The clean energy transition is critical to meeting Australia’s climate targets, securing our energy future and ‘keeping the lights on’, as well as controlling and abating cost of living pressures experienced by Australian households and businesses.

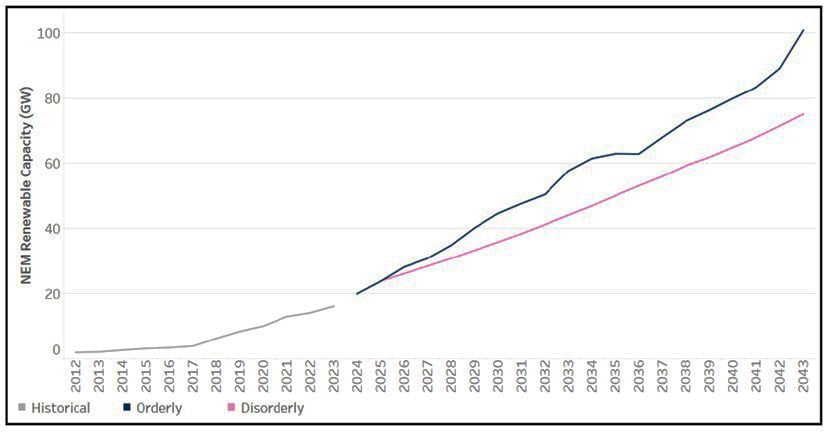

Australia has set goals to be net zero by 2050 (requiring a 43% reduction in carbon emissions), and 82% renewable electricity generation by 2030. However, right now, Australia is behind in this task to deliver a low-emission power system.

The transmission build that will be required to fully connect the new large-scale decentralised generation, rather than centralised fossil fuel power stations, is the equivalent of 25% of today’s entire grid. It will now need to be built in less than seven years.

Although key transmission projects have been identified, across the country we are a long way behind on their development. No new interconnectors have been built in Australia for over 20 years and the five regulated Primary Transmission Network Service Providers (PTNSPs) have yet to demonstrate they have sufficient capabilities or scale to mobilise the resources necessary for Australia’s transmission build out.

Lack of engagement with communities in the early-stage processes of major projects has evoked severe resistance which has become a bottleneck to new renewable generation capacity.

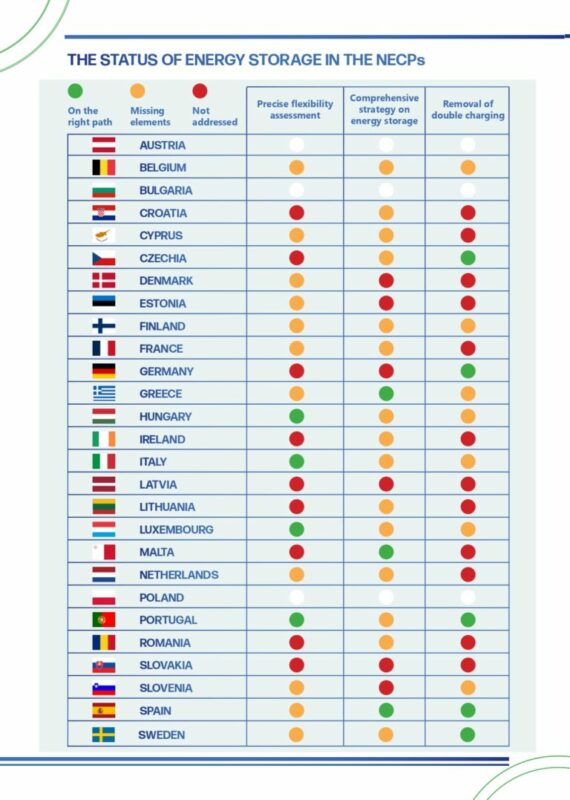

The issues facing our energy transition are exacerbated by the global race to decarbonisation. New programmes in the United States of America, European Union, and Asia are accelerating the clean energy transition by providing clear financial incentives (e.g. the Inflation Reduction Act, USA; the Green Deal Industrial Plan, EU). Australia will need to move quickly to ensure it can attract funding, materials, and skilled people.

The 2022 “climate election” saw a change in Federal Government and the election of several climate-focused independent candidates. The notable increase in pace and ambition of the political leaders in this sphere over the past 18 months means that Australians are beginning to understand that the shift to a clean energy economy is in our national interest.

Since taking office in May 2022, the Australian Government has established new and improved 2030 emissions reduction targets (43%, up from 26-28%), renewable energy targets (82%) and stronger industrial decarbonisation policies.

Figure 1: Required renewable generation (dark blue) in the NEM as recommended in the 2022 ISP Step Change scenario versus projected future delivery of renewable generation (pink) based on past delivery rates (grey) showing the significant and escalating shortfall in delivering renewable generation required. Credit: Nexa Advisory

32GW Capacity Investment Scheme

In November 2023, Minister for Climate Change and Energy, Chris Bowen MP, announced a historic new plan to drive investment in renewable energy generation and storage.

A significantly expanded Capacity Investment Scheme (CIS) will now act as the central enabler of Australia’s 2030 renewable energy target. Its key feature is that the federal government commits to under-write up to 32GW of renewables and storage this decade to drive record levels of private investment in solar, wind and batteries. For context, Australia’s National Electricity Market (NEM) currently has an installed capacity of 64GW, of which approximately 24GW is renewables.

It is expected that the CIS will go a long way towards Australia meeting our 2030 climate targets but, just as importantly, the scheme keeps energy prices down because renewables are Australia’s cheapest source of energy and it will help ensure replacement generation is available as the national fleet of unreliable coal-fired power stations shuts down.

At the energy consumer level, Australians remain prolific adopters of rooftop solar, and, reflecting the more ambitious approach taken by political leaders, we are increasingly aware that harnessing the nation’s unique access to mineral resources and renewables-friendly weather conditions can benefit our families, towns and the nation as a whole.

However, despite these encouraging indicators of progress, we have a long way to go to meet climate targets and make the most of our natural advantages. AEMO forecasts the energy system will need a total of 44GW of variable renewable energy (+28GW), 15GW of storage (+13GW) and 10,000km of new transmission lines before 2030 just to keep the lights on. This is largely to replace coal-fired power stations as they are retired over the next seven to ten years.

Meeting this challenge will be critical to maintaining the confidence in and the buy-in for the transition, both at a political level and, more importantly, for businesses and families.

Energy storage: Opportunities at every scale

Storage capacity at all scales will be required to ensure a reliable energy system. This includes the storage available on the distribution network as well as in homes, such as community batteries and virtual power plants (VPPs), and demand-side management.

AEMO Integrated System Plan – Expected Energy Transition to 2050 (Storage). Credit: AEMO’s 2022 ISP

The 2022 Integrated System Plan sets out the scale of the storage challenge: today, Australia has a little less than 2GW of storage connected to the energy system. By 2030, we need a total of 15GW of storage, and by 2050 we need 61GW. Even with a supercharged Capacity Investment Scheme (which aims to secure 9GW of dispatchable capacity this decade) and the rapid rate that batteries can be deployed, that’s a big ask.

Small-scale storage in households can play a critical role in stabilising the enormous amount of energy being created on Australian rooftops.

Increasingly, rooftop solar and batteries are being paired together in new installations (nearly 50% of new rooftop solar PV installs are accompanied by a battery, according to the Australian Energy Council). This is encouraging. However, while this uplift has made storage more affordable, residential batteries remain out of reach for most households due to cost — likely to remain the case for the foreseeable future without government intervention.

Utility-scale storage is critical to a successful transition

Utility-scale storage will be needed to “firm” Australia’s clean energy grid to stabilise a bigger and more complex energy network — which is already one of the biggest machines in the world — and ensure the lights stay on.

South Australia is the home of the world’s first “big battery,” the Hornsdale Big Battery. Since that was connected, large-scale batteries in Australia have been deployed faster than was expected.

Batteries provide a number of benefits to the system and overall transition, which are sometimes underestimated or not understood.

Utility-scale storage:

Provides “frequency” support which helps to stabilise the grid in real time

Supports the power system’s integrity and the network in case of exceptional events.

Allows “arbitrage” when intraday prices are volatile — with the increase in variable renewable generation in the system and the exit of coal, this will be a significant commercial incentive in Australia.

Provides inertia services as coal power plants phase out, to solve a network issue in the system.

Smooths the intermittency of renewables—firming is critical to a 100% renewable energy system.

What is needed

Australia’s economy remains dominated by fossil fuels, and our national emissions continue to rise. Clearly, there is plenty of work to be done to add more speed and ambition to Australia’s energy transition.

To roll-out transmission infrastructure at speed, we need to open up regulated monopoly markets to competition and investment (as the Victorian government has done) and we need to design the planning approvals process in line with energy generation capacity requirements identified by energy market operators.

The pilot phase of the Capacity Investment Scheme, announced by state and federal governments in December 2022, has seen Australia build more utility-scale storage (“big batteries”) built than ever before. But to meet the “gap” in dispatchable energy caused by forecast coal-fired power station closures, governments will need to ensure the next stage of the CIS delivers on its promise of 32GW of new variable renewable energy and storage by 2030. That could drive the need to legislate the scheme to ensure pollical endurance and investor certainty.

To drive decarbonisation at the household level, governments should look to expand the Small-scale Renewable Energy Scheme to include household batteries and legislate a national mechanism to provide investment. It also means prioritising tariff reform to ensure people are incentivised to build trust and allow for innovation in service delivery.

Australia already has smart solutions to meet new and improved energy targets. The science and economic cases have been made, and political will is beginning to align with 2030 climate targets. What’s left is finding the money, the ambition and the leadership to realise our potential and become a world-leading renewables-powered clean economy.

This is an extract of a feature article that originally appeared in Vol.37 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries. Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the nine-year back catalogue are included as part of a subscription to Energy-Storage.news Premium.

About the Author

Stephanie Bashir has over two decades of experience in the Australian energy sector with extensive experience in commercial, regulation, energy policy, government and stakeholder engagement. She is the founder and CEO of Nexa Advisory advising a broad range public and private clients including renewable energy developers, investors and climate impact philanthropists to help accelerate efforts towards a clean energy transition.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Continue reading