Lithium carbonate mainly comes from Australia, South America and China, while the vast majority of lithium carbonate refining is done in China.

Nickel and Cobalt, other principal metals needed or lithium-ion nickel-manganese-cobalt (NMC) cells, also jumped in 2022 but have since come down.

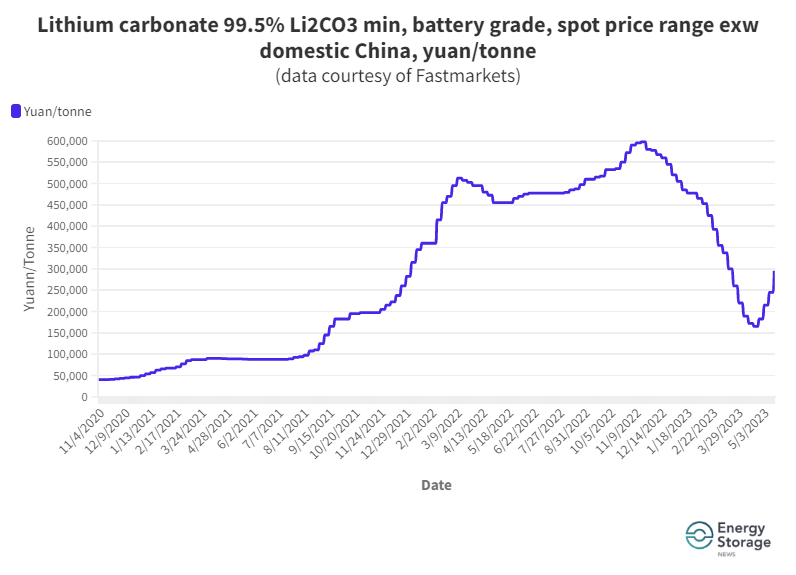

Lithium carbonate prices declined over the start of 2023 to a low in April before picking back up again. Jordan Roberts, Battery Raw Materials Analyst for Fastmarkets, said that the lithium carbonate price would remain elevated over 2023 but not reach the highs of 2022.

“We also have to consider the fact that supply always disappoints to the downside and we can probably expect delays to those new units expected to come online and ramp up during the remainder of the year,” Roberts said in the firm’s BRM Global Outlook webinar on Tuesday (23 May).

“We expect more sensible buyer behaviour and an evolution in contract contracting prices towards referencing spot indices to keep prices from averaging such highs as as in 2022.”

He concluded that long-term average annual prices will continue to move downwards over time. The sharp falls seen in late 2022/23 were due to a combination of new supplies flooding the market, destocking dynamics, lower downstream demand and overall bearish demand.

Muthu Krishna, battery manufacturing cost modeller, talked about the effect of the long-term decline in costs further downstream on the prices EV and energy storage firms will pay for battery packs, both NMC and LFP (lithium iron phosphate).

NMC, or specifically NMC811, would hit US$68/kWh at the cell level by 2029 at which point LFP cells could cost US$65/kWh.

At the pack level, NMC could go under US$100/kWh by 2027 while LFP could achieve the same figure in 2025. Both figures are globally weighted average prices, so will be achieved sooner in China where costs are lower.

However, expected supply shortages post-2029 mean prices could start to pick back up around the end of the decade, Krishna added.