As confirmed on a LinkedIn post published by Geoff Eldridge, National Electricity Market (NEM) and energy transition observer at consultancy Global Power Energy, the BESS asset becomes the second bidirectional unit to be registered on the Market Management System.

The bidirectional unit can charge and discharge energy to support the grid and provide ancillary services, enhancing overall system flexibility.

Neoen’s project will cost in the region of AUS$337 million (US$227 million), with the Australian Renewable Energy Agency (ARENA) set to provide AUS$17 million in funding support. The organisation allocated the funding to implement an advanced inverter technology into the asset, to enable it to provide grid-balancing inertia.

By being registered, the asset will begin its testing phase as a bidirectional unit.

The wind farm at Goyder is part of Neoen’s hybrid renewable energy facility development. Called Goyder South Renewables Zone, it will eventually comprise 1200MW of wind power, 600MW of solar PV, and 900MW of battery energy storage.

Neoen subject to takeover bid from Canadian asset manager Brookfield

It is worth noting that the French independent power producer is set to be acquired by Canadian asset manager Brookfield, in a deal worth €6.1 billion (US$6.7 billion).

The closing of the deal will see Brookfield take a 53.12% majority stake in Neoen at €39.85 (US$42.6) per share from investors Impala and Fonds Stratégique de Participations, an investment vehicle owned by seven French insurance companies, amongst others.

Neoen announced negotiations with Brookfield in late May for a majority sale to the asset owner, along with its institutional partners Brookfield Renewables and Singapore-headquartered investor Temasek.

Once the acquisition has closed, Neoen said that it expects Brookfield to initiate an all-cash mandatory tender offer for all of the remaining shares and outstanding convertible bonds in the company.

Battery storage could meet Illinois resource adequacy need as fossil fuels retire, analysis finds

US$2 billion in regional transmission upgrades

The legislation requires the retirement of all Illinois coal-fired power plants, with the exception of Dallman Unit 4 and Prairie State Generating Station, by 2030 and all methane (natural) gas-fired plants to be retired or switched to burning green hydrogen by 2045.

The 2022 PJM report found that Illinois’s fossil-fuel phase-out would result in the state needing to import a “substantial amount of remote replacement power” to address the estimated loss in dispatchable power between 2030-2045 across Illinois in both PJM and MISO regions.

Calculations from PJM estimated the increase in electricity imports to cost an approximate US$700 million in transmission upgrades by 2030 and an additional US$1.3 billion by 2045.

Potential for extended fossil fuel plant operation

Despite PJM acknowledging that “new generation resources at the same points where units are retiring, or in similarly favourable locations, could decrease the transmission cost estimates,” it did not evaluate the impact of new energy storage resources within Illinois.

Conversely, PJM concluded it might “need to request that certain units operate beyond their desired deactivation dates”, referring to the continued operation of the state’s polluting fossil fuel plants, which the legislation was brought in to stop.

The recent NRDC report built on the 2022 PJM study by performing a resource adequacy assessment on the addition of BESS facilities at fossil-fuel plants set to be retired by 2030 in MISO Zone 4 and PJM’s ComEd service territory – referred to as the “Illinois Zone”.

In order to determine whether reusing interconnection capabilities of retired fossil-fuel plants would be a feasible strategy, the analysis carried out in the NRDC report limited new storage capacity to not exceed that of the retiring plants.

Resource adequacy simulation for four scenarios

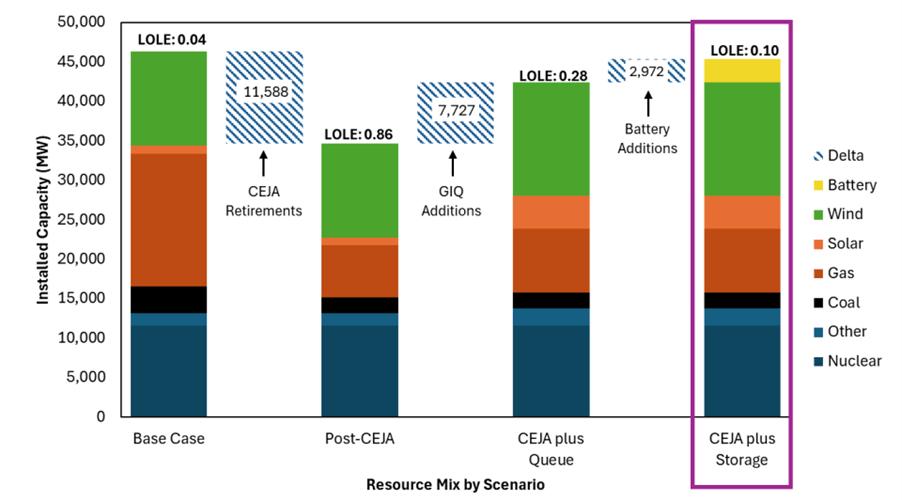

The recent report prepared for the NRDC simulated four resource adequacy scenarios for the Illinois Zone, with each of the cases building on the previous one. This was measured against an industry standard 0.1 loss of load expectation (LOLE) target – equating to electricity demand outstripping supply no more than one day across a 10-year period.

The four cases were as follows:

Base case: existing installed capacity in Illinois (as of March 2024).

Post-CEJA: Base Case minus fossil-fuel retirement capacity as mandated by CEJA by 2030 (estimated 11,588MW reduction).

CEJA plus queue: post-CEJA case plus expected additions from the Generator Interconnection Queue (GIQ) (estimated 7,727MW addition).

CEJA plus storage – CEJA plus queue plus required storage to meet LOLE target.

3GW of BESS to address shortfall

The analysis (displayed in the following graph below) found that although the Base Case exhibited a 4,971MW surplus, both Post-CEJA and CEJA plus queue scenarios presented shortfalls, at 5,065MW and 2,213MW, respectively.

In order to meet the 0.1 LOLE target in the CEJA plus storage scenario, the report concluded that 2,972MW worth of 4-hour duration batteries would be needed.

A graph displaying the results of the four scenarios prepared by Astrape Consulting for the NRDC. Source: Illinois Deactivations – Maintaining Reliability with Energy Storage report (page 4).

Astrape Consulting carried out a separate sensitivity study to determine the required capacity of 8-hour durations batteries to meet the LOLE target.

It concluded that a lower 2,243MW worth of batteries would be required, drawing attention to the importance of longer-duration storage systems, which the California Energy Commission (CEC) also highlighted in a recent study covered by Energy-Storage.news Premium.

Difference in study assumptions and metrics

Although the PJM and NRDC reports both utilised the same methodology for estimating GIQ additions, there was a very large discrepancy between the two figures – with the PJM report estimating 1,723MW of additional GIQ capacity, and the more recent report for the NRDC estimating a much larger 5,605MW.

Astrape Consulting addressed this difference within its recent report citing the use of more updated GIQ data. However, this discrepancy is still worth pointing out.

The NRDC report didn’t quantify the costs associated with the deployment of 3GW worth of BESS, which would likely be substantial, although it stated that this “could be an area of future development”.

It’s also worth noting that, unlike the PM study which looked all the way until 2045, the analysis carried out by Astrape Consulting only took place until 2030.

The full report with all of its findings can be found here.

Illinois ‘Coal to Solar Energy Storage’ grant programme

The Illinois Department of Commerce & Economic Opportunity has created several programmes since instating CEJA to assist in decarbonising its grid, including the “Coal to Solar Energy Storage” initiative which saw funding be issued to the developers of five energy storage projects located at the site of closing or soon to be closed coal-fired plants.

Fortune 500 company Vistra Energy was the recipient of three of these grants in 2022 that will see the developer receive US$40.7 million for each project over a ten-year period, covered in Energy-Storage.News.

The three projects, located at the site of the developer’s Edwards, Havana and Joppa generation stations, will each provide the MISO region within Illinois with 37MW of storage capacity, scheduled to come online next year.

Utility Alliant Energy seeks Wisconsin regulator’s approval for long-duration CO2 Battery storage project

The Energy Dome CO2 Battery is a set of gas compression and turbine equipment housed, as the company’s name suggests, inside a dome-like structure.

It stores energy based on the adiabatic compression of carbon dioxide, which is liquified during charging and evaporated as it discharges. Heat given off during compression is stored and used to expand the gas, driving turbines to generate power.

The Alliant Energy project, for which construction is planned to begin in 2026 and reach completion by the end of 2027, is being developed by a coalition of companies that include two other Wisconsin utilities along with oil and gas major Shell’s Shell Global Solutions US arm, the US Electric Power Research Institute (EPRI) and two academic institutions.

In September 2023, the Columbia Energy Storage Project was among 15 long-duration storage projects selected to each receive a share of US$325 million in funding from the US Department of Energy (DOE). This was part of the department’s Office of Clean Energy Demonstrations’ (OCED’s) efforts to progress significant cost reductions in LDES technologies with potential to scale.

‘Increasing energy security and strengthening the grid’

Energy Dome was founded by Italian inventor and entrepreneur Claudio Spadacini, who aimed to combine off-the-shelf technologies and processes from existing industries to create an LDES solution that can be easily scaled and cheaply manufactured and installed, as well as safe to use.

The company has one existing commercial demonstration plant in Sardinia, Italy. It is also building a 20MW/200MWh project on the southern Italian island, which it closed financing on in 2023.

Energy-Storage.news Premium subscribers can read our interview with Ben Potter, Energy Dome’s senior VP of strategy, corporate development and investor relations, from March this year.

Potter discussed the company’s various business models including its build, own and operate (BOO) development of projects and tolling agreements with offtakers, a year on from a more wide-ranging ESN Premium interview in 2023, in which he introduced the company and its technology, claiming that it can be cheaper than lithium-ion battery storage when scaled and replicated.

While the mention of CO2 as a medium might raise climate-conscious eyebrows, the CO2 Battery’s use of 2,000 metric tonnes of CO2 per 100MWh is a “low volume” of the gas, which can be easily dispersed, Potter said.

“Innovative systems like the Columbia Energy Storage Project are increasing energy security for our customers and strengthening our nation’s power grid,” Alliant Energy director of technical solutions and federal funding, Mike Bremel, said.

The utility is targeting a 50% reduction in greenhouse gas (GHG) emissions relative to 2005 levels by 2030, elimination of coal from its generation fleet by 2040 and achieving net-zero emissions from its utility operations by 2050 under its Clean Energy Vision plan.

“This is a pivotal moment in our transition toward more reliable, sustainable and cost-effective energy solutions,” Alliant Energy VP of strategy and customer solutions Raja Sundararajan said.

D. E. Shaw begins construction at 130MW solar, 260MWh storage facility in New Mexico

“DESRI is pleased to continue our investment in the energy transition in New Mexico with our fourth utility-scale renewable energy facility in the state, and to build on our long-standing relationship with EPE,” said Hy Martin, chief development officer of DESRI.

“In addition, the project will support the local community with economic development opportunities for years to come.”

The New Mexico Public Regulatory Commission (NMPRC) approved the project’s offtake contracts last year, clearing the path for DESRI to begin construction. US engineering company SOLV Energy will provide engineering, procurement and construction (EPC) services at the project, and oversee operations and maintenance work once the project begins commercial operation, and US investors Galehead Development and Lacuna Sustainable Investments were involved in the initial development of the Carne project.

The project is DESRI’s latest in the state, following its 200MW San Juan solar-plus-storage project, for which it completed financing last June, and the 28MW Alta Luna solar project, which started commercial operations in 2017.

The deal is also the latest move towards EPE’s expansion of its clean energy portfolio. EPE aims to add 280MW of new solar and storage capacity next year, alongside a further 50MW of capacity in a ‘business community solar’ programme. The utility plans for carbon-free energy to account for 80% of its total energy mix by next year, and to be fully decarbonised by 2045.

These targets are in line with New Mexico’s Renewable Portfolio Standards (RPS), which obligates investor-owned utilities to meet 80% of their electricity demand with renewable energy by 2040, and be fully decarbonised five years after that.

“The Carne facility is dedicated 100% to serving our New Mexico customers and will be a critical resource in enabling EPE to meet the needs of customer demand and requirements of New Mexico’s RPS goals,” said James Schichtl, vice president of regulatory operations and resource strategy at EPE.

“The battery storage component of the new facility will be the largest serving EPE customers and provide much needed capacity and reliability for our New Mexico customers.”

ESS Inc: ‘Transformative agreement’ with EXIM to support gigawatt-hour production line

It recorded an EBITDA loss of US$18.8 million and revenues of just US$348,000 for the second quarter of 2024, ending the quarter as of 30 June with US$74.4 million in cash and equivalents.

ESS Inc. CEO Eric Dresselhuys said that delays by a key partner had resulted in lower-than-expected revenues, which are expected to “resolve in the coming weeks,” while the company’s plan to move into “volume manufacturing and shipments remains solidly on track”.

Share prices were at US$0.56 per share yesterday after ESS Inc. listed them on the New York Stock Exchange (NYSE) at US$10.00 in December 2020.

They hit a brief high of US$18.75 in November before falling. ESS Inc. received a listing notice from the Securities and Exchange Commission (SEC) in March, and on 8 August, the company filed a definitive proxy statement with the SEC to execute a reverse split, which, once effected following a special shareholder meeting next week would put the flow battery company back into compliance.

ESS Inc. CFO: EXIM loan ‘should support cash needs well into 2025’

Despite these challenges, in presentations and an earnings call with leadership, the company emphasised the demand it expects to see both in the US and internationally for long-duration energy storage (LDES) technologies of the type it produces.

It also highlighted various project and technology development milestones, including a 25% increase in energy density resulting from improved electrolyte chemistry, cutting the commissioning time for its Energy Warehouse product in half and a near-60% reduction in costs for the Energy Warehouse’s production.

ESS Inc. also put emphasis on the fact that its batteries and storage systems can be produced domestically in the US, which is why it has been able to enter negotiations with the Export-Import Bank of the United States (EXIM) for up to US$50 million in funding.

The EXIM deal, disbursed under the state institution’s Make in America Initiative, is a “transformative agreement,” CFO Tony Rabb said.

While it is still in negotiation with EXIM, ESS Inc. expects to draw down US$10 million from that low-interest loan this year, helping the company to “fully fund” current and future capacity expansion.

“We’re extremely well positioned to continue to expand our production capacity through this EXIM financing facility, effectively funding all of our production capacity CapEx needs through 2025 and into 2026,” Rabb said.

“This transformative agreement bolsters our liquidity levels, and we expect should support our business cash needs well into 2025.”

Dresselhuys noted that the plan going into 2024 had been to “moderate” product builds and shipments during the first half of the year, before scaling in the second half once cost reduction had been implemented.

Rabb added that another 40% reduction in the cost of Energy Warehouse production—ESS Inc.’s commercial and industrial (C&I) product—is expected to be achieved during 2024.

Recently published research from the US Department of Energy’s Office of Electricity found that flow batteries are among the LDES technologies, defined as providing 10-hours or more storage duration, with the greatest cost reduction potential through 2030.

Meanwhile, the first unit delivered of the utility-scale Energy Center flow battery system is already cycling at the site of Oregon utility Portland General Electric (PGE), and a second unit is being built for delivery to the customer.

ESS Inc. hopes to make ‘live announcements’ from Honeywell partnership in coming months

Other recent highlights included the start of commercial operation of ESS Inc.’s first overseas project, at Schiphol Airport in the Netherlands, thought to be the first flow battery deployed at an airport.

There was also the award of a US$10 million California Energy Commission (CEC) grant for an ongoing collaboration with California utility Sacramento Municipal Utility District (SMUD) and the selection of ESS Inc. flow battery tech for another CEC-supported project for a microgrid with Native American-owned developer and system integrator Indian Energy. Another California project for community energy supplier Burbank Water & Power was inaugurated in June, with 75kW output and 500kWh capacity.

Meanwhile, the initial engineering contract has been completed for another overseas project for the German utility LEAG. That project, at which the lignite-burning European utility is procuring a 50MW/500MWh (10-hour) flow battery system as part of an energy transition strategy to deploy 2-3GWh of LDES, has a targeted COD in 2026 and is now moving into the detailed engineering phase.

In response to a question from analyst Davis Sunderland, equity research associate at Baird around progress on a partnership with US automation technology provider Honeywell, CEO Dresselhuys said that Honeywell CEO Vimal Kapur had recently visited ESS Inc.’s premises in Wilsonville, Oregon.

“Honeywell certainly has a great appreciation, as we do, for the market environment and the mandate to get down the cost curve as fast as possible. So we’re at the stage now where the go-to-market teams have been organised,” Dresselhuys said.

“We’re putting proposals out to people and our hope would be that we’ll be able to translate that into live announcements with people here over the coming months.”

Dresselhuys spoke with Energy-Storage.news Premium at last year’s RE+ trade event in the US, discussing the potential for LDES technologies, the iron flow battery’s perceived advantages over lithium-ion and other flow battery technologies, as well as offering insights into specific projects and deals.

Conference call transcript by Seeking Alpha.

PNNL opens US DOE energy storage research facility, long-duration LCOS analysis published

Grid Storage Launchpad (GSL) will test, validate, and accelerate new battery materials for stationary energy storage and transport applications in configurations of up to 100kW in 35 laboratories designed to resemble realistic conditions. PNNL said in an announcement last week (13 August) that GSL will be ‘uniquely equipped’ for this type of work.

Construction began in April 2022, as reported by Energy-Storage.news, and its cost was cited at US$75 million at the time.

The bulk of the funding came from the DOE’s Office of Electricity in collaboration with the Office of Science. The Clean Energy Fund (CEF) of Washington State contributed US$8.3 million.

DOE funding was committed through the FY 2021 Energy and Water Development Funding Bill, approved by the US House Committee on Appropriations in summer 2020. GSL’s work to accelerate energy storage development was considered a “national priority”, alongside US$500 million support for energy storage manufacturing and US$770.5 million in grants to US-based manufacturers of advanced batteries and components.

PNNL director Steve Ashby said the new R&D centre will “house some of the world’s most accomplished scientists and engineers from PNNL, other national labs, academia, and industry—working together to develop real-world solutions that will benefit our nation and the world”.

Flow batteries, pumped hydro among technologies that could unlock ‘promise of long-duration storage’

GSL’s opening comes a couple of weeks after the Office of Electricity (OE) published a report, ‘Achieving the promise of low-cost long-duration energy storage’, which the office said charted a path towards understanding the investments and time required in that endeavour.

Part of the DOE’s Energy Earthshots programme to advance R&D and commercialisation of sustainability technologies, the report is a synthesis and amplification of a 2023 technology strategy assessment for achieving a US$0.05/kWh cost of long-duration energy storage (LDES).

“This report is one example of OE’s pioneering R&D work to advance the next generation of energy storage technologies to prepare our nation’s grid for future demands,” OE assistant secretary Gene Rodriguez wrote in the report’s foreword.

Defined as technologies capable of storing and discharging energy over 10+ hours, the DOE has targeted a cost reduction in LDES of 90% from 2021 to 2030, recognising current high prices as a major barrier to widespread deployment.

The full report (PDF) describes 10 different technologies across electrochemical (e.g. flow batteries, sodium-ion, lithium-ion, zinc, supercapacitors), chemical (hydrogen), mechanical (pumped hydro and compressed air) and thermal energy storage categories.

The OE found that flow batteries and the two mechanical storage technologies could achieve the Earthshot’s US$0.05/kWh levelised cost of storage (LCOS) goal by the end of the decade.

Meanwhile, lithium-ion (Li-ion), lead-acid and zinc batteries will have an LCOS of less than US$0.10/kWh as the target date approaches, sodium-ion (Na-ion), lead-acid and zinc batteries could hold the greatest cost reduction potential (falling by US$0.31/kWh to 2030) and pumped hydro energy storage (PHES), supercapacitors (supercaps) and flow batteries will see the next biggest LCOS drops of about US$0.11/kWh.

That said, results vary greatly and the OE said additional analysis and research may be useful given the relative lack of industry data available.

For example, the average investment required to facilitate achievable cost reductions of 12% to 85% across the top 10% of innovation portfolios ranged from US$86 million to US$1,063 million and could take between five and 11-and-a-half years, the report said.

In a separate project to GSL, Pacific Northwest National Laboratory is installing a vanadium redox flow battery (VRFB) system from Anglo-American manufacturer Invinity Energy Systems with a 24-hour discharge duration. As reported by Energy-Storage.news in November 2023, the 525kW/12,600kWh VRFB is being installed at PNNL’s Richland Campus in Washington State.

Iron-air ‘multi-day’ energy storage startup Form Energy breaks ground on first pilot project

The two companies said last week (15 August) that groundbreaking has taken place on the Cambridge Energy Storage Project, set to go into operation in late 2025.

Great River Energy, a non-profit cooperative, will evaluate the iron-air battery system’s operation over ‘several years’—the exact length of the assessment was not specified in last week’s announcement.

While it has since been joined by a number of other pilot deployments announced by Form Energy, the Minnesota project was the first the tech company revealed back in mid-2020 as it emerged from stealth mode and before it even disclosed the battery chemistry a few months later.

‘Renewables as baseload’

The company’s CEO, Matteo Jaramillo, spoke with Energy-Storage.news for interviews as Form emerged from stealth mode, claiming that the battery could complement the roles of lithium-ion (Li-ion) and other technologies like flow batteries and pumped hydro, enabling renewable energy to serve as ‘baseload’ for the grid.

This is due not only to its capability of providing several days’ worth of storage, but also the abundant materials used in its production, which Form claim enable low cost of production.

The project with Great River Energy will be a 1.5MW system with 100-hour duration (1500MWh). That’s somewhat revised from the originally announced sizing, of 1MW to 150-hour duration, albeit with the same megawatt-hour capacity.

Other projects in the works for the iron-air battery include a system of 8.5MW/8,500MWh, to be built in Maine, US, supported by federal Department of Energy funding and announced earlier this month.

That project will receive a share of DOE funding for reinforcing and upgrading transmission networks across the US. It is part of Power Up New England, a transmission project across the states that comprise the region, aimed at increasing the New England ISO’s capacity for integrating renewables, with 4.5GW of new wind energy earmarked for deployment.

Others in the works from Form Energy include pilots with utilities Xcel Energy, also in Minnesota, Georgia Power in the southern state of the same name and Puget Sound Energy in Washington, as well as Pacific Gas & Electric (PG&E) in California.

The startup is currently building its first factory in West Virginia, where the company said the iron-air system for the Great River Energy pilot will be manufactured soon. Minnesota-headquartered construction group Mortenson has been appointed for engineering, procurement and construction (EPC) duties.

“We hope this pilot project will help us lead the way towards multi-day storage and potential expansion in the future,” Great River Energy general manager Cole Funseth said.

Acen Australia secures IPC approval for 1.2GWh solar-plus-storage project in New South Wales

The system will also provide grid stability services and backup capacity to ensure the security of supply.

This approval also marks the first generation and storage project approved for connection to the Central-West Orana Renewable Energy Zone (REZ) transmission network. The REZ recently transitioned into the delivery phase, as reported by PV Tech last month.

According to planning documents, the project will feature around 1.2 to 1.4 million solar PV modules alongside associated mounting infrastructure up to 4.7m in height. An on-site substation with a connection voltage of up to 500kV will also be created.

Construction is anticipated to begin in late 2026 – early 2027 for six months, and it will have an expected operational lifespan of 30 years. However, the project may include infrastructure upgrades that could prolong its longevity.

It is worth noting that the Birriwa solar-plus-storage project will be located next to two other solar projects developed by Acen Australia. These are the 400MW Stubbo solar PV project, at which construction began in November 2022, and the 320MW Narragamba solar project. These projects will connect to new transmission infrastructure developed by the Energy Corporation of NSW (EnergyCo) as part of the Central-West Orana REZ.

With secured approval, Acen Australia said it will turn its attention to preparing for construction, including developing temporary workers’ accommodation, implementing its strategy to employ local staff where possible, and sourcing goods and services from local businesses.

Acen Australia submitted assessment documents for the Birriwa solar-plus-storage through the Federal government’s Environment Protection and Biodiversity Conservation Act (EPBC), last week (12 August).

Construction starts of New England Solar BESS switchyard

Acen Australia also confirmed yesterday (18 August) that construction of a 200MW/400MWh BESS at the site of its proposed 720MW New England Solar project in New South Wales, is one step closer, with work set to commence expanding the Uralla site’s Transgrid switchyard.

The project consists of two stages. The first 400MW stage, comprising about one million solar modules, has been generating clean electricity since 2023. A second stage will then add an additional 320MW of generation capacity alongside the BESS.

Acen Australia project director Sarah Donnan said: “These initial infrastructure works, to expand the switchyard, are an exciting step in the delivery of what is set to be the first large-scale BESS in New England.”

Ormat signs seven-year tolls for two ERCOT BESS projects

Both projects are expected to come online in Q4 2025 and are the first for which Ormat has secured tolling deals in the ERCOT market. The firm said the deals allowed it to proceed with the construction of a third project, the 100MW/200MWh Louisa project.

Tolls are a type of deal where a company, in this case Equilibrium, pays an asset owner, in this case Ormat, a fixed fee to rent and trade the BESS in the energy market.

Doron Blachar, CEO of of Ormat Technologies, said: “By securing fixed, long-term revenues, we have de-risked approximately 50% of our strategically expanded Texas storage portfolio, aligning with our long-term plan to improve segment profitability and accelerate our growth.”

The firm also recently signed a resource adequacy (RA) agreement for a BESS in California, which is akin to a toll in that it is a long-term, guaranteed source of revenues. Such long-term agreements are less common in ERCOT, however.

Tolls are growing in popularity in the energy storage market, long-used in US and Australia but beginning to emerge in the UK too, with recent deals from asset owners BW ESS and Gresham House.

Sodium-ion push accelerates as China and US announce gigawatt-hour production facilities

California-headquartered Natron Energy will build a sodium-ion gigafactory facility in Edgecombe County, North Carolina, with an eventual production capacity of 24GWh, it said yesterday (15 August).

The company didn’t give any firm timelines for commercial operation or ramp-up of the facility, only saying it is a 12-year project. The US$1.4 billion investment will be its second major production facility after a the launch of commercial operations earlier this year at a 600MWh factory in Michigan.

Its capacity will primarily go to the ESS market, with Natron saying it will meet demand for “critical power, industrial and grid energy storage solutions”.

The North Carolina facility is supported by a Job Development Investment Grant (JDIG), approved by the state’s Economic Investment Committee earlier today, and the project will also apply for a US$30 million grant from the North Carolina Megasite Readiness Program.

Furthermore, Natron Energy should be able to benefit from 45x tax credits for US domestic battery production under the Inflation Reduction Act (IRA), which pay out US$35 per kWh of battery cell capacity produced and another US$10 per kWh of modules. The firm said its product is the only UL-certified sodium-ion battery in the market today.

Proponents say that sodium-ion technology promises low cost, long lifespan, high safety, and high energy density although critics say it still faces many challenges in scaling up cost-effectively.

China: sodium-ion plans much further ahead

China, meanwhile, is much further ahead in its push towards production of the battery technology, with much nearer-term projects progressed by two companies recently.

Zhejiang Hu Na Energy recently officially registered and coded its operational annual production of 4GWh of sodium-ion battery cells and modules, along with 1.5GWh of lithium-ion battery modules, at its facility in Nanhu, Jiaxing, Zhejiang Province.

The overall facility is planned to reach 20GWh of sodium-ion production capacity, the company said when launching the project in November last year. The investment in the first 4GWh phase totalled CNY1.125 billion (US$157 million), around three quarters of which was accounted for by equipment costs.

A bulletin detailing the first phase ramp-up was published as a bulletin on the District Natural Resources Planning Bureau website.

In concurrent news, a company called Harbin Bona New Energy is to start building a 2GWh sodium-ion battery production facility at the end of this month, according to Shanghai Metals Market (SMM). The project is in the city of Harbin, Heilongjiang Province.

The facility will produce square sodium-ion cells as well as related energy storage system integration.