Octopus Energy will use the BESS projects’ batteries at a price determined by the duration of the assets – expressed in hours – though it excludes Capacity Market payments the projects will receive separately.

Kieran Stopforth, head of flexibility for Octopus Energy, said: “Through this landmark deal with GRID we’re not only increasing the size of our virtual power plant to over 1.5GW, we’re also unlocking the power of flexibility to drive down costs for consumers across the country.”

The tolling agreement and Capacity Market combined mean GRID will have annual contracted revenues of £43 million (US$55 million) over its two-year lifetime. The remainder of GRID’s portfolio will continue to operate in the merchant market under existing agreements with third-party optimisers.

The deal is likely to be the first such tolling arrangement in the UK BESS market, certainly the first of its size, with the vast majority of projects deriving most revenues from merchant opportunities like ancillary services and energy trading via National Grid ESO’s various available markets. However, opportunities in the latter have saturated in the last 12-18 months leading to substantial revenue falls.

John Leggate, chair of GRID, said: “The Board and Manager (Gresham House) firmly believe that the rebalanced mix of contractual and merchant revenues offers shareholders a superior risk adjusted target return and material risk mitigation, particularly in a revenue environment that remains uncertain in the near term, by reducing direct exposure to the Electricity System Operator (ESO) as the principal counterparty in Great Britain.”

The consumer price index-linked (CPI) tolling agreement price, GRID said, is “a higher price than recent weak performance at the start of the year, and at a competitive price for underlying battery economics” and will help the firm to restart paying dividends in 2025.

Discussing the contracts and alluding to what Octopus will use them for, Ben Guest, fund manager for GRID and MD of Gresham House New Energy, said: “They [the contracts] demonstrate the value batteries offer in balancing the supply (power generation) and customer demand that are managed by retail and wholesale market players, in addition to balancing supply and demand at a national level.”

Adding: “End consumers are increasingly demanding electricity that is both renewable and affordable, as well as reliable. Therefore, electricity suppliers increasingly need to balance intermittent, renewable supply with customer demand, for which batteries are well-suited.”

The markets appear to have reacted favourably to the news, with a 16% jump in GRID’s share price at the start of trading today after the news was released.

Energy-Storage.news heard that the UK BESS industry was starting to look more seriously at alternative structures such as tolls at the Energy Storage Summit EU in London in February, with the merchant, third-party optimisation-driven model dominating until now.

Tolls have been used widely in the US, primarily in Arizona and California and to a lesser extent Texas, as well as in the Netherlands by two largest BESS operators SemperPower and Giga Storage.

Invinity expanding UK flow battery assembly to more than 500MWh annual capacity

It follows the successful raise of £57.38 million (US$73.29 million) financing by Invinity, which was completed on 24 May, and the new plant will be accompanied by an expansion to its existing facility in Bathgate, in the nearby West Lothian council area of Scotland.

Together, the new Motherwell plant, which will focus on assembly of VRFBs, and Bathgate, at which the batteries’ cell stacks are manufactured, will bring Invinity Energy System’s VRFB annual manufacturing capacity in the UK to more than 500MWh, the company claimed.

The new factory is expected to come online in the third quarter of this year, and Invinity said it would assist in delivering products to customer projects in its near-term pipeline.

Invinity is perhaps one of the furthest advanced flow battery companies in terms of commercialisation. It is thought to be the only flow battery technology company included in the first edition of BloombergNEF’s Tier 1 list of global energy storage system (ESS) providers launched at the start of this year, while its projects include some of the biggest of its type worldwide outside China.

Those include Canada’s biggest solar PV-plus-flow battery project so far, at Chappice Lake in Alberta, commissioned in 2023, and Australia’s first utility-scale VRFB project, in rural Yadlamalka, South Australia, currently under construction.

Semi-automated lines to reduce unit production costs, Invinity says

Invinity was formed through the 2020 merger of two existing flow battery companies, Canada’s Avalon Battery and UK-headquartered redT.

It completed an expansion of its Vancouver, Canada, manufacturing facility to 200MWh of annual capacity in June 2023, and in March this year Invinity VP of business development Matthew Walz told Energy-Storage.news that some of the US projects it is negotiating with customers include some that are over 100MWh capacity each. Invinity sold around 31MWh of flow batteries in 2023.

Invinity said this week that upgrades to the Bathgate facility will include the implementation of semi-automated production lines which along with boosting manufacturing capacity will allow the company to reduce unit costs of production.

Meanwhile, when announcing its now-completed fundraise earlier this year, the company’s CCO Matt Harper told Energy-Storage.news Invinity would directly invest around £23 million into large-scale flow battery projects in the UK from the funding.

Reducing costs, largely through increasing scale and automation of production, and evolving business models through strategies, such as direct investment in or ownership of downstream projects, could both be important pathways to successfully commercialising long-duration and non-lithium energy storage technologies such as flow batteries.

Origis Energy brings Mississippi solar PV plant online with first BESS in three-project portfolio

This is the largest storage portfolio under construction in Mississippi, and Origis expects to commission all three projects next year.

“Golden Triangle II is the first step in fostering a zero-carbon economy across the state that supports our nation’s economic and energy security goals,” said Origis chief commercial and procurement officer Johan Vanhee.”

Origis signed a power purchase agreement (PPA) to sell power generated at the projects to the Tennessee Valley Authority (TVA), a utility, at what the companies called “competitive rates”. TVA will use the power to meet the energy demand of its large industrial customers, including Meta, which is among the leaders in clean power acquisition in the US, having signed a PPA with Pine Gate Renewables earlier in May.

TVA has announced plans to expand its renewable energy portfolio in recent years, aiming to add 10GW of new solar generation capacity by 2035, up from 2.4GW in operation currently. The TVA operates predominantly in Mississippi, which has one of the smaller solar sectors in the US, with the Solar Energy Industries Association (SEIA) expecting developers to add just 2.2GW of new capacity to the Mississippi solar sector in the next five years, 24th among the states.

In January, Origis announced that it had received US$317 million in funding from J.P. Morgan to support the development of both the Golden Triangle II project, and the 200MW Escalante Solar project in New Mexico.

This story first appeared on PV Tech.

East Point Energy submits planning review for Virginia BESS, moratorium could impact New York project

Through its Reid Energy Center, LLC subsidiary, East Point Energy is concurrently seeking a Special Use Permit (SUP) for the project which it submitted with Prince William officials back in July last year.

Reid Energy Center project details

The Reid Energy Center is a proposed 20MW/80MWh BESS facility located at 10311 Reid Lane in Nokesville, Virginia adjacent and directly south of two substations owned separately by Dominion Energy and Northern Virginia Electric Cooperative (NOVEC).

Interconnection to the local grid will be via NOVEC’s more westerly Vint Hill Substation which the project will charge and discharge energy from. NOVEC is a not-for-profit electricity provider which purchases power through a combination of market purchases from PJM Interconnection and other bilateral contracts.

East Point Energy expects to use lithium-ion technology for the project although the exact battery chemistry has yet to be decided.

Potential battery storage moratorium in New York town

At a recent meeting (15 May), officials on the Carmel town board in Putnam County, New York, agreed to hold a public hearing on a potential moratorium on battery storage facilities whilst the town considers changes to its zoning laws.

At the end of the meeting, several local residents thanked the board for scheduling the hearing and voiced their concerns surrounding the potential health and safety impacts with battery projects. The hearing is set to take place on 19 June 2024.

The moratorium could affect a 116MW lithium-ion standalone BESS facility being developed by East Point Energy within the local area. Plans for the Union Energy Center put the project in a wooded area within Carmel bordering the Town of Somers in Putnam County.

Interconnection to the New York Independent System Operator (NYISO)-controlled grid would be via the Union Valley – Croton Falls 115 kV transmission line owned by New York State Electric & Gas (NYSEG). East Point Energy submitted a NYISO interconnection request for the facility in May 2021 (queue no. 1180). According to the NYISO interconnection queue, the facility is expected online in October 2026.

Residents first heard of the project after the developer presented initial plans to the Town of Carmel Planning Board in September 2023. East Point Energy has yet to obtain planning approval to construct the facility.

On 28 May 2024, New York State Senator for District 40 Pete Harckham announced his full support for the potential moratorium in a letter sent to Carmel Town Supervisor Michael Cazzari.

The senator said that he had heard from numerous residents and elected officials regarding the proposed Union Energy Center project. In addition to expressing his support, he said that he would be “introducing new state legislation to ensure sound siting, best standards for energy storage system safety and a guarantee all stakeholders are heard.”

I wrote to the Carmel Town Supervisor’s Office yesterday to express my support for the planned public hearing and temporary moratorium on energy storage systems while the town considers comprehensive local regulations. pic.twitter.com/6zlBGwc4B6

— Senator Pete Harckham (@SenatorHarckham) May 29, 2024

Over the past year, there has been a spate of temporary moratoriums on the development of battery storage facilities across the US, including one in Jefferson County, Tennessee, issued in July 2023. The Board of Commissioners issued an instruction preventing the development of battery storage facilities across the county for six months.

Equinor’s ERCOT pipeline

Equinor announced on 10 April that it had given the green light for East Point Energy to build two battery facilities in the ERCOT region. The 10MW/20MWh Sunset Ridge BESS in Frio County and the 110MW/220MWh Citrus Flatts BESS in Cameron County are the first Texas projects for the developer since it was acquired by Equinor in 2022.

The under-construction Sunset Ridge facility is expected to come online during the second half of this year. Construction on Citrus Flatts is expected to commence this year with commercial operation scheduled for 2026.

Poland’s 57% de-rating factor for BESS would be ‘lethal blow’ to market

The de-rating factor – or ‘correction availability factor’ as it directly translates from Polish – determines the level of capacity agreement that a given technology could secure in the capacity market (CM), based on its expected reliability in being available when needed. If the proposed de-rating factor comes into effect, a 100MW BESS would only be able to secure a 57MW agreement.

The ordinance came from the Ministry of Climate and Environment (Minister Klimatu i Środowiska). Pumped hydro energy storage (PHES), meanwhile, has a de-rating factor of 96% while power plants including gas and nuclear have around 93-95%.

A ‘dangerous’ move for Poland

Michał Maćkowiak, managing director of the Poland arm of BESS developer Harmony Energy, was unequivocal in his comments about the proposal to Energy-Storage.news.

“Unfortunately, after analysing the regulations of the capacity market, it turns out that the reduction of the factor can take the lethal blow to the BESS market in Poland for both 4-hour and 2-hour duration systems,” Maćkowiak said.

“The capacity obligation and revenues from CM relate to the net power, and this is to allow delivery for four hours with net power, i.e. both 4-hour and 2-hour BESS will get 40% less from the capacity market, which will limit their revenues. Together with industry, we conduct increased consultations with the public side so as not to allow such dangerous entries.”

Poland’s annual capacity market auctions run every December and secure capacity for five years ahead, meaning December 2024’s winning projects’ delivery period starts in 2029. Last year’s, for delivery in 2028, saw developer and independent power producer (IPP) Greenvolt win the lion’s share of a total 1.7GW of BESS awards, while in 2022, 165MW of projects won contracts.

The ordinance also set separate de-rating factors for ‘additional auctions’ that will be held in 2025 for 2026 delivery, which have comparatively higher de-rating factors across all technologies, but particularly for BESS. There, BESS, kinetic and supercapacitor projects have a de-rating factor of 96.11%.

The topic of capacity market de-rating factors for energy storage was also a recent talking point in the UK, where BESS developer-operators told Energy-Storage.news that electricity market operator National Grid ESO was re-assessing the figures (Premium access).

However, a major difference between the de-rating factors in Poland and UK – or rather, Great Britain (GB), with the island of Ireland on a separate grid – is that Poland’s do not account for discharge duration while National Grid ESO’s increase with duration, with different figures from 0.5 hours all the way to 8-hours-plus.

Business model innovation ‘the critical piece’ for LDES sector

The long-duration energy storage (LDES) sector has seen a lot of successful fundraises, O’Brien said, and the focus for the industry now needs to be about fine tuning use cases, understanding business models and market entries.

Many say that lithium-ion will not be widely cost-competitive for discharge durations significantly beyond 8-12 hours, but what technology fills that gap, and at what scale, is far from clear. BloombergNEF recently published analysis on lithium-ion costs versus LDES at different durations.

Asked about the prospects for the LDES sector, which has dozens, potentially hundreds, of different technologies competing to scale in a market that could soar in the coming decades, both agreed that the technology question alone isn’t the main challenge for LDES firms.

Business model innovation ‘the critical piece’

“We tend to fixate on technology but at the end of the day it’s about how I position my business. Business model innovation is at least as important as technology innovation: how to scale, serve customers, solve a customer’s problem, create value for them. It’s easy to overlook but it’s the critical piece,” Teamey said.

O’Brien similarly said that thinking about the wider electricity system you are selling into is key.

“The ones that can integrate into existing infrastructure will do well. You need to ask, what is the cost of that integration? Sometimes people forget those things, the organisational costs, the training costs, and about how you can ease those burdens,” O’Brien said.

“Companies that think about beyond just selling systems but rather about how it fits into the larger system, for that ease of integration. For a startup, that means having a high degree of corporate empathy.”

LDES companies taking note

The need for this has certainly been noted among at least some LDES technology companies. Several have moved from being primarily technology plays to owning and operating projects in full, or via minority stake investments.

In the past year, Energy-Storage.news has interviewed vanadium redox flow battery (VRFB) firm Invinity Energy Systems, ‘CO2 Battery’ company Energy Dome and gravity energy storage technology firm Energy Vault about (amongst other things) their moves to directly owning and operating projects.

Being a developer and independent power producer (IPP) meanwhile is baked into the business models of compressed air energy storage (CAES) firm Corre Energy and advanced-CAES (A-CAES) firm Hydrostor, both of which are building some of the largest LDES projects seen anywhere in the world.

How many different technologies will commercialise?

With so many different technologies – the ones above are just a snapshot and are amongst the furthest along in commercialising – the question of how many will successfully scale is an open one.

“We’ve looked at LDES from the perspective of different use cases. We don’t think there will be hundreds of technologies but there will be multiple. It’s an open question as to how many in total,” Teamey said.

Kyle also noted that there are still huge opportunities for new solutions within the lithium-ion industry: “One lens on LDES is the new technology, but you have lithium that already has massive scale. For that, it’s about asking how we remove friction points so that it can scale ever faster. Any fast-growing industry will have tons of friction points. There is a lot of value to be had in solving those friction points.

He also pointed out that China is making big investments in the sodium-ion technology space. “That tells you there will be at least two chemistries deployed at scale in EVs and the grid. And even within chemistries, there are lots of variations. There’s lots of variations within ICE (internal combustion engine) vehicle engines,” Teamey said.

One big reason China could be jumping into sodium-ion at scale is that, for that chemistry, it doesn’t have to worry about being cut off from critical materials, he added. Most lithium is mined in Australia and Chile, and Australia recently outlined plans to increase its local battery industry.

Note that the largest lithium-ion battery manufacturer CATL recently joined the LDES Council.

RA Capital Planetary Health’s first investments have been Sortera, a firm using proprietary tech to sort recyclable materials, and AM batteries, a player in the lithium-ion dry-electrode battery space. VC firms in general have been active in funding LDES companies as well.

AI is a critical differentiator for energy storage system success

But there are significant technical efficiencies in battery systems that have yet to be realised by most operators. And these efficiencies provide the solution to unlock very positive commercial viability despite challenges presented by supply-side capacity increases and reduced prices.

I believe the answer points to the value that AI can bring to the market. What’s more, my conviction is not based on some far-off expectation of the benefits of artificial intelligence, but on market-ready technology that has the potential to significantly reduce the investment quantum of new energy storage systems as well as optimise operational revenues.

Market maturity

I spent my research years investigating battery management at Oxford University and helped to found Brill Power to tackle what I considered to be profligacy in the way grid storage batteries have been specified and managed.

My colleagues at Brill have developed hardware, firmware and data analytics to solve the problem of oversizing batteries in the system design phase, by enabling up to 60% longer cycle life for batteries.

Together, we have more recently turned our attention to AI solutions to tackle the sub-optimal operation of systems during their lifetime of operation, thereby providing operators with both a reduction in capital asset costs as well as an increase in operational revenues.

While the market in its emergent phase may have provided sufficient financial insulation for inefficient energy storage solutions for renewable power, maturing market conditions have now thrust system optimisation to the forefront of operators’ considerations.

I believe that AI, if appropriately embraced, is well-placed to ensure continuing financial appeal to those interested in funding new renewables capacity.

Data helps, but AI is the defining feature

As storage capacity has exponentially increased, so the industry has started to collect an ever-increasing volume of data related to the cycling of battery systems and the performance of battery packs at discrete cell level.

That data quantum has already surpassed the levels of information that can be meaningfully interrogated by manual means, so almost by default, automation of data processing has become a necessity. But to achieve what?

Image: Brill Power

There are two levels of application where machine learning and AI tools can help.

At the first level, there is the assessment of multiple sources and types of information to generate useful customer insights, for instance, battery degradation analytics, system lifetime projections, operational anomaly detection and so forth.

This is the insight that enables informed human decision-making as to how best to run a storage system.

The step on from this is the wholesale automation of the system management where essentially we take the human out of the loop and AI collects the data, makes the optimisation decisions and then ultimately executes changes to the system to deliver the most efficient operation of the asset.

For instance, in a scenario where battery management is tightly integrated with cloud analytics, an AI agent can detect drifts in state of charge or state of health accuracy computed by the local battery management and automatically trigger a cloud optimisation algorithm to re-parametrise battery mathematical models that underpin the SOX estimation; the new optimal models are then automatically updated back on the local BMS, thereby unlocking any curtailed capacity arising from SOX inaccuracies.

This is an actionable reality for today’s system operators.

Even better still

The opportunities for driving efficiencies into stationery storage systems are exponential. Once AI is executing changes to optimise systems operation, a feedback loop allows the code to self-learn and ultimately continuously improve operational parameters.

And small incremental improvements, for instance, a 1% increase in available energy across a 1-hour, 100MW system, could increase annual revenue by £51k* (US$65,340), representing a significant financial yield over the lifetime of BESS.

Brill’s analytics, coupled with AI can provide the context for seeking increased yields from systems relative to possible asset degradation. In a market with increasingly tight margins, using AI to understand the cost of cycling, future degradation and increased availability provides a holistic view for asset owners and investors to establish a model for asset management that provides tailored financial returns and greater insight to inform contract negotiations.

This greater level of transparency is key to stimulating more investment liquidity in the sector, not just from a revenue perspective from the current generation of systems, but also to better inform the capital decision-making for future system sizing decisions.

Right-sized and well run

Between the readiness of AI to help drive welcome new margins into stationery energy systems and the 60% longer battery life delivered by Brill hardware, there is a verified 30% reduction in system lifetime costs.

Essentially, everyone either oversizes battery provision at the start of a systems commissioning or augments systems through life to provision for degradation. We minimise the requirement for that through our patented active loading system that makes systems last longer.

This reduces the capital outlay from the get-go. The AI then provides the operational optimisation and together these combined benefits deliver the 30% reduction in cost – or seen another way, a significant increase in revenue potential.

*Modo Energy; based on GB BESS revenues (excl. capacity market)

Read Adrien Bizeray’s co-authored 2021 technical feature article, ‘How to design a BMS, the brain of a battery storage system,’ with your ESN Premium subscription, or read an exclusive extract here on Energy-Storage.news.

About the Author

Adrien Bizeray DPhil, is chief data scientist and co-founder at Brill Power, a startup aiming to make batteries smarter, cleaner, safer and longer-lasting as a critical element of the shift to zero emissions energy, through products including its Battery Intelligence Platform. Bizeray holds an MSc degree from Imperial College London and his PhD was funded by Samsung for the development of physics-based battery models.

ZEN Energy, Sungrow, SEPC build 330MWh South Australia BESS after clearing ‘challenging’ GPS process

For ZEN Energy, it marks a milestone for the project’s push towards the start of commercial operations in 2025, as well as a milestone for the company, being its first battery storage project, acquired in early 2023 from fellow developer RES.

The asset will connect to the National Electricity Market (NEM), participating in the various revenue-generating ancillary service and wholesale markets of Australia’s biggest interconnected system, as well as providing system stability services to the grid. ZEN Energy has secured a long-term electricity supply contract from Templers with the South Australian government and in March brought on board US-based infrastructure investor Stonepeak in a AU$70 million (US$46 million) deal.

Along with the groundbreaking ceremony taking place, balance of plant (BOP) work and manufacturing of the project’s battery energy storage system (BESS) equipment has already begun, with site delivery targeted for later this year, according to Thomas Hou, a director at the Australian offices of Sungrow.

The BESS arm of Chinese solar PV inverter manufacturer Sungrow is serving as the system integrator and BESS provider for the Templers project.

South Australia has the highest penetration of renewable energy among Australian states, and the Templers project will help make the network more stable and in the long run make electricity more affordable in the region, Hou told Energy-Storage.news in an interview.

‘Proactive discussions’ key to clearing process quickly

Some of the biggest hurdles to delivering large-scale battery projects in Australia come long before shovels hit the soil, however. Perhaps chief among those hurdles is clearing the stringent process of obtaining necessary approvals to connect to the grid and into the NEM.

“The grid connection process is quite challenging for the whole Australian market, including both the National Electricity Market, and Wholesale Electricity Market (WEM) which is the one in Western Australia (WA),” Sungrow’s Thomas Hou said.

Resources connecting to the markets need to obtain a 534a letter from the Australian Energy Market Operator (AEMO), which means they have met the requirements for AEMO’s Generator Performance Standard (GPS)—without which they can’t participate.

“For this project, we started our grid connection application from early 2022 and achieved that 534a letter from AEMO in early 2023. The whole process took around 13 months. That’s a record-breaking time because in the market, generally, it’s 18 months or more.”

That required “proactive discussions,” the Sungrow director said, with the technology company continuously in dialogue with the project’s developers and its consultants, and interacting with the network service provider (NSP) and AEMO.

“As an OEM, you need to proactively deliver the modelling and also provide the necessary input and necessary response where it’s required. You need to be very fast responding.”

Hou explained that the process on the regulatory side demands that, by necessity, it will take some weeks or months for reviews of the OEM’s submission, and as soon as there is any variation or revision, the regulatory will take more time to review those.

“From our side, we try to be dynamic, and we try to get ourselves standing by when there is a modelling-related or technical-related question coming up,” Thomas Hou said, adding that the relatively small time difference between Australia and Sungrow’s Chinese HQ helped, as did the company placing a team of grid connection experts at its North Sydney office that enabled the fast-tracking of much of the process.

“We use our own expertise to model all the foreseeable issues that might be occurring during the process, and we’ll try to make sure that the model we’re providing is lining up with the actual product that we are producing in the factory,” Hou said.

“I think that is quite important for each OEM or inverter manufacturer to address.”

Vertically integrated solution: BESS cabinet, PCS, EMS

It also helps that Sungrow provides a very vertically integrated solution including the BESS, power conversion system (PCS) equipment, and energy management system (EMS, aka the power plant controller, or PPC), Hou claimed.

“On the market, I think there are two types of integrators: one type of integrator they do the manufacturing and the R&D themselves. Sungrow is part of that. Another type of integrator is more EPC-driven. They buy PPC from A), buy an inverter from B), and buy the energy storage DC side from C), and they do the integration in their own warehouse, but it’s warehouse-based, not R&D factory-based,” he said.

“We take all the modelling in-house, and also we can control our model very well.”

Sungrow’s PowerTitan 1 BESS solution is being deployed at the Templers site and it is another challenge related to the Australian market’s stringent grid connection rules that the company’s first-generation liquid-cooled BESS product launched in 2022 will be used and not its newest PowerTitan 2 which launched a year later.

“In terms of the product side, another challenge for the Australian market is that sometimes the project is not able to always use the latest technology because, in general, each OEM is providing a new generation every two to three years and a mezzanine level of the new product in every one to two years.

That is the product’s cycle, but in terms of Australia’s local standards and local Generator Performance Standard certification process, one process takes one to two years, and then you need another one year to pass the R1 and R2 to prove your solution.

So, sometimes when even the new generation of the PCS or the battery storage is coming to the market, it’s not always the case that you can deploy that.”

That imposes a challenge on the manufacturers to maintain support for previous iterations of their products, but Thomas Hou said Sungrow will do so for ZEN Energy and its other customers in Australia.

“We’d like to make the commitment to the market and to our client that once we get our system locked in the model, we will deliver, maintain and service that.”

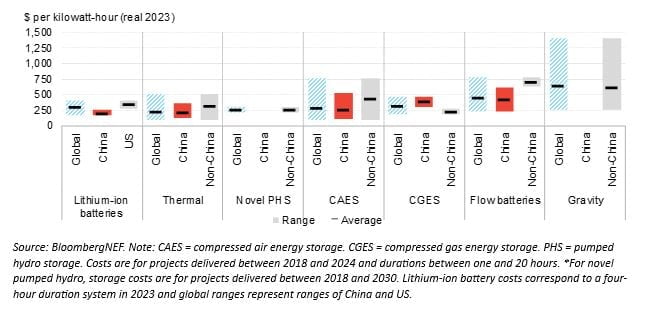

Long-duration storage ‘increasingly competitive but unlikely to match Li-ion’s cost reductions’

It found that the average capital expenditure (capex) required for a 4-hour duration Li-ion battery energy storage system (BESS) was higher at US$304 per kilowatt-hour than some thermal (US$232/kWh) and compressed air energy storage (US$293/kWh) technologies at 8-hour duration.

However, flow batteries, which were the main electrochemical energy storage technology up for comparison against Li-ion, had an average fully installed cost of US$444/kWh in 2023 according to the survey.

BNEF also noted that most LDES technologies offer the potential to decouple costs related to power and energy. This makes it cheaper to increase energy capacity and, therefore, duration, unlike lithium-ion, where each incremental addition of energy capacity requires additional battery stacks and power conversion equipment.

In other words, to get a bigger duration of compressed air energy storage (CAES), you only need to use a bigger underground salt cavern to store the air in, or to get a bigger duration flow battery, you only need to increase the size of tanks holding liquid electrolyte.

Yet for thermal energy storage and CAES, the energy-related costs are much lower than they are for flow batteries, and BNEF said the latter may be better suited for mid-duration applications (which it defined as up to around 12-hour duration of discharge) than their thermal and mechanical counterparts.

BNEF also said that in general, LDES technologies may struggle to match the economies of scale achieved by lithium-ion battery manufacturers, which mostly entered the energy storage industry—at least to begin with—based on rapidly rising manufacturing capacity due to demand for adjacent sectors like electric vehicles (EVs) and consumer electronics.

China’s different market dynamics

An interesting global industry dynamic BNEF identified was the very different market landscape within China versus the rest of the world.

For example, while China is by far the global leader in lithium-ion battery manufacturing, its government has supported the development and deployment of flow batteries too over the past few years.

As a result, a fully installed flow battery system in China had an average cost of US$423/kWh, and when China was removed from the calculation, the cost of a flow battery elsewhere in the world averaged US$701/kWh in the survey.

China also has a lead in thermal energy storage and compressed air technology costs, although not as pronounced as it is in flow batteries, and indeed, in terms of Li-ion, average installed cost in the country was found to be US$198/kWh versus US$304/kWh globally and US$353/kWh in the US.

Li-ion costs are so low in China, in fact, that although it has cheaper LDES technologies in almost every class except compressed gas storage, BNEF analysts believe LDES may not be able to displace lithium-ion even there.

CATL joins long-duration trade group

An interesting parallel development is that in the past few days, the global Long Duration Energy Storage Council (LDES Council) announced the addition of the world’s biggest lithium battery maker, China’s CATL, to its membership.

CEO LB Tan said as the company became the first Li-ion manufacturer to join the group that “CATL is committed to providing lithium-ion batteries-based LDES solutions, designing cells and systems suitable to various application scenarios.”

Definitions of ‘long-duration’ itself are varied and loose, ranging from six hours in a UK government consultation to multi-day or even seasonal technologies over weeks or months. Recent wins in competitive solicitations for 8-hour LDES by companies proposing lithium-ion projects in California and Australia have pointed to the continuing competitiveness of the incumbent technology.

In a video interview with Energy-Storage.news, published last week, Gabriel Murtagh, LDES Council director of markets and technology, noted that going from shorter to longer durations is “critical for decarbonisation,” and that a diverse portfolio of technologies and durations will be a must for the world’s grids.

“We need to transition from thinking about building short-duration storage resources, getting them on the system, to thinking about building multiple different levels of duration,” Murtagh said.

“So, durations of four hours, like we’ve got a lot of today, durations of 10 hours, to do more of that intraday energy movement, and then durations even beyond that, so thinking eventually about seasonal durations. How do we move energy from a relatively abundant time like the spring and the fall and get that energy to the winter and the summer when we have peak, critical needs on the system?”

‘US, Europe have a chance to invest and develop capabilities’

Although they may not have the same economies of scale on their side, LDES technologies will continue to improve in their feasibility and performance, BNEF said, while noting that it may be essential to implement favourable policies to support those ongoing improvements.

Favourable policies have driven China to its leading position in lowering LDES costs, enabling it to deploy “gigawatt-hour scale projects,” BNEF clean energy specialist and report co-author Yiyi Zhou said.

Zhou described the rate of LDES installations in China as “astounding”.

However, colleague Evelina Stoikou, a BNEF senior associate in energy storage who co-authored the report, said that Europe and the US despite seeing higher costs today, “have a chance to invest in their own industries and drive innovation and deployment.”

“Markets outside of China are developing a wider range of technologies compared to China, including more technology types within flow batteries, compressed air, compressed gas, thermal, gravity and novel pumped hydro.

We’ve seen interest in those regions driven by ambitious clean energy targets, higher lithium-ion battery costs and an effort to develop alternative technologies that do not rely on lithium.”

Watch our interview with LDES Council director of markets and technology Gabriel Murtagh.

[embedded content]

US to fund Moldova BESS and grid upgrades to increase energy independence

The announcement press conference did not reveal the size of the BESS project, but Blinken’s statement indicated the BESS should be a substantial, if not majority portion of the funding. Blinken said the funding would “enhance things like battery storage, as well as the high voltage transmission lines that we’ve already dedicated some funds to.”

The US$85 million is part of a larger US$300 million package from the US to Moldova, which borders Ukraine. Russia’s invasion of Ukraine in February 2022 sparked a gas market crisis, which was particularly pronounced in Europe, leading to the continent to up its renewable energy deployment goals.

“We’re partnering closely to support economic and energy security. The Russian attacks on the Ukrainian energy grid have exacerbated Moldova’s own energy challenges – raising electricity prices, hurting business and harming consumers,” Blinken said.

“The partnership that we have to reduce Moldova’s dependence on Russian energy, to enhance connectivity with Europe, to increase the use of renewables – all of that, is moving forward. And we’ve seen you [Moldova] take remarkable steps in a short period of time to move away from this dependence.”

Moldova and Ukraine synchronised with the Continental Europe Synchronous Area (CESA), allowing it greater energy independence from Russia, in 2022.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Central Eastern Europe on 24-25 September this year in Warsaw, Poland. This event will bring together the region’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place, as the region readies itself for storage to take off. Visit the official site for more info.