Many have characterised the wider package of tariff increases these were part of – increasing the solar PV tariff to 50% and full China-made EVs to 100% – as primarily about optics with the upcoming US presidential election. The package also includes tariffs on aluminium and steel products.

China accounts for about 2% of EV sales in the US, for example. But the effect on batteries and solar will be more substantial, and the reaction to them has been mixed.

Within batteries themselves, the effect will be more pronounced for lithium iron phosphate (LFP) cells with Chinese companies virtually the only ones producing them, while there is substantial nickel manganese cobalt (NMC) manufacturing capacity in South Korea and Japan. LFP is the dominant chemistry for BESS.

‘Negative consequences for the energy transition’

Kyle Teamey, managing partner at venture capital (VC) firm RA Capital, said: “The US and EU are erecting walls to protect their industries but China is also kind of doing the same thing. Classical economics says this will make things more expensive for everyone but it will be popular as it will protect jobs. There’s good and bad to this.”

Teamey is a board observer for Our Next Energy (ONE), a company building lithium-ion gigafactories in the US, while RA Capital has also invested in other companies in the US lithium-ion ecosystem. He suggested a price on carbon may be a more economically efficient ‘stick’ than tariffs.

Ed Crooks, vice-chair of Americas for research firm Wood Mackenzie said on LinkedIn: “With former President Donald Trump similarly committed to economic nationalism, that strategy is unlikely to change, whatever the result of the (US presidential) election. The US is set on a course of greater protectionism, which will have far-reaching consequences for the energy transition.”

Erik Strømsø, CEO of international BESS owner-operator BW ESS, in a recent interview, was similarly negative about the move. His firm is part of the Singapore-headquartered international maritime and energy investment firm BW Group.

“I think the energy transition will be impacted negatively by trade wars. Trade, and China, have contributed to a lot of economic development that we’ve seen over the last several decades,” Strømsø said.

“I understand we want to develop our industries in Europe and the US, and there is merit to that, but we must recognise that imposing tariffs will also lead to a slowdown in investment because costs are going to go up and returns will adjust down accordingly.”

Ben Gregory, president of developer Available Power, said the measures come after a period of concern in the industry using imported China products, both in terms of national security but also the risk of projects being disconnected once operational as has happened at some military installations.

Kasim K, energy storage research analyst for Wood Mackenzie, said that the firm expects the tariffs to increase the cost of grid-scale BESS by 6.1% starting in 2026 because of the new tariffs.

US trade body American Clean Power (ACP) issued a supportive statement after the tariffs were announced:

“Today’s decision recognises the value of battery energy storage and its importance to the reliability of our electric grid. As energy demand grows, battery energy storage is lowering costs for American families and businesses. Moreover, this emerging industry is building new manufacturing facilities and bringing thousands of jobs to communities across the United States.”

“Newly enacted tax credits for energy storage, along with US Department of Energy programs supporting the ramp up of domestic manufacturing, will continue to be critical to America’s energy dominance.”

US will still be reliant on China even with the new tariffs

However, our sources said that even with these higher tariffs, the US will still buy batteries from China in significant numbers.

“Even with the tariffs that are being proposed you will still see batteries from China being sold to the US because they are that competitive on price, and their technology is market leading,” Strømsø said.

Gregory added that the US industry has a long way to go to be able to fill demand and so you would have to see even more harsh measures levied against products from China to see imports stop completely.

“The new tariffs imposed on Chinese imported batteries are giving developers and asset owners yet another reason to pivot toward vendors that comply with the domestic supply requirements put forth by the IRA (Inflation Reduction Act),” he said.

“That being said, domestic battery supply still has a long way to go, so reliance on foreign supply chains will likely continue to grow unless we see an outright ban on the imported tech or until higher penalties are applied toward Chinese vendors.”

View from Europe: EU will follow

We also got the view from our sources across the Atlantic, where Europe is also looking to build up its own clean energy industry in order to reduce reliance on China.

Sebastian Enache, head of M&A for European IPP and energy trader Monsson which very vocally talked about using locally-built technology for a BESS project in Romania, appears to be in favour of similarly strong measures as the US’ although not necessarily using tariffs as well.

“The US decision is based on securing an essential business for the 21st century, meaning batteries and EVs. Each state economy is focusing on securing such industries locally for resilience,” Enache said.

“The US always has been a first mover. The EU will follow, but in a more democratic way, such as ESG policy, carbon footprint, battery passport. But, all goes into taxation of batteries coming from the Far East.”

Meanwhile, a CxO of a company building lithium-ion manufacturing capacity in Europe called the tariff levels “crazy”, similarly saying that Europe should respond but not with something as aggressive as the US’ new tariffs.

“Incentives are a better way to protect local industry than tariffs, but they should be done in a mild way. Something like a US$10 per kWh subsidy to the end-consumer for every battery made in Europe. It won’t stop Chinese competition but it will create more value on European goods.”

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

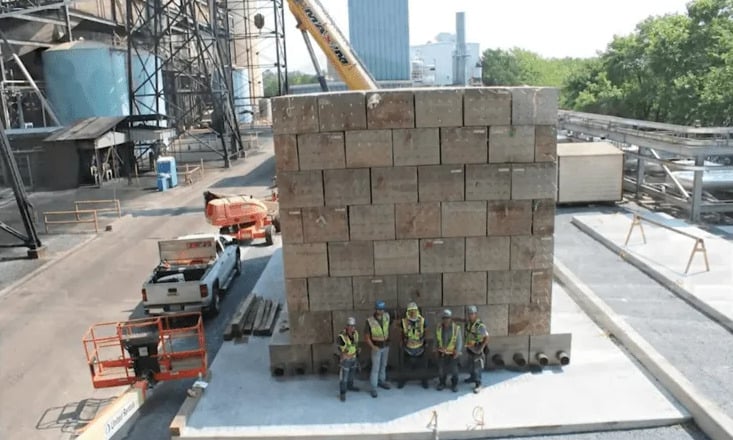

Testing on ‘world’s largest’ 10MWh concrete thermal energy storage unit complete

The system has an energy storage capacity of 10MWh (electricity). It uses heat generated from one of the gas plant’s units to heat concrete blocks that store the energy thermally. That thermal energy is then returned to the power plant by converting feedwater into steam to generate electricity.

EPRI (Electric Power Research Institute) is an independent non-profit that conducts research into the electricity system and is owned by utilities. Southern Company is a gas and electric utility, which owns the Gaston plant via subsidiary Alabama Power, while Storworks is the provider of the concrete thermal energy storage project used in the project.

More than 80 energy charge and discharge cycles on the project were successfully performed, with over 700 hours of total operation. It was temporarily integrated into the plant for the pilot. The goals of the project were exceeded with steam production at several pressure levels demonstrated.

“Advancements in long-duration energy storage (LDES) are key to unlocking the full potential of variable renewable energy resources on the path to net-zero,” said Neva Espinoza, EPRI vice president of Energy Supply and Low-Carbon Resources. “As the power sector navigates a highly complex transition, CTES could play an important role in efficiently delivering the reliable and affordable electricity society depends on.”

The project received federal funding from the US Department of Energy (DOE) under award DE-FE0031761.

Industrial heat is a huge portion of global greenhouse gas emissions (GHG) for heavy industry making thermal energy storage a huge opportunity, as well as challenge, for decarbonising. Thermal energy storage can either store heat for conversion back to electricity or provide that heat for industrial needs.

Just this week, Saudi oil giant Aramco signed a memorandum of understanding (MOU) with ‘heat brick’ firm Rondo to decarbonise its operations globally. In late April, a MW-scale molten salt hydroxide energy storage project was inaugurated in Denmark, also the first of its scale in the world, technology provider Hyme claimed.

Two months prior to that, thermal energy storage startup Antora raised US$150 million to commercialise its tech which uses heat stored in blocks of carbon material.

Developers SENS and Callio working on hybrid BESS, pumped hydro and PV project in Finland

The location will allow the project to utilise existing grid infrastructure and integrate with the nearby Callio Business and Olcconen Green Industrial parks, SENS (Sustainable Energy Solutions Sweden Holding) said.

SENS is primarily a BESS project developer active mostly in Sweden while Callio is owned by the Pyhäjärvi Municipality.

The BESS portion of the project is designed for a power output of 85MW and is already at the ready-to-build (RTB) stage, with commercial operation expected in 2025. It will provide frequency response services and participate in the energy arbitrage market, SENS said.

The pumped hydro energy storage (PHES) unit would be a 75MW/530MWh, 7-hour system built underground though a timeline for its development, construction or operation was not provided. The third stage of the project is a solar PV plant but details on size or timeline were not provided either.

The Pyhäsalmi mine is the deepest metal mine in Europe at 1,444 metres deep and its underground mine operation and copper and zinc processing ended in 2022, although some above-ground refining is set to continue until 2025. The underground mine is currently in the closure and decommissioning stage. It is owned by Canadian company First Quantum Minerals.

Financing for the project will be shared between SENS, Callio, the Calllio Business and Olcconon business and industrial parks, UB Corporate Finance and the Finnish government via €26.3 million (US$28.5 million) in subsidies for foreign direct investments (FDI) in renewable energy.

Axpo, a Switzerland-headquartered independent power producer (IPP) and energy trading firm, has also launched projects in neighbouring Sweden, commissioning a 20MW project in February which was acquired from SENS. A month prior SENS secured the land for another 40MW BESS project.

Sweden and Finland are leading BESS deployments in the Nordic region largely off the back of a lucrative ancillary services market.

Things to know before buying cells for battery storage applications, with DNV

Jason Goodhand leads the engineering, advisory, certification and testing group’s energy storage practice, with around 80 subject matter experts working across five global regions, modelling, testing, and carrying out due diligence on storage equipment and projects.

As reported by Energy-Storage.news when the Battery Scorecard was published, the questions battery buyers should ask cover everything from technology readiness and bankability to degradation profiles and lifetime expectations and, of course, safety.

DNV has extensively researched different cell chemistries and form factors and how, even when these stay the same, cells from different vendors or even different batches can produce results that vary more than expected.

So, while the results of the latest scorecard tests are anonymised and don’t give specific data on named vendors’ cells, the report is designed to be a valuable resource that arms buyers with the right knowledge of how to compare batteries.

“You could get the OEMs themselves to provide you with some information about the battery, but it may not be an apples-to-apples comparison,” Goodhand says.

“So, you don’t necessarily know what you’re getting, or they may just give you a warranty curve that says, ‘Don’t worry exactly how our battery operates; we’ll just cover you if it falls below this level.’” (Following that advice might lead to undervaluing a cells performance in your financial model.)

DNV’s research included testing cells under various conditions, including different C-rates, whereas an OEM may only provide a single curve at, say, C/2, whereas if, in practice, the battery will charge or discharge at 1Cto provide frequency regulation, the operator has no visibility into how it will behave.

“By testing a bunch of different characteristics, you can create a bit of a fingerprint of a particular cell. While we don’t name the individual cells on our graphs, one of the things that I think is really powerful is to show the spread,” Goodhand says.

“We do see that there’s quite a bit of a difference between cells.”

CATL’s non-degradation play

CATL’s recent launch of Tener, a containerised BESS solution, caused some industry waves for two major reasons: the first being its high energy density, packing 6.25MWh of storage capacity into a 20-ft container footprint, and the manufacturer’s claim its batteries would not experience degradation over the first five years of operation.

Asked to comment, Jason Goodhand offers a couple of theories that he says may explain how CATL is able to make the ‘non-degradation’ claim.

“If you look at an individual cell, it’s pretty likely that it is going to degrade over time. We have actually seen increasing capacity early in the cell life and that just has to do with the break-in process during the first few hundred cycles.

“But the long-term trend is that they’re always going to decrease in capacity over time. Now, some of the reason that you lose capacity is that lithium gets lost in solution, or moves into a layer called the solid electrolyte interface (SEI).”

However, if a battery was pre-lithiated, putting more lithium in there than the cell needs, CATL could “sort of skip over some of that lithium loss to the SEI or the electrolyte,” Goodhand says.

“So, as lithium is lost, it doesn’t matter. There’s still enough lithium for the other active materials that are in the battery to hit its rated capacity.”

That’s at the cell level. At system level, there could be some operational strategy in place, where changing the battery management system (BMS) settings through the initial life of the cells could ensure the batteries are underutilised over those first five years.

This type of strategy could involve opening up the battery voltage as cells degrade, to match the guaranteed State of Health. Goodhand notes however that CATL did not mention any operating strategy and instead focused on the SEI and electrolyte in information shared about Tener, which he says he is excited to hear more about.

Addressing degradation

For project owners and developers, there are a couple of strategies to address the degradation issue.

One of those is to “simply overbuild the system for what it needs to do at the outset,” Goodhand says, but this may not be optimal, particularly in terms of Capex.

“Instead, you can plan an augmentation schedule. You have to look at how much money you’re going to make or how you will financially optimise that asset. You also potentially have firm requirements or constraints like a contract, or some sort of performance capability that allows you to bid in for certain merchant services.”

Weighing up all of those considerations, the buyer must then take into account the cost of purchasing the batteries upfront, the expected cost of batteries when the time to augment comes around, and other factors including project discount rate and any incentives that may be available at the outset that might not be available later.

Degradation testing of the type DNV carried out for the Scorecard is among the best ways to figure out the degradation curve, Goodhand claims, using software to model a degradation forecast based on how the battery behaves when undergoing duty cycles.

Application

Of course, how your battery is cycled depends on which applications it will be performing. A BESS asset could be performing one application or set of applications for the length of a services contract, for say, three years when it enters commercial operation.

After that contract ends, the system will be doing something else for the remaining 15 years or more.

In other instances the BESS might be performing different applications on weekdays versus weekends, or during different seasons.

As long as the testing team is provided with an 8760 profile (hour-by-hour analysis for a full year) or sometimes less hourly data than that, for the battery system’s applications, DNV can examine the C-rate and State of Charge (SOC) when modeling the battery to provide estimates of its degradation curve.

An interesting fact about batteries for EV versus BESS is that it is often considered stationary energy storage is far less demanding of the battery cells than electric transport. This is because EVs will be stopping and starting frequently, and Goodhand says it’s a fairly logical assumption energy storage batteries might face less wear and tear, but not entirely true.

“One of the things that happens when you put a battery on load for several hours at full output [as with some BESS applications]: it develops a lot of heat internally, which changes the resistance and starts to create different side reactions,” Goodhand says.

“You can only accelerate a car for a short period of time, you don’t hit those maximum output periods for very long in a car, you reach a cruising speed. They tend to cool off quite a bit easier, so actually the BESS can be much worse than the EVs.

“With the exception of some service vehicles like delivery trucks or Ubers, vehicles are also not used for very long hours every day. Whereas a BESS asset won’t get good ROI in most cases without being used as much as possible. I suppose quick chargers may change this on the charging side.”

Industry trends: fire testing

One industry trend that Goodhand says DNV has observed recently is an increase in fire testing at rack level, or even full-scale burn testing. System integrators Fluence and Wartsila are among the companies to have publicly announced burn tests on complete BESS containers.

It’s obviously a “very expensive test” he says, given it consumes larger equipment, but it speaks to a growing tendency for authorities having jurisdiction (AHJs) wanting more info on how batteries can burn.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

Former PM Malcolm Turnbull’s keynote speech at Energy Storage Summit Australia 2024

The Liberal Party was voted out in 2022 by Labor, which ran on a platform that included action on climate and promoting renewable energy. Today, as a private individual, Turnbull’s business interests include developing two large-scale pumped hydro energy storage (PHES) projects, along with a wind farm, through his company Turnbull Renewables.

His speech this morning focused largely on the need for long-duration energy storage (LDES) for the Australian grid, arguing that PHES and batteries are technologies that both have an important role to play, not just in decarbonisation but also in providing security of energy supply and lowering costs of running the system.

Below, you can read a transcript of his prepared remarks at the event in Sydney today.

‘Challenge has been very clear for some time’

Let me cut right to the chase. We know that renewables are the cheapest form of new generation, particularly in Australia, and they will play the leading role in our energy systems into the 2030s and beyond, and we’re moving into a world where most of our primary generation is going to be either solar or wind.

And I think it’s becoming increasingly obvious that the mixture, as between solar and wind, is going to have more solar than we originally anticipated, because of the challenges of building wind, and that, of course, because of the correlation of solar to when the sun is shining, we’re going to have a need for even more storage than we’d originally anticipated, and that’s what I’m going to talk to you about today.

Now, the update to the Electricity Statement of Opportunities (EESO), AEMO as you know, has forecast gaps in all mainland NEM regions in the next decade. That challenge has been very clear for some time, but it’s worth repeating. We need to firm up the various variable renewables with storage when the wind doesn’t blow and the sun doesn’t shine. Variable renewable energy supported by storage: batteries, pumped hydro, green hydrogen, can take us to a zero emission energy world. It’s absolutely doable.

The level of storage in AEMO’s draft 2024 ISP forecasts an additional six gigawatts of utility storage will be needed to be added to the NEM between 2030 and 2035, but these Step Change scenario forecasts in our view are at risk of underestimating the long-duration storage requirements of the NEM due to four key factors.

Firstly, the ISP Step Change scenario for distributed storage, and this is essentially home batteries, EVS and so forth, is underpinned in part by an unrealised assumption that the Commonwealth will establish a national household battery rebate that subsidises 50% of the capital cost. Now that rebate does not exist, but that’s factored into the ISPs assumptions.

Secondly, the lengthy planning assessment processes for wind farms may see utility-scale and rooftop solar PV grow at a faster pace than wind which further increases storage requirements, as I said earlier. From 2016 to 2024 capacity additions in the NEM comprised 50 wind projects, 9.6GW capacity, compared to 111 solar projects, 13GW, and 17GW of rooftop solar.

Now, the assumption, the third fallacy or flawed assumption, is that the gas market is endlessly flexible, and that assumption is not realistic. For the older people in the room, this reminds me of the what I used to call in Lotus 1-2-3 days the backslash-copy School of Modeling, where you just take an assumption and assume it’s going to be good forever. And I’ll come to some work that deals with that. But treating gas as the sort of limitless corrective that’s going to solve gaps in generation is not viable.

Recent research suggests that the pipeline capacities and gas storage capacity constraints will limit the gas supply needed to adequately meet demand during the winter months.

And finally, slower than expected transmission rollout could increase energy storage requirements by two to five times. Now, one of the problems AEMO has, is because it’s a creature of governments, for the most part, they’re not really in a position to say, let’s assume that all of the government policies that have been announced, fail to deliver as proposed. You can imagine the stakeholders will be peeved by that, but there has to be a more realistic approach to the modelling.

All those four factors mean we need much more long-duration storage that’s been forecast. Paul Simhauser, the CEO of Powerlink which is the big transmission utility in Queensland, and Associate Professor Joel Gilmore, Griffith University have recently done some work and published on the Griffith University energy policy research site, which suggests that a dispatchable long-duration storage target of 162GWh of storage spread across the NEM with a capacity of at least 9GW by 2035, is more appropriate, and that’s in addition to the existing pumped hydro projects under construction, Snowy 2.0 and the much smaller Kidston.

‘Much more needs to be done to incentivise long-duration’

Now, the Capacity Investment Scheme is a welcome policy that will provide greater investment certainty to a range of important renewable projects, but much more needs to be done if we’re going to incentivise the development of long-duration storage that we need to maintain reliability.

Short-duration batteries played a role in firming, wind and solar but we cannot afford to put all our eggs in one technology basket. It’s not a choice between batteries and pumped hydro, we need both.

And as more and more coal comes out, we’re going to need much longer duration storage than we’ve been able to operate with today. In terms of cost, the CSIRO’s own work, as you know, shows that as of next year, 2025, the levelised cost of storage in an 8-hour pumped hydro project is forecast to be about 30% cheaper per megawatt-hour than an 8-hour lithium-ion battery.

Snowing 2.0, much criticised, now with a headline cost of AU$12 billion nonetheless offers storage energy of 350GWh at a cost of approximately AU$34 per kilowatt-hour, which is far below the equivalent cost of batteries.

In addition to being more competitive on cost, pumped hydro has a lifespan of 80 to 100 years. Properly maintained, the civil infrastructure, which is where the bulk of the money is, such as the dams and tunnels, have an indefinite economic life. The electromechanical part of the plant can be operated for many decades, 50,60 years and more if properly maintained. So pumped hydro is absolutely a long-term infrastructure.

It can also defer or reduce the need for network upgrades by balancing load profiles and absorbing excess energy, thereby optimising and increasing the effective carrying capacity of existing infrastructure, that assists by minimising the costly and often unpopular transmission upgrades.

I’ll make another point which is very pertinent. You know, when we talk about, a Future Made in Australia, the investment in pumped hydro is overwhelmingly in Australia. I mean, it’s in the civil works. It is in labour and materials sourced locally and while batteries, whether short-duration or long-duration, are almost entirely imported. So if we’re serious about having investment in infrastructure made in Australia, learning to be able to build and rollout extensive pumped hydro effectively is going to be a big part of that.

This issue, by the way is central to the Indian government’s focus on pumped hydro which some of you may be familiar with. Now, there are currently around 292GWh publicly-announced large-scale pumped hydro projects under development in Australia, and this is in addition to Snowy and Kidston, which are [now] being built. Several are looking to repurpose existing mine voids as reservoirs, but most like our projects involving either two new reservoirs being built, or more often, one new reservoir being built on a hill next to an existing one, which is the case with our projects.

‘We need to look further ahead than 2030’

Now, regrettably, Moore’s law does not apply to digging holes and so we need to drive step change in the pace of delivery of pumped hydro projects and we believe that there are four things that need to be done to the Capacity Investment Scheme. I’ll just run through these and I’m very happy to take some questions and discuss them later.

Firstly, we must set the 2035 target for clean dispatchable capacity. Now, the 2030 target is fine, but we have to be looking further than that, and beyond that. The 2035 dispatchable capacity target sends a clear investment signal to long-duration storage developers who are making investment decisions now.

There should be separate tenders for short to medium storage, that is to say less than eight hours and long duration more than eight hours. Some people would argue really long-duration should be 12 hours but let’s leave that debate to another time. In the absence of a capacity market, the current Capacity Investment Scheme designed inherently drives developers to invest in short-duration projects as these represent the strongest business case. They’re commercially attractive as they arbitrage the morning and evening peaks from the middle of the day solar prices.

But as Australia moves to a NEM dominated by renewable energy generation, stressful periods will emerge that are characterised by lengthy winter periods of low solar and wind availability, as a couple of weeks ago, and can get a lot worse than that.

Long-duration energy storage can be supported if the Capacity Investment Scheme would run clean dispatchable CIS tenders for storage with a minimum duration of at least eight hours.

Thirdly, we believe we need to encourage the most competitive long-duration storage bids via support for pre-bid costs for contractual contingencies. Pumped hydro has a lower levelised cost of storage once operational, but it involves significant upfront costs, time and risk to get to the stage where investors can apply to a CIS tender compared to other types of storage projects.

The planning and geotechnical works are complex, development costs will run into the tens of millions of dollars before a developer can be successful in bidding. A large risk taken before a competitive bid can be submitted has the consequence of deterring or slowing pumped hydro developers who are proceeding more cautiously.

Finally, and fourth, align the Capacity Investment Scheme Agreement (CISA) or support to the technology type. The CISA is designed with a contract term of 15 years. Pumped hydro has a lifespan of 100 years. The New South Wales LTESA by contrast has a contract length of 40 years, which is more appropriate.

The UK’s Cap and Floor scheme, that contract scheme is based on the project lifetime depending on the technology. So extending the contract term will provide revenue certainty in the later years of the project life.

‘Every resource in abundance except one’

Now, I believe that unless we get cracking with building the pumped hydro we need, more of it, the energy transition will fail. Storage is the critical requirement, but there seems to be a breezy assumption which Paul Simhauser has exploded with his work that either gas will fill the build, an endless supply of gas peakers, which of course is burning fossil fuel, which is what I thought we were trying to stop doing. Or and/or that batteries will miraculously solve all the problems.

We have the capacity, as Andrew Blaker has demonstrated in his work, that I’m sure you’re all familiar with, and if you’re not, check out his Pumped Hydro Atlas. So, work that was done with ANU where Andy is a professor, that we have so many buildable sites in Australia, that’s not the problem.

We don’t need a lot of water, but the problem is you’ve got to get cracking and build it and it takes time to get the approvals and do the geotechnical work and so forth.

So, we’ve got every resource to deal with this energy transition, every single resource in abundance, except one, and that’s time.

Thank you very much.

Transcribed with minor edits by Andy Colthorpe.

US solar and storage roundup: RWE triple-buy, Origis financing and Appalachian Power 1GW RFP

The firm has acquired 400MW of solar PV and 199MW of standalone battery energy storage system (BESS) assets from developer Galehead Development, spread across three projects in the states of New York, Idaho and Oregon.

The largest of the sites is the 300MWac Cedar Ridge solar PV project in Blaine County, Idaho, co-located with a 150MW/600MWh four-hour duration BESS. This asset is located within the PacifiCorp region and will “provide regional grid support consistent with PacifiCorp’s resource planning forecasts”, RWE said.

In its 2023 Integrated Resource Plan (IRP), Pacificorp – which operates in the Western US – said that it intends to have installed 20GW worth of solar and wind capacity across its markets by 2032.

RWE also acquired the 199MW/796 MWh four-hour duration Remington BESS in Marion County, Oregon. Both Cedar Ridge and Remington expand RWE’s existing footprint in the Pacific Northwest of the US.

The smallest of the three assets RWE acquired is the 100MWac Champlain solar project in Washington County, New York, where RWE said that there is growing electricity demand. The site is in the mid-stages of development, though the company did not confirm when it is expected online.

Appalachian Power seeking over 1GW of new clean energy capacity

Utility Appalachian Power, active in West Virginia, Virginia and Tennessee, is seeking project proposals for 1.1GW of new solar PV, energy storage or wind power capacity.

In three requests for proposals (RFP) issued recently, the company is seeking a total of 1.1GW of solar PV, wind and/or battery energy storage systems (BESS) under different offtake models.

The first RFP seeks 800MW of projects under purchase and sale agreements (PSA). Preferential treatment will be given to projects in Virginia or West Virginia. They must have a minimum capacity of 50MW for solar and wind and 10MW for BESS.

The second RFP seeks 300MW of solar and wind projects via long-term power purchase agreements (PPA) which include any renewable energy certificates associated with a project. Solar projects must have a minimum capacity of 5MW and wind projects must be at least 50MW.

Origis Energy secures US$300 million for solar and storage pipeline

US solar developer Origis Energy has secured a US$300 million corporate financing facility from investment firm KKR.

Proceeds from the facility will support the developer’s US solar and storage development and construction pipeline. It currently has a 12GW portfolio of projects in operation, contracted and in mature development with a further 13GW in the pipeline.

“Demand for renewable energy financing is stronger than ever and we are pleased to support Origis Energy, one of the leading developers in this space,” said Sam Mencoff, Director at KKR.

This is Origis’ latest financing secured this year for the development of projects, with the developer securing a US$136 million construction financing facility last month for a 75MW solar project in Florida. Earlier in the year it signed a US$317 million tax equity agreement with banking company JP Morgan for two projects located in the US states of New Mexico and Mississippi. Once completed, the projects will have a combined installed capacity of 350MW.

To see the original versions of these articles go to our sister site PV Tech.

‘No better due diligence than a developer keeping skin in the game’: BW ESS talks multi-market approach

A small outfit in a global market

“Our approach has been to combine the strength and expertise of BW as an energy infrastructure investor of close to seven decades with local partners who have expertise in local markets. We have a fairly lean team working on energy storage and we lean on the wider BW Group for finance and other resources,” Strømsø says.

BW ESS invests minority stakes in battery energy storage system (BESS) project developers and majority stakes in developers’ projects, who retain a minority stake in those projects.

It entered the storage space with an investment in UK developer Penso Power in 2021, a firm with a pipeline including a 330MWh unit under construction which will be among Europe’s largest when online.

Strømsø: “We started looking at expansion to other markets at the time of the Penso investment, asking ourselves how we could use that presence in the leading UK market to enter others at an earlier stage in the cycle. We weren’t a first mover there; we didn’t have to be, but for others, we have gone in slightly earlier in the cycle as we have the UK experience.”

In Sweden, that market entry is via an investment into, and development partnership with, developer Ingrid Capacity with construction recently launched on the country’s biggest BESS portfolio at over 200MW.

In Italy, BW ESS, Penso and local developer ACL Energy announced a partnership in February 2024 with three projects totalling 395MW, while in Australia, BW ESS has partnered with Gaw Capital Partners with a 1.6GW pipeline entity called Valent Energy, announced a month earlier.

“Partnering with local developers is how you get local knowledge and expertise, and we also look for partners that want to keep skin in the game. There is no better due diligence you can do on a project than finding a developer that wants to keep equity in it,” Strømsø, whose background is in investment banking, adds.

Sweden and Italy

The discussion hones in on Sweden and Italy, part of the next wave of big grid-scale energy storage markets in Europe after the UK and (to a lesser extent) Germany. The two opportunities are very different, however, and necessitated different approaches, Strømsø says.

“There was one leading company and one attractive opportunity in Sweden, and we invested in it. I wouldn’t have invested in other opportunities in the same way. Italy is a much larger market with more opportunities to go around and it’s possible to do partnerships with lots of developers.”

“Sweden is an ancillary services market similar to where the UK was five years ago. Returns are attractive, but it has a high saturation risk, factored into our business case, so we’re future-proofing our sites.

“Italy, meanwhile, is partly an auction-driven market, partly a capacity-driven one, and then a combination of ancillary or wholesale arbitrage markets, creating a business case that is deeper and larger than what we see in Sweden currently. Sweden, in comparison, is quite simple.”

Technology and procurement

Strømsø says BW ESS can get efficient pricing from BESS suppliers via long and close relationships with Tier 1 companies and scaled procurement across geographies, particularly through the experience gained from Penso Power.

On deciding on which provider to go for, he says it depends on the market while not revealing any specific providers it has contracted with.

“Different OEMs are strong in different markets. Even if we wanted to, it wouldn’t make sense to have one partner across the whole portfolio. We’ll always be working with a handful of players. In Australia, for example, none of the Chinese suppliers are big on the BESS side, while in the UK, Sungrow is market-leading.”

In response to a question about China’s providers, he emphasises that BW Group’s presence in Asia – with headquarters in Singapore, Hong Kong and offices throughout the region – does not give BW ESS any special inroads into China. “It’s still a long way from Singapore, and our relationships there are more based on people in our business with experience.”

Financing

As mentioned earlier BW ESS can lean the wider BW Group for finance, both operationally but also in terms of the company’s strong relationships with banks and decades of experience in the space.

“We can bring a certain credibility to the table with banks in some markets. We can talk to them about structures that are being deployed in markets where batteries are recognised as bankable, where there is a consensus about how to finance these assets and use those frameworks to arrive at attractive financing deals for our projects,” Strømsø says.

In Sweden, BW ESS is starting to build the projects using its own equity before financing them soon after their commercial operation date (COD). Australia is moving towards merchant financing of projects that have until now been heavily reliant on direct subsidies or long-term tolling agreements.

Italy, again, is more complicated: “There, it will depend on the revenue model you end up with, like whether it gets a 15-year contract with the MACSE auction. There are a number of different ways projects will be financed and getting the best cost of financing is going to be really important.”

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

Chile opens land bidding for 13GWh of storage projects in Northern regions

During president Gabriel Boric’s administration, the country has awarded 32 licenses to renewable projects, which are expected to add 6.5GW of capacity, said the minister of National Assets, Marcela Sandoval.

“We hope to achieve an equally successful situation in the case of this application to promote energy storage in our country,” said Sandoval.

The bidding opened on 13 May is applications are only open until Thursday 23 May, in two days’ time.

Presented in November, the ‘Promotion Plan for the Development of Storage Systems’ aims to allocate publicly owned land for projects starting operations in 2026. Projects must be operational by 30 June 2027, while the land license will last up to 40 years.

Developers will be able to apply for the direct allocation of land for storage projects in areas defined in partnership with the Coordinador Eléctrico Naciona (CEN), an independent body which helps to coordinate the electricity system in Chile.

Standalone projects have started to emerge more, as is the example of this programme, with developers and independent power producers adding capacity as Chile decommissions its remaining coal capacity. Last month, utility Engie announced it was to build a 116MW/660MWh battery energy system storage at the former site of a coal plant it operated in the northern region of Antofagasta.

Moreover, energy storage is being added to existing solar PV projects to reduce high levels of solar curtailment and negative pricing.

For more information regarding the process and how to participate, you can access Chile’s Ministry of Energy page here (in Spanish).

Energy-Storage.news’ publisher Solar Media will host the 3rd annual Energy Storage Summit Latin America in Santiago, Chile, 15-16 October 2024. This year’s events bring together Latin America’s leading investors, policymakers, developers, utilities, network operators, EPCs and more all in one place to discuss the landscape of energy storage in the region. Visit the official site for more info.

Sungrow inks 760MWh BESS, inverter partnership for AMAALA off-grid project in Saudi Arabia

The solar and storage project is being developed and led by France-headquartered utility and independent power producer (IPP) EDF Group and UAE state-owned renewable IPP Masdar for customer Red Sea Global.

The project will also feature a 10MW ‘demonstration platform’ which will leverage advanced simulation models such as Hil semi-physical simulation, DigSilent, and PSCAD to ensure system reliability in different scenarios.

Red Sea Global is a Saudi state-owned real estate developer responsible for several huge flagship infrastructure projects, including AMAALA, as the country tries to diversify away from a fossil fuel economy. The AMAALA tourism project is set to be completed in 2027 and Sungrow’s project would presumably need to be online by then.

In December 2022, Sungrow entered into a memorandum of understanding (MOU) with local IPP ACWA Power for a 536MW/600MWh BESS at one of Red Sea Global’s other huge projects, Neom, in 2022, with a firm contract signed nine months later.

Neom is a linear urban development intended to cut through miles of desert all the way to the sea, but was recently scaled back from 170km to just 2.4km.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

‘Let’s get on with it’: Overcoming roadblocks to achieve Australia’s energy storage ambitions

Bashir said that Australia has taken “long strides” forward since the Labor Party took power in 2022, in an interview with Energy-Storage.news.

After setting emissions reduction and renewable energy targets, the government has also introduced the Capacity Investment Scheme (CIS) tenders, major procurements of both variable and dispatchable renewable energy that have been expanded to support decarbonisation agendas at both national and state level.

Prime Minister Anthony Albanese’s party has also committed to building out Australia’s transmission infrastructure via the Rewiring the Nation initiative.

“All of these policies are great, they provide the certainty that we didn’t have in the past to get on with things,” Bashir said.

At the same time, “there is no shortage of private investor appetite” to get involved in the renewable energy, energy storage and even transmission sectors in Australia.

“The problems are when you get on the ground. To get these projects through the planning and environmental approval processes, commissioning with the Australian Energy Market Operator (AEMO) and some of these ‘nuts and bolts’ [issues] is when things get much harder, to get projects through,” Bashir said.

“So from a big picture perspective, there’s a lot of talk about Australia having ambitions to be an energy superpower, and that is absolutely something that Australia can do and should do.

“We’ve got the land, we’ve got the critical minerals, we’ve got all the things that basically would make us an Australian energy superpower. But our plans don’t reflect that. Our current plans are very conservative.”

AEMO’s regularly published Integrated System Plan (ISP) has multiple scenario pathways, and its plan for the National Electricity Market (NEM) that is currently being followed is the Step Change scenario, which Bashir describes again as “conservative”.

Step Change would enable Australia to meet coal plant closure timelines and meet tight reliability standards for electricity supply but lacks the ambition the country would need to become that “energy superpower,” Bashir argued.

One of Australia’s biggest coal power plants, Eraring, in New South Wales, was originally scheduled for closure in 2030, but its owner, Origin Energy, brought that forward to 2025 as it becomes increasingly uneconomic to maintain the 42-year-old asset.

However, building the renewable energy and storage infrastructure that could replace Eraring has proven difficult, with the exception of the flagship Waratah Super Battery, given what Bashir calls “roadblocks” around obtaining planning approvals and meeting AEMO commissioning requirements.

“These types of roadblocks are fairly and squarely in the hands of government to expedite and then make sure that we’re not just building to the timeline to close power stations (which we’re failing miserably as a result) but also to have a bit more ambition to be the energy superpower we actually can be.”

The good news is that Australia has the policy mechanisms in place and the technologies available to achieve that more ambitious goal.

“We just need to get on with it,” Bashir said.

Read an extract of Stephanie Bashir’s article, ‘Australia needs renewables, transmission and lots of storage to quit fossil fuels,’ which was published in Vol.37 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries. ESN Premium subscribers can read the journal in full as part of their subscription.

Architecture of Australia’s Capacity Investment Scheme in focus

The Capacity Investment Scheme (CIS) was a major talking point throughout today’s event. To kick things off, Salim Mazouz from Australia’s government Department of Climate Change, Energy, the Environment and Water (DCEEW) gave a keynote address about its design and aims.

The CIS will incentivise the deployment of 32GW of clean energy, including 9GW of firm dispatchable renewables and 23GW of variable generation—potentially also including hybrid projects in the latter.

It is “designed to reduce price risk and provide investors with a little bit more certainty,” said Mazouz, who heads up DCEEW’s CIS Branch.

At the same time, the scheme has been expanded to include bilateral Renewable Energy Transformation Agreements (RETAs) between Australia’s Commonwealth government and its counterparts at state and territory level, aimed at helping remove barriers to deployment of ever-greater clean energy capacity.

The Commonwealth takes on the downside when prices drop low, and conversely shares in revenues when prices go above an agreed ceiling, in what Mazouz said could be thought of as an “equilibrating mechanism”.

“When you think about it from the taxpayer’s perspective, if we’re successful, we manage to push in a lot of renewables, prices come down and we’ve got a [more] orderly transition than we would otherwise have,” Mazouz said.

“When the capacity investment scheme costs the taxpayer a little bit more, but we’ve been successful, and energy prices are low, should this orderly transition happen and prices end up on the higher end of the scale, well, then taxpayers get money back from the system.”

The expanded CIS has been built upon the foundations of two pilot tenders which were focused on energy storage, including the first in New South Wales (NSW) which resulted in awards for six large-scale battery energy storage system (BESS) projects and one virtual power plant (VPP), and an ongoing pilot scheme for Victoria and South Australia.

“We received an overwhelming response to this tender, demonstrating the depth and vibrancy of the energy storage industry in Australia,” Salim Mazouz said.

Stay tuned to Energy-Storage.news for more coverage of the inaugural Energy Storage Summit Australia in the coming days and weeks…