US-listed private equity firm KKR has also announced a £600 million investment to become a joint majority shareholder alongside Infracapital. This was reported by our sister publication Energy-Storage.news in September but now has been officially confirmed.

In total, this means £870 million will be pumped into the business, equivalent to US$1.095 billion. The company in fact topped a list of VC-funded deals in the battery storage sector for the year to the end of Q3, according to research from Mercom Capital.

The investment in Zenobē will enable the firm to continue to expand its battery energy storage portfolio and support the company in powering 4,000 electric buses, trucks and commercial vehicles by 2026.

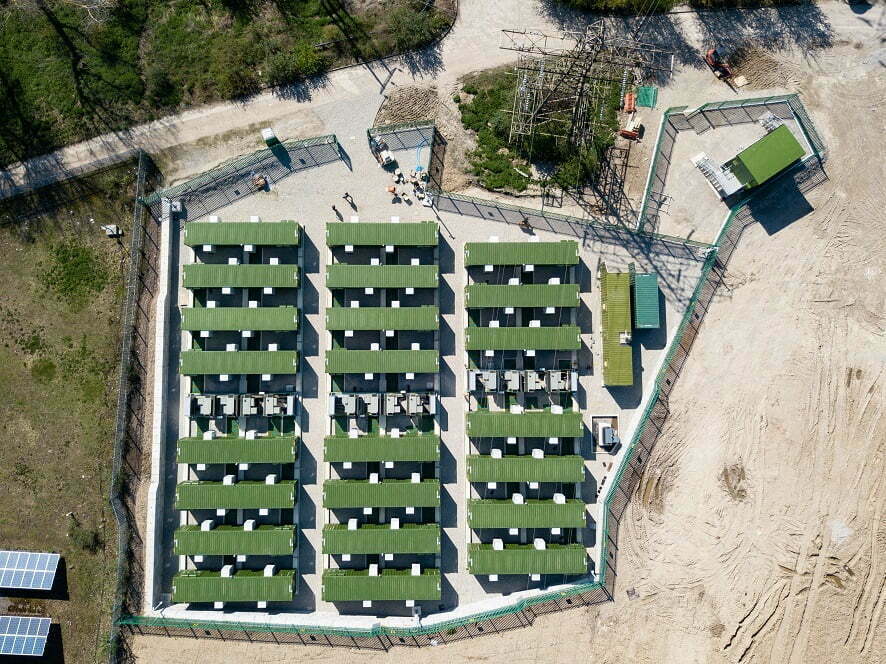

At the time of reporting, Zenobē has supported over 1,000 electric vehicles globally and has 430MW of battery storage in operation or under construction. This is across a number of international markets including the UK, Australia, New Zealand, Europe and North America.

Zenobē has been working on a number of notable grid-scale BESS including a 300MW/600MWh unit in Blackhillock, Scotland, on which construction started earlier this year with commercial operation scheduled for mid-2024. That is part of a portfolio of four sites in Scotland totalling 1050MW/2100MWh of energy storage.

The BESS developer-owner won Developer of the Year at the 2023 Energy Storage Awards three months ago.

To read the full version of this article visit Solar Power Portal.

Energy-Storage.news publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 20-21 February 2024. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.