With a budget of BGN107.6 million, the first tender will finance the construction of solar and wind projects and co-located BESS with an installed capacity of 200kW to 2MW. In this tender, a minimum of 200MW of production capacity from renewables in combination with a minimum of 100MW of BESS will be built. The maximum amount of financing for a project is up to BGN35.9 million.

The financing will cover up to 50% of the eligible costs but not more than BGN1.08 million per 1MW of installed BESS capacity.

The second tender’s budget reaches BGN427.5 million, supporting new solar and wind projects, along with BESS, with an installed capacity of more than 200 kW. This tender aims to build a minimum of 940MW of renewables capacity in combination with a minimum of 200MW of BESS. The maximum financing for one project for one enterprise is up to BGN58.7 million.

The financing will cover up to 50% of the eligible costs, with a maximum of BGN743,215 for 1MW of installed capacity of the BESS.

The Bulgarian government started a public consultation on the country’s first renewable energy auction in October 2023.

To read the full version of this story, visit PV Tech.

Energy-Storage.news’ publisher Solar Media will host the second annual Energy Storage Summit Central Eastern Europe on 24-25 September 2024, in Warsaw, Poland. This event will bring together leading investors, policymakers, developers, utilities, energy buyers and service providers. Visit the official site for more info.

Northvolt on ramping up, staying competitive, German gigafactory and IPO

2024: a year of accelerated ramping up

“We had some setbacks in 2023 and some successes in 2024 so far. One setback was planned downtime to ramp back up more efficiently, but that ramp up didn’t happen as expected. But all these setbacks are great learnings and mean we’ll ramp up more quickly at future sites,” Thors said.

Its first operational facility is Northvolt Ett, a cathode active material (CAM) and cell production facility in Northern Sweden, which has two production lines installed and online with an annual production capacity of 16GWh. That has been the case since 2022, but the company only managed to ship 79MWh of product in the first nine months of 2023.

Thor said 2024 should see a big ramp up however: “We’re going from thousands of cells per week to tens of thousands of cells per week this year. 2023 was a year of investment and learning to scale.”

Thor said that it has been shipping to several customers but a big one is Scania, the Nordic company mainly known for trucks. Thors claimed the two companies have developed a battery that can run for 1.5 million km – longer than the lifetime of the truck. “That’s a big deal for Scania.”

Staying competitive in a market with ever-lower prices from China

Its close work with large automotive OEMs like Scania, BMW and Volkswagen is what the company claims will help it remain competitive in a market where battery cell prices from China fall ever lower.

“It’s the joint development and design of our batteries with our partners that is important. People say batteries will be a commodity, but we’ve shown the opposite. The value premium of these companies’ vehicles is dependent on the battery.”

Sustainability is also Northvolt’s central USP and the firm claims its carbon footprint is 30-40% lower than a standard battery (partially thanks to an abundance of clean hydropower energy in northern Sweden, where Ett is located).

In an earlier Q&A on stage, van Schie had said: “How green we need to be is a debate. Yes, there is an ESG premium, and we know how much it is. But over time, it will stop being a premium”

Northvolt is building nickel manganese cobalt (NMC) battery cells primarily because of its higher energy density than lithium iron phosphate (LFP), as well as its greater recycling value. The European industry is making a big push on recycling as a way to increase – in the long-term – the proportion of raw materials it can source domestically.

Approach to energy storage system (ESS) market and new tech

Northvolt is also targeting the energy storage system (ESS) market from a facility in Poland – executives from that segment discussed the approach at the Energy Storage Summit Central Eastern Europe (CEE) in September 2023.

Asked how its approach to being competitive applied to the ESS segment, which does not have the same EU incentives to use European cells as the EV space, Thor said: “Those differentiators could be transferred to ESS. Those customers are interested in sustainability, having a safe and reliable product, and a digitally connected one. We’ve invested a lot in our digital systems.”

As with Ett, Thor said this year will also be a year of ramp-up for ESS at its Polish plant (Dwa), which started manufacturing its ESS systems late last year and is aiming for 12GWh of max production.

He also described the firm’s move into sodium-ion battery technology with technology partner Altris as “massive”. The tech holds promise thanks to more abundant minerals and a wider range of operation temperatures, and many see it as the next to scale after lithium-ion.

“A lot of Chinese competitors have developed sodium-ion batteries that still need cobalt, nickel, etc. to work. With Altris, our Prussian Blue-based tech does not need any of those metals. That opens up a completely new opportunity for sustainability. We’ve kept quiet about that work for 2-3 years until we had something real to reveal,” Thors said.

“However, it’s still a five-year perspective for mass production of those cells, though it has beautiful potential. We’re also working on lithium metal batteries which have a higher energy density than lithium-ion, with the Cuberg acquisition.”

Germany plant to launch this month

Perhaps the company’s second most-discussed project after Ett is its German gigafactory project, Drei, in Heide. The facility was the first to receive a funding package under a new EU approach to match support offered by other countries to projects which were considering relocating, receiving €1 billion in support in January 2024.

Thors: “We were impressed by the German and European response. We had an honest and open discussion about the impact of the US Inflation Reduction Act. We were seeing our supply chain and customers really start to focus on North America. They came to understand how massive the IRA is, and both the EU and Germany stepped up and created a framework and support system for Drei.”

Construction on the plant will begin with a launch party in March 2023, with the aim to have it operational by 2026.

China sourcing, recycling and Northvolt’s IPO

Thors said that currently, the company sources lithium carbonate from outside Europe including China, which dominates the supply market, but was looking to transition away from that.

“I do want to say that this industry is often expressed as an Asia versus Europe thing. We are built on a lot of Asian competence and Asian partnerships.

As mentioned earlier, the European industry is putting a big focus on recycling. “It’s not something we do just for sustainability; there’s also a strong business case to do it,” Thors said.

Lastly, on the IPO, he said. “Being in this expansion phase, naturally we could tap the public markets. But the interest in us is strong enough that we can also take our time. We’d also prefer more of an IPO window to open back up.”

Dennis van Schie, Northvolt’s Chief Supply Chain Office, speaking at Giga Europe in Stockholm on 12 March. Image: Cameron Murray / Solar Media.

Continue readingSolar Energy Corporation of India begins BESS tenders backed with Viability Gap Funding

They include a notice inviting tender (NIT) for 250MW/500MWh of standalone battery storage, under Tranche 1 of the VGF commitment, which aims to provide support for projects that are not financially viable on their own merits.

India’s finance minister Nirmala Sitharaman announced the government’s commitment to the scheme in her ministry’s Union Budget for 2023-2024, just over a year ago. The cabinet then approved the competitive tender scheme in September.

While India’s major policy commitments toward promoting renewable energy have helped drive interest in battery storage systems paired with solar PV plants – including one of the other tenders announced recently by SECI – the case for large-scale standalone BESS has been slower to develop.

The National Electricity Plan puts the need for energy storage capacity at 74GW/411GWh, from a mix of batteries and pumped hydro energy storage (PHES) by 2030 to integrate a targeted 500GW of non-fossil fuel energy generation by that time.

The VGF scheme will contribute around 40% of the revenue required to make the business case for standalone storage work, while owners or investors will be able to make the rest from merchant opportunities.

The tariff-based competitive bidding opportunity will open soon. The ministry of power is set to issue tender documents shortly, SECI said.

Tender for 1,200MW of PV paired with 600MW/1,200MWh of storage

SECI issued the NIT for the storage project on 16 March. The day before, the corporation issued its NIT for 1,200MW of solar PV systems, to be connected to the Inter State Transmission System (ISTS) and paired with 600MW/1,200MWh of energy storage systems.

Again, to be awarded through a tariff-based competitive bidding process, a timeline for the tender was not provided in the notice, but SECI said that tender documents have been drafted and, like the VGF solicitation, will be “issued shortly”.

It is worth noting that in neither of the above tenders, regions for systems to be deployed have been stipulated besides the requirement in the solar-plus-storage tender to connect to the ISTS.

However, also on that day (15 March), the corporation put out an NIT for solar PV and energy storage for the tropical island territory of Lakshadweep.

A much smaller undertaking, totalling 1,385kW of solar PV with 1,117kWh of battery storage, the projects would be split across four different islands. The largest will be a 600kW PV plant on Kadmat Island with 200kW/600kWh of BESS; the smallest, on Amini Island, will include 240kW of solar PV with a 24kW/12kWh BESS. Tender documents again will be “issued shortly”, SECI said.

India’s prime minister Narendra Modi, one of the many world leaders running in a general election in 2024, recently made a dedication to welcome online India’s largest battery storage project, pairing 100MWac of PV with a 40MW/120MWh BESS, in the state of Chhattisgarh.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will bring together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

ZEN Energy gets US investor Stonepeak on board for 290MWh BESS with South Australian government contract

Stonepeak said yesterday (18 March) that it will be making the investment through Peak Energy, a renewable energy development platform in its portfolio. The government of South Australia will be an off-taker for the Templers project’s stored energy through a long-term renewable energy contract with a retailer, and Stonepeak said this is what will enable construction.

The Australian Financial Review (AFR) reported last night that French investment bank Natixis is also financing the project through a debt deal. AFR said ZEN Energy had confirmed financial close has been achieved and start of construction is imminent, with the media outlet citing the cost of the project at AU$200 million.

As reported by Energy-Storage.news in March last year, ZEN Energy acquired the project from developer and independent power producer (IPP) RES. At that point it had already received approval to connect to the South Australian grid, which has very high shares of renewable energy feeding into it, largely from rooftop solar PV and onshore wind, but also from utility-scale solar PV.

The capacity was given at 270MWh at that time, although the power output has remained the same.

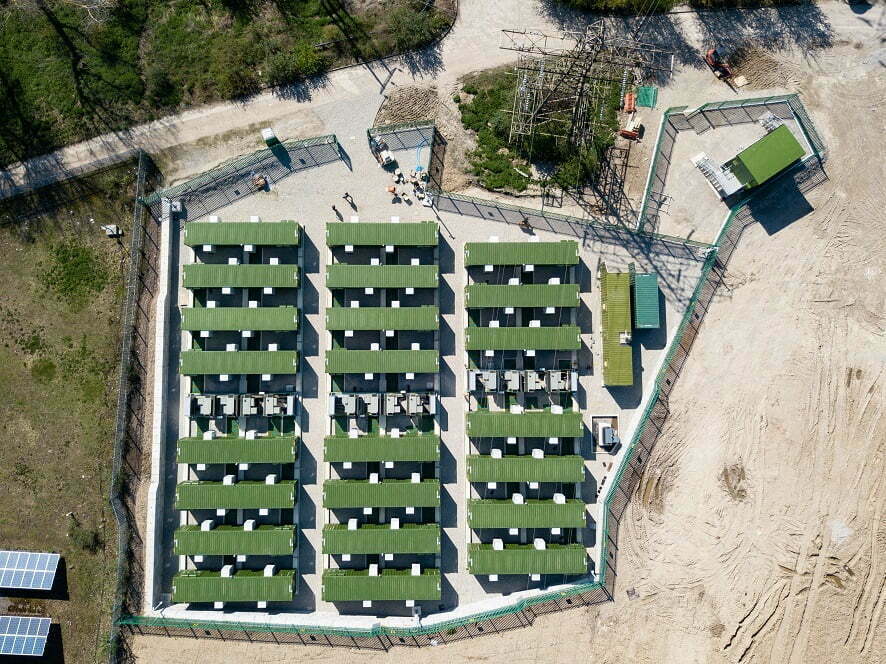

According to ZEN Energy’s website, the project will be equipped with lithium iron phosphate (LFP) lithium-ion (Li-ion) batteries and it will store power generated from renewable energy for outputting to the grid to help manage peak demand, as well as participating in grid-balancing ancillary services markets.

It is currently one of two large-scale BESS projects to have a dedicated page on the company’s site, along with Solar River, a solar-plus-storage project that would feature a 230MWdc solar array and BESS of up to 8-hour duration (although initial duration is planned at 2.5-hour with an output of 650MW), capable of exporting around 256MW into the South Australian grid. The company is understood to be at the stage of seeking development approval for Solar River.

In 2022 it was reported the utility was working to develop an asset of between 600MWh and 800MWh capacity in Western Australia.

Templers will be ZEN Energy’s “first substantial asset” in South Australia where the company was founded, ZEN CEO Anthony Garnaut said.

Peak Energy works on projects across Asia-Pacific, signing a joint venture (JV) agreement late last year with developer TOPINFRA to work on 500MW of renewable energy and energy storage projects in South Korea, where Peak Energy said it already had a 170MW solar portfolio.

Together with Skip Essential, another infrastructure investor, Stonepeak in 2022 made a bid to acquire Australian renewables developer Genex Power, which is working on projects including large-scale solar and battery storage, as well as the country’s first new large-scale pumped hydro energy storage (PHES) plant since the mid-1980s.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

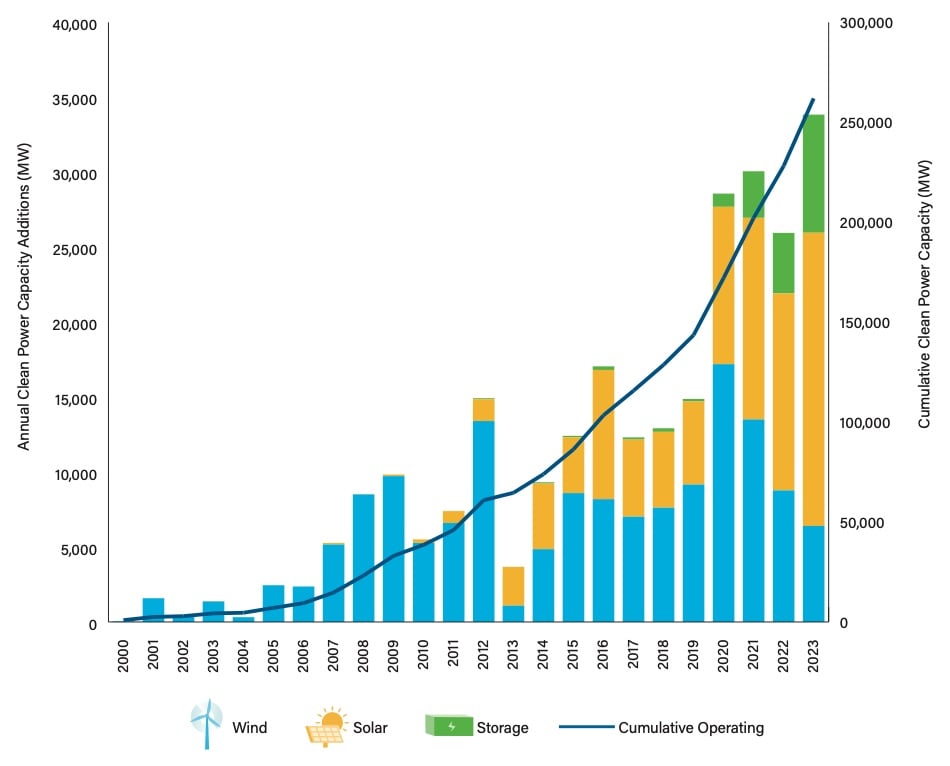

US BESS installations ‘surged’ in 2023 with 96% increase in cumulative capacity, ACP says

The country’s energy storage sector connected 95% more storage to the grid in terms of power capacity in 2023 than the 4GW ACP reported as having been brought online in 2022 in its previous Annual Market Report.

In more precise terms, and with megawatt-hour numbers included, there were 7,881MW of new storage installations and 20,609MWh of new storage capacity deployed in the year.

The cumulative output and capacity of battery storage installed in the US have reached 17,027MW and 45,588MWh, respectively. That meant an 86% increase in cumulative installed capacity in megawatts (power) and an increase of 83% in cumulative installed capacity in megawatt-hours (energy).

Second successive record year

Meanwhile, the levelised cost of a 4-hour duration battery energy storage facility participating in energy markets in the US was found to be in a range between US$126 – US$177/MWh. In 2015, the levelised cost of such a battery energy storage system (BESS) would have been between US$347 and US$739/MWh, albeit not many systems of that duration were being installed in the US nine years ago.

The average levelised cost of a solar-plus-storage installation was US$81/MWh to US$153/MWh. In an article for Energy-Storage.news Premium, published last week, various industry figures commented on the falling prices of BESS and the impact they will have.

As reported by our colleagues over at PV Tech last week, ACP’s report also highlighted that 2023 was a big year for renewable energy, with 33.8GW of new installations, 20GW of which was solar PV. Wind and solar PV, in fact, accounted for 77% of new utility-scale power additions, far outpacing natural gas, of which 8,999MW – or 20% of the total – was deployed last year.

One challenging aspect of solar PV development however is the continuation of delays to new projects, with utility-scale solar accounting for 70% of the more than 60GW of clean power capacity that had been delayed as of the end of 2023. Of that figure, 38GW were projects that missed original COD deadlines during last year with the rest held over from previous years.

Battery storage was not immune from delays, but it was the least affected of the three technologies, accounting for just 12% of the delayed total. This is perhaps due to solar PV also being subjected during the last couple of years to international trade issues over the import of modules from abroad, mainly China.

In all, it was a second successive record year for the US battery storage industry, with 2022 seeing an 80% increase in megawatts and a 93% increase in megawatt-hours in cumulative installations from 2021, ACP said.

ACP CEO Jason Grummet said 2023 had been a “banner year” for solar and for energy storage, also noting the growth in clean energy manufacturing investment that the US has enjoyed since the passing of the Inflation Reduction Act (IRA).

While only two manufacturers in the nascent battery storage manufacturing sector supplied modules or packs to the industry in 2023, ACP expects to see 20 new facilities come online by 2030.

Most of those will support battery cell as well as module manufacturing, the trade group said. In August last year, ACP said that there had already been US$270 billion investment committed to clean energy in downstream projects and manufacturing since the IRA’s passing.

Energy-Storage.news’ publisher Solar Media will host the 6th Energy Storage Summit USA this week, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Li-ion BESS: Look-back and lessons for the future

The last couple of years have been a strange time for the world, with wild ups and downs impacting several industries differently. The lithium-ion-based battery energy storage industry is no exception – swung by the push and pull of supply chain dynamics and key policy developments in the US.

The stationary BESS industry has been reactive in most aspects, reeling to control project economics and schedules. But the industry as a whole has learned several lessons and proactive measures to implement.

Price swings like never before

Lithium mineral prices, specifically lithium carbonate, a key component for Li-ion batteries, have experienced quite a roller-coaster in the past few years. The prices surged in the second half of 2022 as high as 10x of average historical levels. This trend was rooted in the overall shift and positive sentiment around transportation electrification, especially electric vehicles (EVs) around the world.

Lithium supply at the time was not able to scale to meet this demand at such a rapid pace – depending on the process of mining and extraction, it can take three to five years to bring new capacity online because of the permitting and capital-intensive nature of extraction.

However, due to a combination of market factors, namely anticipated reduction of EV purchases in China because of the anticipated expiry of government subsidies, the lack of EVs as forecasted because of COVID-induced limited mobility and a big wave of new factories expected to flood the supply-side, prices came back down in dramatic fashion in 2023 compared to highs in November 2022.

As a result of these market dynamics, two noteworthy things ensued: Li-ion battery suppliers began indexing the price of batteries to raw materials (RMI) such as lithium carbonate to mitigate their risk exposure; and the system cost of building BESS increased compared to prior years.

While time will tell if RMI pricing will be here to stay as standard practice, BESS costs stabilised in H2 2023, and continue on their anticipated downward trend from 2024. (For more insights into BESS pricing, see Clean Energy Associates’ analyses of recent trends.)

Supply chain issues plague other components

Key balance-of-plant (BOP) equipment needed for BESS systems – such as transformers, MV switchgears, enclosures and steel – have been plagued by supply-chain issues leading to unprecedented lead times. As of December 2023, owners and EPCs are facing up to two to three-year lead times for main power transformers when the historical norm has been about one year.

Utility off-takers are often valuing BESS projects that can come online earlier higher than later ones, creating a race to achieve aggressive commercial operation dates (CODs) and further fuelling the demand for equipment with expedited delivery.

Planning is the not-so-secret sauce

The Li-ion BESS market landscape is more competitive than ever. To build projects economically and achieve the target COD, developers need to plan to procure equipment smartly, forge strategic partnerships to secure production volumes for battery systems and take into consideration domestic manufacturing, although it remains to be seen how much of the touted domestic manufacturing will take shape in time to feed the enormous North American battery market.

Interconnection fees have increased significantly as part of the queue reform and process times are expected to get shorter, so it is all the more critical to have ‘firm’ projects in the queue and certainty in the equipment planned to be used (specifically the power conversion system). It is also equally important to plan for BOP equipment in the form of tactical bulk ordering for medium-term projects in the pipeline as lead times stabilise to be the ‘new normal’.

EPC resources are an often-overlooked critical aspect as well – the bulk of the major EPC companies are spread thin between a growing list of developers and massive projects. The preconstruction and construction phases of projects are being pulled left and stretched. Hence there is emphasis on forming strategic partnerships and getting them onboarded as early as two years before the planned COD.

With the ‘world’s biggest BESS’ crown seemingly changing hands every other month, it is an exciting time in the BESS arena, and the winners are the best prepared.

This is an extract of a feature article that originally appeared in Vol.38 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries. Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the nine-year back catalogue are included as part of a subscription to Energy-Storage.news Premium.

About the Author

Swetha Sundaram is the director of BESS project design at RWE Clean Energy, the fourth largest developer and owner of PV and storage projects in North America. She is responsible for development engineering and product management for energy storage projects. Before RWECE, she worked for DNV as a senior consultant in the energy storage independent engineering and advisory group.

Energy-Storage.news’ publisher Solar Media will host the 6th Energy Storage Summit USA, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Great Britain’s battery fleet dispatching 47% more energy after changes brought in by ESO

The bulk dispatch functionality allows for more battery instructions to be issued simultaneously across the GB energy network, which includes England, Scotland and Wales, but not Northern Ireland (hence the GB prefix, rather than the UK, which does).

According to ESO data, approximately half of the battery unit dispatch volume is now being instructed through the Open Balancing Platform (OBP).

The impact of this re-introduction was felt across the battery storage marketplace, both in the increase of weekly dispatches and a newfound lack of correlation between unit size and dispatch rate.

Modo noted that the increase from both system-flagged and energy actions and was led mainly by an increase in offer volume, which rose by 54%. In addition, 86% of individual battery units have experienced rises in dispatch volume, whilst the remaining 14% has decreased since the relaunch of bulk dispatch.

On average, batteries were dispatched at 2.2MWh/MW of the unit’s rated power before bulk dispatch. Following bulk dispatch, batteries are dispatched at 3.6MWh/MW.

Once bulk dispatch had been reintroduced, Modo reported that all units saw a reduced average volume required per instruction. However, this means that batteries are being dispatched more uniformly when taken in proportion to the unit size.

Units that were seeing smaller volumes per instruction have had the smallest decrease in instruction size. Meanwhile, units that received the largest number of instructions saw the biggest reductions.

During the eight weeks before the relaunch, the difference between the smallest and largest instructions on average was 0.4MWh/MW, whereas it is now 0.1MWh/MW.

Previously, units with a higher-rated power had a higher dispatch rate. This is because, before the bulk dispatch function, these units were easier for the control room to dispatch within the timeframes required.

However, there has been no correlation between unit size and dispatch since the relaunch of bulk dispatch for batteries. Now that unit size does not determine how easy it is to dispatch, price has a greater impact on dispatch rates.

To read the full version of this story, visit Current.

Australia: Construction begins at biggest battery storage project so far

The state’s government is funding the project. It forms part of the government’s commitment to increasing the amount of storage available for when variable renewable energy (VRE) sources like solar PV and wind aren’t generating, and in managing peak loads and congestion on the grid.

It’s being added to the growing portfolio of state-owned energy generator-retailer (‘gentailer’) Synergy. Synergy is looking to deploy 3GWh of energy storage from batteries by 2025.

With the Collie BESS set to be completed by the end of that year, the energy supplier is well on the way to reaching that target. Construction began in mid-2023 on Kwinana 2, a 200MW/800MWh BESS project that will complement Kwinana 1 (100MW/400MWh), completed in May last year.

“The build of Australia’s biggest battery right here in Collie marks a significant point in the energy transition,” said Member of the Legislative Assembly (MLA) for the local Collie-Preston electoral district Jodie Hanns.

Hanns noted the historical importance of the Collie region to WA’s energy system, being host to many of its large-scale thermal generation plants, including a Synergy-owned coal power plant at Collie itself scheduled for decommissioning in 2027 and another already retired coal, fuel oil, and gas power station at Kwinana.

Further underscoring the site’s significance is the proposed development by privately-owned French independent power producer (IPP) Neoen of another large-scale BESS at Collie. Neoen has said the sizing of its asset would be 200MW/800MWh but could later be expanded to 1GW/4GWh, which Synergy has also said of its battery project in Collie.

WA Minister for Energy Reece Whitby noted that the battery project will also help “local workers and families” as Collie sees the exit of thermal generation.

Planning approval was granted for the Collie BESS in December. That followed a government announcement in September that Chinese battery maker CATL will supply the BESS for both it and Kwinana 2, with Spain-headquartered Power Electronics to provide power conversion system (PCS) equipment to the projects.

Up to 96GWh of storage needed in region by 2050

Western Australia is not part of the National Electricity Market (NEM) which connects Australian states in the Southern and Eastern parts of the country.

Energy is traded and balanced instead through Wholesale Electricity Market (WEM) for the South West Interconnected System of Western Australia (SWIS) grid network.

While the NEM was recently highlighted as being among the world’s most volatile electricity markets in terms of pricing by Rystad Energy and most of the country’s BESS capacity is being installed in NEM-connected states like Victoria and New South Wales (NSW), the need for storage in the SWIS, which is an isolated grid, is also very large.

The Australian Energy Market Operator (AEMO) has modelled that WA will need between 12GW and 17GW, and between 74GWh and 96GWh of storage by 2050.

National significance of project’s scale and duration

A report published earlier this month by Australian trade association Clean Energy Council (CEC) found that as of the end of 2022, there were 19 large-scale BESS projects totalling 1.4GW and 2GWh under construction throughout the country.

The report, ‘Clean Energy Australia 2023’, recapped project activities including construction and investment commitments across wind, solar and energy storage last year, providing the 2022 figures by way of comparison with 2023’s “significant year” for storage.

It’s boom time for batteries, which, along with rooftop solar PV, provided a bright spot in an otherwise challenging market environment for renewables in Australia, CEC said. As of the end of 2023, there were 5GW/11GWh of big BESS projects in construction.

The largest of those was the Waratah Super Battery in New South Wales (850MW/1,680MWh), making WA’s claim to the single biggest project underway so way valid, although it looks likely more on a similar scale will come.

Waratah Super Battery, also due to go into operation in 2025, has a larger grid output capacity in megawatts than the Collie BESS. However, the bigger megawatt-hour figure and 4-hour duration of Synergy’s BESS at Collie is also significant in a market that has, to date, seen battery storage going from 1-hour to 2-hour duration for most large-scale projects.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

EDP and Rondo Energy introduce industrial heat offering using thermal energy storage

Rondo ‘Heat Batteries’ convert intermittent electric power from renewable assets, such as wind or solar, into continuous high-temperature heat. The technology also has the ability to deliver continuous power through a combined heat and power (CHP) configuration, added Rondo Energy.

In June 2023 Rondo Energy announced its intention to scale the annual production of its ‘Heat Batteries’ to 90GWh.

Following the partnership, EDP will develop wind and solar parks; these will be large-scale and distributed with the latter co-located with a ‘Heat Battery’.

According to EDP these projects will “open a new market”, offering the commercial and industrial customers within the energy company’s core market renewable heat and power supply contracts said to deliver “deep decarbonisation and major energy savings.”

Vera Pinto Pereira, EDP’s board member, said Rondo Energy’s technology opens “a major business opportunity” for the decarbonisation of its energy-intensive clients that use heat in their facilities.

John O’Donnell, CEO of Rondo Energy added that the partnership is a “game-changer” that aims to low-cost clean heat to industrial customers.

“Working together, Rondo and EDP will deliver 24-hour clean heat to industrial customers at prices competitive with gas, and without any factory facility changes,” said O’Donnell.

The partnership follows Rondo Energy completing a US$60 million fundraising round in August 2023, with investors including Rio Tinto and Microsoft.

Friday Briefing: Community opposition fuels local authority reluctance at UK’s Cleve Hill battery project

Unfortunately, it has now hit mainstream media headlines – for the wrong reasons – due to local authorities finding shortcomings in the project’s safety management planning.

First covered by our colleagues at Solar Power Portal back in 2017, as announced by co-developers Hive Energy and Wirsol, it was considered “huge” and “pioneering”, with a solar PV generation capacity in excess of 350MW.

It would still be among the UK’s largest solar PV plants, but since then, the Hive-Wirsol SPV has added 150MW/700MWh of battery storage to its design.

While in the intervening years that battery storage system sizing has become less eye-catching in the context of some of the other very big projects around the world, it remains a landmark project in terms of what it would mean for UK clean energy infrastructure development.

However, at the end of February, local residents held a protest over the perceived fire and explosion risk of Cleve Hill’s lithium iron phosphate (LFP) batteries.

A lengthy debate ensued, and a committee of the local council of Swale Borough in the county of Kent, where the project will be sited, refused its battery safety management plan.

Cleve Hill had already been granted planning permission all the way back in 2020, which went through despite an earlier attempt by Swale Borough Council to overturn the decision. Construction on the solar power plant began in April last year, and investor Quinbrook has come on board.

The latest buffer it has hit is perhaps a temporary obstacle rather than a total halt to proceedings, but it still doesn’t give hugely encouraging signals that community engagement and local authority acceptance of lithium-ion (Li-ion) battery energy storage system (BESS) projects are going smoothly.

We’ll be looking at the topic of fire safety and stakeholder engagement on fire safety in some depth for an ESN Premium article next week. In it, we speak to system integrator and BESS manufacturers Trina Storage and Wartsila, as well as battery analytics company ACCURE about what the industry is doing from a technology standpoint, as well as what’s being done in terms of educating local authorities having jurisdiction (AHJs) and by extension, local communities.

After the 2017 fire and explosion at the McMicken BESS in Surprise, Arizona, US, which many considered a watershed moment, putting together safety response plans and communicating them with first responders and community members has become an industry best practice.

While we don’t know exactly how the Cleve Hill plan was assessed, the story does imply that some level of standardisation in response plans, as well as mandatory aspects that would put local planners’ minds at rest, would be desirable.

We’ve already seen that happen in California last year, and we can likely expect it to be the case in New York soon too.

There will always be challenges associated with gaining acceptance of new energy technologies, but ultimately, the industry needs to get ahead of this issue and show leadership before it becomes an even more thorny one.

This week on ESN Premium

Market reacts to falling BESS prices

We heard from system integrator, developer and EPC delegates at the Energy Storage Summit EU in London about the implications of falling BESS prices.

As Energy-Storage.news reported last month, global prices for battery energy storage systems (BESS) have been on a downward trend since early 2023, having shot up in 2022.

Clean Energy Associates (CEA) took a deep dive into BESS pricing and the dynamics underlying the recent falls in the most recent edition of Solar Media’s quarterly journal PV Tech Power, which of course, you can access in full as part of your subscription to ESN Premium.

Powin developing more energy-dense, higher-power BESS product to compete with China

System integrator Powin is working on a new grid-scale BESS product to compete with increasingly competitive products from China, senior VP Danny Lu told us.

In an in-person interview, Lu also discussed other topics, including the Waratah Super Battery project in Australia, fire safety and manufacturing strategy.

Lu said the new Powin Energy battery energy storage system (BESS) product would be a higher power and higher energy density alternative to its current Centipede modular grid-scale platform in a response to a question about competing with China’s existing and emerging global BESS providers.

Highly technical subject of battery analytics is ‘now something for the CFO to think about’

Kai-Philipp Kairies, CEO of analytics firm ACCURE, discusses some of the areas in which battery analytics can have the most impact on battery energy storage system (BESS) project success.

Kairies says that while analytics may previously have been considered the domain of the more technical members of a battery storage project team, their impact on the bottom line means it’s increasingly “a topic for the CFO”.

Last year, Kairies contributed the article: ‘Using battery analytics to support BESS commissioning: A technical deep dive,’ which ran in Vol.35 of our journal PV Tech Power, alongside the companion piece, ‘Cloud-based analytics for de-risking BESS deployment and operation ‘from Dr Stephan Rohr, Sebastian Becker and Dr Matthias Simolka at TWAICE.

In this article, we take a more informal look at the role of analytics at different stages of the BESS development and life cycles.

Gigafactory firm Morrow Batteries targets lower-lead time ESS market with first-phase production

Andreas Maier, COO of one of the few energy storage-focused lithium-ion gigafactory companies in Europe, Morrow Batteries, talked to Energy-Storage.news about the firm’s go-to-market strategy and what the future holds for Europe’s gigafactory space.

The company is going to begin operations at its first lithium-ion gigafactory in Arendal, Norway, this year, with an initial annual production capacity of 1GWh with three later phases aimed at increasing that to 43GWh by 2028 (all at one site).

Like its fellow Norwegian-founded peer Freyr, Morrow is – at least with its first phase – primarily selling into the energy storage system (ESS) market. It is selling lithium iron phosphate (LFP cells) to system integrators working in the commercial and industrial (C&I) and residential application segments.

Eos, ESS Inc and Energy Vault narrow losses and lower costs on long ‘path to profitability’

Eos Energy Enterprises, ESS Inc and Energy Vault have increased their revenues and narrowed losses, according to financial results from the three ‘non-lithium’ energy storage companies.

The trio, which all listed their stock publicly following mergers with special purpose acquisition companies (SPACs) during the first two years of the COVID-19 pandemic, have reported their latest quarterly and full-year 2023 results in the past couple of weeks.

As Energy-Storage.news covered Eos, ESS Inc and Energy Vault’s financials collectively for Q3 2023, we continue to do so here.