The BESS will provide high-speed and automatically-activated frequency regulation reserves needed for when the Baltic countries synchronise with continental Europe’s grid in 2025 after disconnecting from Russia’s.

The announcement follows a tender procedure from AST (Augstsprieguma tikls) from which Germany-based Rolls-Royce Solutions GmbH was selected as the most economically advantageous tender offer.

It follows similar projects launched in the other two Baltic countries, Lithuania and Estonia.

Rolands Irklis, chairman of AST, said: “Battery systems are an important infrastructure project for the security and stability of Latvia’s energy supply, allowing the necessary balancing reserves in the network to be ensured, the amount of which will increase significantly after synchronisation.”

The contract to Rolls-Royce Solutions is worth €77.07 million (US$83.3 million), of which 85% will be covered by EU funding (100% for Tube and 75% for Rezekne). Rolls-Royce will collaborate with LEC Construction International GmbH and Enersense SIA, a Latvia-based company, to carry out the construction work.

Rolls-Royce deployed the BESS for the second-largest BESS in the Netherlands, which went online in late 2023 (the largest at the time).

UK: Renewable co-location business models still not proven

However, the business case for co-located projects is less simple than that. Rupert Newland, CEO of UK renewables technology provider Arenko Group, said that co-located projects are something of an unknown quantity at the moment. “There isn’t a proven commercial model across this sector,” he said.

This, he continued, is because of the inherent differences between solar or wind and battery energy storage systems (BESS). Not only different technologies, but different supply chains, financing models, use cases and technical parameters present themselves.

“People recognise the benefits [of co-located projects]”, he said, whether it’s shared infrastructure and grid connections or the gradual increase of revenues and capacity that can be generated from a co-located project, “but I think the actual commercial model is still not very well-understood”.

Arenko announced work on its first co-located solar-plus-storage project in the UK last year, a 50MW BESS co-located with a 55MW solar PV plant. The company is offering optimisation services through a partnership with French renewables developer Engie. Newland spoke with Energy-storage.news in October about its existing co-located wind and storage projects (Premium access), and how the projects could provide a blueprint for co-location.

The falling price of BESS over 2023 is likely to continue, panellists said, which would improve the business case for co-located projects. The drop in solar module prices over the last two years has been good news for developers, and if batteries follow suit then co-located projects will become easier and easier to develop, they said.

The panel’s moderator – Anastasios Christakis, managing director at Claritas Investments – ended up asking if co-located projects would be more valuable than standalone assets in the future.

“If done correctly…yes,” said Hernandez. But this is reliant on a list of details and factors aligning to let the project reach its full potential, he said, harking back to Pollard’s call for developers to comprehensively examine the specifics of co-location. “The times when you’re going to find that absolutely everything aligns for a co-location project are quite limited. From the development side, sometimes it’s the weakest link that defines the project,” said Hernandez.

Newland said that co-located sites have the potential to offer more value. He said that the “quality of output from the site is inherently better when it’s a co-located site…you can sculpt the output to fit market conditions, you can move power around to make sure you’re maximising the value of it.” The value will boil down to market signals, the panellists concluded, and whether the specifics and legislation of co-location materialise.

To read the full version of this story, visit PV Tech.

BESS wins highest percentage among clean energy technologies in UK Capacity Market auction

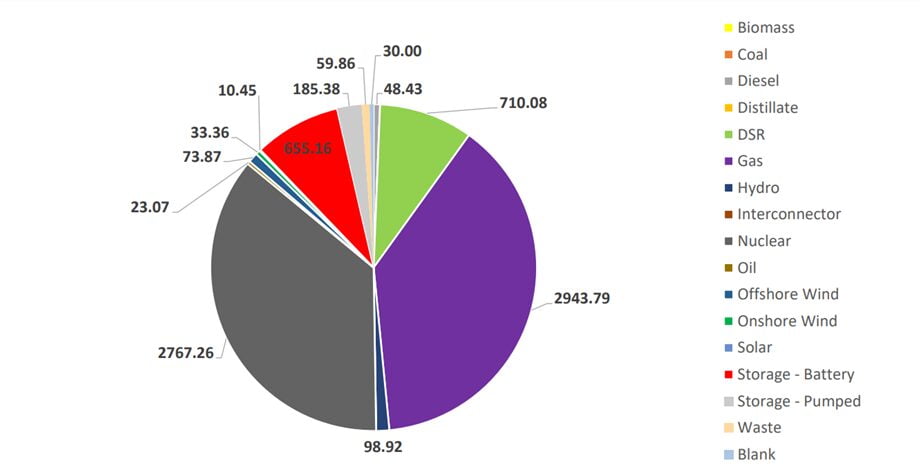

The majority of capacity was awarded to gas as a primary fuel type 2,943.79MW (38.53%), closely followed by nuclear 2767.26MW (36.22%) Demand-Side Response (DSR) was then awarded the third largest volume of capacity at 9.29%.

The provisional results show that roughly 9.5GW of de-rated capacity entered this year’s auction with less than 300MW exiting in the first seven rounds.

Jake Thompson, data scientist at energy data analyst’s Montel EnAppSys pointed out that the c.819MW Sutton Bridge and c.850MW Severn power stations (the two largest units in the auction) both exiting, removing their collective c.1.5GW of capacity from the auction and causing it to clear. This meant that the 7.6GW of capacity was awarded across a total of 277 capacity market units (CMUs).

Georgina Morris, head of capacity market policy – low carbon technologies for the Department of Energy Security and Net Zero (DESNZ), confirmed that the T-1 auction 2024/25 has cleared at £35.79/kW/year (40% less than the £60/kW/year cleared in the 2023/24 auction) on the second day of Solar Media’s Energy Storage Summit 2024.

Explaining what she believed these results mean for the UK BESS sector Morris said: “What I’m seeing from various commentators is that the Capacity Market is starting to become a more important part of the [BESS] revenue stack.”

The T-4 auction for delivery year 2027/28 will take place next week.

To read full version of this story visit Solar Power Portal.

UK BESS owners ready to ride out low revenue period, handle increasing complexity of market

The panel took place on the second day of the event, hosted by our publisher Solar Media. Chaired by Louise Dalton of law firm CMS, the session, ‘UK BESS: Reviewing the policy landscape in detail’ focused on how the industry can stay “at the forefront of the energy transition,” Dalton said.

The UK is widely considered an international leader in battery storage development, both from the viewpoint of deployment figures and in terms of market maturation, with a fleet of around 6.5GW large-scale assets in operation.

“In 2023, we saw a huge build-out of energy storage in the UK, lots of developer and investor interest, including some of the biggest players in the market,” Dalton said.

However, the present moment is characterised by a winter period that has been; Dalton said, “disappointing in terms of revenues”.

Against that backdrop, the lawyer said, the market is facing a gamut of policy changes. Some of these will be very significant and long-term, such as the ongoing Review of Electricity Market Arrangements (REMA) or support mechanisms for long-duration energy storage (LDES).

At the same time, there are changes coming that may resemble “tweaks” or minor adjustments but will nonetheless have a significant impact in their own right.

Well-timed Capacity Market chat

Dalton canvassed views from the assembled panelists on some of those topics, starting with this morning’s big reveal of the T-1 Capacity Market (CM) auction results, which you can read about on our sister site Solar Power Portal.

Georgina Morris, head of capacity market policy and low-carbon networks for the UK government Department of Energy Security and Net Zero (DESNZ), remarked that the clearing prices offered an uplift to the typical BESS revenue stack, taking average revenues from £51k (US$64.4k)/MW/yr to £65k/MW/yr with CM revenues factored in.

So while it isn’t the biggest portion of a stack by far, it is a guaranteed contracted payment that is a useful contribution, particularly in today’s high interest rate environment, Morris said.

Zenobe Energy’s Tom Palmer noted, however, that in terms of the T-4 auctions for delivery further out, some winners of contracts won’t even progress their projects to the build stage if they aren’t able to close financing.

There are proposals to reform the CM, which could include splitting the market into separate low-carbon and carbon-intensive asset pools, Lewis Heather, a director at management consultancy Baringa Partners said.

In addition, the original design of the CM was to cover stress events that may have lasted a few hours, but in future, the market will need capacity for different use cases, such as long periods of low renewable production. Meanwhile, the inclusion of new technologies such as carbon capture might impact the business case for BESS CM units.

DESNZ’s Georgina Morris said that while CM reform may be significant in the long-term, it is “incredibly important” that the current framework be allowed to continue in the meantime. Julian Jansen, markets and policy director at system integrator Fluence added that it is “critical” that CM design does not lock-in dependency on carbon-intensive technologies.

Balancing Mechanism

The Balancing Mechanism (BM), the real-time supply and demand matching tool wielded by the UK’s National Grid Electricity System Operator (ESO), has long been seen as a key opportunity for battery storage that is largely untapped.

While the reasons for that have been well documented on this site as well as on our UK sites Current and Solar Power Portal, Zenobe’s Tom Palmer said that the new Open Balancing Platform launched by the ESO will help to overcome the limitations of a BM which was designed around legacy assets.

It will take a lot of time and “the changes required aren’t simple,” Palmer said, but it is important to move fast, because time is money and in this case that money is coming from the UK’s consumers.

The ESO is introducing 15-minute settlement periods, Palmer said, “which is great,” but has come very late and is perhaps not ambitious enough. This feels especially acute, given that 5-minute settlement (5MS) has already been introduced into the National Electricity Market (NEM) in Australia, moderator Louise Dalton said.

Innovations and new revenues add complexity

The UK now has a plethora of ancillary services market opportunities and other revenue streams for BESS operators to add to their stack, including a new frequency service, Balancing Reserve.

While Fluence’s Julian Jansen said that this and other recent developments mean the complexity of the market is increasing in a way that developers maybe don’t need or want to have to deal with, Zenobe’s Tom Palmer said the industry “can deal with that complexity”.

“I’m not so worried about the complexity in some senses, because I think the industry can deal with it. I think the optimisers are able to go and optimise in different markets, they’re able to understand that,” Palmer said.

“I don’t see that as a kind of a barrier [to the business case].”

Elisa and DNA Tower partner for distributed energy storage in Finnish mobile infrastructure

By creating a virtual power plant using additional network storage capacity, the AI-powered DES system can load-shift to allow participants to purchase electricity from the grid during low-cost periods and use stored resources when costs are higher. That additional capacity can then be used throughout the network or sold to provide balancing services to local grids, including in the Automatic Frequency Restoration Reserve (aFRR) and Frequency Containment Reserve for Disturbances (FCR-D) markets.

“There’s no competition in the fight against climate change and we’re very proud to be working with DNA Tower on this project. We’ve proven the functionality of the solution in our networks in Finland and Estonia. DES is really a win-win for operators as it can help them to bring their energy costs down as well as provide value to society. We’re looking forward to welcoming others in using the solution,” said Henri Korpi, executive VP of international digital services at Elisa.

Elisa claims DES enables participants to make more efficient use of stored surplus technology, both as an additional reserve market revenue stream and by optimising their own power procurement. Indeed, Elisa says that efficiencies in power distribution using the system could halve telecoms networks’ electricity costs.

CEO of DNA Tower Finland, Antti Koskinen, said, “DNA Tower is committed to acting responsibly in a way that enables a better world for future generations. Introducing DES to our networks will allow us to ensure that we make the best use of green energy. It also increases the resilience of our network.”

Elisa received €3.9 million (US$4.17 million) from the government last February to begin work on rolling out a 150MWh VPP via its radio access network. Similar VPP projects are already in operation in the US, such as Swell’s 80MW Hawaii project.

Powin lands first UK project with 50MW/110MWh order from Pulse Clean Energy

It is Powin’s first BESS deployment in the UK and was agreed today (20 February) in a signing ceremony at the Energy Storage Summit EU in London put on by our publisher Solar Media, at which Energy-Storage.news was present.

It is its second in Europe after it secured an order for a project in Portugal, covered by Energy-Storage.news a few weeks ago. Powin president Anthony Carroll said that the European activity began with the acquisition of Spain-based power conversation system (PCS) specialist EKS, a partnership which remains even after the sale to Hitachi Energy.

“We are definitely going to invest more in Europe with Spain a big focus following our deals in the UK and Portugal,” Carroll said.

“There’s going to be a lot of storage needed in Spain because of the massive amount of renewables penetration. Poland is a very interesting market with some short-term opportunities, not quite a long-term strategy because the capacity requirements are limited.”

The project with Pulse also comes after several months of falling BESS prices globally. Asked about how this factored into the timing of the deal, Pulse Clean Energy CEO Trevor Willis told Energy-Storage.news:

“We take into account a number of different things before placing an order and ultimately we place our bets based on where we sit today and the things that we can see, including the pieces of revenue that we can lock down, and then we take a view into the future as to what we believe the market will be and will perform at, and we go forward on that basis.”

“I would say that it’s something that we anticipate will move up and down through time and so, for us, the importance is making sure that we’ve got a long-term strategic partnership with the people that we do business with, so that we’re working through those cycles in a way that that gets us to a long-term techno-economic outcome that delivers against the structural opportunity that we see in the market.”

Energy-Storage.news’ publisher Solar Media is currently hosting the 9th annual Energy Storage Summit EU in London, today and tomorrow (20-21 February 2024). This year it is in a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.

EU’s Battery Passport ‘will give energy storage investors more clarity on bankability’ of projects

The rules include requirements on things like carbon footprint labelling and recycled content, supply chain transparency and health and safety labels. The regulation is considered a key part of delivering the EU’s Green Deal package.

The passport is perhaps the most radical aspect of the regulation from a technological point of view, requiring QR codes to be put on components and materials that give access to crucial data on the batteries.

While that should give transparency and accountability on everything to do with how sustainable the equipment’s manufacture and materials are, the passport will also be crucial for investors, Maher Chebbo of Univers told Energy-Storage.news.

Chebbo was among the panelists speaking about the topic this morning at the Energy Storage Summit EU, hosted in London, UK, by our publisher Solar Media.

Ahead of that session, Energy-Storage.news spoke with Chebbo, who is managing director for Europe at Univers (formerly known as Envision), a digital decarbonisation solutions provider.

The passport is necessary, Chebbo said, because: “we want to trace end-to-end the whole history of the batteries, from the initial design to the manufacturing to the [expectation once it is placed] on the market”.

Chebbo has for the past three years chaired a European Commission (EC) group on the “digital use cases, digital technologies needed to make the batteries of Europe competitive and innovative”. The passport was decided as one of seven key technologies with the potential to do that.

Also speaking on the panel this morning were Patrick Vrank, project lead on the Batteries Pass Consortium which is delivering the passport and Richard Wagstaff, head of project development at UK-headquartered energy storage investor-developer Gore Street Capital.

Project engineer Vrank offered updates on the development of the passport. A major milestone was reached last Spring when the first content guidance was created, and Vrank encouraged the audience to visit the Battery Pass website for the latest information.

Wagstaff said meanwhile that the passport and the wider Batteries Regulation were very welcome, particularly as the fund Gore Street manages has mandates of its own to meet sustainability criteria. The regulation would help Gore Street stay in line with that, although of course, the implementation may be a complex proposition and Wagstaff said questions remain about the timelines for implementation and how that would affect upcoming procurements.

Chebbo told Energy-Storage.news in the interview beforehand that the passport will track and display data that includes “identification data, basic characteristics, and also the context how the battery lives, for the performance and the durability”.

The latter, he said, will enable the industry to extend the battery lifecycle to “as long as possible”.

“So that rather than saying this battery will live for eight years, it could live maybe for 12 years, and extend the performance of the battery as well, that it could charge more, be more effective in the discharge as well.

In other words, while the passport will place some burden on the industry to comply, there will also be definite advantages in terms of helping investors better understand how batteries can be used in various use cases, their expected lifetimes and ultimately their investability as an asset.

“Everything is correlated here. So, the insurance companies, the investors battery energy storage system (BESS) assets, they’re expecting to have a decent IRR out of their investment. Whether it’s 5%, 7%, 10% of the investment, and to be able to see the bankability of the battery energy storage project, you need to calculate the whole capex during the development phase,” Chebbo said.

“Then when you commission the BESS, you have all the OPEX and all the expenses on a yearly basis of the BESS. All of that, you need to calculate it. You need to know how long the life of the battery is. You need to know how much capacity you could use and the performance. How much are you going to spend on the maintenance of the battery? The battery passport will help in the repair, measuring and predicting the end life, it will also help in the health of the asset. It helps also in the safety,” Chebbo said.

“So definitely, this is crucial for the bankability calculation that you would give during the business case at the beginning for an investor.”

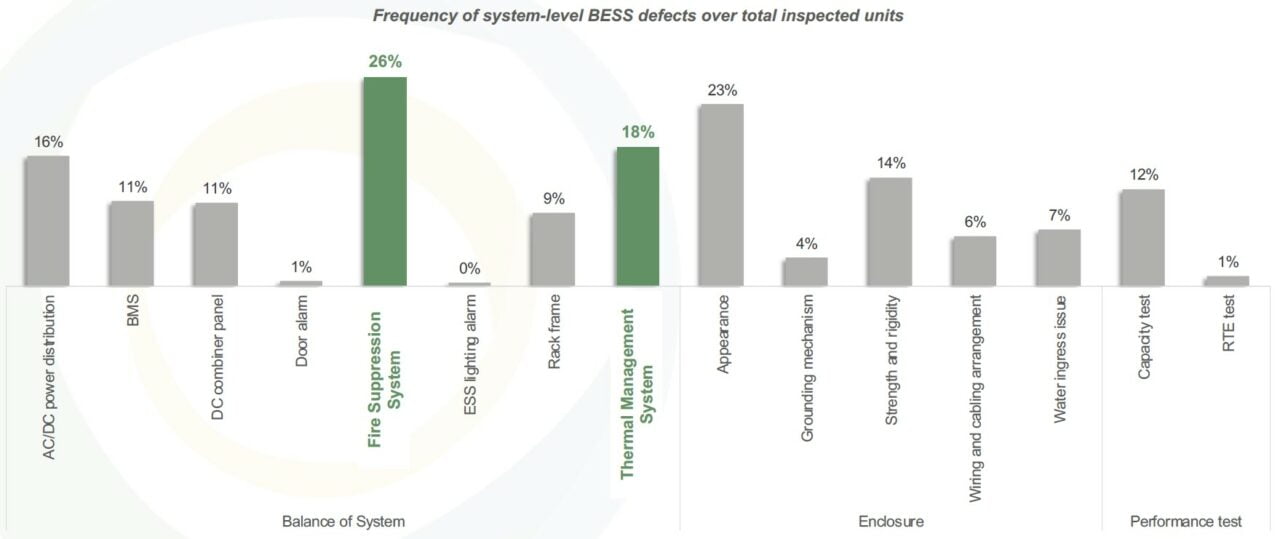

System-level issues account for nearly half of BESS production defects, says CEA

Of these issues identified, almost a third (26%) of BESS units inspected by the CEA had defects in the Fire Suppression System, while 18% of units had Thermal Management System defects, both of which are critical for functional safety, as defects in these systems can lead to increased risk of fire.

Some of the problems detected were a non-responding release actuator for the fire extinguisher agent, which, if malfunctioning, could potentially allow the fire to propagate further; non-responding smoke and temperature sensors, which wired incorrectly, could prevent the smoke sensor from detecting the presence of smoke within the system.

In the US, New York has been one of the leading states in its approach to safety issues regarding fires and earlier this month recommended changing the state fire code to better manage risks associated with battery storage systems installed in the state.

Moreover, an industry-led initiative from the American Clean Power Association (ACP) recently published a battery safety incident guide for first responders. Whereas in California, the state passed legislation last year that requires BESS owners to put in place safety and communications protocols with first responders and other key stakeholders.

Half of the issues came from system-level

These two issues – Fire Suppression System and Thermal Management System – were among the highest defects detected in the system integration of a BESS. Despite much of the industry’s attention being on cell selection, system-level should not be overlooked, as a potential source of problem, since these represent nearly half of (48%) the defects found by CEA.

A higher level of system-related issues is due to two reasons, the first is due to the BESS integration process being mostly manual and labour-intensive, while the second is problems originating from defects in upstream components might not have been caught in earlier quality checks.

Within that category, balance of system (58%) and enclosure (34%) had the majority of system-level findings. Although only 8% of the findings came from performance test, these had larger and more complex issues associated with them.

Recently, Energy-storage.news hosted a webinar with the CEA presenting some of the most common issues seen in the factory, their typical root causes and steps that can be taken in the manufacturing process to prevent these issues. During the webinar, George Touloupas, senior director of technology and quality, solar and storage at CEA, explained that the reason why the report focused on lithium-ion batteries was because: “Nobody is buying anything else than lithium-ion.”

One of the key takeaways from the report was that “quality assurance is the most efficient means to mitigate risks during mass productions,” added Touloupas.

Cell and module issues

Despite a higher automation process, cell issues represent 30% of the CEA’s issues found, with a third of the incidents occurring during electrode manufacturing, 38% during cell assembly and 30% during cell finishing.

The last category was for the module which represented 23% of the total findings, which is largely due to production lines being more manual. Half of the issues were related to interconnection wielding. This is due to the manual aspect of it and a lack of efficient quality control procedures.

For more details on issues related to each category, the report can be accessed here.

Hydrostor president on A-CAES tech, large-scale projects and changing business model

It could have increased efficiency by redesigning parts of the system, but that would have reduced how proven the tech would be, and, subsequently, its bankability. Goldman Sachs Asset Management committed to investing US$250 million in the company in 2022, and Hydrostor is the investor’s “global LDES (long-duration energy storage) play”, Norman says.

The firm’s A-CAES system works on the basic level in the same way as ‘non-advanced’ CAES, by running electricity through a compressor which turns that into high-pressure air to be stored underground and then run back through a turbine to release the energy.

What makes it ‘advanced’ is that it takes the heat from the compressor and instead of releasing it it runs it through heat exchangers to store in pressurised water. That water is then held in a reservoir (seen in the render above) and pushed down into the cavern to push the air back up and out when discharging, and vice versa. The process is called hydrostatic compensation and is where the company’s name comes from.

The company’s A-CAES system uses ten times less space than conventional CAES and 20 times less water than pumped hydro energy storage (PHES), Norman claims.

Major projects: California and Australia

The firm has two, small-scale operational projects in Canada, the larger of which is a 2.2MW/10MWh commercial system in Goderich, Ontario, and is working on several large-scale initiatives elsewhere.

Its most advanced projects are the 200MW/1,600MWh Silver City project in Broken Hill, New South Wales, Australia and Willow Rock, a 500MW/4,000MWh undertaking in California.

Norman: “For the Broken Hill project, we are looking to reach financial close this year. We’re working with contractors and are well advanced in the permitting process. We’re the equity partner for the project and are working with a financial syndicate to secure traditional project financing for it, with an in-service date planned for 2027.”

The project will provide backup power to the city of Broken Hill as well as play into the energy market.

For Willow Rock, it emerged in June last year that the firm was choosing alternative sites for the initiative after ‘superior geological conditions for the compressed air cavern’ were discovered elsewhere, a spokesperson said at the time.

Norman disagrees with the characterisation of this as a project delay: “The media reported this as an unexpected site change. We had to file our permits before we could drill boreholes at the site, so we always had backup sites. We’re still targeting 2028/29 for a commercial operation date (COD) with the option to push that to 2030.”

“The new location is great, and the local authority is extremely supportive of the project. The date issue is more to do with development in California generally, which is one of the more challenging areas to develop in the world.”

Six months prior to that, Hydrostor entered into a long-term power purchase agreement (PPA) for 200MW/1,600MWh of Willow Rock’s capacity with Community Choice Aggregator (CCA) Central Coast Community Energy.

“This was one of the first types of LDES contracts in the world and one of the largest of its kind anywhere in the world for energy storage,” Norman claims.

Challenges of a rapid scale-up

Hydrostor is also working on earlier-stage projects in the UK and elsewhere: “We are keen on Europe, Chile, and India, though in these places [outside its core markets of North America and Australia], we would work with other development partners. We’re working with EDF on project development in the UK.”

Hydrostor has arguably skipped a step in project size scale-up by going from a 10MWh system to the multi-gigawatt-hour space, and that comes with challenges, though not on manufacturing as it might do for a BESS provider.

“I’d love to be able to do a 10MW project and then a 50MW project, as it would be much easier to find value propositions. But that’s not practical; the scale this works at is the multi-hundred-MW scale.”

“We obviously don’t have the manufacturing challenge that comes with that scale-up that a manufactured product has, nor do we have supply chain issues because our components are readily available.”

The main challenge that arises with scaling up for a firm like Hydrostor is around how you deliver and ‘wrap’ projects and demonstrating and warranting operational performance to secure traditional project financing.

“But these are well-known systems, so we have no problem getting major EPCs to tie it all together and wrap the solution, and that is really key,” Norman says.

On investment costs, the company tells Energy-storage.news: “A generic 500MW facility typically requires over US$1 billion in investment, though that all depends on a number of factors like whether or not we’re using an existing cavern (as we are in Silver City), existing transmission interconnection, etc.”

From developer to long-term operator?

As mentioned, for now, Hydrostor has done its own project development work, because of the scale of infrastructure that its projects represent, Norman said. CAES firm Corre Energy is doing something similar with Dutch utility Eneco for a 320MW project there, which has a 2027 target COD, though the latter is taking a 50% stake.

We ask Norman what the long-term goal is in terms of being a technology provider versus an owner and operator of projects, as well as what he thinks about bringing in other capabilities versus building those in-house (like optimisation).

“We are very open to selling these systems outright, but right now, we’ve focused on our own development in particular markets like North America and Australia, where we have excellent name recognition. We have a sophisticated development capability, commercial team and government regulatory function team,” he says.

“On a case-by-case basis, we’ll consider bringing in operating partners as someone else may be more suited to operating it. In Ontario, it’s a bit more straightforward, but in the UK, for example, we’d definitely want someone else to do the energy trading.”

LDES consultation in the UK

After the company commented briefly on it at the time, Norman expanded on this when asked about the UK’s LDES consultation launched last month.

“We’re very excited about it. At a high level, the UK government is taking a very good path, and it’s very important to set clear mandates around LDES. Note that we’ve seen a more technology-agnostic approach in other jurisdictions.”

“We like the cap and floor idea, though obviously the devil is in the detail. You need some long-term contracting mechanism; otherwise it’s short-term incentives, and, with that, you only get lithium-ion batteries.”

Two years ago, Energy-Storage.news interviewed the company’s CEO Curtis VanWalleghem, who discussed the regulatory changes needed to get LDES investment off the ground.

Energy-Storage.news’ publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 20-21 February 2024. . Visit the official site for more info. A month later, the 5th Energy Storage Summit USA will take place on 19-20 March 2024 in Austin, Texas. Then, Solar Media will will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW.

The Energy Storage Report 2024: Feature articles and technical papers for free download

Energy storage continues to go from strength to strength as a sector, with the buildout in leading markets like UK and California/Texas accelerating and other states and countries close behind.

In it, you can read contributed pieces and interviews with leading companies in the sector like Wartsila, Flexgen, Burns & McDonnell, Habitat Energy, Field and Arenko as well as the US Department of Energy (DOE) and Pacific Northwest National Laboratory.

Highlights include:

The latest on BESS deployments in the UK and Continental Europe

Deep-dives on the latest big policy moves affecting storage in the UK, US and Germany

Technical papers covering augmentation, energy density and an 800MWh BESS project case study in Italy

Download the report here.

A limited run of print copies will be distributed at this week’s Energy Storage Summit EU in London (19-21 February).