Inside the Bloxwich battery storage plant in the UK. Image: Arenko.

As you may know, in addition to the international sites Energy-Storage.news and PV Tech, our publisher Solar Media has two UK-focused clean energy news websites, Current± (which covers broad energy transition topics) and Solar Power Portal (which covers solar PV).

Across the two sites, deputy editor Molly Lempriere and Alice Grundy bring readers the top UK energy storage news and views and this week we have a bit of an anthology of recent stories for you here.

Battery storage is ‘standing on its own two feet’ as investor confidence rises

31 January 2022

Investors are now becoming more comfortable with battery storage in the UK, with projects being profitable and cost-effective, according to industry experts.

Speaking at the Annual Marketplace event hosted last week by trade group Electricity Storage Network, Alicja Kowalewska-Montfot, commercial manager-energy storage at Gore Street Capital, said the asset owner had established a “very strong” retail base of investors, who would typically be more risk averse to newer technologies and that are now getting comfortable with this sort of asset class.

This in turn is showing that investors are getting more comfortable with the associated merchant risk and understand that in the absence of long-term or government-backed contracts, “they are indeed capable of functioning in the context of the fundamentals that are happening in the market, so the growth of renewables”.

She added that what is “incredible” about battery storage is that it never had a subsidy.

“This to me is one of those very interesting stories of a technology that effectively proved to be capable of being merchant and unsubsidised pretty much from day one,” Kowalewska-Montfot said.

Indeed, Ben Guest, managing director and head of another major UK asset owner, Gresham House New Energy, said: “It’s a cost-effective technology, and a reliable technology which is resulting in profitable, unsubsidised projects so clearly it’s an area that’s standing on its own two feet.”

Guest went on to detail Gresham House’s revenue model, which he said is focused on three accessible layers, these being trading, frequency response and Capacity Market revenues. He said the Capacity Market revenues are available to every battery, and will be 5-10% depending on the size of the battery and the revenues it is expected to make elsewhere.

Guest added that Gresham has always said from the outset that the ancillary services market including frequency response was going to saturate as it’s naturally a shallower market, while the deepest part of the market is trading.

He said that with the high levels of wind and solar expected on the energy system as the UK decarbonises, and the intermittency of that, storage will be needed and there will therefore be big trading opportunities.

By Alice Grundy

To read the full version of this story visit Current±.

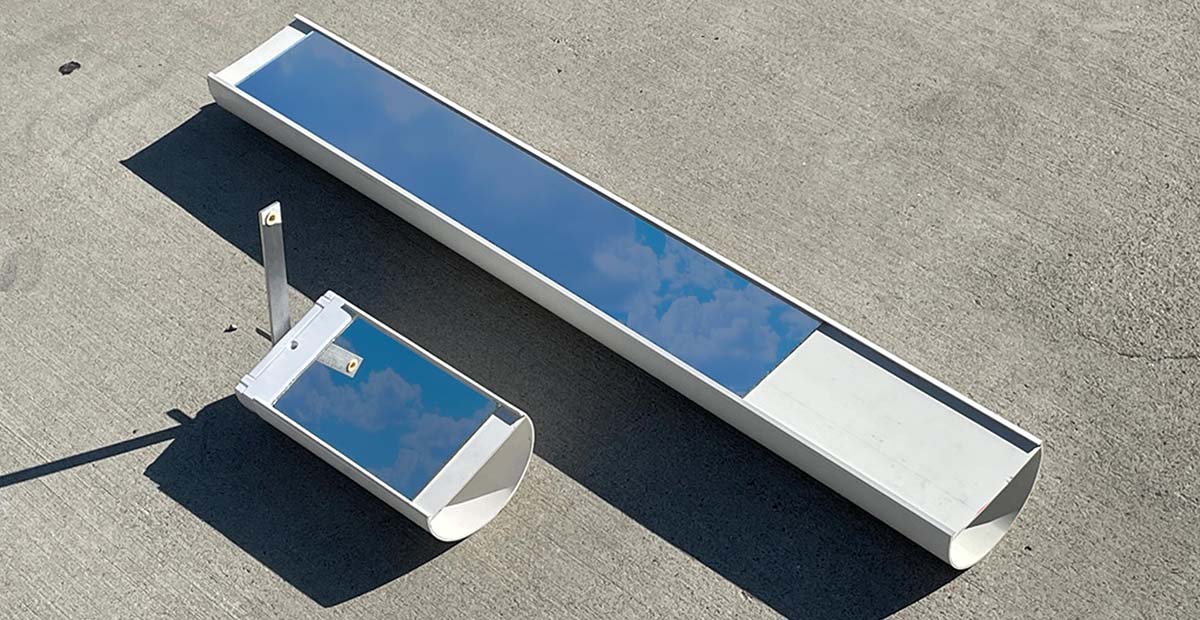

Arenko to optimise a further 455MW of Gresham House battery storage in extended partnership

1 February 2022

Clean energy asset automation and optimisation company Arenko Arenko has been awarded contracts to optimise a further 455MW of Gresham House Energy Storage Fund’s battery storage assets in an expansion of the pair’s multi-year relationship.

Having been working together since 2020, Arenko has now been awarded contracts to carry out asset optimisation on an additional five utility-scale battery storage assets for Gresham House. Totalling 210MW, the contracts are expected to come into force during this year.

An additional framework agreement has also been signed to optimise a further 215MW, while Gresham House has renewed the Byers Brae contract, which Arenko has been optimising since March 2021.

These new agreements mean that Arenko has been awarded contracts for the asset optimisation of over 500MW of Gresham House’s energy storage portfolio in total.

Under the agreements, Arenko will use its end-to-end trade optimisation and automated dispatch software to maximise returns from the battery storage assets.

By Alice Grundy

To read the full version of this story visit Current±.

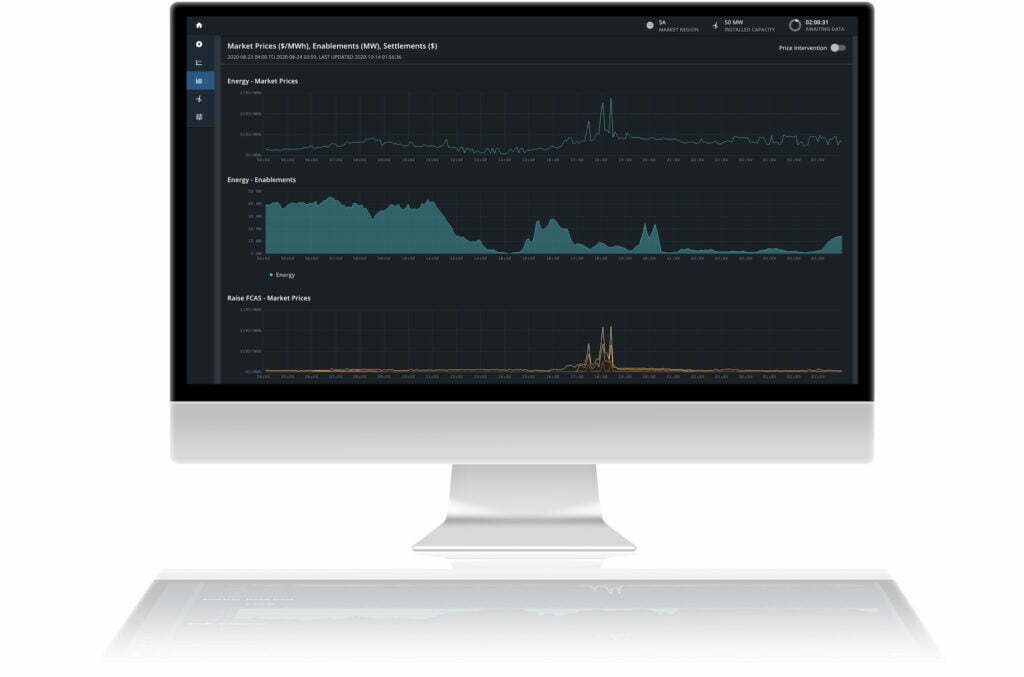

SMS energises its first 50MW battery energy storage site in 620MW pipeline

31 January 2022

UK smart energy tech company SMS has energised its first battery energy storage system (BESS), the 50MW Burwell site in Cambridgeshire, east England.

The lithium-ion BESS will now deliver a range of balancing and ancillary services to National Grid ESO, providing flexibility for the grid. SMS announced the start of construction of Burwell in February 2021, with the project originally expected to be completed in the final quarter of 2021.

It is the first of a pipeline of 620MW of BESS projects either under construction or being planned by SMS, with a second site – a 40MW system in Barnsley, Yorkshire – also nearing completion. Following on the heels of these sites, are two more 50MW sites in Suffolk and Derbyshire.

SMS’s 620MW portfolio includes 140MW of assets already under construction and 100MW that has been fully secured, while the remaining 330MW is under exclusivity. It is planning to complete this pipeline of projects by 2025.

Established in 1995, SMS is best known for its role in the national rollout of smart meters, where it provides funding, installation, operation and management of smart meters and carbon reduction assets.

By Molly Lempriere

To read the full version of this story visit Current±.

SMS’ Burwell 50MW BESS site. Image: SMS.

RES submits application of 100MW Spennymoor battery energy storage project

1 February 2022

Renewable asset developer RES has submitted a planning application for a 99.9MW battery energy storage project in County Durham, northeast England.

The Spennymoor site forms part of the company’s portfolio of over 700MW of energy storage projects in development or construction in the UK and Ireland currently.

If approved it would sit adjacent to the Spennymoor substation, and provide grid balancing services. It has already gone through several design iterations in response to site surveys, with the version submitted including a number of biodiversity measures.

“As we make the rapid transition to low-cost renewables it’s important that we develop more energy storage capacity on our grid to support a more flexible system,” said Jenna Folkard, RES development project manager.

To date, RES has developed 23 energy storage projects globally and has delivered more than 22GW of renewable energy projects, including onshore and offshore wind, solar, energy storage, transmission and distribution, over its 40-year history.

By Molly Lempriere

To read the full version of this story visit Solar Power Portal.

This is just a small sample of the great UK-focused clean energy content, including energy storage and solar, you will find over at Current± and Solar Power Portal. Subscribe to their newsletters for regular updates.

Continue reading