The chief proposal is a cap and floor mechanism for LDES projects which would guarantee a minimum and maximum revenue for projects, with the government funding any shortfall and receiving any money back above the cap.

“The cap and floor mechanism for LDES is a sensible evolution from the simpler strike price model of a Contract for Difference (CfD), which has proven to help get less mature technologies off the ground,” developer and operator Balance Power‘s commercial manager Nick Provost told Energy-Storage.news.

“It’s likely to benefit consumers as asset operators will be able to gain more revenue before breaching the cap, compelling them to pay this extra revenue to the government. This should help provide downward pressure on the cost of the floor which is good for electricity consumers.”

Luke Gibson, COO at another developer-operator Field, similarly told us: “We welcome the launch of this consultation. It’s reassuring to see the recommendation for a cap and floor mechanism that – price dependent – should give greater revenue certainty, which will in turn help to secure financing for these assets.”

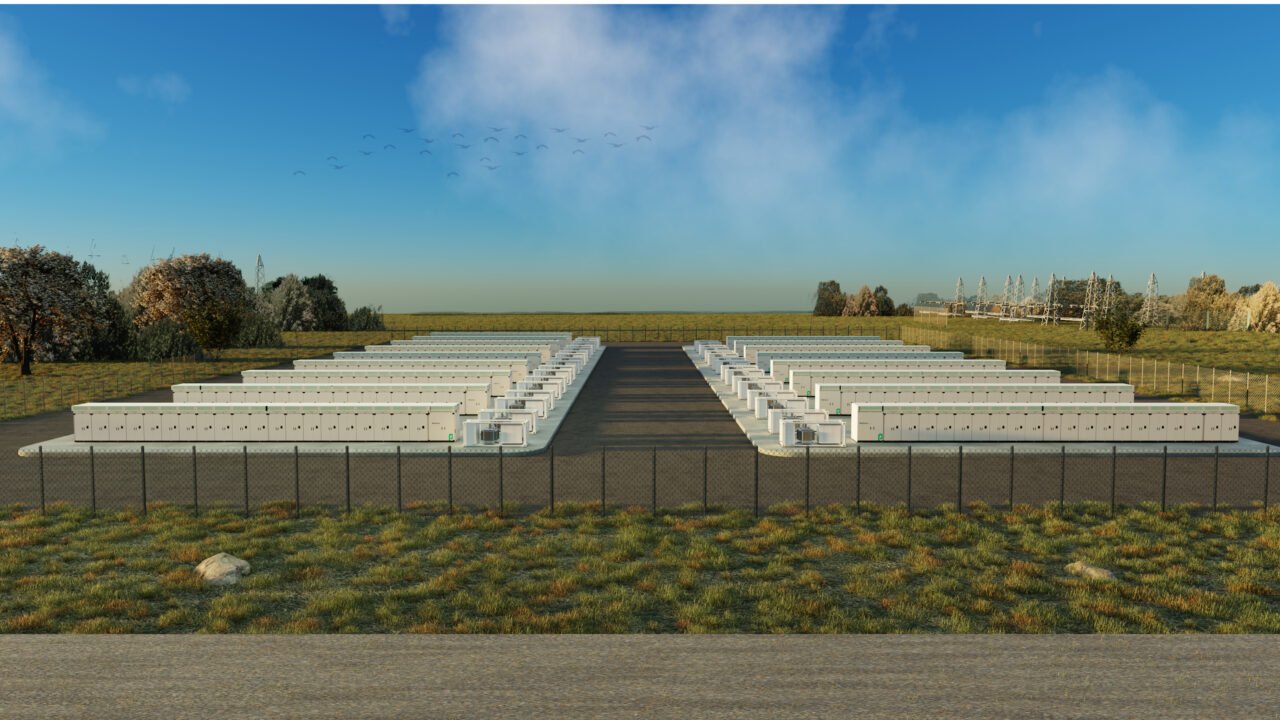

Provost also said that a cap and floor for LDES would complement existing shorter-duration assets. The UK already has 3.9GW/4.8GWh of operational battery energy storage systems (BESS) and the near-term pipeline is 60GW/92GWh pipeline (figures from Solar Media’s UK Battery Storage Project Database Report).

“A cap will discourage LDES assets from seeking the absolute peaks and troughs in the wholesale market which unsupported assets can chase and a floor will encourage LDES assets to provide energy security during periods of lower wholesale volatility,” Provost said.

Lithium-ion exclusion ‘should be reconsidered’ for LDES

The aspect of the consultation that has been most widely opposed by industry figureheads is the proposed exclusion of lithium-ion as an eligible LDES technology for the cap and floor scheme. The government said this is because it is already commercially viable and being deployed at scale without any subsidies. Indeed, lithium-ion technology is being used for the vast majority of energy storage projects being deployed in the UK.

Field’s Gibson said: “However, the exclusion of existing lithium-ion technology at 6-hour duration should potentially be reconsidered if the goal is consumer savings. LFP (lithium iron phosphate) batteries remain cost competitive at this duration.”

In our coverage last week of the consultation, analytics firm Modo Energy’s Ed Porter also opposed excluding lithium-ion but for the opposite reason – that it is not currently commercially feasible at 6-hour duration.

‘Absolutely crucial to police gaming as a priority’

Balance Power’s Provost also discussed the risks of ‘gaming’ and operators exploiting the system for financial gain. Other industry sources have previously opposed cap and floor regimes for energy storage.

Provost: “It’s absolutely crucial that the policing of gaming is prioritised in the final design of any LDES support and we are happy this is considered within the consultation. This is for a couple of key reasons.”

“The myriad of trading opportunities available with storage will provide differentiation between competitors and will provide consumer benefits through innovation. However, this will make transparency harder to achieve and increase the potential for operators to exploit the system for financial gain.”

“The ultimate requirement for LDES is driven by the technical need for energy security during periods of low renewable energy generation (i.e., as coined in the German language expression “dunkelflaute” / “dark lull”). Therefore, there should be a mechanism to compel LDES-supported projects to deliver power during periods of dunkelflaute. Intuitively market signals should be enough but may not be sufficient under all circumstances.”

“However, gaming concerns are not unique to the proposed cap and floor model and will exist in any subsidy regime for storage as revenue is dependent on multiple components within a volatile market.”

LDES technology firms react positively

LDES technology firms have generally reacted positively to the government proposal. Stephen Crosher, CEO of proprietary ‘high-density’ pumped hydro energy storage (PHES) technology firm RheEnergise, said:

“We welcome the commitment to Long Duration Energy Storage from the UK government and the recognition that support mechanisms to initiate the LDES market are needed. In principal, we agree with the proposal for the cap and floor mechanism. We are keen to ensure that the mechanism is applicable for all LDES technologies, and at the various scales needed to support the overall, increasingly distributed, energy system. We will be responding to the consultation in due course.”

Scott Bolton, executive VP global policy & regulatory affairs for advanced compressed air energy storage (A-CAES) technology firm Hydrostor added: “We’re pleased to see this proposal from the UK government, which will go a long way to support the decarbonisation of UK electricity markets while also adding flexible firming capacity. We look forward to reviewing the proposal in further detail.”

Energy-Storage.news’ publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 20-21 February 2024. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.

Continue reading