The firm has been awarded awarded US$8.9 million from the CEC and US$6.7 million from the DoE alongside a US$9.4 million Series A financing led by Khosla Ventures.

The company is aiming to use thermochemical energy storage (TCES) technology to decarbonise industrial heat as well as deploy grid-scale energy storage for electricity on the other. It claimed its thermochemical battery has an energy density comparable to lithium-ion, the industry leader.

RedoxBlox’s technology is a storage module with a vessel filled with a ‘proprietary and abundantly available, low-cost’ metal oxide material. To charge, electricity heats the metal oxide pellets to 1000-1500°C, triggering a chemical reaction that releases oxygen and stores heat in the form of chemical energy.

To discharge, air is directed through the module and the metal oxide consume the oxygen to reverse the reaction and release heat. The heat can either be used directly for industrial purposes, or through a gas turbine to generate power.

The CEC’s funding will go towards a pilot project to power a turbogenerator with up to 24 hours of energy storage capacity, in partnership with the University of California, San Diego (UCSD) and the Electric Power Research Institute (EPRI).

Meanwhile the DoE’s Industrial Efficiency and Decarbonization Office selected RedoxBlox for a an industrial-scale TCES project to decarbonise industrial steam at a West Virginia plant of chemicals firm Dow.

Eos signs electrolyte supply deal

Non-lithium, long-duration battery storage startup Eos Energy Enterprises has signed a supply deal to cover at least 75% of the total zinc-bromide electrolyte to be used in its next generation of products.

The company said last week (9 January) that it has extended its partnership with TETRA Technologies, a completion fluids and water management services provider to the upstream energy industry, through which the pair had since 2021 been working to improve the electrolyte solution’s quality.

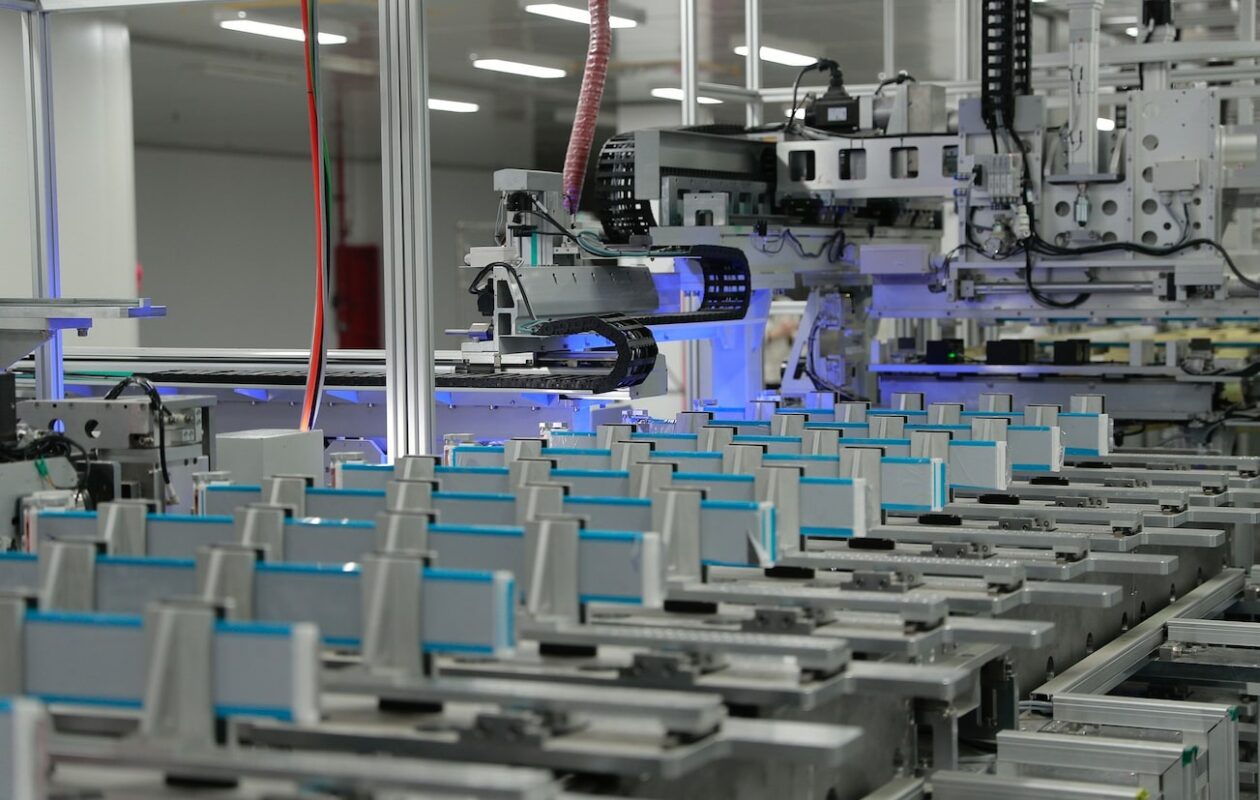

Eos’ zinc aqueous battery technology stores electrical energy through deposition of zinc. Aqueous electrolyte is held within individual battery cells, dynamically separating the electrodes. Ions move through the electrolyte during charge and discharge to the electrodes, creating a current flow through the bipolar stack.

CEO Joe Mastrangelo said the company’s strategy has “centered around finding raw materials being used in other industries to provide both scale and cost efficiencies,” and as such TETRA’s investment in bromine production can be leveraged.

TETRA itself said yesterday (15 January) that it has secured a US$190 million funded term loan and US$75 million delayed-draw term loan to refinance an existing term loan and provide capital towards a bromine processing project in Arkansas, US.

It wasn’t clear from a company release how much of that investment would be geared towards Eos Energy Enterprises’ offtake. However TETRA is set to be supplying at least 75% of the zinc-bromide electrolyte to be used in Eos’ new, third-generation Z3 battery technology and TETRA CEO Brady Murphy said the relationship with the zinc battery maker “dovetails nicely with our bromine production plans, and we are excited to be part of Eos’s future plans and Inflation Reduction Act objectives”.

As a US-based manufacturer of clean energy equipment, Eos can expect to avail of tax credit incentives created in the Inflation Reduction Act (IRA). The company said in quarterly financial results statements in November that it will not be profitable until it can fully automate production of its storage systems, with CFO Nathan Kroeker stating that the Gen3 battery product was designed at around half the cost of the previous iteration.

ESS Inc commissions unit at US military base

An iron electrolyte flow battery system manufactured and supplied by ESS Technology Inc (ESS Inc), has gone online at a US Military base facility.

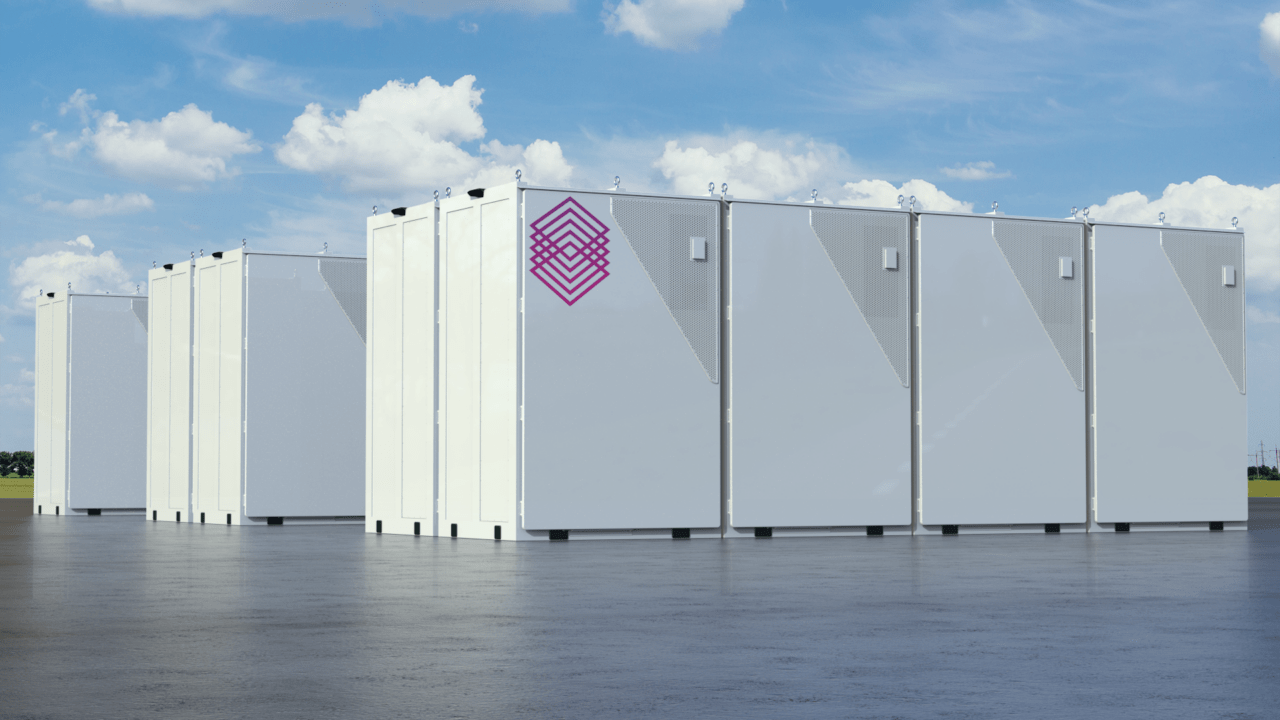

The Oregon, US-headquartered tech company said yesterday (15 January) that its Energy Warehouse branded system has been commissioned at Fort Leonard Wood, Missouri. ESS Inc’s proprietary flow battery design is aimed at medium- to long-duration energy storage (LDES) applications.

Situated at the US Army Corps of Engineers’ (USACE’s) Contingency Base Integration Training Evaluation Center (CBITEC) at Fort Leonard Wood, the system will enable the USACE to reduce its reliance on fuel generators and is integrated into a tactical microgrid.

The demonstration project will therefore show how flexible LDES technologies such as the iron flow battery, “reduces total runtime on generators while increasing efficiency and allowing generators to last longer at Forward Operating Bases”, according to USACE operational energy programme manager Tom Decker.

“ESS’ safe and resilient technology can dramatically reduce refueling logistics requirements and has the potential to assist in transition to renewable energy. We look forward to demonstrating to all service branches how incorporating an iron flow battery can increase resiliency in military power applications,” Decker said.

If the project sounds familiar to long-time industry watchers, it’s because the new Energy Warehouse will be replacing a prototype flow battery system ESS Inc installed at the base in 2016-2017. While the new system’s output and capacity weren’t given, the original system was a 60kW/225kWh unit.

Energy-Storage.news’ publisher Solar Media will host the 5th Energy Storage Summit USA, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Continue reading