There’s no question these beasts have historically played an important role in managing the rigorous demands of maintaining an electric system for a metropolitan area of many millions of people as well as for the millions of New Yorkers that live outside the city itself.

But, increasingly, that is a historical view at best. The reality is that today, there are huge problems with New York City (NYC) being reliant on assets that are among the most polluting on the grid as well as the most expensive to operate.

And when we say ‘polluting’, of course, we mean greenhouse gas (GHG) emissions, but along with that, there are also particulates of nitrous oxide (NOx) and other gases emitted at dangerous levels. NYC peakers don’t just run on natural gas which is arguably the ‘least worst’ option available, but many instead run on heavy fuel oil or even kerosene.

So far, so nightmarish. It gets much worse still when you consider the siting of these power plants. The vast majority are within poorer and disadvantaged, densely populated neighbourhoods and largely around communities of colour. There are also pretty convincing arguments that that’s exactly how they were planned from the start.

This being a Friday Briefing, we always want to bring some positivity or lightness to the discussions we have on these pages. Well, here it comes.

Advocates and energy system experts are adamant that replacing peaking power capacity can be done cost-effectively and is technically viable, using a combination of different low-carbon technologies including distributed solar, offshore wind, demand response and most crucially, battery storage.

I had an interesting and dare I say, inspiring, conversation yesterday with representatives and leaders of PEAK Coalition. Regular and longtime readers might recall that the coalition was formed to take on New York’s monstrous fleet of peaking power plants, by groups including grassroots sustainability non-profit UPROSE, Clean Energy Group, New York Lawyers for the Public Interest, and others.

PEAK Coalition came to Energy-Storage.news’ attention in late 2020 when it teamed up with the New York Power Authority (NYPA) to asses options for retiring the public utility’s own 461MW fleet of gas peakers.

More to come from that interview soon, but to sum it up in a very brief (and largely inadequate) way for the purposes of today’s briefing: UPROSE had been fighting since 2003 on this subject, successfully stopping efforts to repower then already-ageing peaker plants with yet more combustion turbines.

The battle has been uphill. The advocacy group can claim some great victories along the way, particularly in stopping new peaker projects, but overall, the problem is still there and still making people in New York sick, lowering their quality of life and opportunities, or killing them.

That said, since the passing of New York’s Climate Leadership and Community Protection Act (CLCPA) in 2019 committing the state to ambitious clean energy and climate goals, the fight has picked up.

Without battery storage, this would not seem possible at all, I heard from members of the coalition. While, as stated above, other technologies will be needed in abundance, its battery energy storage system (BESS) technology that will be the key piece at the heart of it and the technology that could finally give New York City the strength and tools to take the power back.

Plans of intent to transition nearly two-thirds of all peakers in New York have now been announced. If that sounds a little vague, it’s because it is. Most of those plans are as-yet undefined, so it is really just the start.

That said, 700MW of assets have already been retired. At the same time, more defined proposals are in place to put three large-scale BESS assets in the place of peakers post-decommissioning by their owners, representing “encouraging progress” despite the inevitable pushback from the fossil fuel industry and NYPA is very much on board with the transition, at least publicly.

We’ve all heard how challenging it has been for New York to get its large-scale BESS buildout going, even since the state introduced a major 6GW by 2030 deployment target – equivalent to the legacy peaker plants’ combined capacity – so there are a lot of variables and moving parts to coordinate.

Yet PEAK Coalition’s 2021 study, carried out by consultancy Strategen, modelled that it would be technically feasible to transition NYC’s peakers to clean energy by 2030 and save the state money in the process.

It may be sad in some ways to think that the bottom line might be what it takes to convince people to support changes that will improve the quality of life and life chances of others, but, well, if it does convince them, then all the better.

BESS factory inspections reveal areas for improvement

Can you guess – or perhaps you already know – which components in a grid-scale BESS are the most commonly found to be defective or otherwise inadequate in factory inspections?

Clean Energy Associates (CEA) does. The international quality assurance group for solar PV, green hydrogen and battery storage has undertaken inspections at more than 30GWh of battery storage production lines to date at more than 50 factories around the world.

A few days ago, we hosted a webinar with CEA, where the audience learned about some of the things that can go wrong when taking a battery storage solution from product design through to in-field operation from CEA senior director George Touloupas and senior engineer Chi Zhang.

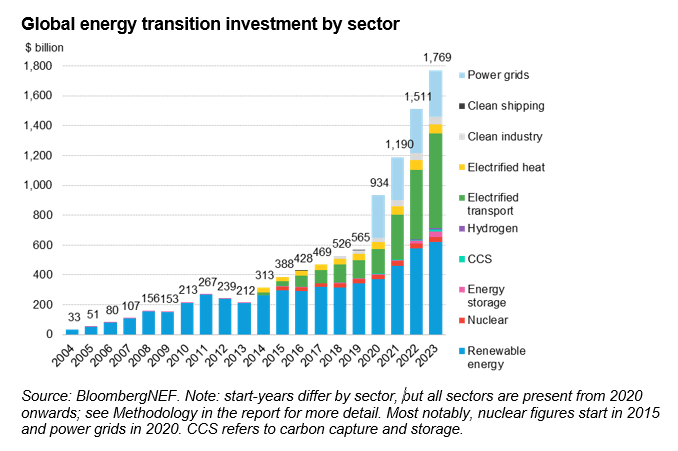

Given the rapid growth of this industry and given the need for it to grow much bigger and grow even faster over in the coming years, as illustrated by the recent publication of BloombergNEF’s 2024 Energy Transition Investment Trends report, the need for assurances on quality also becomes more acute.

It was one of our best attended webinars to date, and we heard about everything from the principles and practices of CEA’s inspections to a series of real-world case studies and plenty of data. Some of that was a little worrying, given that fire suppression systems are among the equipment most commonly found with problematic design or manufacturing quality.

But it is also great to know that folks like CEA are on the case and George and Chi’s presentation and candid and insightful answers to a lengthy audience Q&A demonstrated that, in the right hands, the problems which need to be tackled can be identified and fixed.

Continue reading