“Bonanza adds to SCPPA’s current portfolio of renewable energy projects, bringing the total to over 3,000MWs that will be supplied through SCPPA to Southern California Public Power Utilities to support their transition to a carbon-free energy future,” said Michael Webster, SCPPA executive director.

EDF Renewables first applied for permission to build the project in late 2020, and plans to complete the permitting process by the end of 2025. The developer is yet to complete three permitting processes, including producing an environmental impact statement and compliance with endangered species legislation, but the signing of a PPA suggests both EDF Renewables and SCPPA are optimistic that the project will receive a green light from the Department of the Interior and Bureau of Land Management.

See the full original version of this article on PV Tech.

The reasons why investors are busy buying BESS developers in the UK and Germany

Our two sources, active in each market but speaking anonymously, explain why we’ve seen numerous deals for large-scale BESS developers and operators in recent months – beyond the obvious fundamentals underlying energy storage’s attractiveness as a market to invest in.

UK: falling revenues, and more deals to come

The UK in the second half of 2023 saw numerous large investment firms buy independent BESS developers and operators. EQT bought Statera, Brookfield bought Banks Renewables, Mubadala Investment Company and KKR acquired Zenobē while Searchlight acquired Gresham House, the manager of the Gresham House Energy Storage Fund plc (GRID).

These deals coincided with a period of rapidly falling revenues in the UK market, as covered extensively on Energy-Storage.news, and that is not a coincidence, as a financial advisory source explained.

“It’s now a buyer’s market, with valuations dropping due to a mix of factors in the energy market coinciding with various deadlines for project grid connection fees meaning a bit more urgency to sell,” they said.

“People operating portfolios of BESS assets will need to find buyers if they don’t have patient capital sitting behind them.”

More deals are expected to materialise this year, our source added.

Germany

The start of 2024 has seen two major companies in Germany’s large-scale battery energy storage system (BESS) market transacted on.

Oil and gas major TotalEnergies acquired developer Kyon Energy in January while infrastructure investors Brookfield (through its X-ELIO arm) and NIC invested in system integrator and developer Eco Stor, the announcement of which implied certain shareholders sold stakes as part of the deal.

These deals are partially market-driven but also the result of specific activities at both companies.

“These deals have been driven by the German market becoming mature. It’s had its first really good year or two of deployments,” a software provider source said, speaking anonymously.

But they also pointed out that for Eco Stor, the company has moved from mainly being a technology provider and system integrator to developing its own substantially-sized projects with a pipeline of several 600MWh BESS projects.

This obviously requires additional financing, our source said, adding that Kyon Energy may also be expanding up the value chain from its existing approach of developing and selling projects to long-term owners like investor Obton and utility Verbund.

Spokespersons representing X-ELIO, NIC and Eco Stor declined to comment when asked by Energy-Storage.news, while Kyon Energy gave us this statement:

“This partnership with TotalEnergies represents an important moment for Kyon Energy as we aim to become one of the leading flexibility providers in Europe. By joining forces, we are strengthening our position in the German electricity market and contributing directly to the transition to a more sustainable system.”

UK grid connection specialist G2 Energy moving into full wrapped BESS EPC services under Mitie ownership

Ruck, COO Nigel Hughes and 50 other employees were transferred to Mitie, and the new business unit trades as ‘G2 Energy, A Mitie Business’ while the legal entity is ‘Mitie Technical Facilities Management Ltd (# 0906936)’. The previous entity was G2 Energy Limited. Ruck is now a managing director at Mitie and heads up the new business unit.

Mitie took G2 Energy on because decarbonising buildings is a growing part of its huge facilities management division with many large commercial & industrial (C&I) clients having specific plans for the next 3-5 years. This means G2 Energy will move beyond just being a civil engineering and independent connection provider (ICP), as Ruck explained.

“They see us and their other Mitie companies, such as Rock Power Connections and Customer Solar as key to being able to offer electric vehicle (EV), solar and battery storage behind-the-meter (BTM) to those clients so we’re now also doing some C&I BTM projects whereas before we were only doing large scale front-of-the-meter (FTM) capital projects,” Ruck said.

“We’ve just recruited a dedicated BESS director and in due course, we’ll start offering the full EPC wrap, including the procurement of the BESS equipment, whereas before we only did balance of plant (BOP) and the ICP element. This is because for the C&I clients that’s the way we’d have to do it, and now that is pushing us to do full EPC wraps for large-scale FTM projects too.”

Prior to G2 Energy Limited’s demise it had 30-35% of the IPC services market in the UK BESS sector, and Ruck thinks the firm can get back to that market share ‘soon’. The firm is working on securing the IPC, electrical and civil engineering works and BOP services for a 300MW/1GWh BESS project.

We will be publishing a separate article where Ruck discusses G2 Energy’s fall and the transition to Mitie in more detail in the coming days.

UK batteries, pumped hydro get 2.9GW of T-4 Capacity Market contracts at record price

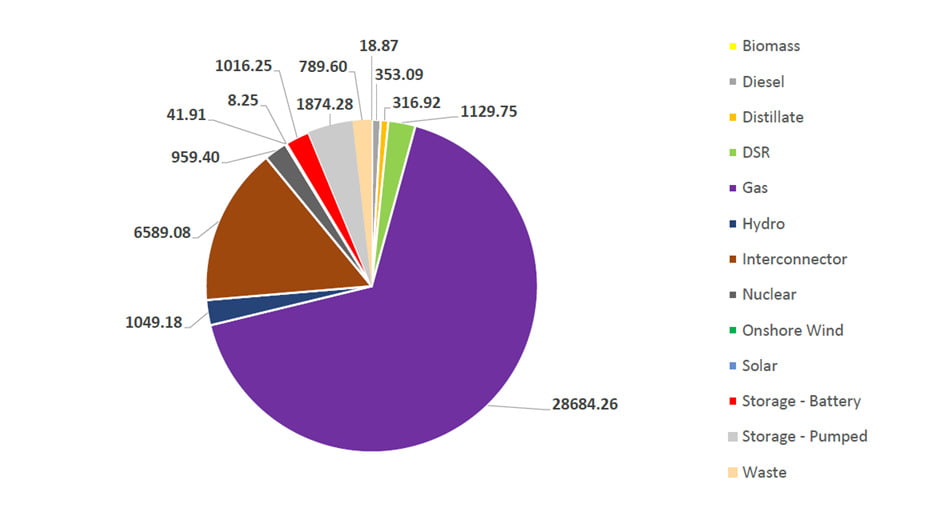

According to the National Grid ESO’s preliminary results, the auction round secured 42,830MW – less than 2,000MW lower than the auction’s revised target of 44GW – with 98.76% of capacity entering the auction awarded an agreement.

As in the T-1 CMA for delivery year 2024/25, gas was awarded the majority of capacity, securing 28,684MW (66.97%), followed by interconnectors at 6,589MW (15.38%).

Pumped hydro energy storage (PHES) secured the most capacity of the low-carbon technologies entered into this year’s auction, securing 1,874MW (4.38%).

Battery storage received 1,016MW (2.37%), nuclear 959MW (2.24%), onshore wind 41.91MW (0.10%), and solar 8.2MW (0.02%).

A new report commissioned by power plant owner Drax revealed that 2028 would see an energy ‘crunch point’ where demand will exceed secure dispatchable baseload capacity by 7.5GW at peak times. According o the report, this means that the results of the 2024 T-4 CMA, specifically how much capacity is awarded in relation to the target, will decide the “scale of the energy crunch.”

Following the T-1 Capacity Market results last week, despite the large share taken overall by gas, battery storage developers and nuclear plant owner EDF were described by one analyst as that auction’s ‘big winners’. T-4 is however much more lucrative and awards 15-year contracts versus 1-year in T-1, so it will be interesting to see what industry reaction may follow the latest results.

To read the full version of this story, visit Current.

Fluence starts work in Australia on 300MW grid-forming battery project with advanced inverters

Sited adjacent to the Australian Securities Exchange (ASX) listed energy generator-retailer’s (gentailer’s) gas-fired peaker power plant at Mortlake, Victoria, the asset will charge from the grid at off-peak times of abundant renewable energy generation and output it as required when demand peaks.

Its location will allow it to leverage new clean energy generation facilities being developed in Victoria’s state-designated South-West Renewable Energy Zone (REZ) V4 region, in which it also sits. That will be one of six REZ developments in the state planned so far. Battery storage is expected to play an important role in enabling REZ developments to maximise their usable energy output.

Origin Energy made the decision to go ahead with the project a month ago when it committed to investing AU$400 million (US$263.7 million) into it and announced the appointment of Fluence as BESS technology supplier. Fluence’s Nispera asset management software will optimise its market participation.

Advanced inverter trend emerging

At the same time, the battery storage system, via its inverters, will join a growing fleet of BESS around Australia – and the world – that provide system stability services, most prominently inertia.

The Mortlake Battery project will receive up to AU$24 million towards its total costs from the Australian Renewable Energy Agency (ARENA) to enable that function.

It is one of eight such projects, adding up to 4.2GWh of capacity, that ARENA has selected for support through its Large Scale Battery Storage Funding Round, which opened in 2022.

The competitive solicitation process was originally set to provide up to AU$100 million in total, but given high interest in the scheme, a total of AU$176 million was made available. It also follows ARENA’s commitment of AU$81 million to another eight large-scale BESS projects prior to the funding round, including two that are similarly equipped with grid-forming inverters.

ARENA said yesterday (28 February) that of the eight projects selected alongside Mortlake, five have been financially committed.

As can be seen below, the inverters will be supplied to those five projects from three different manufacturers: Tesla, Power Electronics, and SMA, the supplier to Origin’s Mortlake project. Links have been included to recent Energy-Storage.news coverage of each project where applicable.

ProjectEntityOutput/Capacity Inverter OEMWestern Downs BESSNeoen255MW/510MWhTeslaBlyth BESSNeoen200MW/400MWhPower ElectronicsVictorian Big Battery (retrofit)Neoen300MW/450MWhTeslaLiddell BESSAGL500MW/1,000MWhPower ElectronicsMortlake BatteryOrigin300MW/650MWhSMA

The concepts behind providing inertia – traditionally an application done by fossil fuel and other thermal generators – using so-called grid-forming inverters were explained by then-SMA product manager Blair Reynolds in an Energy-Storage.news Guest Blog published in 2022.

Last week, Energy-Storage.news Premium covered in-depth a project in Scotland, UK, which will perform a similar set of system stability applications.

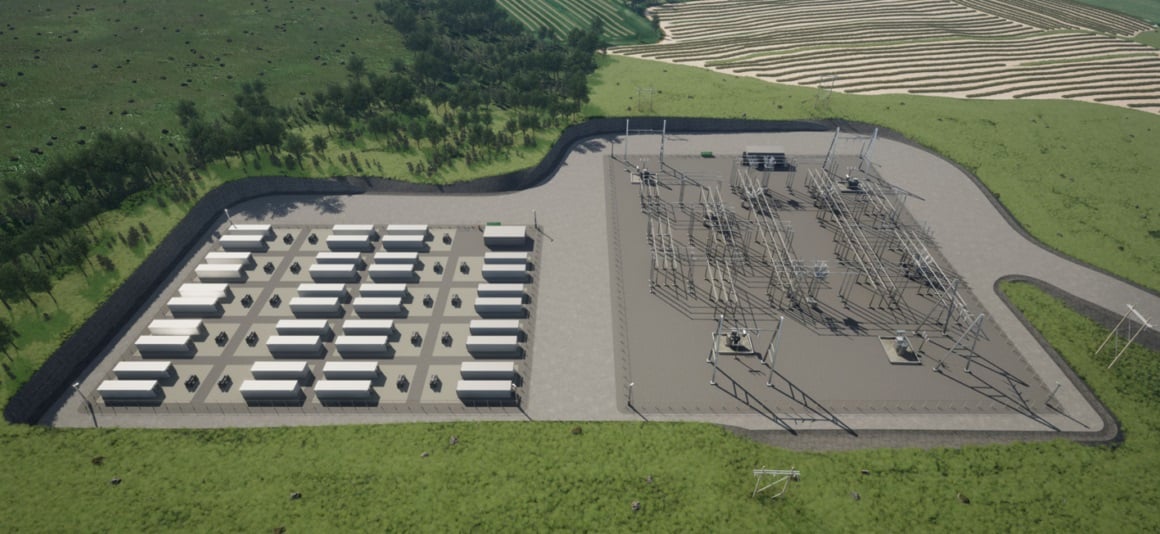

Wärtsilä Energy Storage & Optimisation (ES&O) is the system integrator on that 300MW/600MWh project, in Kilmarnock South, for developer-investor Zenobe Energy.

Much like the ARENA-supported projects in Australia, Kilmarnock South’s advanced inverter aspect is being supported financially, having been selected as one of the electricity system operator National Grid ESO’s Stability Pathfinder projects, as has another of Zenobe’s Scottish BESS projects, Black Hillock.

Other projects around the world equipped to provide this function, sometimes called ‘synthetic inertia’ include Hawaii’s biggest battery storage project, inaugurated a few months back by US developer Plus Power.

It looks set to be a technology trend to watch in the industry as 2024 plays out and the retirement of thermal generation proceeds in tandem with the massive growth of renewables.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Canada Infrastructure Bank loan enables Indigenous communities to hold stake in energy storage projects

CIB announced the investment in mid-February, marking the first commitment to date under the bank’s Indigenous Equity Initiative. The scheme aims to enable First Nation, Métis, and Inuit communities to hold ownership stakes in projects that CIB is also investing in.

“ESC is thrilled the CIB’s first Indigenous Equity Initiative loan is part of the largest battery storage investment in Atlantic Canada to date,” Rangooni told Energy-Storage.news yesterday.

“Equitable partnerships with indigenous communities and securing their active participation in the modernisation of Canada’s grids, including the integration of energy storage, will be key to achieving Canada’s net-zero goals and ensuring a sustainable future for all Canadians.”

CA$130 million to come from federal government

The projects will be constructed in the communities of White Rock, Bridgewater and Waverley, each of 50MW and 4-hour duration (200MWh).

They will be built by Nova Scotia Power (NS Power), the main electricity supplier to the province. NS Power is state-regulated and not state-owned, being a subsidiary of shareholder-owned listed company Emera.

NS Power will get a loan of up to CA$120.2 million from CIB and a partnership between 13 First Nation Mi’kmaw communities called Wskijinu’k Mtmo’taqnuow Agency (WMA), which is working with the energy provider, will get an equity loan worth up to CA$18 million.

CIB said the Indigenous Equity Initiative lending will finance 90% of the Indigenous participation in the portfolio projects, contributing to the bank’s target of financing at least CA$1 billion-worth of projects that will benefit Indigenous communities in the country.

The initiative, launched in November last year, offers loans of between CA$5 million to CA$100 million per project.

While it may be CIB’s first loan to enable Indigenous participation in battery energy storage system (BESS) ownership, Canada’s biggest BESS project in development so far, the 250MW/1,000MWh Oneida project in Ontario, is being co-developed by the Six Nations of the Grand River First Nations community, on whose land it will be built.

NS Power has also secured a further CA$130 million towards the proposed project through Natural Resources Canada, the federal government department which has a remit that includes energy, minerals, and natural resources.

Energy storage developments in Canada have largely been focused on its two biggest provinces, Ontario and Alberta, to date. However, last summer Nova Scotia lawmakers determined that electricity storage will be a key pillar of the province’s transition from coal-fired power generation.

NS Power BESS plan suitable, Clean Energy Task Force finds

Among the regions of Canada most dependent on coal, national statistics showed that in 2019, 51% of Nova Scotia’s power generation came from the environmentally unfriendly fuel source.

The provincial Environmental Goals and Climate Change Reduction Act, signed into law in 2021, demands that usage cease by 2030. In October 2023, the Nova Scotian government said it would deploy between 300MW and 400MW of battery energy storage by 2030 in line with its clean energy plan. The government said this would help it harness the region’s abundant wind resources.

Patrick Bateman, an independent consultant affiliated with Energy Storage Canada, offered some more recent policy context to Energy-Storage.news in a commentary yesterday.

Nova Scotia’s Clean Electricity Solutions Task Force (CESTF), set up to implement goals including the coal phaseout and getting the province to 80% renewable energy by 2030, has recommended setting up an independent energy system operator (IESO), Bateman said.

The Nova Scotia IESO (NSIESO) would have duties that included removing any bias in system planning, interconnection studies, or bias towards NS Power and Emera’s commercial interests, and implementing better and more efficient interconnection procedures.

The IESO would take on roles like integrated energy system planning, operating the grid and administering markets, in a similar way to how respective organisations in Ontario and Alberta take care of the electricity system in those provinces.

More specifically with regard to energy storage, the NSIESO would oversee the implementation of battery storage technology. The Task Force said that the plans to deploy up to 400MW of storage enjoyed “broad-based support”.

“The interconnection of these projects will provide system wide benefits, including: fast response for system disturbance; short term reserves an energy time shifting; and ongoing support of system balancing,” Task Force said in a statement.

“It is the view of the Task Force that the battery storage plans are being appropriately developed to serve the interests of Nova Scotians.”

Patrick Bateman was one of the interviewees for an article published in PV Tech Power (Vol.35) last year, focusing on how lessons learned in Canada’s two leading provinces, which account for more than 80% of the country’s announced energy storage deployments, could be transferred or otherwise learned from in other regions, including Nova Scotia and other Atlantic Canadian provinces.

Energy-Storage.news’ publisher Solar Media will host the 6th Energy Storage Summit USA, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. ESC’s Justin Rangooni will be among the speakers. For more information, go to the website.

Spain and Netherlands launch subsidies for battery and PV manufacturing

Spain

The Spanish Ministry of Ecological Transition (MITECO) has opened a new incentive scheme for renewables and storage manufacturing to a public consultation.

The first round of the scheme will allocate over €750 million (US$811 million) based on the necessities outlined in the information gathered during the public consultation. The funds will be provided through Spain’s recovery and resilience plan (PRTR) and are aimed to incentivise the production of equipment and components for solar panels, batteries and electrolysers, among other technologies. According to MITECO, future rounds could add other aspects of the supply chain.

One of the objectives of the scheme is to strengthen Spain’s domestic manufacturing and its strategic autonomy, as well as Europe’s.

Teresa Ribera, the Spanish minister of ecological transition, said the goal is not just to change the ‘colour’ of the molecules or electrons to green but also: “We want capital goods to be produced in Spain.”

The Institute for Energy Savings and Diversification (IDAE in Spanish) will oversee the scheme and the financial aid, which would include both existing and new projects. For existing projects, this includes the expansion of the annual capacity by adding a new production line or improving existing lines with equipment not previously in use. However, only projects that have not been started prior to the auction will be accepted.

The public consultation is open until 15 March and more details can be accessed here (in Spanish).

Netherlands

The Netherlands has launched a new subsidy aimed at supporting domestic manufacturing of solar panels, batteries and electrolysers.

Published earlier this month by the Netherlands Enterprise Agency (RVO in Dutch), the new Manufacturing Industry Investment Subsidy Climate Neutral Economy (IMKE) will support companies in the Dutch manufacturing industry for solar panels, batteries and electrolysers for hydrogen production.

This new subsidy aims to reduce the Netherlands’ dependence on other countries to procure these components.

A consultation has been opened until 3 March 2024 and can be accessed here (in Dutch). The consultation aims to collect information regarding the conditions of the subsidy, its duration and the amount of the subsidy, among others.

The announcement of both schemes comes only weeks after the European Parliament and the EU Council agreed on new regulations to boost the region’s solar manufacturing industry with the Net Zero Industry Act (NZIA).

Full details of the NZIA are yet to be disclosed, but among the criteria implemented is a 50% quota on solar capacity auctioned by member states for which modules can be sourced from a single country per year.

The full original versions of these two articles can be read on PV Tech: Spain (here) and Netherlands (here).

Europe: Rising battery storage markets playing catch-up to the UK’s lead

While the UK is a standout leader of the continent in terms of deployment figures, and arguably also sophistication of business models – as pointed out in a new study by Aurora Energy Research – tracking the European market is also becoming much more interesting, Darmani said.

“There was maybe not as much to speak about a couple of years ago on the European energy storage market, but then it’s definitely changing,” the analyst said, referring to media interest in the US as well as the UK.

“I think the scale is really taking off in Europe, and that’s a good thing.”

Previously, there had really only been one major talking point across continental Europe: the early opportunities for batteries to provide ancillary services and how quickly those would saturate. In light of falling costs making battery storage more viable and new market opportunities opening up, those conversations are now changing.

Conversely, while the UK is the biggest European market so far, with around 4GW of installed battery energy storage system (BESS) capacity, the sector’s maturation means that the opportunities and business case for storage on the GB grid (including England, Scotland, and Wales, but excluding Northern Ireland, which shares its grid with the Republic of Ireland), are well understood.

So, there are obviously a lot of discussions around the UK, but beyond that, Wood Mackenzie (WoodMac) clients want to know which other markets present opportunities within Europe.

“In Europe, outside the UK, we were always interested in Germany and Spain. Germany, we already see that the market is taking off, based on our analysis and what we hear from clients,” Darmani said.

A big difference between Europe’s most established market and Germany is that the UK, as Energy-Storage.news readers will likely know, is a market growing comfortable with merchant opportunities, with stacking revenues from the different available streams to create a business case.

With Germany however, it is still more the case that clients want to know where the contracted revenues will come from, when tenders will take place and what the criteria are for eligibility, or perhaps when newer opportunities will emerge, such as the capacity market the German government is currently considering introducing.

Curtailment of renewables among major drivers across Europe

Ancillary services markets are still open in Germany, with storage able to participate in primary Frequency Control Reserve (FCR) markets, where that isn’t yet the case in Spain. Germany’s electricity network experiences “good volatility” that BESS assets can help correct, and growing shares of renewable energy will contribute to that need.

At the same time, curtailment is seeing literal terawatt-hours of renewable energy being generated and then wasted at negative prices and enormous costs to the German public, which again, provides a fundamental driver for energy storage, Darmani said.

Spain, meanwhile, has plenty of room to grow, with both its grid-scale and residential markets fairly small. The drivers are different but still fundamental to the smooth and stable operation of the grid.

“Spain is not benefiting from interconnections to a neighbouring country like Germany [is],” due to its location on the Iberian peninsula, with only France offering meaningful import and export volumes of power across the border.

“They have a huge share of solar power installed there [in Spain]. We saw on some days last year that the curtailment rate of solar hit 45%, which is significant. At the same time, they have a [national] energy storage target of 20GW by 2030,” Darmani said.

However, so far there isn’t investment happening in Spain because the market signals, designed for a pre-battery storage era, are not there. Darmani cited again the example of ancillary services markets being closed off to energy storage, meaning there are few opportunities to provide batteries with contracted revenues in Spain.

A few weeks ago, Spain’s government held a tender for energy storage under the national PERTE scheme for economic recovery and resilience. A total of 880MW/1,809MWh was awarded to companies, including Iberdrola and Naturgy, with the majority of awards in Spain’s central provinces.

Participants were looking at and waiting for that tender for a “very long time,” the analyst said, and that also tells you that bidders realised they would have no near-term opportunities to deploy energy storage in the country without it.

“The prices of the bids were very, very different from one another in the market, so that tells you also that there was a different risk appetite of the developers that were going into that market,” Darmani said.

Another takeaway is that most of the projects were co-located with solar PV, and the WoodMac analyst believes that will be a significant market segment for Spain in the years to come.

Attendees at last week’s summit, which was hosted by our publisher Solar Media, heard about the appeal and opportunities for energy storage in other rising European markets.

Country-specific sessions were held on Poland, Italy and Germany, and in a panel discussion on EU Electricity Market Design reform, Doriana Forleo, executive director of the Energy Storage Coalition, highlighted that pan-European opportunities will become a necessity due to Europe’s need to integrate renewables onto its grids en masse in the next few years.

Sungrow launching battery cell production as China’s BESS providers move upstream

“We are also trying to set up our own cell manufacturing soon because that is the really key thing to the storage of the energy and the long-term life of the BESS, and controlling quality. Next year we’re hoping to have a production line producing our own lithium-ion battery cells”.

James Li was speaking to the site at the Energy Storage Summit EU last week. Solar PV giant Trina Storage launched its latest BESS solution which uses in-house manufactured lithium-ion cells at the event.

The moves are part of a wider industry trend of China’s BESS providers moving upstream and manufacturing their own battery cells to integrate into BESS systems. The trend has been noted previously by industry commentators including BloombergNEF’s head of energy storage Yayoi Sekine when it launched its BESS Tier 1 list in January (Premium access).

Downward vertical integration has already happened, with battery manufacturing companies like CATL, BYD and LG Energy Solution launching their own integrated BESS products. Sungrow, Huawei and BYD were in the top five BESS providers by 2022 deployments according to Wood Mackenzie.

Other benefits of using in-house cells in BESS solutions to what Li mentioned include a more integrated design potentially allowing for better mitigation of potential fire safety risks.

It also allows providers to offer an energy density superior to pure-play system integrators, whose modular design allows for optionality but at the expense of energy density. Energy density is becoming key for the industry.

Masdar Arlington, RPC and TagEnergy progress UK BESS projects totalling 162MW

It was a big focus of last week’s Energy Storage Summit event in London, with topics ranging from falling revenues and co-location business models to the optimal size for larger-scale projects.

Masdar Arlington Energy begins building two UK BESS units

Developer-operator Masdar Arlington Energy has started construction on two BESS projects with a combined capacity of 55MW, one in Rochdale and one in Stockport.

The announcement follows Masdar’s announcement last year that it plans to invest £1 billion (US$1.26 billion) in the UK BESS market. The UAE state-owned renewable energy company acquired Arlington Energy in late 2022, which it renamed Masdar Arlington Energy.

The energy management system arm of utility Octopus Energy, Kraken Flex, will optimise Masdar Arlington Energy’s UK BESS pipeline, which it claims is 3GWh.

Masdar didn’t say when the two projects would come online or the MWh size of the projects, though most being built in the UK today are 2-hour systems.

Renewable Power Capital acquires construction-ready 57MW project

Renewable energy investor-operator Renewable Power Capital (RPC) has acquired its first ready-to-build (RTB) project in the UK. The project has a power rating of 57MW at the grid connection point, though, like Masdar, RPC didn’t reveal the MWh capacity.

It didn’t detail where the project is but said in its announcement (27 February) that construction would start imminently and that the project would come online in summer 2025.

It follows development partnerships that RPC has agreed with developers Greenfield (500MW) and Elmya Energy (4GW).

TagEnergy reaches financial close on a 49.9MW project in Scotland

Renewable energy investor-operator TagEnergy has reached financial close on its 49.9MW/99.8MWh Pitkevy facility in Fife, Scotland. Pitkevy is TagEnergy’s first split-contract project, with Tesla providing the Megapack 2 XL battery systems and RJ McLeod completing site works and battery container installation.

Financed by a non-recourse green loan package on a fully merchant basis, except for Capacity Market revenues, the package was originally secured to finance the construction and operation of TagEnergy’s Lakeside Battery Energy Storage System (BESS) project. This is the sixth UK battery storage facility in the company’s portfolio.

Backed by Santander UK, Rabobank, and Triple Point, the finance package includes an uncommitted accordion facility that allows TagEnergy to include the Pitkevy site in the funding structure.

The TagEnergy article originally appeared on Solar Power Portal.