The deal was signed with EMOAC, which has worked as COPEC’s energy trader since 2020, and will last for 15 years, but Atlas did not announce when it expects to begin commercial operation of the BESS. The company has already contracted 5.2GW of renewable capacity in Latin America, and the deal follows a number of other investments into the region, including the signing of a PPA with mining company Codelco for “24/7 renewable energy” earlier this month.

“The BESS del Desierto project is a key part of our strategy to enhance energy reliability in the region through advanced solar resource utilisation and offer customised energy solutions to our clients,” said Carlos Barrera, CEO of Atlas Renewable Energy.

This latest development in the Chilean storage sector follows Engie’s launch of commercial operations at a 139MW/638MWh BESS earlier this month, also in Antofagasta. Spanish firm Ingeteam has also announced a collaboration with Grenergy on the Oasis de Atacama project, a solar-plus-storage project that is expected to have a storage capacity of 4.1GWh, the largest of any facility in the world.

These investments come as Chile looks to significantly expand both its renewables and storage sectors, with the government aiming to meet 70% of its energy demand from renewables by the end of the decade. Research firm Interact Analytics forecasts Chile to add more than 1GW of new storage capacity to the national grid each year between 2024 and 2026 to minimise the variability of these renewable power investments.

Primergy signs PPA for 400MWac/1,600MWh solar-plus-storage project with California CCA

The project is not Primergy’s first in the space, following its work on its US$1.2 billion Gemini solar-plus-storage project, also in Nevada. The developer has worked with a number of key industry players on the project, including major solar manufacturer Maxeon and lithium-ion battery manufacturer CATL, and its work on the project, which boasts a power generation capacity of 690MWac and a BESS capacity of 1.4GWh, could help with the development of its latest Nevada project.

The deal with SDCP is also notable, as it will aid the initiative in meeting its growing energy demand, with the SDCP expanding its customer base to close to a million people by the end of 2023. The SDCP is a Community Choice Aggregator (CCA), a programme where local governments can manage and distribute power to local citizens, currently in operation in ten states in the US.

To read the full version of this story, visit PV Tech.

From a big year for BESS to an even bigger one: Predictions and take-aways for 2024

As each year draws to a close, Energy-Storage.news approaches a select few industry figures for their views on the 12 months just gone and the year ahead as part of our annual ‘Year in Review’ series.

Here are some quotes from the industry representatives we heard from this time around, as 2023’s big year for energy storage ended and we welcomed 2024 with cautious optimism.

What did 2023 mean for the energy storage industry, both from your own company’s perspective and in bigger-picture terms?

The energy storage industry has continued to grow in 2023 – both in terms of the number and size of projects. Despite this growth, several important hurdles – including the rise in global interest rates – have held the US industry back. Projects are expected to be delayed into 2024 and beyond due to changes in local regulations, uncertainty around how policies like the Inflation Reduction Act/Green Deal will be implemented, and the market looking for stability in interest rates.

Andy Tang, head of Wärtsilä Energy Storage & Optimisation

Have supply chain constraints eased in 2023 and what sort of supply chain dynamics are you seeing in the industry going forward?

The supply chain disruptions caused by the COVID-19 pandemic have been mostly resolved, and their resolution is coinciding with an ease in demand for EVs, which means there is more lithium carbonate available to devote to energy storage projects.

On the battery front, more manufacturers are coming into large scale battery production, first spurned by the EV market and now into the energy storage space. That is a good thing for the energy storage projects: there is physically more supply coming off production lines and there is more innovation in energy density and safety features as manufacturers work to keep up and exceed each other.

Ray Saka, VP of business strategy and services, IHI Terrasun

The challenges we face in the supply chain continue to be diverse. The biggest bottleneck encountered in battery storage projects is still the long delivery times for high-voltage components, especially HV-transformers. This bottleneck is affecting projects throughout the industry and has increased further due to the strong expansion momentum.

At the same time, there are encouraging signs that the market for battery components, including modules, containers, inverters and switchgear, is easing. Delivery times for these crucial elements have normalized again to less than 12 months, depending on the size of the project. This easing of the market promises greater flexibility in the planning and implementation of our projects.

Florian Antwerpen, managing director, Kyon Energy

What are some major trends in energy storage technologies that readers should keep an eye out for?

Lithium-ion. No, for real. In the solar sector in the mid-2000s, there were about a dozen competing technologies that triggered investment and media, but they all lost to the basic solar photovoltaic technology. Solar PV started getting deployed, creating an unstoppable feedback loop of incremental efficiency gains and supply chain consolidation. Over a 15-year timeline, that combination dominated the market.

It’s the same now with lithium-ion. Don’t get me wrong, there are some really exciting technologies out there and I wish everyone the best but look at cost curves. It’s going to take a lot of time for the new entrants to come to the market in a truly cost competitive way.

It’s not sexy and doesn’t get clicks – but watch and report on the incremental lithium-ion gains on the density and efficiency side. Pay attention to what’s boring – that is what is going to have a big impact.

Jeff Bishop, CEO, Key Capture Energy

What should the industry’s main priorities be in 2024?

Education. Education. Education. As we talked about in our interview with Energy-Storage.news at RE+ last year, positive engagement with authorities having jurisdiction (AHJs) is vital for success in the US battery storage industry. We need to continue educating the AHJs on each project we’re building and the change in technologies and what that means for their first responders.

Adam Bernardi, director of renewables sales and strategy, and Chris Ruckman, vice president of energy storage, Burns & McDonnell

To take full advantage of the opportunity storage systems present, there are several challenges we must look to address in the coming year. Firstly, we urgently need a paradigm shift in the political and regulatory community on every level to acknowledge the importance of storage. A key component to this is increasing the number of studies that emphasise the cost benefits and flexibility advantages of storage systems, especially to political decision-makers.

Last year’s Energy Storage Awards, organised by PV Tech Power and ESN publisher Solar Media, gave the assembled industry in Europe the chance to celebrate. Image: Solar Media

We also need political regulation to grant storage systems priority access to the grid and creation of market environments that offer many different applications such as wholesale trading, frequency and non-frequency ancillary services and capacity markets so that it becomes a more economically attractive venture to storage developers. The regulations in the European Renewable Energy Directive (RED III), as well as the planned approval of the new Energy Market Design, are steps in the right direction.

There must also be a concerted effort to get communities on board with storage systems. Community acceptance is a pivotal part of the success of any renewable energy solution. Although concerns must be taken seriously, these can be mitigated by planning, executing and operating projects to the highest social, technical and environmental standards.

Julian Gerstner, head of storage, Baywa r.e.

Congratulations on being recognised for your Outstanding Contribution to the industry at the Energy Storage Awards 2023. What does being part of this industry mean to you, personally and professionally?

It has always been and remains a privilege to work with one of the most important asset classes there is within the transition to a low carbon society. I’ve been a renewable energy investor for many years and energy storage is the most complex and rewarding technology I’ve come across in what it can achieve to move us towards a sustainable future.

It gives me a huge amount of satisfaction in my daily working life to be surrounded by dedicated, knowledgeable and passionate colleagues using their talents to drive energy storage forward on a global scale.

Alex O’Cinneide, founder and CEO, Gore Street Capital

This is an extract of a feature article that originally appeared in Vol.38 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries. Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the nine-year back catalogue are included as part of a subscription to Energy-Storage.news Premium.

ARENA funds microgrid trials for sodium-sulfur, zinc-bromine LDES tech in Western Australia

The agency will provide AU$2.85 million towards the expected project cost of AU$5.7 million for Horizon Power, an energy company owned by the state government of Western Austalia, to install the systems at two remote sites through ARENA’s Regional Microgrids Program.

The total value of the programme, launched in August 2023, is AU$125 million, and it runs until December 2025.

Its aims include facilitating innovation and accelerated deployment of microgrid technologies that can enable renewable energy integration, increasing resilience of electricity supply in rural and remote areas and – in a separate stream of the programme – aiding indigenous First Nation communities to benefit from microgrid technologies.

ARENA said that while lithium-ion (Li-ion) battery storage systems have been installed across Horizon Power’s networks to facilitate renewable energy uptake and add resiliency in remote areas, a need for rugged, longer duration storage technologies, has also been identified.

The trial will see a 100kW/400kWh zinc-bromine flow battery system deployed at a microgrid in the town of Nullagine, in the historic WA gold mining region of Pilbara, and a 250kW/1,450kWh NAS battery system at the coastal town of Carnarvon.

While the agency described the trial as a test of two long-duration energy storage (LDES) technologies, and both technologies are touted as suitable for applications requiring 6-hour discharge duration or more, the project will assess other specific characteristics of the batteries, such as their ruggedness in extreme heat conditions.

Technologies could become ‘important part of energy mix in regional communities’

The sodium-sulfur battery tech has been developed by Japanese company NGK and deployed worldwide at sites for over 20 years, totalling around 5GWh of cumulative installs. NGK has partnered with the energy arm of German chemicals company BASF for the distribution and ongoing commercialisation of the technology.

Recent project wins for the pair include a first order in Eastern Europe to a site in Bulgaria. The technology also went on trial elsewhere in Western Australia a few months ago at a copper mine owned by resources company IGO and backed through the Future Battery Industries Cooperative Research Centre (FBICRC), formed by industry, academia and the Australian government.

NAS batteries can operate at high or low ambient temperatures, and the manufacturer claims it uses abundant raw materials in its construction, adding up stacks of 1.2kWh battery cells assembled into 20-ft containers of 250kW output and 1,450kWh capacity.

The zinc-bromine flow batteries are made by Redflow, headquartered in Queensland, Australia. The Redflow battery tech relies on zinc, which as CEO Tim Harris pointed out in a 2023 interview with Energy-Storage.news is the “fourth most abundant metal in the world,” and bromine, which Harris said is currently sourced from the Dead Sea, but could also be sourced “from other places in the world”.

Harris claimed that choice of electrolyte composition gives the Redflow battery higher energy density and power density than other electrochemical flow batteries, while the core design is a hybrid of a flow battery that relies on tanks of electrolyte while also plating and replating zinc as it charges and discharges.

Redflow has seen some recent success internationally, including winning funding from the California Energy Commission (CEC) for four microgrid projects so far. One which will feature a 20MWh hybrid flow battery system is currently underway with US microgrid designer and developer Faraday Microgrids.

ARENA said today that the ability of both new battery technologies to withstand higher ambient temperatures and undergo many more cycles of charge and discharge without experiencing degradation could be advantageous over Li-ion tech.

“Renewable dispatchable technologies such as solar PV and wind combined with lithium-ion battery energy storage systems, and pumped hydro are well established, however, there are characteristics of each that may not be suited to all locations, particularly in locations with extreme heat,” ARENA CEO Darren Miller said.

“Horizon Power’s project, if proven successful, could see these innovative battery technologies become an important part of our energy mix in regional communities.”

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

99MW/198MWh BESS energised as Harmony Energy and Fotowatio Renewable Ventures continue partnership

Both Felipe Hernández, chief innovation officer of FRV and Peter Kavanagh, CEO of Harmony Energy, called the project “an important milestone”. David Menéndez, managing director UK and BESS CoE at FRV added that the project was “one of the UK’s largest battery storage in operation per MWh”.

The project builds on the joint portfolio shared by the renewable energy development company and the renewable energy operator, which includes the 34MW/68MWh Contego BESS in West Sussex and the 7.5MW/15MWh Holes Bay.

The Hole Bay project began operation in June 2020, just as construction began on the Clan Tye site. FRV closed financing for a non-contracted revenue model for the project with NatWest in October 2021.

Earlier this year, Harmony Energy Income Trust, advised by Harmony Energy Advisors Limited, a wholly-owned subsidiary of Harmony Energy, successfully bid six BESS projects in the latest T-1 Capacity Market auction for delivery years 2024/25, which the company says will increase its revenue for this period to £3.2 million.

This article was taken from our sister site, Solar Power Portal.

Friday Briefing: US industry leaps forward, and community engagement matters

You may have already seen our coverage from 18 March of ACP’s annual market report into utility-scale clean energy, which found that after a “banner year,” grid-scale cumulative deployments in the country reached 17,027MW/45,588MWh by the end of 2023.

Wood Mackenzie’s US Energy Storage Monitor has been something of a go-to resource for the industry for many years, beginning as a publication of Greentech Media’s GTM Research, which was acquired by Wood Mackenzie a few years ago.

In its Q4 2023 US edition, Wood Mackenzie’s analysts observed a third successive quarter of deployment records being broken and, in this instance, “shattered,” with 3,983MW of new grid-scale projects completed between the start of September and the end of December.

Exciting stuff, and what’s really encouraging is that Wood Mackenzie senior analyst Vanessa Witte noted many of the constraints and headwinds that faced the industry in 2023 appear to be easing, not least of all “supply chain challenges.”

ACP also noted that throughout 2023, while each of the three clean energy technologies its report covered continued to be subject to delays in project development, execution, and commissioning, out of wind, solar PV, and energy storage, batteries suffered the least.

Witte said Wood Mackenzie is forecasting 59GW of grid-scale deployments through 2028, while ACP found the levelised cost of a 4-hour duration battery energy storage system (BESS) in the US has fallen to just US$126 – US$177/MWh.

So far, so very good. And, of course, the Inflation Reduction Act (IRA) continues to provide further impetus to an industry that was already on an upward trajectory.

At this week’s Energy Storage Summit USA, hosted in Texas by our publisher Solar Media, Department of Energy (DOE) office of policy director Carla Frisch said the US development pipeline has grown 300% since the passing of the IRA.

“Before IRA, our national labs were projecting about 50GW of energy storage buildout by 2040. Post-IRA, our analysis, and pretty much everyone else’s, is now projecting more than 200GW by 2040,” Frisch said in a keynote address.

Again, excellent news, but we must not forget that for all this momentous change, the US political landscape could face momentous change of a different kind over the next few months as the election looms.

In his excellent article ‘What goes up must come down: A review of BESS system pricing’ (PV Tech Power Vol.38), supply chain expert Dan Shreve at Clean Energy Associates (CEA) wrote that falling prices are going to drive the fourfold increase in deployments many are forecasting.

You can read an extract of that article on the site, or you can read the article in full as part of the journal (included in your subscription to Energy-Storage.news Premium) for the nuts and bolts of Shreve’s take and CEA’s analysis of the market.

However, the two biggest drivers of risk posed to the US market today are in the policy arena, namely US trade policy and the general election.

Trade policy is CEA’s “top concern in terms of resource availability and pricing,” Shreve wrote. Expansion of the Uyghur Forced Labor Prevention Act (UFLPA) into the energy storage system (ESS) sector could create even bigger waves than it has done in the solar PV market, which was “upended” in 2022.

This is because the supply chains supporting DC container production are “exceptionally complicated,” and unravelling them could take “months or even longer”. That said, some companies are already looking for ways to introduce greater transparency and traceability, but these efforts will likely result in a price premium.

Perhaps because he was writing his article around the time of a certain “Big Game” taking place, Shreve referred to the “political football” being tossed.

He went on to say that the IRA, “central to US clean energy plans,” is not immune from political risk. Detrimental impacts could be felt by the electric vehicle (EV) and BESS sectors were any changes to the structure or value of incentive mechanisms to be made in the wake of a new (or new-old) president with a less-than-friendly stance towards renewables and storage getting into power again.

Perhaps that’s not the worst consequence some people can imagine of the election in November, but for the energy storage industry, it could be pretty severe. A repeal of schemes such as the investment tax credit (ITC) and production tax credit (PTC): “would affect pricing and demand for battery cells, modules and DC containers in the US,” Shreve wrote.

Community engagement on energy storage project development – and, more specifically, getting community buy-in to the positives of energy storage – is a topic that will not go away.

In fact, it’s something that is going to have to be actively embraced. You may have seen or heard me comment before on media reports of communities objecting to BESS projects in their local area.

In last week’s Friday Briefing, we looked at Cleve Hill, the ‘landmark’ large-scale solar PV plant co-located with battery storage in the UK which has fallen foul of local authorities. The detail there is that it is the battery safety management plan that the local Swale Borough Council in Kent, England, found issue with, but the big picture is that the decision came after protest from the local community based on their perceived fears of fire and explosion risk.

We will have to see if a revised plan for Cleve Hill can allow that project to go ahead as planned – we think it’s likely that it will – but this is the sort of situation that might arise time and again in the future.

From the other side of the pond comes news that Vistra Energy is holding community meetings regarding a proposed large-scale battery storage project in California following the publication of an Environmental Impact Assessment (EIA).

Electricity generator and retailer Vistra held the first such meeting on Wednesday at an elementary school in the Morro Bay area of California’s San Luis Obispo County. The company wants to site a 600MW/2,400MWh battery energy storage system (BESS) asset at the site of the former Morro Bay thermal power plant, which stopped generating in 2014. Vistra proposed the project to local authorities in 2021.

It follows the City of Morro Bay’s publication of the draft EIA on 11 March, and, to cut a long story short, there is tension in the local community, not so much about the fire safety risk, it seems, but more about land use.

Local community advocates want to see the site no longer designated for industrial use, with the bay already now being used for paddling, surfing and other leisure pursuits. In fact, this topic is coming up on the local ballot in November, and it seems likely the industry will watch closely for the outcome.

Happy Friday!

This week on ESN Premium

Northvolt on ramping up, staying competitive, German gigafactory and IPO

Executives from Northvolt discussed the gigafactory company’s ramp-up after a slow 2023 and how the company intends to be competitive in the global market, as well as cell technology, recycling, sourcing from China and an eventual IPO.

Energy-Storage.news was talking to Anders Thor, Northvolt’s VP of communications, whilst at Giga Europe in Stockholm, a two-day event (12 & 13 March) hosted by Benchmark Mineral Intelligence. The event brings together Europe’s battery ecosystem, from gigafactories to raw material producers. Dennis van Schie, Northvolt’s chief supply chain officer, also gave a talk and Q&A on-stage with industry consultant and speaker Nigel Atkins.

EU Batteries Regulation ‘will force energy storage industry to think more about end of life’

The new Batteries Regulation will be a driver of change in the European Union in how the energy storage system industry thinks about procurement and managing batteries at the end of life.

That’s the view of Kevin Shang, senior energy storage analyst at Wood Mackenzie, who spoke to Energy-Storage.news last month at the Energy Storage Summit EU, hosted in London by our publisher Solar Media.

Sungrow’s high expectations for Spanish energy storage market despite lack of regulation

For many years now, Spain has been one of the leading European markets for solar PV but has yet to match that for energy storage.

The expectations for this to happen in the coming years are pretty high for the battery energy storage system (BESS) division of major global PV inverter manufacturer Sungrow.

Proof of this interest in the Spanish market is the company’s choice of location to host its PowerTitan 2.0 Experience Day in Madrid – which Energy-storage.news attended – earlier this month, showcasing its latest product in energy storage systems to the European scene.

Gotion, Daiwa Securities-backed investor DEI target 1GWh of BESS deployments in Japan

Daiwa Energy & Infrastructure said it is targeting the deployment of 1GWh of Gotion battery energy storage system (BESS) solutions within two years.

Daiwa Energy & Infrastructure (DEI) is backed by capital from major Japanese investment bank Daiwa Securities. Since 2018, it has invested more than a billion US dollars into renewables and infrastructure projects, mainly in Japan and Europe. The company also announced a US partnership with developer Solariant for North American solar and energy storage projects in 2022, targeting 2.5GWh of projects.

CO2OS will serve as the engineering, procurement, and construction (EPC) partner, providing technical assistance to Gotion.

DEI and CO2OS have already got started on their BESS ventures in Japan: in September DEI and two other investors, Fuyo Sogo and Astomax announced they would co-fund large-scale projects beginning with a 50MW/100MWh project on the northern island of Hokkaido.

Gotion, DEI and CO2OS signed their business partnership agreement, 1 March 2024. Image: Gotion/DEI/CO2OS

That project is thought to have already begun construction to come online in 2025. In February, DEI and CO2OS brought online a 580kWh battery system at an existing solar PV plant in Kagoshima, which is on the southern island of Kyushu.

Toshiba ESS serves as that project’s aggregator, with the PV plant benefitting from Japan’s new feed-in premium (FiP) subsidy scheme which DEI said enables some “creativity” in how batteries can be paired with PV to optimise generation and market participation.

Japan’s BESS revenue opportunities evolving gradually

The trio’s new business partnership agreement was signed at the beginning of March and has just been publicly announced.

Vertically integrated manufacturer Gotion is involved in the whole supply chain, from raw materials to recycling. As of 2022, it had 100GWh of total annual production capacity worldwide, and is ramping up to 300GWh by 2025, making it one of the world’s biggest lithium-ion (Li-ion) battery manufacturers.

Its Japanese subsidiary was formed in 2017 to serve other segments including electric vehicles (EVs) and residential energy storage batteries, as well as R&D activities developing next generation battery tech.

The islands of Hokkaido and Kyushu, at opposite geographical ends of Japan’s biggest populated island, Honshu, are Japanese renewable energy development hotspots, and more recently have become the place to be for battery storage too.

Yesterday, Energy-Storage.news reported that major Japanese conglomerate Marubeni is building a 103MWh 4-hour duration BESS in Hokkaido.

Japanese BESS market expert Shunsuke Amanai provided some commentary on the market in an interview, noting that the majority of the BESS revenue stack today is coming from ancillary services like frequency regulation, with capacity market set to play an increasing role.

Wholesale energy trading through the Japanese JEPX power exchange, is possible since market regulations to allow BESS participation were introduced, but currently this is a small slice of the total revenues that can be earned by most projects.

Amanai said this is due to JEPX price caps which suppress some of the volatility and fluctuations in price that could be captured by BESS. However, the cap of JPY80 (US$0.53) on imbalance has an implication on spot market prices and spot market prices themselves have a low end cap of JPY0.1 imposed, which means negative pricing does not occur.

That imbalance price cap is an “artificially low” price, independent expert Amanai said, but it is tentatively planned to be brought up to closer to JPY200, and then to JPY600, with price setting set to be further exposed to market forces.

BESS projects are currently being supported by government subsidy schemes to promote their use in integrating renewable energy to the grid and enhancing grid stability.

Shunsuke Amanai said that the market is currently not as lucrative as more mature markets such as the UK, parts of the US and Australia, but is likely to present a much bigger opportunity within the next five years, driving major companies like Daiwa and Marubeni to make their play into the market early, particularly in the regions of Hokkaido and Kyushu, where Amanai said increasing competition can be expected.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

US energy storage market ‘shattered’ previous deployment records in Q4 2023

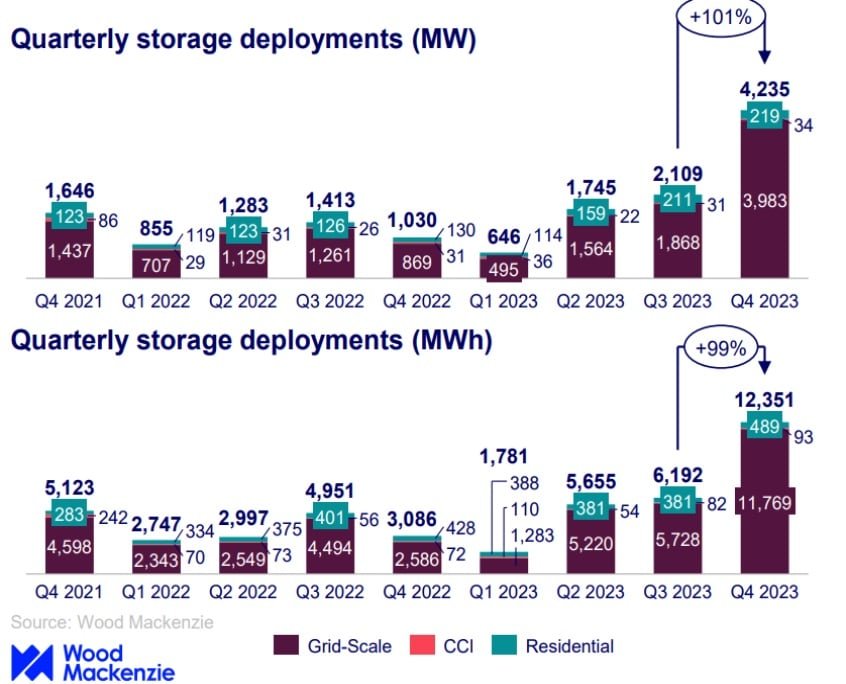

It found that 4,235MW was installed across the three main market segments of grid-scale, residential, and community-scale commercial and industrial (CCI) in the last three months of the year.

Headline deployment figures

For residential and grid-scale segments, it was a record quarter, with grid-scale enjoying a particularly strong period with 3,983MW of new capacity additions, marking the first time on record that quarterly installations exceeded 3GW.

That equated to a 358% increase in megawatt terms from Q4 2022’s 869MW. Grid-scale saw a similar increase in megawatt-hours year-on-year, growing 354% from 2,590MWh in Q4 2022, to 11,769MWh in the final quarter of 2023.

California, the leading state for the quarter, and with 6,593MW brought online in the period dominated the market with a 56% share of all Q4 deployments. Arizona and Texas were the next closest rivals.

Meanwhile, residential, with 218.5MW of deployments, “barely” beat its record of 210.9MW set in the previous quarter. That Q4 2023 figure was a 68% increase from 130.2MW in Q4 2022, although in megawatt-hours, the increase was just 14%, from 428.3MWh to 489.2MWh.

Again, California led, being the first state-level market to exceed 100MW of new storage capacity in any given quarter. However, over the course of the full year, Wood Mackenzie noted that Puerto Rico installed the most storage of any US territory, due to a favourable policy environment.

The CCI segment continued to lag. Growth remained “stagnant,” with just a 9% increase from 31.2MW to 33.9MW when comparing the final quarters year-on-year. The segment fared better in megawatt-hour terms, growing 29% to 92.8MWh of new deployments in Q4 2023 from 72MWh in Q4 2022.

Market challenges eased up

Despite Q3 and Q2 also representing record deployments, Wood Mackenzie had warned in both instances that the industry was facing “multiple headwinds”. For instance, in Q3 2023, the firm reported that 82% of grid-scale projects expected to be completed during the quarter had seen their COD pushed back.

“Q4 2023 was extremely strong for the US energy storage market, helped by easing supply chain challenges and system price declines,” Wood Mackenzie senior energy storage analyst Vanessa Witte said.

Wood Mackenzie is forecasting 59GW of new grid-scale storage capacity in the US between now and 2028. At the Energy Storage Summit USA, hosted by our publisher Solar Media in Austin, Texas, this week, US Department of Energy Office of Policy principal deputy director Carla Frisch said the department had increased its expectations for coming storage deployments to 2040 around four-fold, to about 200GW by 2040.

Frisch said this was broadly in line with “everyone else’s analysis” of the market, while in the shorter term, the Inflation Reduction Act has given the sector a massive boost.

Wood Mackenzie also provided full-year 2023 figures in its Q4 US Energy Storage Monitor. Total deployments across all market segments added up to 8,735MW/25,978MWh for the year.

Numbers pertaining to utility-scale storage, which enjoyed a near-100% increase in deployments year-on-year can also be found in the most recent annual market report from the trade group American Clean Power Association (ACP), which partners with the analysis firm on the Monitor’s publication. Energy-Storage.news covered the ACP report a few days ago.

Sungrow’s high expectations for Spanish energy storage market despite lack of regulation

Proof of this interest in the Spanish market is the company’s choice of location to host its PowerTitan 2.0 Experience Day in Madrid – which Energy-storage.news attended – earlier this month, showcasing its latest product in energy storage systems to the European scene, where it targets to deploy 200MWh of Power Titan 2.0 systems this year, all between the UK and Germany.

One of the reasons for Spain to be a late bloomer in the storage scene, is due to its lack of regulations which could draw some parallels with Italy, says Javier Izcue Elizalde, vice-president and responsible for Southern Europe at Sungrow.

“We need to have clear regulations because right now, the standard is under development. And needless to say, the capacity market is also not yet defined, but some of our customers have an appetite for these kinds of investments,” explains Izcue.

Last year alone Spain only added 5MW/10MWh of capacity, according to data from consultancy LCP Delta, with 2025 expected to be the year where BESS deployment will kickstart. A broader look at the Spanish market and other European countries’ grid-scale deployment in the coming years can be read in Energy-storage.news recent Energy Storage Report.

Sungrow hosted an event in Madrid last week to introduce the new product to the European market. Image: Jonathan Touriño Jacobo for Energy-storage.news.

During a panel at Sungrow’s event, Alberto Quesada, head of engineering at renewables developer Fotowatio Renewable Ventures (FRV) explained the reason for the Spanish market to be behind in the energy storage scene is due to the lack of specific regulation and a lack of capacity market, adding: “You can only go to the wholesale market.”

The lack of regulation is not an issue unique to the Spanish market, but more broadly at the European level, as Margareta Roncevic, policy officer at the European Association for Storage of Energy (EASE), explains: “Energy storage, in general, is not recognised in many regulatory forms on the EU level and on the national level. That is a big barrier dragging in the market, even though technologies are commercially viable.”

Quesada also highlighted the issue of negative prices or close to zero in the Spanish market due to high amounts of PV during sunny days in the Summer, or wind during the winter.

Spain’s energy storage tenders

Izcue added that with Spain’s first tender for energy storage to be co-located with renewables – which awarded 1.8GWh of capacity – projects are expected to be much smaller, as is the case of Spanish utility Iberdrola which was awarded 300MW of BESS to be co-located with existing solar PV plants. It will deploy six 25MW/50MWh lithium-ion systems in the regions of Castilla y León, Extremadura, Castilla La Mancha and Andalusia.

However, with the results of an upcoming 2.4GWh Spanish standalone energy storage tender to be unveiled, in the coming months, Izcue expects the size of battery storage projects built to increase.

If these tenders could help kickstart interest in energy storage in the country, these will not necessarily be the main driver for Spain to reach 22GW of energy storage by 2030, explains Izcue.

Deployment of BESS in Spain is not expected to kickstart before 2025. Chart: Cameron Murray for Energy-storage.news.

“I don’t think that’s going to be the future of Spain, because these [auctions] are funded from Europe. We have been discussing recently with customers and some of them are not working in these plans.” Izcue added that “not everything is going to be subsidised”.

Grid issues and lack of professionals

If the lack of regulations for BESS to soar in the coming years is one of Spain’s main challenges, grid congestion and lack of personnel are also high on the list, which the solar PV industry has been facing too. With the higher complexities of storage technology, Izcue says: “It’s not easy to also find a specialist in storage.”

A report last year by Aurora Energy Research highlighted that 5% of Spain’s renewable energy generation could face economic curtailment between 2025 and 2030, which Quesada said was expected to increase in the coming year. However, long-duration energy storage (LDES) could reduce or eliminate these constraints with the deployment of 15GW LDES.

DOE: US energy storage pipeline up 300% since Inflation Reduction Act passed

Frisch was speaking during a keynote address – ’18 Months On: The Impact of the IRA on the Energy Storage Industry’ at this week’s Energy Storage Summit USA 2024 in Austin, Texas, put on by our publisher Solar Media.

As Energy-Storage.news reported this week, the US grew its battery energy storage system (BESS) – the technology of choice for the vast majority of projects today – to 17GW by the end of 2023, according to trade body American Clean Power Association’s (ACP) latest figures. 2023 saw the US deploy 7.9GW of new capacity, double the prior year, ACP said.

The DOE’s Frisch said that deployments would roughly double in 2024 to 15GW, though was citing a lower estimate for 2023 deployments of 6.5GW. She noted that the DOE’s forward forecasts acknowledged that some projects in the interconnection queue, which is much larger, would fall out and not get built.

The keynote address primarily went through the various measures that the IRA has taken to give its clean energy sector a boost. The most relevant for energy storage are the 45x manufacturing tax credit, which pays US$35 per kWh for cell production and another US$10 for battery pack assembly, and the investment tax credit (ITC) for 30% of downstream projects’ capital expenditure, with the option to grow that to 70% with various adders.

Long-duration energy storage (LDES) is also a specific goal for the government department. “We have the goal to reduce storage costs by 90% for storage systems that deliver 10-plus hours of duration. We’re projecting a massive need for LDES by 2050.”