comes about a month after the Oregon-headquartered integrator launched a new 5MWh BESS solution fitting the dimensions of a standard 20-foot container.

New Zealand’s first-ever second life battery storage system goes online

Repurposed Nissan Leaf electric vehicle (EV) batteries are being used in what is thought to be New Zealand’s first-ever ‘second life’ stationary storage system.

Electricity distribution company Counties Energy announced this week (4 June) the official launch of its second life project, Berm Battery, installed at the side of a state highway in the district of Waikato, on New Zealand’s North Island.

The low-voltage (LV) solution uses 18 Nissan Leaf batteries—which Counties Energy said would otherwise have been discarded and destined for landfill—integrated in a 240kWh system which is used to enable high-power EV charging.

The technology was provided by Australian energy storage developer Relectrify. Relectrify’s commercial and industrial (C&I) AC battery storage solution Revolve uses a patented technology, Cellswitch, which the company claimed is much lower cost than comparable products, due to its replacement of key components like battery management system (BMS) and conventional inverters.

The battery system increased the available power for charging at the site in Mercer, Waikato, from 120kWh to 180kWh. It was commissioned in October 2023, following a process that included two years of field-based real-world testing, before its official launch this week.

ESS Inc commissions long-duration flow battery in Burbank, California

ESS Inc’s iron and saltwater electrolyte flow battery installation for community-owned energy supplier Burbank Water & Power has been officially inaugurated.

With more than 6-hour storage duration, the 75kW/500kWh iron flow battery system is paired with a 265kWh onsite solar PV array at Burbank Water & Power’s (BWP) EcoCampus, in the Californian city.

The project deal was announced in late 2022, shortly after ESS Inc struck a much bigger agreement with another California utility supplier, Sacramento Municipal Utility District (SMUD) for up to 200MW/2,000MWh of iron flow batteries.

BWP is targeting 100% carbon emissions-free power by 2040 and its deployment of the ESS Inc battery unit, branded Energy Warehouse, “will enable our team to gain experience with iron flow long-duration energy storage technology which will be a linchpin of the renewable grid of the future,” BWP general manager Mandip Samra said.

BWP’s target is five years ahead of California’s 2045 statewide decarbonisation goal. ESS Inc noted in a press release that trade group California Energy Storage Alliance has estimated 13,571MW of long-duration energy storage (LDES) will be required by 2028 to achieve that goal.

ESS Inc’s Energy Warehouse will be used to demonstrate the use of the iron flow battery technology, with BWP’s EcoCampus housing employees and administration buildings while showcasing various sustainable building and landscape technologies, such as LEED Platinum Certified buildings and a solar PV carport in the Art Deco style.

LDES deployments in Ireland held back by lack of incentives and market design, report says

LDES, for example, is seen as key to balancing the grid’s growing renewable generation, like wind, over multiple days rather than just hours once their share of loads hits a critical mass. As such, the technology is seen as a crucial component of net zero.

The report cautions that without an increase in LDES rollout and deployment speed, Ireland could fall short of its 2030 renewables target, aiming to increase the share of electricity generated from renewable sources up to 80%.

For this 2030 scenario, it is estimated that LDES capacity will need to reach 2.4GW. At present there is only 0.29GW of LDES on the Irish grid, all coming from a pumped storage hydro (PSH) asset operational at Turlough Hill. Another 0.36GW of PSH is planned at Silvermines in Tipperary.

GB LDES consultation will see ‘major decisions’ made

LDES is equally important for the country’s net zero goals in the Great Britain (GB) energy market. Because of its importance, the government initiated a consultation into the technology and how it could be supported. The House of Lords Science and Technology Committee stated in March that “major decisions about future energy infrastructure” would need to be made.

The organisation’s Long-duration energy storage: get on with it report highlighted that the government must “act fast” to ensure LDES technologies can scale up and contribute to the decarbonisation of the electricity system with this target a mere 11 years away.

See the full original version of this article on our sister site Solar Power Portal.

Leeward signs cross-border RA deal with California’s PG&E for 450MWh Arizona BESS

Although the project is in Arizona, PG&E primarily serves customers in neighbouring California and so the BESS will benefit both states’ electricity networks. California’s wholesale energy market is administered by CAISO but the state is part of the Western Interconnection, a wide synchronous grid area covering some or all of 14 states.

The Sierra Pinta BESS is adjacent to Leeward’s 179MW White Wing Ranch Solar project which is already under construction. That solar PV project has its own separate power purchase agreement (PPA) with telecoms giant Verizon, as covered by our colleagues at PV Tech.

A resource adequacy (RA) agreement involves a resource committing to bid or self-schedule its capacity into the CAISO market, and is CAISO’s means of ensuring there is enough capacity to meet demand, with a reserve margin, without using centralised capacity market (CM) auctions.

California has long been the leader in the US BESS market with high solar PV deployments and electricity demand, and plentiful land to build projects on meaning it has over 10GW online today (and growing).

But Arizona is quickly becoming a hotbed of grid-scale BESS activity, with long-term PPAs, tolling agreements and RA deals driving the construction of large-scale projects. In May, Plus Power secured tax equity for a 360MWh project while in March Longroad Energy started building an 855MWh system. The same month, a 1GWh project came online, claimed to be the state’s largest.

Germany’s Eco Stor to start building another 238MWh BESS in November 2024

Schuby will be built on a 1.5 hectare plot of land comprising one block of Eco Stor’s proprietary battery energy storage system (BESS) configuration, ‘ECO STOR ES-100C’. That will comprise 64 BESS units and 32 power conversion system (PCS).

The Schuby was developed in partnership with local developer EPW GmbH.

The firm is planning to start construction on two larger systems this year as well, 300MW/600MWh projects in Rhineland-Palatinate and Saxony-Anhalt. Eco Stor managing director Georg Gallmetzer has previously told Energy-Storage.news that the firm manages all parts of the project lifecycle and value chain with the exception of route-to-market (RTM).

The company also recently commissioned a study which found that large-scale energy storage could save the Germany taxpayer €3 billion a year, by 2037, simply by increasing the revenues of renewable energy projects and thus reducing the payouts needed by subsidy schemes.

Germany has ambitious renewable deployment targets, including over 200GW of solar PV by 2030, and could deploy as much as 62GW/109GWh of energy storage by then to integrate it, BloombergNEF has forecast.

Commenting on the Schuby announcement, Gallmetzer called for battery storage to be included in a regulation that allocates 90% of trade tax for renewables, namely wind and solar, to local municipalities.

“Localising the trade tax promotes structural change in rural regions and contributes to the acceptance of major infrastructure measures among the population,” Gallmetzer said.

In an interview with Energy-Storage.news published yesterday (Premium access), a senior exec at the US renewables arm of Germany-headquartered utility and independent power producer (IPP) RWE said enabling and communicating such financial benefits to local populations was absolutely key to clean energy project development.

See more recent news on the German energy storage market here, including BESS projects from Uniper, NGEN, Sungrow, Nofar Energy, Atlantic Green and NGK.

Lazard: IRA brings LCOS of 100MW, 4-hour standalone BESS down as low as US$124/MWh

It found that, unsubsidised, the LCOS of a utility-scale 100MW, 4-hour duration (400MWh) battery energy storage system (BESS) ranged from US$170/MWh to US$296/MWh across the US.

However, with the full range of tax credit subsidies made available through the IRA, that range falls to as low as US$124/MWh for projects which include ‘energy community’ adders to the investment tax credit (ITC) rate. The highest LCOS calculated for subsidised projects of that scale was US$226/MWh.

Lazard said ‘the power of the IRA is clear,’ and despite some uncertainty still over domestic content provisions and how they will be applied. It was already having some impact between the legislation passing in 2022 and Lazard’s 2023 edition of the LCOS report, largely in offsetting cost increases in lithium carbonate, a key material input for the manufacture of lithium iron phosphate (LFP) battery cells commonly used for BESS applications.

However, its impact is now broader, driving industry trends such as oversizing battery capacity to offset future cell degradation and extend asset lifetime, leading to increased residual value and project returns.

Lazard said that the impact of other policy developments, such as the raising of Section 301 tariffs on imported cells from China is yet to be seen. Industry analysis group Clean Energy Associates (CEA) said a couple of weeks ago that the tariff increases could result in cost increases of 11% to 16% for US battery storage projects, but CEA said that the impact on demand would likely be “limited”.

Increased variability between modelled costs

The LCOS report found more variability in LCOS between its low-end and high-end modelling than in previous years. This was attributed to cell and raw material cost declines at the low end and, conversely, rises in EPC costs due to factors including workforce shortages, tighter delivery timelines, and prevailing wage requirements to meet ITC eligibility requirements at the high-end.

The firm noted that lithium-ion (Li-ion) battery-based storage remains the dominant technology particularly for short-duration (1-hour to 2-hour) applications, but fire safety concerns as well as potential for decreasing competitiveness at longer durations means that some companies are looking to non-lithium solutions, especially for long-duration energy storage (LDES) applications.

As recently identified in BloombergNEF’s inaugural LDES cost survey however, Lazard pointed out the various challenges for commercialising novel LDES technologies, such as building out manufacturing capacity at scale to achieve cost reductions.

Lazard modelled the cost of storage on both a US$/MWh and US$/kW-year for a 100MW utility-scale front-of-the-meter (FTM) standalone battery storage project at 1-hour, 2-hour and 4-hour durations, as well as for behind-the-meter (BTM) commercial and industrial (C&I) standalone (1MW, 2-hour) and residential standalone (6kW, 4-hour).

Residential remains the most expensive by far, ranging from US$653 – US$855/MWh and US$857 – US$1,122/kW/-year on a subsidised basis, with C&I next along at US$280 – US$409/MWh and US$176 – US$258/kW-year subsidised.

Meanwhile, utility-scale standalone with 1-hour duration was cheapest by far in kW-year terms ranging from US$49 – US$84/kW-year, although 4-hour duration was the cheapest in US$/MWh terms.

Lazard’s report also looked at the levelised cost of energy (LCOE) for different generation technologies, including solar PV, which you can read about over at PV Tech, as well as a levelised cost of hydrogen section.

Prevalon-Rept partnership targets 2.5GWh of US BESS deployments in 2024

While the scale of the deal was not publicly discussed at the time, Prevalon said last week (30 May) that it has formalised a Letter of Intent (LOI), for the deployment of 2.5GWh of systems during 2024.

The LOI marks the start of work towards a cumulative deployment target exceeding 10GWh, according to the company. It also builds upon an existing business relationship that has already seen Prevalon/Mitsubishi Power Americas use 1.5GWh of Rept batteries in US projects to date.

Prevalon was spun out of the BESS division of Mitsubishi Heavy Industries subsidiary Mitsubishi Power Americas in February, by which point it had already deployed over 3GWh of storage at 30 projects in North and South America.

It scored its first deal post-spinout in late March with US utility Idaho Power for 82MW/328MWh of BESS equipment.

Rept cells and modules are being integrated into Prevalon’s High-Density (HD) 511 Integrated Energy Storage Platform for utility-scale applications.

HD 511 is a modular AC battery system which Prevalon claimed achieves a 360MWh per acre energy density, suitable for 2-hour to 8-hour storage applications and scalable from megawatt-hour to gigawatt-hour project sizes.

It features liquid-cooling of LFP battery modules, and provides up to 5.11MWh storage capacity in a 20-foot ISO enclosure, and runs on Prevalon’s own energy management system (EMS). The platform also includes inverters and medium-voltage (MV) transformers.

At the time of the partnership announcement two months ago, Prevalon CEO Thomas Cornell told Energy-Storage.news the Rept-manufactured cells and modules will be assembled by a third party for project delivery with input from the two partners.

Prevalon would “participate in the design part that relates to specific markets, utility requirements, grid interconnection requirements,” and then “layer its software onto that,” Cornell said.

The BESS solutions company has also been designated as service provider for Rept’s entire fleet of supplied BESS projects throughout the Americas, which Cornell said last week signified a “strategic alignment” between the pair.

Also in April, Rept signed a “renewed” supply framework agreement with US-headquartered system integrator and manufacturer Powin for 12GWh of Wending 320Ah cells, following a previous 3GWh deal. Rept also has a 10GWh supply deal in place with the BESS integration arm of gravity-based energy storage tech company Energy Vault.

‘Industry still learning about cost, complexity of BESS projects’: RWE Clean Energy on development, EPC and supply chain

Development challenges

Hanson Wood is its senior VP utility-scale development, and said that energy storage project development increasingly necessitates being closer to populations, which represents a huge challenge that the clean energy sector has not yet had to contend with.

“Most utility-scale renewable development to-date has happened in rural areas so we (as an industry) have not really learned about the complexity of building in hyper urban areas,” Hanson said.

“Over the last several projects, RWE has learned, it’s very different in terms of permitting and constructability, and I’d say about half of our standalone storage pipeline is in hyper-urban areas in order to be near the right electricity market node. The difference in approach for development and construction cannot be underestimated.”

Another challenge the industry has yet to tackle is around getting local support and approval for projects, Wood said: “A real concern I have is opposition around permitting projects locally. We as an industry need to get more sophisticated around generating active support from constituents that benefit from BESS projects.”

An important part of that is communicating the local benefits of rural economic development, not just the energy transition ones, particularly around property tax revenues and the low visual and footprint impact compared to other renewables.

Storage focus for RWE

The firm’s storage activities are currently focused on the ERCOT (Texas) and California markets, with three currently under construction in ERCOT and two being built in California.

“Beyond those core markets, RWE has a larger pipeline in the desert Southwest and are expanding our standalone business into the Pacific Northwest, New York and PJM. We’ll be active in almost every major market for storage in the US,” Wood added.

He added that there were four key areas to focus on to ensure successful execution of projects: siting for locational value, interconnection vintage, permitting expertise and strong engineering, procurement and construction (EPC) partnership, the latter particularly important in said urban areas.

EPC, BESS and high-voltage equipment supply and cost: ‘not out of the woods’

When asked about BESS technology providers, Wood said the firm works with Tier 1 vendors Tesla, LG, Fluence, Samsung and CATL “to name a few”.

On the EPC side, Wood said; “We try to build preferred relationships with EPCs to get around the workforce constraints. We also aim to do 30% of the design work for a project in-house before selecting an EPC to help streamline that process by having some of the work already teed up.”

“But on workforce, as an industry we need to address this comprehensively and I don’t think we can confidently say we have the workforce that we need for the scale of the IRA.”

Wood reiterated that there has been easing on major equipment costs but that EPC, high-voltage and balance of plant (BOP) equipment is still an issue.

“There is some easing on major equipment costs but there is still a lot of scarcity around EPC vendors, high-voltage equipment, BOP equipment, and the general cost and complexity of all of that is being learnt as we build projects. If these projects are located closer to load, which is increasingly happening, expect higher land, permitting and interconnection costs,” Wood said.

“On net, I do not think we are expecting dramatic cost reductions going forward – while battery cost may be declining, EPC, land and HVDC (high-voltage direct current) costs are increasing. We are not out of the woods on cost from a macro-economic perspective.”

In fact, when asked why he thinks the US energy storage industry saw a downturn in the first quarter of 2024, Wood said he suspects it is down to delays around grid interconnection and high-voltage equipment.

Are we accurately valuing storage

Overall, Wood is adamant that the existential need for energy storage is clearer today than it’s ever been, and with growing renewables it is essential to system reliability. However, that doesn’t mean that in practice it is being valued as it should at the local market level.

“I don’t believe all sub-market RTOs (regional transmission organisations) have appropriately been able to define the value of energy storage. If we had, would we see even greater demand and adoption than we are currently? Are we as an industry and energy community in tune with how fundamental storage is to the energy transition and maintaining system reliability?”

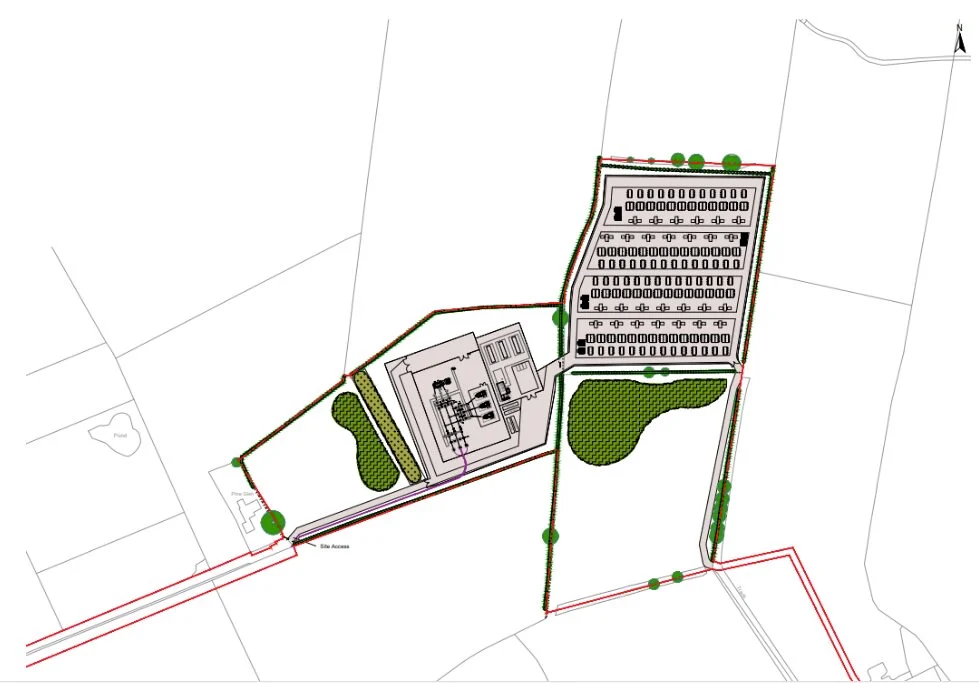

Planning approval, grid connection date review for Recurrent Energy’s jointly developed 400MWh BESS in Cumbria, UK

It is anticipated to start construction in Q4 2029, although transmission system operator (TSO) National Grid is currently reviewing the acceleration of its grid connection, which could mean it comes online sooner, Recurrent said.

The planning application approval follows a period of local consultation, Recurrent Energy said. This included meetings with various key stakeholders, a dedicated project website, extensive landscaping to provide robust visual and noise mitigation, extensive acoustic fencing to limit noise impact, the provision of detailed battery storage FAQs and the implementation of a 23% Biodiversity Net Gain aim.

Recurrent Energy is the project development arm of Canada-headquartered PV module and BESS manufacturer Canadian Solar, and just last week secured a revolving credit facility of £1.1 billion for its global pipeline.

Its BESS arm e-Storage is active in the UK market already, in December signing a deal with international utility and independent power producer (IPP) Engie for two separate 50MW/100MWh projects.

In other UK BESS industry news, this week also saw the first BESS units arrive on-site at a 150MW/300MWh project under construction by SSE Renewables, while last week developer NatPower announced plans for an earlier-stage 1GW BESS project in North East England.

This story first appeared on Solar Power Portal.

New Mexico regulator approves state utility plan to add 310MW of battery storage by summer 2026

PNM submitted the application with the state regulator on 25 October last year, following a summer which saw the utility twice surpass its record peak electricity demand consecutively on 17 July and 18 July 2023. The NMPRC published an order on its online electronic docketing system approving the application on 31 May.

Clenera solar and storage project

The approved application includes a 20-year ESA with Boise, Idaho-headquartered Clenera, covering 100MW/400MWh of energy storage output and capacity from the developer’s Quail Ranch Solar and Storage facility located in the city of Rio Rancho, Bernalillo County, New Mexico. The facility has an expected commercial operation date (COD) of November 2nd 2025.

PNM will also pay Clenera for the capacity and associated energy from the 100MW solar portion of the facility to be co-located with the BESS through a separate 20-year PPA.

NextEra hybrid facilities

The application also includes separate 20-year ESAs covering storage capacity from two facilities being developed by NextEra Energy Resources (NextEra). The first covers 100MW/400MWh of energy storage capacity from the developer’s Sky Ranch II Energy Storage facility located in Valencia County, New Mexico.

NextEra recently commissioned the first portion of the Sky Ranch complex which comprises a 190MW solar facility co-located with a 50MW/200MWh BESS.

In collaboration with Meta (then still called Facebook), PNM signed an ESA and PPA with NextEra back in 2021 for the entire output from the first portion of the Sky Ranch facility. PNM and NextEra originally agreed upon a US$6.60/MWh payment rate for energy storage capacity but this was later renegotiated to US$7.86/MWh following major disruptions to the global supply chain.

The second ESA covers 49.5MW/198MWh of energy storage capacity from the Route 66 Energy Storage Project which NextEra is adding to its operational 49.5MW Route 66 Solar facility in New Mexico’s Cibola County. NextEra and PNM have an existing PPA for the solar capacity from the project.

CODs for the Sky Ranch II Energy Storage and Route 66 Energy Storage facilities are both 1 February 2026.

Energy storage capacity pricing

During the project selection process, the Financial Accounting Standard Board (FASB) made changes to lease accounting rules meaning a regular fixed-price energy storage agreement (ESA) would be treated as a “lease liability” introducing associated imputed debt on power offtaker’s balance sheets.

Instead of considering fixed price ESAs, PNM decided that for the first time it would move forward with volumetric ESAs that tie the price for storage capacity on the output of the co-located solar production facility. Under generally accepted accounting principles (GAAP), this would avoid any recognition of lease liability and the associated imputed debt.

On a long-term basis, PNM calculated that the three volumetric ESAs would save customers US$13 million on a net present value (NPV) basis compared to three fixed term ESAs if the impact of imputed debt was also included.

PNM will pay a volumetric rate of US$49.2/MWh to Clenera for storage capacity from the Quail Ranch facility. The utility will pay NextEra a volumetric rate of US$28.04/MWh and US$48.95/MWh for capacity from the Sky Ranch and Route 66 facilities, respectively.

Utility-owned storage plant also approved

PNM also received approval to construct a 60MW/240MWh standalone BESS called the Sandia Storage Project to be located near the utility’s existing Sandia Substation in southeast Albuquerque. PNM has already entered into an engineering, procurement and construction (EPC) agreement with Depcom Power to develop the facility.

The utility-owned facility is expected to cost US$131 million and have a COD of 1 May 2026. PNM will recover the costs of the project in a general rate review where the utility will seek to adjust its base rates.

New Mexico portfolio mandates

The projects were selected by PNM following the utility’s 2026-2028 Generation Resources RFP released back in 2022. The procurement sought to acquire bulk transmission and distribution level capacity as well as demand side management resources to serve PNM’s forecasted needs.

PNM has committed to having a 100% carbon-free resource portfolio by 2045 which is five years ahead of the date mandated by the New Mexico Energy Transition Act (ETA).

The New Mexico ETA (Senate Bill 489) was enacted in March 2019 and established a net zero carbon resource goal for investor-owned utilities within the state. It also created funds for those affected by the closure of the coal-fired San Juan Generating Station, which was retired at the end of 2022.

In March 2023 the state Senate of New Mexico passed a bill that would have required investor-owned utility (IOU) companies to procure or deploy 2GW/7GWh of energy storage, to be online by 2034. Senate Bill 456 then headed to the House of Representatives’ House Energy, Environment and Natural Resources Committee (HENRC), but on 16 March the action was postponed indefinitely, according to state legislative records.

Utility acquisition by Iberdrola terminated

Multinational energy company Iberdrola announced at the beginning of the year that it had terminated an agreement to acquire PNM’s parent holding company PNM Resources (as reported by our sister site PV Tech) after the two parties failed to obtain approval of the acquisition from the NMPRC.

Under the terms of the agreement, either party had the contractual right to terminate the deal if all regulatory approvals weren’t granted by the end of 2023. Iberdrola intended to acquire PNM Resources through its US subsidiary Avangrid.

PNM Resources also owns another utility called Texas New Mexico Power (TNMP) which serves North Central Texas, parts of West Texas, and the areas near the Gulf Coast.

Additional reporting by Andy Colthorpe.

Chile: CJR, Sungrow to deploy BESS for Atlas as government finalises capacity market payments

Atlas has enlisted CJR as the primary contractor for both the civil and electrical works for the project, which will be built at Atlas’ existing 244MWp Sol del Desierto solar PV plant in Antofagasta, northern Chile (pictured above).

Some 320 battery energy storage system (BESS) units from Sungrow will be installed, to go on 320 newly constructed foundations, and 40 foundations which will house power conversion system (PCS) units. It brings the total BESS installations in Chile for CJR, an engineering, procurement and construction (EPC) firm, to 523MW, it said in its Linkedin announcement last week (30 May).

Note that the BESS will be an independent project from Sol del Desierto with its own power purchase agreement (PPA), separate to solar PV plant’s. In March, Chilean energy and forestry company COPEC agreed with Atlas to buy the power from the BESS under a 15-year deal.

New capacity market regulation passed

The incorporation of standalone energy storage into the electricity market was finalised in late 2022, but changes to the capacity market to facilitate payments to standalone projects, as well as co-located ones, needed to be finalised.

Supreme Decree No. 70 of 2023 (DS 70) has now been passed and introduces significant changes in the recognition and compensation of energy storage projects, law and tax advisory firm Garrigues said.

The updated capacity market regulations now explicitly address energy storage and provide a method for determining the payment for renewables with energy storage, and for determining the power capacity of storage in the capacity market, the firm added.

Based a conversation with developer Flexen last year about the capacity market regulations, Energy-Storage.news believes the latter refers to the ‘de-rating factor’ for energy storage based on its duration, i.e. the amount of its capacity it can bid in, and be paid for, in the capacity market.

A table from Garrigues said the de-rating factors will be:

less than 1-hour duration: 0%

1-hour duration: 36%

2-hour duration: 65%

3-hour duration: 85%

4-hour duration: 98%

5-hour+ duration: 100%

Energy-Storage.news has heard recently from local BESS developers about the de-rating factors in Poland and the UK – specifically, that they are too low and don’t reflect the value of storage. Chile’s appear to be significantly higher.

Standalone and co-located being deployed at scale

Both standalone and PV-connected BESS projects are being deployed at scale in Chile as it increases its renewable generation and phases out coal and legacy plants.

BESS are being added to existing solar PV plants to increase their profitability with substantial, prolonged periods of negative pricing being seen. Independent power producer (IPP) Innergex recently commissioned its second such large-scale project in Chile while utility and IPP Engie is building the third and fourth of its PV co-located BESS projects and will soon start building its first standalone one.

Standalone projects meanwhile will be able to capitalise on wide spreads in the wholesale energy market as well as the long-term capacity market payments.

Energy-Storage.news’ publisher Solar Media will host the 3rd annual Energy Storage Summit Latin America in Santiago, Chile, 15-16 October 2024. This year’s events bring together Latin America’s leading investors, policymakers, developers, utilities, network operators, EPCs and more all in one place to discuss the landscape of energy storage in the region. Visit the official site for more info.