Various discussions on Day One of the Energy Storage Summit Australia, held in Sydney yesterday (21 May) focused on the FTM revenue stack in the country’s main interconnected energy market.

Ranging from what one speaker called the “alphabet soup” of 10 different Frequency Control Ancillary Services (FCAS) markets and a wholesale market offering merchant revenues today, to contracts for system stability services that many expect to see become available soon, the consensus appeared to be that battery energy storage system (BESS) projects can remain profitable, especially if the different streams can be layered on top of one another.

NEM evolution can be navigated by flexible approach

Today’s megawatt-scale systems are largely between 1-hour and 2-hour duration, based on lithium-ion (Li-ion) battery technology, and earn most of their revenues from FCAS markets run by the Australian Energy Market Operator (AEMO) which oversees the NEM.

On top of that, a smaller wedge of merchant revenues can be found in arbitrage on the spot market.

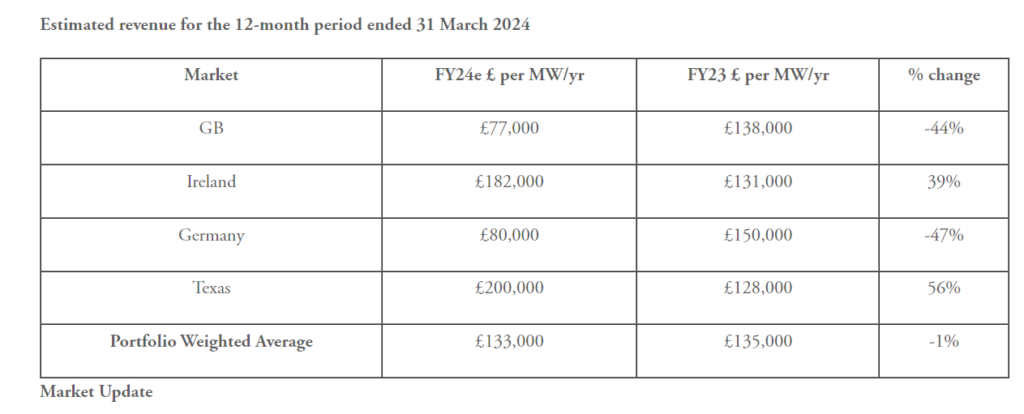

As has been seen in the maturing energy storage markets of Germany a few years ago and, more recently, the UK, ancillary services revenues begin to see downward pressure as more and more assets join the markets and they begin to saturate.

However, the risk of revenue depression may be overestimated by some, Ben Irons, co-founder and director of BESS optimiser Habitat Energy told Energy-Storage.news in an interview.

“If you look at where the revenues are coming from today, it is disproportionately FCAS,” Irons said.

“Us and everybody else is well aware of the fact that FCAS is starting to saturate, and those revenues will come down, but it’s not as bad as saying: ‘Well, if we’ve got, say [for example], 20% spot market and 80% FCAS, and FCAS drops by half, does that mean that missing revenue is gone, and the entire revenue stack comes down by the same amount?’”

Irons said that this is not the case. As FCAS prices paid for a service go down, traders can “substitute” away from FCAS and towards the spot market, or away from the saturating FCAS opportunities and onto other markets that are not yet as crowded.

“That allows you to replace a large proportion of the revenue that would otherwise have been lost.”

Potential for contracted as well as merchant revenues

“It’s still evolving in terms of the revenue streams that are available for storage systems in the NEM,” Andrew Kelley, VP and Australia country director at energy storage technology provider Fluence, which also offers services and optimisation software including bid optimisation and asset performance management for renewables and storage, said.

AEMO introduced new 1-second fast frequency response (FFR) services to its FCAS suite in the NEM in October of last year, for example, which is proving to be “quite a lucrative market,” said Kelley.

“For many of our customers, we’re starting to see a larger portion of their FCAS revenues coming from that market than some of the other FCAS products. Batteries are really well-placed to provide those types of flexible services, and there’s lots of discussion about opening other types of revenue streams as well.”

It will be “very interesting” to see how big the energy arbitrage spreads will be in the coming years, as well as what sort of revenues can be earned from volatility events, Fluence senior manager for growth and market development for APAC Lara Panjkov told Energy-Storage.news.

Contracted revenues for network security arrangements are also looking like an interesting avenue for BESS assets, Panjkov said, with the Australian Energy Market Commission (AEMC) having recently passed rules around providing services that improve system security frameworks.

AEMC’s resolution could allow AEMO to contract for system stability services including inertia over three and 15-year terms, “and that could be great for battery storage assets,” according to Panjkov.

A handful of assets already provide these services, including under System Integrity Protection Scheme (SIPS) contracts with AEMO. These see batteries guarantee availability to step in in the instance of major grid disruptions that could be caused by, for example, lightning strikes or bushfires.

Examples of BESS assets with SIPS contracts include the under-construction Waratah Super Battery in New South Wales (NSW) and the existing Victorian Big Battery in the state of the same name, where BESS equipment and integration have been provided by Fluence rivals Powin and Tesla respectively.

A total of 4.2GWh of grid-forming battery projects were supported by grant funding from the Australian Renewable Energy Agency (ARENA) as a pilot deployment.

Fluence has three projects in construction for customers in Australia that will deliver inertia via the functionality of grid-forming advanced inverters, with the 300MW/650MWh Mortlake Battery for Origin Energy and the 500MW/1,000MWh Liddell BESS for AGL receiving funding from ARENA through that round in late 2022, while its 50MW/50MWh Broken Hill project, also for AGL, got grant funding through the agency on a demonstration basis a little earlier that year.

Meanwhile SIPS procurement by AEMO has been done on a project-by-project basis based on their location on the grid and the corresponding need for protection from outages.

With new large-scale facilities now mandated to include grid-forming inverters, and AEMC’s decision set to potentially create procurements for SIPS-type contracts, the evolution of contracts to remunerate these services is of particular interest.

“There’s still a little bit of confusion about how much they will value the services, but we should know that over the next few years,” Lara Panjkov said.

‘The other side of the equation’

These contracts could be layered as part of the revenue stack, providing some longer-term revenue certainty, while it’s likely assets will continue to be able to trade some of their stored energy into merchant opportunities.

Back on the subject of those merchant opportunities, Habitat Energy’s Ben Irons said that while revenue opportunities in the NEM might saturate for some of today’s more lucrative services as competition increases—which is good for Australia’s billpayers as it can bring electricity costs down—the NEM itself is a piece which will evolve as the mix of energy resources participating does too.

While it is “easy to talk about more batteries creating saturation and bringing prices down, you’ve got to also think about the other side of the equation,” Irons said.

“Which is: more renewables [in the mix], pushing the demand for FCAS services up, and creating more volatility,” and thermal generators will come off the system too.

“So it’s about the balance of those two things, and whilst right now we’re definitely going through a ‘down phase,’ I would say over a five or 10-year period, there’s every reason to assume the market is actually going to be deep enough to absorb significant gigawatts of additional battery storage and all of it to be fairly profitable.”

Continue reading