Despite new records being set in consecutive quarters, the tally could have been much higher. The research firm warned that 82% of grid-scale projects expected to be completed in the period ending September were delayed to later dates.

Wood Mackenzie has also lowered its deployment forecast through 2027 by 5%, with lead analyst Vanessa Witte noting that “multiple headwinds” emerged during 2023 which have dampened expectations in an otherwise booming industry.

Those headwinds have resulted in a “volatile” near-time pipeline as well as “difficulty in bringing projects to mechanical completion”.

“Grid-scale declines were more focused on challenges not only with supply and permitting, but also with the backlog of applications in most ISOs interconnection queues that are preventing projects to move through the development process,” Witte said.

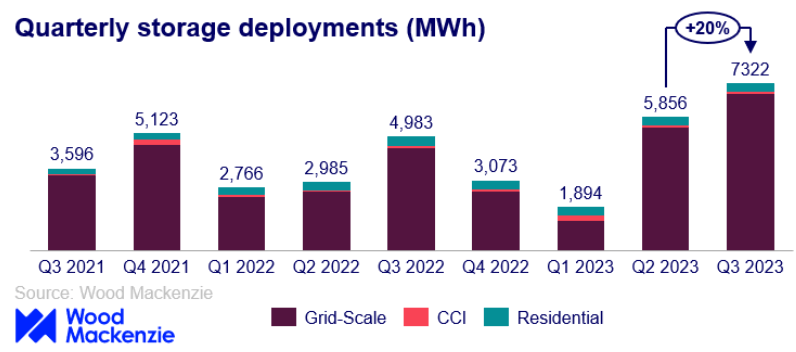

It was a similar story in this year’s second quarter, which with 1,680MW/5,597MWh of deployments across all segments including 1,510MW/5,109MWh of grid-scale, held the title for biggest on record for an extremely short time. Wood Mackenzie said then that 1.7GW of front-of-the-meter (FTM) projects scheduled for completion in Q2 had been pushed back to later dates and 308MW cancelled entirely with supply chains, permitting and lengthy or uncertain waits for interconnection typically to blame.

Back then, Wood Mackenzie had said it expected to see 67GW of installations across all scales between 2023 and 2027, 55GW of which would be grid-scale. That has now been revised down to an approximate 63GW of installs.

Still, despite these challenging dynamics, the firm said 2023 and 2024 will be huge growth years for the grid-scale segment, and there have already been more installs in the first three quarters of 2023 (4,225MW) than the entirety of last year (3,966MW).

Texas, California level on megawatts but not megawatt-hours

The two leading US grid-scale markets by state continue to be Texas and California. In Q3, the pair were almost neck-and-neck for deployments in megawatt terms, with California on 694MW and Texas on 758MW.

However, due to the emphasis in California’s CAISO market being increasingly on 4-hour duration assets and Texas’ ERCOT market still seeing durations at around 2-hour, California was well ahead in megawatt-hour terms with 2,722MWh deployed in Q3 to 1,506MWh in Texas.

In fact, for the entire US, Wood Mackenzie found average grid-scale battery energy storage system (BESS) duration installed in the quarter to be 3.1-hours – projects outside of Texas averaged out at 3.8-hour, while projects within Texas’ average duration was 1.9-hour.

Material costs decline

As with recent reporting from rival S&P Global Commodity Insights, Wood Mackenzie noted that lithium battery raw materials costs have declined again in 2023, after 2022 saw the first reversal in the trend of falling prices in around a decade.

Both S&P and Wood Mackenzie said lithium carbonate prices have fallen to their lowest since 2021. Wood Mackenzie said this has contributed to a 23% quarter-on-quarter decline in the median cost of grid-scale battery storage systems.

Recent market analysis from BloombergNEF found that battery pack prices (including the electric vehicle and stationary BESS markets) fell 14% from 2022 to 2023, reaching an average of US$139/kWh, a record low.

However that good news is tempered with findings that balance of plant (BOP) and engineering, procurement and construction (EPC) costs are rising, partly due to high demand for labour and the need to meet requirements on wages and apprenticeship numbers. Various sources Energy-Storage.news has spoken with have remarked additionally that while getting hold of battery cells and packs is not as challenging in 2023 as it was in the past couple of years, it is now long lead-time equipment, particularly transformers, that are becoming scarce.

California’s grid-scale, residential lead to extend to CCI segment

The third quarter saw 166.7MW/381.4MWh of residential segment deployments and just 30.3MW/92.9MWh of community, commercial and industrial (CCI) energy storage.

For residential, this was a rebound from a quiet Q2, while the level of CCI deployments is broadly in line with what Wood Mackenzie typically expects to see in a segment which enjoys very few if any state-level policy incentives.

California dominates the residential segment by far, with 78.4MW of installs, versus 88.31MW across all other US states. The state is expected to open a community solar-plus-storage programme next year, which will likely make it a leader in the CCI segment too, with the scheme predicted by Wood Mackenzie to result in a doubling of CCI deployments across the US for the year.

Energy-Storage.news’ publisher Solar Media will host the 6th Energy Storage Summit USA, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Continue reading