It covers a multitude of technologies, from electrochemical batteries to mechanical and thermal energy storage, with the latter often capable of providing power as well as heat (or cooling) energy.

While technically, lithium-ion (Li-ion) batteries are capable of longer durations than the typical 1-hour to 4-hour deployments that dominate today’s new additions of storage capacity and are considered cost-competitive for even 6-hour, 8-hour and perhaps even 10-hour applications, there are a broad range of non-lithium-based technologies emerging or already commercially available.

For example, US utility company Salt River Project, which is based in Arizona, just put out a request for proposals (RFP) specifically for non-lithium inverter and non-inverter-based energy storage technologies of 10-hour duration, for two pilot projects of between 5MW and 50MW rated power output.

Redflow – zinc bromine hybrid flow battery

The state of Queensland, Australia, is betting big on supporting and promoting its homegrown battery industry value chain.

Queensland launched a statewide battery strategy in February this year, as part of its AU$62 billion Energy and Jobs Plan policy to both stimulate the economy and enable its transition to 70% renewable energy by 2032, 75% by 2035 and net zero emissions by 2050.

A position paper commissioned by the state and written by consultancy Accenture found that Queensland has potential competitive advantages not just in the production and processing of Li-ion batteries, but also holds vast reserves of vanadium, the key ingredient in the electrolyte for vanadium redox flow batteries (VRFBs).

While VRFBs are the best-known electrochemical technology designed to scale up for long-duration applications, Queensland is also home to Redflow, a flow battery maker which bases its devices on zinc-bromine electrolyte chemistry.

The ASX-listed company announced this morning (2 July) that it has signed a deal with Queensland government-owned power company Stanwell Corporation. The deal could see co-developed flow battery technology used in a large-scale energy storage project “of up to 400MWh”.

A preliminary due diligence feasibility study will be conducted for an initial 5MWh flow battery project at a Stanwell innovation and training hub, using Redflow’s newest X10 battery.

The feasibility study should be completed early next year, for the deployment of the 5MWh system in the first half of 2026.

In a mid-2023 interview with Energy-Storage.news Premium, Redflow CEO Tim Harris explained the perceived advantages of the company’s technology and the use of zinc and bromine as abundant and relatively easy-to-source materials.

That interview happened as Redflow was awarded its single biggest project to date, a 20MWh system for a renewable energy microgrid in California, supported with grant funding from the California Energy Commission (CEC).

Queensland’s battery strategy was published a few months before the Australian federal government published a National Battery Strategy, and along with a shared aim to make their respective jurisdictions competitive in the global battery value chain, one thing the two plans have in common is their identification of zinc-bromine flow batteries as a potential contender for scale-up and widespread global deployment.

Redflow will design and deploy the next-generation X10 technology in partnership with Stanwell, and the company said the potential 400MWh project could underpin its plans to build a factory in Queensland.

Rondo Energy – thermal heat and power storage

US-headquartered thermal energy storage provider Rondo Energy has secured €75 million (US$80.5 million) funding to support three projects in Europe.

The company manufactures a ‘Heat Battery’ in two configurations, aimed at providing low-carbon industrial heat and power that can be a ‘drop-in’ solution to replace current processes in sectors including food, beverages, clean fuel and the production of chemicals.

The Heat Battery uses a brick made of refractory material that can be heated up to 1,500°C (2732°F) and still retain its strength and form. The heat can be discharged over multi-day durations as required, outputting the energy as heat or steam, or driving turbines to generate electric power.

The tech is designed to enable sectors from which emissions are considered hard to abate to replace conventional technologies such as gas-fired power or heat. Like Redflow, Rondo claims the materials used in its storage technology’s design—oxygen, silicon, and aluminium—are abundant.

Rondo announced last week (26 June) that the new funding will come from the Bill Gates-founded Breakthrough Energy Catalyst sustainable VC investment platform and the European Investment Bank (EIB).

The company made its first commercial deployment in early 2023, shortly after that announcing ambitions to ramp up its annual manufacturing capacity to 90GWh, although a timeline was not given.

The three projects will be deployed for customers with differing needs.

One will be for polymer producer Covestro in Germany, where a Rondo Heat Battery system will produce continuous steam from variable renewable energy (VRE) inputs. Another will be in Denmark, for Greenlab, an industrial park where renewable energy will again be used, this time to produce steam that then drives turbines to generate low-carbon, baseload electricity.

Details of the third project are yet to be disclosed, but the technology provider said it will be for a food and beverage producer and will charge from solar PV deployed both on-site and off-site.

“Rondo’s deployment is crucial at a time when European manufacturers are urgently looking for ways to eliminate their dependence on natural gas,” Breakthrough Energy Catalyst head Mario Fernandez said, calling the Heat Battery a “unique opportunity” for industry to decarbonise with low-cost renewable energy and long-duration storage.

ESS Inc – iron flow battery

One of the other prominent non-vanadium flow battery technologies is the proprietary iron electrolyte flow battery designed by US manufacturer ESS Inc.

ESS Inc holds the IP for the technology and so only it and licensees, including ESI Asia-Pacific, a partner based in Australia, can make and deploy the systems.

Indeed, while its Australian partner’s efforts include a factory being built in—where else—Queensland, ESS Inc’s own domestic manufacturing base in Wilsonville, Oregon, has received a boost from the US government Export-Import Bank (EXIM).

The US official export credit agency has approved a US$50 million financing package, which ESS Inc. will use to fuel the expansion of the Wilsonville factory.

As of the beginning of 2023, the company’s annual production capacity stood at 800MWh. ESS Inc claimed the funding would enable a tripling of production capacity at the site.

The company said the financing package would help it meet demand from global customers, with iron flow batteries already delivered or contracted to overseas projects and portfolios in Europe, Australia and Africa.

EXIM provides loans and insurance to export-oriented businesses, and the support for ESS Inc has come from its Make More in America initiative. ESS Inc’s flow batteries are made in the US, with the majority of its supply chain also domestically based.

“This transaction will ensure that EXIM continues to meet our mandates to support technologies that are critical to the global energy transition while bolstering supply chains and supporting hundreds of good-paying jobs at home,” said EXIM chair Reta Jo Lewis, who noted that this will be the fourth EXIM package for ESS Inc.

NYSE-listed ESS Inc’s recent orders and ongoing projects abroad include the company’s first deal in Africa for a 1MW/8MWh project booked with Nigerian independent power producer (IPP) Sapele Power announced in May, and an order for a project in Germany of up to 50MW/500MWh with utility LEAG, booked in the summer of 2023.

e-Zinc – zinc-air battery

Canadian proprietary zinc-air battery tech company e-Zinc closed a Series A2 funding round in June with investors including Mitsubishi Heavy Industries (MHI).

The round was held as a follow-on to a successful US$25 million Series A round, and the latest was oversubscribed, the company said on 27 June.

Early-stage sustainability VC investor Evok Innovations led the round and along with Japan’s MHI, those joining included Export Development Canada—the northern equivalent to EXIM—another sustainable tech VC, Ultratech Capital Partners, and others.

According to the battery startup, the funding will be used to accelerate product development and fuel manufacturing plans.

In an April 2023 interview with Energy-Storage.news Premium, e-Zinc CCO and US country manager Balki Iyer said that the company would target construction of a factory with 1GWh annual production capacity which would open before the end of 2025.

Iyer, who said the e-Zinc technology is suitable for applications requiring 12-hour to 100-hour durations, also claimed the raw materials used in its production are “very, very low cost compared to those in lithium batteries,” and that it is suitable for a range of applications from industrial microgrids to renewable energy time shifting.

Iyer also discussed a planned project with another Japanese company, Toyota Tsusho, which is being carried out as a technology demonstration in partnership with the CEC.

“Following the upcoming pilot demonstrations and the validation of our manufacturing processes, we will have proven the advantages of our innovative energy storage solution and the infrastructure needed to bring our proprietary technology to market at commercial scale,” e-Zinc CEO James Larsen said of the new funding.

Conclusion: LDES challenges could give way to opportunities

The challenges for all of these companies competing to become long-duration complements or even alternatives to Li-ion battery storage are twofold.

These are to reduce costs to the point where they can be cost-competitive with Li-ion or thermal power generation when paired with renewables, and to survive long enough to see demand for LDES solidify into widespread market opportunities.

Energy markets around the world do not tend to value multi-hour storage beyond about 4-hour duration, but as renewable energy penetration grows and fossil fuel use declines, the need for longer durations of storage is set to grow.

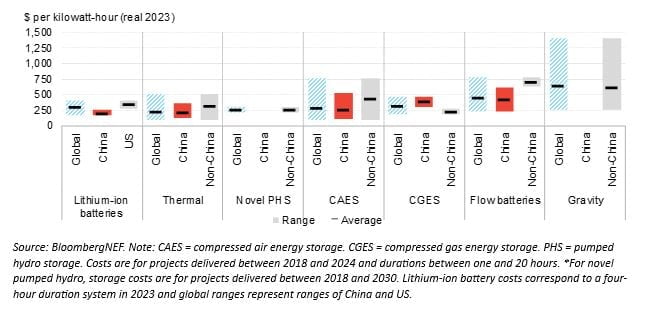

BloombergNEF (BNEF) recently carried out its first-ever cost survey of LDES technologies, finding that some mechanical energy storage technologies, namely thermal storage and compressed air energy storage (CAES) are already competitive at scale with 4-hour duration Li-ion.

However, BNEF said that average Capex for flow batteries worldwide is about US$701/kWh, versus about US$301/kWh for a fully installed Li-ion battery energy storage system (BESS), although in China which has seen government support for flow battery demonstration projects and R&D, the average Capex for a flow battery was much lower at US$423/kWh.

In a video interview with Energy-Storage.news, published in May, Gabriel Murtagh, director of markets and technology at global trade association LDES Council discussed some of the issues around commercialisation, as well as opportunities up ahead, for long-duration technologies.

“Lithium-ion is a technology that’s been built, it’s been proven, it works, it can interconnect to the grid, it can provide grid services, and a lot of these other long-duration energy storage technologies are a little bit newer, so it’s going to take a little while for them to get to the same point in these competitive processes,” Murtagh said of some early solicitations for long-duration storage seen in markets such as California in the US and New South Wales in Australia.

“Some of those procurement requirements in California were [also] met by alternatives to lithium-ion, so there certainly have been some contracts signed for non-lithium-ion and we’ll see those on the grid in just a few years, in pretty large quantities, which is super-exciting,” Murtagh said.

Watch Energy-Storage.news’ interview with LDES Council’s Gabriel Murtagh below.