The 650MWh project will have a 2-hour duration with 300MW output and will also be equipped with grid-forming capabilities via advanced inverters.

“Origin’s strategy is to accelerate renewable energy and storage in our portfolio and we expect large-scale batteries and other storage technologies to play a vital role in Australia’s energy transition,” Origin Energy CEO Frank Calabria said today (29 January).

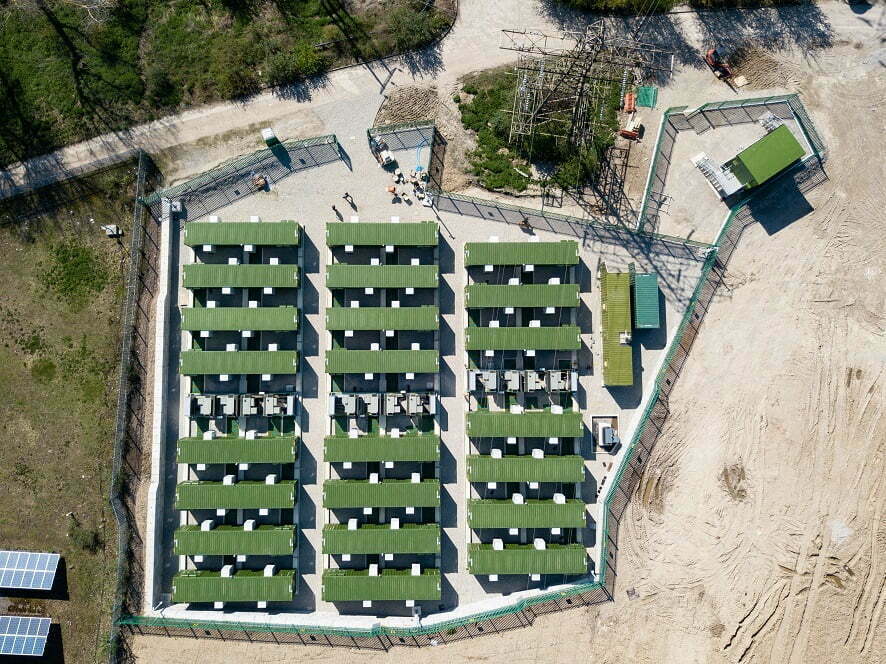

Origin has selected Fluence to supply its battery energy storage system (BESS) technology for the Mortlake Battery project. Energy storage system integrator and services provider Fluence’s GridStack modular, scalable BESS solution, based on its sixth-generation Fluence Cube technology will be deployed, with the two companies’ contract including a 15-year service agreement.

Meanwhile, Fluence’s asset performance management software Nispera will optimise the battery storage system’s operation.

Fluence said in a release yesterday that site preparation and civil works will commence after the completion of design and procurement activities, with the BESS expected to go into commercial operation late in 2026.

Being sited within the Victorian government’s designated South West REZ, it will be able to capture abundant, surplus energy generated by an expected proliferation of large-scale wind and solar PV plants in the area. At the same time, it will be able to leverage existing electricity transmission infrastructure at the Mortlake peaker facility.

The Origin BESS is also among eight projects totalling 2GW/4.2GWh across Australia which are being supported with funding from the Australian Renewable Energy Agency (ARENA) to equip them with advanced inverter technologies.

This is what will enable the planned ‘grid-forming’ function of the 300MW Mortlake system. Grid-forming BESS projects deliver inertia to the network which helps keep its operation stable. Traditionally inertia has been provided by the rotating mass of turbines in thermal power plants, which are being retired and replaced by renewables.

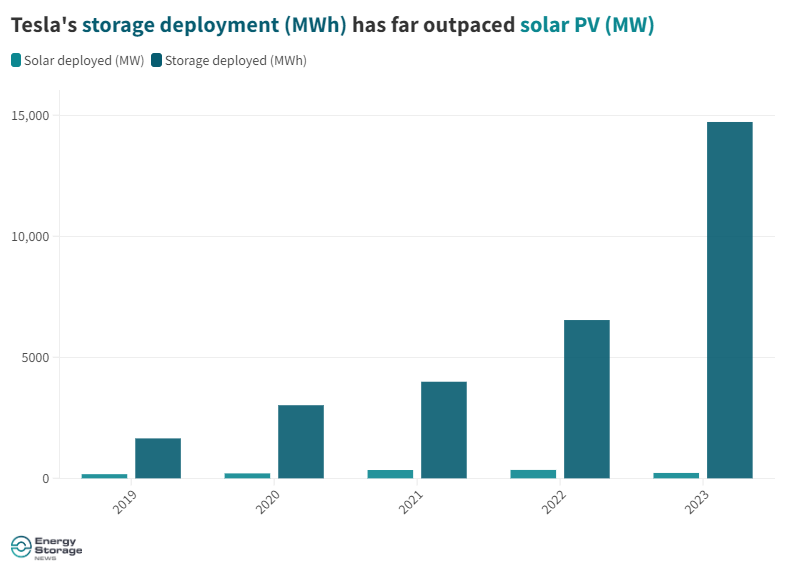

Earlier this month, Fluence announced that it has now deployed, or has under contract, in excess of 20GWh of grid-connected battery storage worldwide from the 47 different markets the company is active in. That includes its most recently contracted BESS in Australia prior to Mortlake, the 500MW/1,000MWh Liddell Battery Project in New South Wales for AGL, another of Australia’s major generator-retailer (‘Gentailer’) utility companies.

BESS project at retiring Eraring coal plant underway in NSW

“With the proliferation of wind and solar farms, particularly in Victoria’s South West Renewable Energy Zone, the Mortlake battery will help keep the grid stable and support more renewable energy coming into the system as the market continues to decarbonise,” Origin CEO Frank Calabri said.

Mortlake is Origin’s second committed utility-scale battery storage project. Its first is currently under construction at the site of Eraring in New South Wales (NSW), the only coal-fired power plant in the Gentailer’s portfolio of generation assets.

Eraring is scheduled for closure in 2025, a date that Origin brought forward by seven years from an original plan due to coal’s diminishing competitiveness in Australia’s National Electricity Market (NEM). Origin took its Final Investment Decision (FID) to proceed with building the first 460MW/920MWh phase of its BESS project at the site in April last year. Interestingly, at that time, the company also estimated the first phase at Eraring to cost around the same AU$400 million sum it would be investing into Mortlake.

While Origin has said the Eraring BESS could go to as much as 700MW/2,880MWh if market conditions support it, the 2,880MW coal plant’s capacity and services to the system will also be replaced by a mix of other technologies including a virtual power plant (VPP) and 3GW of peaking capacity.

With coal traditionally accounting for Australia’s biggest share of generation by far, the country’s energy transition will ultimately hinge on a smart mix of technologies and planning, from transmission network buildout to rooftop solar PV adoption.

In a recent article for our quarterly journal PV Tech Power (Vol.37), Stephanie Bashir, CEO of consultancy Nexa Advisory, wrote about the coordinated efforts required and highlighted the vital role grid-scale battery storage must play in enabling the transition to happen on time and at least cost.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Continue reading