The report tracks the grid-scale (aka utility-scale), commercial and industrial (C&I), including community storage and residential battery storage market segments in the US, with the latest edition published this week covering Q1 2024 numbers and trends.

New additions included 993MW/2,952MWh of grid-scale storage, which was a 101% jump from the same period last year in megawatt terms.

Grid-scale in turn was dominated by just three states: Nevada, California and Texas. For the first time, Nevada was the leader, deploying 38% of all new battery storage in that segment, followed by Texas with 35% of total capacity.

Nevada’s battery storage sector growth has largely comprised solar-plus-storage hybrid installations, and as regular readers of this site may have noted, that generally means projects of 4-hour duration with long-term resource adequacy (RA) or power purchase agreement (PPA) type contracts.

Conversely, Texas, and more specifically Texas’ ERCOT merchant market comprises mostly shorter duration assets performing grid services with some arbitrage, leading to assets more typically being standalone battery energy storage system (BESS) configurations of 1-hour and 2-hour duration.

As a consequence, in megawatt-hour terms Nevada far outpaced Texas, deploying 1,416MWh of grid-scale batteries to just 553MWh. In fact, Nevada did so from just one project coming online, Gemini, which pairs 690MW of solar with the 1.4GWh BESS, developed by Arevia Power and Quinbrook energy storage platform Primergy.

By contrast, 12 new grid-scale projects went online in Texas and nine in California. California remains the leader for installed megawatts, surpassing the 10GW mark earlier this year for cumulative BESS capacity connected to the CAISO grid, but some projections forecast Texas to overtake during 2024.

2024: ‘US’ first double-digit year’

There is a “tight race for top storage state” playing out between the latter two, said ACP vice president of markets and policy John Hensley, that the association look forward to cheering on.

Hensley also said ACP was looking forward to the US seeing its first double-digit year of installations by gigawatt, with Wood Mackenzie predicting that the grid-scale segment alone will hit 11.1GW and 31.6GWh by capacity in 2024, and 12.9GW/35.8GWh across all segments combined.

In 2023, 8.7GW/25.8GWh of new storage was added, including 7.9GW/24GWh of grid-scale, according to the research group.

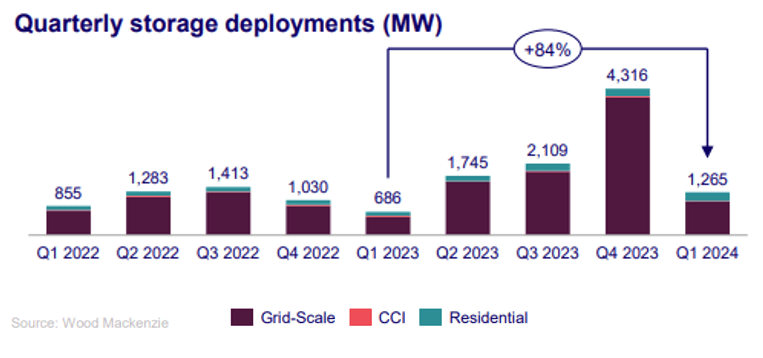

The first quarter has historically been the quietest of the year, so it’s unsurprising the market did not reach the heights of Q4 2023’s installs, which were the highest of any quarter to date.

The US grid added 4,235MW across all scales and 12,351MWh in the final quarter of last year, including 3,983MW/11,769MWh at grid-scale.

Nonetheless, it was a “strong start” to this year which “sets expectations high for the remainder of the year,” according to ACP’s John Henley.

“The rapid growth of the energy storage industry comes at a critical time, providing a solution to growing energy demand and increasingly variable weather conditions that are placing added stress on the grid.”

Tailwinds for OEMs, some headwinds for developers

Wood Mackenzie has revised its five-year forecast upwards by 5%, predicting that 62.6GW/219GWh will be installed cumulatively in that time.

While the grid-scale segment will likely continue to represent the biggest share by far, the distributed segments will experience major growth, with about 13GW of new installations forecast through 2028, about 79% of which (10GW) will be residential.

The value of exporting rooftop solar-generated power to the grid during the middle of the day continues to fall, while new opportunities for distributed storage are emerging. California’s controversial NEM 3.0 policy meanwhile which slashes daytime export tariffs for solar, contributed to a year-on-year tripling in household installs in the state.

A total 252.4MW/515.7MWh of residential installs were recorded across the US in Q1 2024, to 170MW/388.2MWh in Q1 2023, growth of 48% and 33%, respectively. The C&I segment had its “worst quarter in years” on the other hand, with just 19.4MW/44.4MWh of new additions, down from 33MW/105.6MWh in Q1 2023.

The C&I segment does however hold strong potential over a 10-year outlook, Wood Mackenzie said, due to underlying fundamental market drivers.

Despite the broadly positive outlook, however, the research group expects some flattening of grid-scale additions over 2025-2026 due to the often discussed early-stage project challenges, such as lengthy interconnection queue waits and permitting and siting, which are likely to push completion dates of projects further out.

Yet grid-scale BESS prices dropped year-on-year by 39%, with cost declines from cell to DC block-level, largely through marketplace competition and lithium battery oversupply, meaning that from US$1,778/kW in Q1 2023, grid-scale BESS costs overall fell to US$1,080/kW. The extent and impact of falling costs, a trajectory that has resumed after post-pandemic price spikes from around 2021-2022, has been a widely discussed topic throughout the industry.

Domestic Content guidance recently issued by the Treasury Department and IRS meanwhile will add a further boost to the market, Wood Mackenzie senior energy storage analyst Vanessa Witte said.

“US OEMs and integrators were dealt a win with the recently released Domestic Content guidance for the Inflation Reduction Act (IRA)– this changed the reporting structure to qualify for the 10% adder and enabled developers to declare their qualification without the use of manufacturing costs from the OEM directly.

While US installations look poised to break a metaphorical 10GW ceiling this year for the first time, Europe already did in 2023, with 10.1GW of additions across all segments, according to an edition of the European Market Monitor on Energy Storage (EMMES) published by consultancy LCP Delta and the European Association for Storage of Energy (EASE) in late March.

As well as marking the first time in recent memory that Europe has installed more energy storage in a calendar year than the US, it was notable that by contrast to its North American rival’s dominance of grid-scale, Europe’s new additions were about 70% in the residential segment.