The UK Government’s Department for Energy Security and Net Zero’s (DESNZ) new consultation¹ – which applies to the British mainland – on LDES is a key step in defining a policy to enable the rapid rollout of LDES to meet the 2035 power sector decarbonisation deadline.

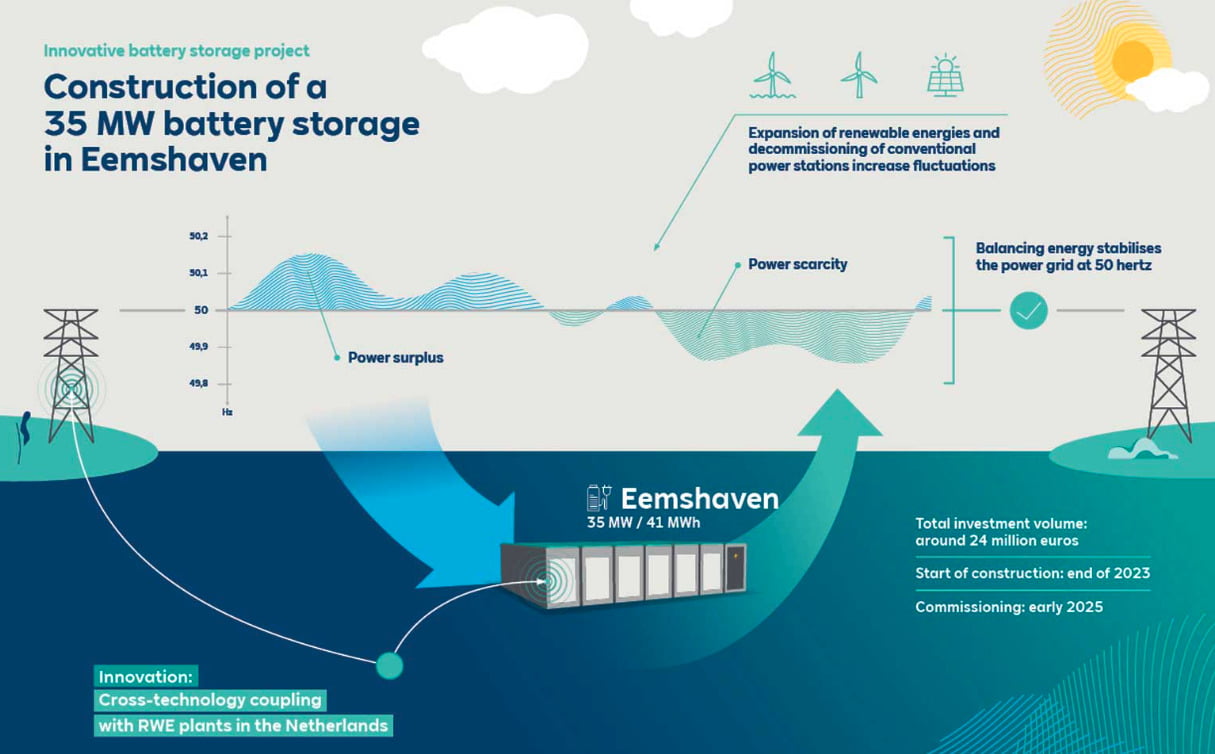

There are two key challenges to a decarbonised energy system, spatial and temporal, and LDES is essential to solving the latter. Storing energy from intermittent renewable sources, primarily wind and solar, during periods of high generation so that it may be dispatched when demand exceeds the renewable generation mix, is a key part of decarbonising the electricity system.

The need for a conversation on LDES

According to the National Grid Electricity System Operator (National Grid ESO): “2023 was the greenest year on record, with carbon intensity averaging 149 grams of CO2 per kWh. The lowest carbon intensity record of 27 gCO2/kWh was achieved on 18 September 2023.”²

As electrification of heat and transport progresses, DNV projects in our latest research of the UK energy system³, that total UK electricity consumption (including from off-grid renewables) will increase by a factor of 2.5 from 310 TWh/yr in 2021 to 760 TWh/yr in 2050.

Production from renewables continues to take a larger share of the mix, and providing flexibility and reducing carbon intensity in future will require greater effort. LDES alongside the current Battery Energy Storage Systems (BESS) solutions, presents a complementary opportunity to support the deployment of additional renewable energy and use it over periods of greater variable resource peaks and troughs.

The need for clear objectives and definition of LDES

By defining LDES as storage capable of a six-hour minimum supply duration, the framework also helps set a common understanding of what constitutes long duration in the UK. However, this is lower than the United States Department of Energy (DoE) which applies a 10-hour minimum duration. Different minimum durations between regions could lead to some differences in technology selection, but length is part of the ongoing consultation and it is possible this will change before the policy is finalised.

The consultation outlines five key objectives:

Policy Alignment – The policy framework should work alongside and compliment wider energy policy to deliver a resilient, diverse, net zero energy system of the future at least cost to the consumer.

Reduce System Costs – The policy framework should ensure that consumers are protected from unnecessary system costs from arising from high operational costs throughout the lifetime of the project.

Enable Investment – The policy framework should enable investment in large-scale, long duration electricity storage technologies through reducing uncertainty in revenue projections.

System Benefits – Storage projects should be incentivised to respond to market signals and behave flexibly to maximise benefits to the whole system.

Delivery – The policy framework should deliver projects in a timeframe that will provide the most benefit to the system, meet public commitments and will help the system to meet net zero targets.

The basis for the consultation is to adapt the ‘cap and floor’ mechanism, which is similar to the approach taken for interconnectors. The cap and floor mechanism has supported six interconnector projects, with a further three pending Final Project Assessment and seven new projects undergoing initial project assessment. The Viking interconnector, which connects the UK to Denmark, started commercial operations in December 2023 and is supported through the cap and floor regime for interconnectors.

The necessary technology

Pumped hydro is currently the UK’s leading long duration storage technology with 2.8 GW deployed, and is the country’s only established LDES. There has, however, been no new pumped hydro plants commissioned in the UK for 40 years.

A number of LDES technologies have developed in recent years funded through private investment funding and government technology development grants, such as LDES Demonstration in the UK. The technologies that emerge as prevalent – albeit at different readiness levels – predominantly fall into the following categories:

Flow batteries that circulate liquid electrolytes through battery stacks to generate electricity via the redox reaction. Examples of industry players are Invinity and ESS.

Gravity storage, such as Energy Vault which has a conceptual solid mass equivalent of pumped storage, with automatic cranes creating a tower of 35-ton blocks that drop back down when energy is needed.

Compressed air energy storage (CAES). This requires natural or man-made caverns or giant tanks in which air is pressurized and released to power a turbine. Technology from Canadian company Hydrostor uses water to pressurize air in man-made caves or abandoned mines.

Liquid air energy storage (LAES) Air is cooled using electricity to a liquid phase, which when warmed and released as a gas, spins a turbine. British company Highview Power has one demonstrator projects and a 50MW / 300 MWh project under construction in the UK.

Metal-air batteries. US-based Form Energy has developed an iron-air-exchange battery — based on the redox reaction between iron and oxygen. The company claims that the battery can store 100 hours of energy.

In terms of siting and techno-economic indicators, those technologies present a combination of pros and cons such as round trip efficiency, design life, capital and operational expenditure. Despite large differences in the efficiencies of each LDES technology, the consultation has not proposed a minimum efficiency criteria, and instead recommends assessing the overall benefits of each technology and project on a system basis.

The consultation recognises that the technologies may be at different Technology Readiness Level (TRL), and plans to only support through the proposed revenue support mechanism technologies at TRL 8 and 9. The consultation paper uses pumped hydro as an example of TRL level 9 technology, and lists Flow batteries, CAES and LAES as TRL 8. TRL 8 technologies have achieved small to medium scale operating pilot projects.

Similar to the exclusion of Li-ion technology, it is anticipated that categorisation of technology against TRL as barrier entry in the revenue mechanism and access to Stream 1 or Stream 2 revenue level will need further refining and re-assessing over time.

It is unclear whether the effect of such technologically-agnostic support to a range of LDES technologies, both in the UK and elsewhere in the world, will achieve the cost reduction that would over time allow such projects to compete with other forms of storage and dispatchable generation. The development of the LDES policy framework is a positive step to supporting emission free technology and recognising their benefits at the system view.

Why no Lithium-Ion and what that means

When it comes to the provision of utility-scale energy storage solutions to date, Li-ion has established itself as the primary technology.

By being cost competitive, displaying high energy density, fast response and high efficiency, as well as having modular and controllable power electronics conversion solutions, Li-ion technology currently contributes around 3.5 GW to the stability of the GB power grid through:

Participation in frequency response markets, the capacity market, the balancing mechanism, and locational stability services (provision of reactive power, synthetic inertia and/or black start facility);

Trade in the wholesale electricity market, taking advantage of electricity price spreads (difference between the lowest and highest cost of electricity throughout a given period, usually the 24-hour daily trading cycle).

Boosted by the growth of both the consumer electronics market and the electric vehicle market, Li-ion technology has experienced significant growth, accompanied by technological improvements and a continuous price reduction. According to DNV‘s Energy Transition Outlook⁴, cost is expected to continue its downward trajectory and reach the 200 USD/kWh mark by early 2030. Sodium-ion batteries are also expected to become on par from a cost perspective with Li-ion and play a role in stationary battery energy storage solutions.

Li-ion BESS with up to 8-hour duration are in development in Europe, the USA and Australia. Other forms of long duration storage have advantages over Li-ion with respects to fire safety, ability to decouple power and energy capacity giving economic advantage for longer durations, and lower degradation. Regardless of the validity of those claims, technological development in battery storage will close the gap on those fronts, especially considering the volume and pace of technological development in this space.

It is worth nothing that Li-ions are currently mostly manufactured in China – and the appetite for Europe and UK to minimise dependency to China for energy infrastructure may give an edge to alternative solutions. However, the pace of gigafactory development in UK and to a lesser extent in Europe, will not allow to fuel the BESS development without heavy reliance on import for the foreseeable future.

The consultation proposes to exclude electricity storage technologies such as Li-ion from the scheme on the basis they can already be funded under existing market arrangements.

It is an element of the consultation which is expected to generate some debate across the industry. Li-ion average energy duration is increasing, having been historically deployed as a one-hour system in the UK. Now with the bulk of the plants recently commissioned and under construction as two-hour systems, and the future pipeline showing signs of four-hour projects entering the mix, this indicates that the energy sizing of projects is limited by the economics.

Indeed, longer duration energy storage makes economical sense if the ability to discharge for its full duration hours is aligned with merchant market signals or is called upon or recognised by the system operator (e.g. under the Capacity Market), without which a part of the initial investment is in effect stranded.

Whether the exclusion of Li-ion from the scheme appears fair or unfair depends very much on the level at which the floor is placed, and whether such floor facilitates investment into LDES technologies and projects bring an unfair advantage to those technologies over established Li-ion.

The state of the grid

Storage and low carbon generation exist as part of a system connected by the grid. In the near term, transmission and distribution grid constraints are emerging as the key bottleneck for renewable electricity expansion and related distributed energy assets, such as grid-connected storage. BESS technology has already demonstrated how storage can reduce load on the grid and mitigate curtailment of wind and solar. The overall system benefit is a key consideration for LDES projects under the proposed scheme and all the technologies can provide system benefits beyond simple capacity.

To achieve what the consultation labels the “low regrets” option of 3 GW of LDES by 2035 – nevermind when compared to as much as 50 GW potentially being needed by 2050¹ – these new projects must be connected to the grid. Power grids across the world are suffering long lead times for new connections. In mainland GB, the pipeline stood at around 600 GW at the end of 2023. Fortunately, recent changes to queue management policy arrangements allow DNOs and National Grid Electricity System Operator [NGESO] to proactively manage the queue to connect projects that have met the development milestones.

Other announcements from the ESO, such as the acceleration of 10 GW of BESS connections⁵ will be welcomed by parties interested in LDES.

Pumped hydro is geographically constrained, generally in Scotland or Wales, and construction of new projects struggle with planning related challenges, however it is anticipated that we will see a number of existing hydro sites retrofitted as pumped storage.

While the energy flow across GB is generally towards the south-east of England and network boundary constraints already affect projects in Scotland. New developments for HVDC links, such as the western HVDC link and similar developments on the east coast, could alleviate these constraints but take time to build. Potential constraints in energy flows across England could also present technical challenges for projects in Wales. In addition to the environmental impact of the projects themselves, pumped hydro will spark debate over the connection routes, in particular overhead lines vs underground cables.

The current consultation on LDES is an important step towards a policy to support LDES this year with the aim of having operational assets by 2030. The consultation asks many questions which could impact the final policy. When finalised, the policy framework should enable investment in established and emerging technologies. LDES, along with other technologies, can provide flexibility and enable a secure, cost-effective, and low-carbon energy system.

References

1: DESNZ consultation

2: Reduced investment in coal

3: DNV UK ETO: UK Energy Transition Outlook 2022 – DNV

4: DNV ETO: Energy Transition Outlook 2023 – DNV

5: National Grid to accelerate up to 20GW of grid connections

About DNV

DNV is an independent assurance and risk management provider, operating in more than 100 countries, with the purpose of safeguarding life, property, and the environment. It provides assurance to the entire energy value chain through advisory, monitoring, verification, and certification services. Stephen Guthrie is head of storage and grids for the UK and Ireland region while Thibault Delouvrié is an energy storage principal consultant.

Energy-Storage.news’ publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 20-21 February 2024. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.

Continue reading