In BloombergNEF’s 2H 2023 Energy Storage Market Outlook report, the firm forecasts that global cumulative capacity will reach 1,877GWh capacity to 650GW output by the end of 2030, while DNV’s annual Energy Transition Outlook predicts lithium-ion battery storage alone will reach 1.6TWh by 2030. In other words, both see the terawatt-hour mark being breached well before the end of this decade.

For BloombergNEF, it follows successive upward revisions of its forecasted numbers. In the report for the first half of this year, published in March, it predicted 508GW/1,432GWh of cumulative installed capacity by the year-end 2030. A year ago, the figures had been 411GW and 1194GWh, representing enormous leaps from the 27GW/56GWh of cumulative installs recorded as of the end of 2021.

‘Brink of innovation’: Grid-scale Li-ion costs to fall to US$130/kWh by 2050

DNV said that by 2050, lithium-ion (Li-ion) installs will hit 22TWh, and the majority of that will comprise lithium-ion with utility-scale solar PV, with a smaller portion of standalone Li-ion battery storage and a much smaller but growing wedge of long-duration energy storage (LDES) technologies adding up to about 1.4TWh by that time.

The legacy LDES technology, pumped hydro energy storage (PHES) is however likely to see relatively few new installs, DNV forecast, staying at around the 3TWh that it stands at today.

Lithium-ion is on the “brink of innovation”, according to DNV, and despite some recent cost pressures from supply chain challenges, it forecasts the cost of utility-scale Li-ion battery energy storage system (BESS) technology to fall below US$200/kWh by 2030 and as low as around US$130/kWh by 2050.

DNV said that it also considers LDES technologies, and vanadium redox flow batteries (VRFBs) in particular, to “appear promising for 8- to 24-hour applications” with potential cost advantages over Li-ion.

Despite this, as regular readers of Energy-Storage.news will be aware, revenue models that value longer duration applications are largely absent from global energy markets, while other newer technologies may have to rely on policy support and successful efforts to reduce costs.

DNV did note however that as storage capacity surpasses 0.5% of total grid-connected energy resources, the need for storage shifts from high power applications such as frequency regulation and other ancillary services towards high energy applications that require longer durations of storage.

This is evident in many of the world’s leading regional energy storage markets, such as California, the UK and Texas’ ERCOT market, where average durations are in the range of 2- to 4-hour durations today versus perhaps an hour or less just a couple of years ago.

Sector set for 34% growth year-on-year in 2023

On the subject of LDES, BloombergNEF analyst Helen Kou said that the case for it “remains unclear despite a flurry of new project announcements across the US and China”. Its new report found that by the end of 2023, cumulative LDES installs add up to 1.4GW/8.2GWh.

BloombergNEF’s new report looked in more detail at the shorter term market outlook than DNV’s, with the latter largely focusing on expected trends through to the mid-21st Century.

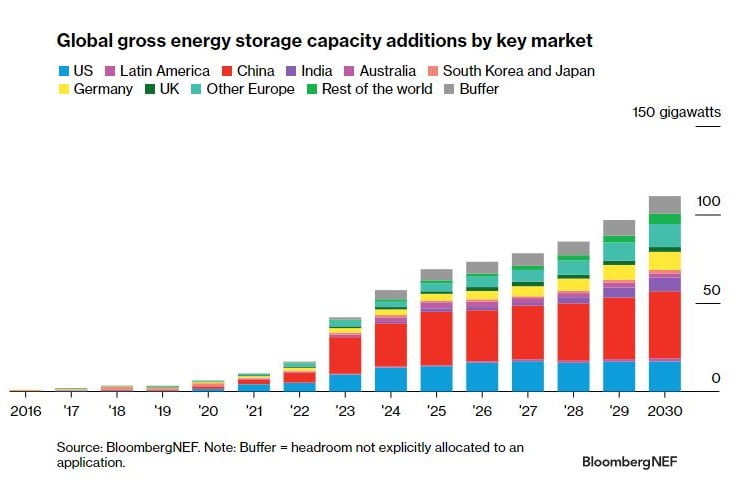

According to BloombergNEF, total energy storage deployments this year will be 34% higher than 2022 figures, with the industry on track for a total 42GW/99GWh of deployments in 2023. That will be followed by compound annual growth rate (CAGR) of about 27% through 2030, an increase from the 23% CAGR it predicted as recently as March.

That means that as of the end of this decade, 110GW/372GWh of annual installations are likely. BloombergNEF, like DNV, has observed that durations are growing as capacity and other energy-driven applications for storage become the primary focus.

Storage is being sought as capacity – including through capacity markets – in countries as diverse as Japan, Poland, Chile, the UK, Australia and regional US markets in the Southwest and New York, Helen Kou wrote on the company’s blog.

In terms of regions, BloombergNEF saw the Asia-Pacific region dominate, forecast to account for 47% of all new additions in 2030. The Europe, Middle East and Africa (EMEA) region will represent 24% by that time, while the Americas will be the smallest of the three major regions with a share of 18%.

The APAC region’s large share, perhaps unsurprisingly, will be driven largely by China’s policy reforms and energy storage targets, which prompted BloombergNEF to up its 2030 forecast for deployments in the country by 86% over previous forecasts.

Our publisher Solar Media is hosting the 10th Solar and Storage Finance USA conference, 7-8 November 2023 at the New Yorker Hotel, New York. Topics ranging from the Inflation Reduction Act to optimising asset revenues, the financing landscape in 2023 and much more will be discussed. See the official site for more details.