Photon’s proposal was for a 185MW solar PV project and a 50MW/5,000MWh energy storage system using its thermal energy storage technology, which would be able to deliver eight hours of solar PV a day, 16 hours of stored renewable power via daily cycling plus 84 hours of backup power.

The RFI was seeking project proposals for a long-term renewable power purchase agreement (PPA), and Photon said its proposal could have been the first project of its kind in California.

The proposal was recently notified it would not be progressed to further stages of the RFI, which is specified for projects to be online by 2030, but Photon Vault chief commercial officer (CCO) John Langhus told Energy-Storage.news that conversations with other customers are ongoing and gave us more details on the tech.

“Ours is a thermal energy storage system, storing energy as heat and dispatching as electricity. There are three core innovations to our technology, each patented. The first is our hybrid charging process, by which we charge the system first with electricity, and then in a second stage, with direct heat. The rationale for that is primarily economic,” he said.

“The electricity stage is basically a refrigeration cycle during which we make ice in our patented ice tanks. It loses about 50% of the energy during that stage. Our heat comes from simple, passive low-cost solar thermal (not PV) collectors that is stored in our patented sand bricks. So that heat is way cheaper than the electricity and in particular, has no day-to-day cost at all – it is 100% capex.”

By replacing its lost electricity with free heat each cycle, the technology ends up with as much electricity or more during discharge than it brought in during charge, Langhus claimed.

“We call this our eRTE, our electrical-to-electrical efficiency. This high eRTE is very powerful for long duration storage that includes daily cycling. Because we don’t need a big spread between charge and discharge price.”

Photon Vault CEO Dr. Kent McCormick added: “Batteries do a great job of profiting off the daily price swings that happen when the sun stops shining and the wind stops blowing in places like California and Texas where there are lots of renewables now. But a couple of hours per day of profit-taking doesn’t really get us any closer to a well-balanced utility grid, powered mostly by renewable power.”

The firm is looking to deploy systems using its basic 5MW building blocks starting in 2026/27, and is positioning itself as a lower-cost alternative to buying power from new combined cycle gas turbine plants. However, its first system may harvest industrial heat rather than self-generating heat with solar thermal energy collectors like its RFI project proposed.

The firm has raised US$3.5 million-plus to-date with backers including Houston Angel Network, deep tech VC firm rpv, law firm Wilson Sonsini and a strategic investor called Conifer Infrastructure Partners.

Australia: An ‘exciting and unique’ BESS market, says Waratah Super Battery provider Powin

That was a big jump from the 1.4GW/2GWh in construction a year earlier, speaking to a growth in average duration as well as seeing the number of projects grow.

The biggest BESS in construction as 2023 ended was the Waratah Super Battery, a government-backed project in New South Wales (NSW) which is expected online in 2025.

US system integrator and manufacturer Powin is delivering the BESS equipment to Waratah Super Battery for developer Akaysha Energy, and the system is designed as a “giant shock absorber for the grid,” to quote the NSW government’s own description.

That role will be played through a System Integrity Protection Scheme (SIPS) contract, which ensures that it will be available to protect the network from major disruptions in electricity supply, essentially providing a buffer of power.

Danny Lu, Powin’s executive vice president, says the company sees great potential in the Australian market and is excited to be there.

Working on such a major project, and working within the often unique structures and dynamics of the country’s electricity sector does come with some challenges too, Lu explains.

Progress report

The Super Battery’s 477-tonne high-voltage transformer arrived onsite early this year, and it made mainstream news headlines in the region given its sheer scale. Lu says this milestone is a significant part of a construction and commissioning process that is running on time.

“As of now, the high-voltage transformer has been delivered, most of the power conversion systems (PCS) have been delivered, and the battery stacks and collection segments are in the process of being delivered.

We’re still on track to meet the delivery dates, and we’ll commission the system block-by-block. There’ll be a lot of ‘parallel’ work happening. As the last part of the site is being finished, we will commission some of the first parts of the site.

We want to really get ahead of the commissioning process, so we’ve established these tests labs in Tualatin (Oregon, US) as well as locally in New South Wales, to be able to simulate the tests that we’re going to be completing onsite. We want to be able to get as much done in a lab setting using real equipment, as well as the models that have been approved by the Australian Energy Market Operator (AEMO) to be able to expedite the commissioning process.”

‘Different and demanding’ grid connection process

In April, Energy-Storage.news reported that the project had received its key Generator Performance Standard (GPS) approval from AEMO. That means AEMO determined the Super Battery’s design met performance requirements for transmission-connected generation or storage. Akaysha CEO Nick Carter noted that getting approval took around a year in total, and various sources have said that connecting storage to the grid in Australia is a unique process and Danny Lu agrees there are big differences from grid connection standards and codes in other markets.

“It’s very different, but it’s also demanding. AEMO is trying to protect the grid’s stability and integrity. Certain parts of Australia’s grid are fairly congested, so the Generator Performance Standard (GPS) aims to ensure that these systems and the new generation and power being deployed onto the grid do not harm the grid in any way.

Recently, they’ve also announced system strength measures, where all new storage needs to be grid-forming [capable of providing inertia and other stability services] to be interconnected to the grid without a large penalty. I think that adds a bit of complexity to what was already complex, but I think it’s necessary for them to accomplish their goals of having a hardened and reliable grid for the future.”

By the time Waratah was contracted, the announcement (which happened about a year ago) still had not been made. So, we were able to grandfather in the grid-following functionality, but we are planning on switching it over to grid-forming, probably within 12 to 24 months of commissioning.

At Ulinda Park, [Powin’s other project for Akaysha, a 150MW/300MWh system in Queensland], interconnection was also applied for prior to the announcement, but both of these are grid-forming compatible, and all the hardware can be grid-forming. We just need to go through the process with AEMO again to approve the grid-forming version of the models.

I think Australia is ahead of its time in mandating this. Australia is definitely a leader in terms of thinking about its grid holistically and trying to establish solutions for problems that may arise in the future. They’re thinking ahead.”

Local content strategy helped get transformer onsite, on time

Regular readers will know that the battery supply chain crunch the industry experienced for much of the pandemic, with lithium prices rising and peaking in 2022, has thankfully eased.

However, long lead time equipment has become a tricky supply chain conversation in its stead, with transformers in high demand and delivery times extending to several times what might have been seen in years past. Lu says Akaysha’s strategy of buying local helped mitigate the procurement challenges Waratah Super Battery might otherwise have faced.

“Transformers are definitely a bottleneck for many renewable energy projects being installed in the next few years.

I think Akaysha really wanted to utilise a local content strategy for the transformers. So, they’re utilising a local Australian vendor named Wilson Transformer Company, which was able to provide them with a priority production slot for the Waratah project, because it was considered an infrastructure security type of project. Having that local supplier of transformers helped with the global lead time issues that everybody has been seeing in the transformer market.

All medium- and high-voltage transformers were manufactured in Australia for the Waratah project.”

SIPS contract

The SIPS contract has been signed with EnergyCo, which is a NSW authority tasked with implementing the state’s Electricity Infrastructure Roadmap. Akaysha Energy won its contract through a competitive solicitation, agreeing to provide 700MW/1,400MWh of shock-absorbing power and energy from the 850MW/1,680MWh BESS.

“The System Integrity Protection Scheme means a project needs to be designed for the highest availability. We need to provide close to 100% fully guaranteed availability on the 700MW, but we’ve oversized the project to 850MW to be able to provide some level of redundancy.

If certain parts of the PCSs [fail], or if a transformer blows, things that you cannot predict happen on the project, we would have to see a large percentage of the project fail to be below that 700MW requirement.

We’ve designed, in partnership with Akaysha, to oversize the power of the project, and then be able to have some level of cushion or tolerance to ensure that the 700MW is consistently delivered. There are large penalties associated with missing these signals, so we wanted to ensure protection for Akaysha as well as Powin to have that redundancy built in.

Rendering of Waratah Super Battery, which got its SIPS ‘shock absorber’ contract through a competitive solicitation. Image: Powin Energy.

The added benefit of the oversize is that it allows you to have some protection over SIPS, but it also allows you during non-SIPS times, to have some additional power to make additional revenues for the project.

[In terms of the 2-hour duration] The SIPS signals will come once every 30 minutes if needed and a maximum of four times in a row, which gets you to the two hours (1,400MWh).”

Some other unique or unusual aspects of the Australian market

Lu says that in addition to the two projects it has already secured and announced with Akaysha Energy, Powin has a number of other projects in Australia that are at late stages of GPS certification processes.

Customer names cannot be revealed just yet, but they signify the “exciting” potential of the Australian market, he says, but companies aiming to join Powin in tapping the opportunities need to be ready to face a steep learning curve based on its unique qualities.

“There’s a lot of quirks to the Australian market. GPS is just one of them, but we’ve also had to go through a lot of learnings in terms of product design. We needed to think about bushfire compliance and design some special webbing within the product. We’ve also needed to go through AS3000, a local wiring protocol, or standard.

So, there are a lot of different things that companies need to do to get ready to come to Australia. In addition to those product-style compliances, we’ve hired over 20 people locally in Australia to really support our projects and allow our customers to feel like we’re supporting them in their timezone. We’re investing locally, and we’re creating a team that is widely capable of decision-making and problem-solving within the local country.”

This week, Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Don’t let noise be a drain on BESS developments

In these cases, acoustical consultants worldwide will be relied upon to mitigate the noise from BESS installations so that they can be properly sited per local regulations, and to reduce the risk of community annoyance. BESS sound is of particular importance because these stations can be located within communities very close to residential properties.

Cautionary tales can be found in the haste to deploy data centre and bitcoin mining facilities, where in some jurisdictions without specific noise regulations there have been instances of intense public negativity surrounding the industrial noise produced by the facility.

Battery energy storage facilities are still an emerging piece of our electrical grid. A few of the key items of equipment in BESS installations are relatively new to the market, and information on the amount of sound they generate is not always available. Yet, the developer of a site is often still beholden to meeting noise limits for the nearby community. The equipment is not very different from that used in substation facilities or building heating ventilation and air conditioning systems.

However, the manufacturers of equipment in these more mature markets have had the time to invest in quieter products, and better documentation of their sound emissions. The manufacturers of BESS equipment will eventually need to catch up to this level of acoustical sophistication so that the risk of noise issues can be managed.

As BESS technology proliferates, it will increasingly be deployed closer to populations as more remote plots of land become increasingly less available, making the topic of noise and noise mitigation highly relevant. Noise is a particular issue in population-dense geographies in Europe but increasingly in the US, Australia and elsewhere too.

Noise sources

You might be thinking: “what makes sound at a battery energy storage facility?” The main noise sources from a BESS facility are:

Cooling systems

Like any electronic device, grid scale battery systems operate most optimally and safely at an ideal temperature and humidity. Therefore, various air or liquid cooling and heating systems are used. Sound from inlet and outlet airflow vents, as well as fans and pumps are emitted from each battery enclosure. The sounds from these systems are like rooftop heating ventilation and cooling units in residential and commercial buildings.

Inverters

Sound level meter near an inverter. Image: Acentech

Inverters convert electricity from direct current (DC) in the batteries to alternating current (AC) that we use in our homes. The process also happens in reverse when AC electricity is used to charge the batteries. A small amount of energy is lost in the form of heat with this conversion, so cooling is needed to prevent overheating. This is usually accomplished with air-cooled fans that produce some noise.

The process of converting DC into AC power requires very fast switches which change the polarity (or direction of electrical flow). In the United States AC power cycles 60 times per second (or 60 hertz), so the switches must activate twice per electrical cycle. This process produces tonal sound at twice the electrical line frequency (120 hertz), as well as its harmonics (240, 360, 480 hertz and higher).

In many parts of the world the AC power cycles 50 times per second (50 hertz), so the harmonics are slightly different (100, 200, 300, 400, hertz). The nature of this sound is typically heard as a buzz. Tonal noise is often much more noticeable in the presence of other background sounds, which can be particularly annoying to the people hearing it.

Transformers

Sound level meter near a transformer. Image: Acentech

The sound that most people think of from transformers is a distinctive “hum”. If you’ve ever been around an outdoor substation or a building’s transformer vault, you may be familiar with this sound. Transformers are used to change AC voltages to step up or step down in the level. Everyone should be familiar with the cylindrical transformers on telephone poles that lower the voltage from the high voltage transmission lines to a level that is safe for use in homes and businesses.

The transformers at a BESS facility are much larger than those you see on telephone poles.

There are three sources of noise from within the transformer: (1) core noise, (2) coil noise, and (3) fan noise. The core and coil noise are caused by electromagnetic forces which occur two times for every cycle of AC power. Like the inverters, this results in a 120-hertz or 100-hertz primary sound source, along with its harmonics. The third source of sound is from cooling fans mounted outside the transformer, but some transformers do not have fans and instead have passive radiant cooling fins. This is a quieter option.

Mitigation

While BESS facilities are relatively new developments, each of these noise sources are common among many other industries that have been around for a very long time. Therefore, we have the tools necessary to design a BESS facility with the right noise control treatments so that it can be a good noise neighbor, just like any other industrial facility. To do that, we generally follow these steps:

Understand the noise criteria for the site

Thousands of cities, towns, and jurisdictions around the world have documented noise ordinances that are aimed at limiting industrial noise emissions to residential areas. Their level of complexity and clarity can vary a lot, with some giving very specific details on the exact noise metrics and conditions that must be met, to just a single decibel number limit or even simply a qualitative description pertaining to “peaceful enjoyment” of one’s property. In some locations there may not even be a noise ordinance pertaining to a BESS facility. Even if that is the case, it could be appropriate for BESS developers to at least consider their impact on neighbors and their potential negative response to the project, even if there is no legal mandate to abate noise.

Many noise criteria impose a penalty for the presence of tonal noise, which is a sound character generated by many pieces of BESS equipment like inverters and transformers. A tonal sound is one composed of a single frequency component, like a whistle or hum, and can be particularly challenging to fully mitigate.

Model the sound from the BESS facility to the community

During the design process for a BESS facility, an acoustical consultant will identify all the significant sound sources from the various equipment. Vendors provide information regarding their product’s noise emissions, and sometimes this information is obtained from field measurements at existing installations. This data will be used to generate a model of the total facility’s sound emitted at the property line and at sensitive receptors such as homes. The acoustical model includes these equipment sound sources along with topographical features of the surrounding area. The results of this modeling evaluation will be compared to relevant noise limits for the project. The results of an example BESS sound modeling analysis are shown in the figure below.

A BESS sound modelling graphic. Image: Acentech.

As mentioned earlier, not all BESS equipment manufacturers have data on the amount of sound their products make. A single BESS project could have many different suppliers, which can make accurate modeling of the total facility noise levels challenging if there is missing information. There are American and international standards for measuring the sound emissions of products used in BESS facilities. The National Electrical Manufacturers Association (NEMA) standard publishes limits for average audible sound levels from electrical equipment to achieve a NEMA rating.

The International Electrotechnical Commission (IEC), and The Institute of Electrical and Electronics Engineers Standards Association (IEEE) also have standards for quantifying the sound output of various electrical equipment. For the cooling systems there are standards published by the Air-Conditioning Heating and Refrigeration Institute (AHRI), American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE), American National Standards Institute (ANSI), and the International Standards Organization (ISO). These standards can also be supplemented with field measured sound data at existing BESS facilities.

Measure the site ambient sound levels

Many noise ordinances, such as the Massachusetts Department of Environmental Protection’s noise policy, stipulate that the facility sound levels must not exceed a threshold above ambient conditions. Those ambient sound levels need to be established before the project is installed, or during a time when the facility is completely shut down. It is common to measure ambient sound conditions for a week or more during relatively calm weather to obtain a full characterisation of the sound environment at a site. Because the noise limits are relative to the ambient site conditions, a quiet area will require a lower limit than an already noisy area.

Noise ordinances in other places often prescribe a fixed limit for noise that may be produced by a facility. This may not necessarily need a site study for demonstrating compliance, but ambient noise measurements are usually recommended to help put the results of modeling efforts into context of the existing environment.

Add noise control measures

Designing noise control measures for a BESS facility is an iterative process. If the initial design and layout of the noise producing equipment is expected to exceed the relevant noise limits for the project, then an acoustical consultant will need to devise solutions to lower the predicted sound emissions from the total facility. Solutions to noise problems can be found by considering a source/path/receiver model.

Source

The first action should be to consider how the noise levels can be lowered at their source. Lowering sound at the source of the equipment is often the most preferable way to mitigate noise issues for a given receiver. This can be achieved by selecting quieter products. There is certainly an opportunity for BESS equipment manufacturers to differentiate themselves from their competitors by offering lower noise alternatives. Other source mitigations can include surrounding the equipment in an acoustical enclosure or wrap when possible, or quieting fans and air ducts with silencers or louvers. Orientation of the BESS equipment within the grid of systems can also be considered so that the loudest equipment faces away from a sensitive receptor.

Path

The second action should be to consider the path sound makes when traveling between its source and a sensitive receiver. Sometimes the easiest mitigation is to simply move the loudest noise sources farther away from the nearest property line or sensitive receptor. This would change the length of the path from source to receiver and result in lower sound levels at the receiver. However, BESS facilities often place multiple large battery systems in a grid to fit as many of them in an area as possible. The most common form of noise control is a noise barrier (or wall) of appropriate height. This is path mitigation because it places a barrier between the source and receiver to block the direct path of sound.

Receiver

Finally, one should consider how to reduce noise levels at sensitive receivers. An example of mitigating noise at the receiver would be providing upgraded windows to affected homeowners. This is a strategy often applied near airports. While this may provide some goodwill to neighbors of BESS projects, it isn’t practical, because the noise regulations specify sound limits at the receiver regardless of whether there is a building present.

These various mitigations are then added to the acoustical model of the facility and surrounding area. The process is complete when the predicted sound levels are compliant with the relevant noise limits for the project.

Post-construction sound measurements

Sometimes it is appropriate to measure the sound levels at sensitive receptors after a facility is fully completed to demonstrate compliance with the noise criteria for the site. This is typically done at night when the ambient sound is at a minimum and may include turning all BESS equipment on and off for periods of time to fully characterise the total facility sound emissions.

The equipment used for measuring environmental sound is required to have accuracy standards as defined by relevant international standards for measurement equipment. Sound level meters are classified by standards that define a wide range of accuracy, performance, and calibration specifications that the microphones in our cellphones do not meet. Failure to use the appropriate sound measurement equipment could discredit reported values in a regulatory or litigious situation.

Sound level meter near a solar farm. Image: Acentech.

Don’t take noise for granted

When planning for a battery energy storage site, it is important to enlist the help of acoustical consultants to navigate the regulatory process surrounding noise and ensure the right controls are implemented. When this is done in the initial design and planning of a BESS facility it can help avoid future problems with permitting and with public relations. With a thoughtful approach and effective noise control treatments, BESS facilities can continue to be added to our electrical grids without causing undue noise for anyone living close by.

About the author

Ethan Brush is a Principal at Acentech, an acoustics, noise, vibration, and technology consulting firm. With over 18 years of engineering and project management experience in structural dynamics and acoustics, he directs teams of engineers and technical specialists in the areas of environmental noise and vibration testing, analysis and design of mitigation systems, and real-time remote noise and vibration monitoring for numerous industries. He serves as the Energy, Environmental and Transportation Co-Market Leader at Acentech responsible for marketing strategy, client development, and industry thought leadership.

This article is an expanded version of one originally posted by Acentech.

Saudi oil giant Aramco and thermal energy storage firm Rondo in GW-scale deployment MOU

Rondo’s Heat Battery is a refractory brick that can be heated to 1500°C, or 2732°F, and retains the heat to then be used either in heat form or for conversion back to electricity.

Aramco is the world’s largest oil producer, with oil and gas fields and refineries in and around Saudi Arabia and facilities elsewhere.

Aramco and Rondo also intend to assess potential deployments of the technology at the oil firm’s facilities worldwide, including for use cases around hydrogen production and carbon capture, the announcement said.

It follows Aramco, which is 90% owned by the Saudi Arabia government, taking part in a US$60 million investment round into Rondo Energy in August last year.

Industrial emissions are a massive portion of global greenhouse gas (GHG) emissions, as much as 36% according to Rondo at the time of its fundraising. Much of the emissions come from huge demands for industrial heat.

“Aramco has stated its ambitions to achieve Net Zero Scope 1 and Scope 2 operational greenhouse gas emissions by 2050 across its wholly owned and operated assets, and sees opportunities to build substantial lower-carbon new energy business,” said Ali Al-Meshari, Aramco senior VP of technology, oversight & coordination.

The first large-scale project, 2MWh, using Rondo’s technology came online in California in March 2023.

Aramco has also invested in other novel energy storage companies including long-duration energy storage (LDES) carbon-oxygen battery firm Noon Energy in January 2023 and Energy Vault, the company known for its gravity energy storage technology, in June 2021.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

Entech and Eiffage partner to build transmission-connected BESS projects in France

The JV is targeting BESS projects connected to the 50-400kV high-voltage network in France and the pair are already involved in several projects, with upstream design work at a relatively advanced stage, they said. The target market in France is worth over €1 billion (US$1.08 billion), the announcement added.

Eiffage Énergie Systèmes will own 60% of the entity while Entech will own 40%, but governance will be equally shared. Eiffage Énergie Systèmes is focued on the electrical, industrial, HVAC and energy systems and facility industry, while the wider group is active in all types of construction markets.

Both JV companies already have a presence in the energy storage market. Entech last year won a public tender for 50MWh of BESS projects in France with public utilities in Isère and Savoie in the Auvergne-Rhône-Alpes region, and Loiret and Val d’Oise near Paris, as reported by Energy-Storage.news.

Two years ago, we reported on a BESS project in Ivory Coast (Côte d’Ivoire) that Eiffage Énergie Systèmes was building for state-owned electricity management group CI-Energies as well as a ship-to-shore BESS solution at a port in Toulon, southern France (via a separate subsidiary).

Further upstream, the Eiffage group is also part of the consortium building a lithium-ion gigafactory in France for Automotive Cells Company (ACC), a JV between automotive groups Stellantis and Mercedes-Benz and battery technology firm Saft (itself part of oil and gas major TotalEnergies).

BESS projects directly connected to high-voltage transmission networks are less common than ones connected to lower-voltage distribution networks, but have grown in prominence.

The construction, software and infrastructure requirements to connect to the high-voltage network may be higher, but can bring greater visibility in system operator control rooms and a more reliable grid connection than distribution network projects.

Romania’s largest BESS operator: ‘showing a viable business with local technologies’

The project made headlines for using mostly locally produced technology with battery equipment from local battery manufacturer and system integrator Prime Batteries. Monsson’s head of M&A, Sebastian Enache, and energy storage project manager, Mihaela Popescu, discussed the project, the technology choice, and the wider Romanian market.

Entry into energy storage and designing in-house technology

We started by asking Enache and Popescu how Monsson, a renewable developer, operator and energy trader, got into the energy storage market, both as a project owner and technology developer.

“We are developing around 5,000MW of renewables and the question of how to improve the revenues for renewables kept coming up. Our R&D team was looking at energy storage for the last four years, and the price of the technology came down, and it became available at scale,” Enache said.

“We looked for an energy storage solution for our renewables but couldn’t find ones that were flexible enough for renewables and the day-ahead and intraday market requirements on the software side and also in terms of operational maintenance. Most solutions were containerised, and we wanted to have easy access for maintenance and operation.”

Monsson, therefore, designed its own energy storage solution—which can use any battery producer—and Prime Batteries manufactured the battery technology for the project, including the battery cells, via a framework agreement, Enache claimed. Monsson also designed the software for the system to operate in the energy market and holds a patent for a specific type of BESS water cooling system.

The BESS project is hybridised with a 35MW PV, 50MW wind plant and is primarily optimising the dispatch of those renewables to increase revenues for the overall power plant. The 24MWh deployment is the pilot phase of a larger 216MWh deployment there, which would be the largest in Southeast Europe, Enache said.

‘Made in Europe’

We then asked him about how the technology procurement for the project worked and whether Prime’s solution was more expensive than buying BESS from China.

Enache: “We had a technological tender for our solution, and Prime was the one able to integrate their technology into ours. It wasn’t about the price, it was about showing we can have a viable business with European technologies. The price might have been slightly higher, but this way, the money is being spent in Europe.”

“I have a strong opinion on supporting European producers. The market should still be a free one but there is a middle ground between using local and foreign technology.”

Sweden and Northvolt link

Building BESS projects at scale with local technology will clearly need manufacturing capacity beyond what Prime alone can provide, and Enache alluded to the possibility of using other manufacturers.

“If we do a project in Romania we can use Prime batteries, if we do it in Sweden we can use Northvolt batteries. We wanted to have a solution with 99.9% European components,” Enache added.

Northvolt is the large Sweden-headquartered firm building numerous battery gigafactory, component manufacturing, BESS and recycling facilities across Europe and also North America.

Sweden’s ambassador to Romania attended the 24MWh project’s inauguration ceremony. Enache explained that the company has links to Sweden via operation and maintenance (O&M) contracts on renewable assets there. “With our Swedish partners, we are looking at implementing similar solutions in Sweden, probably with locally produced batteries.”

Romanian market

Enache said that Romania needs to deploy around 2.5GWh of BESS to accommodate its renewables pipeline, that this was “very easy to implement by 2030,” and that the Romanian energy environment is “in a good place to accommodate such investments.”

Monsson also has a separate 6MW standalone BESS project, though said that the business case is not quite as proven as for a co-located or hybridised one. “Everyone is currently testing the market to see what kind of revenues you can generate via a standalone project.”

Like many other European countries, Romania is deploying funds from the EU-wide Recovery and Resilience programme to support energy storage and other clean energy technologies.

The Romanian government relaunched a competitive solicitation for grants towards 240MW/480MWh of BESS though Enache and Mihaela Popescu, energy storage project manager for Monsson, said that other technologies would most likely take priority for now, and a large-scale storage one would only be properly tendered in late 2024.

Enache claimed that Romania could become the most advanced energy storage market in Europe. Others have said the same about the wider Central and Eastern Europe (CEE) region, where utility-scale BESS deployments are set to grow substantially in the coming years from a negligible base.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Central Eastern Europe on 24-25 September this year in Warsaw, Poland. This event will bring together the region’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place, as the region readies itself for storage to take off. Visit the official site for more info.

UK system operator reassessing ‘outdated’ Capacity Market de-rating factors for storage

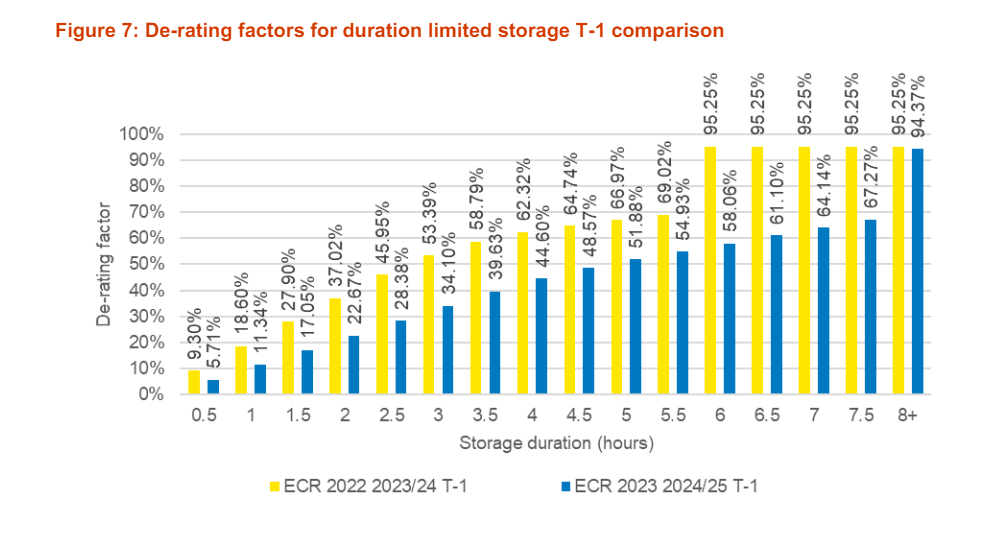

The Capacity Market pays resources for being available for energy dispatch during grid stress events and tariffs are therefore weighted depending on how ‘reliable’ a resource is seen to be in delivering that stand-by capacity. The percentage of the headline auction tariff that a technology type receives is its ‘de-rating factor’.

Thermal gas plants and hydro get the highest at 90-95% while solar and wind get the lowest at 5-12%, reflecting their variable nature. Energy storage’s de-rating factor depends on its duration, with 0.5-hour systems getting around 4-5% with a phased increase to around 95% for 8-hour and more systems.

However, most battery energy storage system (BESS) projects being developed in the UK today are 2-hour and 4-hour systems which, if they bid in to the Capacity Market auction reflecting that, would only get 19-22% and 30-40% of the tariff respectively (the figures are different for the T-1 and T-4, and shown in full in charts at the bottom of this article).

Most systems online today are 1-hour and 2-hour systems, but operators can bid in projects at a higher duration than the whole systems’ true duration, explained further down.

ESO looking at de-rating factors for energy storage

The Electricity System Operator (ESO) recently discussed the topic in a ‘Storage de-rating factors methodology review’ webinar, which developer-operator Field’s technical director Chris Wickins characterised as an admission that the figures weren’t fairly reflecting the value of energy storage.

“National Grid is looking at de-rating factors for energy storage in the capacity market and has proposed increasing them in future auctions. This is because, having looked more closely at the energy storage that has been procured so far, they have realised that the assets as a whole are more useful than current de-rating factors would imply,” Wickins told Energy-Storage.news.

EV infrastructure and BESS developer-operator Zenobe’s global director of network infrastructure Semih Oztreves similarly said, via written comments: “We’re calling for DESNZ (Department for Energy Security and Net Zero) and ESO to introduce a battery storage-specific methodology for calculating technical availability.”

“The current de-rating methodology is outdated having been introduced in 2014, long before battery storage was an established technology in the UK electricity system. The UK now has around 3GW of large-scale electricity storage, so it’s important the methodology is updated to reflect storage’s important role of ensuring national security of supply.”

In response to a request for comment, National Grid ESO pointed out that the current method was introduced in 2018 and that the organisation periodically reviews its modelling assumptions and methods in light of market development.

The ESO spokesperson added that it is DESNZ that sets policy direction for the Capacity Market and is responsible for changes to its rules and regulations, and commissions a panel to scrutinise the modelling with a report published annually.

Oztreves said that energy storage operators are not being paid adequately for their contributions in the Capacity Market and that unfair de-ratings push up the overall clearing price of the auction, increasing prices for consumers.

Suggested improvements

As mentioned earlier, operators can bid in at a higher duration than what their project is in reality, by bidding in a lower MW power capacity than their nameplate output. Nick Provost, commercial manager for developer Balance Power, suggested a way to get around this as well as make investment in long-duration energy storage more attractive.

“A good compromise that addresses both challenges would be to make bidders in the Capacity Market auction provide both the maximum amount of energy a project can store (MWh) and how quickly it can release it (MW),” Provost said.

“This would allow the Capacity Market to reward projects that genuinely store energy for longer periods and offer up the incentives needed to stimulate the procurement of these systems that provide important stability to the energy system.”

Field’s Wickins said that moving from a self-dispatch system, where operators are responsible for and control their dispatch in response to stress event notifications, to one of central dispatch where ESO or an equivalent delivery body controls the entire fleet of energy storage resources, would improve storage’s utility.

“At Field we think the key thing for energy storage to be utilised to its full potential to provide support in a system stress event, is giving the system operator more control over when electricity is dispatched in that system stress event. Rather than self-dispatching at the start of a system stress event, energy storage assets could instead be utilised for the duration or at the peak of the system stress event,” Wickins said.

“If the Capacity Market was operated using central dispatch, de-rating factors for limited-duration storage would, therefore, be higher because the ESO would have complete control to deploy batteries during peak system stress events when electricity margins are tightest. This would maximise energy storage’s value to the system and ensure as little fossil fuel generation as possible was needed at the critical moment.”

See the latest publicly available de-rating factors for energy storage in the T-1 and T-4 below, taken from the ‘ESO Electricity Capacity Report’ (May 2023).

Source: ESO

Electricity Capacity Report May 2023

Source: ESO

Electricity Capacity Report May 2023

Energy-Storage.news’ publisher Solar Media will host the Renewable Energy Revenues Summit on 21-23 May 2024 in London. The event will explore PPA structuring, revenue risk management strategies, renewable energy certificates, and much more. For more information, go to the website.

Uzbekistan: Voltalia deploying co-located 100MWh BESS, plans 1GWh project

Voltalia has also signed two partnership agreements to deploy BESS in Uzbekistan. The first will extend the Sarimay project with a 50MW/100MWh BESS, the sales contract for which is expected to be signed in summer 2024. Voltalia signed an expansion deal for the Sarimay site in November 2023 during French President Macron’s visit to Uzbekistan, as reported last year.

The second deal will pursue the development of a 500MW/1,000MWh BESS complex. In partnership with the Uzbek Ministry of Energy and Ministry of Investment and Foreign Trade, Voltalia will construct and develop the site as part of what CEO Sébastien Clerc called “our commitment to strengthening our presence in Uzbekistan.”

See the original version of this article on PV Tech.

Battery storage failure incident rate dropped 97% between 2018 and 2023

Claimed as the first publicly available analysis of battery energy storage system (BESS) failures, the work is largely based on EPRI’s BESS Failure Incident Database and looks at the root causes of a number of events inputted to it.

The authors said the report is an attempt to help mitigate issues and concerns around BESS performance and safety, identifying gaps that need to be addressed.

The rate of failure incidents fell 97% between 2018 and 2023, with a chart in the study showing that it went from around 9.2 failures per GW of battery energy storage systems (BESS) deployed in 2018 to around 0.2 in 2023.

But when failures have occurred there is often a lack of transparency around root causes leading to a lack of understanding on how to deal with them as an industry.

For instance, while the safety of lithium batteries is often called into question in the wake of fires or explosions, the report found that 65% of incidents could be linked to operation and integration of batteries, and just 11% were caused by failures of battery cells or modules.

However, no public resource exists that categorises failure events by their cause, while in the US, there are no requirements anywhere at federal, state or local jurisdiction level for incident reporting. There are often even legal barriers that prevent details of detailed root cause analysis from being made public even where they have been carried out.

The report did note however that for events logged prior to 2017, any sort of root cause indication was rare, and was less so the case after 2018. The industry matured around the 2017-2018 timeframe, when annual BESS deployments worldwide surpassed a gigawatt for the first time, marking the “advent of the commercial BESS industry,” as the report put it.

Reluctance from battery OEMs and integrators keeps transparency limited, and the authors found that out of 81 incidents on the database, sufficient information to assign a root cause was made public for just 26 of them.

Classification of incidents recommended

Classifying failure events by their causes would enable better understanding of how they occur, which components are most often the cause, and further the knowledge of both technical and non-technical stakeholders, the authors argued.

The report gave five possible categories of root cause: design, manufacturing, integration, (including assembly and construction) and operation. Three separate categories of system element meanwhile can be identified in each case: cells/modules, controls and balance of system (BOS).

Among elements, BOS failures, which can include power conversion system (PCS), thermal management and other non-battery hardware, were the most common cause along with controls. Among root causes, it is in integration, assembly and construction where the majority of failures originate.

New projects are the most likely to experience a failure, with 72% of incidents occurring during construction, commissioning or within the first two years of operation.

The full report can be downloaded from the EPRI website.

InfraVia acquires Dutch/Belgian developer Giga Storage

Giga Storage has built up a near-term pipeline of 2GW of battery energy storage system (BESS) projects in the two countries, with operational projects in the Netherlands including what was, at the time of its November 2022 commissioning. the largest BESS there at 24MW/48MWh.

Since then however its focus has shifted towards neighbouring Belgium which industry sources say has a much more storage-friendly policy and market environment. It is developing separate 300MW/1,200MWh and 600MW/2,400MWh BESS projects there, with the latter recently approved for construction which should start this year.

Athanasios Zoulovits, partner at InfraVia, said: “We are thrilled to welcome GIGA Storage into the InfraVia family. This partnership underscores our conviction that BESS is an enabler to the decarbonisation of the European power market.

Ruud Nijs, CEO of Giga Storage and a previous guest blog contributor on Energy-Storage.news, added: “Our ambition is to have a multiple of GWs of installed energy storage power in Europe in the years to come.”

Energy-Storage.news heard last week that new grid connection and grid fee arrangements could slash grid opex costs for operators, significantly improving the business case and leading to more deployments than previously forecast (Premium access).

The acquisition of Giga by InfraVia follows a trend of the biggest BESS developer-operator also being bought by large investment firms in the UK and Germany, explored in a recent analysis piece (also Premium access).