In each case, despite improvements in various metrics, guidance as to when the technology providers expect to become profitable on a sequential basis has not been provided.

Meanwhile, stock prices – which listed at US$10 as is customary for entities listing after SPAC business combinations – continue to remain low: ESS Inc’s was at US$0.81 (NYSE), Eos’ at US$1.00 (NASDAQ) and Energy Vault’s US$1.90 (NYSE) as trading closed yesterday (13 March).

Back in August 2023, Energy-Storage.news Premium reported that the three companies and Stem Inc, which also listed after a SPAC merger, had seen their share price fall on average by 80% since listing by that time.

As Energy-Storage.news covered Eos, ESS Inc and Energy Vault’s financials collectively for Q3 2023, we will continue to do so here.

Energy Vault

In financial terms, the Swiss-US technology company behind a novel gravity-based energy storage system (ESS) appears to be best off.

Energy Vault reported full-year 2023 (FY 2023) revenue of US$341.5 million, an increase of 134% year-on-year and within its annual guidance range, while its cash position at the end of the year stood at US$146 million with no debts, beating previously offered guidance of US$132 million.

However, adjusted non-GAAP EBITDA was -US$62.1 million for the full year 2023, versus -US$11.36 million for 2022 while net loss (GAAP) was US$98.4 million, increased from US$78.3 million as of the end of 2022.

As with the other two companies covered in this article, Energy Vault did have some operational highlights to talk about.

These included the near-completion of its first multi-megawatt gravity energy storage project in China, which has now connected to the grid, and the start of work on three more in the country. Energy Vault claimed the four projects will generate high margin recurring royalty revenue streams.

The company also signed a licensing deal for its gravity storage tech in South Africa and is working with a US utility to develop and deploy gravity energy storage.

As regular readers of Energy-Storage.news will know, Energy Vault has also diversified to add more familiar technologies to its offerings, namely lithium-ion (Li-ion) battery storage, green hydrogen, and software-as-a-service (SAAS).

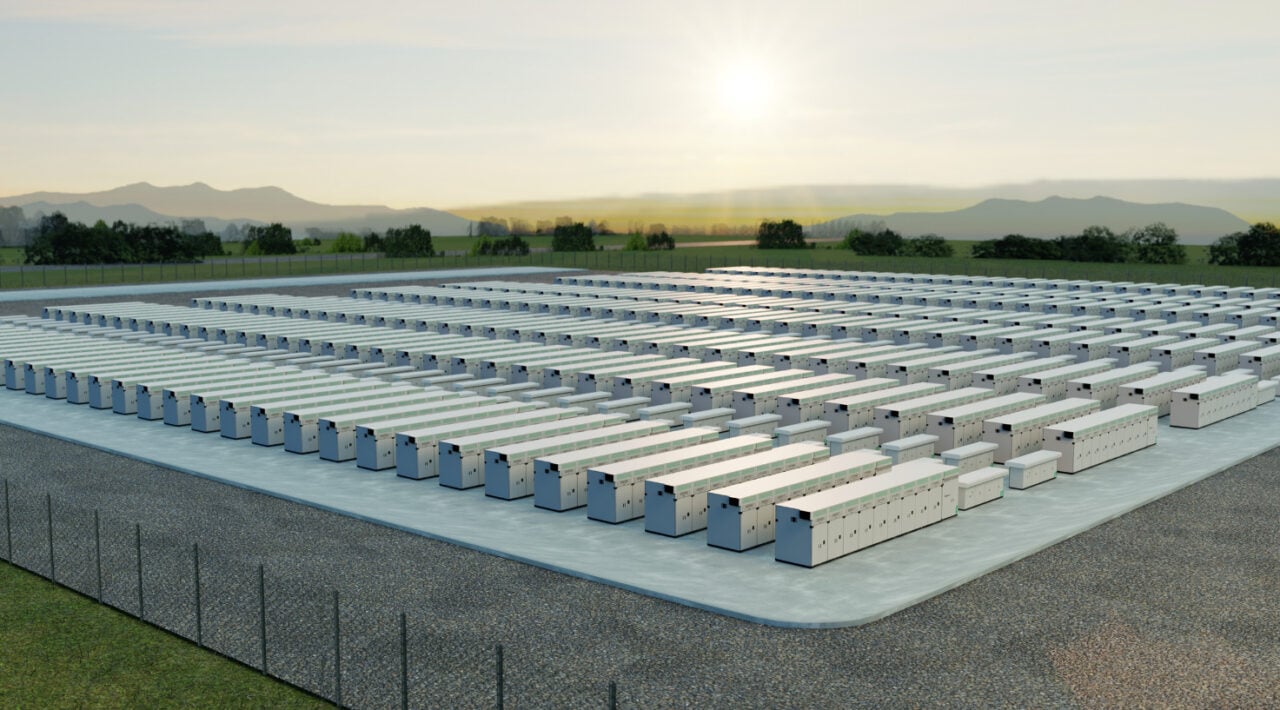

While revenues for each business area were not broken out in presentation materials seen by Energy-Storage.news, three large-scale lithium-ion battery energy storage system (BESS) projects in the US built with Energy Vault’s proprietary design will likely have made a big contribution to its revenues.

Two have been recently completed and commissioned while the third is set to go online during this quarter. The company also expects to have its first green hydrogen project online in Q2 2024, for which it has signed a 10.5-year tolling agreement with utility Pacific Gas & Electric (PG&E) in California.

Energy Vault claimed it has reduced the time it expected to take to reach profitability on an adjusted EBITDA basis, through cost reductions that took effect from the final quarter of 2023 and projected to result in 25 – 30% lower operating expenses in 2024.

After listing in Spring 2021, the highest the company’s stock price has reached since was US$18.32, in April 2022.

Eos Energy Enterprises

Eos Energy Enterprises is the manufacturer of a proprietary zinc-based battery technology, aimed at providing medium to long-duration energy storage (LDES).

The company earned US$16.4 million in revenue during 2023, down from US$17.9 million the prior year. However, it expects to earn between US$60 million and US$90 million in 2024 and the company said – as it has done in the past – that its ability to turn a profit relies largely on implementation of automated production lines.

That process is already underway, and the company claimed it has further reduced costs and improved its value proposition with the development during last year of its third generation Z3 battery product.

The Z3 battery design, “provides improved power density along with lower unit costs from its simpler mechanical design,” CEO Joe Mastrangelo said.

Eos reduced its operating costs year-on-year by 7% to US$79.5 million, as a result of “tighter cost control measures”. Costs of goods sold was also reduced to US$89.8 million, which was a reduction of US$63.5 million from US$153.3 million in 2022, and equivalent to a gross margin improvement of 41%.

Mastrangelo claimed “strong demand signals for long-duration energy storage remain,” and talked up the company’s strategy of basing its production in the US, which will enable it and its customers to avail of higher level tax credit incentives for domestically made clean energy technologies. The company could also yet be a recipient of lending via the US Department of Energy Loan Programs Office to fuel its manufacturing ambitions.

Eos, which listed in June 2020, saw its stock price reach its highest level to date in January 2021, when it hit US$28.83.

ESS Inc

Iron electrolyte flow battery company ESS Inc – which holds the IP for its technology – achieved its highest annual revenues to date in the year ending 31 December 2023 of US$7.5 million. That was below the US$9 million guided in Q3, but a massive increase from the US$610,000 revenue it earned in 2022, the first year it began recognising revenues.

The company talked up a number of partnerships, milestones and customer projects that have progressed, including a first system delivered to Honeywell, with which it has a co-development agreement and partnership in place to work on flow battery technology and commercialisation.

ESS Inc also explained that revenue recognition to the tune of US$2 million for a customer project in Australia was pushed back from the end of last year into Q4 2024, which would account for the reported revenue coming in lower than guided.

Against its US$7.5 million revenue came a US$20.5 million cost of revenue, meaning a loss of US$12.95 million for the full year just gone.

The flow battery company, which has licensed its proprietary tech to Honeywell as well as ESI Asia-Pacific, an Australia-based distributor and manufacturer, said that during 2023 it lowered its cost of production for its Energy Warehouse product by nearly 60%, cut commissioning time in half and improved energy density by 25% through improvements to the electrolyte. It is also nearing the scale production of Energy Center, its flagship utility-scale long-duration battery storage solution, the company claimed.

While, like Eos and Energy Vault, it has yet to reach its destination on the path to profitability, ESS Inc did cut its Q4 adjusted EBITDA losses down to US$12.8 million, halving it on a year-on-year basis.

Also like the other two companies, ESS Inc talked up the macro environment for energy storage and in particular long-duration, which the flow battery company claimed represented a likely US$3 trillion investment by 2040 worldwide.

ESS Inc listed in December 2020, with US$18.75 the highest its stock price has gone so far, in early November 2021.

Energy-Storage.news’ publisher Solar Media will host the 6th Energy Storage Summit USA, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Sodium-ion: ‘Perfect for applications where energy density is not paramount’ says BMZ CEO

However, they will not be widely commercially available for a while. BMZ has got to the stage of testing prototype cells in 26700 and 32140 formats, with further formats in development. The company said cells are already being made for specific customers’ projects, and capacity exists to deliver more should demand arise, but series production is not expected to begin until summer 2025, or thereabouts.

CEO and founder Sven Bauer said the Na-ion technology: “offers us and our customers unique new opportunities as well as rapidly growing market potential, and we are looking forward to breaking new ground together”.

Sodium-ion has theoretical advantages that could make it complementary to lithium-ion in the battery market, if not a direct competitor.

The energy density of most types of lithium battery tends to be much higher than that of its newer counterparts, but on the flipside, sodium-ion batteries could be produced much more cheaply.

Meanwhile, a switch could enable a decoupling from the supply chains for lithium that are subject to huge volatility and fluctuations in demand, from sectors that include electric vehicles (EVs) and consumer electronics, as well as stationary battery storage.

There could also be a safety advantage, with the less reactive sodium cells not subject to dendrite formation that can cause lithium cells to short circuit, and ultimately to thermal runaway.

“The sodium-ion technology is the perfect solution for applications where energy density is not paramount,” BMZ Group CEO Bauer said.

“This includes industrial and home storage systems or industrial trucks, such as forklifts.”

Na-ion ‘expected to become popular choice’ for developers

As part of our Year in Review articles, at the end of 2023, and looking ahead into this year, Energy-Storage.news canvassed views from a number of developers of BESS projects on the technology trends they see coming up.

“Storage technologies are always evolving, so you should keep an eye out for the development of sodium-ion batteries, which can be one of the few technologies able to achieve a market share comparable to lithium batteries, in the short term,” said Julian Gerstner, head of energy storage at Baywa r.e.

Gerstner noted that sodium-ion battery development is largely in the R&D stage, but that the devices were expected to “become a popular choice for battery storage systems in the near future” (Premium access).

Interestingly, other respondents including Jeff Bishop, CEO of Key Capture Energy, said that newer tech like sodium-ion captures the imagination and media attention, but that advances in lithium-ion tech should not be ignored, because that is likely what will push the needle on stationary storage deployments.

In November last year, sodium-ion battery firm Altris, in partnership with European battery mass manufacturing startup Northvolt, claimed a “breakthrough” in creating Na-ion batteries with 160Wh/kg energy density.

Designed for stationary energy storage applications, the energy density of the pair’s battery tech compares favourably to the lower end of the 120 – 260Wh/kg range typically expected of Li-ion devices.

Price reporting agency (PRA) Fastmarkets recently wrote in a Guest Blog for this site that sodium-ion and solid-state batteries have an opportunity to gain market share amid the lithium supply crunch. In China, construction is reportedly underway on a 50MW/100MWh sodium-ion grid-scale battery storage system project, in the country’s Hubei province.

Again, with that being said, Li-ion doesn’t look likely to get knocked off its perch as the go-to technology, especially for longer range EVs or even BESS installations in more land-constrained areas.

BMZ’s Sven Bauer said the company, which makes and sells complete energy storage solutions in addition to cells, racks and modules, invests around half of its profits annually into R&D activities, but the enthusiasm it has towards the potential of sodium-ion – or other new technologies – “does not mean that we are abandoning any existing technologies”.

“As a pioneer in lithium-ion battery technology, we have made history in the world of batteries, and we continue to value their unrivaled energy density. Thanks to our many years of expertise, we are the industry experts who can give customers sound advice on which cell chemistry to use for any given application.”

BMZ’s Na-ion devices are being made by its specialist lithium-ion battery cell manufacturing subsidiary, TerraE.

Gigafactory firm Morrow Batteries targets lower-lead time ESS market with first phase production

Like its fellow Norwegian-founded peer Freyr, Morrow is – at least with its first phase – primarily selling into the energy storage system (ESS) market. It is selling lithium iron phosphate (LFP cells) to system integrators working in the commercial and industrial (C&I) and residential application segments. One of those announced last year was Eldrift.

In an interview at the Giga Europe conference in Stockholm this/last week, COO Andreas Maier explained why the company had gone this route, and how it expected it stay competitive in that market considering the price falls from Chinese suppliers and ESS’ lack of incentives to use European cells (compared with the EV market).

Giga Europe was put on by Benchmark Mineral Intelligence and brought together the continent’s battery supply chain, including gigafactory companies, critical material producers and traders and those active in financing.

Quicker route to ESS market

“It is about the the accessibility of the ESS market. Automotive customers have much longer lead times for qualifying batteries to their platforms, it could be a five-year lead time,” he said.

“Staying competitive – that’s a challenge for the market which is now flooded with cheap Chinese LFP batteries. There is still an opportunity for us to work with smaller companies not necessarily served by the big suppliers; specifically mid-sized companies that put an emphasis on sustainability and independence from the Chinese supply chain.”

Gigafactories in Sweden and Norway can benefit from being able to achieve 100% renewable energy from hydropower, with energy a massive portion of a gigfactory’s carbon footprint.

However, Morrow still needs to source its cathode active material (CAM) for LFP batteries from China. “The LFP supply chain is highly Chinese. However, we have a second generation chemistry we are looking at and talking to customers about, which is LNMO (lithium nickel manganese oxide). The LNMO supply chain is much more European, and we could produce the CAM for that.”

Like any battery manufacturer targeting the ESS market, there is also an opportunity to go into full ESS provision considering the cell is the biggest single part of that cost. Maier: “At the moment we are acting as a cell supplier but we are looking at strategic partnerships and maybe even a joint venture to become a full ESS supplier.”

Wider market

Maier spent six years at South Korea-headquartered Tier 1 battery supplier Samsung SDI from 2012 to 2018, so is well-placed to discuss the how competitive Europe will be with suppliers from China and East Asia at a high-level (on top of his comments about Morrow’s own competitive strategy). That competitiveness with both China and the US was a major theme at the Giga Europe event.

“If you look at the European gigafactory market’s incumbents – Northvolt, PowerCo, ACC, Verkor, Morrow – I think they will take their market share to the extent of the GWh capacity they have announced,” Maier said.

“Whether they will further scale will depend on how efficient those facilities will be scaled and how efficiently they will operate. There is also European production by Asian makers – the Korean companies are strongest but the Chinese and others are also coming in. How much they scale will be based on how much the European ones do.”

Maier claimed that the European premium for lithium-ion battery cells will only be 10-15% compared to Chinese ones, a bit higher in the ESS market because of the lower volumes, and that he expected that difference that premium to stay similar over time. One ESS player said the premium for European cells is more like 20-65%, even higher right now because of the lack of capacity.

All major European gigafactory projects are supported by a big European automotive OEM (original equipment manufacturer). Those European automotive OEMs over their history have moved away from manufacturing components to procurement components and assembling them with their technology know-how.

“Their role in battery production marks their re-integration back into production, though it’s not clear what their strategy is. But you could see it as a long-term game to eventually do their own production. If they don’t, I imagine a certain share of their cell procurement will be from existing suppliers in East Asia.”

Morrow’s main shareholders are Norway-based energy group Å Energi, PKA (Maj Invest), Siemens Financial Services, ABB, and Nysnø

Morrow Batteries COO Andreas Maier.

Continue readingLong-duration energy storage: UK’s House of Lords tells government to ‘get on with it’ and act fast

The Committee which published the report is among a number of select committees set up by the House of Lords, the upper house of the UK Parliament which is independent of the elected House of Commons. The committees are appointed to examine and explore general issues affecting the country.

In a bid to support the technology, the Committee’s report outlined that a coordinated effort is needed to unlock investment in LDES and to ensure a strategic reserve of storage is delivered both to achieve net zero and to protect the UK from future energy supply shocks, a perspective shared by various members from across the energy industry.

One of the biggest questions raised by the energy industry in response to the government’s consultation on LDES technologies was the decision to exclude lithium-ion batteries from the LDES business model. For example, battery developer-operator Field’s COO, Luke Gibson, stated that excluding lithium-ion technology at a 6-hour duration “should be reconsidered”.

The report also discussed this topic, with the Committee stating that one of the most significant barriers to LDES technologies has been a greater focus on lithium-ion batteries. It said, “One of the key barriers is that there is still too much focus on lithium-ion”.

Whilst the Committee has welcomed the government’s recent reforms to the energy system, such as committing to delivering a Strategic Spatial Energy Plan, the report raises concerns that it is unclear who will be responsible for implementing this plan or how future energy supply crises will be managed.

To read the full version of this story, visit Current.

Highly technical subject of battery analytics is ‘now something for the CFO to think about’

Cloud-based battery analytics. Even if you have not come across this software-based solution to gaining better understanding of batteries in your work, you will likely have seen articles or webinars on the subject, including ours here at Energy-Storage.news.

We speak to Kai-Philipp Kairies from ACCURE, one of the growing number of cloud-based battery analytics vendors and service providers. ACCURE started as a spin-out from RWTH Aachen University’s battery practice.

Like its rivals, which in Europe include fellow German company TWAICE and PowerUp from France, ACCURE’s software is also used for electric vehicle (EV) batteries, but as Kairies says, its role in stationary BESS is growing rapidly.

The company went from ten managed sites to 40 in the 12 months leading to our interview at February’s Energy Storage Summit EU in London, UK, with each over 10MWh and the largest at 200MWh, across various markets, the CEO claims.

Last year, Kairies contributed the article: ‘Using battery analytics to support BESS commissioning: A technical deep dive,’ which ran in Vol.35 of our journal PV Tech Power, alongside the companion piece, ‘Cloud-based analytics for de-risking BESS deployment and operation‘ from Dr Stephan Rohr, Sebastian Becker and Dr Matthias Simolka at TWAICE.

Below, we take a more informal look at the role of analytics at different stages of the BESS development and life cycles.

Commissioning delays

“A lot of sites have seen quite relevant delays [in commissioning]. In our portfolio, we see three to four months delays, on average, with some sites having substantially longer delays. Analytics can drastically reduce that.

Obviously if you’re delayed because the transformer isn’t delivered, that’s something else. But if you can’t get site acceptance because the capacity isn’t provided [or] because of imbalancing, or maybe some of the modules were not correctly installed, it’s very difficult to figure out what exactly is the problem.

Analytics can give you the answer in a week, versus running across the site in circles, trying to figure it out. That’s what some of our partners did before contracting us.

One project that I can talk publicly about [that] I think is a nice example is National Grid Renewables in the US. They contracted us for commissioning support, because they were delayed on commissioning with their site.

It was really such a nice demonstration of how analytics can help because the timeline that they were looking at, it was already late and then they thought, ‘It’s going to take another two or three months.’ Using analytics it was weeks. So they were very positively surprised of how much we could help.

National Grid Renewables also contracted us for continuous monitoring afterward, for their entire fleet. Once you can show the value of analytics in one small thing, it really opens up the mind for everyone to say, ‘Oh, we could use that in other ways as well, like for the lifetime of an asset’.”

State of Charge assessment

“More and more companies are becoming aware of State of Charge (SOC) problems. Everyone’s using LFP lithium iron phosphate batteries now and as long as you’re making your money on highly contracted revenue stacks, perhaps frequency response, an error in the State of Charge estimation wasn’t that bad, but if you’re going into fully merchant or taking more merchant risks, it becomes very important how to dispatch your system. And if you’re operating on assumptions that are flawed, you’re not making the full revenue.

More and more people, as they move towards more merchant risk, become aware of technical problems that have been around for some time, but they weren’t relevant [previously]. Now they become more relevant and they need solving. And again, analytics can really improve that, we have demonstrated that with sites [of capacity] above 100MWh, we can improve the tradeable capacity by 5-10%.

This is really relevant on the revenue side. Analytics, in the beginning, has been more of a technical topic that engineering departments were interested in, but now it really becomes a topic for the CFO.”

Warranties and Long-term Service Agreements (LTSAs)

“More and more companies have complex setups for their traders. So, they might have two different traders, or they might think about getting trading [capabilities] in-house.

Now the question is, how does the trading affect the warranties? Does it violate some of the LTSAs? Do you lose your warranty because a trader made the wrong decision? How do you track that?

Again, analytics is just an information layer to help owners and operators make informed decisions, while right now a lot of them are flying blind.”

From factory to field deployment

“When I give talks these days, I always start with a small Pop Quiz.

Which percentage of batteries produced today come from factories that are less than two years old? The answer is: more than half. Over 50% of the batteries being produced today come from immature production lines.

Young production lines tend to have a larger spread in the output quality, and of that spread, some of the batteries go to scrap. You can’t just throw away 70% of your production, so they kind of pre-test it, batch it together and sell them at different price points.

Very good ones go into the Triple-A bucket and then the so-so ones. This is one of the reasons why commissioning sometimes has problems with site acceptance. Multiple batches of a production go to the same site and then you have some cells that are quite good, and some cells that are mediocre.

Which in itself is not a problem, but if they’re mixed, the mediocre cells will always limit the great ones. It’s like with solar, like the worst panel in the string will limit the string. With batteries, one mediocre module is enough to limit the capacity of an entire container, and that leads to huge problems.

Sometimes you can even get through site acceptance, you’re successful with all the tests, and then the owner-operator doesn’t even find out that some of these cells will have a much stronger degradation in the long term.

Then after three or four years, it becomes much more difficult to claim quality defects, versus on Day One. Three or four years down the line, the OEM might say: ‘Oh, you abused it, and let’s look at all the data. Maybe you did this one small thing that kind of voids the warranty.’

If you can do it on Day Zero, [you have] much more leverage.

We can provide these insights that are not available without analytics right now. The standard approach for site acceptance testing, or just looking at the voltage value, checking that’s within the range, it doesn’t give you the answer. Analytics can do really deep modeling that tells you the internal resistance spread is 20%, and it should only be 10%, and so on.”

Energy-Storage.news’ publisher Solar Media will host the 6th Energy Storage Summit USA, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Inflation Reduction Act doing well versus EU Green Deal because of ‘how easy it is to understand’

Clark was speaking at the conference on mass production of batteries for the region, hosted by Benchmark Mineral Intelligence this week in Stockholm, Sweden.

“It’s US$35 per kWh if you’re a battery cell manufacturing company, it’s US$10 per kWh if you’re a solar module company, it’s US$7,500 if you drive an electric vehicle and it’s very clear what you need as the components to get that. Everybody understands it and there’s US$369 million behind it.”

“Europe completely can beat North America, but even European companies like Northvolt and Freyr have been looking at what they should be doing in North America versus Europe, because of how easy it is to understand. Europe has to simplify it and realise that if it isn’t simplified, it will be China and North America.”

Clark was speaking on the ‘Cathodes, Anodes & Battery Innovation Panel: creating a European hub for mid stream capacity & next generation battery development’ on day one of Giga Europe yesterday (12 March, pictured above).

In one of a few keynote speeches via video on day one, European Commission executive VP Maroš Šefčovič said the EU was ‘stepping up its game’ on providing the financial support and conditions for the bloc’s battery manufacturing ecosystem to thrive.

In the same session as Clark, towards the end of the day, investor Vertical Ventures’ Anthony Tse said that the USA has essentially adopted China’s playbook, the ‘carrot and stick approach’.

“You’ll get penalties if you don’t hit these targets but here’s a carrot if you do. Every country has the same ability to play with their balance sheet, and this will by no means be a cheap exercise for the US. Minimum estimates are that the Inflation Reduction Act will cost them around US$300 billion, I would say they’re lucky to get away with twice that, and closer to US$1 trillion,” Tse said.

“The Chinese, and others, are so used to saying a project can be done in two years. I’d love to see that in Europe, but just the paperwork can prevent that happening, so that can be streamlined.”

“The US has basically designed a structure, whereby they are saying to the industry ‘if you do this, you will get this. In China, they said ‘we’d like you to do this, and you must do this’ and the industry turned around and said ‘what’s in it for me’. In Europe, there’s a lot of pressure for the private sector to take on that financial burden for projects, whereas other parts of the world are looking at ways for government and private funding to work more closely together.”

Alongside its grants and tax credits for clean energy manufacturing, the Inflation Reduction Act also has tax credit incentives covering investment and production for downstream clean energy projects, including energy storage.

Energy-Storage.news’ publisher Solar Media will host the 5th Energy Storage Summit USA, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Australia: 2023 a ‘significant year’ for utility-scale battery storage construction and financing

Last year, Australia added 3.1GW of rooftop solar PV capacity, equivalent to 337,498 households and small businesses, the CEC said. The country has long been the world’s leading market for rooftop solar – according to a March 2023 report from the CEC, distributed rooftop solar fulfilled 14% of Australia’s electricity consumption in Summer 2022/23.

Another March report, from solar industry consultancy SunWiz, found that total rooftop solar capacity in Australia had surpassed 20GW.

2023 also saw “record-breaking” financial commitments into new utility-scale energy storage projects.

“27 battery projects are under construction, up from 19 at the end of 2022,” CEC chief executive officer Kane Thornton said. This represents 5GW/11GWh of storage capacity, the report said – up from 1.4GW/2GWh of capacity in 2022. These speak to a general increase in the average duration of storage projects in Australia, as well as their prevalence.

The largest project currently under construction is the 850MW/1,680MWh Waratah Super Battery in New South Wales, in which the government-backed Clean Energy Finance Corporation (CEFC) invested AU$100 million in June 2023. This project is expected online in 2025 and Energy-Storage.news Premium published an interview this week with Danny Lu, executive VP of Powin Energy, the battery storage system integrator to it.

2023 also saw AU$4.9 billion (US$3.2 billion) in new financial commitments for utility-scale energy storage and hybrid projects with storage, an increase from AU$1.9 billion (US$1.2 billion) in 2022. Q2 2023 alone saw storage investment break the billion-dollar mark, a large portion of which is attributable to the Waratah project.

The year ended with impressive figures despite a significant downturn in financial commitments in Q3.

Over 56,000 household battery systems were also installed in 2023, according to figures from SunWiz, up from around 43,000 in 2022.

Whilst energy storage and rooftop solar are going from strength to strength, the outlook for Australia’s utility-scale generation market is less positive.

2.8GW of large-scale capacity was added in 2023, a 500MW increase from the previous year, spread across 22 projects.

Financial commitments to new large-scale generation projects were lacking in 2023 – no backing was announced for new wind capacity, and just seven new solar projects with a combined 912MW capacity were announced. 2022 saw ten new solar projects receive backing, with a combined 1.5GW capacity.

To read the full version of this story, visit PV Tech.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Ib vogt sells 50MW/50MWh ready-to-build BESS project in Finland

The developer said the project will provide “a variety of services” to Finland’s electricity network, including frequency regulation and energy trading in wholesale markets over its expected 30-year lifetime.

It marks the first entry into the Finnish battery energy storage system (BESS) market for buyer RPC, which will procure equipment and components as well as construct the project for expected completion in the last quarter of 2025.

RPC is already active in the Nordic country’s renewables market primarily through investments in offshore wind. The renewables platform is backed by institutional investor CPP Investments, an arm of the Canada Pension Plan. CPP Investments invests money not needed for payouts to the pension fund’s 20 million or so contributors and beneficiaries.

‘Race against time’ in Finland to capture ancillary service revenues

It’s the latest in a number of large-scale BESS projects in Finland and the wider Nordic region, with Sweden also a growing market.

In late January, Energy-Storage.news covered French developer Neoen’s announcement of Yllikkälä Power Reserve Two (YPR2), a 56.4MW/112.9MWh BESS set to be Finland – and the Nordics’ – biggest project to date by megawatt-hours.

That project will be located close to Finland’s first large-scale BESS, a 30MW/30MWh also by Neoen. Henri Taskinen, CEO of BESS optimiser Capalo AI said the newer, larger project and its longer, 2-hour duration was notable of a shift towards longer durations in the Finnish market.

This was for two reasons, Taskinen said: new regulations around frequency response services that limit the amount shorter duration assets can bid into and a move towards a heavier emphasis on arbitrage in wholesale markets.

More recently, Energy-Storage.news Premium spoke with a couple of the folks behind another project in the country, a 38MW/40MWh BESS to be owned through a joint venture between equity investor Ardian and utility Lappeenrannan Energia.

The site heard that frequency control ancillary services prices in Finland are currently very high, while growing shares of variable renewable energy (VRE) generation are driving a fundamental need for more energy storage on the grid.

However, as with other markets, frequency markets are set to reach saturation sooner rather than later. That means there is, in the words of investment manager Aleksi Lumijärvi for e-Nordic on behalf of Ardian, “a race against time to bring batteries online to capture those revenues”.

Of the new project it has bought from ib vogt, Renewable Power Capital managing director of power markets and asset management Steven Hunter said that Finland has a “real need for battery storage at the moment,” which can provide stability to the grid that enables renewable energy deployment.

RPC recently also acquired its first ready-to-build BESS project in the UK on which it said construction is due to begin imminently. That follows the investor signing UK partnerships with BESS developers including Eelpower and Greenfield targeting a portfolio of more than 1.5GW in Europe’s (currently) leading market.

Fluence to supply BESS to 300MWh UK project at decommissioned coal power plant site

SSE Renewables selected Fluence to supply the BESS, and contracted Stockport-based OCU Energy as principal contractor at Fiddler’s Ferry.

The battery storage project is situated at the former SSE-owned coal-fired power station at Fiddler’s Ferry in northwest England. The power station was decommissioned in March 2020 and the final demolition of its cooling towers occurred at the end of last year.

Construction on the project will begin at the site in the coming weeks after SSE Renewables made a final investment decision in December 2023.

Brian Perusse, managing director of Fluence Energy UK, said: “Fluence is committed to delivering safe and reliable energy storage systems that advance the energy transition and we are proud to work with SSE Renewables on this highly significant project.

“Fluence has a track record of operating systems with high performance levels and we are committed to doing the same for Fiddler’s Ferry.”

To read the full version of this story visit Solar Power Portal.

Longroad builds Arizona project with First Solar Series 7 modules, Powin’s Centipede BESS

Spanning portions of Arizona’s Pinal and Pima Counties, Serrano will be equipped with thin-film cadmium telluride (CdTe) solar PV modules manufactured domestically in the US by First Solar.

First Solar’s new Series 7 modules will be used, marking the first Longroad-financed project to use them as well as being the fourth large-scale solar project in Arizona overall in a partnership between the two companies over the past four years.

Solar tracker maker NEXTracker will supply the PV plant’s tracking systems, while solar inverter (and latter battery storage) manufacturer Sungrow will supply the PV inverters.

Meanwhile, the BESS will be provided by US-headquartered system integrator and manufacturer Powin Energy, using Powin’s Centipede modular battery storage platform, which enables the connection of dozens of units to make multiple hundred-megawatt installations.

The BESS will use power conversion system (PCS) equipment made by solar inverter manufacturer SMA, as well as battery cells made by AESC. Powin signed a 2GW supply deal with SMA in 2022.

Powin executive VP Danny Lu spoke to Energy-Storage.news Premium recently at the Energy Storage Summit EU in London, UK. The interview, published this morning, covers topics that include the integrator’s approach to manufacturing, increasing energy density, fire safety, and the 1,680MWh flagship Waratah Super Battery project for developer Akaysha Energy in New South Wales, Australia.

Energy from the Serrano project will be sold under a long-term power purchase agreement (PPA) to utility Arizona Public Service (APS). Debt financing is coming from a number of lenders, led by CIBC and Societe Generale, while Apollo Global Management affiliate Athene Annuity and Life Insurance Company is the tax equity investor.

Arizona has been previously cited as an important growth market for Longroad, which secured US$500 million from investors, including reinsurance company Munich Re, in 2022 to help fund its pivot from developing projects to flip and sell into becoming an owner-operator of its developed assets. It made a further raise of US$600 million towards growing its portfolio of renewables and storage late last year.

The four Arizona projects supplied with First Solar modules include the Sun Streams portfolio, which Longroad acquired from the thin-film manufacturer. The pair also have a multi-year module supply deal in place through which the developer has to date secured around 8GW.

The portfolio includes the 200MWdc standalone PV Sun Streams 2, as well as Sun Streams 3 and Sun Streams 4, the latter both featuring battery storage systems.

Sun Streams 3 is a 285MWdc PV plant hybridised with 215MW/860MWh of BESS, on which financial close was achieved at the beginning of 2023. Meanwhile, Sun Streams 4 closed in Q4 last year and is the biggest project in the portfolio at 377MWdc of solar PV and a 300MW/1,200MWh BESS.

NEXTracker, Sungrow, Powin, SMA and AESC are all involved in the solar-plus-storage projects with EPC contractor McCarthy. Operations and maintenance (O&M) duties will be carried out by specialist NovaSource Power Services, together with Longroad on the PV side, while Powin is also contracted for O&M on the battery side.

Energy-Storage.news’ publisher Solar Media will host the 6th Energy Storage Summit USA, 19-20 March 2024, in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.