It brings the total BESS capacity operated by the government-owned Central Electricity Board (CEB) to 38MW. That includes two 2MW systems built first in 2018, followed by 14MW of batteries split across four sites at substations, three of 4MW and another 2MW connected to the grid.

The BESS resources are aimed at enabling Mauritius to reach its energy policy goals, including a target of sourcing 60% of its electricity from renewables by 2030 and reducing greenhouse gas (GHG) emissions 40% and ending the burning of coal for electricity by that year.

CEB is responsible for electricity transmission, distribution and supply to the island, producing about 37% of the country’s total power requirement from four thermal power plants and 10 hydroelectric plants, and along with coal, heavy fuel oil are the main sources of generation, and both are expensive, imported and polluting.

The new system at Amaury substation’s total cost was cited at MR700 million (US$15.5 million), installed and commissioned by the French subsidiary of Siemens. A government media statement noted that the containerised system will be capable of sub-20 millisecond response times to fluctuations in grid frequency.

Siemens also delivered the earlier 14MW, four system portfolio, the cost of which was given at around US$10 million as it was completed in late 2021.

At the Amaury projects inauguration this week, CEB general manager Rajden Chowdharry described it as a crucial step towards a more stable and resilient power grid helping to buffer against frequency and voltage deviations, while also performing peak shaving applications by shifting off-peak solar-generated power to output to the grid during afternoon and evening peaks.

According to official statistics, in 2020, 23.9% of the Indian Ocean island state’s electricity was from renewables, with the largest share generated from sugarcane waste.

Under the 2022-2023 national budget, the government committed to initiatives including setting up 140MW of hybrid renewables-plus-storage facilities with private entities, investment in about 30MW of ground-mount and commercial solar PV, and the new 20MW battery storage system.

CEB launched a tender for 90MW to 110MW of hybrid renewables facilities in March 2022. French independent power producer (IPP) Qair Energy was awarded contracts for 60MWac of solar PV paired with an undisclosed capacity of energy storage at four sites in the country, representing the solicitation’s biggest win, announced in March the following year after the RFP launched.

The government also brought in measures to promote the adoption of rooftop solar PV through loans and concessions, while regulations to allow private individuals and businesses to generate their own renewable energy up to 150% of their own energy demand were introduced, as was a feed-in tariff (FiT) for medium-scale distributed generation.

China’s power market regulation update accomodates energy storage, revises trading rules

This marks the first time in 20 years that China’s power market operation rules have undergone changes. Compared to previous and existing legislation, the new rules include significant revisions and are intended to improve various aspects of market design and operation.

Firstly, the new rules further clarify the qualifications of power market participants and make specific provisions on the rights and obligations of various types of market players.

According to the document, new types of business entities such as energy storage companies, virtual power plants (VPPs), and load aggregators have been added to lists of eligible and qualified power market members while the market registration management system has been widely promoted.

For the first time, capacity trading has also been included in the scope of power trading. It has grown to be one of the three major types of transactions alongside energy trading and ancillary service trading.

The subject of capacity trading is the output capacity that can reliably support the maximum load in a certain period in the future provided by generating units, energy storage, etc.

Changes ahead for China’s ancillary services, power trading markets

In line with the construction needs of China’s future power system, efforts will gradually be made to establish a market-oriented capacity cost recovery mechanism. This includes exploring ways to guide operating entities to invest rationally through capacity compensation and capacity markets to ensure a long-term capacity abundance in the power system.

It should also be noted that the document has refined the definitions and trading methods of power and ancillary services trading. According to the trading cycle, power trading is divided into long-term and spot trading.

Ancillary service trading includes paid ancillary services such as frequency regulation, backup, and peak shaving.

Power trading can be carried out through bilateral and centralised trading methods, and qualified auxiliary services providers are chosen by way of market competition.

Furthermore, the new rules have also strengthened the regulatory measures for power market operation. By setting stricter market access thresholds and intensifying the crackdown on market manipulation, the aim is to prevent and curb phenomena such as market monopoly and unfair competition, ensuring the stable power market operation.

At the same time, the new regulations have also proposed higher penalty standards for violations.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

US real estate developer Gardner to host VPP-connected flywheels and batteries in Utah

They will then be enrolled into Wattsmart, the virtual power plant (VPP) aggregation programme run by utility company Rocky Mountain Power, which leverages energy stored at customer sites to help the energy supplier manage its grid network.

Wattsmart pays back enrolled customers a per-kilowatt upfront fee based on the battery capacity made available for discharge into the grid, in addition to an annual bill credit which is divided up into 12 and paid out monthly.

The market-based incentive programme runs statewide across Utah and Idaho. Rocky Mountain Power (RMP) uses it to provide eight different grid services, integrating energy storage systems directly into its own operating system.

The US arm of German residential battery storage player Sonnen played a key role in helping the utility create the programme, with the pilot deployment of 12.5MWh of connected systems at Soleil Lofts, an apartment complex near Salt Lake City, in 2019.

Sonnen USA CEO Blake Richetta told Energy-Storage.news Premium in an interview a few months ago that Wattsmart now saw over 40MWh of household batteries “networked and swarm-dispatched every day” into the RMP grid.

Hybrid solution pairs flywheels with batteries

To this swarm, or fleet, will be added Torus’ hardware and own VPP platform, which uses predictive analytics to optimise participation in grid services that include demand response, arbitraging stored energy from off-peak to peak times, and frequency regulation.

As mentioned, the tech company’s installations will combine flywheels and batteries, which is fairly unusual, particularly at distributed scale. Only a handful of flywheel projects have been reported by the media in recent years.

There was a wave of interest in the technology, which uses high speed rotors to store rotational kinetic energy, in and around the early 2010s, but this was largely passed over by the storage industry in favour of lithium-ion’s (Li-ion’s) momentous rise.

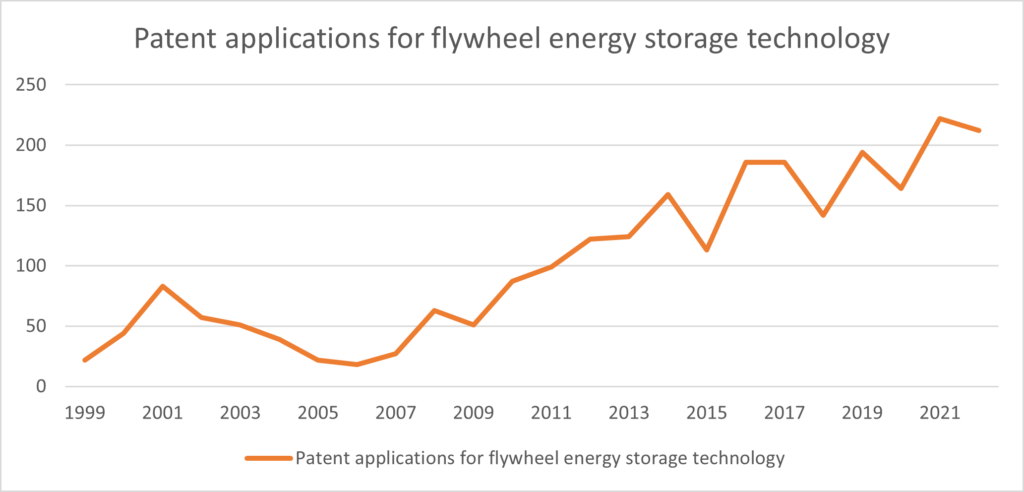

However, in a Guest Blog on patent activity in non-electrochemical energy storage technologies published by this site in August last year, patent lawyer Ben Lincoln of Potter Clarkson highlighted that dozens of successful flywheel technology patent applications have been made by companies including Boeing to date.

Lincoln also found that flywheel patent applications have been steadily rising since 2006, as seen in the graph below.

Chart: Ben Lincoln / Potter Clarkson

Torus claims its Torus Station hybrid solution enables commercial and industrial (C&I) properties to effectively provide both shorter and longer-duration energy storage applications. The flywheel is designed to be 95% recyclable and has a 25-year service life.

The company secured US$67 million investment in April, as reported by Energy-Storage.news, at the same time adding former Vivint Solar and Vivint Smart Home CEO David Bywater to its board. Former Rocky Mountain Power CEO Gary Hoogeveen joined the Torus board a few weeks later.

Torus has just opened a 44,000 square foot HQ and manufacturing facility in South Salt Lake, Utah, where the Torus Station for the Gardner properties will be made. A grand opening on 16 May was attended by Utah state governor Spencer Cox.

Installation of Torus Stations across multiple Gardner Group properties will begin in the fourth quarter of this year, with completion anticipated by Q1 2026.

Ørsted and JP Morgan close US$680 million tax equity financing for US solar and storage

The company will also build the Sparta project alongside its Helena Energy Center, a 518MW solar-plus-wind project that is Ørsted’s first co-located wind and solar project.

The Eleven Mile project will benefit from some of the supportive investment opportunities provided by the Inflation Reduction Act (IRA) in the US, with its solar component to generate production tax credits (PTCs) over the next ten years, while its storage component will receive a one-time investment tax credit (ITC).

The companies also announced that the deal includes the option for tax credit transferability, another new IRA mechanism to make ITCs easier to trade between companies.

See the full version of this article on PV Tech.

‘China selling below cost’: Serbian LFP gigafactory firm ElevenEs on state of the market and ramp-up

China’s suppliers ‘selling below cost’

Alleged ‘dumping’ of solar PV modules from China into Europe has been covered regularly by our colleagues at PV Tech, but the term is less commonly used for its sale of lithium-ion batteries into the continent.

“China is probably selling US$10-15 per kWh below what it would like to be selling at in a ‘healthy market’, in order to maintain its volumes. It’s not normal, but I don’t know how long it will last. When they increase the average price by US$10-15 per kWh, then we’ll be talking about healthy market prices,” Mikac said.

He adds that European buyers of lithium-ion batteries are ready to pay US$5-10 more per kWh “but not more than that,” a figure which tallies with what others have told Energy-Storage.news. “That difference is not a lot, but it’s hard,” he said.

“I’ve heard stories of prices as low as US$55 per kWh from China, I haven’t seen it first-hand though. In Europe, you don’t really talk below US$100 per kWh, though we are getting there. Cell prices in the global market are US$55-75 kWh right now but I think we’ll find a middle point, and a healthy annual decrease thereafter will be around 3%.”

Europe’s gigafactory cost challenges and buyer appetite

Europe is investing billions in building up its own lithium-ion battery ecosystem, including battery and battery component production as well as recycling and some raw material projects, although most agree there is not enough focus on that last area.

However, the cost falls from China as well as the US’ generous tax credit incentives for battery (and other clean energy technology) manufacturing have put the European sector’s potential to be cost-competitive under threat. More recently the US slapped huge new tariffs on battery products from China, our coverage of which included some of Mikac’s comments.

“Europe talks a lot about sustainability but still buys on price. The EV and industrial space are very public about looking to decouple from China but are still reliant on it quite significantly. The energy storage system (ESS) space doesn’t have such public statements and continues to buy from China, though is exploring options,” Mikac said.

He explained why Europe’s battery products will, at least at first, have a fairly substantial cost premium to China.

“Raw material costs are higher here, we need to import everything and the volumes aren’t big yet. It’s a huge factory,” Mikac said.

“On top of that, it simply costs more to build these projects in Europe. Gigafactory capex averages around US$45 million per gWh in China while in Europe its more like US$100 million per GWh, that’s a crazy difference. We at ElevenEs are at around US$60 million and targeting US$50 million.”

“On top of those things you have the price of energy, infrastructure and labour laws which also add something but to a smaller extent.”

ElevenEs’ gigafactory ramp-up

The company opened its first lithium iron phosphate (LFP) facility last year with a pilot line capable of producing 100 battery cells a day, for potential customers to use in small and pilot projects for validation, Mikac said.

It is targeting the EV, industrial and ESS markets, the latter of which could eventually become 50% of its sales. LFP is increasingly the dominant chemistry of choice for ESS, while most European gigafactories are opting for nickel manganese cobalt (NMC) chemistry, more suitable for EVs and also allowing for a quicker decoupling from Chinese supply chains (China is more dominant in LFP than NMC).

The company plans to have its first large-scale facility operational with a 1GWh annual production capacity by the second half of next year. It will then build a large facility reapplying that model across larger facilities, one 8GWh and two of 20GWh, meaning a total 49GWh annual manufacturing capacity by 2030.

The firm has developed its own intellectual property (IP) and LFP manufacturing with no licensing from a larger established firm. Though, the company does source most of its materials and components including cathode material from China, with long-term plans to localise that production which will “definitely” happen by 2030, most likely in 2026/2027 according to the CEO.

How market segments differ

ElevenEs plans to build cells, modules and racks but has no plans to integrate further than the rack level – with the level beyond the rack being full containerised BESS comprising multiple (around 10) racks.

“Where to stop in the vertical value chain depends on how deeply the system integrators want to buy – cells, modules racks or full BESS – by the time your capacity is online, and that’s something of an estimation game,” Mikac said.

The EV, industrial (machinery and heavy vehicles) and ESS market segments differ greatly in the sales cycles, Mikac explained, though all involve long development timelines.

“EV buyers don’t buy anything for ages and then they buy loads. Industrial players are somewhere in the middle, development cycle is a bit less long and the ramp-up is somewhere between,” Mikac said.

“ESS meanwhile has many, more players coming in so the demand is pretty spread out. We’re selling to people who will integrate our cells and modules into full systems. We’ve designed our product to go into a 20-foot 5MWh container. The potential customers are system integrators big and small, none of them publicly named yet.”

Financing challenges

In an interview about the European gigafactory space in February, lawyer Thomas Herman told Energy-Storage.news that financing projects was one of the biggest challenges, something Mikac also touched on.

“Financing these gigafactories is more risky than solar, this is a bit of an unknown territory and people are still learning. A lot of companies and investors are trying to find their way. There have been good and bad investments, it’s been a bit hit and miss.”

“There are some projects that don’t have much substance behind them and that makes the whole industry look weaker than it actually is. A few projects are super huge already and are investing billions a year and still looking to turn a profit, which I obviously hope they do.”

He said the firm has its own investors and capital mainly from the “growth capital” space – not quite institutional investors because of the higher risk of the investment but not venture capital (VC) either, something in between.

“It’s hard to explain to investors that the first few years of the project will have barely any revenue. The returns are further into the future, which turns away lots of kinds of investors. Further market education and showcase projects will really help this.”

ElevenEs will be in a position to launch the project and make a final investment decision (FID) in a few months time, around Q3 2024, so it’s quite advanced with existing investors: “but there is always room for new investors.”

Utility EWS and developer MW Storage expand Swiss BESS to 28MW

The announcement didn’t reveal the MWh energy storage capacity of the expanded project. Prior to the expansion it was the joint-largest BESS in the country by megawatts along with a 20MW/20MWh system owned by independent power producer (IPP) Axpo.

EWS’ BESS project has primarily been deployed to help transmission system operator (TSO) Swissgrid keep the grid stable, via the provision of frequency response services to maintain a 50hz frequency.

It is being monetised in the Swiss electricity market by both CKW, part of Axpo, and utility Alpiq, the announcement said. The BESS is part of a network of power plants, consumers and batteries, it added.

The large-scale BESS market in Switzerland has been relatively quiet with renewable penetration on the country’s grid still relatively low. Axpo commissioned its BESS in February this year while utility Thurplus commissioned a 3MW system in September last year.

But Switzerland was the location for one of the largest energy storage projects commissioned in recent years, a 20GWh pumped hydro energy storage (PHES) unit which started operations in June 2022 in the Canton of Valais.

MW Storage is a developer of BESS projects which is also active in the German market, with a 100MW/200MWh project underway that it claimed is the country’s largest.

The inauguration ceremony for the BESS project. Image: EWS AG.

Continue readingIreland’s first 4-hour battery project indicates market evolution, challenges remain

Battery storage technology for the project is being provided and integrated by Fluence. The company’s growth and market development director for the EMEA region, Julian Jansen, told Energy-Storage.news that Ireland has been among the markets to see the fastest evolution, and most diverse set of BESS assets built.

“When we look at the island of Ireland, it really is an interesting testbed for the energy transition as a whole,” Jansen told Energy-Storage.news.

“You have this island with limited interconnectivity, very high wind penetration, increasing electricity demand, driven, in particular, by the data centre industry, and then [grid] congestion issues between the west of Ireland, towards the Dublin region.”

Long-duration batteries help IPPs balance generation portfolios

Stakraft Ireland head of grid services Rory Griffin has written about the project for the latest edition of PV Tech Power (Vol.39), which is out now and available to Energy-Storage.news Premium subscribers.

The article details both the technical aspects of the project and the market dynamics that led Statkraft to become a first mover on a grid that has typically seen systems of 0.5-hour to 2-hour duration built, tied to opportunities in the DS3 grid services market.

The longer-duration project at Cushaling will enable renewable energy sources in the midlands to be stored at times of low demand and outputted at times of peak demand, reducing the need for costly curtailment.

This is important for companies like Statkraft which are building up portfolios of solar PV and onshore wind on the island of Ireland. Energy stored in batteries can be traded through the Integrated Single Electricity Market (ISEM).

Fluence’s Jansen said that while he cannot comment on how Statkraft’s trading portfolio is operated, independent power producers (IPPs) that own large portfolios of generation are seeing energy storage assets as a useful tool for managing the imbalance cost of those portfolios.

Jansen said this is being seen in Ireland already but is also likely to characterise the Great Britain (GB) market (note: the Irish grid includes Northern Ireland, part of the UK, as well as the Republic of Ireland) and is also being seen in other European markets.

“There’s a clear interest towards that and I think that often means you may start seeing longer-duration assets being developed in a merchant context because they’re not looking at it from an asset perspective,” Jansen told Energy-Storage.news.

“They’re looking at it from a portfolio perspective, which is a very different investment approach from what we may have seen historically in the UK, where it’s been very much a single-asset type of assessment.”

Uncertainty around future direction of market

In addition to trading, the project will provide ancillary services to transmission system operator (TSO) EirGrid, while Cushaling also has in place a 10-year capacity market contract.

However, each of these three available revenue streams: ancillary services, energy trading and capacity market, come with attendant challenges, Griffin wrote in his PV Tech Power piece.

While DS3 has driven rapid market development to date, leading to about 800MW of 0.5-hour, 1-hour and 2-hour systems being deployed, the regime was introduced in 2017 and the market is now “overheated”.

It is now unclear what will happen to tariff rates for ancillary services, which have already been cut in response to that market saturation, at least until April 2026, when DS3 is due to be replaced with a new regime, the Future Arrangements System Services (FASS) market.

The Statkraft team decided to build a 4-hour duration asset meanwhile based on the capacity market design, which incentivised longer-duration storage through de-rating factors in place at the time of the contract’s award in 2020.

Since then, the de-rating factors have halved, and it is unclear if future opportunities for new-build storage with 4-hour discharge duration will be present. That means capacity auctions “are no longer providing the revenue certainty required to make an investment decision,” Griffin wrote.

As with its British neighbours, the Irish government has been holding a consultation on the role that long-duration energy storage (LDES) can play in the country’s energy transition from fossil fuels and in providing energy security and stability of supply.

Griffin wrote that Statkraft will be awaiting the next step in that consultation, the publication of a recommendations paper to policymakers.

(De-rating factors for energy storage in the Capacity Market in GB have also been falling, and the electricity market operator for GB, National Grid ESO, is currently re-assessing them.)

‘One-size-fits-all’ doesn’t work for energy storage

Statkraft’s BESS at Kilathmoy wind farm, commissioned in 2020, was the first to play in the DS3 market. Image: Statkraft.

Fluence’s EMEA VP for sales and market development, Brian Perusse, noted some of the project design differences that come with stepping up duration from anything up to 2-hour, to double that.

“The duty cycle and lower C-rate of longer-duration storage systems are less strenuous for the battery cell,” Perusse told Energy-Storage.news.

“However, the engineering, controls, data collection, and operational aspects of the systems become more complex and important. For example, meeting the speed of response requirements of DS3 and inertia-like response with longer-duration storage is more challenging from a controls and design perspective.”

While Fluence has delivered 4-hour duration projects in other markets to date, perhaps most notably California where the company was behind some of the earliest projects in the multiple megawatt-scale, a one-size-fits-all approach does not work for energy storage, Perusse said.

“Each market is unique and has its own requirements, so storage needs to be tailored to those market-specific needs. Much of the hardware is similar across markets, so, to the casual observer, the systems look the same,” Perusse said.

“However, high-performing systems are localised to ensure they operate at the best level in each of the markets they operate. This includes different software controls, different types of electrical equipment, and various commercial structures. A one-size-fits-all approach in storage leaves money on the table for the customer.”

That localisation piece has already been evident in Fluence’s projects in Ireland, the company’s VP said, highlighting that the DS3 market on introduction had “among the fastest and most stringent response times” among ancillary services opportunities.

Another aspect of the project’s technology is its co-location with wind power. It is still more common to see energy storage deployed together with solar PV, which Perusse said is often due to the commercial or regulatory benefits in many markets of that combination.

However, Perusse notes that the first energy storage project he worked on, commissioned in 2011, was a co-located wind and battery project, and going forward, Fluence expects the case for co-located wind and storage in Ireland to grow stronger.

Around 8.5% of all wind power generated on the island in 2022, around 1,280GWh, was curtailed according to EirGrid’s own Annual Renewable Energy Constraint and Curtailment Report.

Both Perusse in his interview, and Starkraft’s Rory Griffin in his article said that one of the key challenges for wind and BESS co-location is that current regulations make it difficult for renewable energy and storage systems to share the same grid connection.

Regulators are aware of this and other challenges that have limited opportunities for hybrid resources of this type to date, and Perusse said Fluence is “hopeful regulators are working to solve these shortly”.

Read Rory Griffin’s article, ‘The benefits of longer-duration storage and energy project co-location’ in the newest edition of PV Tech Power (Vol.39), out now and included in your ESN Premium subscription.

Solar Media Market Research’s ‘Republic of Ireland Battery Storage Project Database Report’ provides comprehensive details across the rapidly growing pipeline of battery storage projects across the Republic of Ireland and Northern Ireland.

Deploying Internet of Things (IoT) technology for battery storage

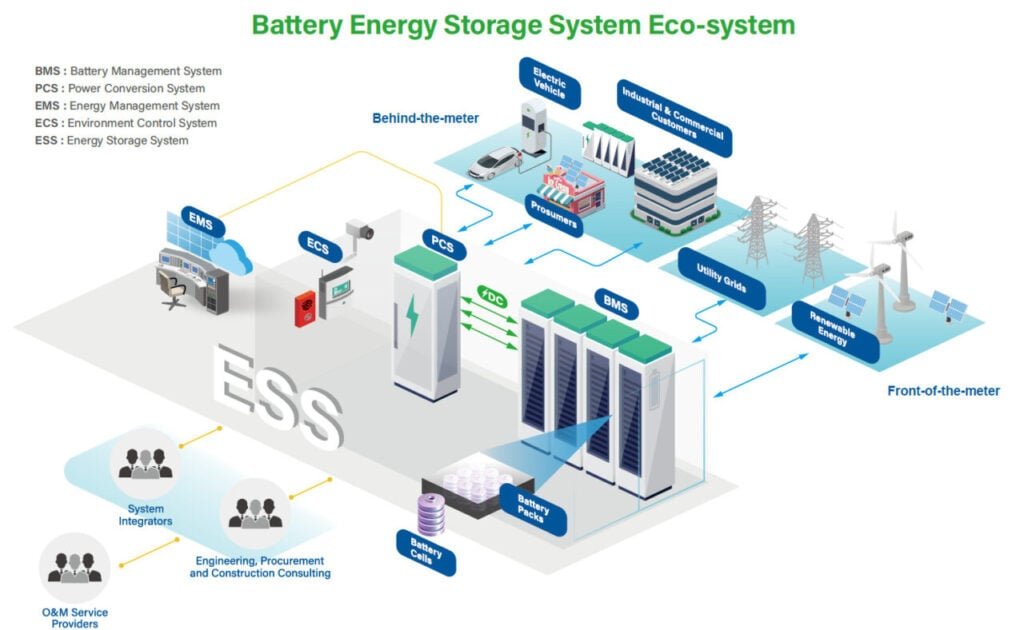

Through this integration process, it becomes possible to optimise BESS operations and communications with real-time monitoring and control. In short, application-specific IoT solutions for BESS can help facilitate the energy industry’s transition towards a successful future driven by digitalisation, decentralisation, democratisation and decarbonisation, catering to both front-of-meter and behind-meter prosumers.

Green energy trends and opportunities

Grid digitalisation means establishing energy storage solutions that can support the integration of renewable energy into smart, flexible power systems. The effects of digitalisation will have an impact on the whole process, from generation and storage, to transmission, distribution and consumption. If businesses want to take control of energy demands on both sides of the meter, they will need to deploy energy systems capable of real-time AI.

Another trend/opportunity is decentralisation, which is becoming critical for any systems that need to demonstrate energy security. Decentralisation will necessitate a major contribution from businesses, especially larger enterprises, in the adoption of self-generation solutions. These solutions will permit businesses to manage their own energy requirements through the construction of micro grids.

Aligned to decentralisation, energy democratisation will continue to engage public effort in the transition to renewable energy. The enablement of independent energy producers and energy trading will result in better guidance for the entire sector. The industry will also become more responsive, driven by policies and decisions made on the basis of local requirements.

In tandem, advancements in decarbonisation will require the re-evaluation of business objectives by exploring viable sustainability pathways and alternative financing options in order to cut emissions. A key consideration will be partnering with suppliers that can help deliver energy efficiency targets via the deployment, operation and management of renewable energy systems.

The challenges

When it comes to IoT integration for a BESS installation, businesses must navigate many challenges, not least system cost, scalability, connectivity, network security and remote device management.

BESS cost is always a primary concern, and when implementing an IoT-based BESS, users need to consider costs that include hardware, software, installation and maintenance to reach an estimate of TCO (total cost of ownership). After all, if the system is not profitable, the business model is not sustainable. Simplifying design and maximising system efficiency are key elements of driving profitability.

Future scalability also comes into the equation regarding both system success and cost. A scalable BESS is essential for future growth and development. By partnering with a technology supplier which can offer a complete IoT product portfolio, users are able to build a scalable IoT infrastructure for their BESS, within budget.

A well-connected BESS also needs to utilise reliable and secure communication infrastructure, as well as robust computing power that can work autonomously. Connectivity is necessary in both the sensing and network layers – the latter aggregates data from the various IP devices present in the system.

During integration, most projects will encounter a multitude of different connectivity interfaces, including serial, one-wire, CAN bus, digital input, analogue I/O, Ethernet and fibre. Connectivity might sound like a simple plug and play exercise, but it involves lots of interface integration to achieve reliable data transmission pathways. Here, the latest IoT sensing, computing and communication products enable users to create a well-connected system for their BESS without concerns about system integration.

As a further point, it is necessary to embed network security in multiple layers at each connection point to thwart potential threats. A VPN, firewall and data encryption are among the crucial tools of effective system security

Similarly, whether the BESS is operating on a grid scale or commercial scale, it requires remote device management to ensure overall grid stability and robust power capacity. Remote device management is also very useful for BESS troubleshooting, system health monitoring and the implementation of predictive maintenance strategies that help maximise asset uptime.

A proven IoT device management service can connect and manage all IoT devices, whether on a public cloud or on-premise instance. The selection process should take account of easy integration with third-party platforms via open standards, such as OpenAPI, for seamless remote data and device management.

Data, data and more data

All of these objectives, challenges and opportunities require the same thing to succeed: data, and lots of it. To help achieve the optimal system solution, there is a need to achieve real-time data communications, or as close to it as possible. Only this way will energy grid operators and producers be able to deliver a sustainable, stable and resilient power supply into the rapidly and ever-changing energy ecosystem of the future.

The energy industry has seen heavy investment in renewable sources for many years now; from wind and wave to solar and green hydrogen. Everyone knows that the output of these technologies is highly variable depending on weather conditions. The ability to store the energy produced for various purposes – including power quality, stability and peak demand response – therefore becomes essential

To complete this ecosystem of sustainability, energy storage is critical, necessitating the deployment of BESS in both grid-scale, front-of-the-meter (FTM) and commercial-scale, behind-the-meter (BTM) applications.

FTM installations, a rapidly expanding area where much of the growth in demand for BESS is coming from renewable developers using short-term storage to address intermittency issues, are typically larger than 10MWh.

BTM installations range from 10MWh down to 30kWh in capacity and fall into four broad categories: as well as public buildings, factories and offices, BESS is being adopted in electric vehicle charging infrastructure, as backup supply for critical infrastructure, and as a replacement for petrol and diesel generators.

Whatever the scale, integrating an IoT solution which combines sensing, communication and computing technologies can help to build a sustainable BESS installation that is reliable and flexible.

Certain technology providers are spearheading the development of hardware and software that can facilitate the roll-out of integrated renewable energy/BESS solutions. This capability includes the collection of analogue data in solar arrays and wind turbines, as well as in battery management systems (BMS).

The BMS is responsible for the real-time monitoring and load control of each battery cell. A BMS typically uses a CAN bus for external communication, with a communication gateway required to convert CAN bus data to Ethernet data. Selecting the right gateway will ensure seamless data transmission and power dispatch to utility grids.

It is also necessary to collect data from the power conversion system (PCS), which serves as the core of electricity scheduling and dispatch because it converts AC and DC power with a focus on real-time control via EtherCAT.

Energy storage systems (ESS) and environmental control systems (ECS), which combine the fire and HVAC system, are further data collection targets. This activity even extends to applications in the overall energy management system (EMS), providing a seamless and highly effective offering.

The EMS typically includes SCADA software and industrial PCs (IPCs) working together to provide overall monitoring of the energy storage container. Usually, two sets of IPCs provide back-ups of each other for SCADA stability, while a further two sets provide back-ups of each other for database redundancy.

A typical BESS ecosystem. Image: Advantech.

Deep product stacks

The latest deep product stacks (both hardware and software) can address the specific needs of key applications, helping to build the ideal solution.

Firstly, taking a holistic approach, one of the key challenges is connecting to devices with both Ethernet and CAN bus across all of the potential applications within a BESS, regardless of their location to the meter. Data requires seamless transfer between BESS functions and applications to maximise performance and efficiency.

Overview of key BESS applications with potential product solutions. Image: Advantech.

Optimal component selection becomes paramount to project success in applications such as grid-scale BESS (where technologies connected to the power grid can store energy and supply it back to the grid at a more advantageous time) and higher level installation architecture. Such components include Ethernet switches, with both copper and fibre interfaces.

In the large grid-scale energy storage field, the BMS, PCS and EMS function in different containers, and each container must maintain data communication at all times to manage charging and discharging. The containers connect using fibre-optic ring topology to enhance network redundancy and ensure the highest stability.

By leveraging the latest managed Ethernet switch technology, it becomes possible to connect each BMS and transmit Ethernet signals over fibre-optic cables. This ensures seamless data exchange between distributed BMS containers. On the ring network’s top layer, it is advisable to use IEC-61850-3-certified managed Ethernet switches to connect PCS, EMS and multiple BMS containers.

Grid-scale BESS application. Image: Advantech.

Another core component is the media converter. Since security management of the energy storage system is critical, an industrial gigabit Ethernet-to-fibre media converter is necessary to extend the twisted-pair network over fibre technology to connect with surveillance cameras and transfer video signals back to the network for security monitoring.

Media converters and wireless gateways based on LTE/5G cellular technology ensure the PCS and EMS remain connected to battery assets, helping to deliver peak shaving, frequency regulation and energy management. As a point of note, peak shaving helps flatten demand peaks and avoid peak demand charges.

Equally, for behind-meter (commercial building/home) BESS applications, the optimal selection of I/O modules, protocol gateways, Ethernet switches and substation-grade (IEC 61850-3) automation computers will support the device bus protocols required in the architecture.

A typical behind-meter BESS application. Image: Advantech.

In a typical compact behind-meter BESS set-up, Ethernet I/O will serve to collect HVAC data, including temperature changes. This data will connect to a gateway that employs a CAN bus interface to convert BMS data to Ethernet networks. A visualisation gateway can act as a human-machine interface (HMI), facilitating the efficient visualisation of BESS data.

To establish connectivity, all machines can link to an eight-port unmanaged switch that subsequently transmits the acquired data to the EMS. An edge device management cloud service will enable the remote monitoring and management of devices across all behind-meter BESS installations, ensuring complete micro-grid performance and visibility.

The stable operation of BESS is also reliant on the identification and adoption of optimal remote I/O gateways and edge computers. These devices can effectively monitor BMS, EMS and ECS conditions to ensure the safety of BESS, while industrial switches, routers and protocol gateways provide robust network infrastructure with VPN and IT protocols for enhanced data security.

Potential gains

To highlight the potential gains available from creating a connected IoT infrastructure for BESS efficiency, balanced energy utilisation and better energy security, consider the following real-life example involving HVAC control. HVAC control in BESS requires I/O signals such as analogue inputs for temperature data acquisition in the battery rack, and digital output for alarm detection. In addition, edge gateways are necessary to deal with data processing and control, while edge computers provide overall system management.

This particular solution sees each battery rack feature a single I/O gateway as the HVAC controller. Notably, these I/O gateways contain I/O modules and basic computing functions to deal with the I/O control process and alarm/event handling. Each battery bank (comprising several battery racks) takes advantage of edge gateways to manage devices (including the I/O gateways) and transmit data to the edge computers. In turn, these edge computers run the management systems that monitor the equipment status of each battery bank. An unmanaged switch connects the Ethernet devices.

Case study example: building a connected IoT infrastructure to achieve BESS efficiency. Image: Advantech.

The benefits of this solution are many. Firstly, it allows the completion of key energy management tasks and maximises solar power output. Furthermore, the use of a web-based platform provides immediate access to data.

Edge-to-cloud solution

In another real-world use case, an energy storage technology company wanted to build an IoT-ready BESS with an edge-to-cloud solution for its client, a metal extraction and refining plant. The IoT-based solution facilitates BESS monitoring and control for the efficient use of electricity at the plant.

Among the main requirements were an IoT gateway or edge controller with high density I/O points for this large-scale BESS and the implementation of IoT network infrastructure for remote monitoring. The system integrator (SI) developed an energy storage management system to monitor and control the energy facilities at the customer’s plant, using an EtherCAT automation controller with CODESYS as the edge controller and main data gateway.

In this case, the automation controller collects status data from the subsystems, converts the data into a unified format for processing with SI-developed algorithms, implements subsystem control such as battery charging or discharging, and uploads filtered data to the local server and the cloud SCADA system.

The SI chose this particular automation controller because it is a high-density and flexible computing system that can easily expand to over 20,000 I/O points for larger scale BESS deployment in the future. In addition, the EtherCAT controller supports the CODESYS programming environment and can run on both Linux and Windows operating systems, making it very convenient for the SI to develop domain-specific applications.

Another industrial PC takes care of video streaming from the plant’s surveillance system. Here, a Modbus RS-485 remote I/O unit acts as the access control system, which not only collects and transmits data from devices at an access point but also receives commands from the controller to open or lock the door.

The success of the project hinged on field-proven ruggedness: the metal extraction and refining plant and its power generation and energy storage facilities exemplify the harshest environmental conditions prone to dust, shock, vibration, high temperatures and electromagnetic interference. Hardware units with wide temperature support, high EMC capability and other rugged designs are proving their reliability in this project.

Another key factor was openness and scalability: the operator expects its energy system to continue growing, whether in the public cloud or on-premise. The open standard cloud platform made it easy to develop a highly scalable system and migrate systems across platforms and clouds.

The future is connected

Companies around the world are facing the challenges of rising energy prices and a pressing environmental agenda that calls for cleaner energy use. An increasing number are therefore building – or considering building – on-site power generation systems and BESS. A reliable Industrial IoT framework is part of the critical infrastructure that enables effective BESS management and the digital transformation of energy practices.

The IoT collects and communicates real-time data, giving BESS asset managers unparalleled visibility into devices and operations. It exchanges data to assist with asset monitoring, metering measurement, equipment maintenance, performance optimisation, demand and capacity management, and the identification of cost-saving opportunities.

About the author

Paul O’Shaughnessy serves as both the Industrial IoT Sales Director for Northern Europe and the Energy & Utilities Sector Head at Advantech, a provider of IoT intelligent systems and embedded platforms which manufactures its own hardware and software. The company offers a full turnkey design service to provide customers with an all-in-one control and communication solution for fully integrated BESS control and management.

RWE reaches FID on Australia’s first long-duration lithium-ion battery storage project

The FID comes after RWE won out in the New South Wales government’s first tender for long-duration energy storage (LDES) and was awarded a Long-Term Energy Service Agreement just over a year ago.

The competitive solicitation was administered by AEMO Services, an arm of the Australian Energy Market Operator (AEMO). AEMO Services is running biannual tenders on behalf of the NSW state in a 10-year plan under the NSW Electricity Infrastructure Roadmap, with developers competing for generation and storage projects as well as access rights to the state’s five planned Renewable Energy Zones (REZs).

The Limondale BESS will be sited inside one of those, the NSW South West REZ, and will connect to transmission lines via existing substation infrastructure.

REZ developments in several Australian states will each host multiple gigawatts of wind and solar, along with battery storage and potentially other technologies such as green hydrogen.

Tesla Megapack lithium-ion (Li-ion) BESS solutions will be used at Limondale. Construction is expected to begin in the second half of 2024, for commissioning late next year.

Australian renewable energy and infrastructure contractor Beon Energy Solutions will provide balance of plant (BOP) equipment.

Ongoing NSW tenders for long-duration resources, REZ access rights

As detailed in the Energy-Storage.news Premium article published after the contract award, RWE’s LTESA with NSW has a 14-year term.

The state will underwrite the developer’s revenues for the project, paying out to RWE when market-based revenues are low, and RWE will pay the balance back to the state when revenues go above an agreed ceiling.

While, as RWE pointed out, the project will be Australia’s first-ever 8-hour duration Li-ion battery storage project, NSW has just launched its next tender for LDES.

Tender Round 5 under the NSW Electricity Infrastructure Roadmap opened last week (22 May). AEMO Services has sized the LDES portion of the tender at an indicative 1GW of project bids, along with up to 3.98GW of access rights for the South West REZ.

The tenders come in growing recognition of the fact that while longer durations of energy storage will be needed to fill in gaps when solar PV and wind resources are not generating for the grid, current market structures do not incentivise building long-duration storage plants.

At the Energy Storage Summit Australia, hosted last week in Sydney by our publisher Solar Media, many of the speakers—including former Australian prime minister Malcolm Turnbull—agreed that while Li-ion BESS projects with shorter durations, typically 1-hour and 2-hour, can make decent returns from opportunities in the National Electricity Market (NEM), market reforms or supportive policies are needed to create a business case for long-duration storage.

On a related note, Australia’s new National Battery Strategy, aimed at making the country competitive in battery and battery materials value chains through manufacturing, processing and extraction, envisages supporting short-, medium- and long-duration storage technologies.

Germany’s Uniper and NGEN to deploy 100MWh BESS at retiring coal plant

The Heyden plant, one of the most powerful in Germany, will be decommissioned by Uniper on 30 September, 2024. Decommissioned power plant sites provide excellent locations for new clean energy projects with substantial existing grid infrastructure and interconnections which can be re-utilised.

The new BESS will comprise of 26 energy storage packs, so around 3.85MWh each. In an interview with Energy-Storage.news in September 2023, NGEN CEO Roman Bernard said the company had primarily used Tesla Megapacks for its projects to-date, including the largest BESS facilities in Slovenia, Austria and Croatia. Tesla’s Megapack’s have an energy storage capacity of 3.9MWh.

NGEN is a developer and operator of those projects but also describes itself as a provider of energy solutions, with its own energy management system (EMS) platform, Energy Smart Grid Platform, which can aggregate numerous technologies into virtual power plants (VPPs). As part of the move into Germany the company will open an office in Frankfurt.

Uniper was formed through the spin-off of German multinational energy company E.On’s electricity generation businesses from its retail utility operations, after the split became effective at the beginning of 2016.

Uniper is aiming to be carbon-neutral by 2040, and for 80% of its generating capacity to be zero-carbon by 2030. This includes growing its renewable and clean energy portfolio but also converting its legacy gas plants to alternative gases like hydrogen and biomethane.

Germany’s grid-scale energy storage market has picked up in the last few years with the right market and policy signals incentivising investment in large-scale projects. Energy-Storage.news has recently reported on BESS projects of around 230MWh being launched by developers Eco Stor and Nofar.

Transmission system operator-led (TSO) ‘grid boosters’ are also underway, with system integrator Fluence recently starting to ship BESS for TransnetBW’s and TSO Amprion getting its project approved by the regulator.