Gridstor has the backing of Goldman Sachs Asset Management, and the acquisition follows the late 2023 start of commercial operations of the company’s first project, Goleta, which is in Santa Barbara, California.

Construction could begin on the 2-hour duration lithium-ion (Li-ion) BESS project this summer for Evelyn to come online in the spring of 2025. It is being sited to connect to an existing substation operated by utility Texas New Mexico Power, a subsidiary of energy holding company PNM Resources.

Gridstor claimed that the use of the existing electricity transmission infrastructure would enable the BESS to begin its grid-connected operations quickly, taking part in the ERCOT market which accounts for more than 80% of Texas’ load. Delays in connecting to the grid are being increasingly cited among the major barriers to energy storage deployment, not just in Texas or even the US, but in mature markets around the world that include the UK and continental Europe.

ERCOT’s energy-only market has made it attractive to owners, operators and investors of merchant energy storage assets. According to stats from the US government Energy Information Administration (EIA) published in January, around half of all new utility-scale battery storage facilities planned to be added by the end of 2025 are in Texas.

Engineering and procurement work has already begun for the Evelyn project, with Gridstor claiming to have engaged “leading suppliers and contractors”.

While ERCOT is still second to California’s CAISO grid and market territory in terms of BESS deployment – as of November 2023 EIA said CAISO had surpassed 7GW of grid-connected large-scale storage to less than half that figure in ERCOT – the Texas-based merchant market is currently growing much faster than its California counterpart.

That said, CAISO’s installed battery assets are trending toward 4-hour duration or even more, while typical ERCOT projects are at around the 2-hour mark.

On that note, Gridstor said a couple of days prior to the Texas announcement that it had closed the sale of tax credits in its California project, Goleta, with JP Morgan. Investment tax credits (ITCs) for standalone energy storage, introduced in US president Joe Biden’s Inflation Reduction Act (IRA), can be traded from energy storage project owners to other entities with tax liability.

The value of the tax credit transaction was not disclosed, however Gridstor did say the project, which is at 60MW/160MWh and oversized in order to meet the terms of a 40MW long-term resource adequacy (RA) contract with utility Southern California Edison (SCE) as well as capture potential merchant market upside, was also financed through a debt deal with NORD/LB and Mitsubishi HC Capital America.

Energy-Storage.news first covered Gridstor in late 2022 when the company bought a 500MW/2,000MWh pipeline of BESS projects in Los Angeles from developer Upstream Energy, expected to come online by the end of 2026. Backer Goldman Sachs’ other interests in energy storage include a US$250 million investment commitment to Canadian advanced compressed air energy storage (A-CAES) company Hydrostor.

Energy-Storage.news’ publisher Solar Media will host the 6th Energy Storage Summit USA, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

EU ‘stepping up its game’ on battery gigafactories in Europe

While there was an acknowledgement across the several keynote speakers of the scale of the challenge Europe (and the world) faces in scaling up battery manufacturing, mainly lithium-ion (Li-ion) technologies, there is still optimism that Europe can catch up and be a major player in gigafactories, something Charlotte Lejon from the Swedish Energy Agency unequivocally stated.

While the bulk of manufacturing capacity will go to the electric vehicle (EV) segment, the energy storage sector will also provide some offtake.

Šefčovič via videolink said that the EU is ‘stepping up our game in Europe’ in supporting the sector’s scale-up, and has recently adjusted its state aid policies under the ‘Temporary Crisis and Transition Framework’ to provide additional support to projects that would ‘match the support offered by a third country’.

Northvolt, for its Drei Germany gigafactory, was the first recipient under the revised policy, receiving a c.€1 billion package in January 2024.

Northvolt’s first gigafactory, Northvolt Ett, in Northern Sweden. The firm has six gigafactory projects, plus ESS assembly, battery recycling, R&D and joint venture projects. Image: Northvolt.

Northvolt’s chief supply chain officer Dennis van Schie sat down for a Q&A with Energy-Storage.news, in which he discussed the company’s approach to, and challenges in scaling up.

“We have had delays, but our customers are backing us and we’re keeping going. We were shipping thousands of cells by the end of last year and see it at tens of thousands of cells by end-2024. It took the automotive industry 10-20 years to get off the ground. We’re super confident on our ramp up, yields and many other metrics are constantly improving,” van Schie said.

Energy-Storage.news will publish more content from the event, including on Northvolt and its plans, in the coming days and weeks.

Chile: Mining company Codelco signs ’24/7 solar-plus-battery’ power purchase agreement

Atlas was awarded the contract after winning a public tender issued by Codelco. Neither company disclosed the nameplate generation or energy storage capacity of the project, or its name or location. PV Tech has contacted them for clarification.

“With this project, we formally announce our entry into battery storage technology. We see this as an essential element to materially amplify the volume of renewable energy sources in the power system,” said Carlos Barrera, CEO of Atlas Renewable Energy.

Chile is being seen as a fertile market for energy storage, partly off the back of its rapidly growing market for renewables, particularly solar PV. Other recent developments include the Oasis de Atacama project, which will pair 1GW of solar PV and what could be the largest battery energy storage system (BESS) in the world at 4.1GWh capacity.

Developer Grenergy is behind the project, with PCS technology to be supplied by inverter maker Ingeteam, while Oasis de Atacama is among many energy storage projects underway in the country.

Many of Atlas’ solar operations are concentrated in Latin America, and the company has signed a plethora of PPAs in the region. In March 2022, it began commercial operations at a 244MWp solar PV plant in Antofagasta, Chile under a 15-year PPA with Engie Energía Chile.

Brazil, in particular, has been a target market for Atlas. In November 2023 it secured US$448 million from the Brazilian Development Bank towards a 902MWp project in the southeastern state of Minas Gerais – the ‘largest’ single-phase solar PV project in the country. In the preceding April, it signed a corporate PPA with Brazil’s largest aluminium producer for the entire 902MWp capacity.

In September of the same year, it inaugurated 600MW of solar PV capacity in Minas Gerais, spread across two projects, each with corporate PPAs in place.

In October 2022, Atlas was acquired by fund manager Global Infrastructure Partners (GIP) and private equity firm Actis for an undisclosed amount.

This story first appeared on PV Tech.

Additional reporting for Energy-Storage.news by Andy Colthorpe.

Powin developing more energy-dense, higher-power BESS product to compete with China

Lu said the new Powin Energy battery energy storage system (BESS) product would be a higher power and higher energy density alternative to its current Centipede modular grid-scale platform, in a response to a question about competing with China’s existing and emerging global BESS providers.

The emergence and growing market share of more providers from China has also, anecdotally, been described as the main factor behind a global fall in BESS prices from the highs of 2022. Many of those companies are launching products with a very high energy density, of between 4MWh and 5MWh per 20-foot shipping container-sized unit – in some cases helped by using in-house manufactured battery cells.

Centipede ‘has many advantages’ but energy density will increase

Speaking to Energy-Storage.news at the Energy Storage Summit EU in London last month, Lu said: “Our current Centipede platform has many advantages compared to competing products from China, but one area of opportunity for us is around increasing its energy density.”

“We are currently investing resources into engineering and partnerships to get a faster time to market for our next generation product – a more energy-dense and also higher-power product.”

“In specific markets where land is less abundant, like the UK, Europe and Southeast Asia, energy density is very important. This is less of an issue in other geographies like the US and Australia.”

“We also have the advantage of being a US company, with all our software designed in the US. The US and other markets have political barriers to software from China.”

On price, Lu said: “We’re aiming to be net-margin positive, which means we cannot take every deal. We are seeing certain suppliers losing money or making zero margin on projects just to take on market share and we don’t think that’s sustainable practice. Companies have tried and failed doing that.”

Using multiple battery suppliers for Waratah project

The conversation then moved on to a curiosity regarding Powin’s 850MW/1680MWh Waratah Super Battery project in Australia, the company’s largest to-date and potentially the world’s largest ‘single-phase’ BESS project in the world.

The two largest BESS online today – Moss Landing and Edwards Sanborn, both in California – are both larger overall but were built in multiple stages.

Powin publicly announced over the course of 2023 that it would integrate cells from two different suppliers into its Centipede BESS platform for the Waratah project: 280Ah lithium iron phosphate (LFP) cells from REPT and EVE Energy.

We asked Lu why the company has gone that route. He claimed that Powin is the first to utilise that multi-cell strategy for one product and project and that it made the company’s commercial offer for the project stronger, but also that it ‘de-risked’ the timelines of the project.

“We pitched that ability (to use different cells) to the customer, where we can offer the same performance, warranty, monitoring interface, and service process – that’s a compelling commercial offer,” Lu said.

“It’s more work for us that way, but it’s also a competitive advantage because when you are dependent on one supplier difficult situations can arise.”

“The offtaker for the Waratah project really bought into what we told them about leveraging these advantages to de-risk the timelines of the project. Based on that agreement, we all agreed that we needed to utilise two cell suppliers.”

Construction on Waratah, for developer Akaysha Energy, started in June 2023 for commercial operation in 2025.

Fire safety events

Last year also saw Powin in the headlines for the wrong reasons, with a Centipede BESS unit at one project catching fire and another ‘setting off a fire alarm’ and ‘experiencing problems’, both in New York State and owned by developer Convergent Energy + Power, which issued a statement in June noting that the manufacturer would be assessing what went wrong with one of its first field-deployed Centipedes.

The EPRI BESS Failure Event Database also lists a third fire event, based on local news reports, of a Powin BESS unit at an Idaho Power substation in October.

In a response to a question about what learnings Powin had gained from its recent fire safety events, Lu said: “We’ve come out of these experiences more knowledgeable about fire safety. We have learned even more about our product, its applications, and general processes to mitigate and manage fire safety situations.”

Manufacturing

The final topic we discussed during the interview touches on all of the above: bringing BESS manufacturing and assembly in-house versus using a third-party through contract manufacturing, the latter being the industry standard for most large system integrators.

Lu said that using contract manufacturing allowed it to scale up and down quickly while also having flexibility to evolve products.

“For the short and mid-term, we’ll still be contract manufacturing. The products are evolving so quickly, we want to depend on partners to support the ramp-up,” he said.

We also want to ensure we have flexible capacity so we can be called on when a mega project like Waratah comes around. And that is the case for the way we contract for both BESS manufacturing and cell capacity, resulting in greater manufacturing flexibility.”

The Oregon-headquartered company now has teams of 20 in both Australia and Europe (Madrid), having entered the European market at the start of 2024 with an order in Portugal from Galp and one in the UK from Pulse Clean Energy.

Energy-Storage.news’ publisher Solar Media will host the 5th Energy Storage Summit USA, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

Market reacts to falling BESS prices

Clean Energy Associates (CEA) took a deep dive into BESS pricing and the dynamics underlying the recent falls in the most recent edition of Solar Media’s quarterly journal PV Tech Power, an extract of which was published today (11 March).

The obvious: improves the business case

The obvious point to make is that falling BESS prices improve the business case for energy storage. One delegate from the Netherlands, where BESS has struggled to get off the ground, told us the falling BESS prices had definitely improved the business case there.

Another obvious: price isn’t everything

Perhaps another obvious point: price isn’t everything. Jeremy Powell, BESS director for engineering, procurement and construction (EPC) firm G2 Energy said: “If you buy cheap, you buy risk. You need to carry out proper due diligence to ensure they are complying with the regulations of the country and have adequate after-sales services and spare parts.”

But price has become more important

Price is, however, becoming more important as more players come into the space from an increasingly financially opportunistic point-of-view rather than a strategic one, as system integrator Sungrow’s Europe ESS director James Li explained in an interview published after the event.

This was echoed by EV supercar and (as of recently) BESS technology company Rimac Energy, whose head of business development told us that, although it was launching a product based on superior performance than others, it acknowledged the need to be “highly competitive” on pricing.

How price changes affect an order negotiation

The two-day event also gave the opportunity to sit down with both the BESS provider and developer customer, in this case Merus Power and eNordic/Ardian discussing their 40MWh Finland project, and Powin and Pulse Clean Energy discussing their 110MWh UK project, both announced in February (Powin/Pulse’s during the event itself).

Merus’ sales director Markus Ovaskainen said that the project order negotiations “…saw numerous iterations on the price and ended up somewhere else from where we started,” while eNordic’s M&A director Aleksi Lumijärvi added that “negotiations need to react to” the falling prices.

Similarly, Pulse Clean Energy CEO Trevor Wills said that everyone expects that the price of BESS will move up and down over time and stressed the importance of having long-term strategic partnerships to see through those cycles.

Prices affect some projects more than others

Powin president Anthony Powell echoed the point about long-term partnerships but also highlighted that the BESS prices have different implications for different kinds of projects.

“We have different types of customers. We have partners like Pulse where you’re looking at a two or three-year partnership where you want to give them the best price at every given point in time,” he said.

“And that includes proactively reaching out and saying, ‘Hey, we’re able to improve these numbers or this project or that project in delivery this quarter because we’ve been able to improve our supply chain’. I think doing that proactively creates this feeling that we’re not trying to make more money when lithium goes down, which is not a sales strategy that we follow.”

“The other type of project is one that just doesn’t get built until you reach a certain threshold of cost. The IRA and the period of lithium going down have seen specific kinds of projects which are going to be flipped soon after commercial operation, and those customers are waiting for the price to go down to a certain level before executing the deal. These are two different ways to deal with price volatility, and we obviously prefer the partnership approach.”

‘Land grab’ is not sustainable practice

In a separate interview with Energy-Storage.news, Powin’s senior VP Danny Lu further discussed Powin’s approach in a market of falling prices: “We’re aiming to be net-margin positive, which means we cannot take every deal. We are seeing certain suppliers losing money or making zero margin on projects just to take on market share, and we don’t think that’s sustainable practice. Companies have tried and failed doing that.”

Energy-Storage.news’ publisher Solar Media will host the 5th Energy Storage Summit USA, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

NextEnergy Capital raises US$110 million for Europe/US solar and storage fund

NPV ESG’s 18GW pipeline includes projects in Spain, Poland, Italy, Canada and the US. The capital commitment brings the fund’s total to date to US$580 million, a third of the way to the US$1.5 billion target (with a US$2 billion) hard cap.

According to Shane Swords, NextEnergy Capital managing director and global head of investor relations, the new funding will “further accelerate the fund’s positive momentum and growth”.

Swords said: “NextPower V ESG is our largest international fund to date which will provide a real impact and tangible benefits to the communities and countries where its assets are located whilst also providing an opportunity for investors looking for strong and stable renewable energy returns.”

To see the original version of this article go to Solar Power Portal.

What goes up must come down: A review of battery energy storage system pricing

2023 is in the books, and early indications are that the global energy storage system (ESS) market may very well have doubled again in terms of gigawatt-hours (GWh) installed. This is a remarkable feat, especially in the face of geopolitical tumult, elevated interest rates and impossibly crowded interconnection queues.

The market has shown reliance and is, indeed, poised for further growth, with a fourfold increase in annual installs possible by 2030. The reason why is simple: pricing.

As a start, CEA has found that pricing for an ESS direct current (DC) container — comprised of lithium iron phosphate (LFP) cells, 20ft, ~3.7MWh capacity, delivered with duties paid to the US from China — fell from peaks of US$270/kWh in mid-2022 to US$180/kWh by the end of 2023.

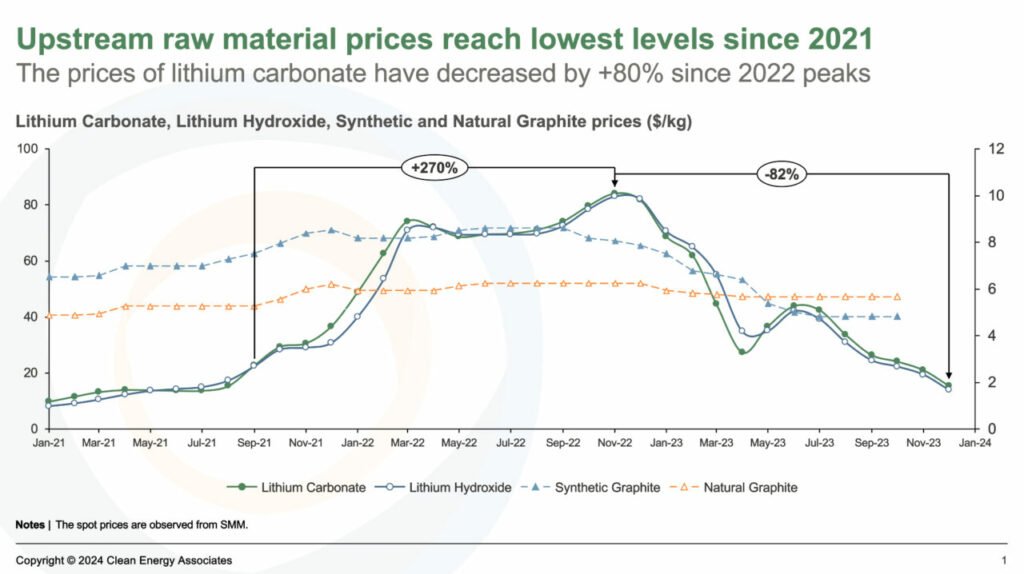

The primary price driver is universally recognised as a frothy lithium market that suddenly lost its fizz. Lithium carbonate pricing is down more than 80% from its 2022 peak. Supply/demand imbalances are to blame; or rather, how third-party estimates regarding those imbalances developed over the past three years (Figure 1).

Figure 1. Upstream raw material prices since 2021. Source: CEA

To illustrate, in December 2021, S&P Global forecasted 2023 global lithium supply to top 762,000 tons, with a small surplus of 9,000 tons over demand. By the end of 2022, supply estimates for 2023 had grown to 864,000 tons, surpluses were nil and long-term shortages were expected. The market shifted dramatically in 2023, and S&P’s latest estimate pegged global lithium supply at 968,000 tons, corresponding to a market surplus of 95,000 tons. A longer-term lithium carbonate surplus is now the industry consensus.

To be clear, the supply swing caught the entire market by surprise. Most industry pundits misjudged the pace of supply expansion from existing lithium mines, the dwindling electric vehicle (EV) demand dynamics, and the apprehensive buying behaviour in this still-youthful commodity segment.

For example, although supply/demand imbalances drove price volatility from 2021 through 2023, the magnitude of those price excursions was exacerbated by stocking and destocking within the lithium-ion battery value chain. EV battery cell suppliers, especially those in China, have been locked in a heated battle for market share for years. Fears of critical raw material shortages at a time when global EV demand was achieving growth rates of +60% stoked irrational buying behaviour.

The result was a 270% increase in lithium carbonate costs from Q3 2021 to Q4 2022. The removal of China’s New Energy Vehicle incentive in 2023, lingering range anxieties among Western consumers and a global increase in interest rates cast a pall on the EV market, resulting in a “disappointing” YOY growth rate of 31%. As demand slipped, suppliers were left sitting atop mountains of inventory and thus moved aggressively on price to bring their balance sheets back in order.

Savvy ESS developers recognise the critical importance of monitoring the broader EV sector alongside their own market. EVs represent around 80% of global lithium-ion battery demand, and the knock-on impacts to the ESS segment in terms of raw material pricing are meaningful as DC container suppliers generally apply raw material index pricing to their proposals.

Consequently, ESS developers and integrators should be mindful of near- to mid-term EV downside demand risk as they could be leaving money on the table. The next wave of EV adopters will need a rollback of interest rates, rollout of lower-cost EVs and an expansion of charging infrastructure, all of which will take time. BNEF just downgraded its global EV forecast (again) for 2024 by 775,000 vehicles.

Just when you thought it was safe… pricing falls to new lows

ESS market participants entered 2024 with enthusiasm and confidence, under the impression that market conditions had settled down and that they would finally be able to ink purchase orders.

That euphoria was dashed by the time Intersolar North America 2024 took place as US$20/kg lithium carbonate pricing fell to US$14/kg. This left many to wonder where the floor for lithium really is. Interviews with ESS developers by CEA at the event revealed pricing for DC containers had dropped again, with average pricing at US$150/kWh. Aggressive bids from Tier II/III suppliers seeking to gain a foothold in the US were even lower, which raises the question as to whether current pricing is sustainable.

Lithium’s impact on ESS system pricing has been established but does not fully explain the extent of current market pricing. In fact, the lithium impact is diminishing mightily, as lithium carbonate within the battery cathode constitutes only around 5% of DC container system cost at current market pricing.

CEA has been advocating for months that ESS developers and integrators begin to evaluate other price drivers for their DC container buy, including the impact of anode active materials costs, increased battery module manufacturing efficiencies, battery cell technology advancements and supplier margins in general.

In terms of production efficiencies, the market continues to move along the same path as the solar photovoltaic market, pushing to increase the level of automation applied at gigafactories. In the case of batteries, operational scale has enabled producers to introduce automation to handle tasks such as cell sorting, cell stacking, busbar installation and welding of electrical connections.

Battery module balance of system component integration and cell/module testing likewise are being automated to increase production throughput. These capital investments have a meaningful impact and can lower DC container production costs by more than US$10/kWh.

Technology advancement in the ESS sector will also contribute to a steady downward price trajectory for DC battery containers. The ESS value chain remains focused on evolutionary advancements to the ubiquitous prismatic LFP battery cell, as evidenced by the mass market transition from 280Ah to +300Ah battery cells.

This is largely the result of battery manufacturers increasing electrode active material loading while reducing electrode thickness, without sacrificing battery performance. This evolution in energy density will yield incremental cost reductions from the current 280Ah architecture in large part thanks to balance of system savings at the container level.

The IRA is not bulletproof

The Inflation Reduction Act (IRA) is central to current US energy transition plans, and any changes to its structure or the value of its incentive mechanisms could have detrimental impacts to both the domestic ESS and EV sectors. A new administration could hinder its implementation through executive action by withholding loans and grants, or even revising Department of Treasury guidance for rules that have not been finalised. A new Congress could potentially revisit the Investment Tax Credit, Production Tax Credit or the New Clean Vehicle Credit.

A repeal of these provisions would affect pricing and demand for battery cells, modules and DC containers in the US.

This is an extract of a feature article that originally appeared in Vol.37 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries. Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the nine-year back catalogue are included as part of a subscription to Energy-Storage.news Premium.

About the Author

Dan Shreve is Vice President of Market Intelligence at Clean Energy Associates (CEA). He has worked in a range of renewable energy engineering and commercial leadership roles for over 20 years. He previously served as Head of Energy Storage Research at Wood Mackenzie after its acquisition of MAKE, a global wind energy advisory, where he was a Managing Partner. He earned a Bachelor’s in Mechanical Engineering from Worcester Polytechnic Institute, and his MBA from the University of New York.

Friday Briefing: LDES project developers, Europe’s gigafactories and ESS, challenges of vertical integration

We had the same discussion with advanced compressed air energy storage (A-CAES) company Hydrostor a few weeks ago, while Energy Vault – which has now connected its gravity storage project in China to the grid – is doing the same for some of its US projects.

Each will give its own particular reasons for doing so, but we suspect the primary one is that the only way to get large-scale projects underway using their tech is to do it themselves (Energy Vault’s China project is being rolled out through a technology licensing agreement with an outside company, however).

The project development market just hasn’t bought into LDES in the way some expected it would.

Europe plans 1TWh-plus of lithium-ion gigafactory capacity, but how much will go to ESS?

Numerous projects to build lithium-ion gigafactories across Europe are underway, primarily driven by EU-wide mandates that incentivise domestically manufactured batteries in electric vehicles (EVs) built on the continent.

Some of that capacity has been slated to go to the ESS market, but the most ESS-focused company building gigafactories, Freyr, has paused its European projects until it gets additional funding.

How much of the capacity will ultimately go to the ESS market? Are gigafactories being designed to serve both the EV and ESS market? In cases of the latter, could we see downstream vertical integration where gigafactories begin BESS assembly as well?

How much more expensive will a BESS with EU-made cells be versus a BESS with Chinese ones? And why does it need to be more expensive, for that matter?

Energy-Storage.news will be at Benchmark Mineral Intelligence’s Giga Europe event in Stockholm next week to ask these very questions.

Challenges of vertical integration

A gigafactory beginning BESS assembly is an example of downstream vertical integration, but it goes the other way too. Trina Storage, the BESS arm of solar PV giant Trina, talked to Energy-Storage.news about how its latest BESS product uses in-house manufactured cells.

That isn’t without challenges, though, beyond those that come with how capital-intensive and complex lithium-ion battery production is.

Going with your own cells means you are cutting out, and arguably competing with, your existing cell suppliers, without whom you’d never have had a BESS business in the first place. The argument is that you can better control quality by integrating your own cells, which is a compelling one but one that could be interpreted as a criticism of existing supplier’s technology.

This week on ESN Premium

Energy Dome: Tolling the CO2 Battery ‘with investment grade off-takers’

Energy-Storage.news learns why Energy Dome, maker of the proprietary CO2 Battery for long-duration energy storage (LDES), has moved into the project business.

Provider Merus and customer Ardian talk 40MWh Finland BESS project: ‘Negotiations have to move with the market’

We discuss a 40MWh project in Finland with both the BESS provider Merus Power and customer/project owner eNordic, the investment manager in the region for private equity firm Ardian.

Trina Storage: BESS product design and market strategy in focus

We sit down with Helena Li, executive president at Trina Solar, to discuss the launch of Elementa 2, the group’s new integrated battery storage solution.

UAE utility announces EOI for 400MW BESS project

EWEC said the BESS would provide flexibility to the system and ancillary services such as frequency response and voltage regulation. The BESS is crucial to the utility’s plan to increase solar PV capacity to 7.5GW by 2030, part of an aim to reduce carbon emissions by 42% by 2030 from 2019 levels, it added.

Othman Al Ali, CEO of EWEC, said: “Compared to traditional grid storage solutions, BESS offers unmatched advantages, including increased flexibility, scalability, cost-effectiveness, and improved efficiency. EWEC continues to see BESS as a critical investment to manage system operability when large amounts of renewables are synchronised to the power system.”

Al Ali didn’t clarify what he meant by traditional solutions, but most energy storage capacity is pumped hydro energy storage (PHES), but this is typically slower reacting than BESS and has a lower round-trip efficiency (RTE). Dubai Electricity and Water Authority (DEWA), a utility in the neighbouring Emirate of Dubai, is building a 250MW PHES plant for a reported 2024 operation.

The project will involve the development, financing, construction, operation, maintenance and ownership of the BESS system and associated infrastructure, with EWEC then entering into a long-term power purchase agreement (PPA) for the project’s offtake.

It follows EWEC’s recommendation made this time last year that the UAE should deploy 300MW/300MWh of BESS capacity by 2026. It didn’t reveal when it hoped the 400MW (MWh capacity undisclosed) would come online, so it’s not clear whether this is part of a longer-term target or whether its forecasted needs have increased.

Interested parties should submit their EOI to [email protected], after which EWEC will issue a request for qualifications to parties wishing to proceed to the next stage.

Developer NatPower claims 60GWh UK BESS plans

According to a statement released by the company this morning (7 March), NatPower UK will develop “GigaParks” with the first three to go for planning permission in 2024. A further 10 will apply for planning permission in 2025.

£600 million has been earmarked for the development of substations in the initial phase as the company attempts to tackle and overcome grid bottlenecks and connection delays. This continues to be a key obstacle with many renewable developments with National Grid ESO anticipating the register to reach over 800GW by the end of 2024.

Stefano Sommadossi, CEO at NatPower UK, highlighted this could be solved via investment. Sommadossi said: “To solve the bottlenecks that are slowing the shift to clean energy, we will drive investment into the grid itself, collaborating with grid operators to deliver more than 20% of the new substations required.

“By investing in substations and focusing on energy storage first, we will enable the next phase of the energy transition and bring down the cost of energy for consumers. We plan to deliver the benefits of the energy transition to all corners of the UK and our portfolio will play a big part in the UK achieving 100% of its targets.”

See the full version of this article on Solar Power Portal.