For context, 2021 was the first year ever that total installations had exceeded 1GWh, with an estimated 1,089MWh recorded by Sunwiz.

Grid-scale projects ( >10MWh) dominated the market, with 1,410MWh brought online during the year, but 656MWh of residential installs and 402MWh of C&I joining the National Electricity Market (NEM) also made significant contributions, with their respective best-ever tallies.

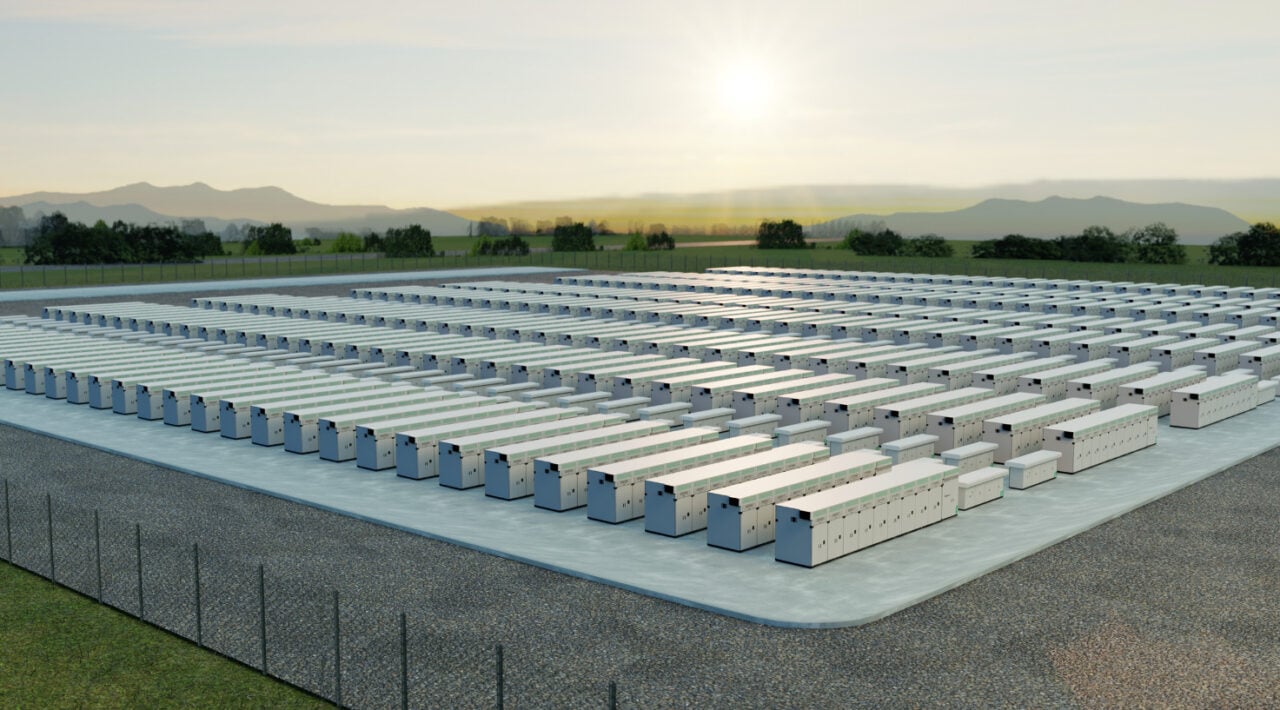

Furthermore, Sunwiz said that while it had found more than 1,900MWh of utility-scale battery energy storage system (BESS) projects in construction in Australia as of the end of 2022, that number had leaped to more than 12GWh by the end of last year.

While those projects will not all be completed and brought online during 2024, Sunwiz said it is confident this will be another record-breaking year for these so-called ‘big batteries.’ The consultancy and analysis group’s numbers are slightly higher than those released by the Clean Energy Council (CEC) trade association, which said in its own annual report that it counted around 11GWh under construction by the end of 2023, but nonetheless, again, a record-breaking year ahead looks more than likely.

The consultancy expects 23% growth from 2023-2024 in the residential segment, which has grown 21% year-on-year. It predicts that about 70,000 home storage systems will be installed over the 12 month period totalling about 788MWh.

The addition of community battery—or ‘neighbourhood battery’ projects around Australia, classified within the C&I segment—will help drive a 50% growth in C&I installs. After years of slow growth, the C&I market has “now become material,” Sunwiz said, with 600MWh forecast for 2024.

Stressing that it remains “our best estimate,” Sunwiz said utility-scale could add about 4GWh in 2024, although the company said there might be hold-ups relating to grid connection.

Overall, hinged largely on how much grid-scale storage can come online on time, Sunwiz forecasts estimated total installations at 5,388MWh across all scales for 2024.

Nearly 6GWh of cumulative installs in Australia by end of 2023

In all, Sunwiz called 2023 “the year of the big battery,” with government tenders a major factor. This is again likely to grow as a driver across Australia as the Capacity Investment Scheme (CIS)—coordinated federally and administered state-by-state—solicits an initial 6GW of energy storage to back firm renewable energy this year, pursuing a total of 32GW by 2030.

The first tranches of tendering under CIS took place this year in Victoria and South Australia, awarding long-term energy service agreement (LTESA) contracts to six projects, including three large-scale BESS and three aggregated virtual power plants (VPPs).

Some interesting trends were observed in the market. These included increase in interest in electrification at mining sites, expanding investment in local battery production and the supply chain, pilots and tests for non-lithium technologies, particularly vanadium flow batteries, as well as increased attention for battery reuse, recycling and repurposing.

As Energy-Storage.news readers will know, 2023 also saw Australia’s first-ever tender for long-duration energy storage (LDES), which was held in New South Wales (NSW) and won by RWE with an 8-hour lithium-ion (Li-ion) BESS project, Limondale. This was followed by a further 4GWh of LDES resources winning another NSW tender in December, including a large-scale advanced compressed air energy storage (A-CAES) project and other 8-hour Li-ion projects.

In all, Australia’s total cumulative installed battery storage capacity by the end of 2023 was counted at 5,966MWh. Interestingly, residential still made up the largest share of that, with 2,770MWh accounting for 46% of the total, while utility-scale had a 44% share with 2,603MWh online and distributed C&I taking just a 10% share, with 593MWh.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Maryland is first US state to pass vehicle-to-grid legislation, alongside virtual power plant tariff rules

In addition to its “first-of-a-kind” treatment of bidirectional vehicle-to-grid (V2G) technology, the act also enables the creation of distributed energy resource (DER) virtual power plants that pool the capabilities of home solar PV, batteries, smart thermostats, and other equipment.

The legislation also expands utility time-of-use tariffs to allow drivers to charge their EVs at off-peak rates. The utility rules will apply to investor-owned utilities (IOUs), which are distinct from municipal utilities or cooperatives.

The General Assembly first heard the bill in late February and went through three readings in total before passing it with amendments. It now passes over to Governor Wes Moore, who is reportedly set to sign it in the coming days, although as Maryland struggles with the impact of the 26 March Francis Scott Key Bridge disaster, the timing is apparently a little unclear.

Once signed, the state’s regulatory Public Service Commission will be required by 1 May 2025 to put forward new regulations that will allow EVs to inject energy into the grid as well as drawing energy out.

As trade association Advanced Energy United pointed out, this makes Maryland the first state in the nation to adopt such legislation. Efforts are underway in California to also enable widespread bidirectional charging, with California Senator Nancy Skinner attempting to pass a bill that would require the majority of EVs and EV charging equipment in the state to allow bidirectional charging.

However, that California bill, SB-233, which would have gone into effect in 2027, was defeated in the state assembly. It is not classed as ‘inactive’ on the state’s legislative information site, although an order was made to study the issue further.

It is worth noting that various pilot programmes and studies are being carried out in California, such as launched by IOU Pacific Gas & Electric (PG&E) in 2022.

Elsewhere, V2G and its cousins vehicle-to-home (V2H) and vehicle-to-building (V2B), which all fall under the helpful umbrella term of vehicle-to-everything (V2X), are making progress in fits and starts around the world.

Ford is apparently scaling back production of its new F150 Lightning truck, on which the carmaker has partnered with residential solar provider Sunrun to make it V2H compatible and V2G-ready.

In the UK, energy supplier Octopus Energy has launched what it called the first “mass market” V2G tariff, with the company’s head of flexibility Alex Schoch recently speaking with our UK energy transition site Current about it. Schoch claimed the technology offered “huge opportunity for consumers switching to EVs to save even more money whilst also balancing the grid”.

‘Big step forward for Maryland’s energy transition’

The Maryland legislation follows a series of pilot projects in the state which explored a range of technologies, applications and perhaps most notably, ownership structures for energy storage, from distributed to grid-scale.

Meanwhile the new virtual power plant (VPP) legislation, which will come into effect later this decade, brings Maryland on a par with VPP leaders like California, Texas and Massachusetts, Energy-Storage.news heard.

“The DRIVE Act is a big step forward for Maryland’s clean energy transition as it joins states like Texas and California in leveraging virtual power plants to stabilise the grid when demand surges,” Solar Energy Industries Association (SEIA) mid-Atlantic senior manager Leah Meredith said.

“Harnessing distributed solar and storage systems and using their collective energy will relieve strain on the grid, add resiliency, and expand access to low-cost clean energy for residents across Maryland.”

Sunrun director of public policy Thad Culley described the DRIVE Act as “a massive step forward in Maryland’s commitment to clean energy and building a resilient grid in the face of extreme weather events.”

“By leveraging clean energy technologies in people’s homes, including home solar and storage systems, the DRIVE Act helps us wean off dirty and costly fossil fuels while managing the impacts of electrification on the grid,” Culley said.

Read more of Energy-Storage.news’ coverage of activity in the vehicle-to-grid space.

UK: Battery storage could help reduce wind curtailment costs by 80%

However, according to Field’s analysis, the cost of curtailment to billpayers could be trimmed by approximately 80% if existing technologies like battery storage are used more effectively on the current grid.

Increasing the number of intertrip services the National Energy System Operator can buy and using grid booster batteries would both help tackle the problem. The latter technology is already being deployed in continental Europe and Australia.

Field said that the B6 boundary, a pinch point between the Scottish and English borders, caused most curtailment costs across the year. The B6 boundary was explored in a previous blog post on Current±, in which Matthew Boulton, director of solar, storage, and private wire at EDF Renewables UK, similarly argued that battery storage could help mitigate curtailment costs.

See the full original version of this article on our sister site Current.

‘Non-lithium, cobalt-free’ ESS battery startup Alsym Energy tight-lipped on product chemistry

The company has developed a technology free from cobalt, nickel, and lithium that it claims is not derived from or based on improving anything else available on the market today.

According to Alsym, the battery will be suitable for applications requiring discharge durations of between 4 and 110 hours and can be fully charged in just 4 hours. The company describes this versatility to go from short to long-duration and beyond to multi-day storage as characteristic of the battery being so-called “wide-duration storage”.

Alsym said in a statement sent to Energy-Storage.news in response to our enquiries that the potentially disruptive battery is its “core intellectual property,” of which the company has to be protective. The company stated that while it has “a number” of patents pending review, even patents may not offer sufficient protection, especially in markets outside Europe and North America.

“Once we get to the point where we’re ready to start high-volume manufacturing we know that we’ll have to be less guarded, but until that point, we prefer to keep some things under wraps,” the company said.

Others have chosen similar route

To be clear, this approach is not unprecedented for the energy storage industry. Numerous other companies, including startups emerging from stealth mode and big corporations developing products in-house, have used it.

Multi-day energy storage company Form Energy went for several months after emerging from stealth touting its novel battery tech’s claimed advantages and capabilities, and even announcing a first pilot project with utility Great River Energy in Minnesota shortly before its CEO Matteo Jaramillo gave his first interview for this site.

Eventually, Form made a ‘big reveal’ that the chemistry was based on iron and air. Having scored several more pilot project contracts with utilities since then, it is now building its first factory in West Virginia.

In the flow battery space, US corporates Honeywell and Lockheed Martin have both ‘launched’ technologies without revealing their exact chemistry, with Lockheed’s flow battery being piloted at a US Military facility microgrid.

Honeywell, meanwhile, has since partnered with ESS Inc., the holder of another proprietary technology, an iron electrolyte flow battery. It isn’t clear if Honeywell’s own product is linked to that or is a separate technology.

Mechanism, manufacturing: ‘similar to lithium-ion’

Alsym did give Energy-Storage.news a few details around the technology: how it works, its claimed and expected performance levels, and the applications and markets it will be aimed at.

The mechanism of the battery is “analogous to lithium-ion, with the working ion shuttling between the anode and cathode,” the company said, and the manufacturing process is apparently also similar to those of Li-ion batteries, meaning that equipment and processes from that industry can be used.

And while the materials within cannot be disclosed at this time, Alsym said both electrodes are made using metal oxide formulations that “take advantage of low-cost materials,” mined and processed in regions that include both US and EU territories as well as countries with free trade agreements to both.

Alsym claimed the battery materials are non-flammable and non-toxic, while the electrolyte is water-based. The chemistry is “immune to dendrite formation,” according to the company.

Alsym CEO Mukesh Chatter previously blogged for Energy-Storage.news on why the company feels it is important for the energy storage industry to have alternatives to lithium-ion, especially as stationary storage systems are getting to increasingly larger scales.

“When considering battery technologies, the energy industry should keep in mind the old adage, ‘don’t put all your eggs in one basket’,” Chatter wrote in his February 2024 Guest Blog.

“Lithium-ion is not a one-size-fits-all solution, and giving attention to new, non-lithium battery chemistries and expanding the range of options is essential to ensuring battery self-sufficiency and promoting a clean energy future that is safe and sustainable for everyone.”

Alsym product puts 1.7MWh into 20-ft container format

Alsym Green, the company’s first product for the grid-scale BESS industry, can achieve a system-level energy density of 1.7MWh per 20-ft container, and up to 3.4MWh in a 40-ft container. While that is far below the energy density lithium-ion can get to, with a number of leading providers now touting 5MWh capacity in 20-ft containers, it compares very favourably to other non-lithium chemistries, Alsym claimed.

Similarly, while claimed round-trip efficiency (RTE) of Alsym’s mystery battery is 85%, much lower than lithium-ion, it again compares favourably with most available flow batteries at 70-80% and is much higher than green hydrogen electrolysis, which is below 50%.

The company said its levelised cost of storage (LCOS) is low, and “industry-leading,” a claim that, like the others above, it now must prove out to the wider industry if not to its investors.

All sorts of end-users are interested to see if it can do what Alsym says it can. Partnerships have been formed with an undisclosed automaker based in India as well as shipping company Synergy Marine, while Alsym also claimed customers from the stationary storage industry for the grid, large industrial users with remote microgrid operations, and even home energy storage manufacturers are taking an interest.

EsVolta secures US$185 million pre-NTP financing for US BESS deployments

Financial holding company Nomura was the sole lead arranger, bookrunner and administrative agent for the facility, with participation from peers Copenhagen Infrastructure Partners (CIP) and Voya.

It follows EsVolta beginning construction on three BESS projects in Texas totalling 490MW/980MWh in February 2024: the 240MW/480MWh Anole project, the 150MW/300MWh Desert Willow project and the 100MW/200MWh Burksol project.

The first two are near Dallas while Burksol is in Dickens County, northwest Texas, and all three projects have hedge contracts in place. Of EsVolta’s 20GWh pipeline, 1.5GW is in operation or in-construction, it said in February.

In November 2023, it secured tax equity financing for its 30MW/60MWh Santa Paula BESS project in California, as reported by Energy-Storage.news.

EsVolta is owned by Generate Capital following an acquisition in 2022. It was originally formed through the acquisition of the development assets of Powin Energy, when the latter transitioned to become an energy storage technology provider only.

“We are delighted to have led this strategic pre-NTP financing for esVolta as they are one of the first movers in the US battery storage space,” said Alain Halimi, Managing Director, Nomura’s IPB.

The Texas market, operated by ERCOT, and California, operated by CAISO, are the two largest by BESS deployments in the US with around 7-8GW online, each.

Battery price falls threaten second life model as Fenecon opens assembly plant in Germany

Second life energy storage involves deploying used electric vehicle (EV) batteries into stationary battery energy storage systems (BESS) and German company Fenecon announced last week (3 April) that its manufacturing facility in Lower Bavaria, which does just that, has officially gone into operation.

The 24,000 sqm, c.US$30 million investment facility will produce BESS units for the residential and commercial and industrial (C&I) sectors using “new obsolete electric vehicle batteries”, alluding to the fact most second life systems use batteries which were destined for EVs but never made it onto the road, for manufacturing or warranty reasons.

The C&I units, of between 82kWh to 1,288kWh, will only use new electric vehicle batteries from German premium vehicle manufacturers, it said. The company is also building a facility in South Carolina, US, where it says there is also an excess of EV batteries and demand for large-scale energy storage.

New battery price falls could threaten second life economics

However, the prices of new lithium-ion battery cells, packs and full BESS have fallen substantially since Fenecon started building its plant in late 2022, which coincided with Energy-Storage.news publishing a feature on the sector for Solar Media’s quarterly journal PV Tech Power.

The price falls led one company, Finland-based Cactos, to tell us in January 2024 that using new batteries was now more economical than repurposing EV batteries, compared to late 2022 when it presented itself as one primarily doing the latter.

A few months prior to Cactos’ statements, recycling firm Stena sold its second life energy storage arm BatteryLoop to a new, EU-backed energy storage investment vehicle Repono, and it isn’t clear whether the new owner will continue the approach.

And just before that, Germany-headquartered Stabl’s CEO Dr Nam Truong said its systems cost €400-600 per kWh, several times higher than what ‘first life’ BESS cost now thanks to rapid price falls: the comparison here is between Stabl’s C&I-sized units and 20-foot DC blocks for the grid-scale market in the US, but it still has some relevance.

Performance and cost-effectiveness

The model of repurposing EV batteries into stationary ESS has always had its critics who say it is too technically complicated to be cost effective at scale, an argument repeated by sources in the European lithium-ion gigafactory and EV battery technology space in recent conversations with Energy-Storage.news.

Using batteries of different models, chemistries and state-of-health (SOH) in a cost-effective way, at scale, is an arduous task for battery management systems (BMS), they say. Even Stabl’s Dr Truong told us the second life sector would ‘struggle’ with performance for this reason, when announcing a fundraise in August 2023.

The other option for when an EV battery can’t be used in a vehicle anymore, recycling, also has the near-term advantage of putting local materials directly back into the local supply chain (assuming they can be fully recycled domestically). Building up a local battery supply chain is a big political aim in both the US and Europe in order to reduce dependence on China which dominates the market.

Second life energy storage still has many advantages

However, second life energy storage companies can pay more for used batteries than recyclers can. One second life energy storage source, based in North America, told us recyclers would typically pay US$8 per kWh for batteries while a second life firm would pay around US$30 per kWh.

They also pointed out that deploying EV batteries in second life energy storage systems still helps to build up a local supply chain, by softening the demand for first life batteries. Another, the first source we quoted earlier on, pointed out that the batteries will still get recycled eventually, their company just gives them “another few years’ life”.

The prices of ESS units deployed using old EV batteries should also be falling as the price for new ones do. In the near term, marketplace prices for used batteries will need to fall to stay competitive with new ones, having increased during the price spikes of 2022.

Buyers of second life energy storage also take into account more than just price. One big attraction during the battery shortages and global supply chain bottlenecks of 2022 was potentially quicker delivery times versus new batteries. That is unlikely to be the case right now, but isolation from future bottlenecks is a plus.

Buyers can also avail of economic benefits by opting for second life BESS, such as obtaining better environmental ratings for real estate where it is deployed, which can then open up green financing opportunities.

At the broader level, second life energy storage reduces battery-related waste, CO2 emissions and battery recycling costs, and deployment of second life BESS systems should nonetheless grow as EV adoption becomes more widespread.

A BESS from UK-based Connected Energy, one of Europe’s big names in second life energy storage, using Renault batteries. Image: Connected Energy.

Continue readingAustralian Energy Market Operator grants ‘milestone’ GPS approval to Waratah Super Battery

The project has been under construction since May of last year and will have a total power output of 850MW to 1,680MWh storage capacity.

Of that total, 700MW/1,400MWh will be made available to state government-owned EnergyCo NSW, serving as a ‘giant shock absorber’ for the grid under an Energy Service Provider contract. Meanwhile, developer Akaysha Energy is expected to play the remaining stored energy into the National Electricity Market (NEM) on a merchant basis.

EnergyCo said in an announcement yesterday (8 April) that the granting of GPS approval is a “milestone” for the project, claiming that with it, “one of the most substantial technical barriers for the project” has been overcome.

“The approval of the Generator Performance Standard is a significant milestone because the project has passed the simulations needed to know that it can successfully connect to the grid later this year,” EnergyCo executive director for network planning and technical advisory Andrew Kingsmill said.

Battery storage systems to the project are being supplied and integrated by US system integrator and manufacturer Powin Energy. In a recent interview with ESN Premium, Powin executive VP Danny Lu discussed how the project will use 280Ah lithium-ion (Li-ion) battery cells from two different vendors, REPT Battero and EVE Energy, both from China.

The choice of two different vendors to one project helped to de-risk its supply chain procurement, and better enable it to get commissioned on time, Lu said.

Powin is working with developer Akaysha Energy on two other large-scale BESS projects in Australia, both in Queensland. Generator Performance Standards (GPS) approval was granted to one of those, the 150MW/300MWh Ulinda Park BESS, in Queensland’s Western Downs region, just before the end of last year, shortly before a FID was made on the other.

The Waratah project is being built on the site of Munmorah, a decommissioned coal plant, and a big driver for its development is in helping replace the power and network services provided historically by Eraring, a coal power plant owned by stock exchange-listed energy generator-retailer (‘gentailer’) Origin Energy.

“Connecting energy projects to the Australian grid poses unique challenges due to stringent interconnection standards resulting from a combination of an inherently weak electrical grid, strict performance requirements, and high renewable energy penetration,” said Nick Carter, CEO of Akaysha Energy.

Carter said the process of getting GPS approval had taken more than a year. The CEO said that Powin Energy and power conversion system (PCS) supplier eks Energy – which Powin owned until it was recently sold to Hitachi Energy – provided support on the ground which was “critical” in securing the approval within required timeframes, as well as the pair’s advanced technology and willingness to work with Akaysha’s interconnection partners, including consultancy Aurecon.

Incidentally, while Waratah Super Battery was found to be the largest project of its type under construction in Australia during 2023 by the national trade group Clean Energy Council (CEC), and the country’s biggest overall so far, it has been overtaken by a 500MW/2,000MWh project in Collie, Western Australia, which kicked off construction in March, supported by that state’s government.

Controversial twist for doomed coal power plant

Waratah Super Battery has been deemed a Critical Infrastructure project by the NSW government, which has invested directly in the project towards its capital cost. It is expected to go fully into commercial operation in August 2025. This would have been around the same time as Eraring’s planned retirement. However, there has been controversy over the last few months.

Origin Energy said in September last year that it would be requesting assistance from the state government to keep the 2,880MW plant open past 2025, claiming that its closure would endanger the security of energy supply.

Conversely, environmental and local community groups have produced studies showing that keeping it open would endanger lives, while costing the taxpayer more money for short-term system stability than investment in renewables and storage.

A decision from the NSW government is expected soon.

Origin had presented a plan to investors in 2022, which would see Eraring replaced with the company’s own large-scale BESS project, expansion of Origin’s virtual power plant (VPP), and increased utilisation of the company’s natural gas peaker plants. The initial 460MW/920MWh phase of the battery storage system, which Origin claimed could eventually reach 700MW/2,880MWh if market conditions allow, is under construction after the company took a Final Investment Decision (FID) in April last year.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

BESS noise has ‘exploded as a concern’ recently

“I’d say that in the last six months noise has exploded as a concern. One of our team just toured a dozen customers in Europe and every single one brought up concerns about noise, and what we are doing to mitigate it. A year ago, nobody asked,” said Darrell Furlong, director of product management and hardware for Wartsila ES&O (energy storage & optimisation).

Sound is bound to be more of a concern for population-dense Europe compared with places like the US, but Forlong said that he first noticed it for projects in Australia, where land is also far more plentiful than Europe.

“The first customers I recall bringing it up were in Australia, but now it’s a global thing – everyone is focusing on it,” Furlong added, talking to Energy-Storage.news at the recent Energy Storage Summit USA in Austin, Texas.

BESS solutions are getting more energy-dense which requires additional cooling. Wartsila itself just launched a new product which has an energy density of 4MWh per 20-foot unit, versus 1.6MWh prior, and it comes with additional noise suppression systems.

Many China-based companies have 5MWh systems in the same space, and Western system integrators like Wartsila and Powin are subsequently responding.

More sophisticated cooling systems mean that the noise emissions are not necessarily growing with the increased energy density, however. Inverter and BESS firm Sungrow pointed out to Energy-Storage.news in a recent interview that its latest generation product increased the energy-per-container from 2.5MWh to 5MWh but the max noise emissions went from 79dB to 75dB.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

Energy-Storage.news’ publisher Solar Media will then host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Quinbrook closes US$600 million fund for solar, storage projects in Nevada, Colorado, Arizona

Blackstone Strategic Partners is the lead investors in the Valley of Fire fund, and the vehicle has now acquired 51% of the Gemini project, along with all of the remaining projects owned by the LCPF. The remaining stake in the Gemini project is owned by Dutch pension asset manager APG.

The Valley of Fire portfolio consists of seven projects, including Gemini, with over 2.65GW of solar PV capacity, and the potential to add 1.5GW of additional battery storage capacity. The projects are located in Arizona, Colorado and Nevada, and Quinbrook describes them as “between early-to-late-stage development”.

The news is Quinbrook’s latest development in the space, following the work of its subsidiary, Primergy Solar, to collaborate with lithium-ion battery manufacturer CATL at the Gemini project in 2022. Primergy also signed a long-term power purchase agreement (PPA) with San Diego Community Power last month to sell power from its Purple Sage Energy Center as it expands its portfolio in the US.

This story first appeared on PV Tech.

Non-lithium energy storage tech firms Torus and Alsym raise combined US$145 million

Massachusetts-based Alsym meanwhile has raised US$78 million in venture capital funding from Tata Sons, part of the large Indian conglomerate Tata, and General Catalyst, it announced on the same day as Torus (3 April). Its fundraise also saw participation from Thrive Capital, Thomvest and Drads Capital.

Torus to scale up flywheel tech and software offering

Torus deploys residential and commercial-sited energy storage systems using flywheel technology and offers virtual power plant (VPP) solutions in collaboration with utilities like Rocky Mountain Power in Utah through its Wattsmart programme. It also has an energy management system (EMS) which it said allows it to connect to third-party products like inverters and batteries.

The company claims its flywheel-based technology is differentitated from chemical batteries by being 95% recyclable, unaffected by temperature fluctuations and has a 25-year service life.

Torus added that it will use the new funds to “deepen its energy solutions portfolio in the commercial and large-scale utility sectors and add critical talent to the Torus team.”

Two immediate additions are at board level, with the additions of Brent Hill, MD of Origin Ventures, and David Bywater, former CEO of home security firm Vivint Smart Home and its former solar arm Vivint Solar, which was acquired by solar installer Sunrun in 2020.

Alsym raises capital for mystery non-lithium battery technology

Alsym has not publicly revealed what battery chemistry it uses but has said it is a “low-cost, high-performance rechargeable” and contains no lithium or cobalt.

It will use the fresh funding to grow its Boston-based team and expand prototyping and pilot lines to address growing customer demand for samples.

The first product is called Alsym Green, and it’s claimed to offer a superior system-level energy density than other non-lithium battery chemistries. It said it is applicable for stationary energy storage as well as maritime and automotive (two- and three-wheelers and consumer vehicles).

Energy-Storage.news has asked the company for more details on its battery chemistry and will update this article if a response is received.