Dispatch of the VF FCAS opportunity opened on 9 October 2023 with two new markets for contingency FCAS, Raise-1 (R1) and Lower-1 (L1), implemented by the Australian Energy Market Operator (AEMO). The ‘1’ refers to the number of seconds response time required, with existing Fast Frequency Response services requiring response within 6 seconds.

It began with limited volumes of up to 50MW to ensure a smoother introduction, with AEMO reviewing the levels of registered capacity against expected requirements every two weeks. With the transition period currently ongoing, the maximum volume requirement for R1 is 175MW and 100MW L1 at the moment.

Contingency FCAS markets, of which there are eight in the NEM, ensure there is enough frequency response available in the system to deal with a single credible contingency that could be caused by something like a large generating unit or industrial load suddenly going offline.

Traditionally provided in Australia by fossil fuel generators, battery storage is now considered the low emissions technology best suited for providing those contingency services and due to the millisecond response times of batteries, to do it more efficiently. Coal, historically Australia’s main source of electricity generation, is being retired by 2038.

“The potential for substantial profits, combined with the vital role batteries play in ensuring grid stability, means they are poised to be a driving force in this revolutionary energy landscape,” Cornwall Insight Australia modelling manager Ben Tudman said.

“With coal slowly fading out of the picture, VF FCAS markets will hopefully offer the contingency needed to maintain the stabilisation of the grid.”

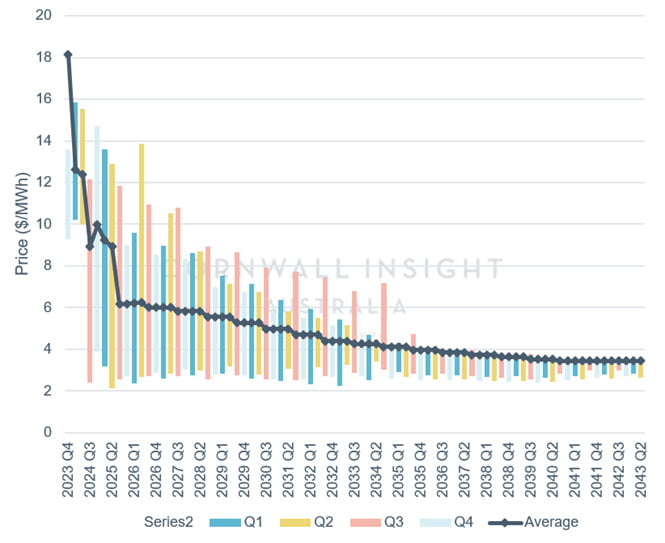

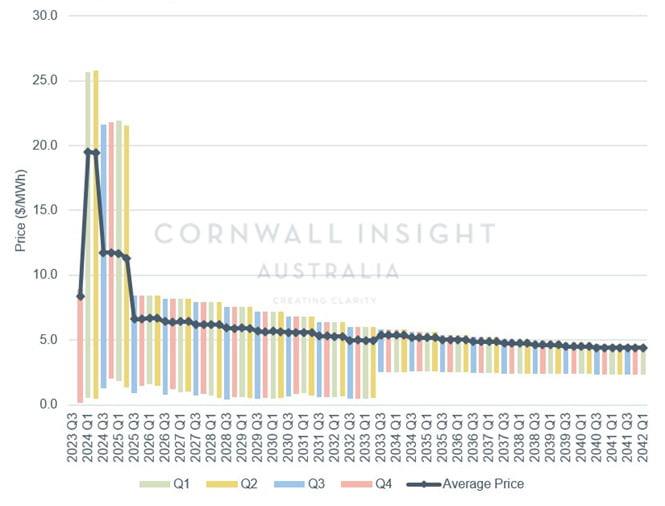

Cornwall Insight Australia said that according to its price forecasting (see below), between now and 2026, participants in R-1 could make AU$9.64 (US$6.45)/MW/hr on average and L-1 participants AU$10.95/MW/hr.

Quarterly average price forecast and average daily P1 to P90 price spreads for Raise-1 (left) and Lower-1 (right) VF FCAS markets. Credit: Cornwall Insight Australia.

That’s about ten times more than other markets available today, in which Cornwall Insight Australia is seeing revenues of under a dollar per megawatt. While that initial high value of VF services will calm, it will nonetheless remain high, averaging a predicted AU$5.5/MW/hr over a 20-year forecasted period.

While energy arbitrage is becoming an increasing portion of the revenue stack available to large-scale battery storage in Australia, FCAS is thought to still represent the biggest share, and if Cornwall Insight Australia’s analysis is correct, VF FCAS will be the most lucrative among those.

The consultancy said it expected to see more than a gigawatt of batteries available for the VF FCAS market by 2026, including existing and new-build facilities, with the surge in involvement driven by those attractive revenues.

“We are optimistic that the higher prices available will see appetite grow for involvement in the markets, enticing both new players and existing battery assets to actively participate and contribute to these evolving energy markets,” Ben Tudman said.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.