On top of carbon emissions, diesel generators in California’s South Coast and Bay Area communities alone emit an annual 20 tons of fine particulate matter, 62 tons of volatile organic compounds (VOCs), and nearly a thousand tons of nitrogen oxide, the single most significant ozone-depleting emission.

Exposure to diesel exhaust has been linked to lung cancer and is classified as carcinogenic to humans by the World Health Organization.

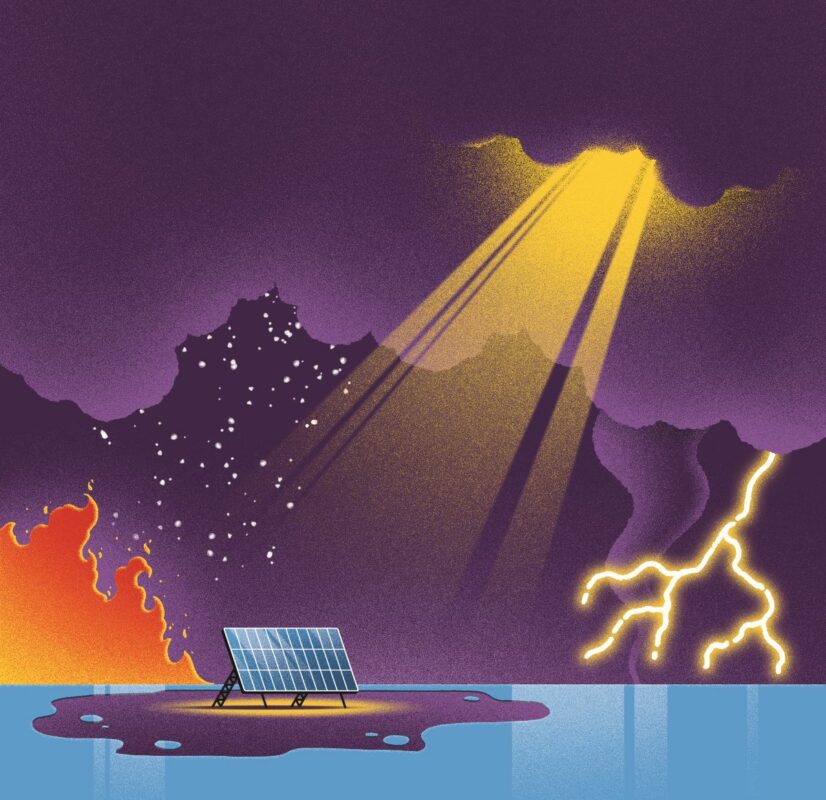

As a result, industry and regulatory pressure has mounted for cleaner temporary electricity alternatives that address the shortcomings of diesel generators and protect the planet. Net-zero targets have been set by more than 140 countries and the private sector is following suit. More than 9,000 companies have pledged to halve global emissions by 2030.

Fortunately, an innovative, cleaner solution is gaining traction to replace dirty generators: mobile battery energy storage systems (mobile BESS).

Mobile BESS products provide mobile, temporary electricity wherever and whenever it’s needed. By storing low-cost off-peak grid power and dispatching it onsite as needed, mobile storage provides operators with emissions and noise-free electricity – often for days or weeks without having to recharge.

Mobile BESS products can also charge from local microgrids powered by renewable energy sources like solar panels and wind turbines. Some providers also offer a “battery swap”, where they will replace an empty mobile BESS with a fully charged unit to take the charging burden away from the customer.

For certain applications, where swapping or recharging is difficult, hybrid operation with a generator is an option. This method can still deliver 50-80% fuel savings and emissions reductions, while providing a learning period for customers to get accustomed to the new technology. From remote construction sites to disaster response hubs, mobile BESS products are delivering reliable, affordable power everywhere generators can.

And the world is listening. In 2023, one of Time Magazine’s Best Inventions was a mobile battery system.

Compared to diesel generators, the benefits of mobile batteries are clear. Diesel generators emit carbon dioxide, harmful particulate matter, volatile organic compounds, nitrogen oxides, and other pollutants. In contrast, mobile batteries produce no exhaust fumes, improving local air quality and worker health. Unlike loud diesel generators, mobile battery storage systems operate virtually silently. By eliminating disruptive noise, batteries facilitate clearer communication between workers on construction job sites or disaster relief efforts, better experiences at live events and more productive environments for film production.

Replacing fossil-fuel-burning generators with zero-emission battery storage also reduces projects’ carbon footprints. This helps companies follow emissions regulations, achieve their decarbonisation goals, and align with global efforts to reach net zero emissions. Operators can also avoid costly diesel fuel markups since mobile batteries charge from cheap off-peak grid or microgrid power.

Generators need to idle to be ready to dispatch electricity. This constant operation wastes energy, fuel and money. On the other hand, mobile batteries simply wait on standby and provide immediate power when it’s needed.

As demand surges for cleaner temporary power, this definitive guide provides an overview of how battery systems are transforming access to sustainable off-grid energy.

The basics of mobile battery storage

Mobile battery systems typically use lithium iron phosphate (LFP) chemistry. They plug into grid or microgrid connections for charging when available, then disconnect for dispatch onsite. This allows them to provide emission-free electricity anywhere, anytime, without relying on continuous generator operation and diesel delivery. Some batteries can be even charged using standard EV charging infrastructure.

Mobile BESS come in all shapes and sizes. For example, Moxion Power houses battery hardware in rigorously engineered shells mounted on all-terrain trailers. The units can be towed by a standard truck over vast distances, then manoeuvred into place on-site. They withstand challenging on- and off-road conditions such as construction sites and rough dirt roads. Other mobile BESS are built into standard shipping containers for easy transport. Mobile storage systems range in capacity from 200 kilowatt-hours (kWh) to over 1,000kWh. To put those figures into perspective, there is enough energy in the 530kWh Moxion MP-75/600 to power a Tesla Model 3 for over 2,200 miles.

By providing silent, affordable, grid-charged power, mobile storage solutions are transforming industries that rely on diesel for off-grid energy.

During recent construction at a Moxion facility, mobile BESS powered a concrete grinding crew’s battery-powered tools for one week on a single charge—far exceeding typical runtimes expected of batteries. Mobile batteries also helped power the 2023 PGA Tour Championship, providing reliable electricity for the hospitality tent and scoreboard for the tournament’s four days of competition. And when supporting an electric excavator pilot, portable batteries enabled the machine to operate eight hours daily with overnight charging. These examples show that mobile storage runtimes pack enough on-demand power for even the most enduring loads.

Where mobile batteries are helping cut fuel costs, pollution and noise

Mobile BESS are already deploying across a range of industries. One of the key features that distinguishes batteries from diesel generators is that some providers offer a fully programmable power supply which can be customised to the customers’ needs. For example, some mobile BESS can output any voltage, frequency, phase, AC, or DC out of a single unit. This versatility makes mobile BESS an attractive choice across any industry that needs temporary power.

Construction

Since global building and construction account for nearly 40% of carbon emissions, construction firms are facing rising regulations and project emissions reporting requirements. External pressures such as the proposed European Green New Deal, the revised Construction Products Regulation, and new green building codes across the US are pressuring them to reduce their carbon footprint, along with their customers who have their own ambitious ESG goals. This growing focus on net-zero targets has led the industry to seek cleaner options, including a shift to electric equipment.

While replacing gas-powered construction machinery with electric alternatives does help to reduce emissions, relying on diesel-fueled generators to charge these electric machines offsets some of the environmental gains. In contrast, mobile batteries operate emissions-free and almost silently, allowing convenient indoor operation (unlike generators) and easier on-site communication. Batteries also provide clean, silent temporary power for job site trailers, lighting and tools. They can even integrate with renewables like solar to create self-sufficient off-grid microgrids at remote sites. As portable batteries begin to replace diesel generators, construction companies can unlock the full sustainability benefits of electric equipment and decarbonise more effectively.

Live events

Music festivals require temporary, mobile power setups, making them a suitable use case for mobile battery storage. Image: Rawpixel.

Music festivals have a less glamorous side: they are often powered by diesel generators that create significant emissions. In 2022, music festivals in Switzerland alone emitted 128,000 tons of carbon dioxide, the equivalent of powering over 16,000 households for a year. Larger festivals’ emissions are staggering.

Mobile storage batteries provide an emissions-free alternative to support events’ dynamic energy needs. The virtually silent mobile BESS enhance guests’ experiences far more than noisy generators. They’ve already reliably handled fluctuating loads like stages, lighting, LED walls, and sound systems for days, and can be operated indoors.

For example, at Austin City Limits, mobile batteries smoothly powered an art exhibit for two weekends and a hospitality tent for 12 hours daily. While two units were deployed for the art market, post-event analysis showed that just a single unit could have powered the entire area, saving almost 1,200 gallons of diesel fuel and avoiding 27,600 pounds of CO2 emissions. For the hospitality tent, almost 870 gallons of diesel and 1,900 pounds of CO2 emissions were avoided.

Film sets

Mobile storage offers a reliable, eco-friendly solution to replace noisy, disruptive diesel generators on film sets. Batteries can quietly power basecamps, lighting, catering, hair and makeup trailers and device charging. Their runtime can last for multi-day shoots, and they can easily adjust output to handle shifting energy needs.

In fact, Amazon Studios recently adopted Moxion’s modular battery systems on the sets of Candy Cane Lane, a holiday special starring Eddie Murphy, Sitting in Bars with Cake, a rom-com featuring Yara Shahidi and Bette Midler, as well as the Freevee series Bosch: Legacy. The batteries reduced noise, enabled indoor operation without exhaust fumes, required no warm-up or cool-down time, and provided smoother, lower-maintenance operations compared to diesel generators.

Crew member connects in a Moxion Power mobile BESS on an Amazon Studios film set. Image: Moxion.

The virtual silence of the battery systems is a game-changer for the film industry, where even minor background noise can disrupt shoots. By eliminating the constant rumble of diesel generators, mobile BESS are a perfect match for the silver screen.

EV fleet charging

As EV adoption accelerates, growing demand is outpacing available charging infrastructure. To fill in this gap, mobile storage batteries offer interim charging while permanent stations are built.

Mobile batteries can charge at sites with grid access, then disconnect to provide off-grid power for EV fleets at remote locations. This flexible deployment model allows the batteries to be quickly set up for temporary charging when needed, and later relocated as charging demands shift. By avoiding the high fixed costs of extensive permanent charging infrastructure, mobile battery storage enables cost-effective interim EV charging solutions.

Adding mobile battery capacity also allows buffering grid demand from high-power DC fast charging. By shaving peak loads, mobile storage increases charging access without costly grid upgrades.

Finally, mobile BESS provides resiliency. If the power goes out entirely, fleet operators are still able to operate their fleet moving.

Utilities

Much like EV chargers, mobile batteries can also serve as bridge infrastructure for utilities. There’s often a multi-year lag between a customer requesting an upgraded utility connection, and the project’s completion. In the interim, mobile battery storage can be deployed on the same day to boost the customer’s connection.

This flexible capacity allows utilities to earn revenue sooner from upgraded connections, rather than waiting years to recoup costs. By rapidly deploying mobile storage as needed, utilities can meet demand growth quickly while major grid upgrades progress.

Disaster response

While diesel generators are the standard for providing temporary power in disaster areas, they require continuously transported fuel that can be difficult to obtain. Islands, mountainous regions, and other remote areas often struggle to transport diesel when they undergo hurricanes, wildfires, and other natural disasters.

Mobile batteries offer a more resilient solution that avoids fuel logistics issues. The batteries can charge in two ways, depending on what works best in a specific situation. They can charge where grid power is available, then transport to disaster sites, or connect to locally generated power like wind or solar to form an independent microgrid.

Rather than trying to continually ship diesel to inaccessible areas, mobile batteries paired with renewables can provide self-sufficient emergency power without ongoing fuel needs. With mobile storage pre-positioned nearby, communities can restore power faster after disasters – without depending on difficult or delayed diesel delivery.

The economics of mobile BESS

Until recently, diesel generators were the only option for off-grid temporary power. Customers are now used to paying high fuel costs without thinking twice. Even now, many diesel generator users don’t realise their true fuel costs due to convoluted supply chains. For instance, construction sites hire contractors, who rent generators and pass through marked-up diesel bills. Each middleman can take up to a 25% cut, often resulting in US$7-10 per gallon diesel.

As a result, just the diesel to run generators can cost an astronomical 50 to 75 cents per kWh in optimal scenarios – and even more factoring in inevitable idling, underuse, spills and leaks for generators that need to operate on short notice. Regulations and practices often mandate running generators even when little power is used.

For instance, OSHA requires dedicated generators for elevators and man lifts. Since these must be ready for immediate use at any time, they’re forced to idle constantly. Similarly, generators must run overnight in job trailers just to maintain minor loads – even as little as a sandwich in the fridge. In contrast, mobile storage only discharges energy on demand, and can do so instantly; they don’t need to idle at all. This can dramatically lower energy costs, especially combined with their ability to charge off-peak at 10-15 cents per kWh.

Beyond fuel savings, mobile storage batteries require much lower maintenance than diesel generators. So, in total lifecycle costs, mobile batteries multiply savings through greater reliability, efficiency and performance.

Mobile battery storage’s addressable market

Mobile battery storage solutions are starting to gain traction and have immense potential to replace diesel generators for off-grid power needs. Recent projections estimated the global temporary power market at $12 billion in 2021, growing to over US$20 billion by 2028—a compound annual growth rate of nearly 8%. Even when narrowed to just the addressable market in the US, the opportunity is substantial.

Currently, there are over 500,000 diesel generators already deployed in the US. Each unit represents a chance to reduce emissions through mobile battery storage. On a global scale, the total addressable market is even larger as mobile storage solutions enter new regions worldwide. As this technology advances, mobile battery storage is poised for significant near-term growth in the race to provide clean, quiet power anywhere.

What the future holds for mobile battery technology

Current mobile BESS technology is ready today for cost-effective, at-scale adoption. Those who adopt it can drive sustainability gains now, without waiting years for possible technology advances.

Currently, most mobile storage relies on lithium-ion batteries, which see incremental density improvements of a few percentage points annually. No dramatic leap is on the immediate horizon; the closest option with the potential for a major jump in density is solid-state battery technology, which remains around a decade away from viable commercialisation. For now, today’s models are already highly optimised for commercial use and, in the long term, cost-competitive with diesel generators.

Looking ahead, mobile storage systems will increasingly integrate with diverse power generation sources including solar, wind, hydropower and other batteries. The industry’s goal is to eventually achieve fully integrated systems capable of linking to any asset, storing its energy, and dispatching it on demand.

Another innovation currently on the horizon, intelligent software platforms, will enable sophisticated remote control, upgrades and optimisation. Similar to Tesla’s over-the-air EV updates, mobile storage can also benefit from centralised software that improves performance and flexibility.

The electric shift transforming the vehicle industry has now reached the mobile power industry. Today’s mobile storage options make complete electrification achievable and cost-competitive. Just like electric vehicles, mobile storage is driving the transition beyond diesel dependence and toward emissions-free, grid-connected sustainability.

About the author

Alex Smith is the co-founder and CTO of Moxion Power, where he leads product development. Prior to Moxion, Alex led advanced battery development at NIO and launched several automotive programmes at LG Chem, including the Ram 1500 eTorque battery. Smith holds a master’s in mechanical engineering from Kettering University. He started his career in 2005 working on heavy-duty hybrid vehicles at ISE Corporation.

Continue reading